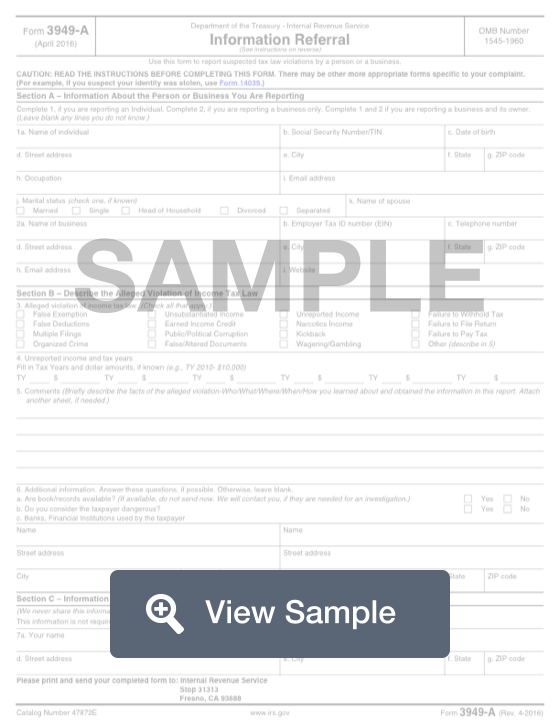

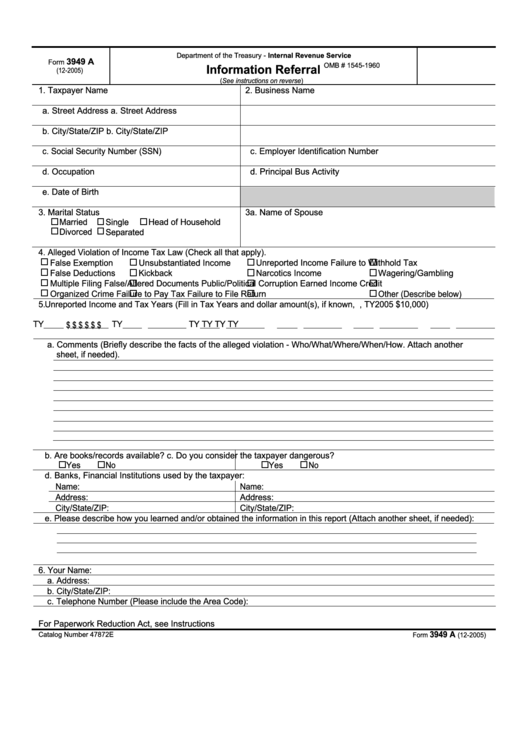

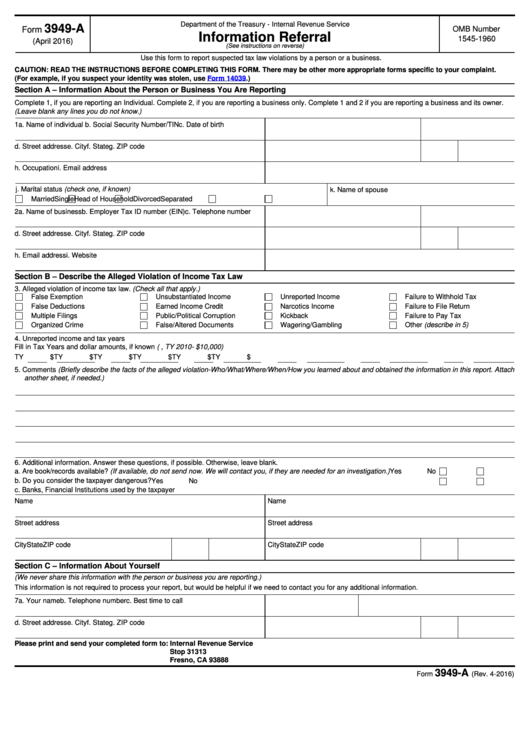

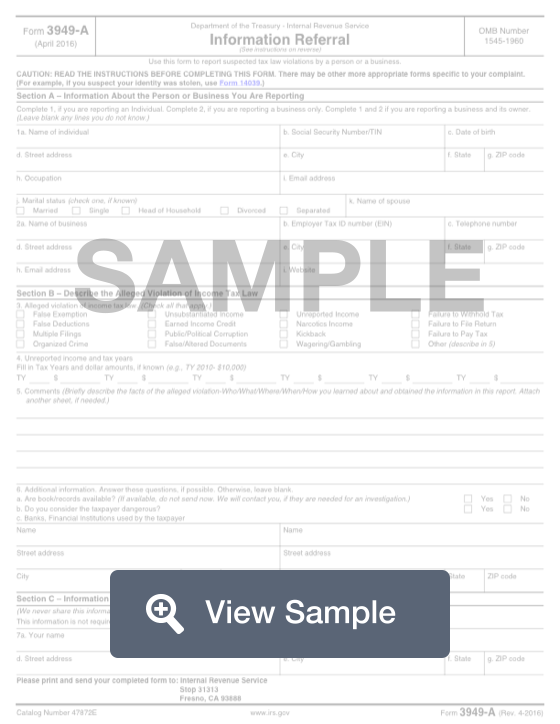

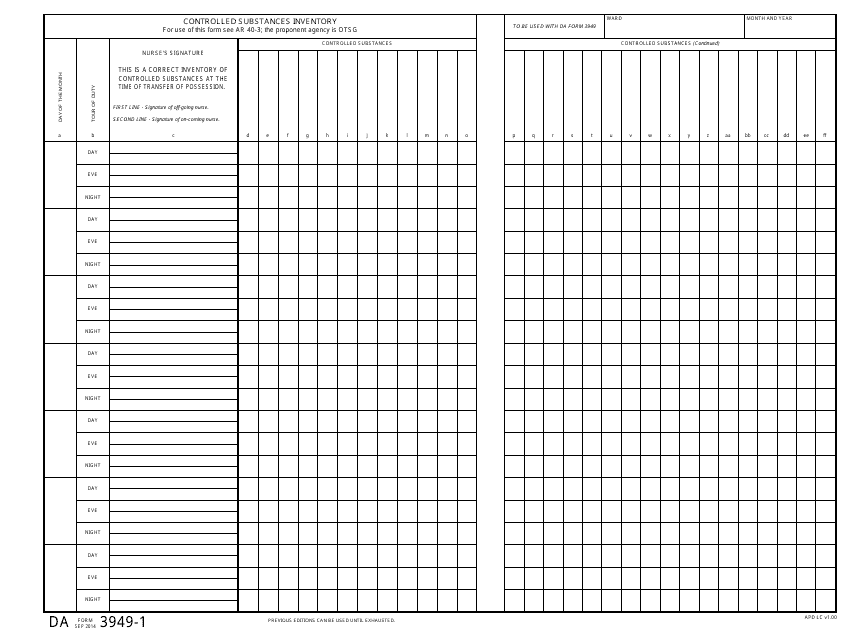

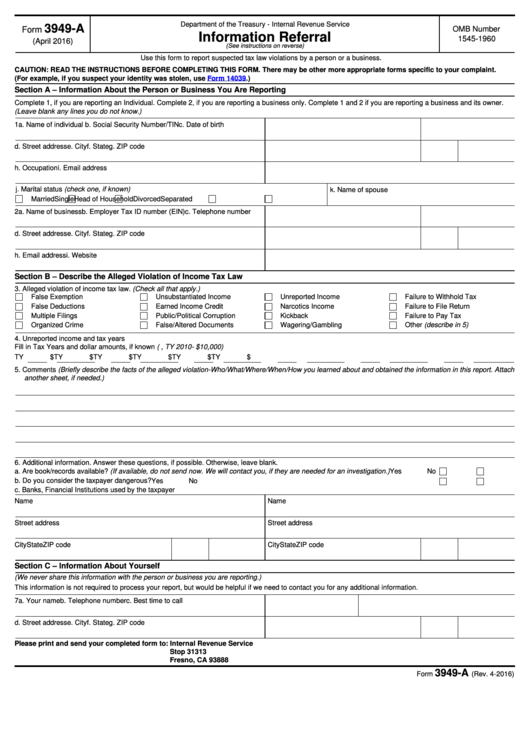

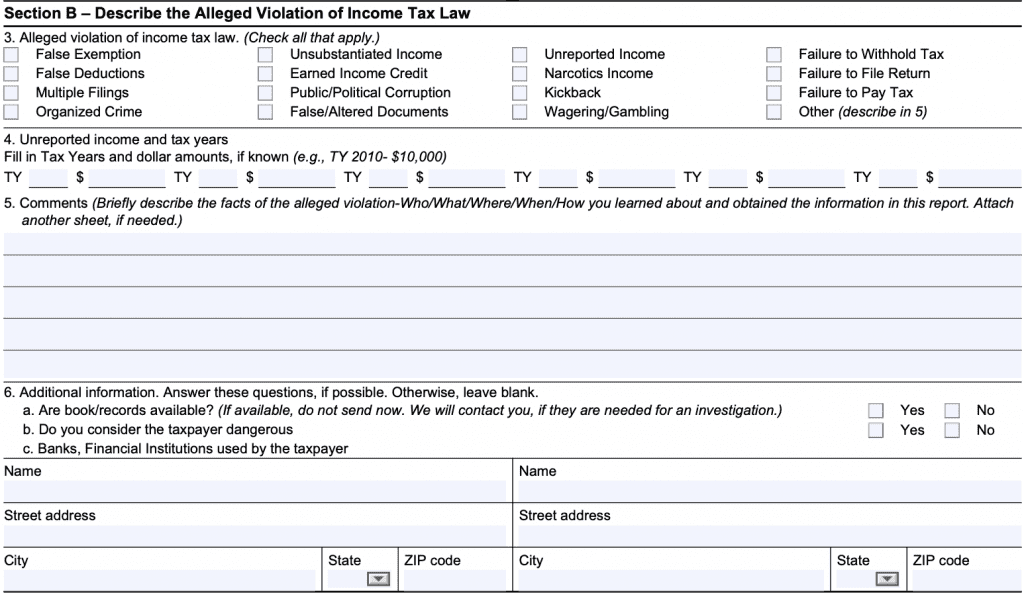

Printable Irs Form 3949 A Use Form 3949 A Information Referral PDF to report alleged tax law violations by an individual a business or both You can report alleged tax law violations to the IRS by filling out Form 3949 A online Fill Out Form Online Use this form to report alleged tax law violations False exemptions or deductions Kickbacks A false or altered tax document

Form 3949 A Rev 2 2007 Instructions Provide the following information for the Person Business You Are Reporting if Known Name Street Address of Residence City State and Zip Code Social Security Number Date of the Person s Birth Business Name Street Address of Business City State Zip Code Use the Form 3949 A Information Referral if you suspect an individual or a business is not complying with the tax laws You can submit Form 3949 A online or by mail We don t take tax law violation referrals over the phone We will keep your identity confidential when you file a tax fraud report

Printable Irs Form 3949 A

Printable Irs Form 3949 A

https://www.pdffiller.com/preview/445/288/445288349/big.png

IRS Form 3949 A Fill Out Online How To Report Tax Fraud FormSwift

https://formswift.com/seo-pages-assets/images/documents/form-3949-a/form-3949-a-sample.png

Fillable Form 3949 A Information Referral Form Department Of Treasury 2005 Printable Pdf

https://data.formsbank.com/pdf_docs_html/174/1748/174813/page_1_thumb_big.png

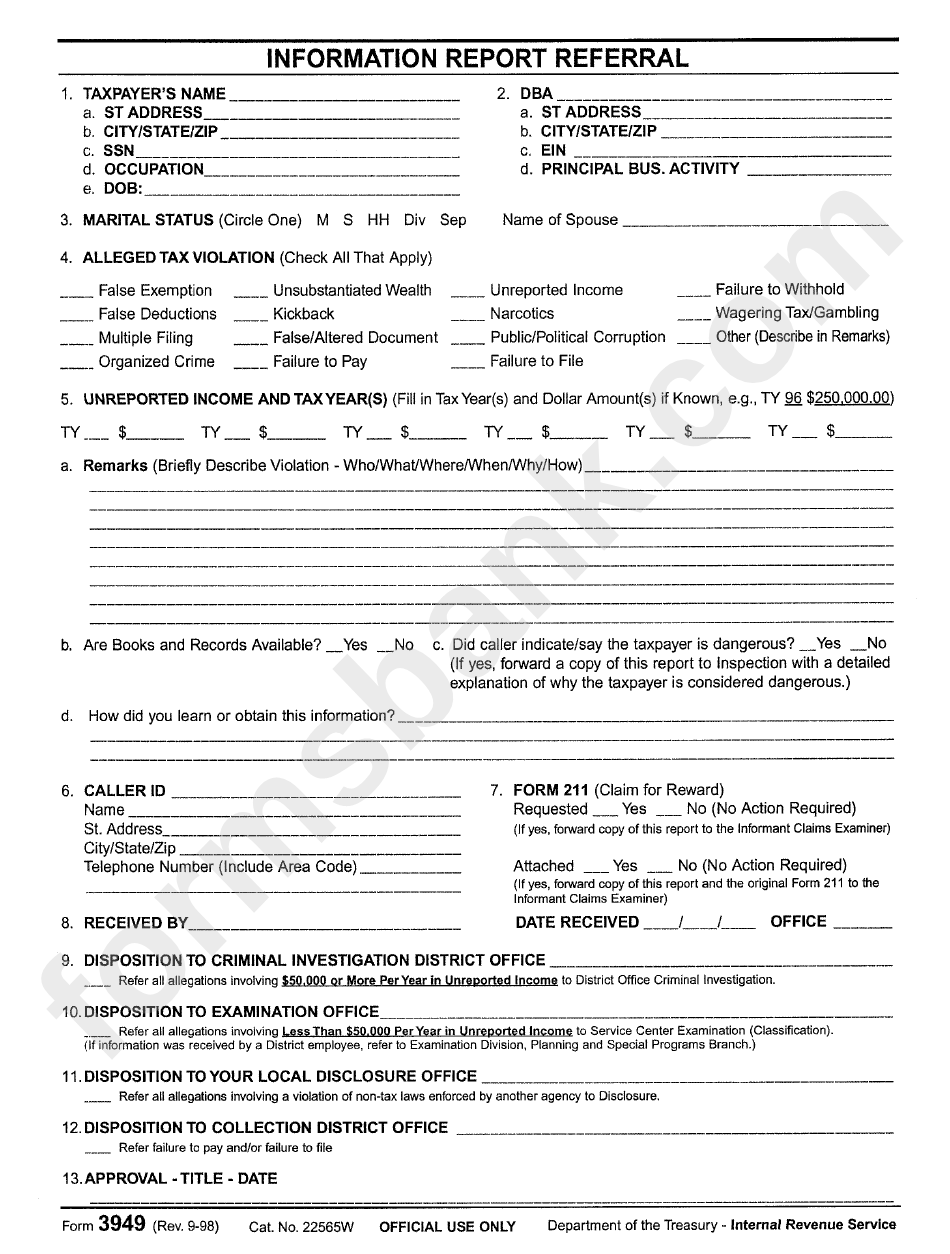

The Form 3949 A is a tax related public use form submitted voluntarily by customers to report alleged violations of tax law by individuals and businesses to the IRS and remain confidential Form 3949 Information Report Referral Print INOLES screen for individual listed in section A box 1a 1g for IMF or section A box 2a 2g from BMF Print This Form More about the Federal Form 3949 A Other TY 2023 We last updated the Information Referral in January 2024 so this is the latest version of Form 3949 A fully updated for tax year 2023 You can download or print current or past year PDFs of Form 3949 A directly from TaxFormFinder You can print other Federal tax forms here

Create My Document IRS Form 3949 A should be completed and provided to the IRS by someone who suspects that another person may have committed tax fraud This form can be used to report individuals or businesses Once this form is completed and provided to the IRS they will contact the person who submitted the report for more information A fraudulent return is a return in which the individual is attempting to file using someone else s name or SSN on the return or where the taxpayer is presenting documents or information that have no basis in fact Note Fraudulent returns should not be filed with the Service A potentially abusive return is a return that

More picture related to Printable Irs Form 3949 A

Printable Irs Form 3949 A TUTORE ORG Master Of Documents

https://www.irs.gov/pub/xml_bc/33440086.gif

Irs Form 3949 A Fillable Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/37/593/37593064.png

Form 3949 Information Report Referral Department Of The Tressury Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/236/2365/236503/page_1_bg.png

What Is IRS Form 3949 A IRS Form 3949 A Information Referral is a fiscal instrument any individual is free to use to report an alleged tax violation Alternate Names Tax Form 3949 A Federal Form 3949 A Form 3949 A Information Referral is a tax form used for reporting suspected tax law violations to the IRS and sometimes whistleblowers can receive awards for reporting this information Understanding Tax Law Violations

If you suspect or know of an individual or company that is not complying with the tax laws you may report this activity by completing Form 3949 A PDF You may fill out Form 3949 A online print it and mail it to Internal Revenue Service Fresno CA 93888 If you do not wish to use Form 3949 A you may send a letter to the address above Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal form 3949 a pdf and you can print it directly from your computer More about the Federal Form 3949 A eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms

Fillable Form 3949 A Information Referral Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/305/3059/305970/page_1_thumb_big.png

IRS Form 3949 A Walkthrough Information Referral YouTube

https://i.ytimg.com/vi/xUpOUPWhfiw/maxresdefault.jpg

https://www.irs.gov/forms-pubs/about-form-3949-a

Use Form 3949 A Information Referral PDF to report alleged tax law violations by an individual a business or both You can report alleged tax law violations to the IRS by filling out Form 3949 A online Fill Out Form Online Use this form to report alleged tax law violations False exemptions or deductions Kickbacks A false or altered tax document

https://www.irs.gov/pub/irs-access/f3949a_accessible.pdf

Form 3949 A Rev 2 2007 Instructions Provide the following information for the Person Business You Are Reporting if Known Name Street Address of Residence City State and Zip Code Social Security Number Date of the Person s Birth Business Name Street Address of Business City State Zip Code

Printable Irs Form 3949 A TUTORE ORG Master Of Documents

Fillable Form 3949 A Information Referral Printable Pdf Download

Form 3949 A Edit Fill Sign Online Handypdf

Information Referral Form 3949 A Formsbox

Form 3949 A Information Referral 2014 Free Download

3949a Form Fill Out Sign Online DocHub

3949a Form Fill Out Sign Online DocHub

IRS Form 3949 A Information Referral

Form 3949 A Edit Fill Sign Online Handypdf

IRS Form 3949 A How To Report Tax Evasion Fraud

Printable Irs Form 3949 A - What is Form 3949 A People can utilize this form as an information referral to notify any income tax irregularities perpetrated by other people or companies Whistleblowers voluntarily fill out Form 3949 A and submit it to the Internal Revenue Service along with any relevant details and proof of the alleged tax fraud