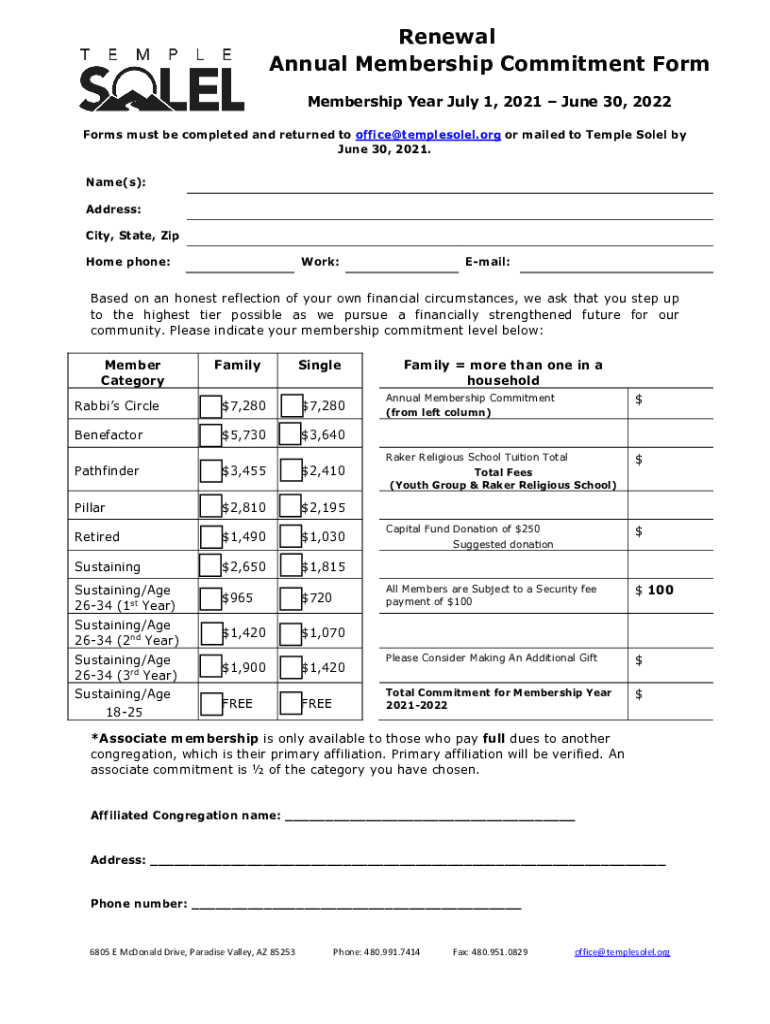

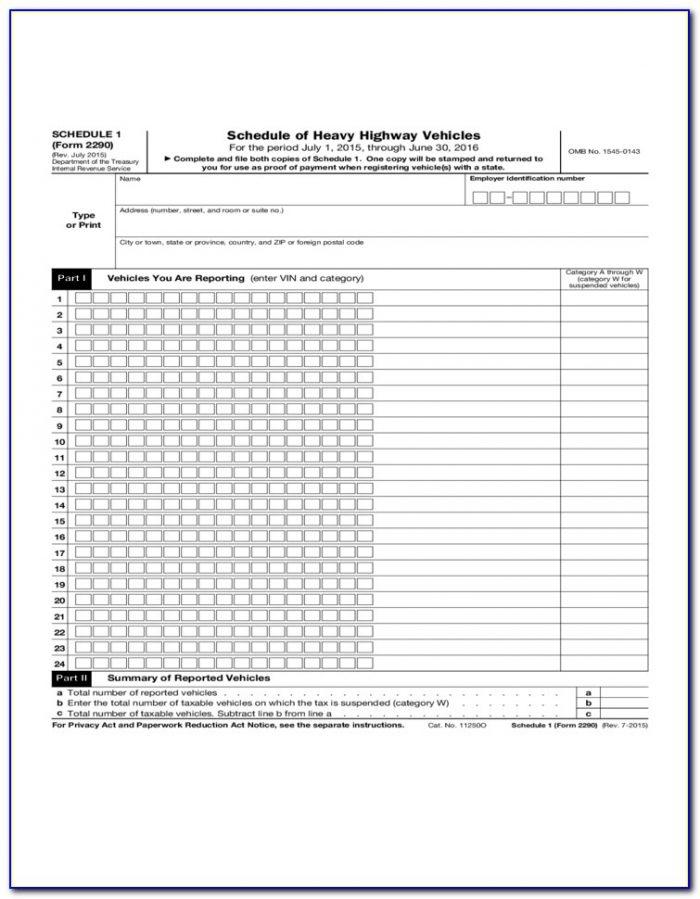

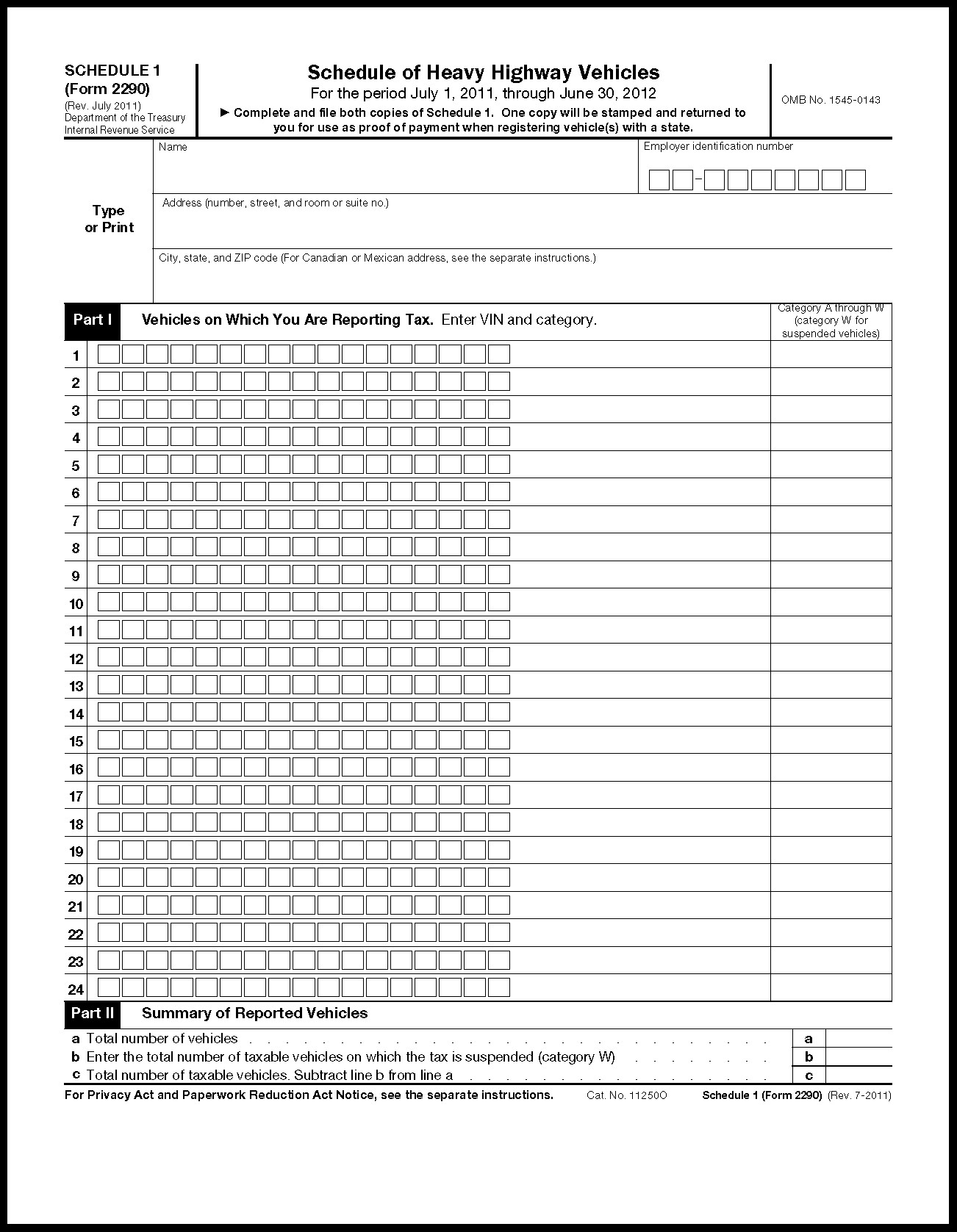

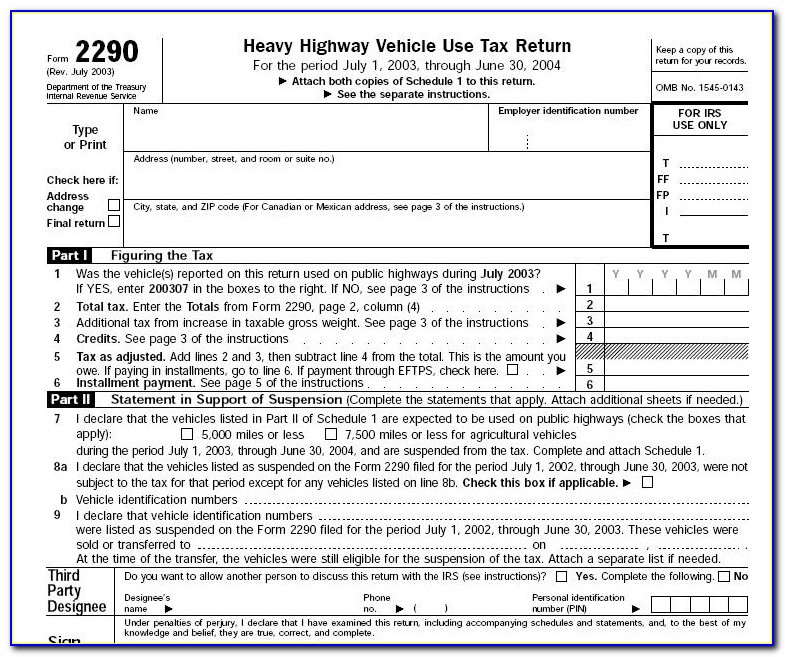

Printable Heavy Road Use Tax Form 2290 Rev July 2021 Heavy Highway Vehicle Use Tax Return Department of the Treasury Internal Revenue Service 99 For the period July 1 2021 through June 30 2022 Attach both copies of Schedule 1 to this return Go to www irs gov Form2290 for instructions and the latest information Keep a copy of this return for your records

What is Road Tax Form 2290 If you own and operate a heavy highway motor vehicle with a taxable gross weight of 55 000 pounds or more then you must file road tax form 2290 and pay the Heavy Vehicle Use Tax failure to which leads to IRS penalties Complete and attach Schedule 1 I declare that the vehicles listed as suspended on the Form 2290 filed for the period July 1 2019 through June 30 2020 were not subject to the tax for that period except for any vehicles listed on line 8b

Printable Heavy Road Use Tax Form

Printable Heavy Road Use Tax Form

https://www.formsbirds.com/formimg/individual-income-tax/2710/heavy-highway-vehicle-use-tax-return-l8.png

Fillable Online 2290 Heavy Highway Vehicle Use Tax Return IRS Tax Forms Fax Email Print

https://www.pdffiller.com/preview/576/890/576890172/large.png

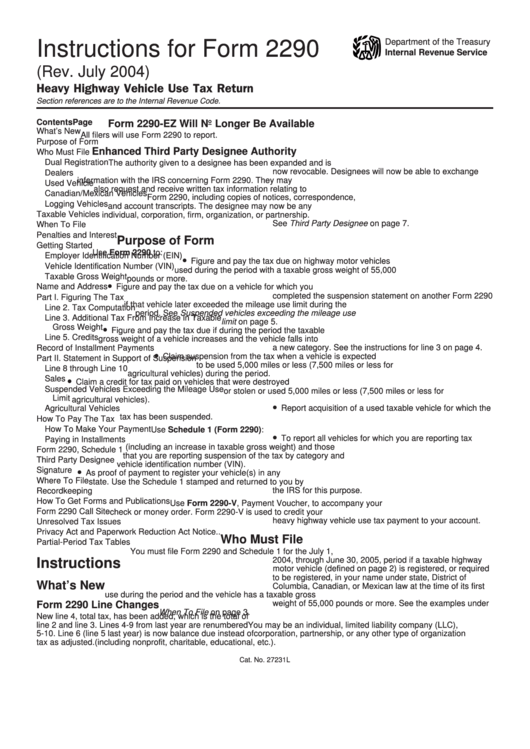

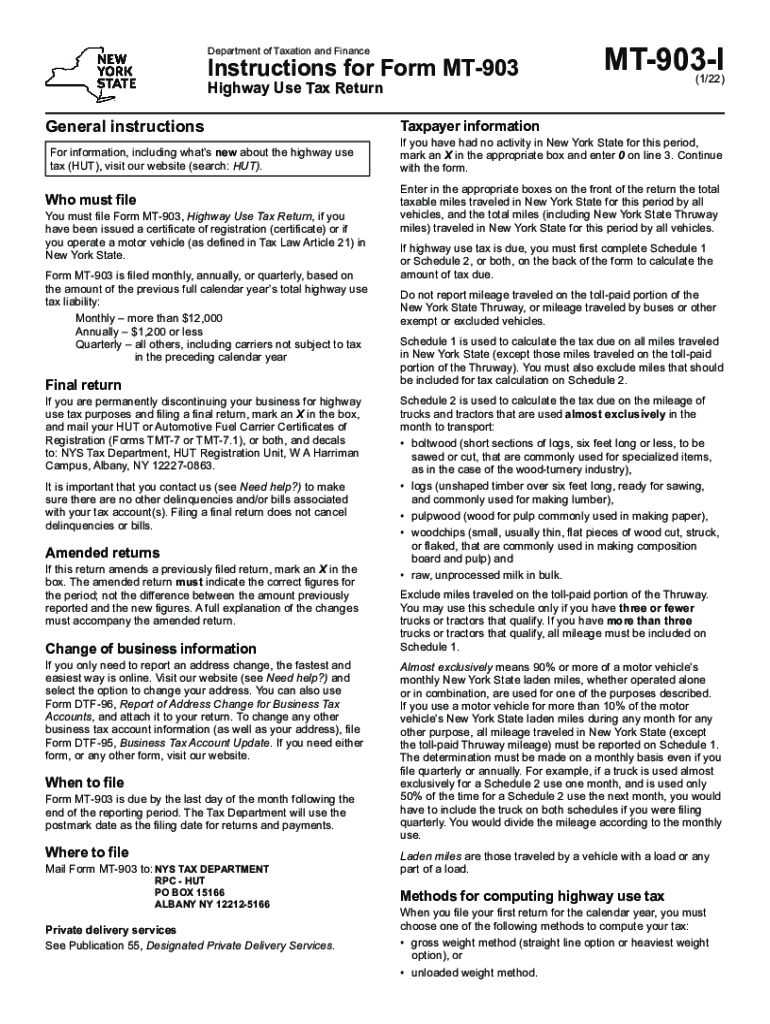

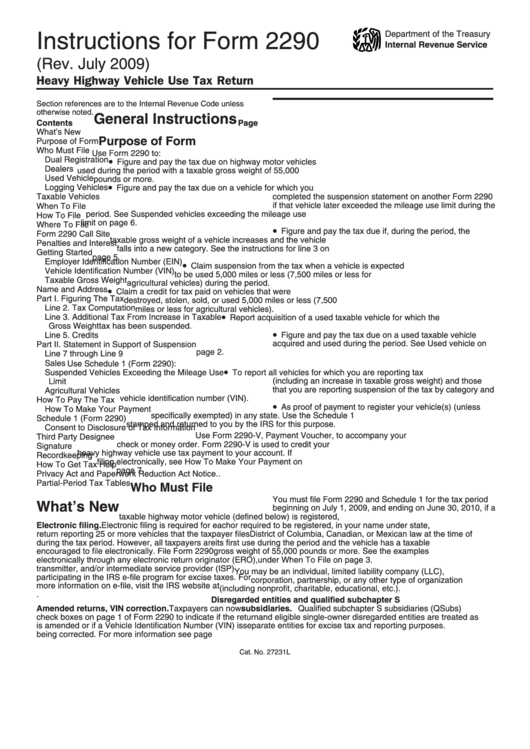

Instructions For Form 2290 Heavy Highway Vehicle Use Tax Return 2004 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/251/2516/251604/page_1_thumb_big.png

Form 2290 Heavy Highway Vehicle Use Tax Return is generally used by those who own or operate a highway motor vehicle with a taxable gross weight of 55 000 pounds or more A highway motor vehicle for use tax purposes is defined inside the instructions booklet As we mentioned in the previous slide the tax is paid at the time the 2290 is due The Heavy Highway Vehicle Use Tax is a graduated tax meaning the heavier the register weight the more taxes owed The Heavy Highway Vehicle Use Tax for a full year ranges from 100 to 550 And the tax is prorated for partial years

The Heavy Highway Vehicle Use Tax or HVUT 2290 is a federal tax imposed on vehicles with a taxable gross weight of 55 000 pounds or more The taxable gross weight is the actual weight of the vehicle that is fully equipped for service without load The HVUT is paid using IRS Form 2290 which can be filed electronically through an IRS approved e 1 Employer Identification Number EIN 2 Vehicle Identification Number of Each Vehicle VIN 3 Taxable Gross Weight of Each Vehicle File Form 2290 Now Government Required 2290 E Filing Now you can electronically file or e file your heavy vehicle use tax HVUT Form 2290 for any vehicle over 55 000 pounds

More picture related to Printable Heavy Road Use Tax Form

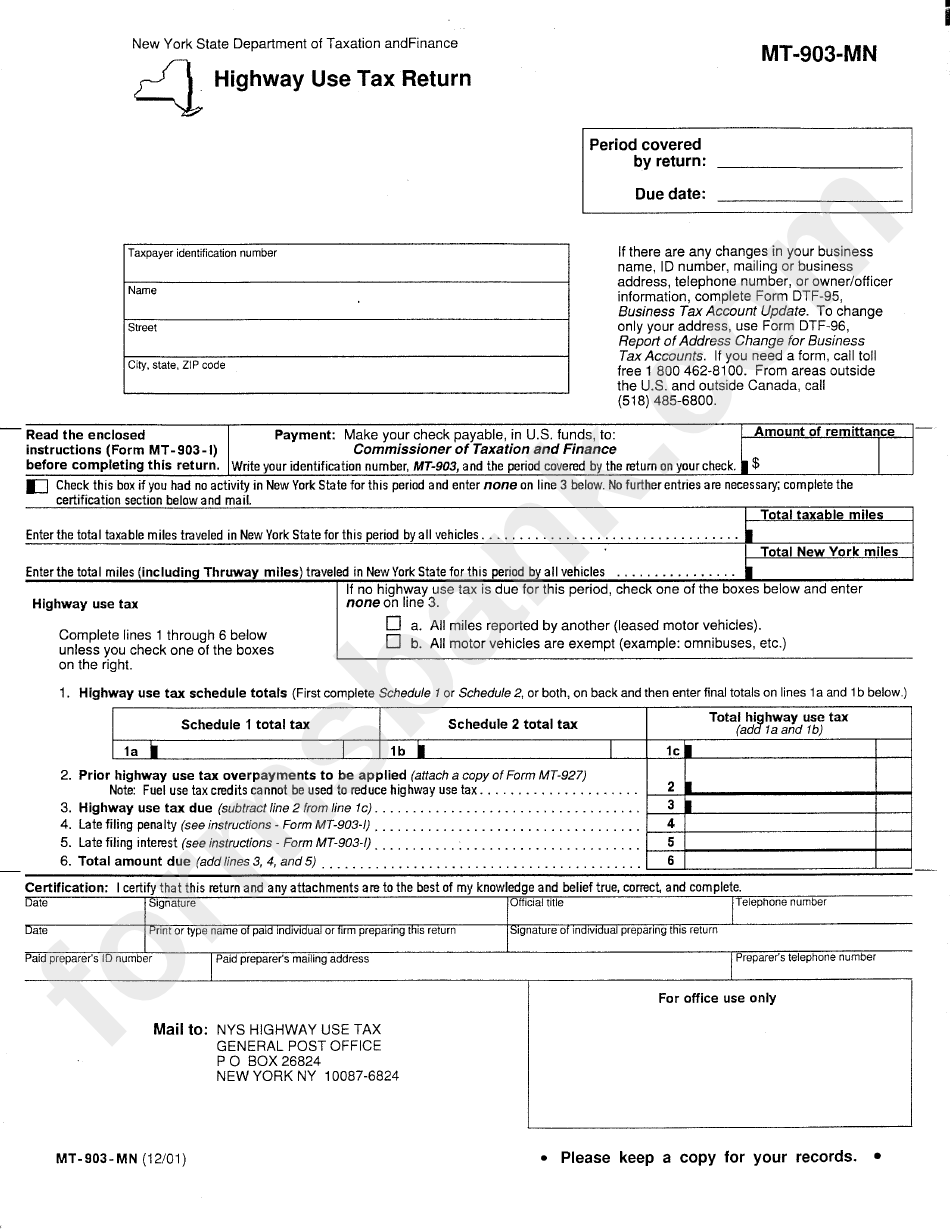

Form Mt 903 Mn Highway Use Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/263/2633/263312/page_1_bg.png

Mt 903 2022 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/596/152/596152261/large.png

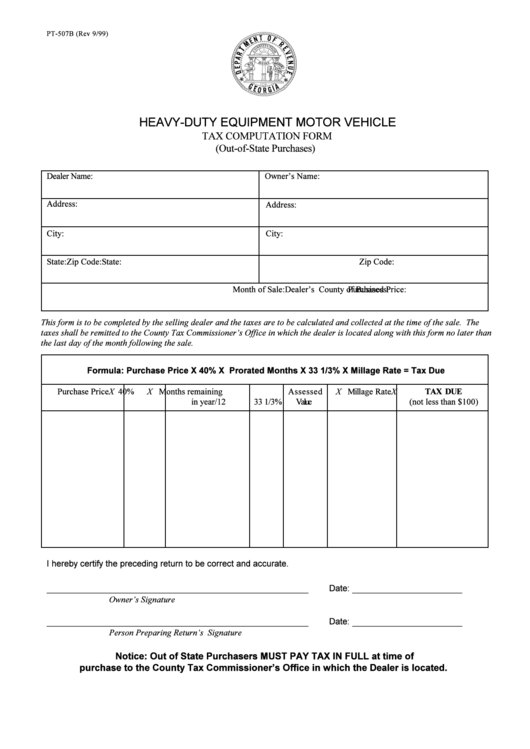

Form Pt 507b Heavy Duty Equipment Motor Vehicle Tax Computation Form Georgia Department Of

https://data.formsbank.com/pdf_docs_html/198/1987/198795/page_1_thumb_big.png

Form 2290 is due Tuesday August 31st 2021 This summer we re open 7 days a week to help you We re working the weekends because we know you do too Give us a call any time and we ll be happy to help you file 909 596 0050 Don t be late File Today Credit Card The Heavy Highway Vehicle Use Tax or IRS Form 2290 is a tax imposed by IRS on highway motor vehicles that has a gross weight of 55 000 pounds or more Services Heavy Highway Vehicle Use Tax FHUT or HVUT 2290 or Road Taxes are just some of the names used for this tax Owner operators contact ATBS every year with questions about this

Heavy Highway Vehicle Use Tax HVUT and IRS validated proof of payment Heavy Highway Motor Vehicles with a taxable gross vehicle weight GVW of 55 000lbs or greater Taxable Vehicles are required to provide an Internal Revenue Service IRS receipted Schedule 1 of Form 2290 as proof of payment of Heavy Highway Vehicle Use Tax HVUT prior to and as a condition of Highway Motor Heavy Vehicle Use Tax Exemption Valid for the current tax year July 1st to June 30th Year MC 2290 Rev 8 15 Year This form must be completed by the requested owner or his agent to exempt the following listed vehicle s from the IRS 2290 Heavy Vehicle Use Tax Name and Address of Registered Owner

Printable 2290 Form Customize And Print

https://www.universalnetworkcable.com/wp-content/uploads/2019/02/2290-heavy-highway-tax-form-2017.jpg

Heavy Highway Vehicle Use Tax Return Free Download

https://www.formsbirds.com/formhtml/a48b0ecbc6a9c3da67eb/f2290711791c1040c0429521b/bg5.png

https://www.irs.gov/pub/irs-access/f2290_accessible.pdf

2290 Rev July 2021 Heavy Highway Vehicle Use Tax Return Department of the Treasury Internal Revenue Service 99 For the period July 1 2021 through June 30 2022 Attach both copies of Schedule 1 to this return Go to www irs gov Form2290 for instructions and the latest information Keep a copy of this return for your records

https://www.eform2290.com/instructions/form-2290/2290-road-tax/

What is Road Tax Form 2290 If you own and operate a heavy highway motor vehicle with a taxable gross weight of 55 000 pounds or more then you must file road tax form 2290 and pay the Heavy Vehicle Use Tax failure to which leads to IRS penalties

Heavy Highway Use Tax Form 2290 Due Date Form Resume Examples 3nOlRnYDa0

Printable 2290 Form Customize And Print

Heavy Highway Use Tax Form 2290 Due Date Form Resume Examples 3nOlRnYDa0

Instructions For Form 2290 Heavy Highway Vehicle Use Tax Return 2009 Printable Pdf Download

Download Heavy Highway Vehicle Use Tax Return Form For Free Page 8 FormTemplate

Printable Heavy Road Use Tax Form Printable Forms Free Online

Printable Heavy Road Use Tax Form Printable Forms Free Online

File IRS Form 2290 Online Heavy Vehicle Use Tax HVUT Return

File IRS Form 2290 Online Heavy Vehicle Use Tax HVUT Return

Heavy Highway Vehicle Use Tax Return Free Download

Printable Heavy Road Use Tax Form - E File Form 2290 Heavy Vehicle Use Tax Print and use to get your tags Electronic Filing Anyone who registers a heavy highway motor vehicle in their name with a gross weight of 55 000 pounds or more must file Form 2290 and pay road tax Typically owners of vans pickup trucks panel trucks and similar smaller trucks are not