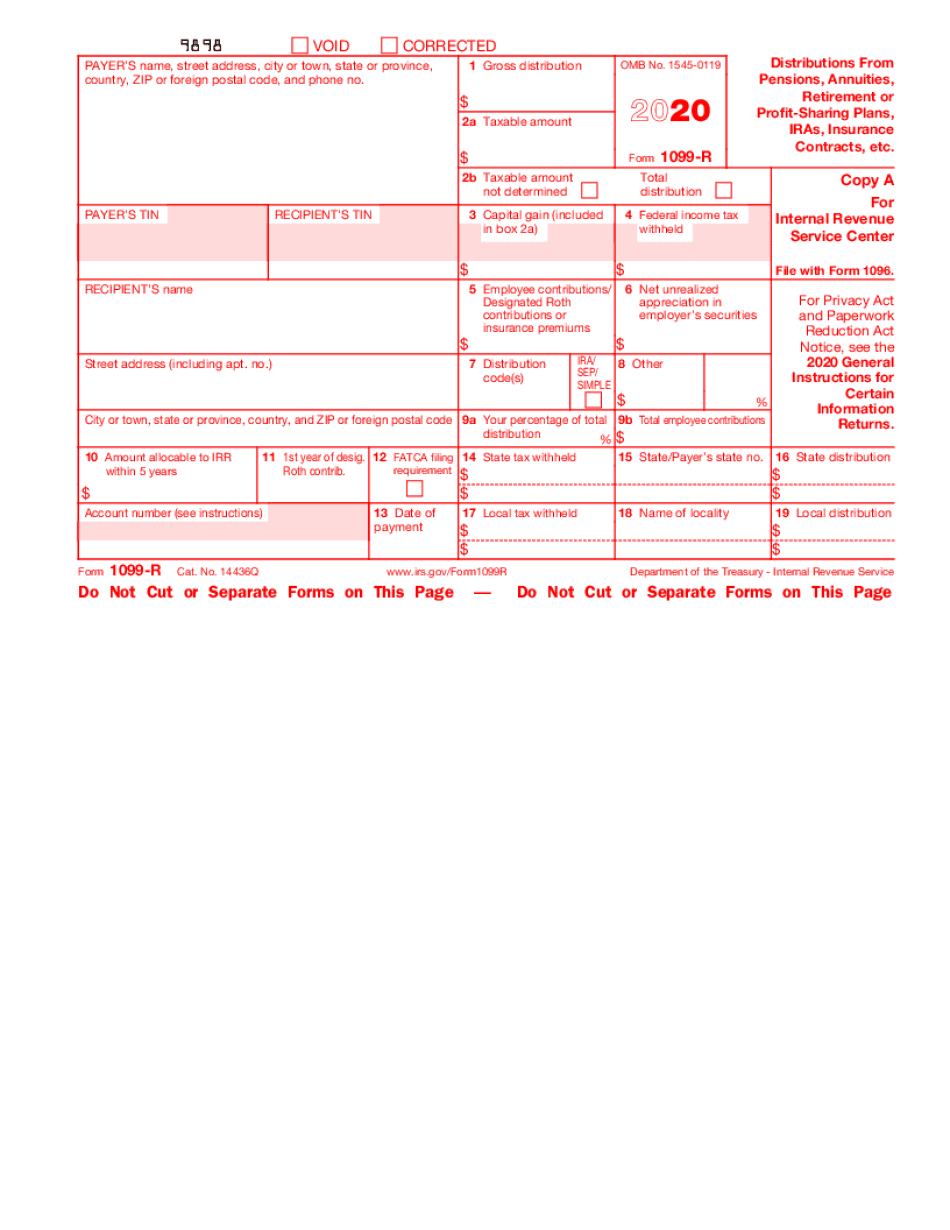

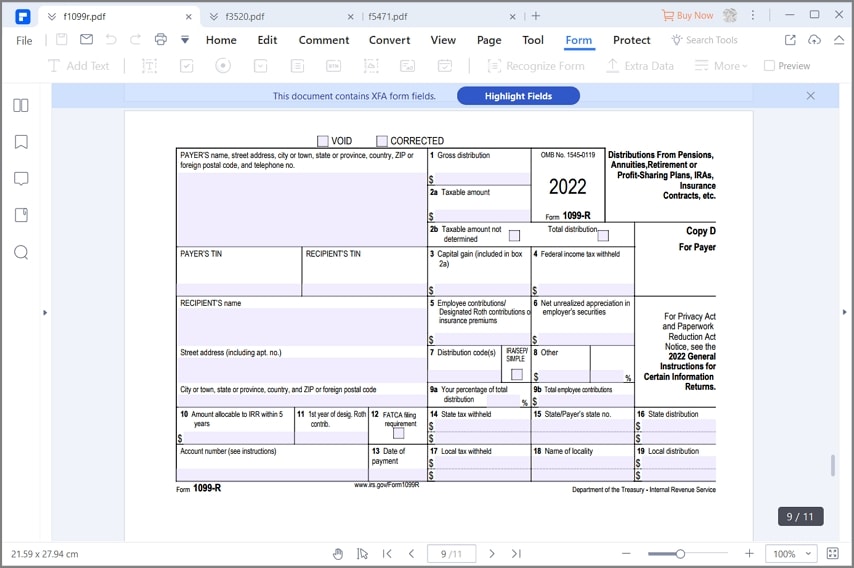

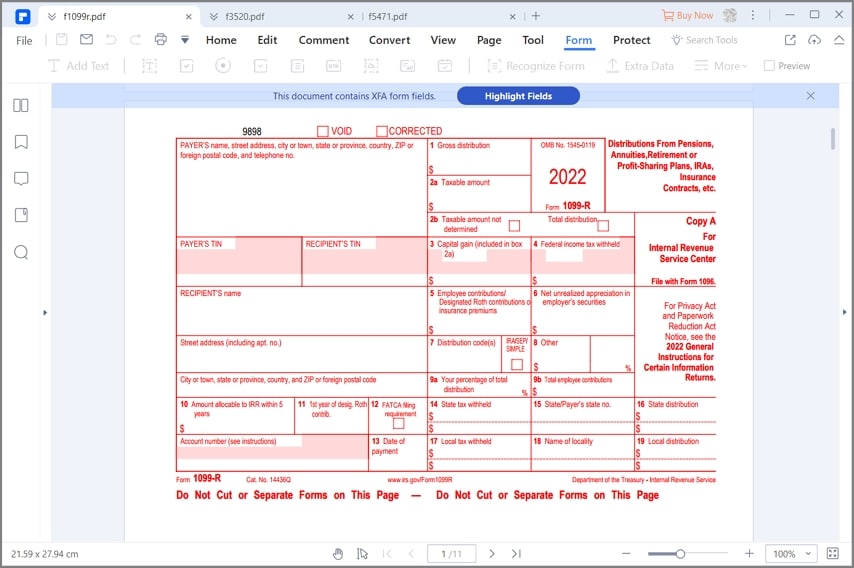

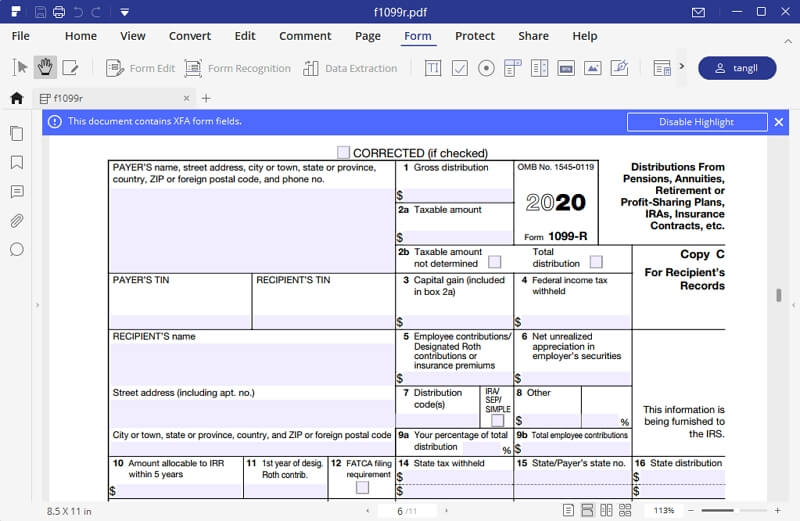

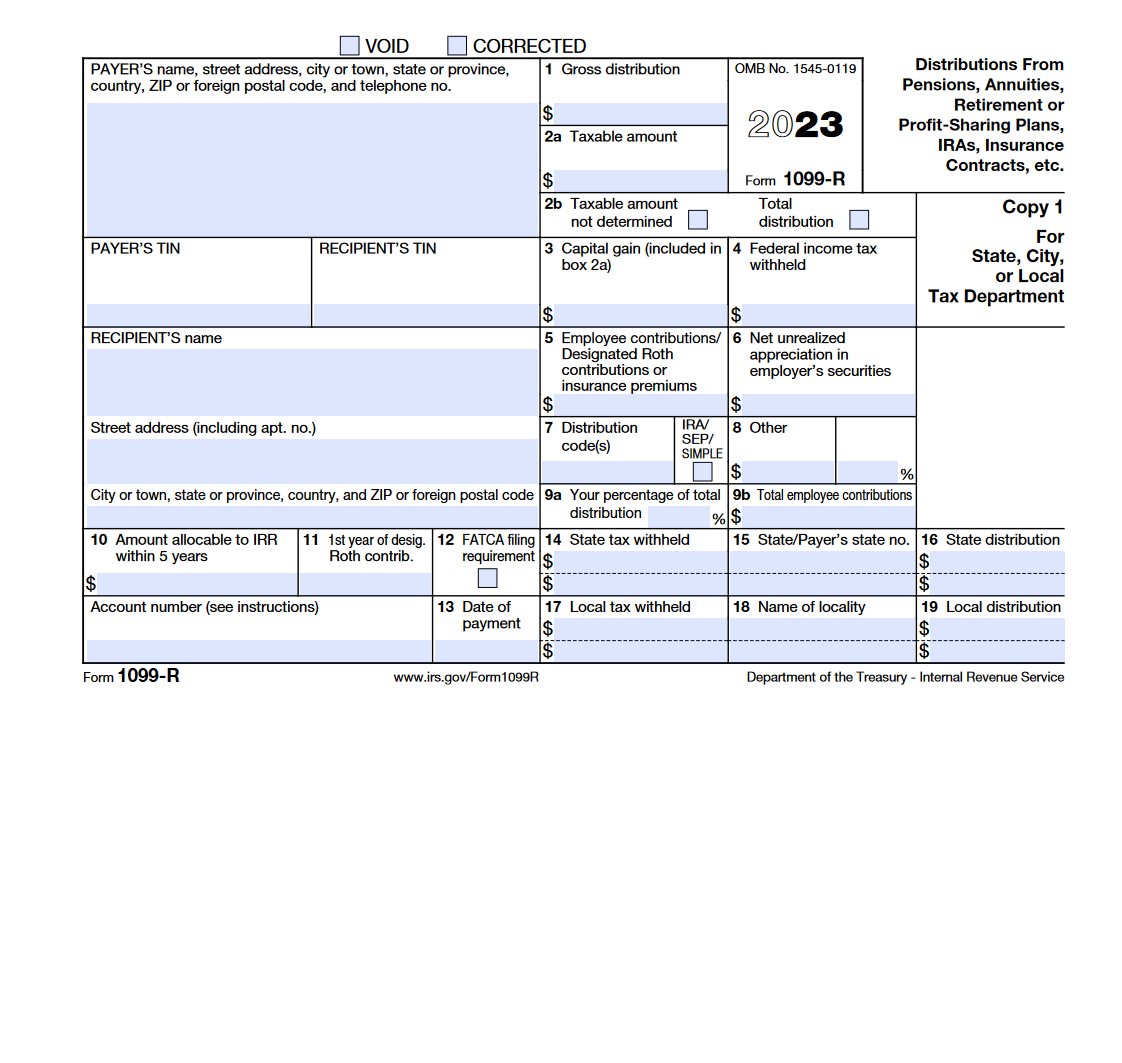

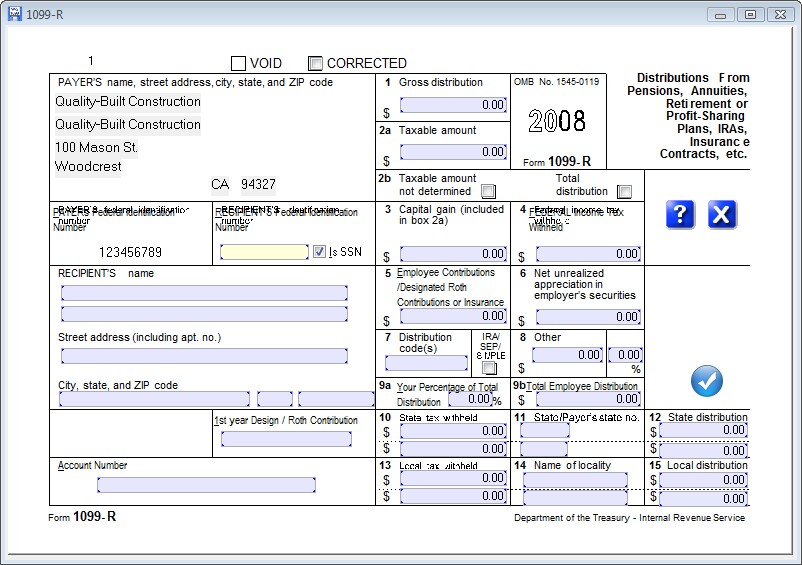

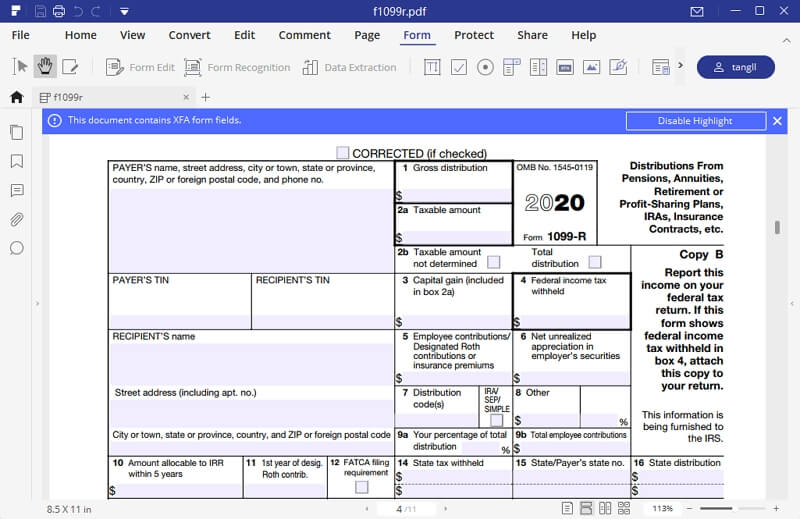

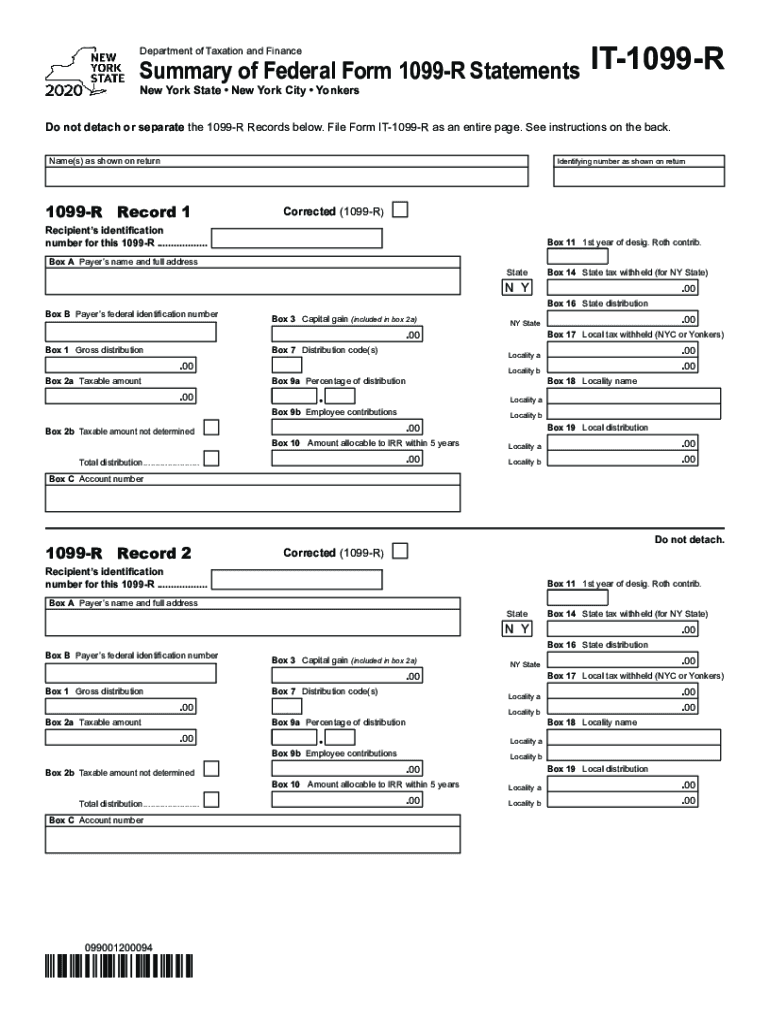

Printable Irs Form 1099 R File Form 1099 R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from Profit sharing or retirement plans Any individual retirement arrangements IRAs Annuities pensions insurance contracts survivor income benefit plans

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution Learn how to view download print or request by mail your annual 1099 R tax form that reports how much income you earned from your annuity How to access your 1099 R tax form Sign in to your online account Go to OPM Retirement Services Online Click 1099 R Tax Form in the menu to view your most recent tax form

Printable Irs Form 1099 R

Printable Irs Form 1099 R

https://www.pdffiller.com/preview/496/222/496222006/big.png

IRS Form 1099 R 2023 Forms Docs 2023

https://blanker.org/files/images/form-1099r.png

Formulaire IRS 1099 R Comment Le Remplir Correctement Et Facilement

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-1099r-05.jpg

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN Form CSA 1099 R Civil Service Retirement Benefits The Ofice of Personnel Management issues Form CSA 1099 R for annuities paid or Form CSF 1099 R for survivor annuities paid The CSA Form 1099 R box numbers reflect the standard numbering on a Form 1099 R If the taxable amount isn t calculated in Box 2 the Simplified Method must be used

Form 1099 R is used to report distributions from annuities profit sharing plans retirement plans IRAs insurance contracts or pensions Anyone who receives a distribution over 10 should Form 5498 New repayment code We have added code BA for reporting a repayment of a qualified birth or adoption distribution See the instructions for Box 14a Repayments and Box 14b Code later Required minimum distributions RMDs

More picture related to Printable Irs Form 1099 R

Formulaire IRS 1099 R Comment Le Remplir Correctement Et Facilement

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-1099r-01.jpg

Form 1099 R Instructions Information Community Tax

https://www.communitytax.com/wp-content/uploads/2016/04/Tax-Form-1099-R.jpg

Form 1099 R Wikipedia

https://upload.wikimedia.org/wikipedia/commons/thumb/0/05/Form_1099-R%2C_2015.jpg/1200px-Form_1099-R%2C_2015.jpg

A 1099 R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts You ll generally receive one for distributions of 10 or more The plan or account custodian completing the 1099 R must fill out three copies of every 1099 R they issue One for the IRS Form 1099 R Form 1099 R is used to report the distribution of retirement benefits such as pensions annuities or other retirement plans Additional variations of Form 1099 R include Form CSA 1099R Form CSF 1099R and Form RRB 1099 R Most public and private pension plans that aren t part of the Civil Service system use the standard Form 1099 R

Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds Request a duplicate tax filing statement 1099R change your Personal Identification Number PIN for accessing our automated systems establish change or stop an allotment to an organization change your mailing address start direct deposit of your payment or change the account or financial institution to which your payment is sent

IRS Form 1099 R How To Fill It Right And Easily

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-1099r-01.jpg

IRS Form 1099 R How To Fill It Right And Easily

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-1099r-03.jpg

https://www.irs.gov/forms-pubs/about-form-1099-r

File Form 1099 R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from Profit sharing or retirement plans Any individual retirement arrangements IRAs Annuities pensions insurance contracts survivor income benefit plans

https://eforms.com/irs/form-1099/r/

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution

What Is A 1099 R Form Distributions From Pensions Annuities

IRS Form 1099 R How To Fill It Right And Easily

Free Printable 1099 R Form Printable Templates

Understanding Your Form 1099 R MSRB Mass gov

IRS Form 1099 R How To Fill It Right And Easily

1099 r Blank Form Armando Friend s Template

1099 r Blank Form Armando Friend s Template

My IRS 1099 R Information Screen

SDCERS Form 1099 R Explained

It 1099 R 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Printable Irs Form 1099 R - The 1099 R form is a tax form that s used to report any money withdrawn from a retirement account like your Later account to the IRS Taking money out of a retirement account is known as a distribution It s one of a few different kinds of 1099 forms which generally report different kinds of income you earned in a year to the IRS