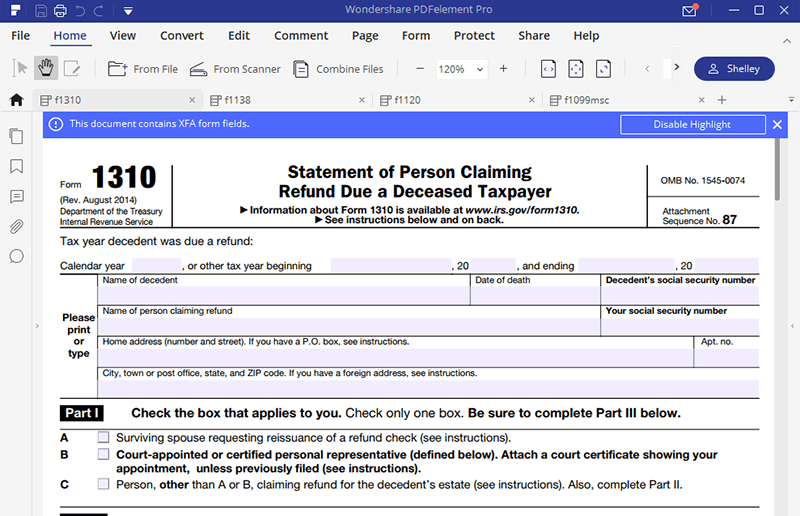

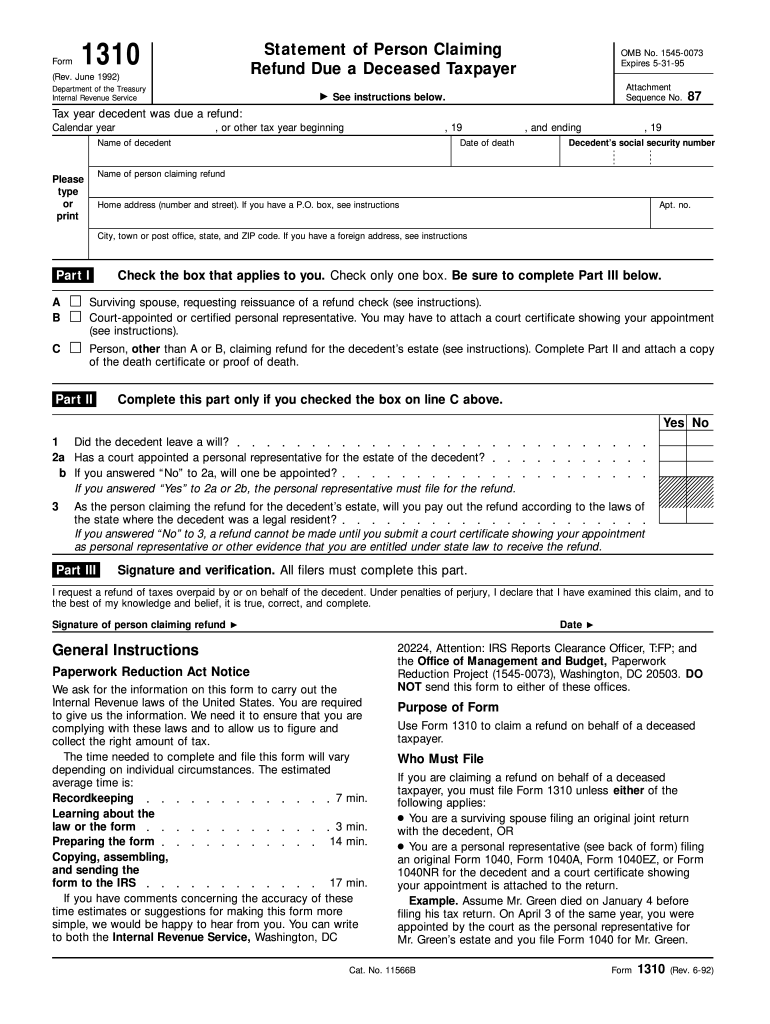

Printable Irs 1310 Form Printable Collect the right amount of tax Use Form 1310 to claim a refund on behalf of a deceased taxpayer If you are claiming a refund on behalf of a deceased taxpayer you must file Form 1310 unless either of the following applies Example Assume Mr Green died on January 4 before filing his tax return On April 3 of the same year you were appointed

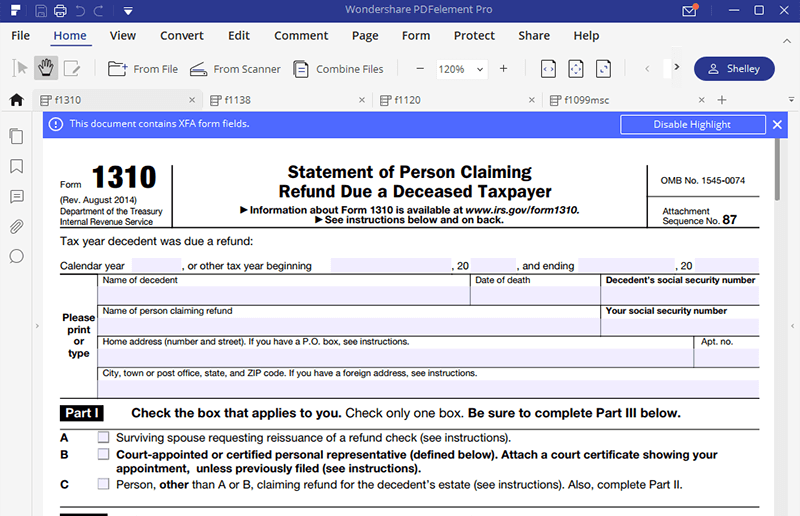

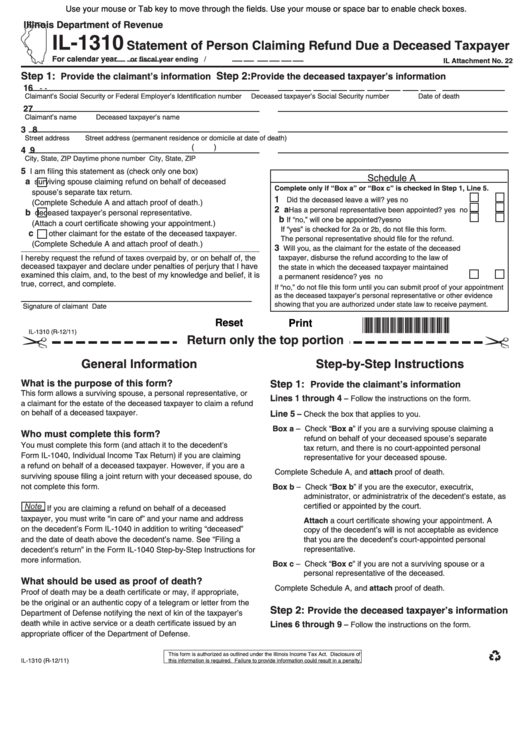

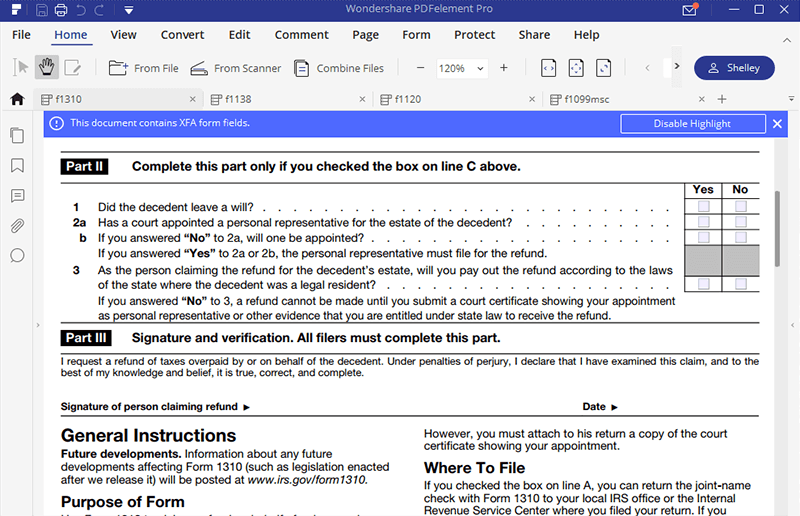

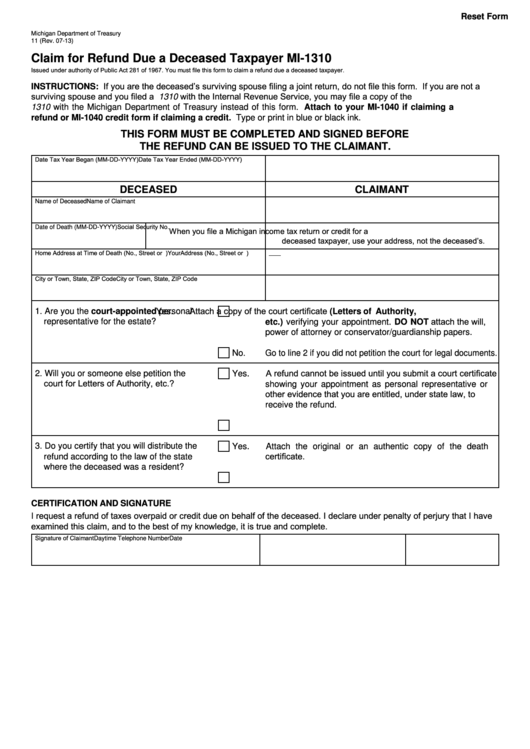

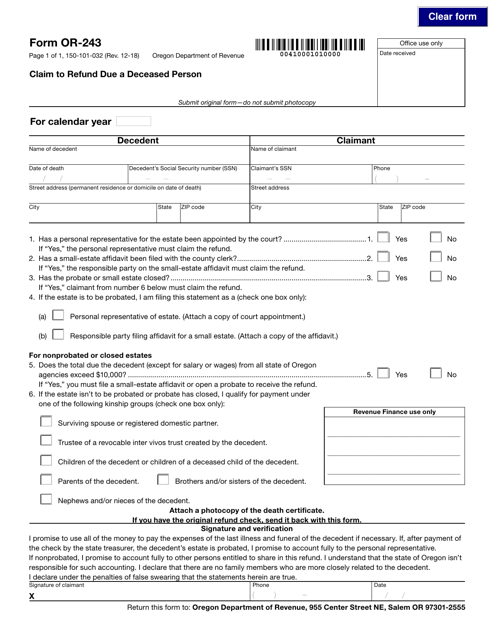

Create a high quality document now Virginia Create Document Updated January 04 2024 IRS Form 1310 is used by an executor administrator or representative in order to claim a refund on behalf of a deceased taxpayer A surviving spouse or court appointed representative uses this form only as required Download or print the 2023 Federal Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer for FREE from the Federal Internal Revenue Service But if you have already sent the court certificate to the IRS complete Form 1310 and write Certificate Previously Filed at the bottom of the form Line C Check the box on line

Printable Irs 1310 Form Printable

Printable Irs 1310 Form Printable

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-1310-part1.png

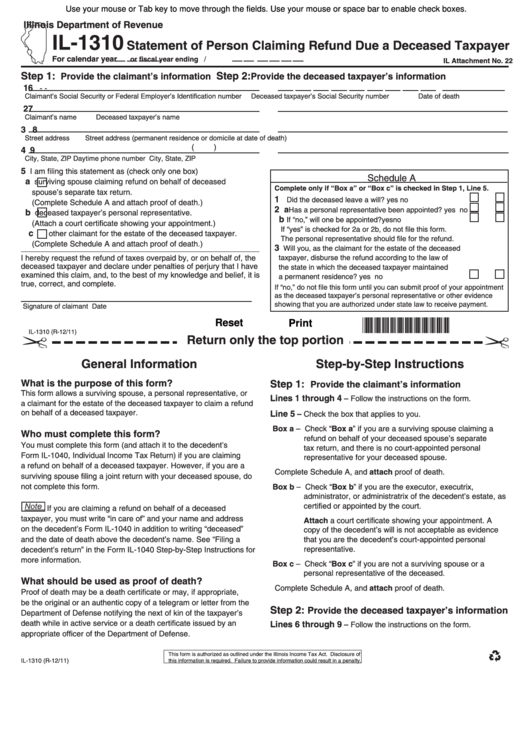

Irs Form 1310 Printable Printable World Holiday

https://data.formsbank.com/pdf_docs_html/335/3354/335431/page_1_thumb_big.png

Irs Form 1310 Printable

https://data.formsbank.com/pdf_docs_html/246/2467/246722/page_1_thumb_big.png

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer A tax form distributed by the Internal Revenue Service IRS and used by taxpayers looking to claim a refund on behalf of a File Now with TurboTax We last updated Federal Form 1310 in January 2024 from the Federal Internal Revenue Service This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the Federal government

Tax year decedent was due a refund Calendar year or other tax year beginning 20 and ending 20 Please print or type Name of decedent If filing a joint return and both taxpayers are deceased complete a Form 1310 for each See instructions Date of death Decedent s social security number Forms Instructions and Publications Search Page Last Reviewed or Updated 14 Nov 2023 Access IRS forms instructions and publications in electronic and print media

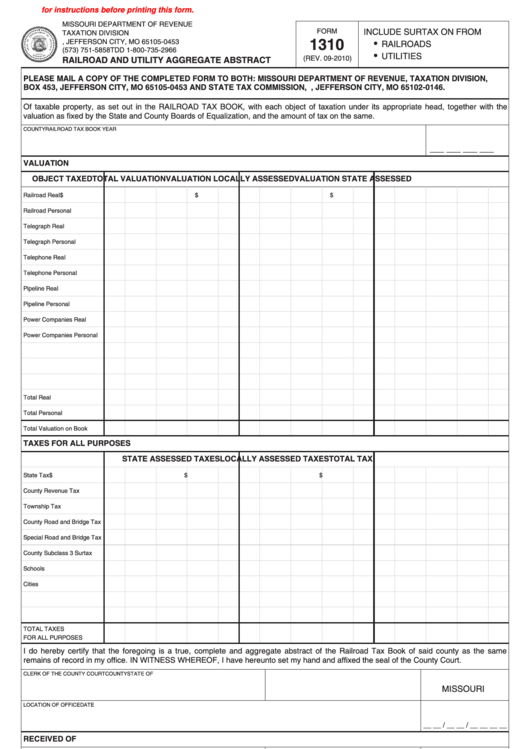

More picture related to Printable Irs 1310 Form Printable

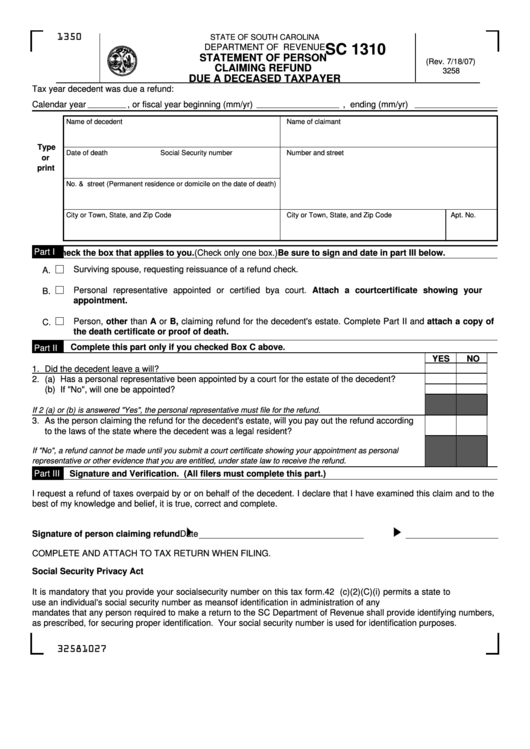

Form Sc 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/320/3200/320083/page_1_thumb_big.png

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

https://www.zrivo.com/wp-content/uploads/2020/11/4852-Form-2021-1080x607.jpg

Free Printable Irs Tax Forms Printable Templates

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

Download Fillable Irs Form 1310 In Pdf The Latest Version Applicable For 2024 Fill Out The Statement Of Person Claiming Refund Due A Deceased Taxpayer Online And Print It Out For Free Irs Form 1310 Is Often Used In Refund Due Deceased Taxpayer Social Security Number Form U s Department Of The Treasury Income Tax Form U s Department Of The Treasury Internal Revenue Service United Yes you can file IRS Form 1310 in TurboTax to claim the tax refund for a decedent return a return filed on the behalf of a deceased taxpayer Here s how Open the My Info section of your return Select Passed away before filing this return Provide the date passed away Search for form 1310 and select the jump to link On the Complete a claim for refund screen select Yes

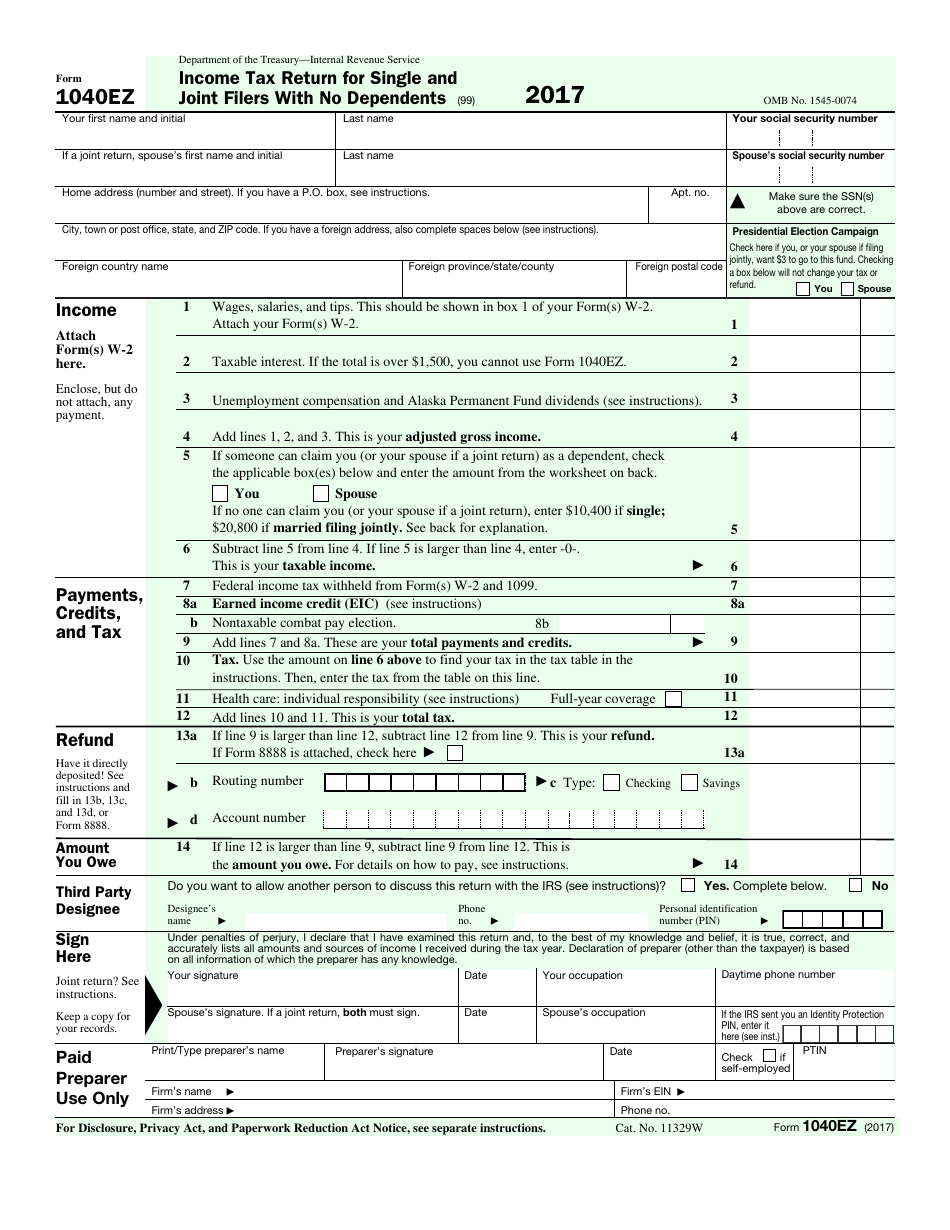

Form 1040 U S Individual Income Tax Return 2023 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space For the year Jan 1 Dec 31 2023 or other tax year beginning 2023 ending 20 See separate instructions Your first name and middle initial Last name According to the IRS website Form 1310 is known as a Statement of Person Claiming Refund Due a Deceased Taxpayer In other words if the Internal Revenue Service owes a taxpayer money that hasn t already been accounted for then a personal representative of the taxpayer s estate would file Form 1310 on the decedent s behalf

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Printable Pdf

https://data.formsbank.com/pdf_docs_html/121/1214/121479/page_1_thumb_big.png

Irs Form 1310 Printable TUTORE ORG Master Of Documents

https://www.irs.gov/pub/xml_bc/33917099.gif

https://www.irs.gov/pub/irs-prior/f1310--1995.pdf

Collect the right amount of tax Use Form 1310 to claim a refund on behalf of a deceased taxpayer If you are claiming a refund on behalf of a deceased taxpayer you must file Form 1310 unless either of the following applies Example Assume Mr Green died on January 4 before filing his tax return On April 3 of the same year you were appointed

https://eforms.com/irs/form-1310/

Create a high quality document now Virginia Create Document Updated January 04 2024 IRS Form 1310 is used by an executor administrator or representative in order to claim a refund on behalf of a deceased taxpayer A surviving spouse or court appointed representative uses this form only as required

IRS Form 1310 How To Fill It Right

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Printable Pdf

Irs Form 1310 Printable Printable World Holiday

Irs Form 1310 Printable TUTORE ORG Master Of Documents

Form 1310 Instructions 2023 2024 IRS Forms Zrivo

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

Free Printable Irs Tax Forms Printable Templates

Ir s Form 1310 Fill Out And Sign Printable PDF Template SignNow

Irs Form 1310 Printable TUTORE ORG Master Of Documents

Printable Irs 1310 Form Printable - After you ve filled out the return search for form 1310 inside TurboTax and select the Jump to link You ll come to the Let s see if you need to file Form 1310 screen Answer Yes and follow the instructions We ll give you the option of paper filing the form by itself or including it with the decedent s return when filed Related Information