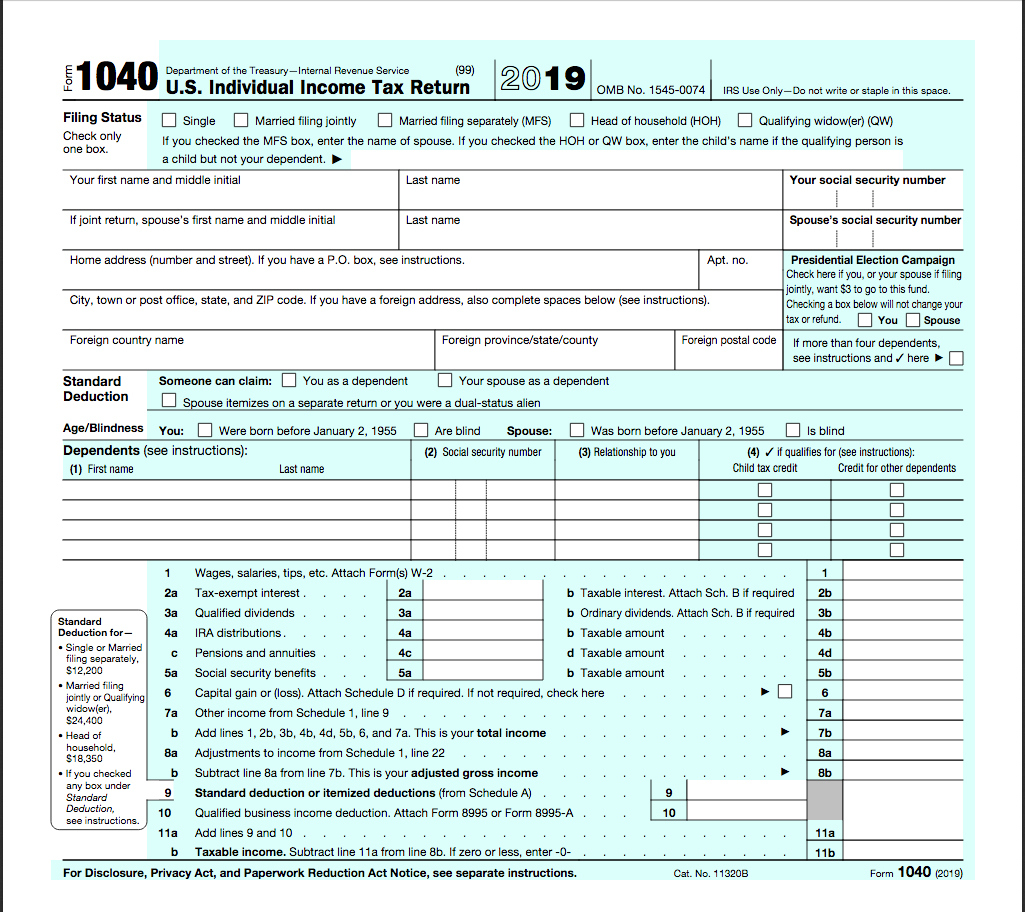

Printable Illinois State Tax Forms Individual Income Tax Return 60012231W or for fiscal year ending Enter personal information and Social Security numbers SSN You must provide the entire SSN s no partial SSN Step 1 Personal Information Step 2 Income Federal adjusted gross income from your federal Form 1040 or 1040 SR Line 11

The Illinois estate tax is administered by the Office of the Attorney General Current Year Prior Years Estate Inheritance Tax Use Tax TaxFormFinder provides printable PDF copies of 76 current Illinois income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 62 Corporate Income Tax 50 Show entries Search Showing 1 to 25 of 62 entries Previous 1 2 3 Next

Printable Illinois State Tax Forms

Printable Illinois State Tax Forms

https://www.signnow.com/preview/6/962/6962503/large.png

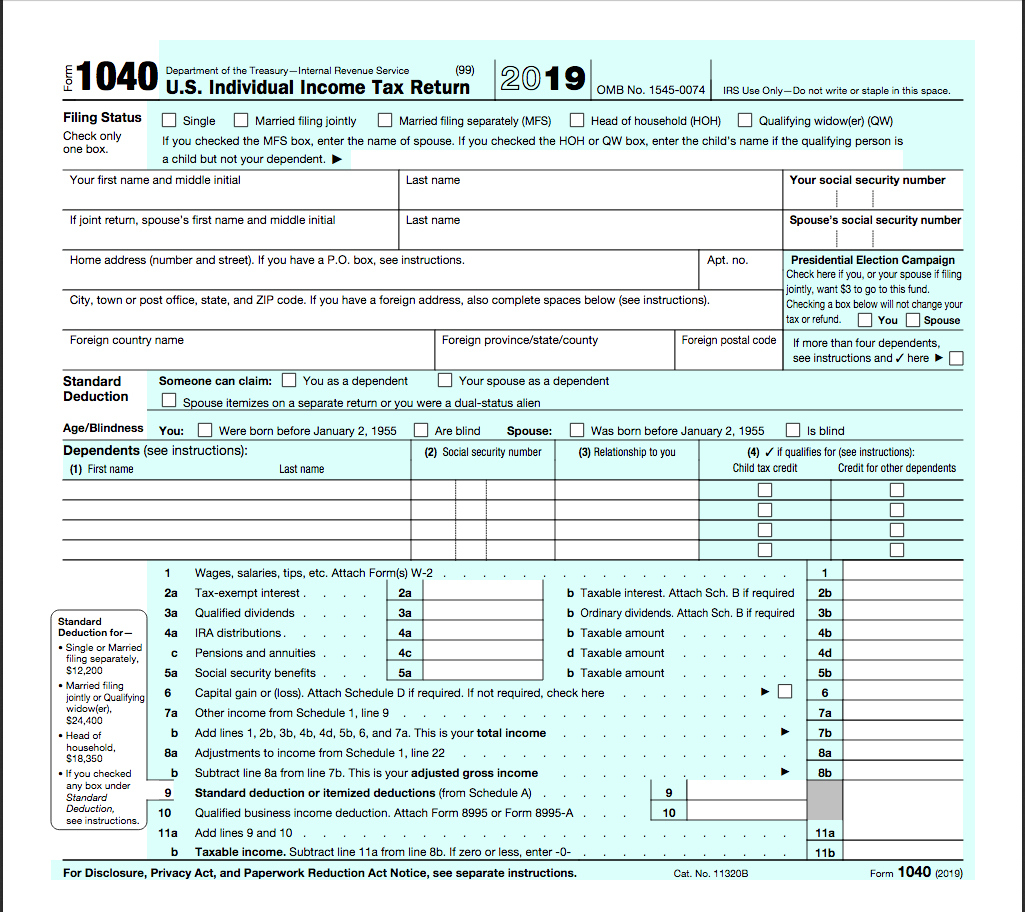

2020 ILLINOIS TAX FILING SEASON BEGAN MONDAY JANUARY 27 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/2020-illinois-tax-filing-season-began-monday-january-27-5.jpg

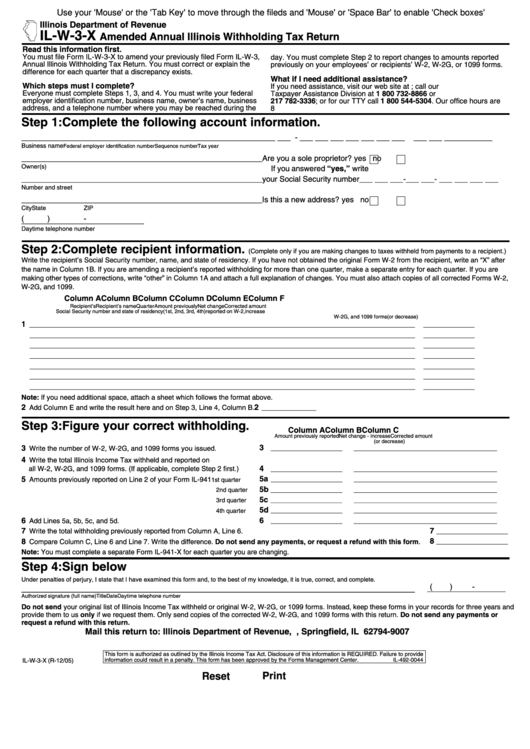

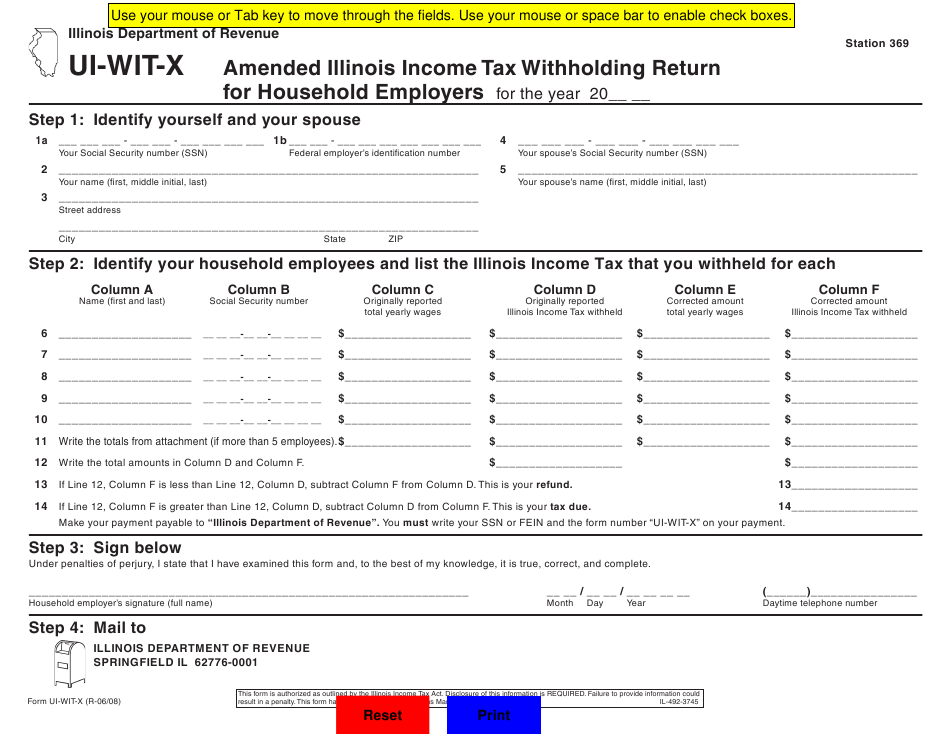

IL ST 4 X 2001 2021 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/397/403/397403647/large.png

Printable Illinois state tax forms for the 2023 tax year will be based on income earned between January 1 2023 through December 31 2023 The Illinois income tax rate for tax year 2023 is 4 95 The state income tax rate is displayed on the Illinois 1040 form and can also be found inside the Illinois 1040 instructions booklet If you are trying to locate download or print state of Illinois tax forms you can do so on the Illinois Department of Revenue Website Illinois Income Tax Forms Instructions The most common Illinois income tax form is the IL 1040 This form is used by Illinois residents who file an individual income tax return

Form IL 1040 is the standard Illinois income tax return for all permanent residents of Illinois For more information about the Illinois Income Tax see the Illinois Income Tax page Illinois may also allow you to e file your Form IL 1040 instead of mailing in a hard copy which could result in your forms being received and processed faster The IRS Volunteer Income Tax Assistance and the Tax Counseling for the Elderly programs offer free tax help for families making 64 000 a year or less 32 000 for individuals people 60 years of age or older individuals with disabilities and taxpayers with limited English speaking skills The AARP Foundation Tax Aide Program provides free tax assistance with a special focus on taxpayers

More picture related to Printable Illinois State Tax Forms

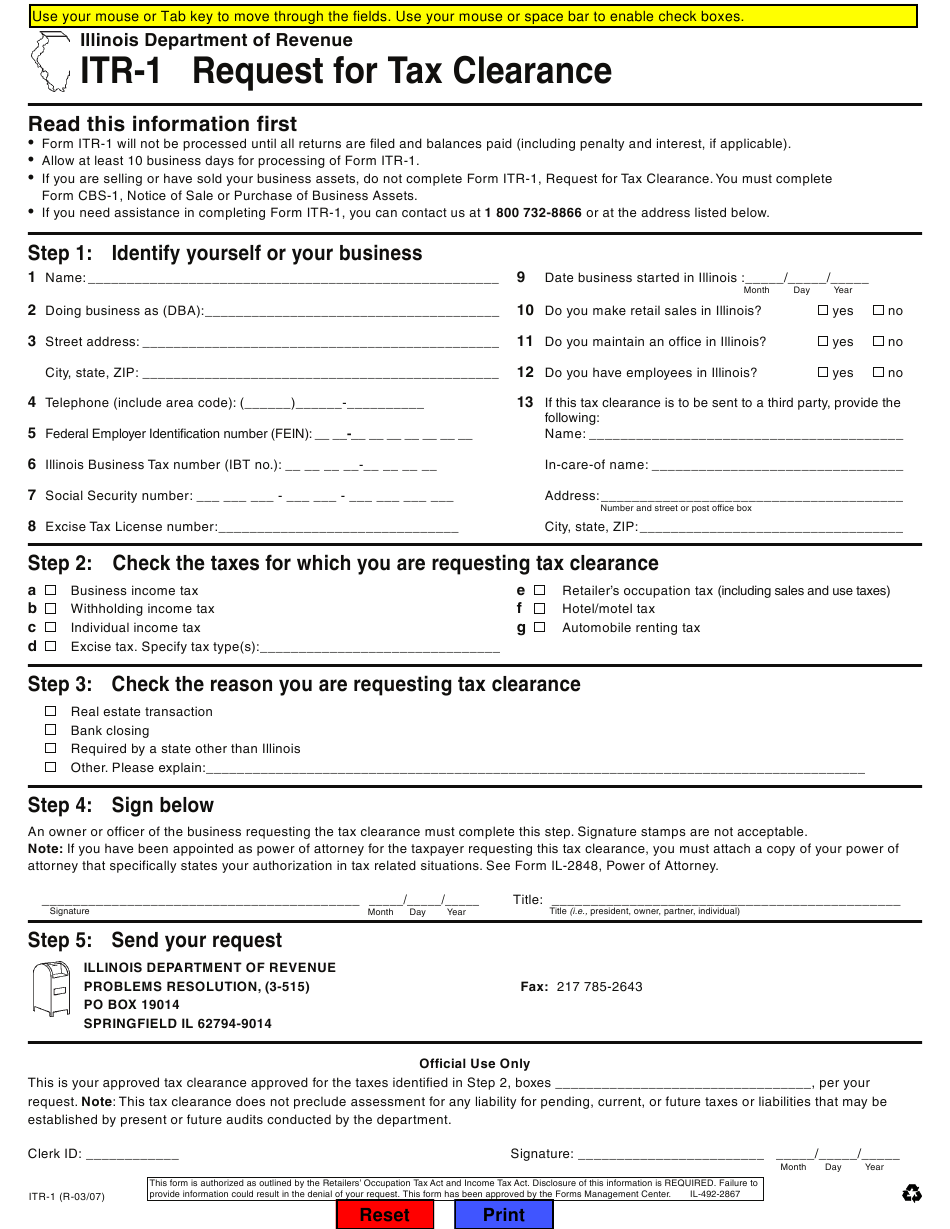

Illinois New Employee Tax Forms 2023 Employeeform

https://www.employeeform.net/wp-content/uploads/2022/06/form-itr-1-download-fillable-pdf-or-fill-online-request-for-tax.png

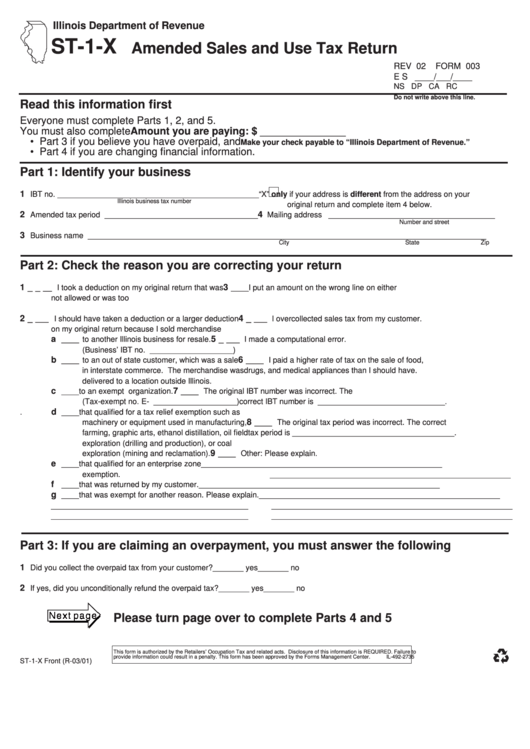

Form St 1 X Amended Sales And Use Tax Return Form State Of Illinois 2001 Printable Pdf

https://data.formsbank.com/pdf_docs_html/224/2240/224042/page_1_thumb_big.png

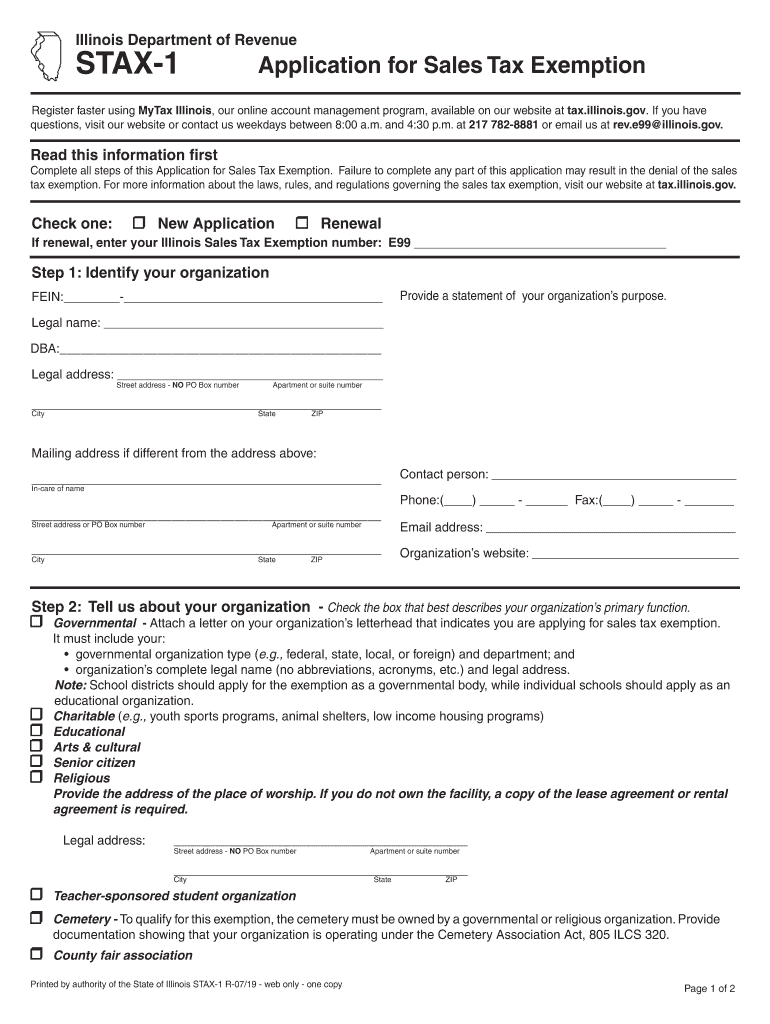

IL STAX 1 2019 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/489/44/489044156/large.png

Download or print the 2023 Illinois Income Tax Instructions Illinois Income Tax Instructional Booklet for FREE from the Illinois Department of Revenue If your employer in any of these states withheld that state s tax from your compensation you may file the correct form with that state to claim a refund You may not use tax withheld by You can print other Illinois tax forms here eFile your Illinois tax return now eFiling is easier faster and safer than filling out paper tax forms File your Illinois and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax

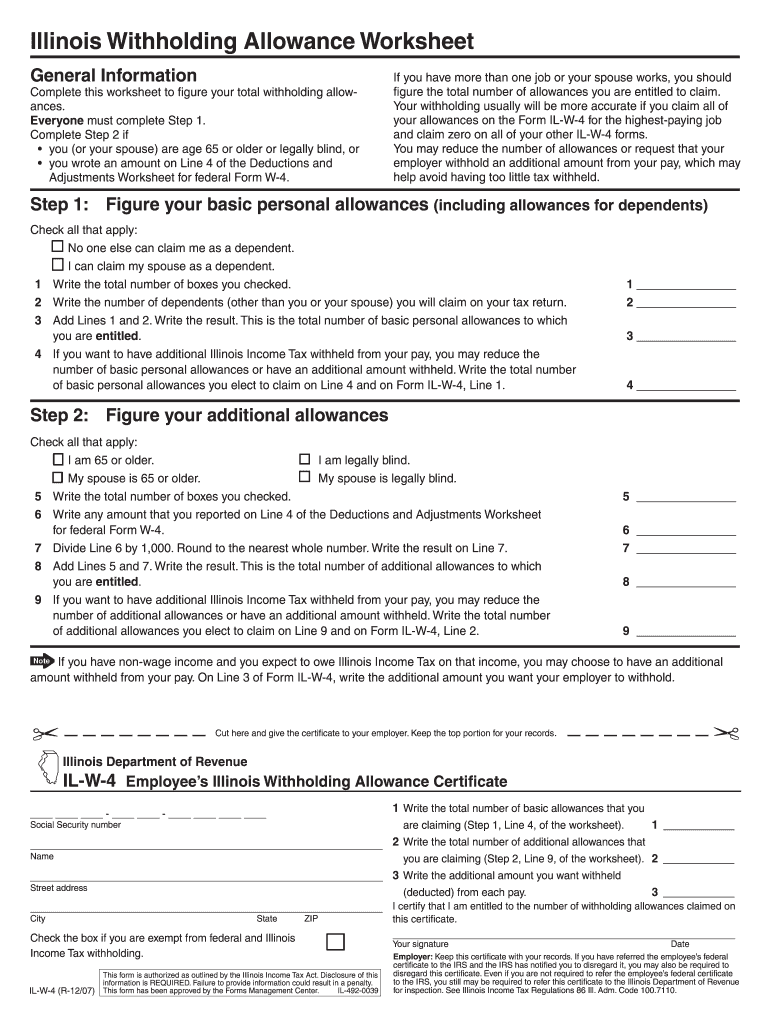

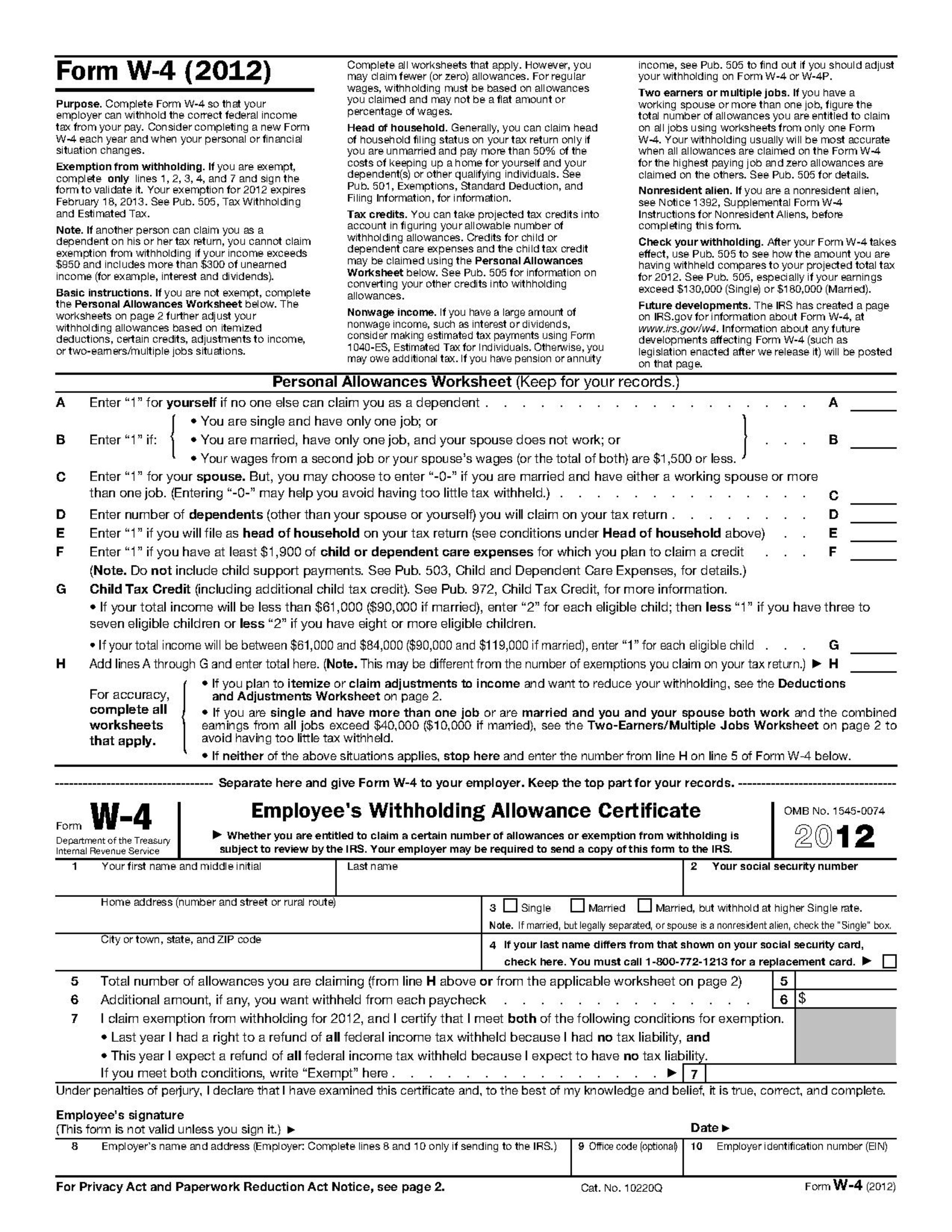

Federal Tax Withholding Tables 2023 Illinois State Income Tax Exemptions 2023 Fiscal Year 2022 Illinois Comptroller Susana Mendoza joined WXAN to talk about the Rainy Day Fund established by the State of Illinois and how the recent budget deposited 850 million dollars into that fund December 2022 December 2022 Fiscal Year 2023 Quarter 2 Give your completed Form IL W 4 to your employer Keep the worksheet for your records If you are a partner in a same sex civil union and are subject to federal income tax on health benefits your employer pays for your partner these benefits are not taxed by Illinois Your employer will still withhold Illinois tax on these benefits

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/453/14/453014487/large.png

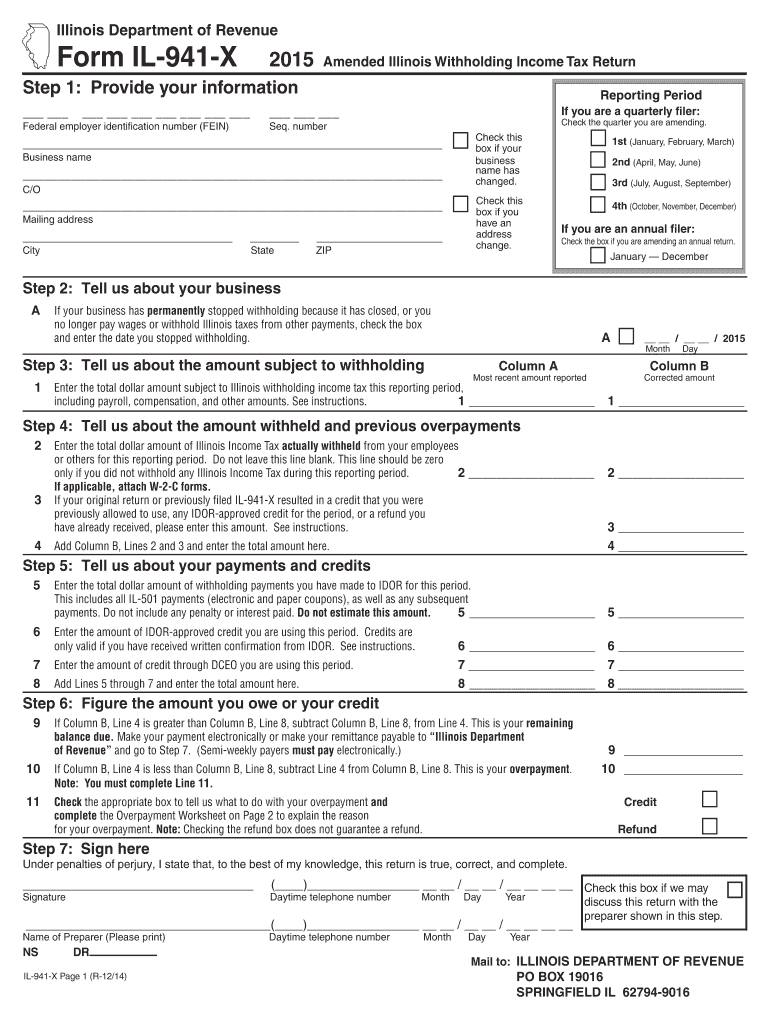

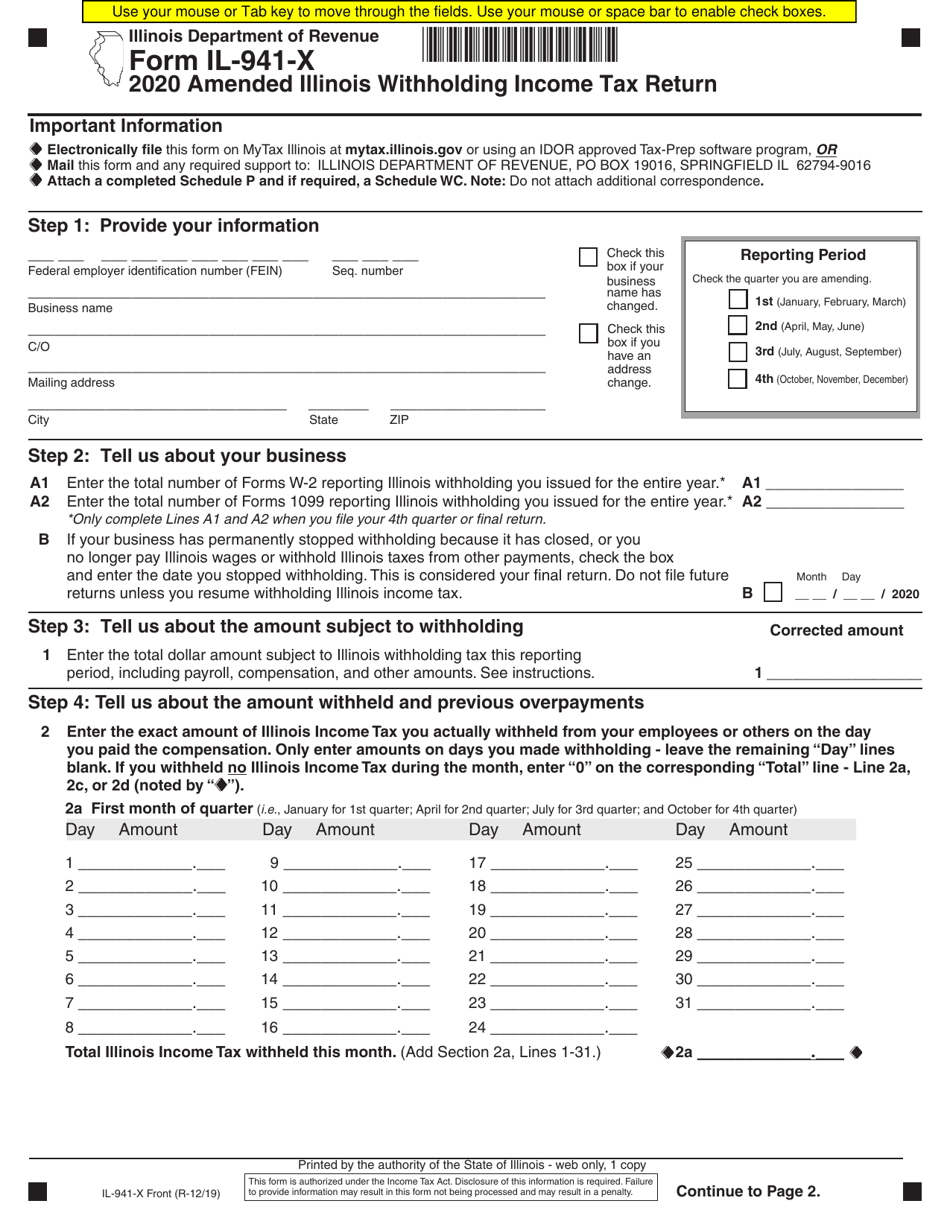

Illinois State Tax Forms Printable

https://data.templateroller.com/pdf_docs_html/2063/20638/2063864/form-il-941-x-amended-illinois-withholding-income-tax-return-illinois_print_big.png

https://tax.illinois.gov/content/dam/soi/en/web/tax/forms/incometax/documents/currentyear/individual/il-1040.pdf

Individual Income Tax Return 60012231W or for fiscal year ending Enter personal information and Social Security numbers SSN You must provide the entire SSN s no partial SSN Step 1 Personal Information Step 2 Income Federal adjusted gross income from your federal Form 1040 or 1040 SR Line 11

https://tax.illinois.gov/forms/incometax/individual.html

The Illinois estate tax is administered by the Office of the Attorney General Current Year Prior Years Estate Inheritance Tax Use Tax

Illinois State Tax Forms Printable

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign Printable PDF Template

Illinois Income Tax Withholding Forms 2022 W4 Form

Printable Illinios Tax Forms Printable Forms Free Online

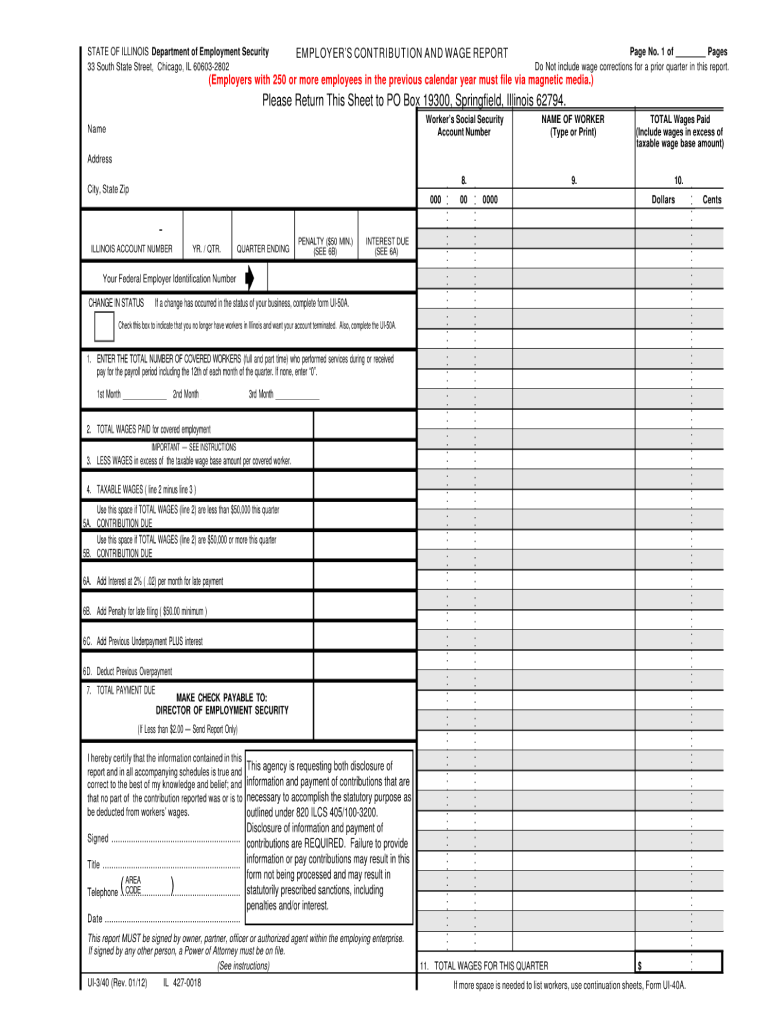

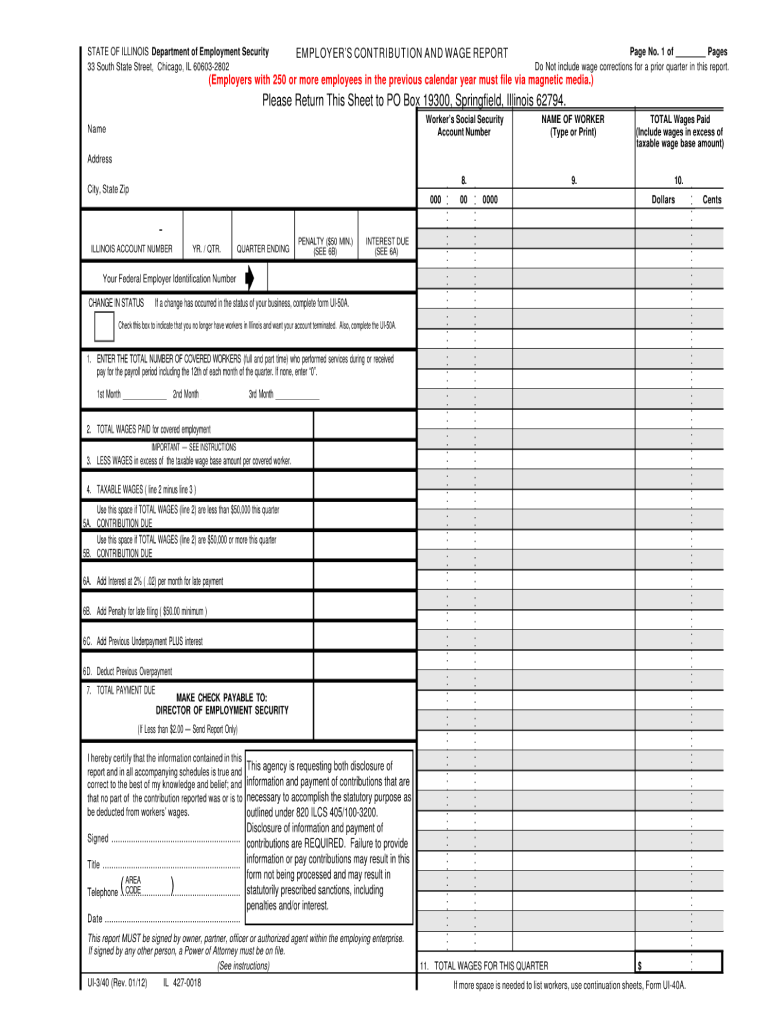

IL UI 3 40 2012 Fill And Sign Printable Template Online US Legal Forms

IL UI 3 40 2012 Fill And Sign Printable Template Online US Legal Forms

IL IL 1040 Schedule ICR 2020 2021 Fill Out Tax Template Online US Legal Forms

State Of Illinois W4 Printable 2022 W4 Form

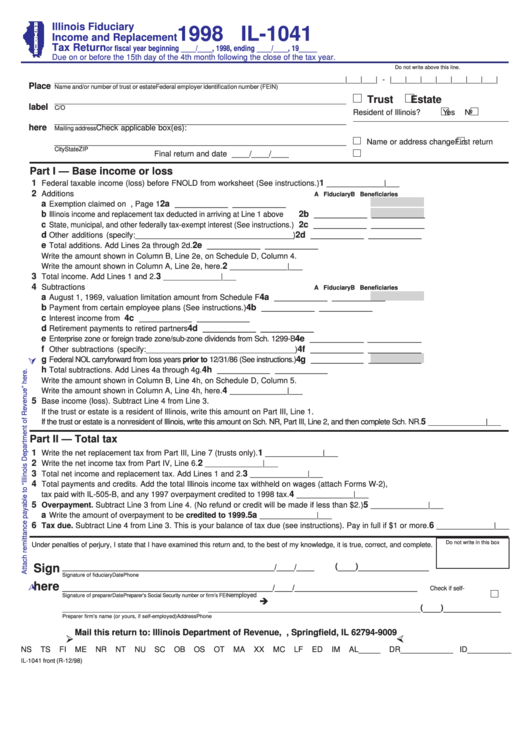

Fillable Il 1041 Form Printable Forms Free Online

Printable Illinois State Tax Forms - 2023 decedent with an estate of 142 857 Illinois Estate Tax 5 000 000 with 50 in Illinois and even though Florida imposes 50 in Florida no State Estate Tax 0 Federal Estate Tax 2023 decedent with an estate of Illinois QTIP 8 920 000 12 920 000 a surviving spouse 0 Illinois Estate Tax and an IL QTIP election 0 Federal Estate Tax