Printable Form Mcl 211 7b State Of Michgian MCL 211 7b 1 a provides an exemption from property taxes under the General Property Tax Act for real property owned and used as a homestead by a disabled

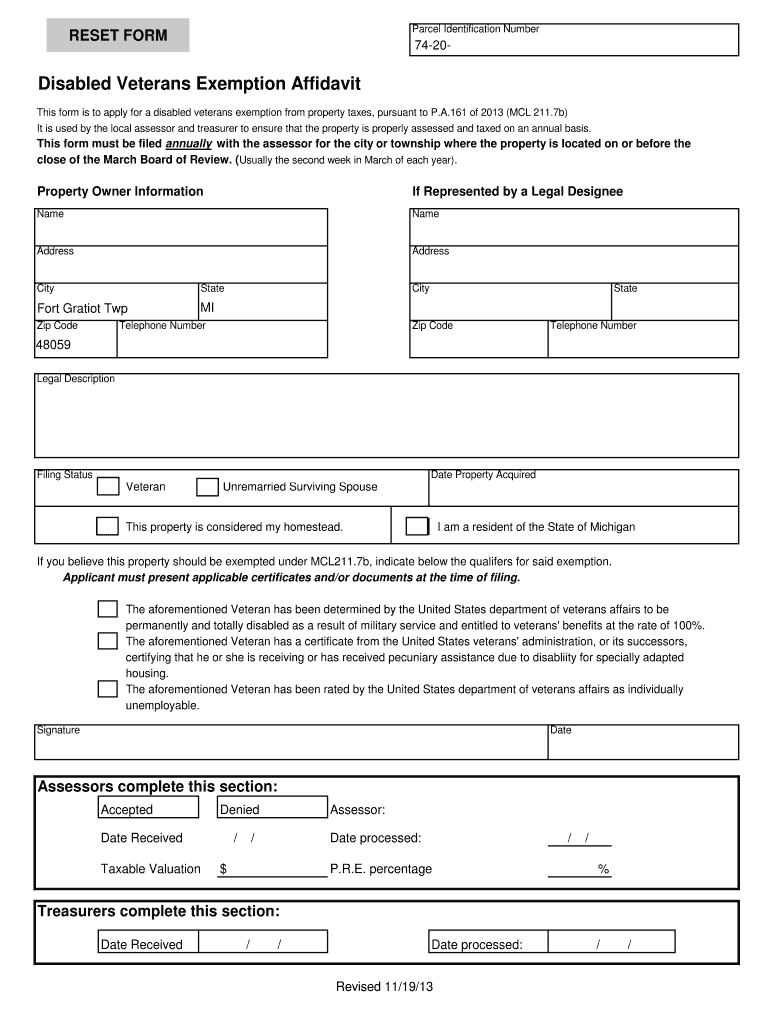

Disabled Veterans Exemption In accordance with MCL 211 7b real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or the disabled veteran s un remarried surviving spouse MCL 211 7b For more information on the Disabled Veterans Exemption This application is to be used to apply for the exemption and must be filed with the Board of Review where the property is located This application may be submitted to the city or township the property is located in each year on or after January 1 To be considered complete this application must 1 be completed in its entirety 2 include

Printable Form Mcl 211 7b State Of Michgian

Printable Form Mcl 211 7b State Of Michgian

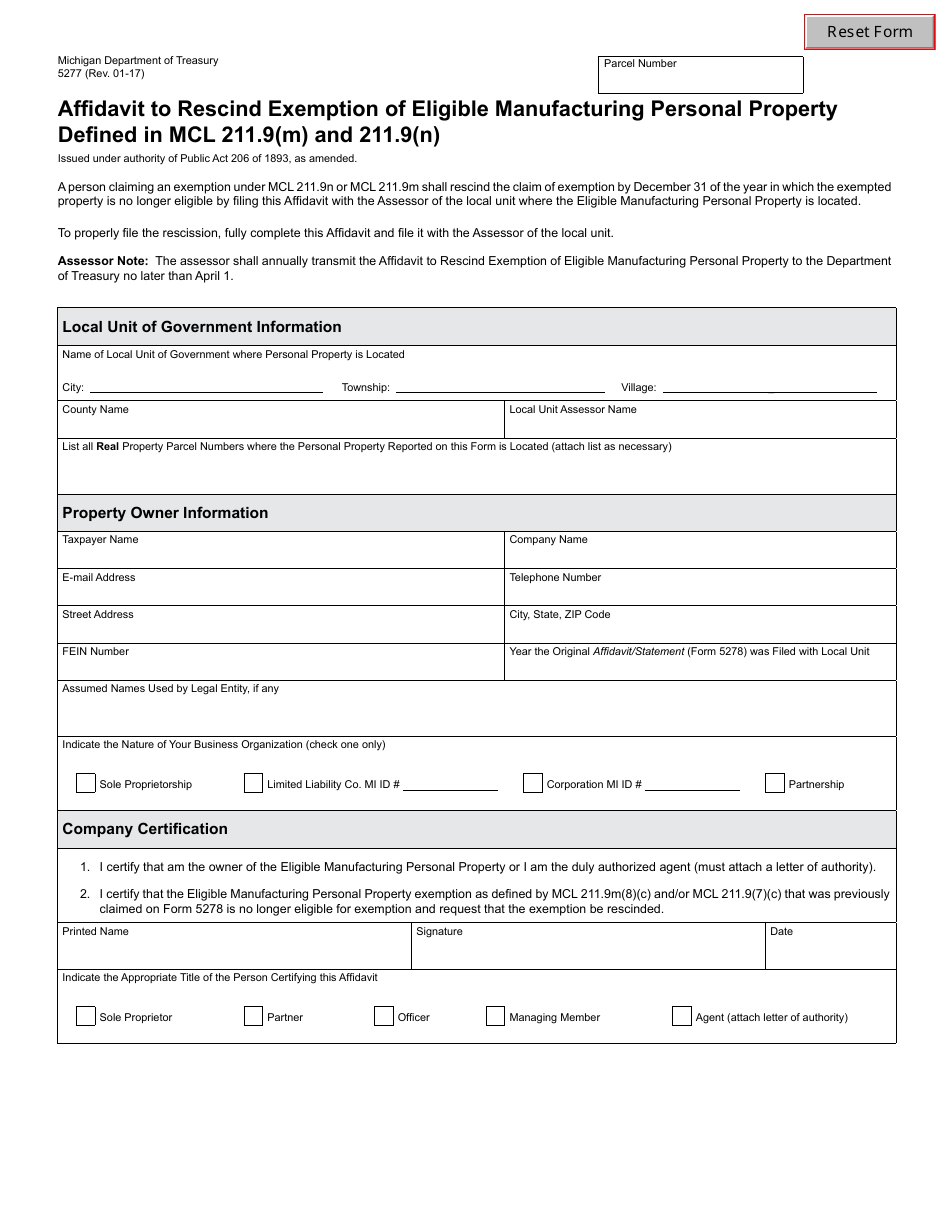

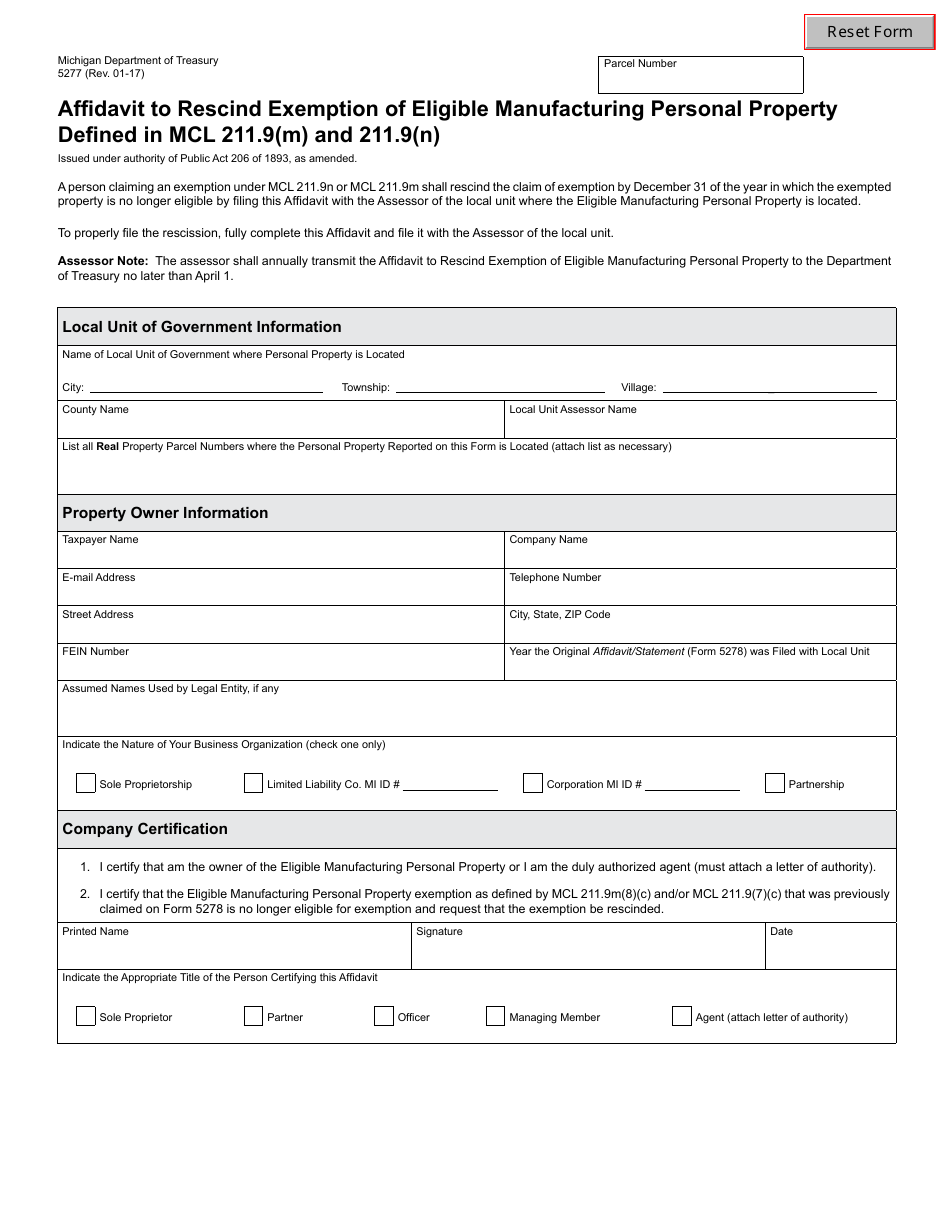

https://data.templateroller.com/pdf_docs_html/1739/17394/1739446/form-5277-affidavit-to-rescind-exemption-eligible-manufacturing-personal-property-defined-in-mcl-211-9-m-and-211-9-n-michigan_print_big.png

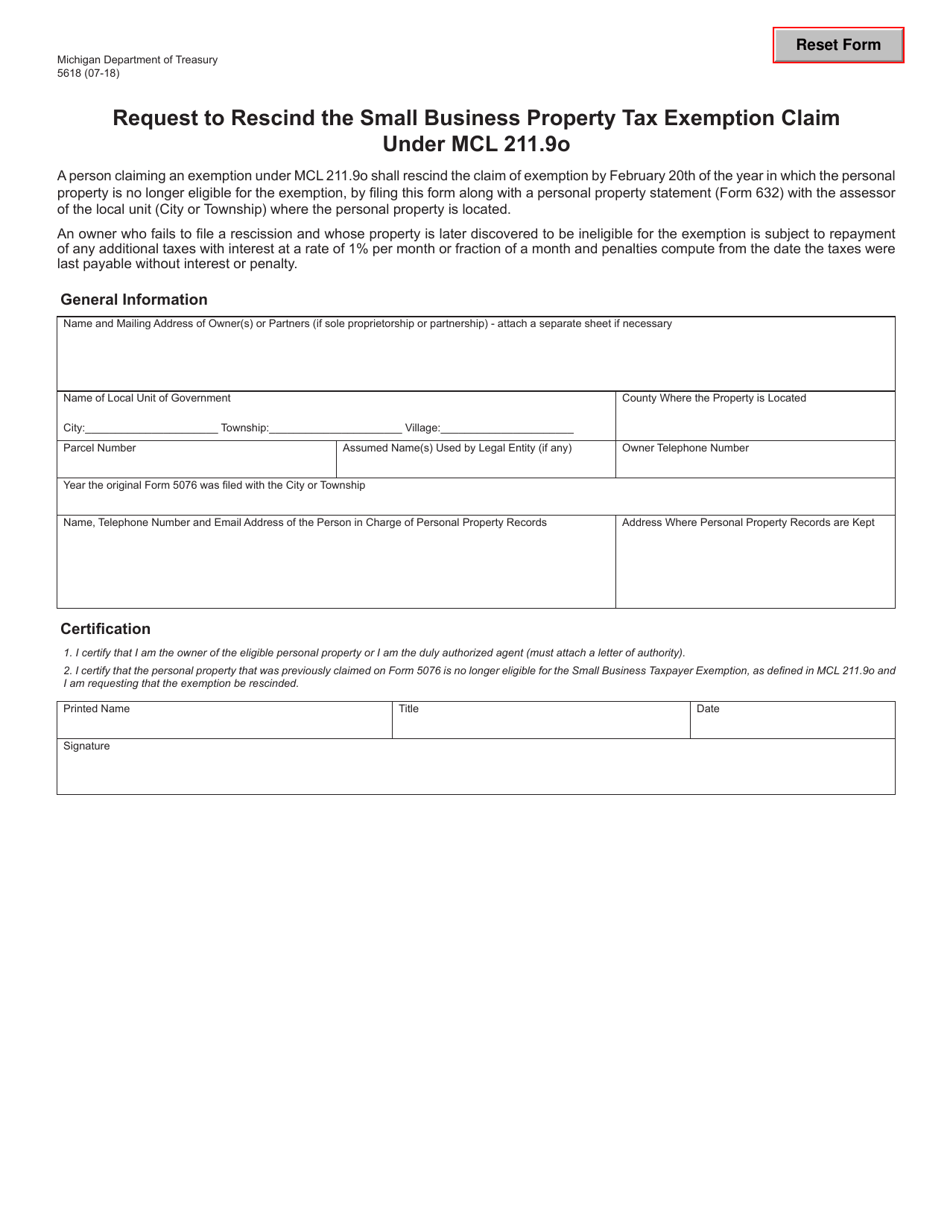

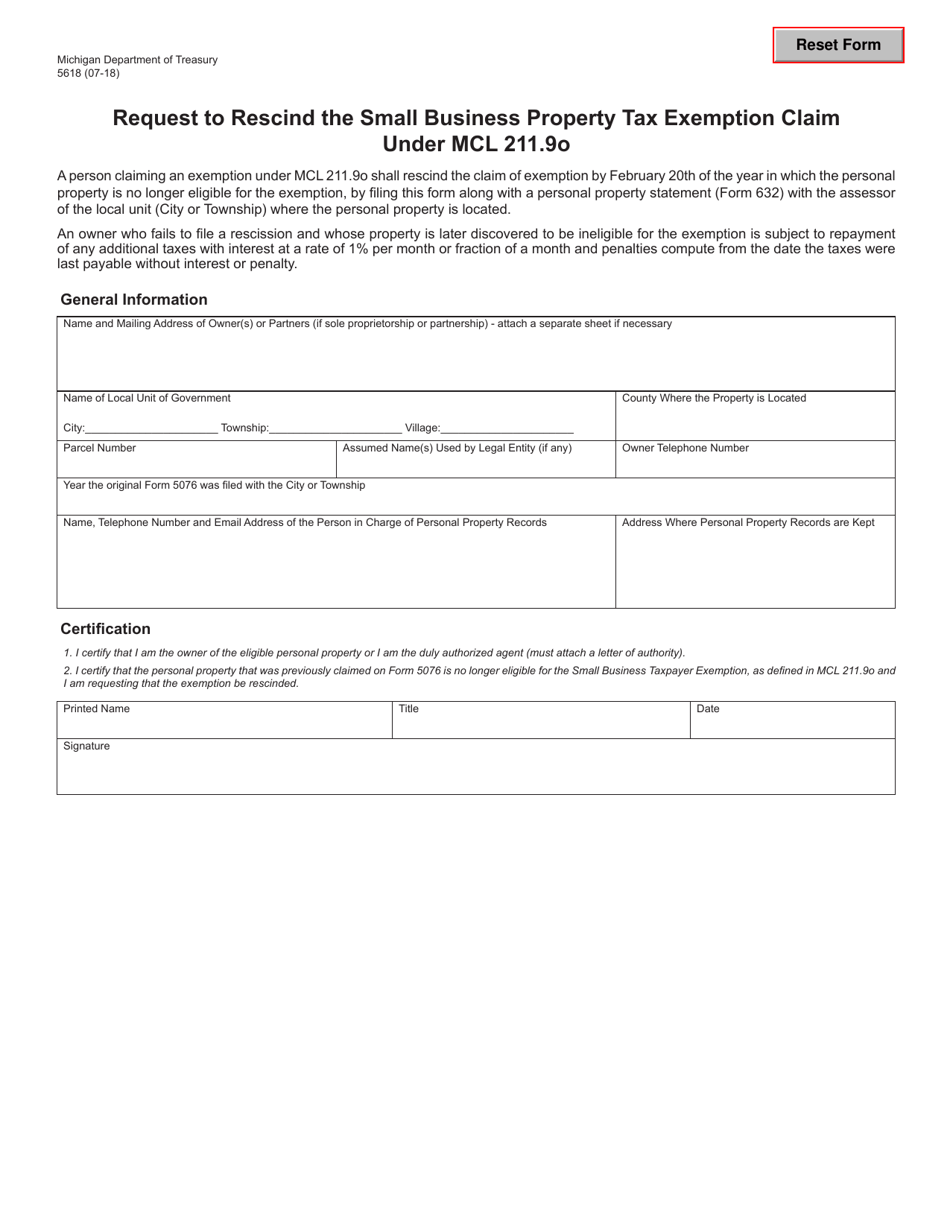

Form 5618 Download Fillable PDF Or Fill Online Request To Rescind The Small Business Property

https://data.templateroller.com/pdf_docs_html/2027/20279/2027952/page_1_thumb_950.png

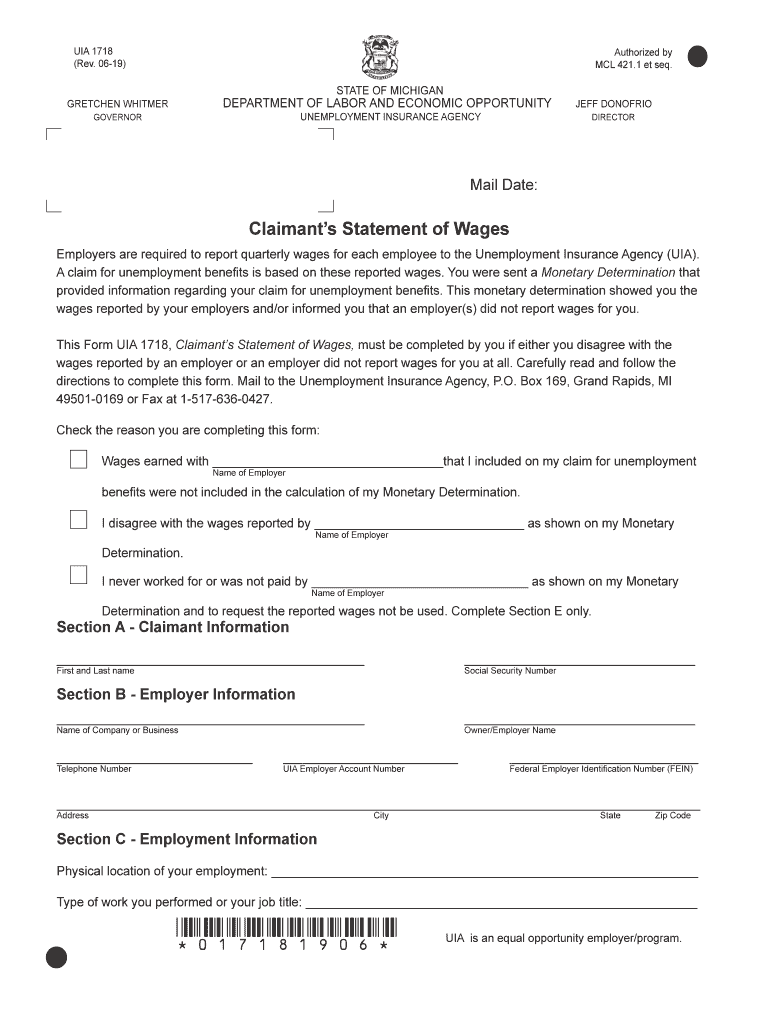

Form Uia 6347 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/318/100318988/large.png

MCL 211 7b Disabled Veteran s Exemption Michigan P A 161 of 2013 amended MCL 211 7b relating to the exemption for disabled veterans Specifically this Act changed MCL 211 7b to read as follows Section 211 7c 211 7c Continuation of exemption granted under MCL 211 7b rescission or subsequent denial of exemption Sec 7c An exemption granted under section 7b as to taxes levied on or after January 1 2025 remains in effect without subsequent reapplication until it is rescinded by the individual who was granted the exemption or is

Page 5 Appeal Rights A written denial by the assessor may be appealed by completing and submitting a petition to the Michigan Tax Tribunal within 35 days of the date of the denial Act 108 of 2023 Statute SOLAR ENERGY FACILITIES TAXATION ACT 211 1151 211 1165 NAVIGATE CHAPTERS MCL Chapter Index Chapter 211 The Michigan Legislature Website is a free service of the Legislative Internet Technology Team in cooperation with the Michigan Legislative Council the Michigan House of Representatives and the Michigan Senate

More picture related to Printable Form Mcl 211 7b State Of Michgian

2019 2024 Form MI LRA UIA 1718 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/492/753/492753071/large.png

Wisconsin Tax Exempt Form S 211 Fillable Printable Forms Free Online

https://www.pdffiller.com/preview/6/961/6961927/large.png

Fillable Online Fortgratiottwp It Is Used By The Local Assessor And Treasurer To Ensure That The

https://www.pdffiller.com/preview/55/543/55543746/large.png

Instructions This form is to be used to apply for an exemption of property taxes under MCL 211 7b for real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or his or her unremarried surviving spouse The property owner or his or her legal Free printable templateslike Printable Form Mcl 211 7b State Of Michgian are an useful source for anybody seeking to develop professional looking documents without spending a lot of time or money With a vast array of templates offered online you make sure to discover the ideal one for your requirements So next time you require to produce a

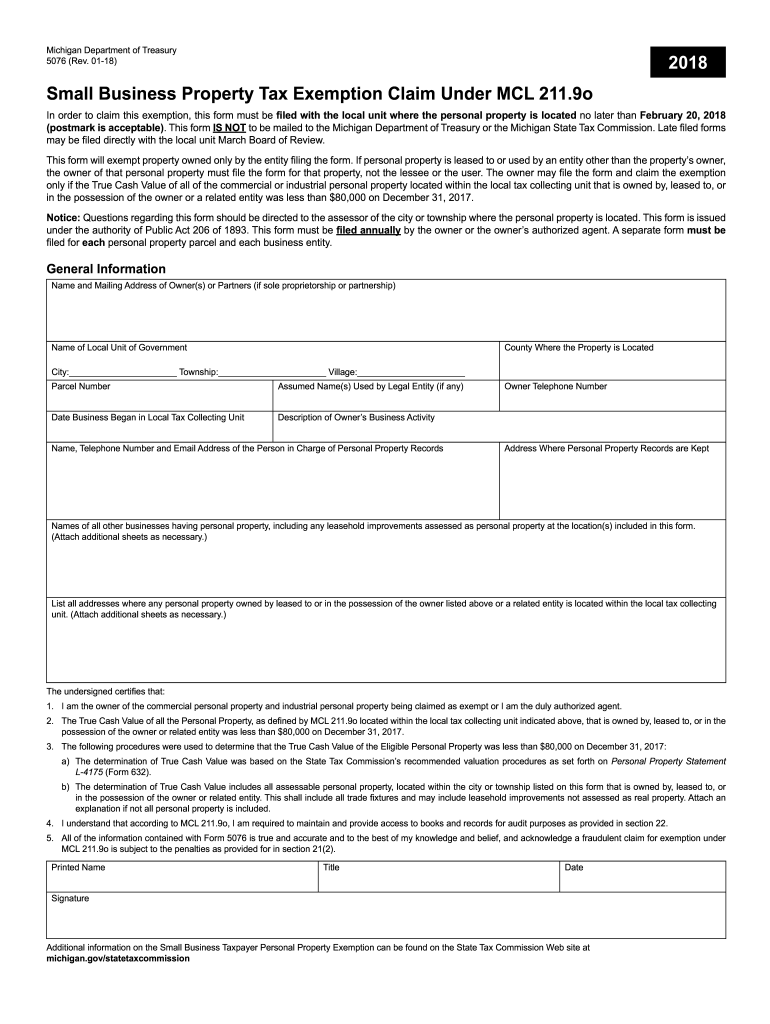

Act 206 of 1893 211 7u Principal residence of persons in poverty exemption from taxation applicability of section to property of corporation eligibility for exemption application policy and guidelines to be used by local assessing unit duties of board of review exemption by resolution and without application for certain tax years Instructions for Small Business Property Tax Exemption Claim Under MCL 211 9o Form 5076 MCL 211 9o provides for a personal property tax exemption for eligible personal property This is commonly referred to as the Small Business Taxpayer Exemption MCL 211 9o defines eligible personal property as meeting all of the following criteria

Printable Form Mcl 211 7b State Of Michgian Printable Forms Free Online

http://www.mywordtemplates.net/wp-content/uploads/2016/07/quitclaim-deed-form.jpg

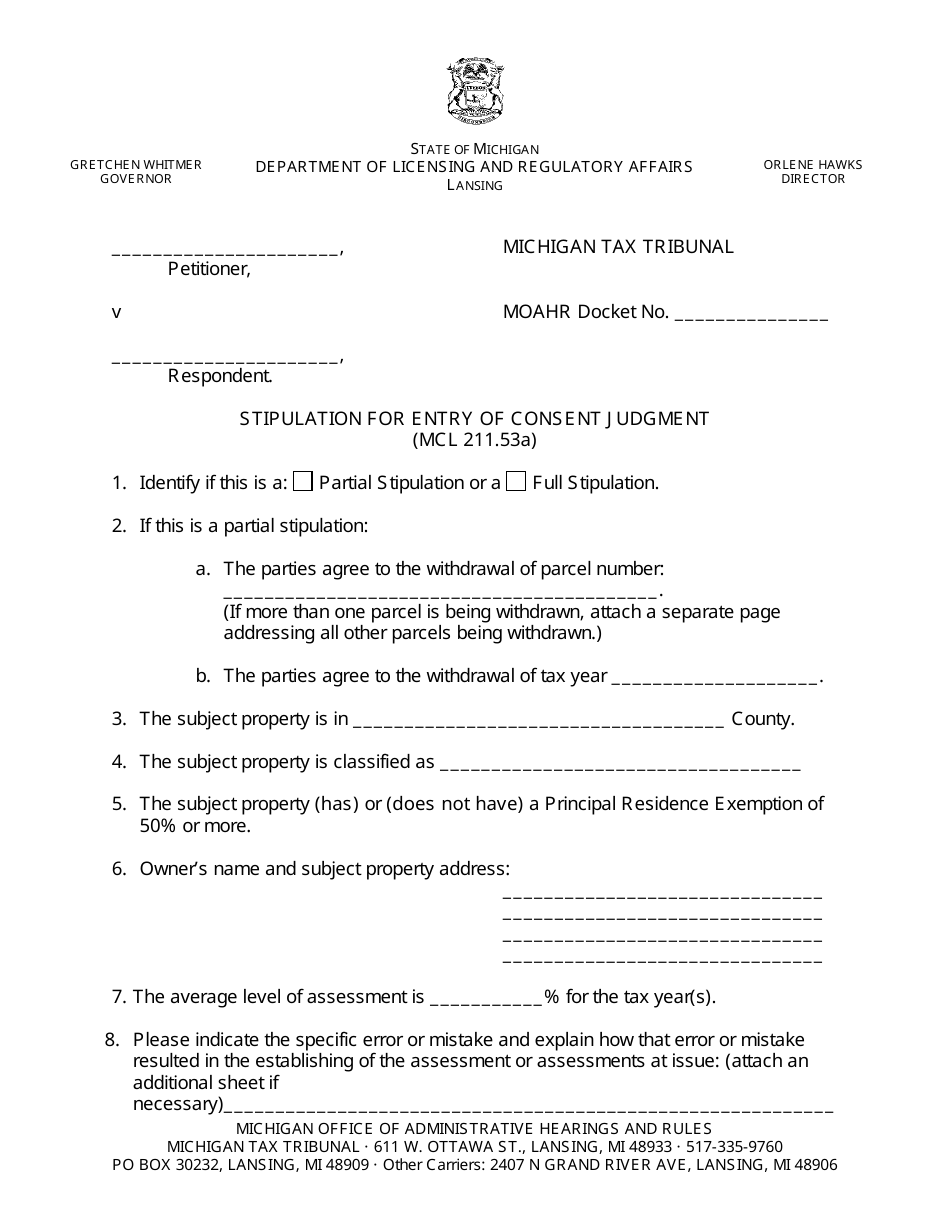

Michigan Stipulation For Entry Of Consent Judgment Mcl 211 53a Fill Out Sign Online And

https://data.templateroller.com/pdf_docs_html/2601/26012/2601202/stipulation-for-entry-of-consent-judgment-mcl-211-53a-michigan_print_big.png

https://www.michigan.gov/treasury/-/media/Project/Websites/treasury/STC/2023/Disabled-Veterans-Exemption-FAQ-w-samples---Revised-1424.pdf?rev=2d647054d1404594b522924f10f22675&hash=34B5C80C329A16C91F330A56BA63428B

MCL 211 7b 1 a provides an exemption from property taxes under the General Property Tax Act for real property owned and used as a homestead by a disabled

https://www.michigan.gov/taxes/property/exemptions/veterans/disabled-veterans-exemption

Disabled Veterans Exemption In accordance with MCL 211 7b real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or the disabled veteran s un remarried surviving spouse MCL 211 7b For more information on the Disabled Veterans Exemption

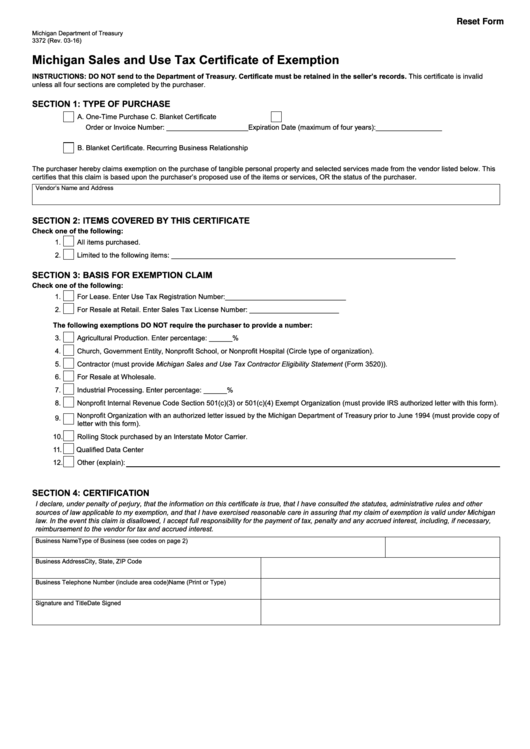

Michigan Fillable Form 3372 Printable Forms Free Online

Printable Form Mcl 211 7b State Of Michgian Printable Forms Free Online

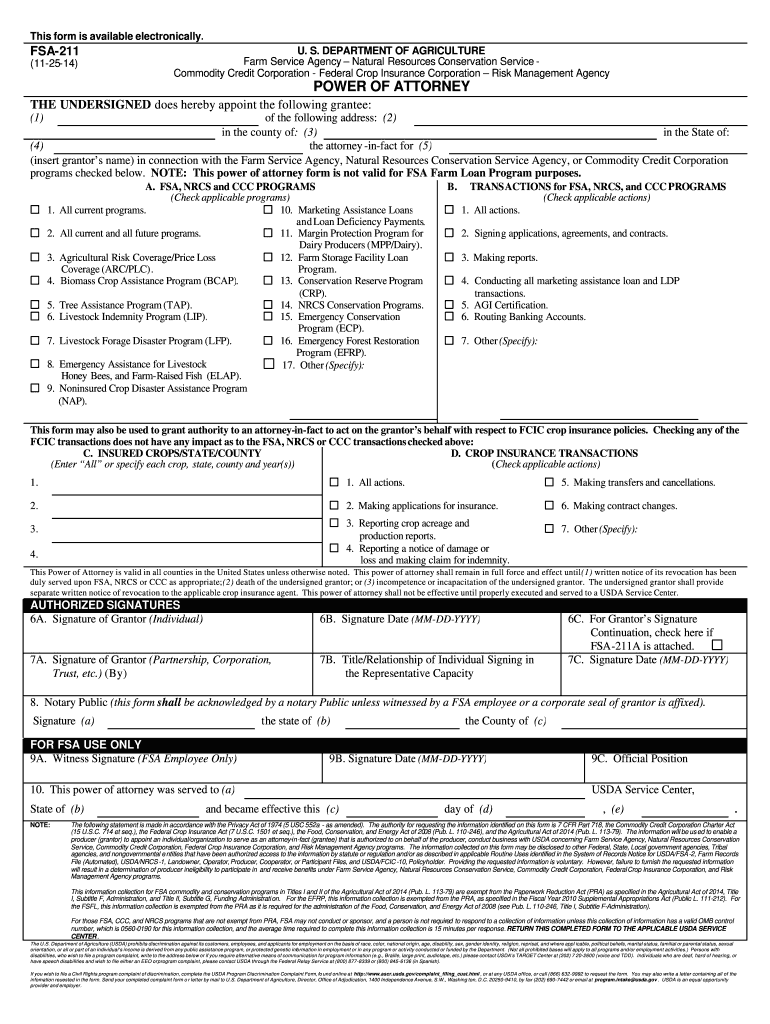

Fsa 211 2014 2023 Form Fill Out And Sign Printable PDF Template SignNow

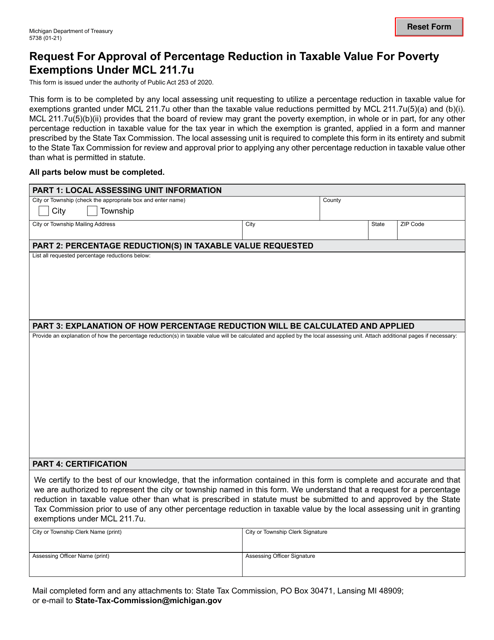

Form 5738 Fill Out Sign Online And Download Fillable PDF Michigan Templateroller

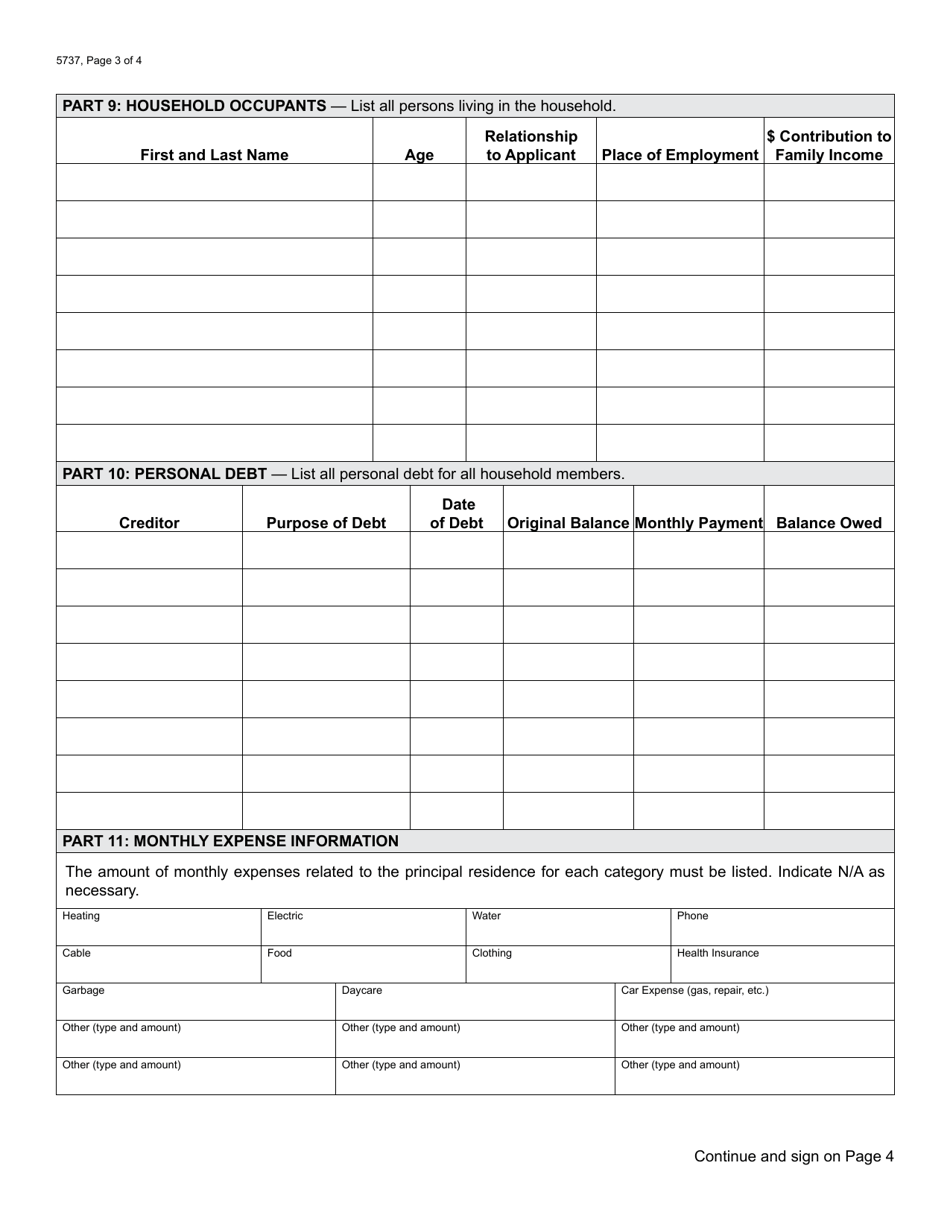

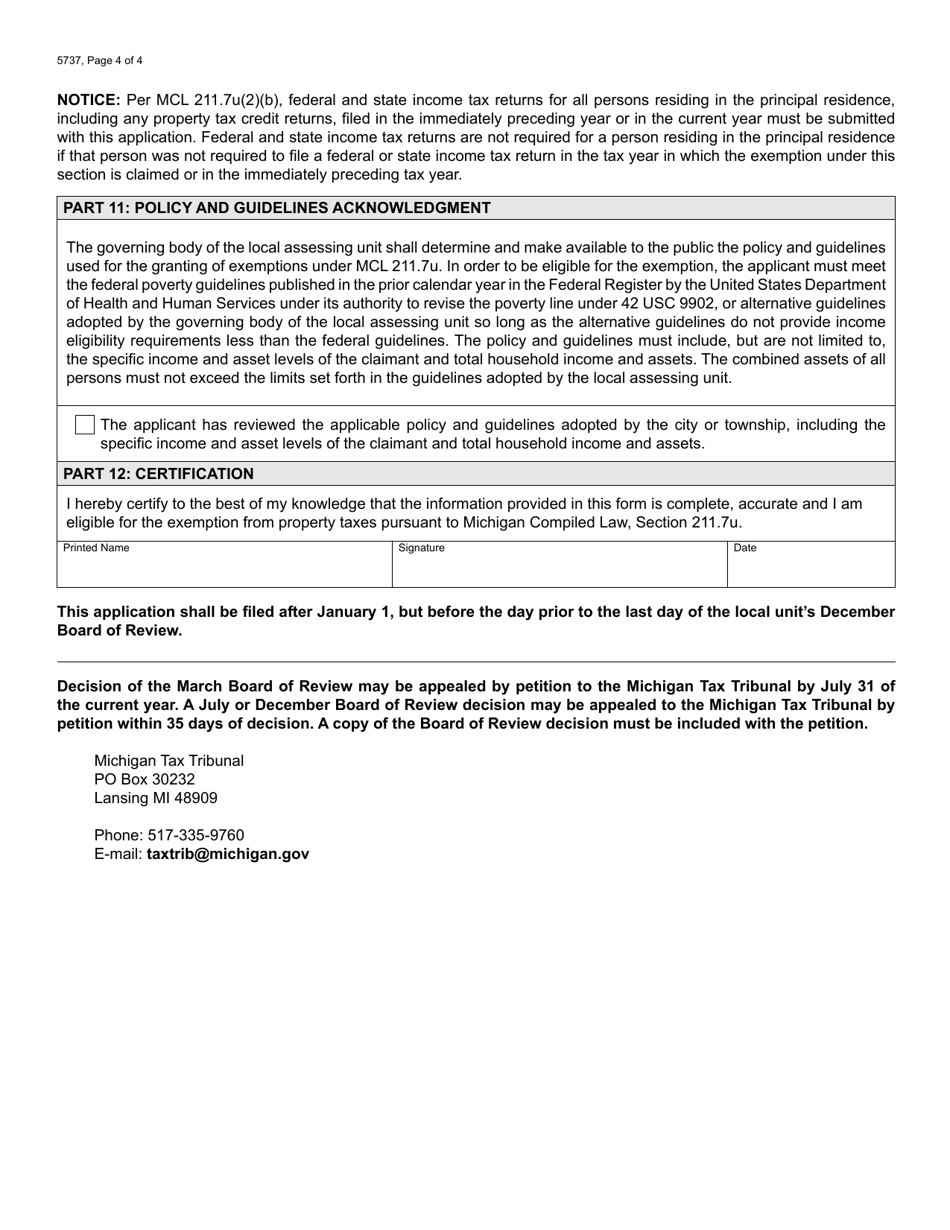

Form 5737 Download Fillable PDF Or Fill Online Application For Mcl 211 7u Poverty Exemption

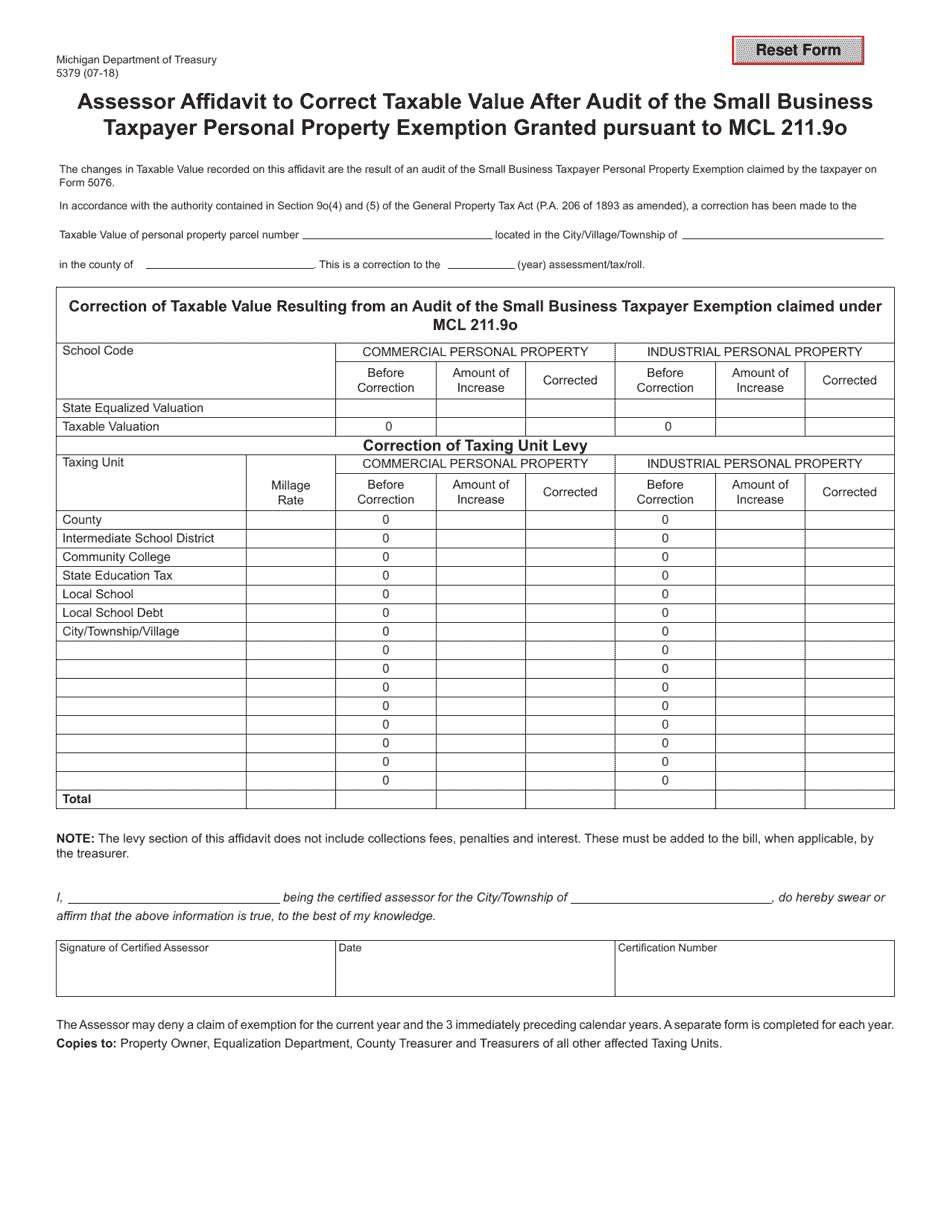

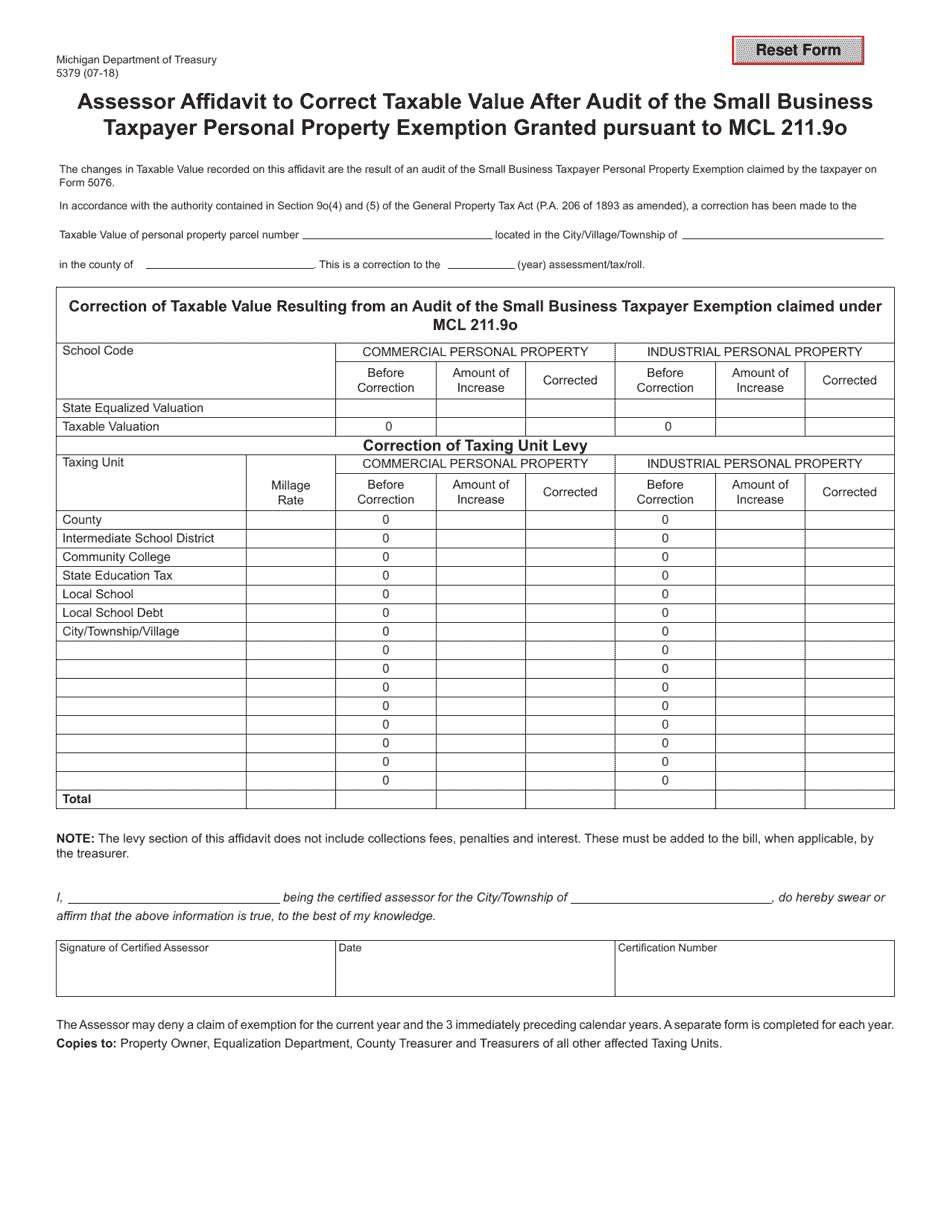

Form 5379 Fill Out Sign Online And Download Fillable PDF Michigan Templateroller

Form 5379 Fill Out Sign Online And Download Fillable PDF Michigan Templateroller

Small Business Property Tax Exemption Claim Under MCL 211 Fill Out And Sign Printable PDF

Form 5737 Download Fillable PDF Or Fill Online Application For Mcl 211 7u Poverty Exemption

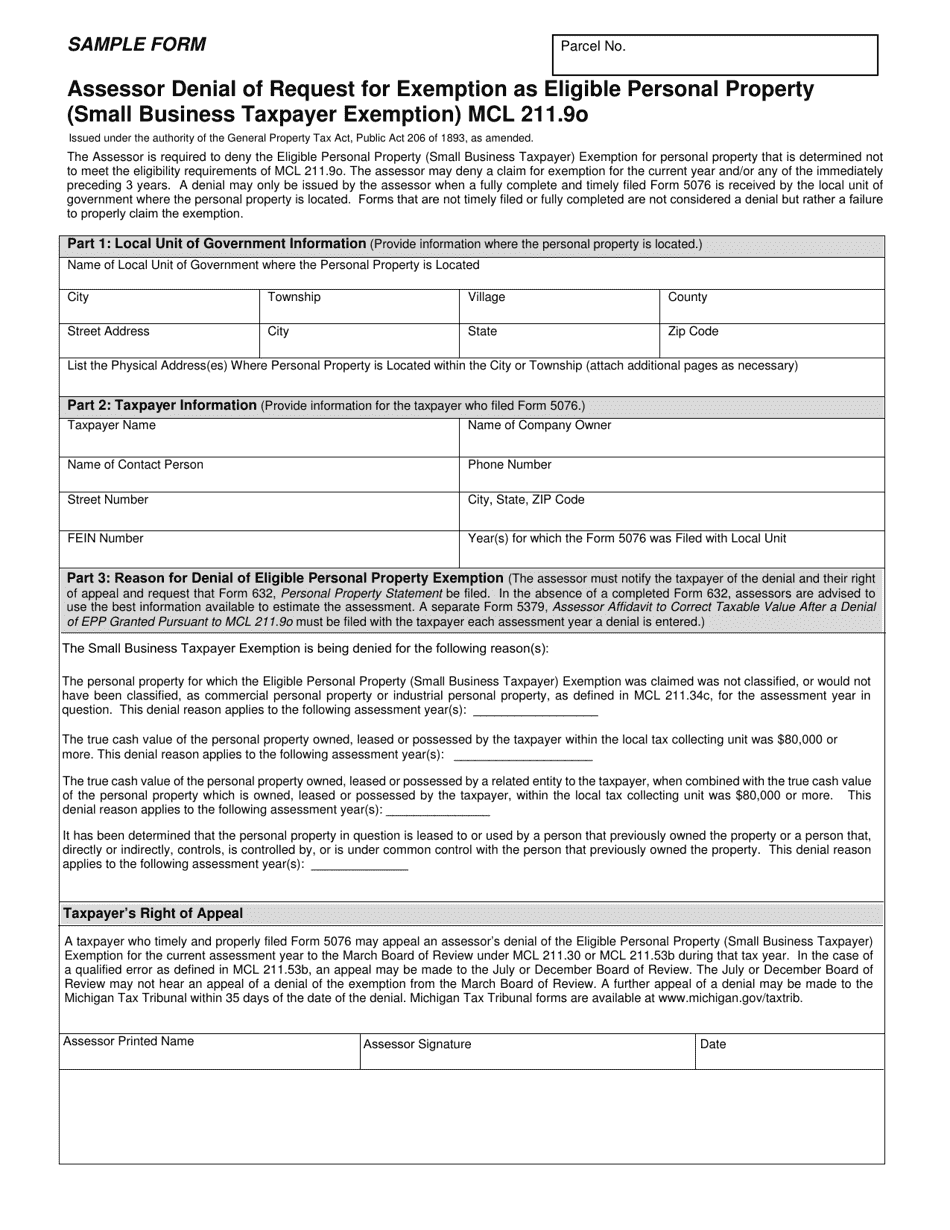

Michigan Assessor Denial Of Request For Exemption As Eligible Personal Property Small Business

Printable Form Mcl 211 7b State Of Michgian - Page 5 Appeal Rights A written denial by the assessor may be appealed by completing and submitting a petition to the Michigan Tax Tribunal within 35 days of the date of the denial