Printable Irs Form 1099 Misc Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN What Is It Used For If you make certain types of payments in the course of your trade or business you must issue a 1099 MISC to the payment recipient and file it with the IRS Common reportable payments include 1 Royalties or broker payments 10 or more Rents 600 or more Prizes and awards 600 or more

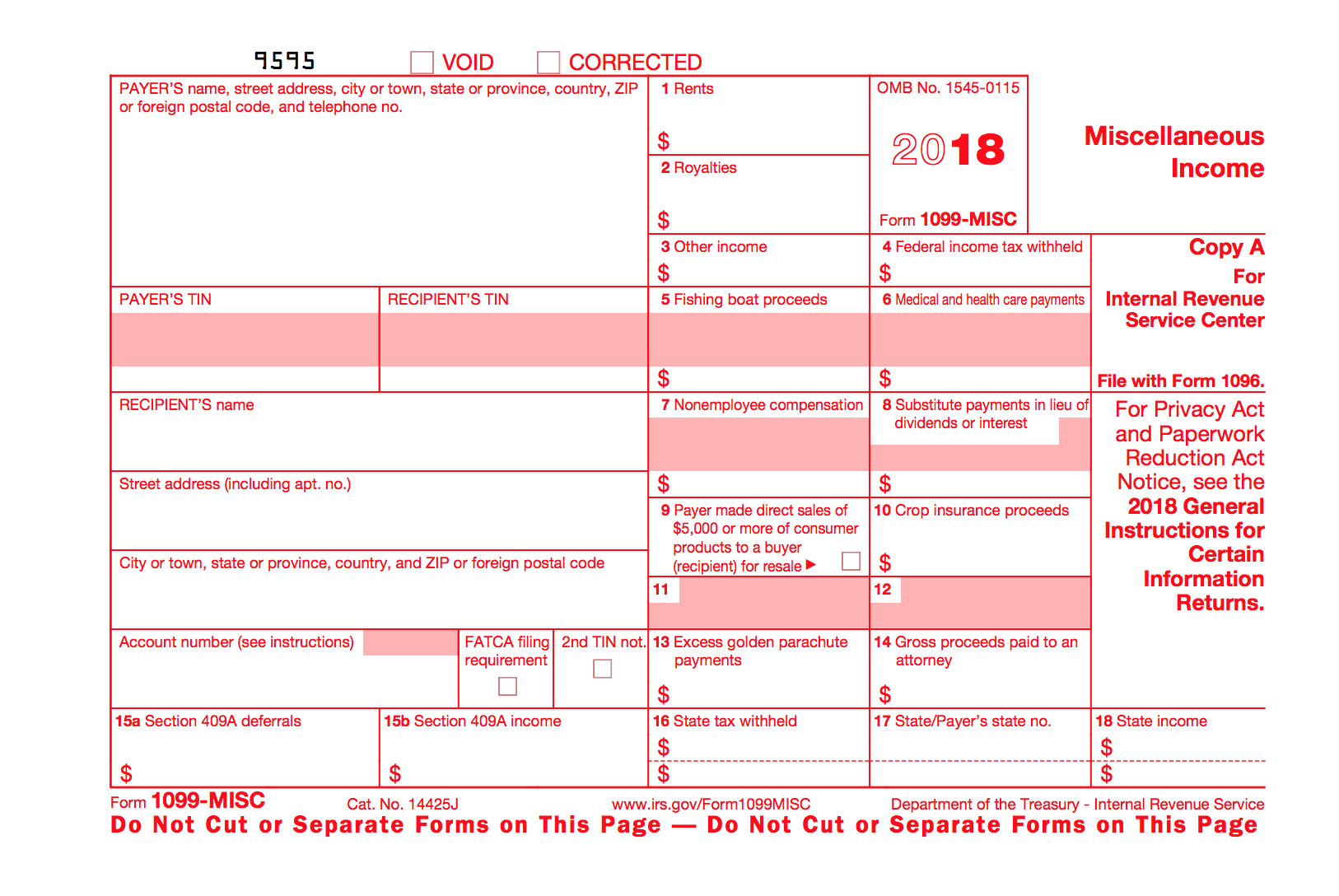

Printable Irs Form 1099 Misc

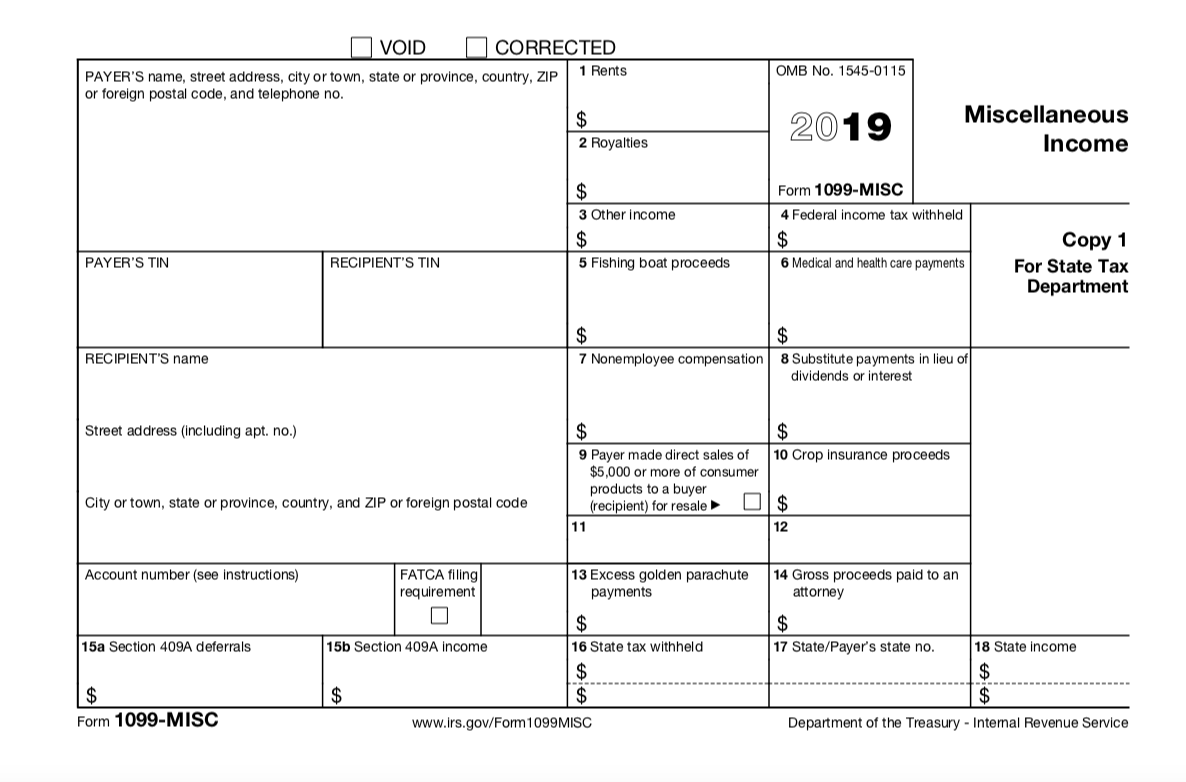

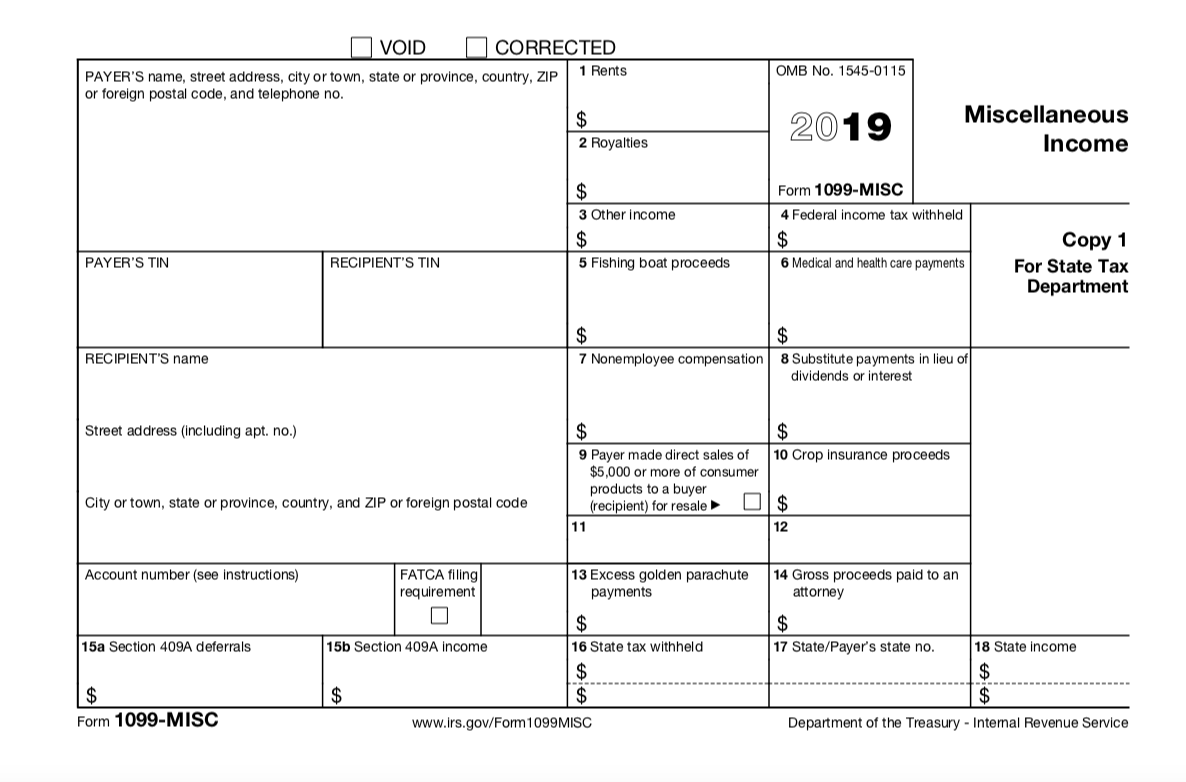

Printable Irs Form 1099 Misc

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

What Is A 1099 Misc Form Financial Strategy Center

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

How To File A 1099 Misc As An Employee Printable Form Templates And Letter

https://jumbotron-production-f.squarecdn.com/assets/11075493e5b6812373621.png

The due date for filing Form 1099 MISC with the IRS is February 28 2024 if you file on paper or March 31 2024 if you file electronically Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation forms used to prepare your return and forms or schedules included in your Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099 MISC form is featured below

A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or tax exempt In tax year 2020 the IRS reintroduced Form 1099 NEC for reporting independent contractor income otherwise known as nonemployee compensation If you re self employed income you receive during the year might be reported on the 1099 NEC but Form 1099 MISC is still used to report certain payments of 600 or more you made to other businesses and people This article covers the 1099 MISC

More picture related to Printable Irs Form 1099 Misc

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1099-misc-tax-basics.png

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

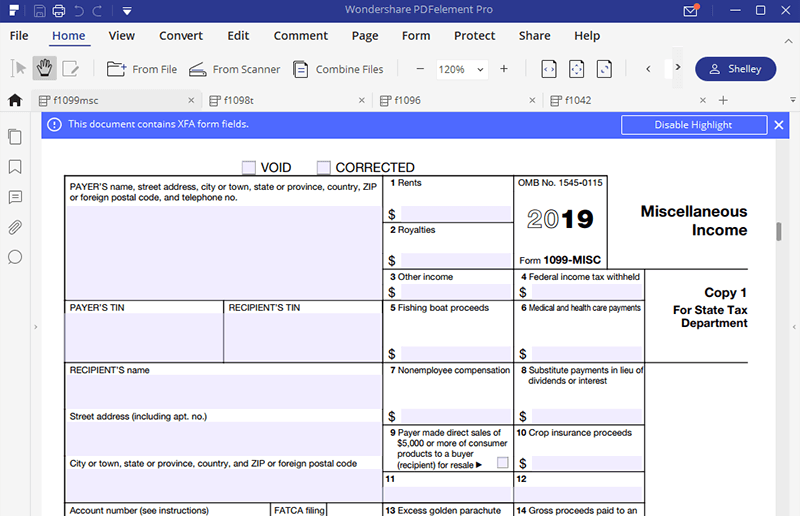

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more Frequently Asked Questions What Is Form 1099 MISC Used For Businesses file form 1099 MISC for each person to whom they ve paid 1 At least 10 in broker payments or royalties in lieu of tax exempt interest or dividends At least 600 in The fishing boat proceeds

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/1099-misc-software/images/1099-copyA.jpg

Free Printable 1099 Misc Forms Free Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

https://www.irs.gov/instructions/i1099mec

Revised 01 2024 Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

How To Print And File 1099 MISC Miscellaneous Income

How To Fill Out And Print 1099 MISC Forms

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season

2009 Form IRS 1099 MISC Fill Online Printable Fillable Blank PdfFiller

Determining Who Gets A 1099 MISC Form And When It s Due

Determining Who Gets A 1099 MISC Form And When It s Due

Form 1099 Misc Fillable Universal Network

1099 MISC Form Rellenable Imprimible Descargar Gratis Instrucciones 2020 Mark s Trackside

IRS Form 1099 MISC How To Fill It Right

Printable Irs Form 1099 Misc - On Nov 21 2023 in Notice 2023 74 the IRS announced that calendar year 2023 would be a transition year for third party settlement organizations TPSOs TPSOs which include popular payment apps and online marketplaces must file with the IRS and provide taxpayers a Form 1099 K that reports payments for goods or services where gross payments