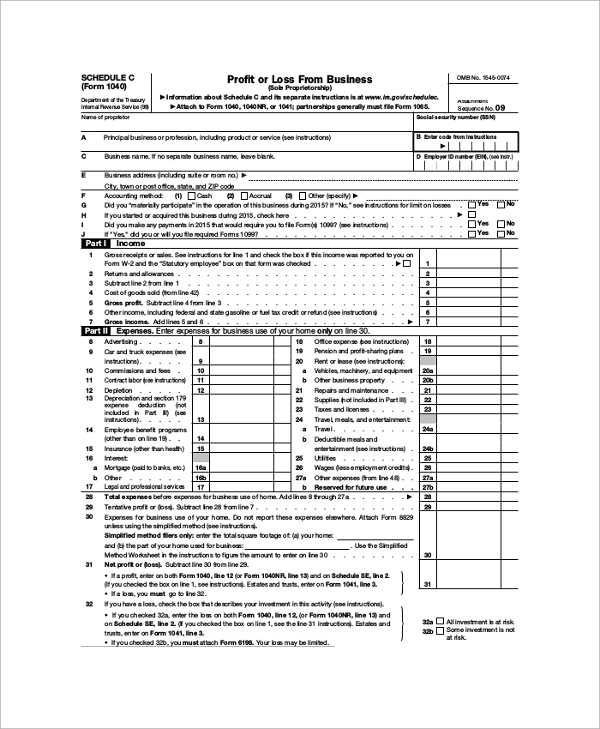

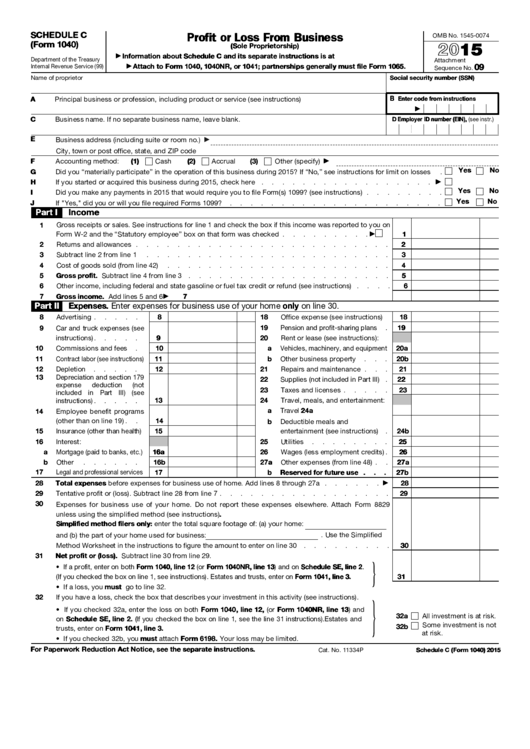

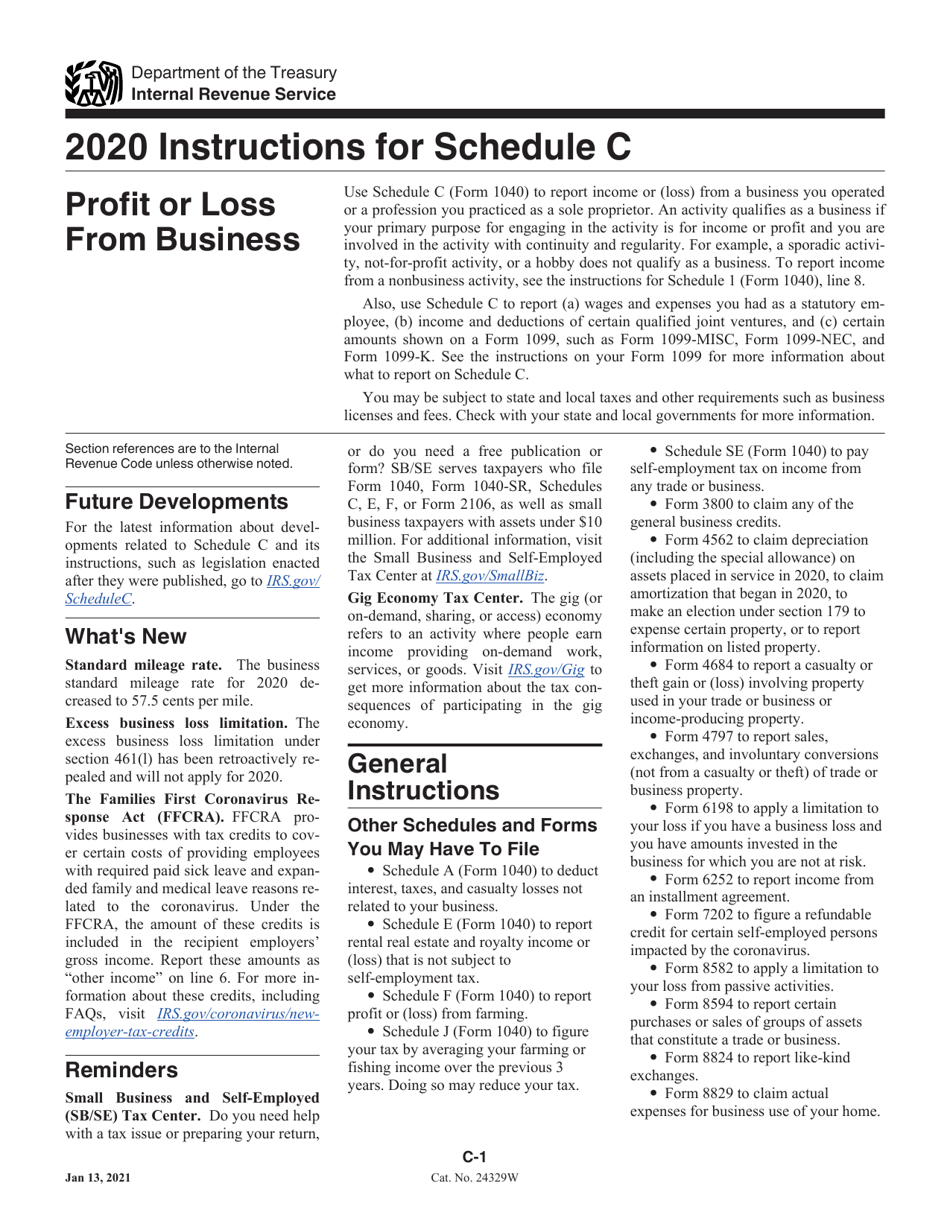

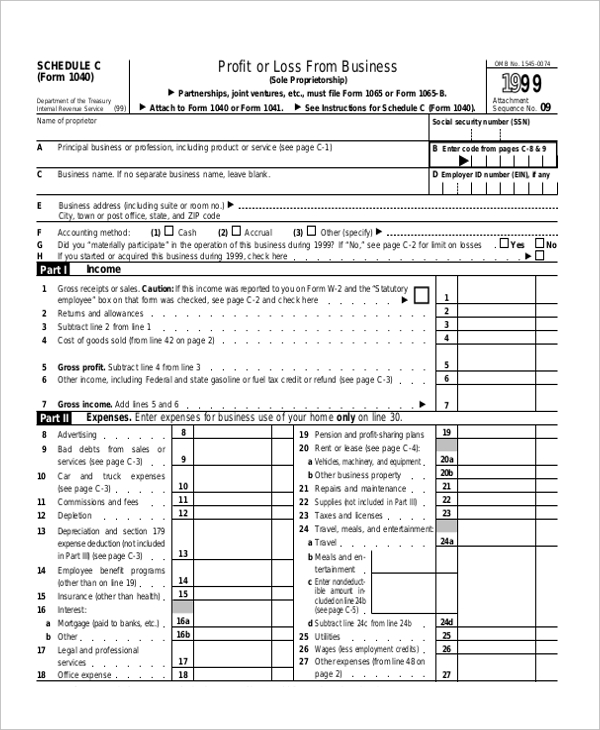

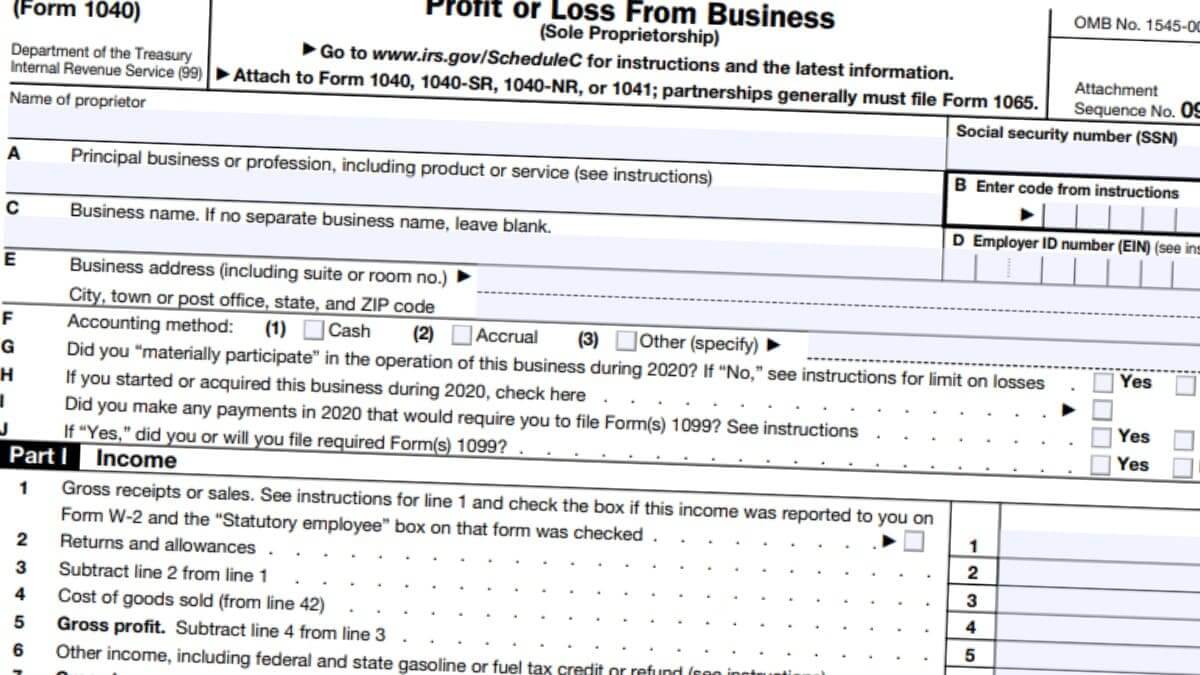

Printable Irs Form 1040 Schedule C Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity Access IRS forms instructions and publications in electronic and print media Skip to main content An official website of the United States Government English Espa ol Form 1040 ES is used by persons with income not subject to tax withholding to figure and pay estimated tax Form 1040 ES PDF

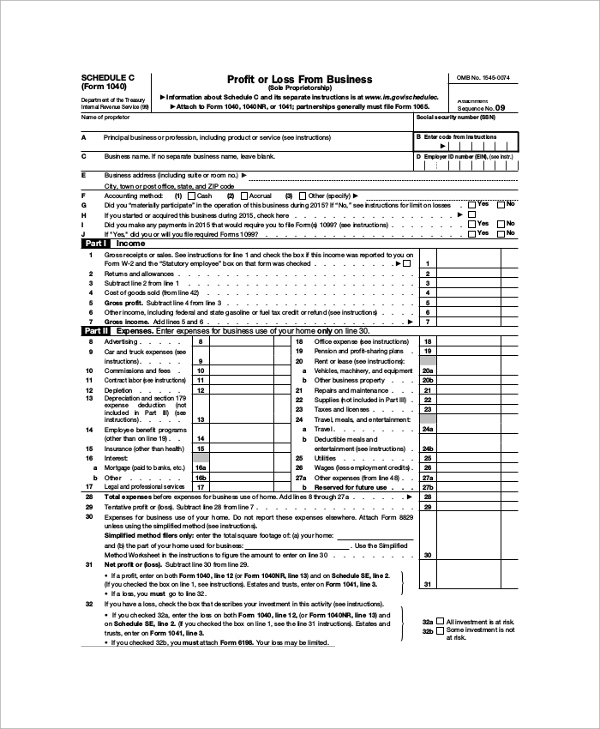

Printable Irs Form 1040 Schedule C

Printable Irs Form 1040 Schedule C

https://1044form.com/wp-content/uploads/2020/08/sample-schedule-c-form-examples-in-pdf-word.jpg

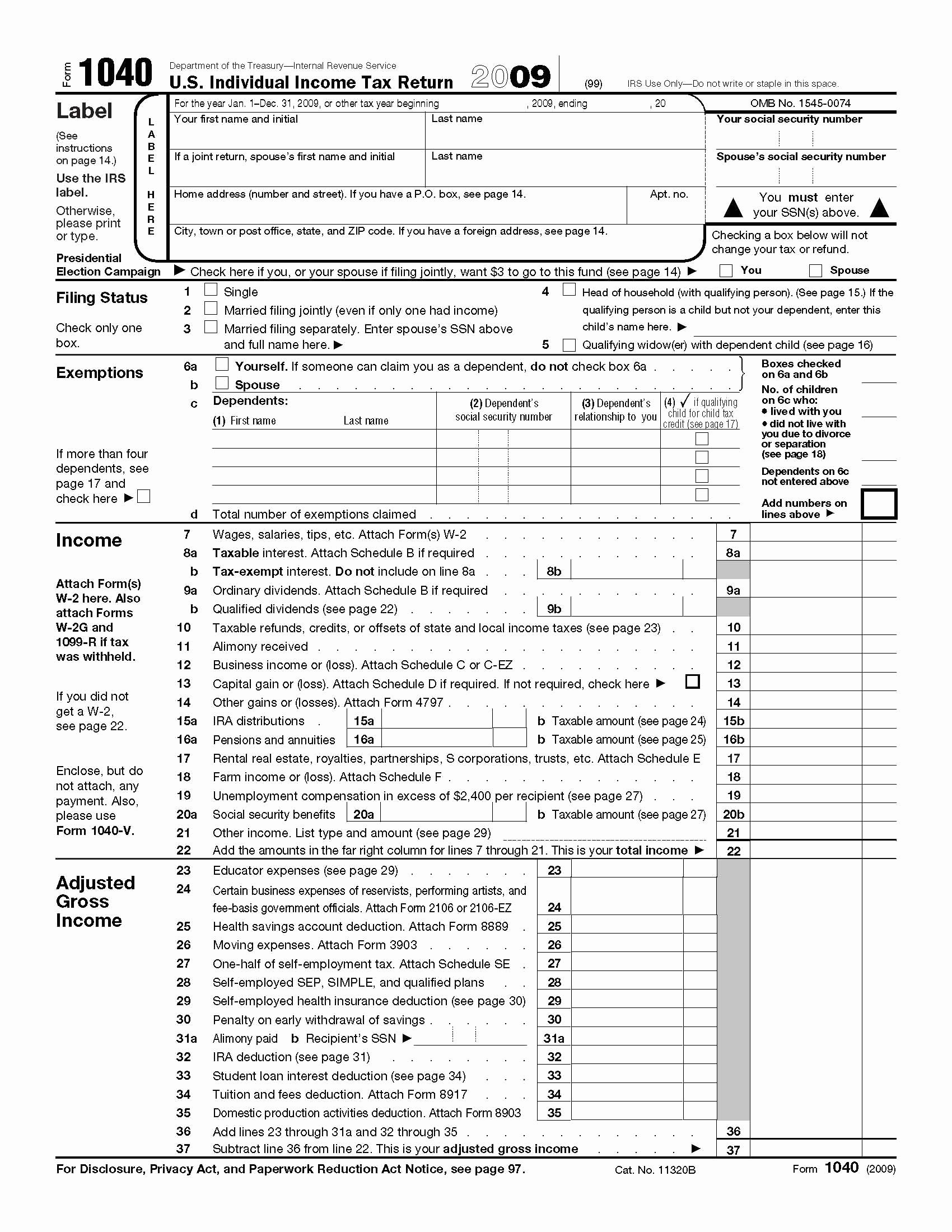

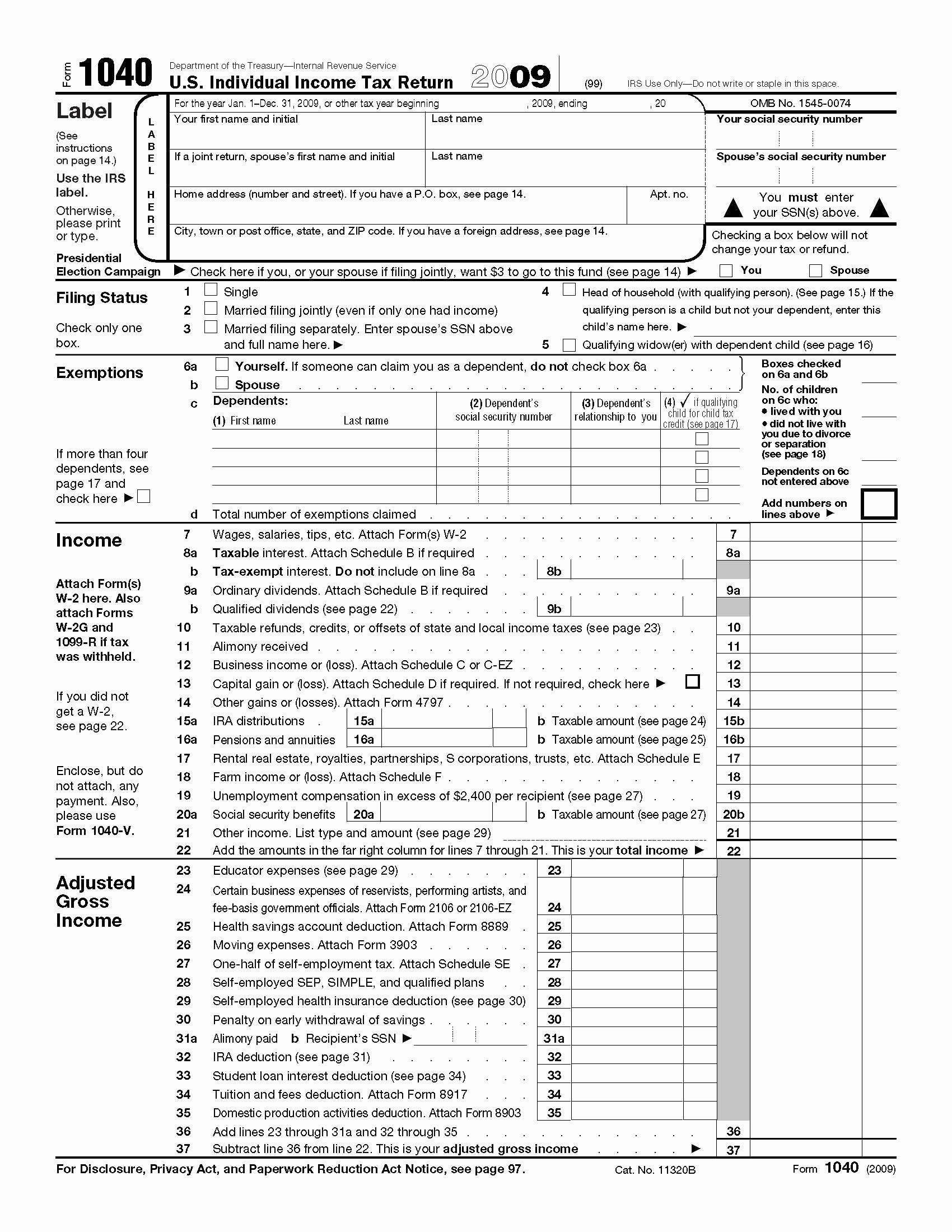

Irs Printable Form 1040

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

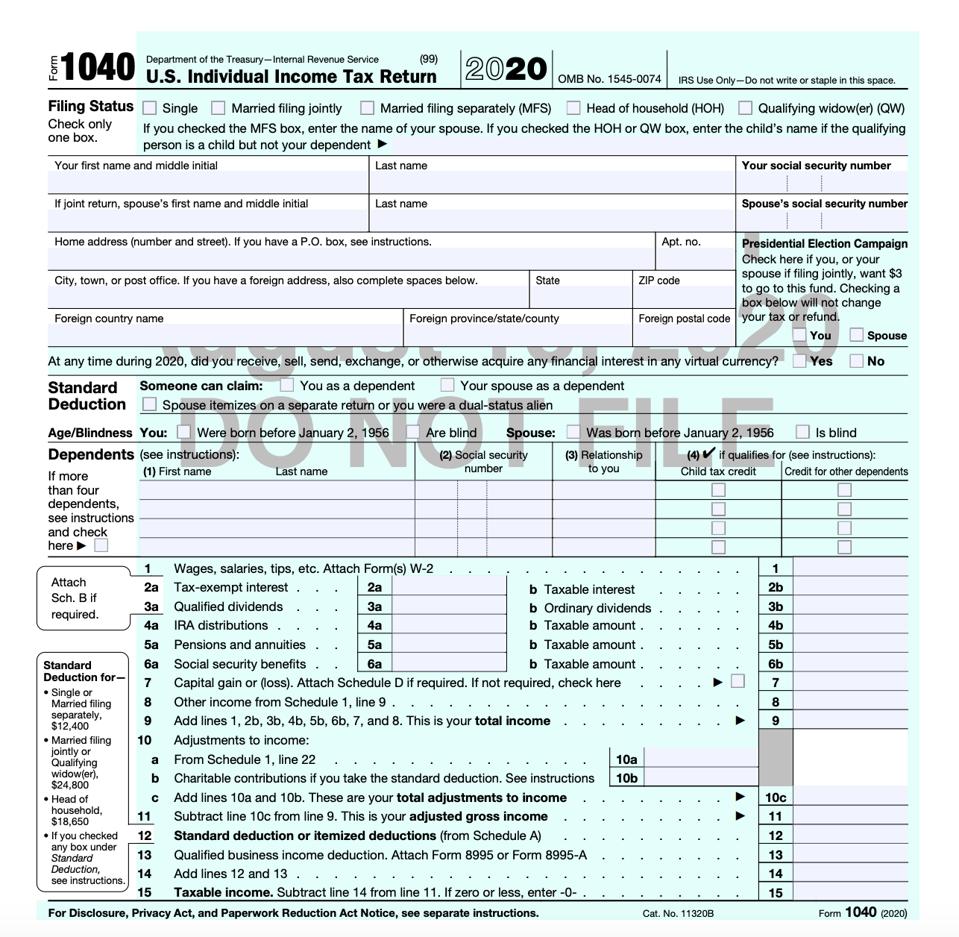

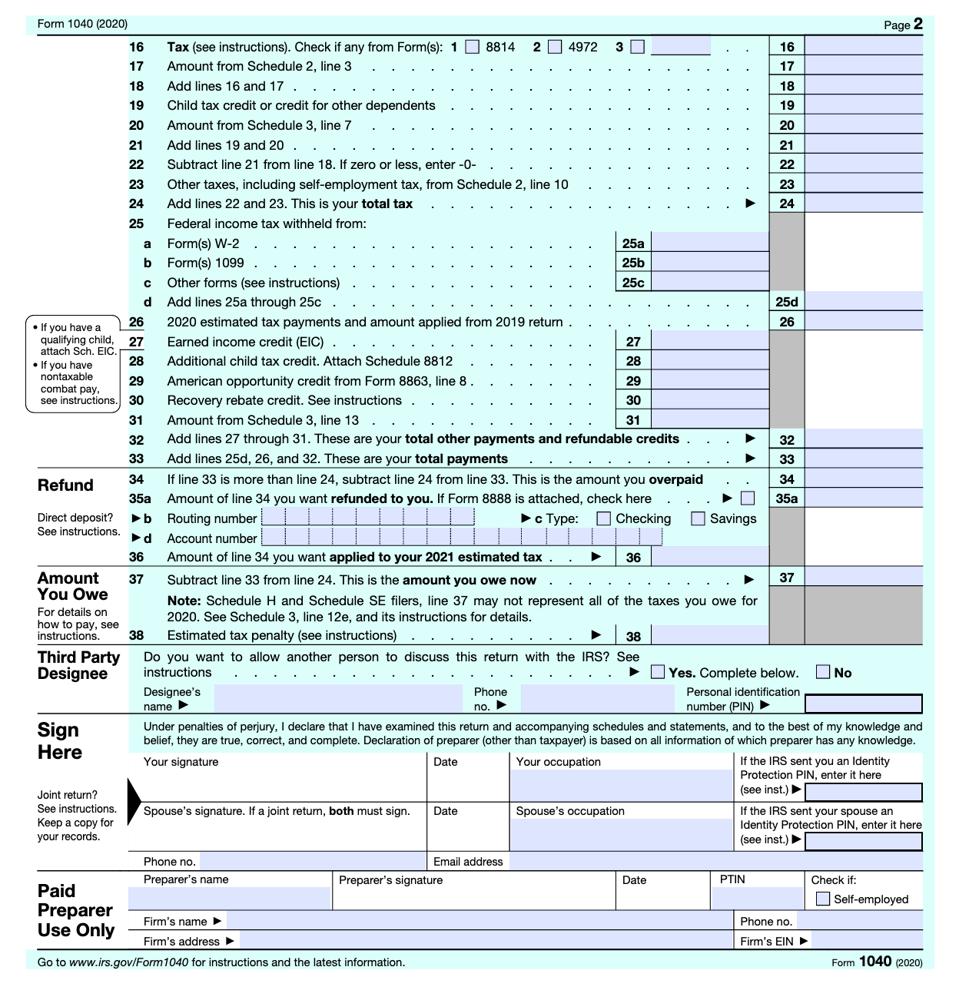

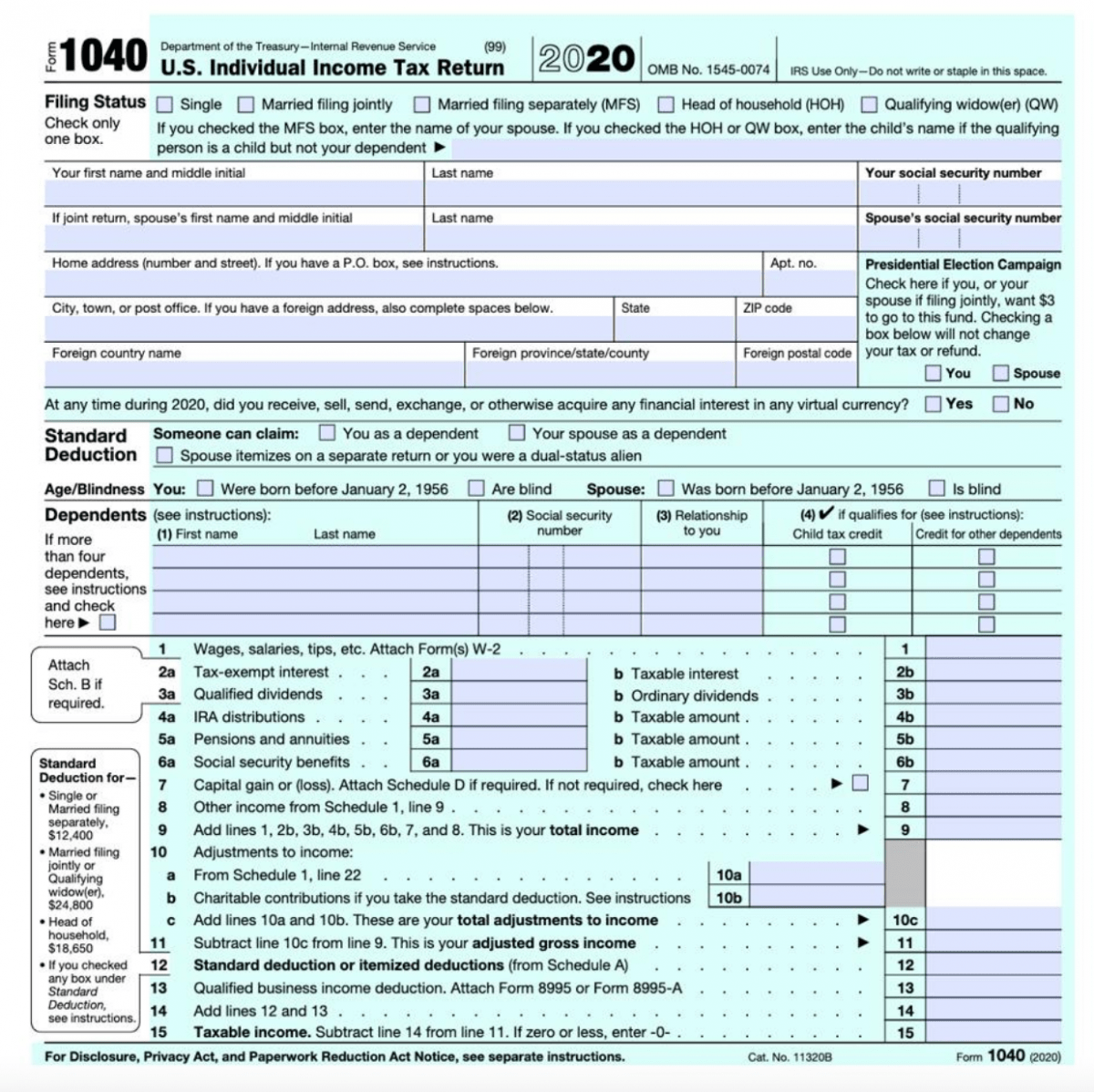

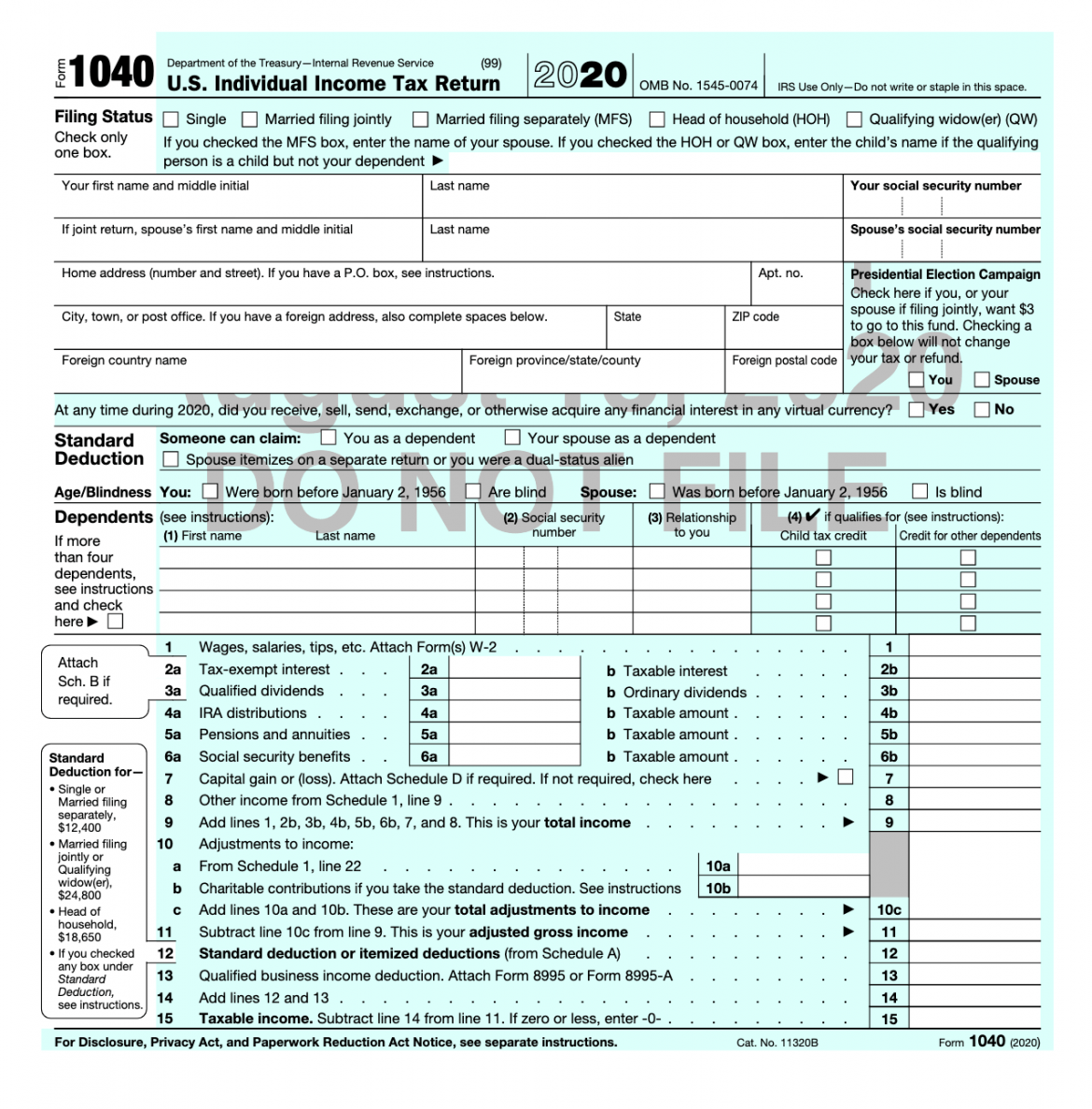

IRS Releases Draft Form 1040 Here s What s New For 2020

https://specials-images.forbesimg.com/imageserve/5f3ed50b6c322baa3b67a319/960x0.jpg?fit=scale

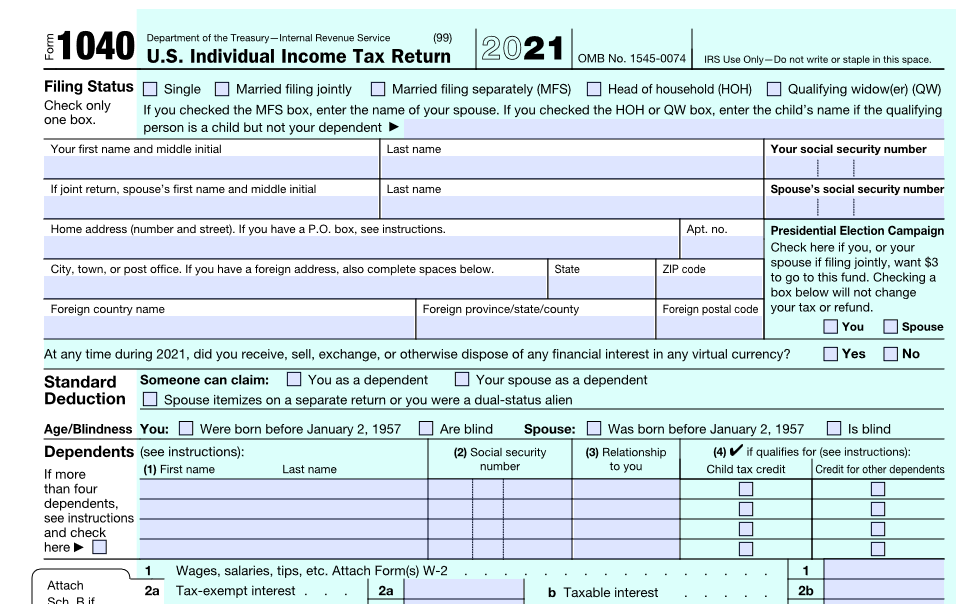

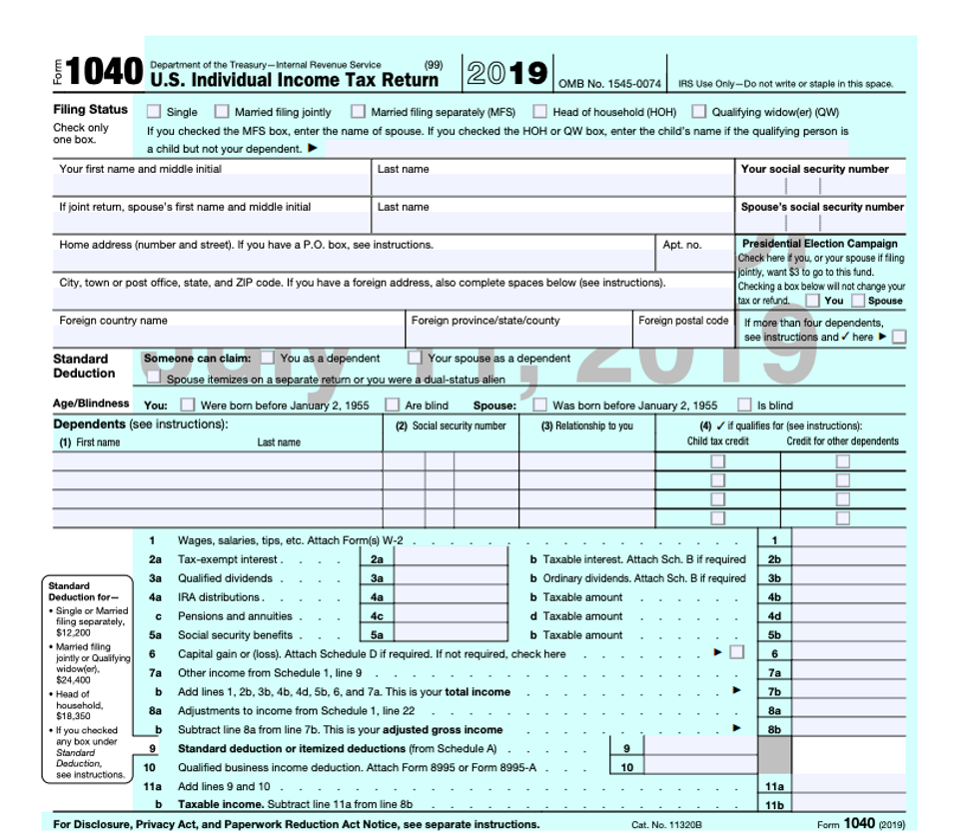

Schedule SE Form 1040 is used by self employed persons to figure the self employment tax due on net earnings About Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file Form 1040 U S Individual Income Tax Return 2023 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space For the year Jan 1 Dec 31 2023 or other tax year beginning 2023 ending 20 See separate instructions Your first name and middle initial Last name

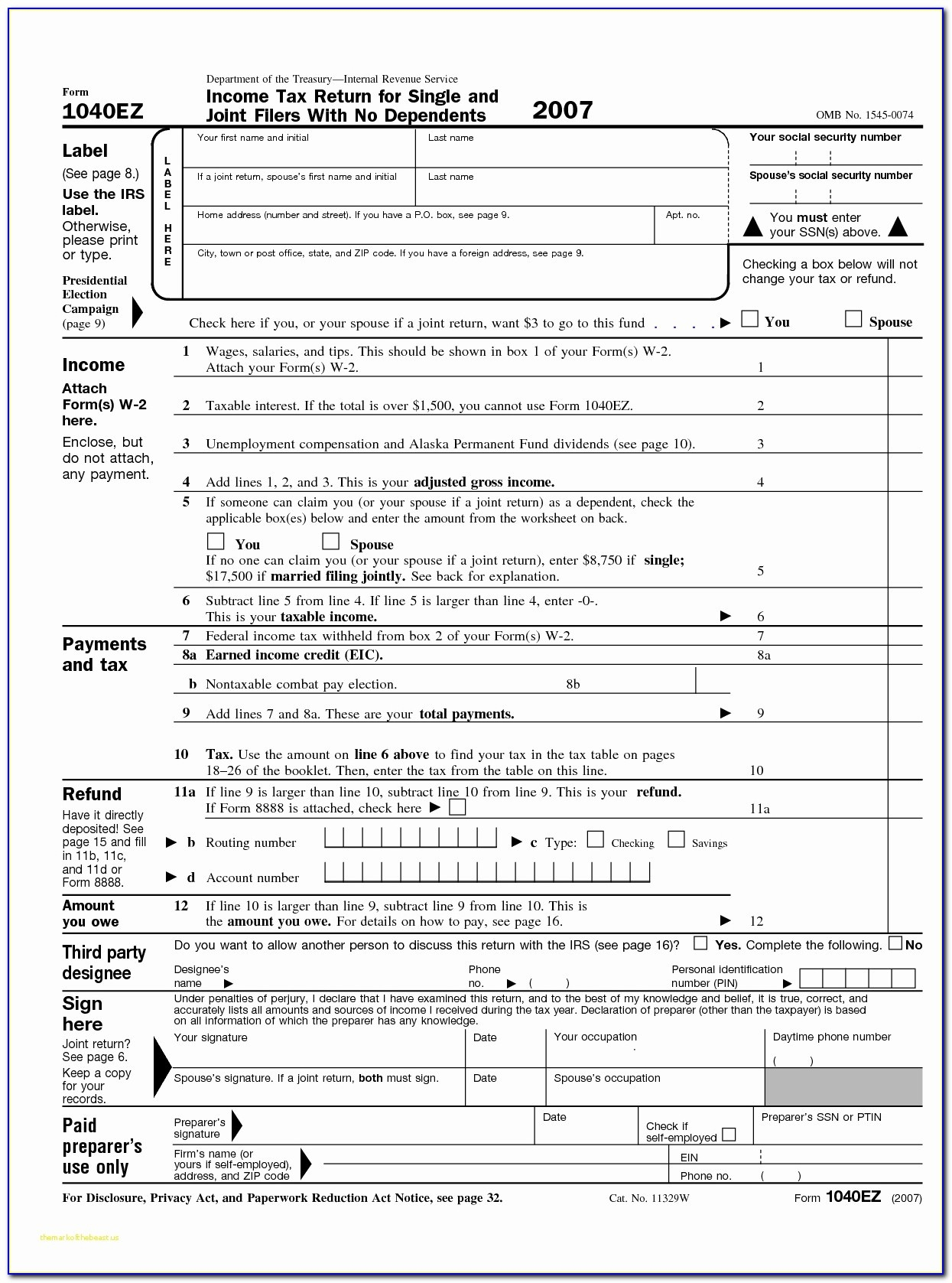

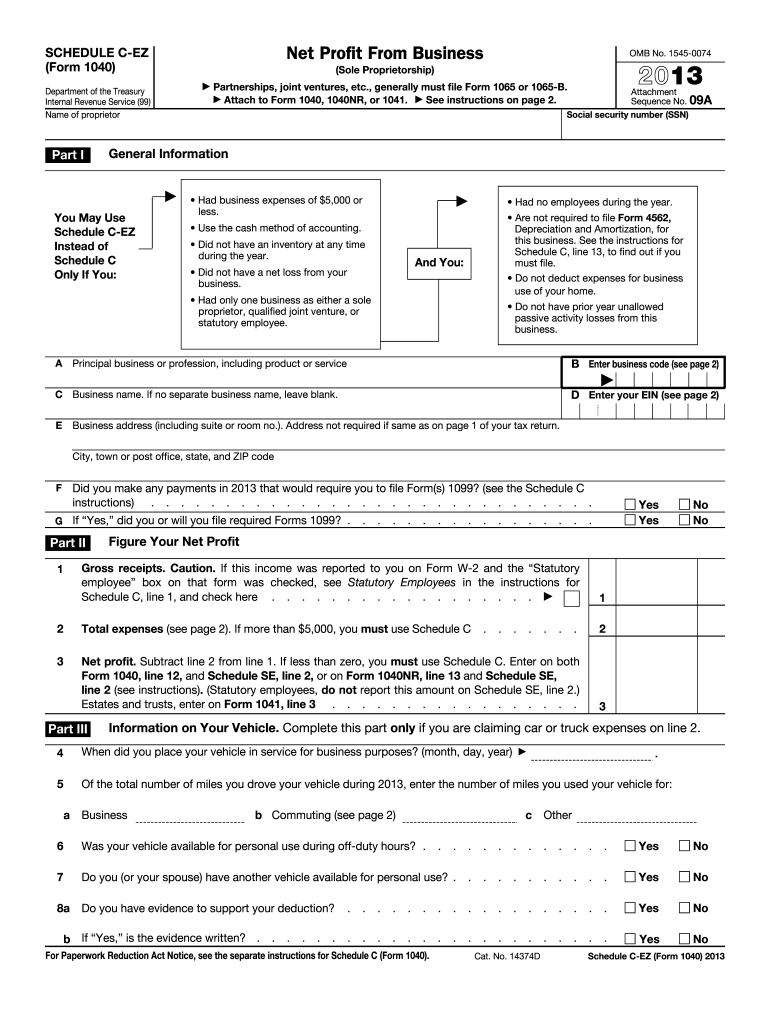

IRS Form 1040 Schedule C Profit or Loss From Business Reporting form sequence number 09 for attachment to IRS Form 1040 Profit or Loss from a Sole Proprietorship business OMB 1545 0074 OMB report IRS OMB 1545 0074 2020 Form 1040 Schedule C Document pdf Download PDF pdf What Is Form 1040 Schedule C Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule C or Schedule C EZ to report a business income or loss You can not file Schedule C with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule C is the long version of the simplified easy Schedule C EZ form

More picture related to Printable Irs Form 1040 Schedule C

Irs Printable Form 1040

https://data.templateroller.com/pdf_docs_html/1862/18621/1862187/irs-form-1040x-amended-u-s-individual-income-tax-return_print_big.png

Printable Irs Form 1040 Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/07/how-to-fill-out-irs-form-1040-with-form-wikihow-free-1.jpg

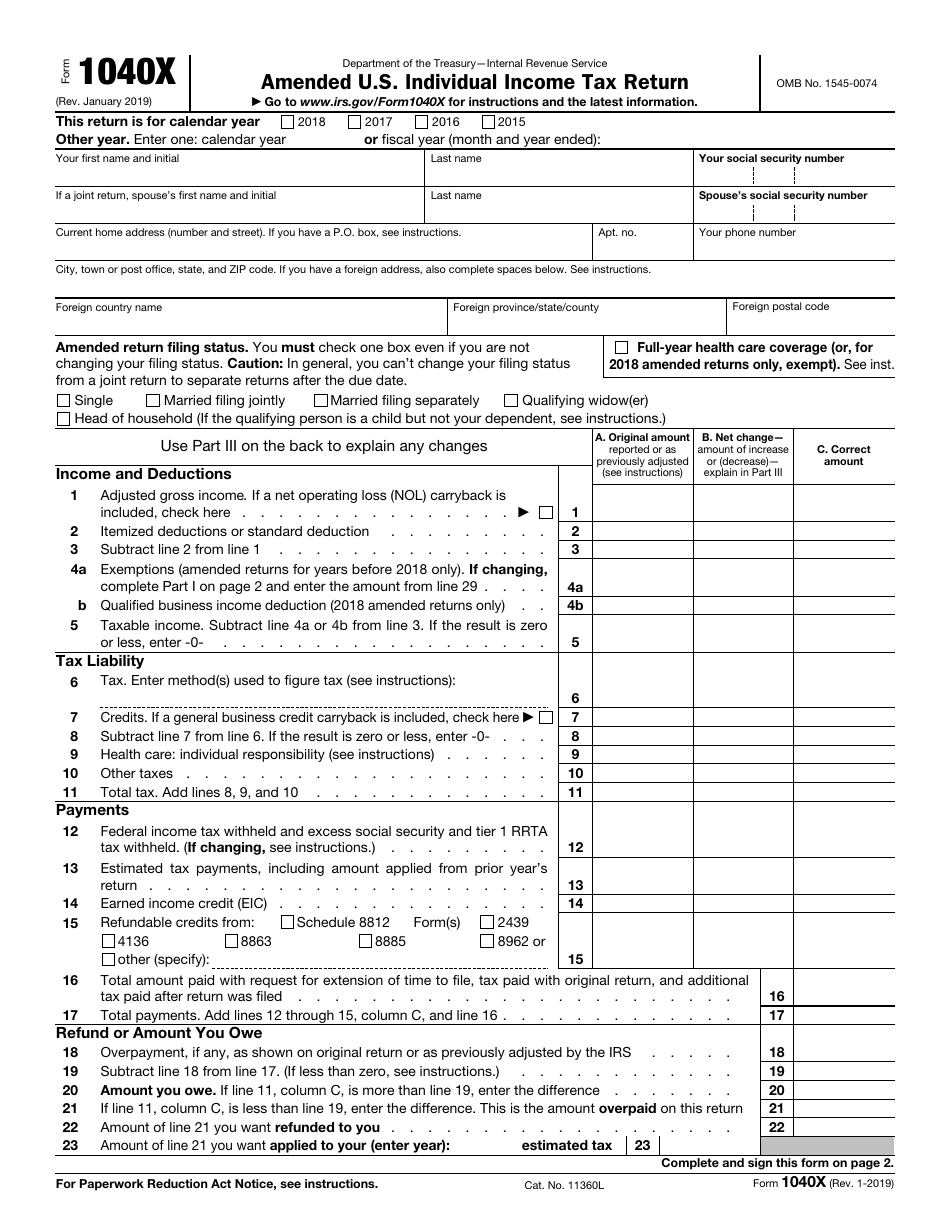

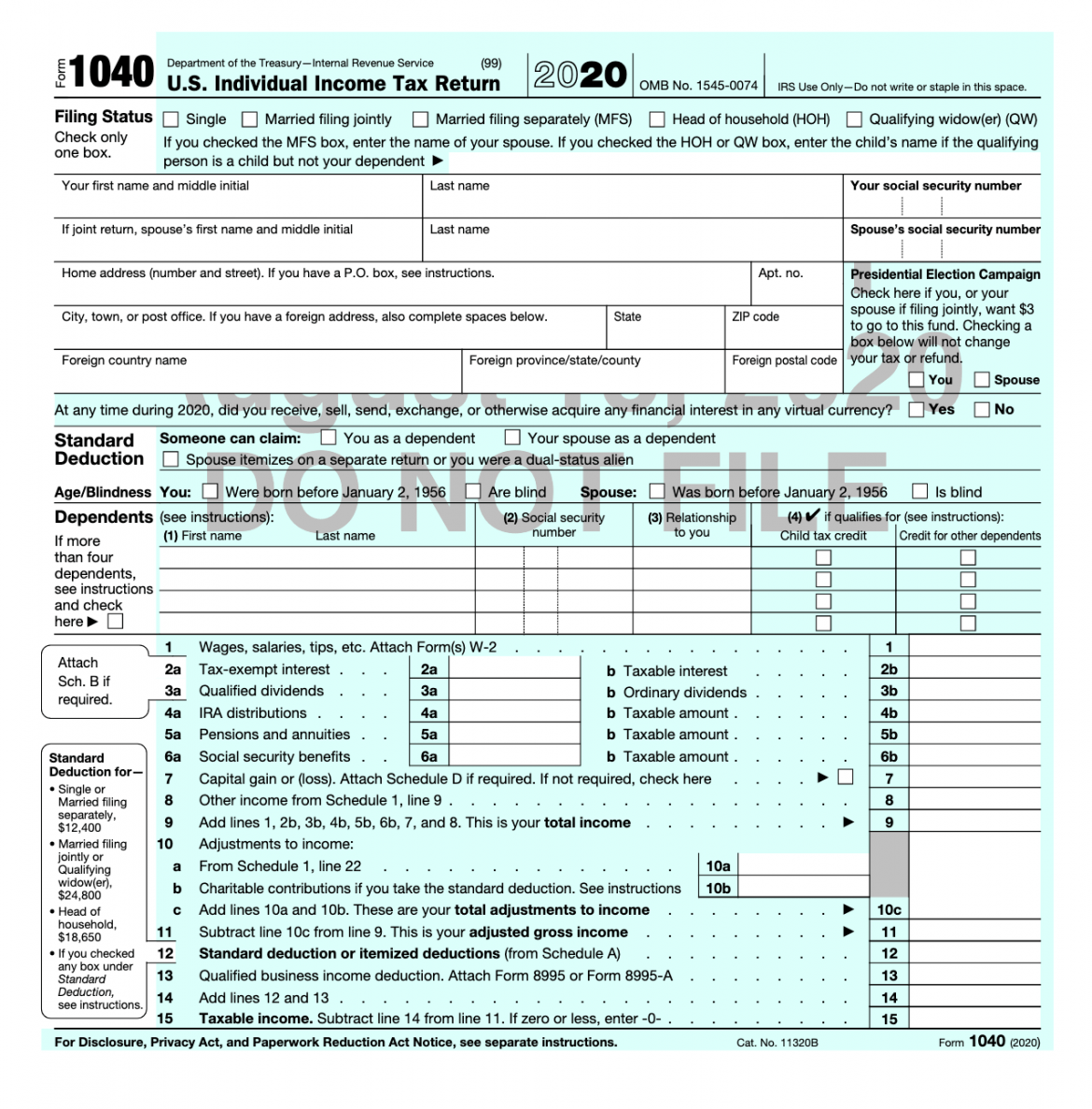

Irs 1040 Form 2020 Printable IRS 1040 2018 Fill And Sign Printable Template Online

https://specials-images.forbesimg.com/imageserve/5fd3d26ac6323f845ed85872/960x0.jpg?fit=scale

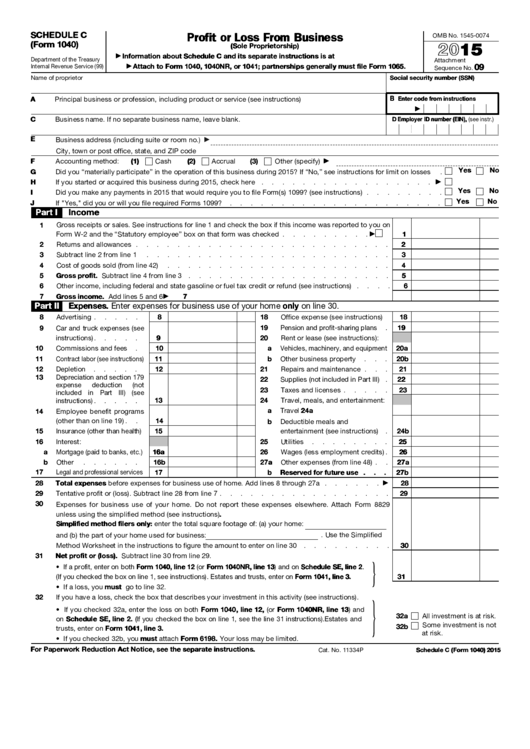

SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2023 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065 What is Schedule C IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it electronically

Option A involves completing Form 8829 by calculating the total area of your home and getting a percentage for your home business Include the total allowable expenses resulting from those calculations on Line 30 of Schedule C Option B is a simplified calculation 5 per square foot of home business space up to 300 square feet for a maximum 1 500 deduction The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Accessible federal tax forms

Fillable Schedule C Irs Form 1040 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/7/72/7265/page_1_thumb_big.png

2013 Form IRS 1040 Schedule C EZ Fill Online Printable 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/2013-form-irs-1040-schedule-c-ez-fill-online-printable.png

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

https://www.irs.gov/instructions/i1040sc

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity

1040 Form 2022 Schedule C Season Schedule 2022

Fillable Schedule C Irs Form 1040 Printable Pdf Download

Fillable Schedule C Irs Form 1040 Printable Pdf Download

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

2019 Form 1040 Printable IRS Form Download PDF Online

What s New On Form 1040 For 2020 Taxgirl

What s New On Form 1040 For 2020 Taxgirl

2019 IRS Tax Forms 1040 Printable 2021 Tax Forms 1040 Printable

FREE 9 Sample Schedule C Forms In PDF MS Word

1040 Schedule C 2021

Printable Irs Form 1040 Schedule C - Schedule SE Form 1040 is used by self employed persons to figure the self employment tax due on net earnings About Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file