Printable Independent Contractor 1099 Form If you paid someone who is not your employee such as a subcontractor attorney or accountant 600 or more for services provided during the year a Form 1099 NEC needs to be completed and a copy of Form 1099 NEC must be provided to the independent contractor by January 31 of the year following payment

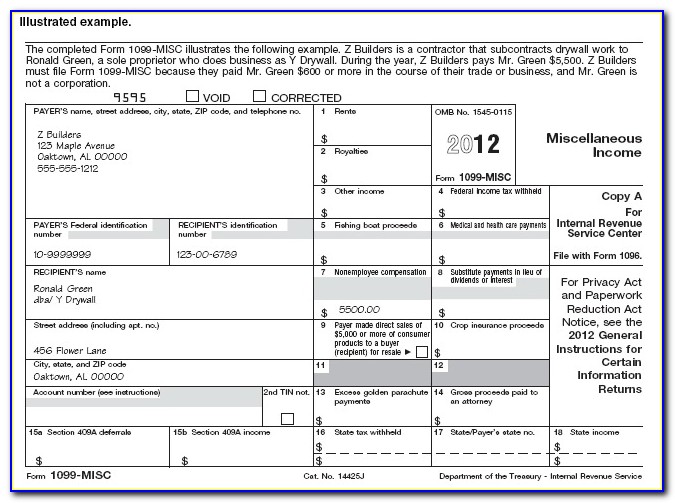

Report payments of 600 or more made in the course of a business in rents prizes and awards other income and for other specified purposes including gross proceeds paid to an attorney Form 1099 MISC An independent contractor agreement is a legal document between a contractor that performs a service for a client in exchange for payment Also known as a 1099 agreement due to the contractor not being an employee of the client A contractor is commonly hired on a short term or intermittent basis unlike an employee Paying Taxes

Printable Independent Contractor 1099 Form

Printable Independent Contractor 1099 Form

https://i1.wp.com/eforms.com/images/2018/05/Independent-Contractor-Agreement.png?fit=1600%2C2070&ssl=1

6 Must know Basics Form 1099 MISC For Independent Contractors Bonsai

https://uploads-ssl.webflow.com/58868bcd2ef4daaf0f072902/5ab4028e9825160f3b4e4824_Screen Shot 2018-03-22 at 3.22.21 PM.png

Free Independent Contractor Agreement Template 1099 Word PDF EForms

https://i2.wp.com/eforms.com/download/2018/06/1-Page-Independent-Contractor-Agreement.png?ssl=1

How contractors use Form 1099 NEC Most freelancers and independent contractors use Schedule C Profit or Loss From Business to report self employment income on their personal tax returns Here is the process for reporting income earned on a Form 1099 NEC Part 1 of Schedule C reports income earned by the contractor As an independent contractor you may be required to file a 1099 form with the IRS The 1099 form is used to report income that is not subject to withholding tax This includes income from freelancing consulting or other self employment activities The first section of the form is devoted to establishing the necessity of the form

Form 1099 NEC reports how much a business paid annually to nonemployees including independent contractors Form 1099 MISC reports a business s miscellaneous payments e g rents paid to property managers Form 1099 K reports payment card transactions through third party networks How Does Form 1099 Affect Independent Contractor Taxes Unlike regular employees who have taxes withheld from each paycheck independent contractors are responsible for setting aside money for their own taxes Your 1099 form aids in determining how much you owe Remember 1099 forms are printable and having a physical copy can often be

More picture related to Printable Independent Contractor 1099 Form

Printable 1099 Form Independent Contractor TUTORE ORG Master Of Documents

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-1099-misc-2012-download-free.jpg

Printable 1099 Form Independent Contractor Printable Form Templates And Letter

https://s30311.pcdn.co/wp-content/uploads/2020/03/form-1099-misc-fold.png

Irs 1099 Forms For Independent Contractors Form Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2018/11/irs-1099-form-independent-contractor.jpg

STEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors once you have bought the 1099 forms Fill in your Federal Tax ID number SSN or EIN and contractor s information SSN or EIN accurately Fill out Form 1099 MISC accurately using the information you ve gathered Form 1099 NEC Nonemployee compensation is a form businesses use to report payments made to independent contractors within a tax year The IRS uses it to determine the amount of taxable income acquired by independent contractors Form 1099 NEC was part of Form 1099 MISC but became a separate form in 2020

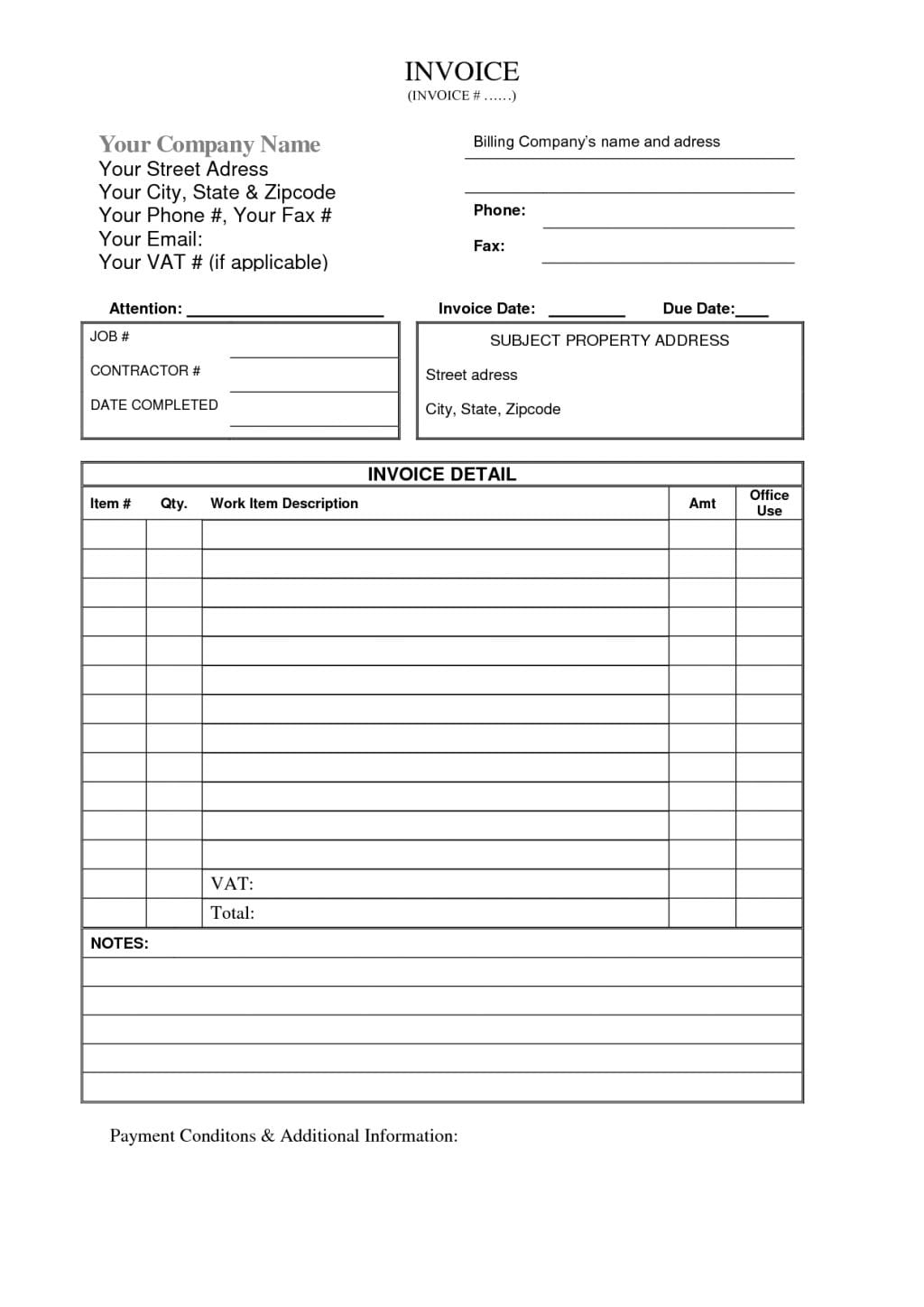

There are three independent contractor tax forms that businesses must file to avoid penalties Learn about what tax forms to give contractors from Paychex Everything You Need to Know How To Print 1099 Forms on Your Regular Printer by Soo Lee CPA Updated March 29 2023 Reviewed by Isaiah McCoy CPA If you hired a contractor or freelancer and paid them more than 600 in a year directly you have to send them a 1099 NEC

Printable Independent Contractor 1099 Form Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/7AaGwx9GYM2YM9YyWJLFqv/b9806db0e4623117df61caf7b38e80e4/2022_1099_Form_Copy_B.png

Independent Contractor 1099 Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Independent-Contractor-Invoice-Template.png

https://www.irs.gov/businesses/small-businesses-self-employed/forms-and-associated-taxes-for-independent-contractors

If you paid someone who is not your employee such as a subcontractor attorney or accountant 600 or more for services provided during the year a Form 1099 NEC needs to be completed and a copy of Form 1099 NEC must be provided to the independent contractor by January 31 of the year following payment

https://www.irs.gov/faqs/small-business-self-employed-other-business/form-1099-nec-independent-contractors/form-1099-nec-independent-contractors

Report payments of 600 or more made in the course of a business in rents prizes and awards other income and for other specified purposes including gross proceeds paid to an attorney Form 1099 MISC

Form 1099 For Independent Contractors A Guide For Recipients

Printable Independent Contractor 1099 Form Printable Forms Free Online

1099 Contractor Invoice Template Excelxo

How To File A 1099 Form Independent Contractor Universal Network

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

1099 Form Independent Contractor Pdf Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

1099 Form Independent Contractor Pdf Free Independent Contractor Agreement Templates Pdf Word

Printable 1099 Forms For Independent Contractors

Printable 1099 Form Independent Contractor Form Resume Examples

Printable Independent Contractor 1099 Form - And these self employment taxes really add up The current self employment tax rate is 12 4 for Social Security and 2 9 for Medicare a total of 15 3 just in self employment tax The good