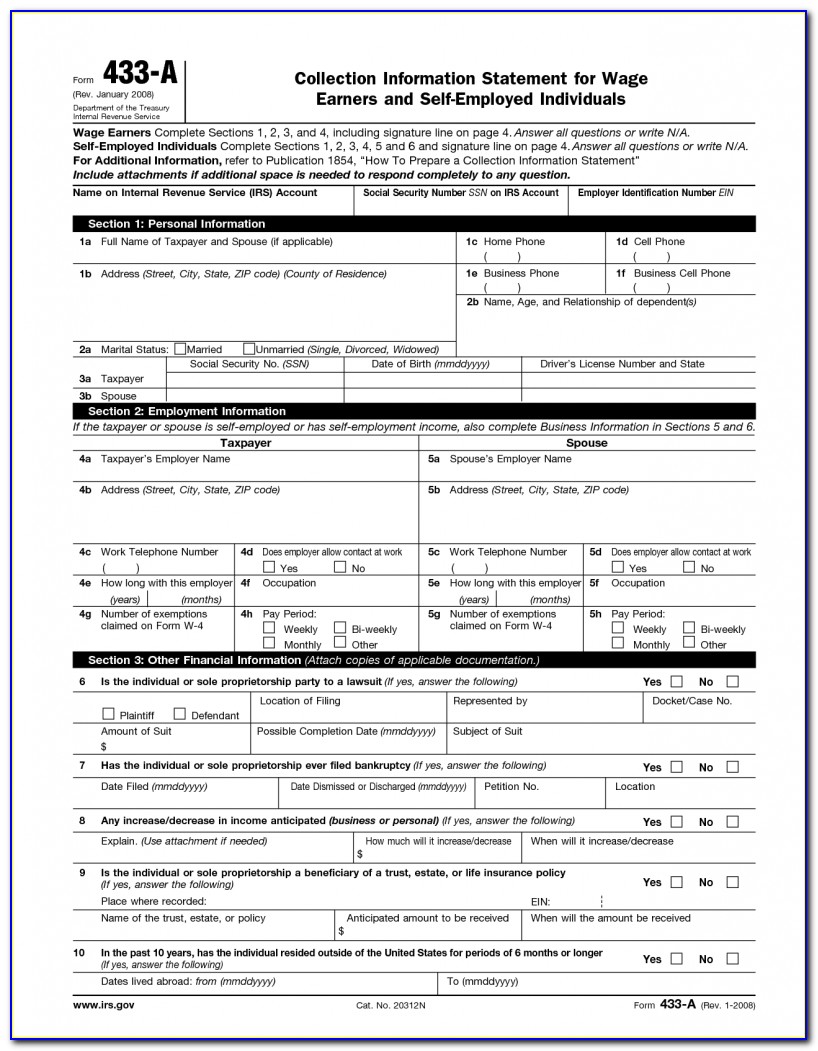

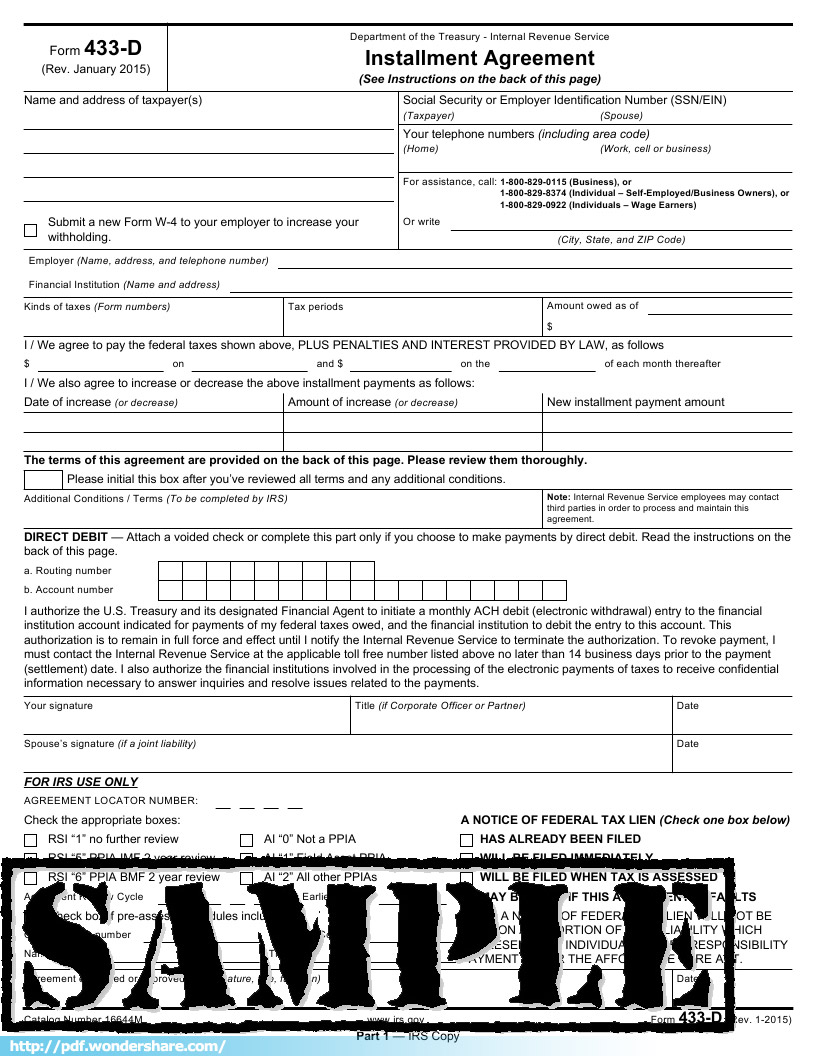

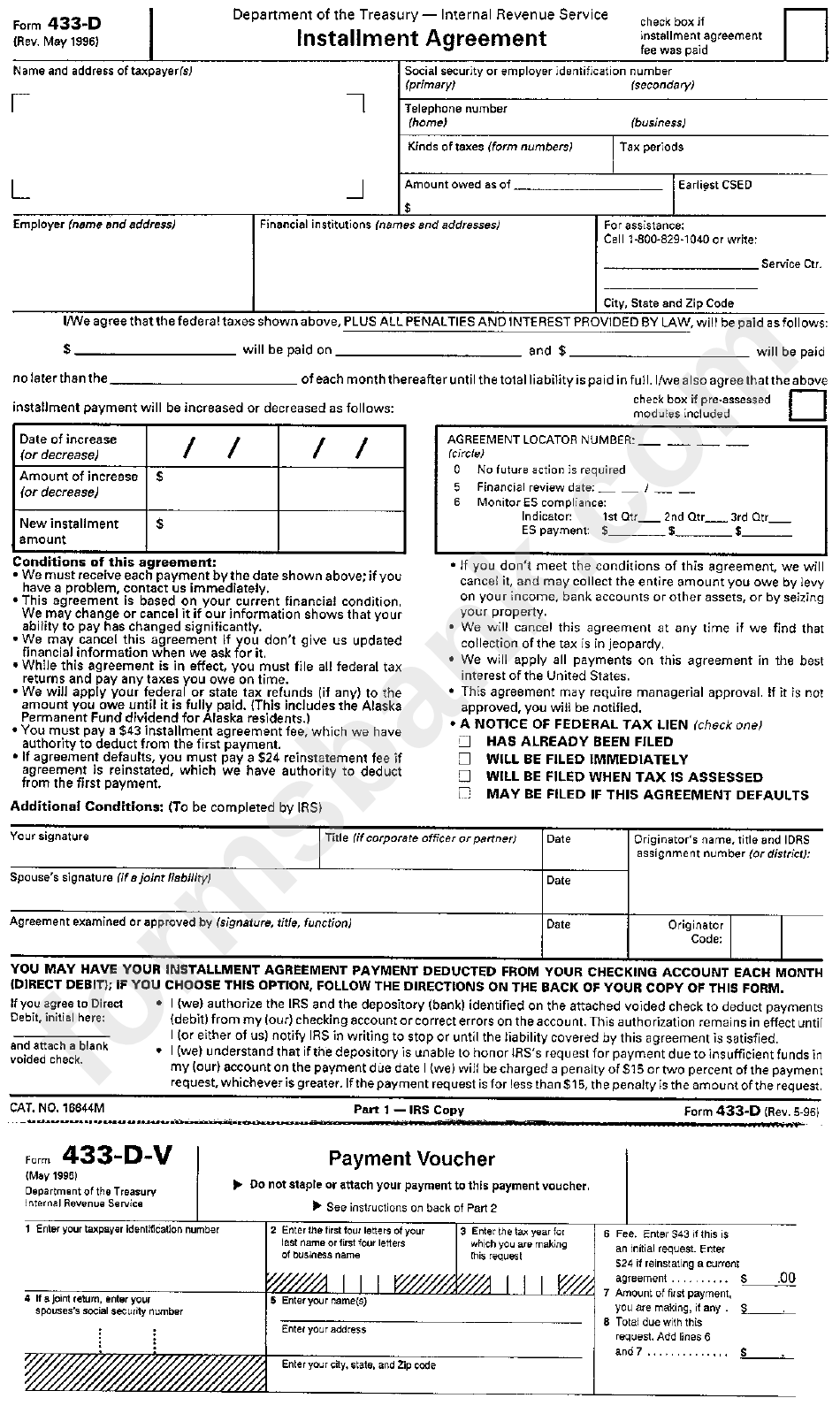

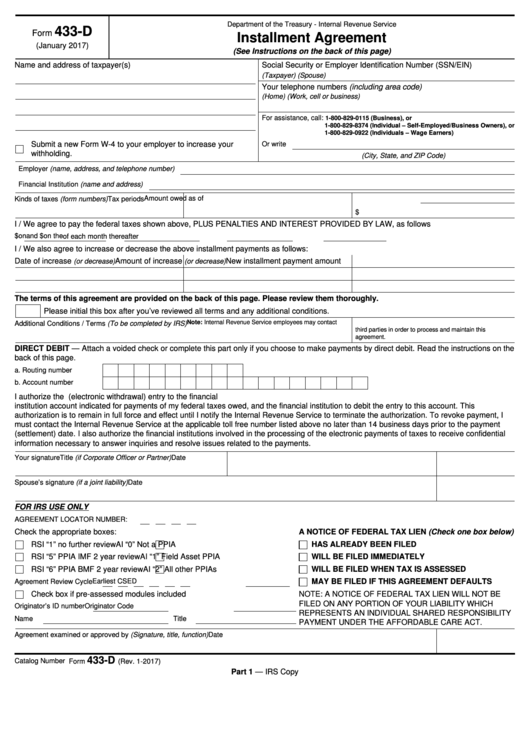

Printable Irs Form 433 D Form 433 D Rev 8 2022 We agree to pay the federal taxes shown above PLUS PENALTIES AND INTEREST PROVIDED BY LAW as follows on and on the We also agree to increase or decrease the above installment payments as follows Date of increase or decrease Amount of increase or decrease

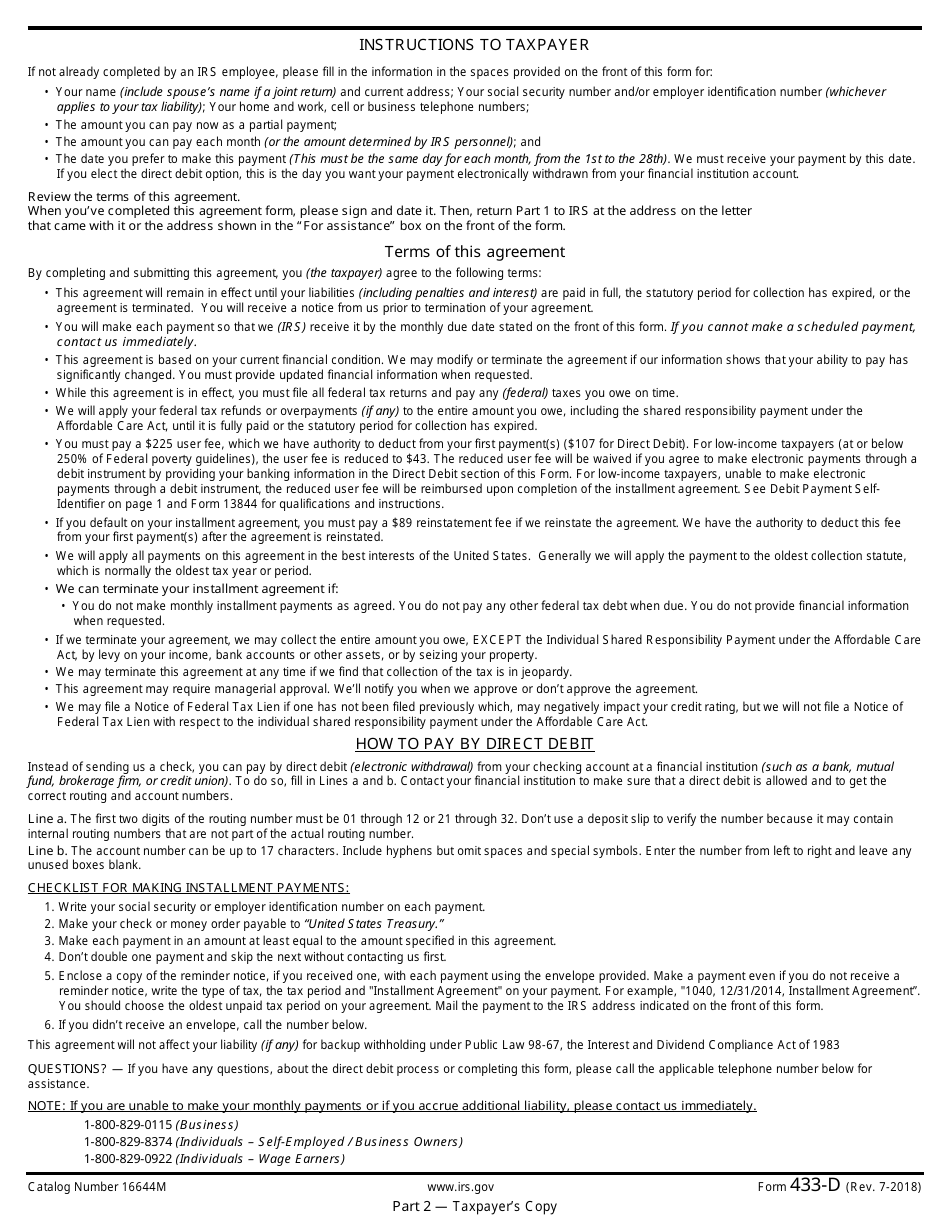

An IRS form 433 D or installment agreement is a form that taxpayers fill to authorize automatic direct debit as a means to resolve overdue taxes The document finalizes the agreement between an individual or a business and the IRS However you need a form 9465 from the IRS to initiate the tax resolution Who Should File an IRS Form 433 D The good news is that business owners with no delinquent employment taxes can use Internal Revenue Service IRS Form 433 D to find relief as can those who are out of business sole proprietors What is 433 D and how does it keep you from being in hot water with the IRS

Printable Irs Form 433 D

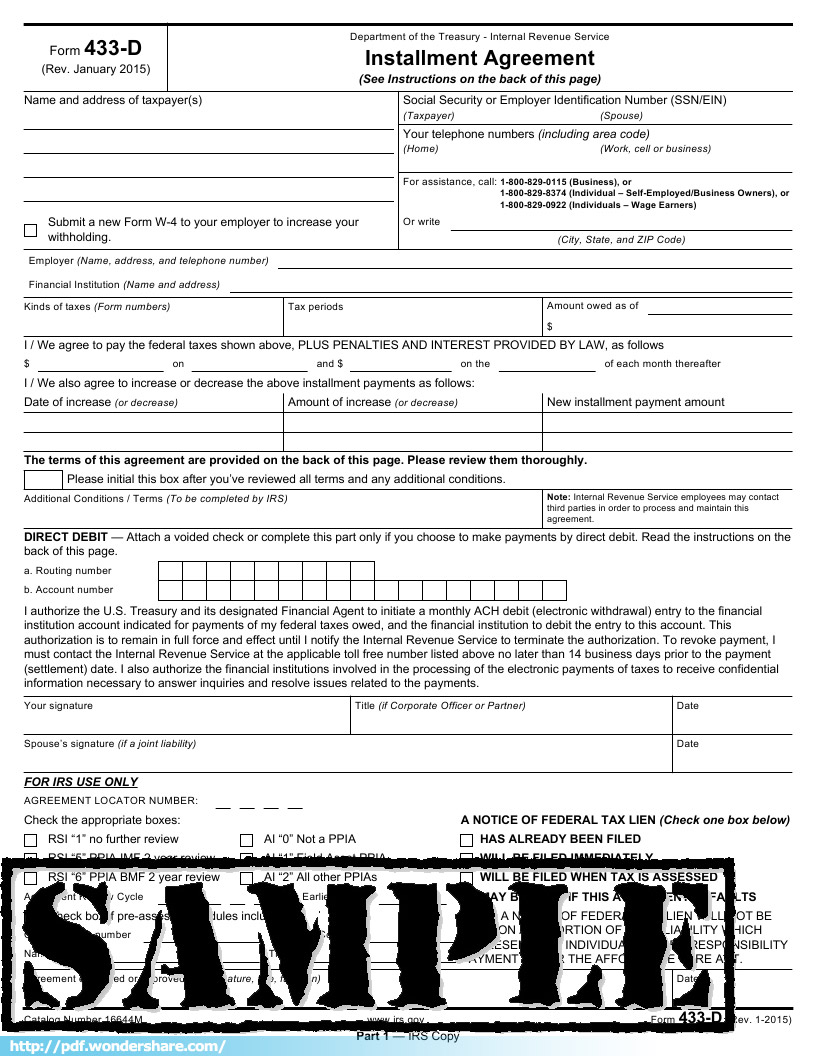

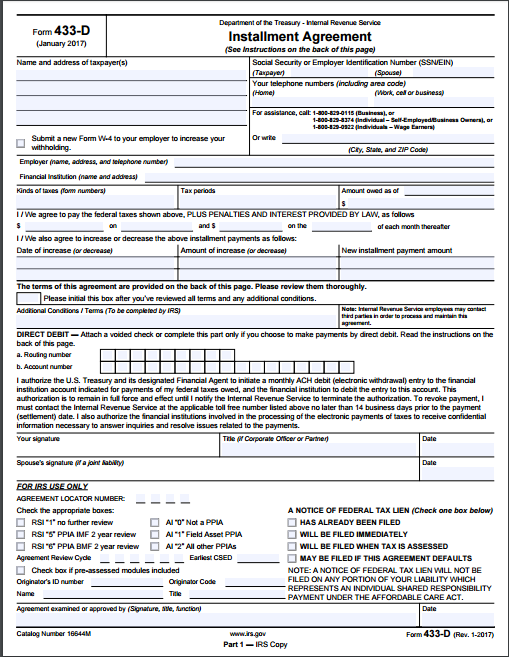

Printable Irs Form 433 D

https://www.docformats.com/wp-content/uploads/2022/07/Form-IRS-433-D-PDF.jpg

Irs Form 433 D Printable

https://www.viralcovert.com/wp-content/uploads/2018/12/irs-form-433-d-mailing-address.jpg

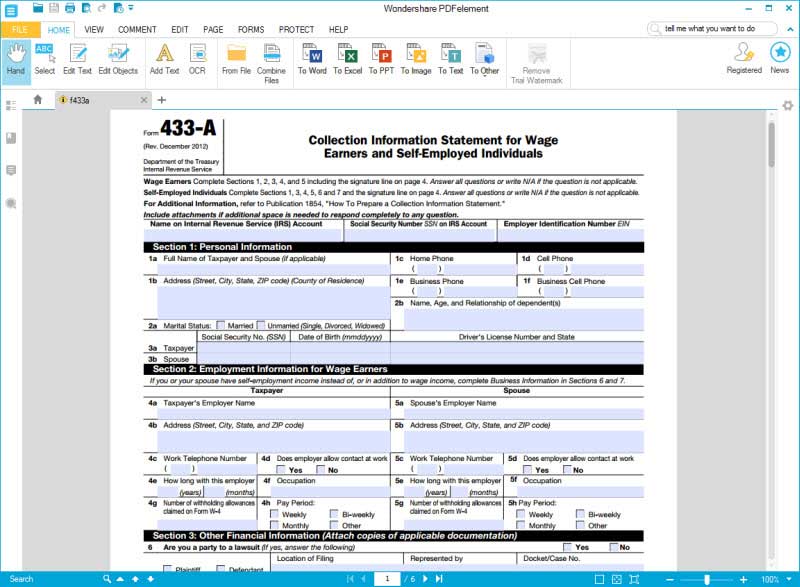

IRS Form 433 d Fill Out Sign Online And Download Fillable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/1742/17425/1742534/page_4_thumb_950.png

What is an IRS Form 433D This form is used by the United States Internal Revenue Service A Form 433 D is known as an Installment Agreement and it is used for taxpaying purposes This form will be used to help formulate and finalize payment plans and installments for people who owe taxes What is Form 433 D IRS Form 433 D is one of the set of forms used to set taxpayers up with a tax resolution This particular form is used to apply for an Installment Agreement which breaks up an overdue tax balance into smaller monthly payments Filing Form 433 D carefully and accurately is very important as it can impact whether an

Service Fees As of IRS Form 433 D in 2020 the IRS charges different service fees If a taxpayer wishes to complete the entire process online see OPA the service fee is either 149 or 31 The lower rate applies to anyone using the direct debit payment option Conversely anyone paying via check money order or card must pay 149 An IRS installment agreement is an option to manage federal tax debt and Form 433 D serves as the finalizing document for direct debit payments from your bank account This is where Form 433 D also known as the Installment Agreement form comes into play

More picture related to Printable Irs Form 433 D

How To Complete An IRS Form 433 D Installment Agreement

https://images.taxcure.com/uploads/page_image/image/installment-agreement-irs-2018-to-2019.jpg

Irs Form 433 D Printable

https://www.pdffiller.com/preview/438/61/438061662/big.png

IRS Form 433 A How To Fill It Right

https://pdfimages.wondershare.com/pdf-forms/tax-form/irs-form-433a-section-1-2.jpg

Download Fillable Irs Form 433 d In Pdf The Latest Version Applicable For 2024 Fill Out The Installment Agreement Online And Print It Out For Free Irs Form 433 d Is Often Used In Monthly Payment Form Installment Agreement Tax Debt Payment Plan Form U s Department Of The Treasury U s Department Of The Treasury Internal Revenue Service Tax Return Template United States Federal Download This Form Print This Form More about the Federal Form 433 D Other TY 2023 We last updated the Installment Agreement in January 2024 so this is the latest version of Form 433 D fully updated for tax year 2023 You can download or print current or past year PDFs of Form 433 D directly from TaxFormFinder

What is IRS Form 433 D Video walkthrough Where can I get a copy of IRS Form 433 D Related tax articles What do you think How do I complete IRS Form 433 D Fortunately the Form 433 D is pretty straightforward Furthermore the IRS representative who sent this form to you has probably already completed the most important information fields Www irs gov Form 433 D Rev 7 2020 Part 1 IRS Copy Form 433 D July 2020 Department of the Treasury Internal Revenue Service Installment Agreement See Instructions on the back of this page Name and address of taxpayer s Submit a new Form W 4 to your employer to increase your withholding

IRS Form 433 D Free Download Create Edit Fill And Print

https://pdfimages.wondershare.com/images/templates/241-form-433-d-f433d.jpg

A Simple Guide To The IRS Form 433 D Installment Agreement Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/5/451/5451079/big.png

https://www.zillionforms.com/2022/F2255007870.PDF

Form 433 D Rev 8 2022 We agree to pay the federal taxes shown above PLUS PENALTIES AND INTEREST PROVIDED BY LAW as follows on and on the We also agree to increase or decrease the above installment payments as follows Date of increase or decrease Amount of increase or decrease

https://www.docformats.com/irs-form-433-d/

An IRS form 433 D or installment agreement is a form that taxpayers fill to authorize automatic direct debit as a means to resolve overdue taxes The document finalizes the agreement between an individual or a business and the IRS However you need a form 9465 from the IRS to initiate the tax resolution Who Should File an IRS Form 433 D

Irs Form 433 D Printable

IRS Form 433 D Free Download Create Edit Fill And Print

IRS Form 433 D Walkthrough Setting Up An Installment Agreement YouTube

Form 433 D Installment Agreement Community Tax

Irs Form 433 D Printable Printable World Holiday

IRS Form 433 D Instructions Setting Up An Installment Agreement

IRS Form 433 D Instructions Setting Up An Installment Agreement

Fillable Form 433 D Installment Agreement Printable Pdf Download

2012 Form IRS 433 D Fill Online Printable Fillable Blank PdfFiller

Form 433 A Income Tax Alloble Expenses 433D Instructions Db excel

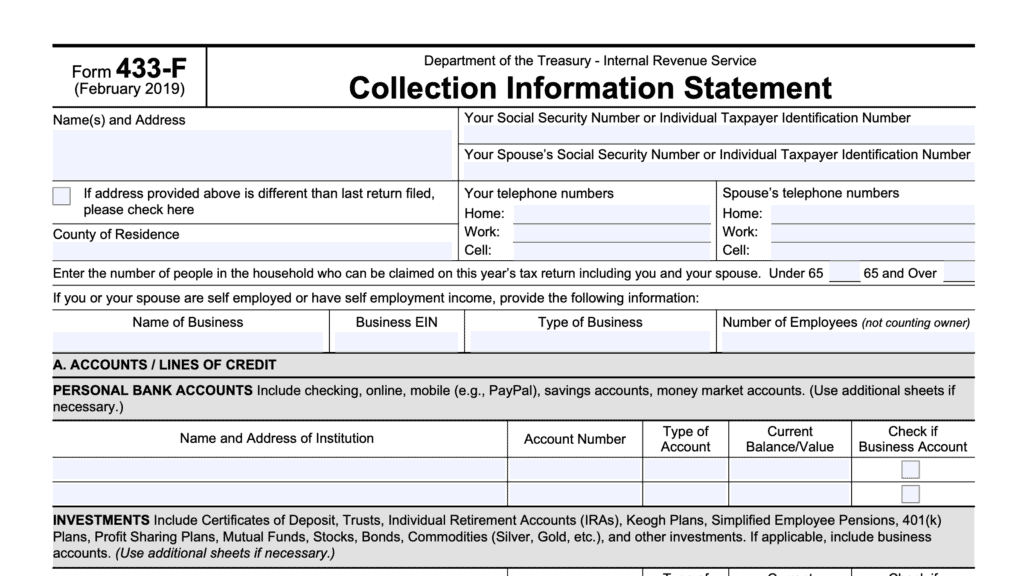

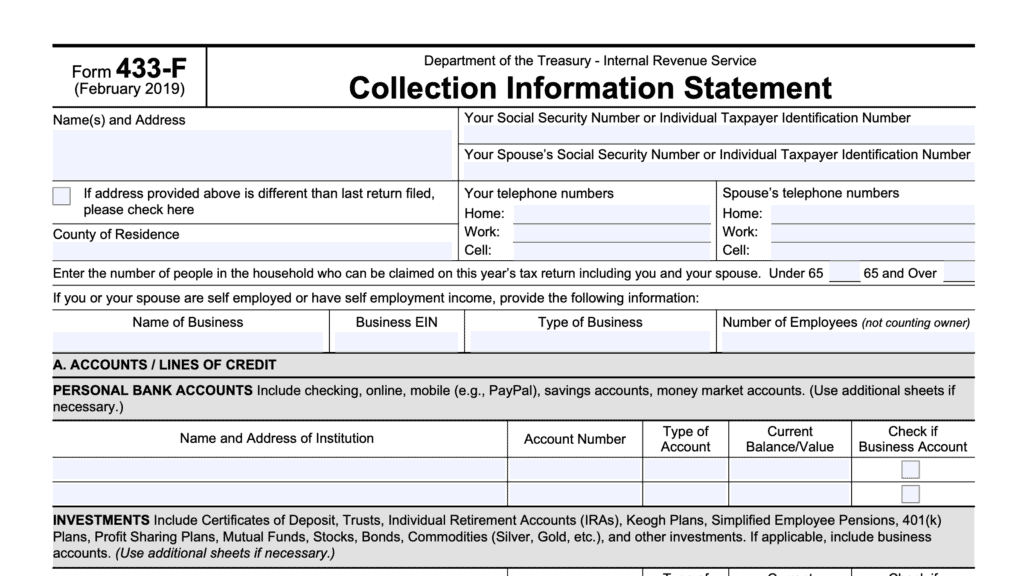

Printable Irs Form 433 D - Under 65 65 and Over If you or your spouse are self employed or have self employment income provide the following information TURN PAGE TO CONTINUE Catalog Number 62053J www irs gov Form 433 F Rev 2 2019 E BUSINESS INFORMATION Complete E1 for Accounts Receivable owed to you or your business