Printable Idaho Employer Quarterly Unemployment Insurance Tax Report Form Idaho Department of Labor 4 1 2015 CT P UI EP 10 Review Quarterly Report Summary Report Summary takes you to your complete listing of online quarterly summaries Make a Payment takes you to options to pay See second image below and page 11 for payment options 000000000 00 0000000 General Employer Pending 208 000 0000 PO BOX 0000

Department of LaborUnemployment Insurance Tax Reporting Employers can report their quarterly unemployment insurance taxes make payments and edit their account information here Phone 208 332 3576 Ext 3794 Email karen rogers labor idaho gov Brenda Ellis UI tax support supervisor Phone 208 332 3576 Ext 4190 Email brenda ellis labor idaho gov The Idaho Department of Labor connects job seekers with employment opportunities supports workers through career and life transitions and administers state

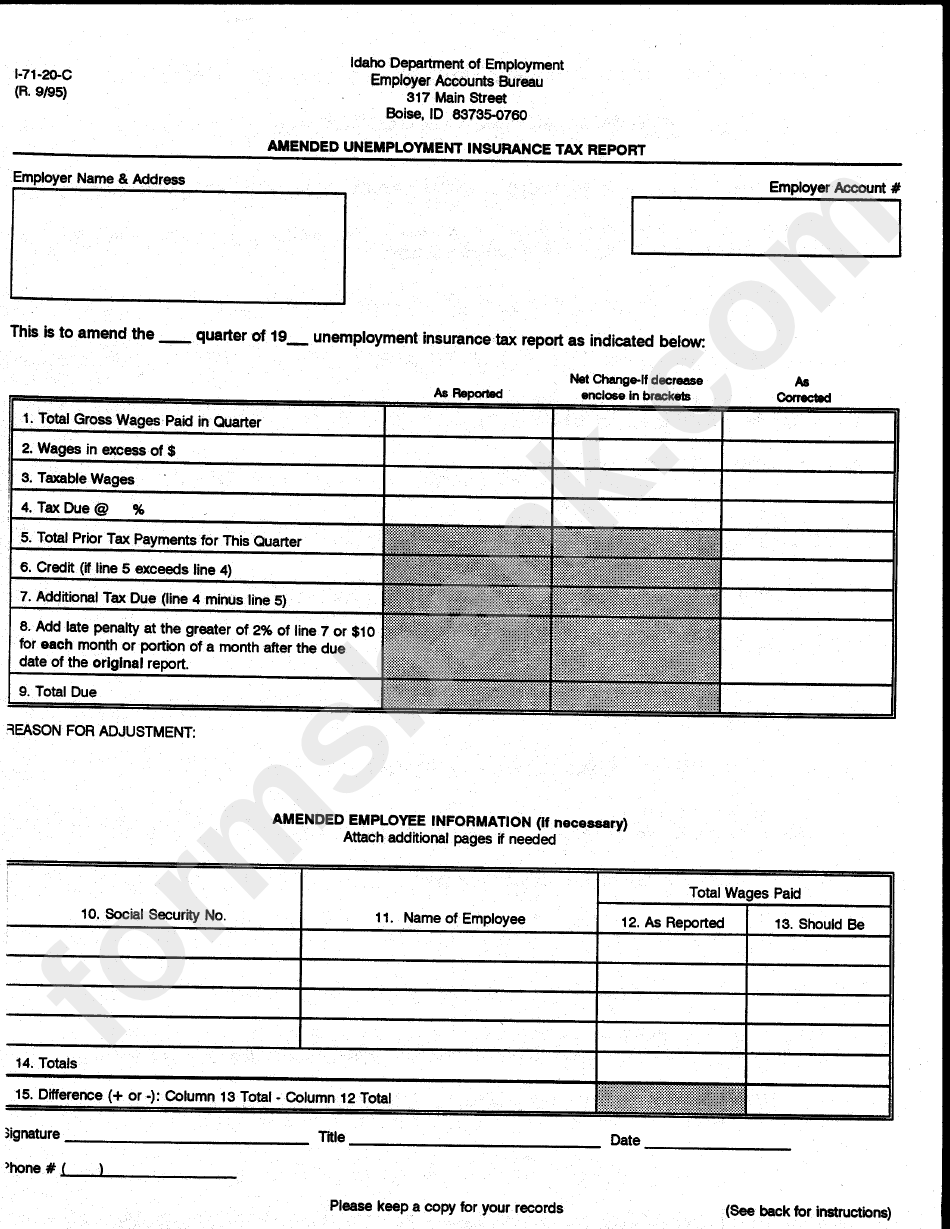

Printable Idaho Employer Quarterly Unemployment Insurance Tax Report Form

Printable Idaho Employer Quarterly Unemployment Insurance Tax Report Form

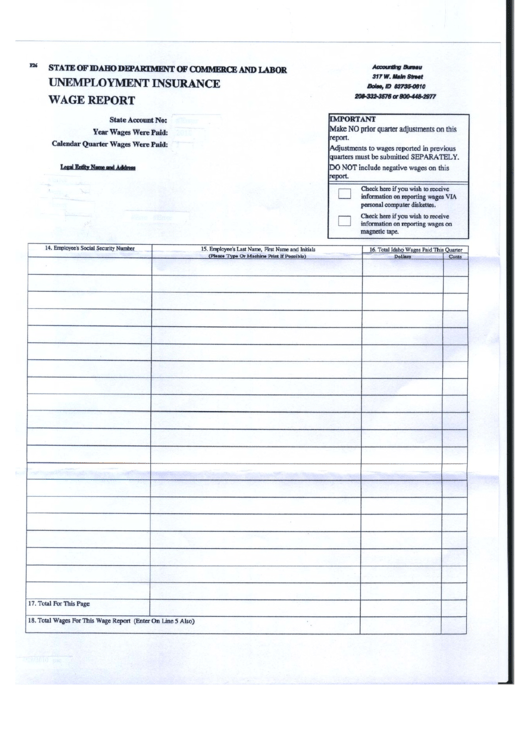

https://data.formsbank.com/pdf_docs_html/249/2490/249011/page_1_bg.png

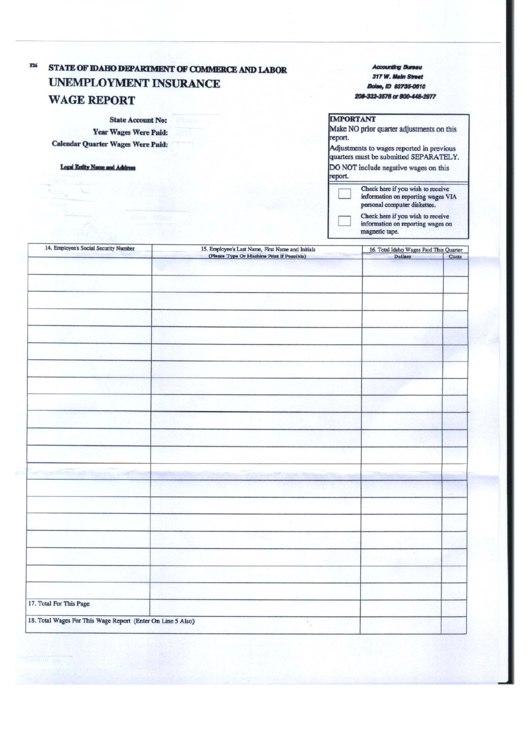

Form F 26 Unemployment Insurance Wage Report Form State Of Idaho Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/251/2512/251293/page_1_thumb_big.png

Wg15 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/97/100097350/large.png

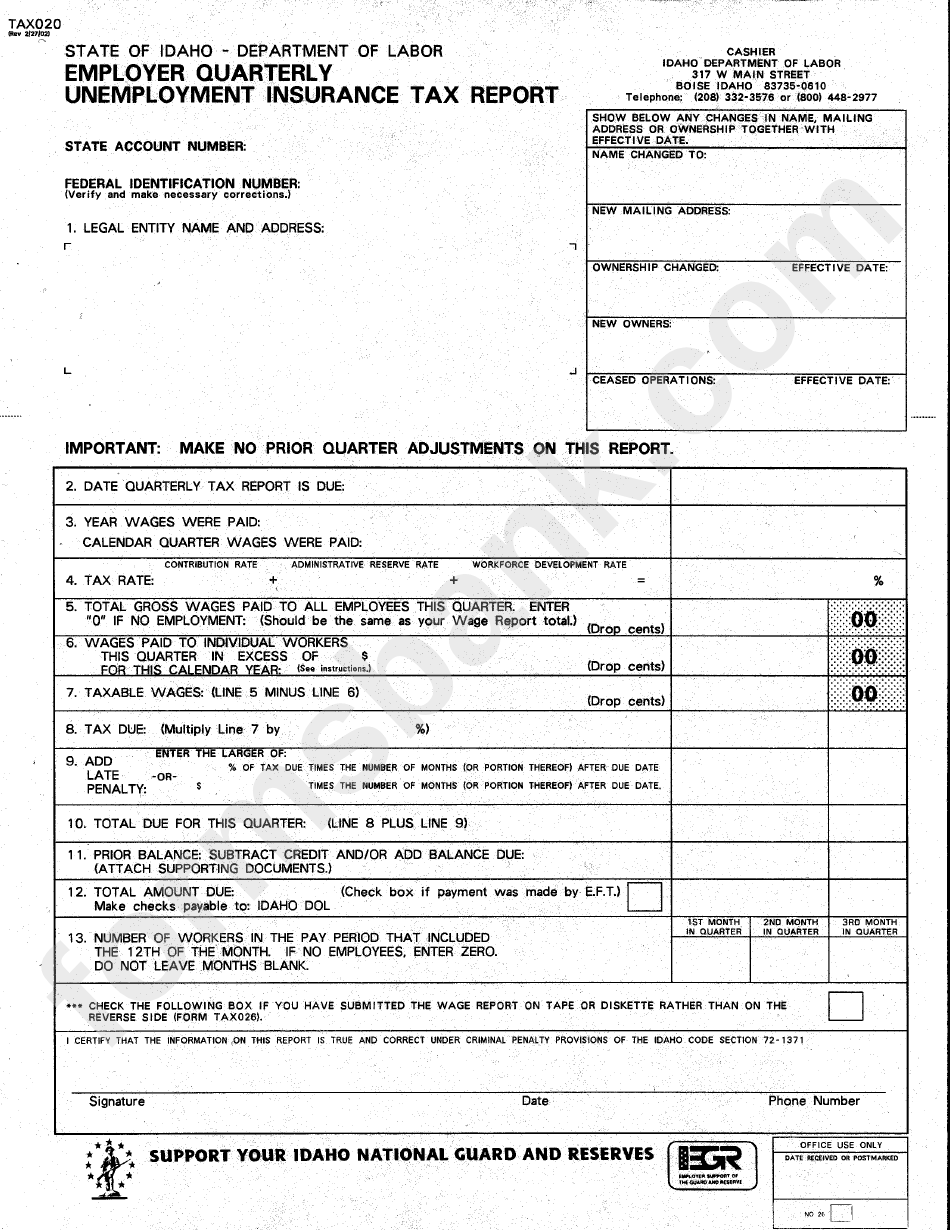

Please contact the Idaho State Tax Commission at 208 334 7660 800 972 7660 or the Internal Revenue Service at 800 829 1040 The Idaho Department of Labor connects job seekers with employment opportunities supports workers through career and life transitions and administers state labor laws Unemployment insurance tax must be paid on both cash and noncash wages 2 For agricultural employment unemployment insurance taxes are paid on cash and cash equivalent wages only Noncash wages not considered cash equivalents are not reportable Include H2 A workers wages to determine the coverage but do not pay unemployment insurance tax

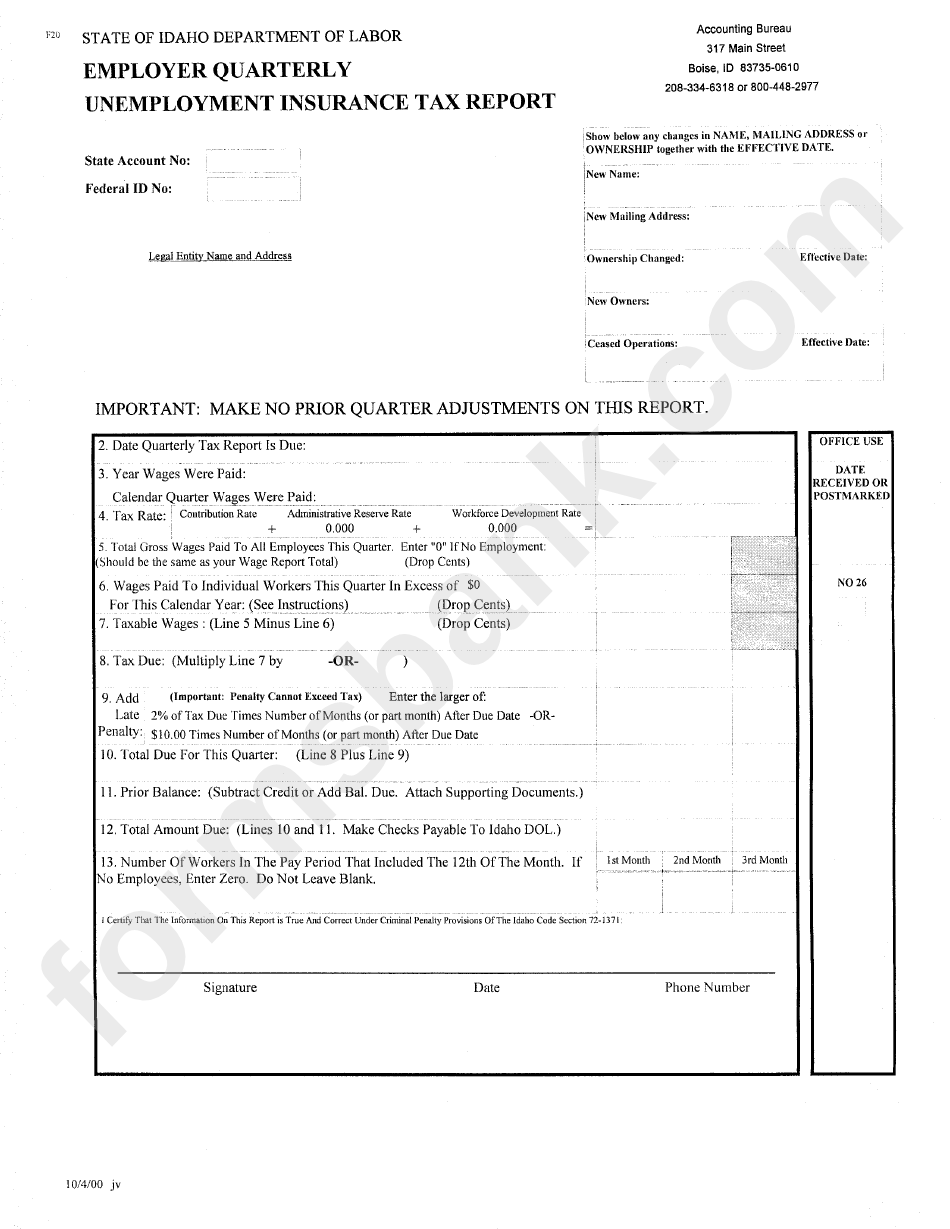

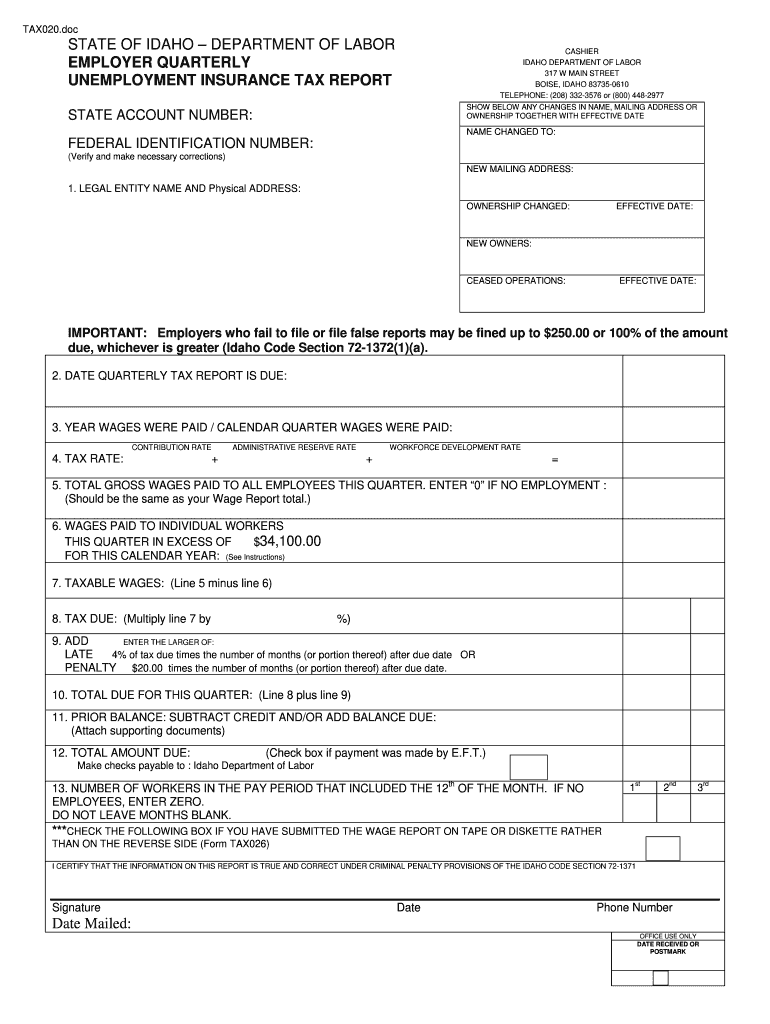

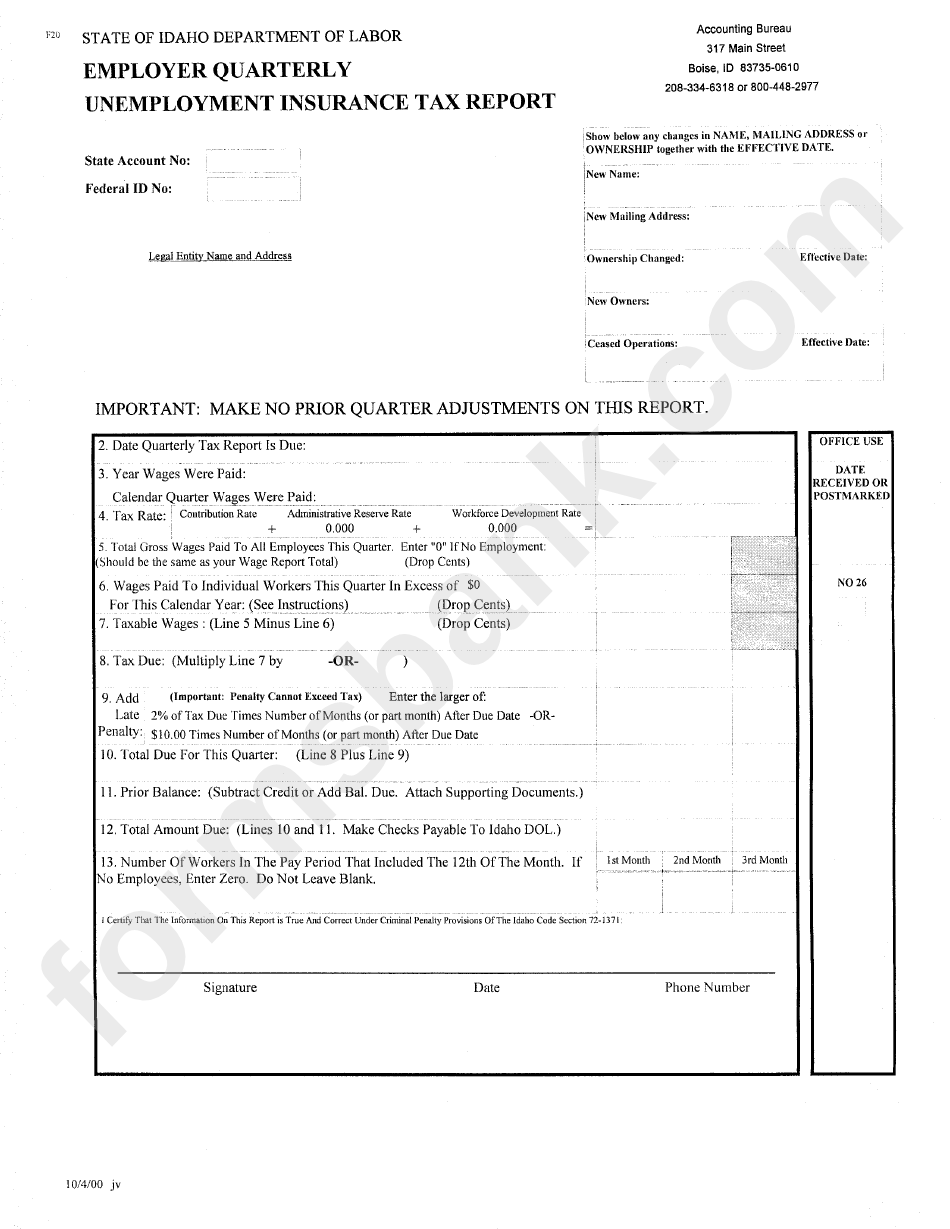

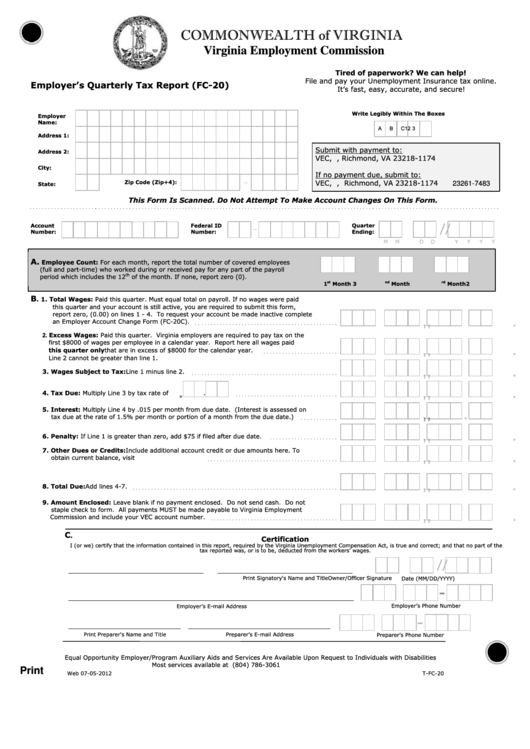

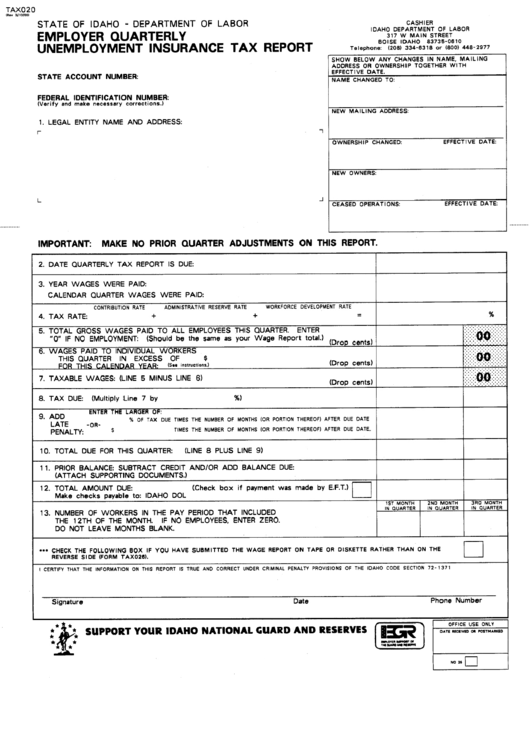

IMPORTANT Employers who fail to file or file false reports may be fined up to 250 00 or 100 of the amount due whichever is greater Idaho Code Section 72 1372 1 a 2 DATE QUARTERLY TAX REPORT IS DUE 3 YEAR WAGES WERE PAID CALENDAR QUARTER WAGES WERE PAID CONTRIBUTION RATE ADMINISTRATIVE RESERVE RATE WORKFORCE DEVELOPMENT RATE 4 Your account number can be found on your quarterly tax form by logging in to send a secure message to the Tax Department or by calling Employer Accounts at 208 332 3576 or 800 448 2977 Q Do I need to report a new employee who quit before I reported the employee as a new hire

More picture related to Printable Idaho Employer Quarterly Unemployment Insurance Tax Report Form

Form For Employee State Tax Idaho 2023 Employeeform

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/07/form-40-download-fillable-pdf-or-fill-online-idaho-individual-income.png

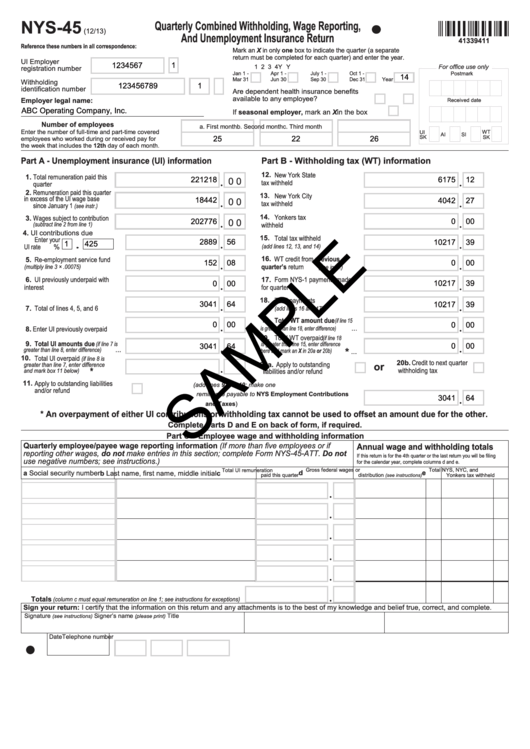

Printable Nys 45 Form Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/149/1494/149487/page_1_thumb_big.png

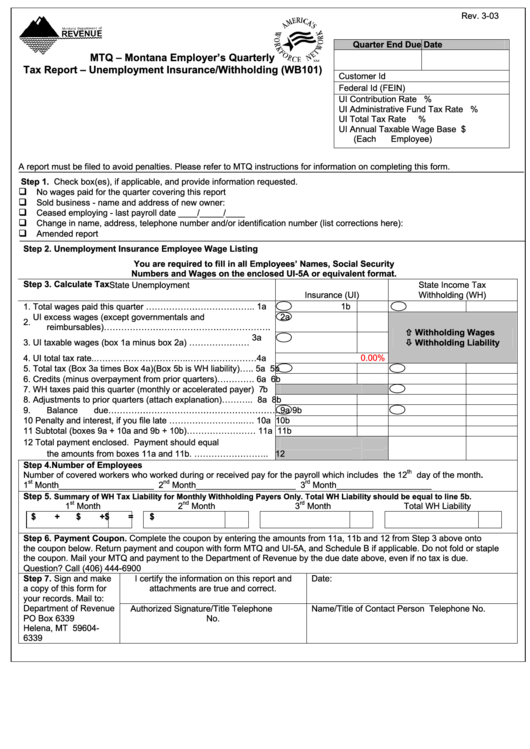

Fillable Form Wb101 Mtq Montana Employer S Quarterly Tax Report Unemployment Insurance

https://data.formsbank.com/pdf_docs_html/291/2919/291936/page_1_thumb_big.png

Welcome to Employer Portal with the Idaho Department of Labor Employer Portal is a self service system that allows each employer to securely manage unemployment insurance tax and benefits account information directly with the Idaho Department of Labor IDOL The Employer Portal User Guide has been created to help Idaho employers properly The Idaho Department of Labor connects job seekers with employment opportunities Report wages and pay taxes Report new hires Respond to claim information requests Login to Employer Portal Learn the steps to take if you did not apply for unemployment insurance benefits Job Search Search for a job Create an online profile with

Many new business owners do not realize that they are considered employees if they work in their business All corporations including s corps whose owner officers provide services to the business must open an unemployment insurance tax account with Idaho Department of Labor and either report wages or opt out as a corporate officer For filing to the Idaho Department of Labor DOL DAS produces A PDF copy of Form TAX 020 Employer Quarterly Unemployment Insurance Tax Report and Form TAX 026 Unemployment Insurance Wage Report A txt or csv file for e file Note All employers are required to file Idaho quarterly reports online

Employer Quarterly Unemployment Insurance Tax Report State Of Idaho Department Of Labor

https://data.formsbank.com/pdf_docs_html/269/2692/269201/page_1_bg.png

Idaho Effective Labor Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/86/100086939/large.png

https://www.labor.idaho.gov/wp-content/uploads/publications/EmployerPortal_ReportingGuide.pdf

Idaho Department of Labor 4 1 2015 CT P UI EP 10 Review Quarterly Report Summary Report Summary takes you to your complete listing of online quarterly summaries Make a Payment takes you to options to pay See second image below and page 11 for payment options 000000000 00 0000000 General Employer Pending 208 000 0000 PO BOX 0000

https://www2.labor.idaho.gov/UITaxReporting/(X(1)S(xliqdalck2stw43ravsbrx2q))/Login.aspx

Department of LaborUnemployment Insurance Tax Reporting Employers can report their quarterly unemployment insurance taxes make payments and edit their account information here

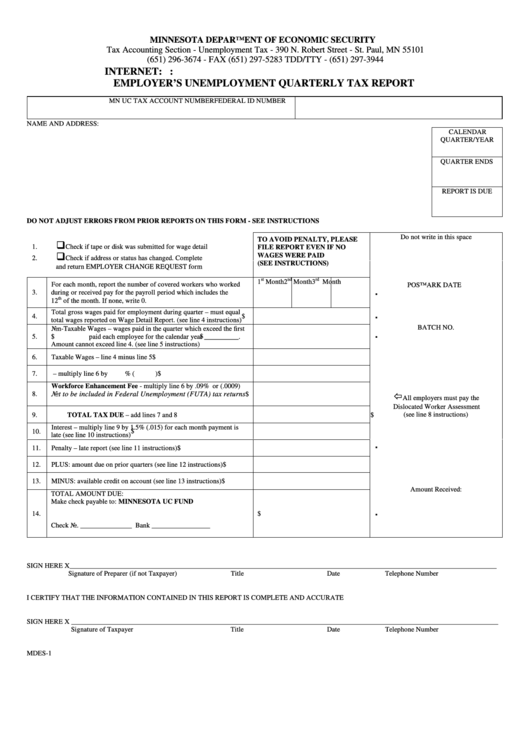

Form Mdes 1 Employer S Unemployment Quarterly Tax Report Printable Pdf Download

Employer Quarterly Unemployment Insurance Tax Report State Of Idaho Department Of Labor

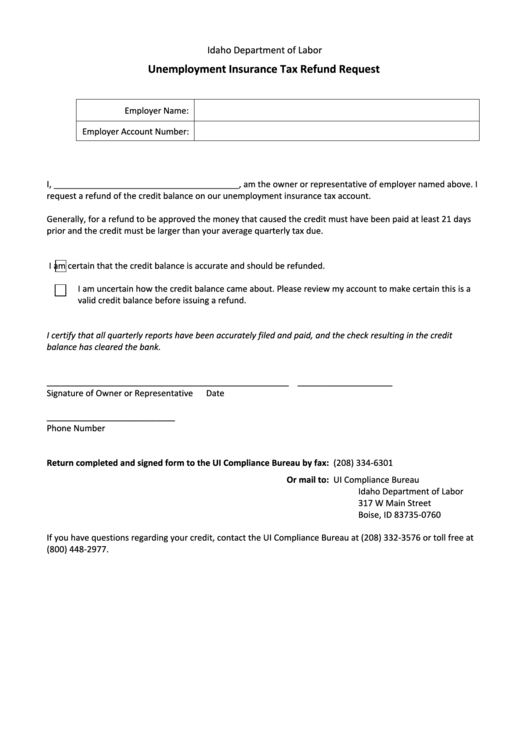

Unemployment Insurance Tax Refund Request Form Idaho Department Of Labor Printable Pdf Download

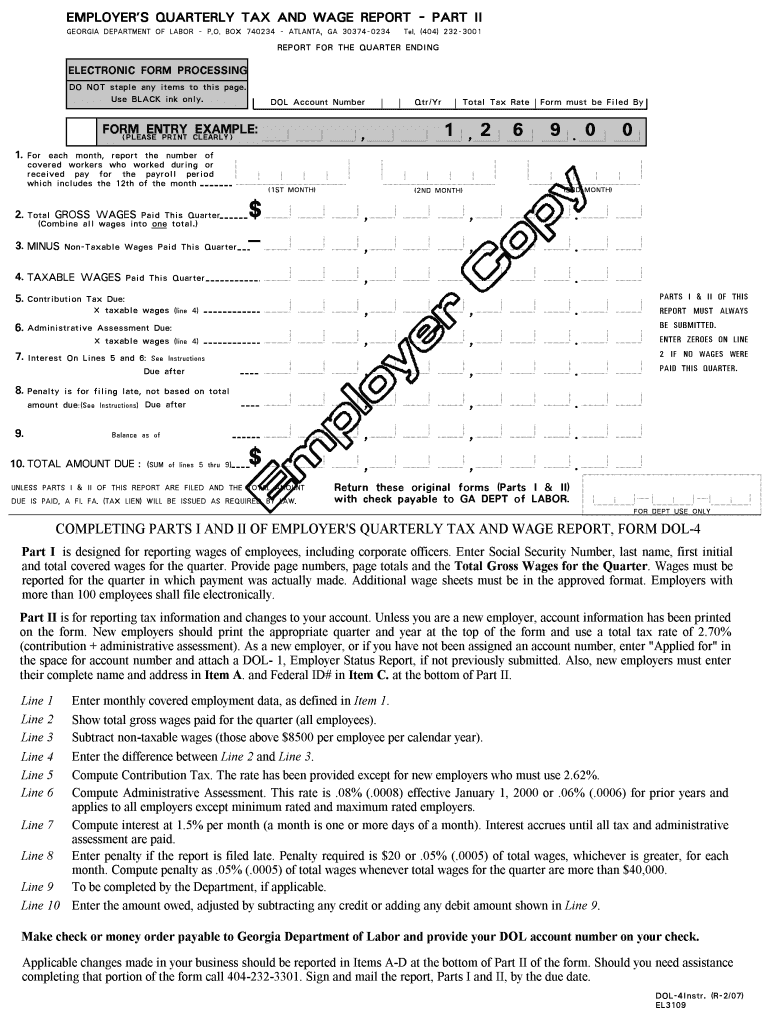

Fillable Form Fc 20 Employer S Quarterly Tax Report Printable Pdf Download

Unemployment Insurance Claim Application Financial Report

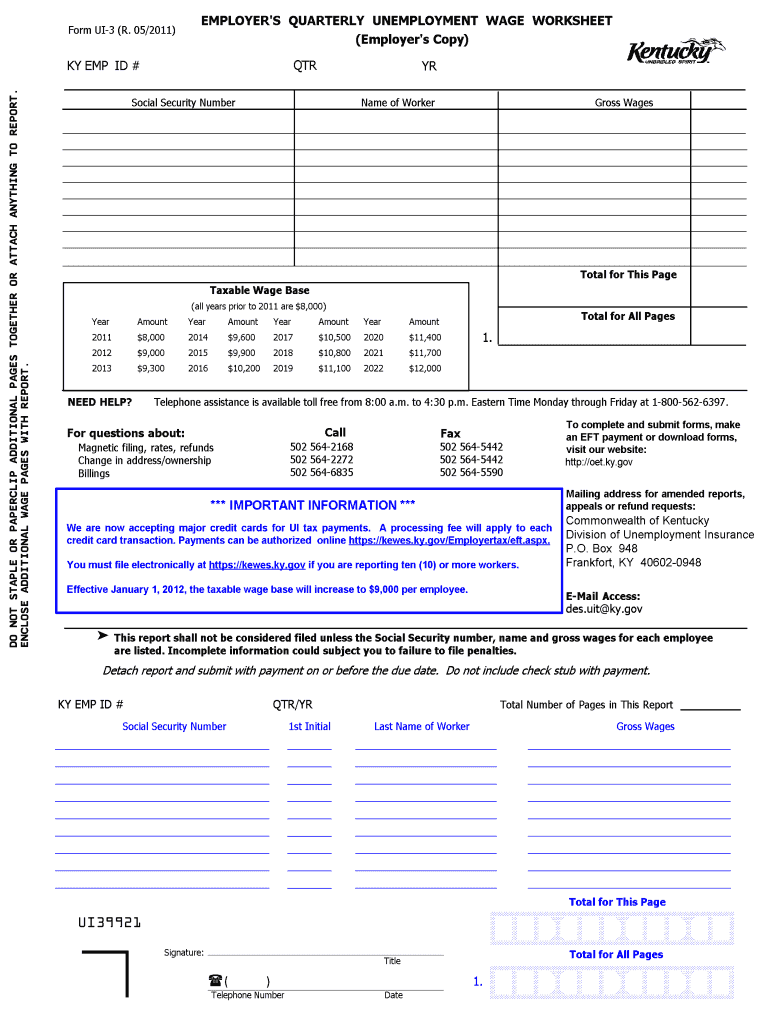

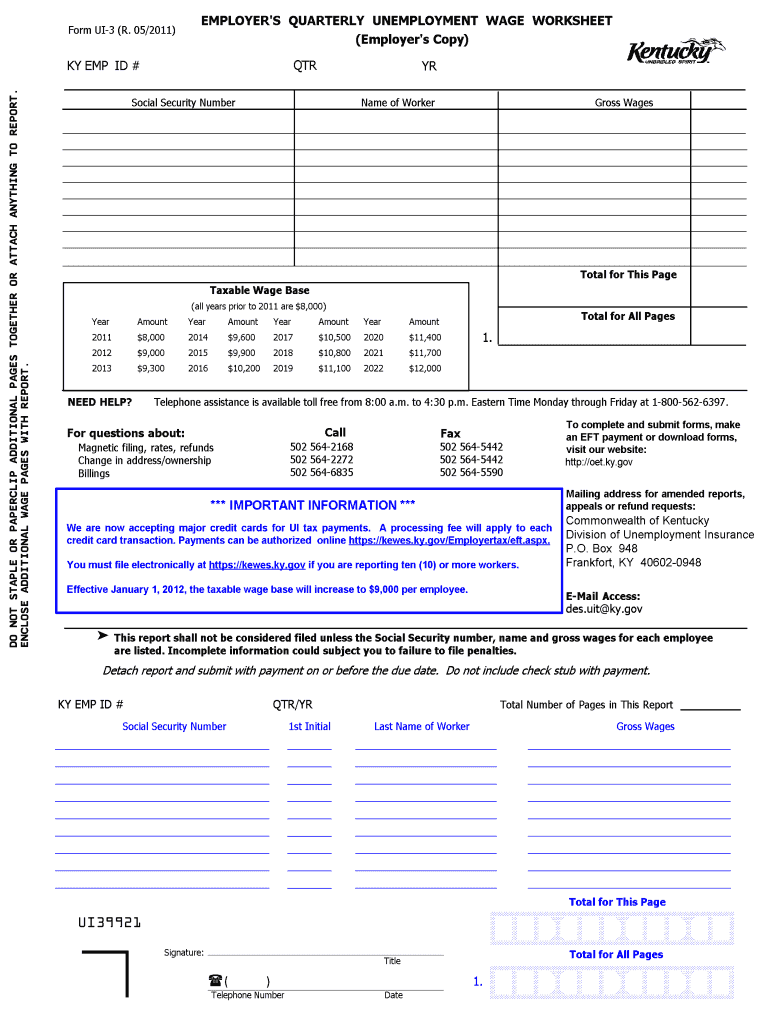

Employer s Quarterly Unemployment Wage Worksheet Form UI3 DocHub

Employer s Quarterly Unemployment Wage Worksheet Form UI3 DocHub

Form Tax020 Employer Quarterly Unemployment Insurance Tax Report Department Of Labor Idaho

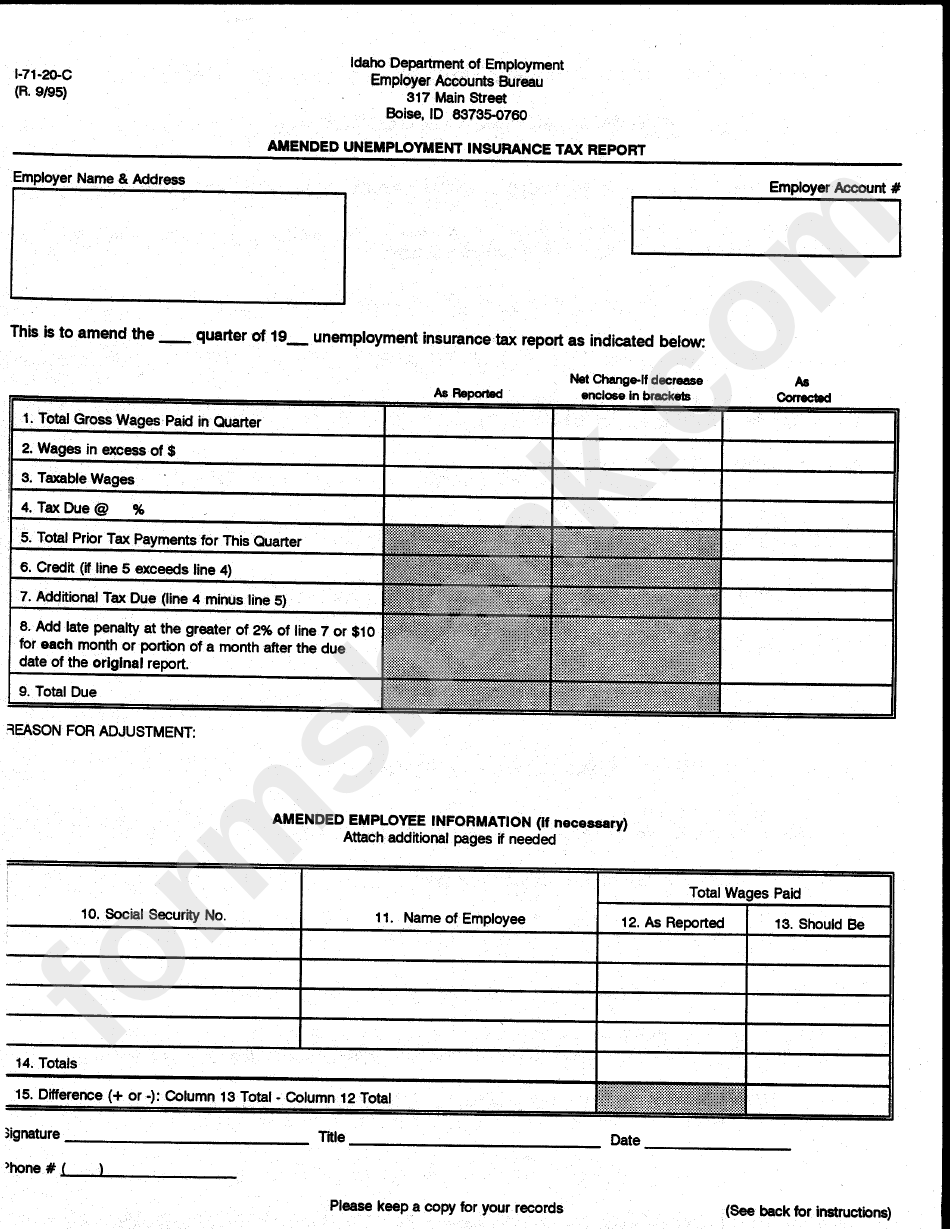

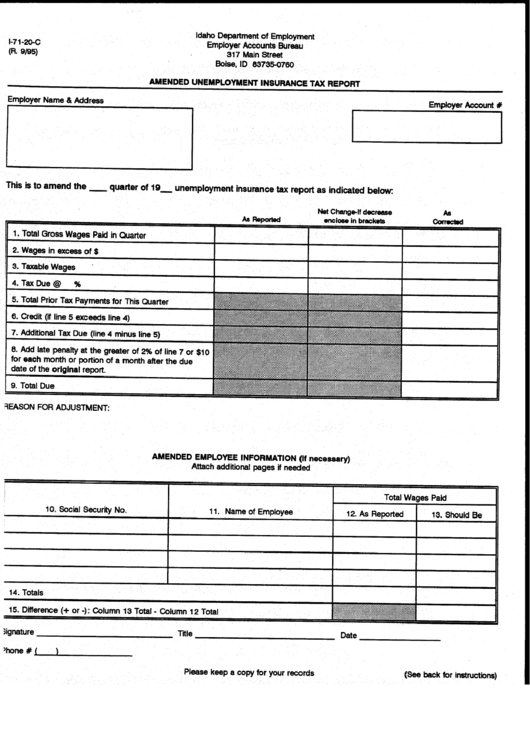

Form L 71 20 C Amended Unemployment Insurance Tax Report Idaho Department Of Employment

Form Tax020 Employer Quarterly Unemployment Insurance Tax Report Printable Pdf Download

Printable Idaho Employer Quarterly Unemployment Insurance Tax Report Form - IMPORTANT Employers who fail to file or file false reports may be fined up to 250 00 or 100 of the amount due whichever is greater Idaho Code Section 72 1372 1 a 2 DATE QUARTERLY TAX REPORT IS DUE 3 YEAR WAGES WERE PAID CALENDAR QUARTER WAGES WERE PAID CONTRIBUTION RATE ADMINISTRATIVE RESERVE RATE WORKFORCE DEVELOPMENT RATE 4