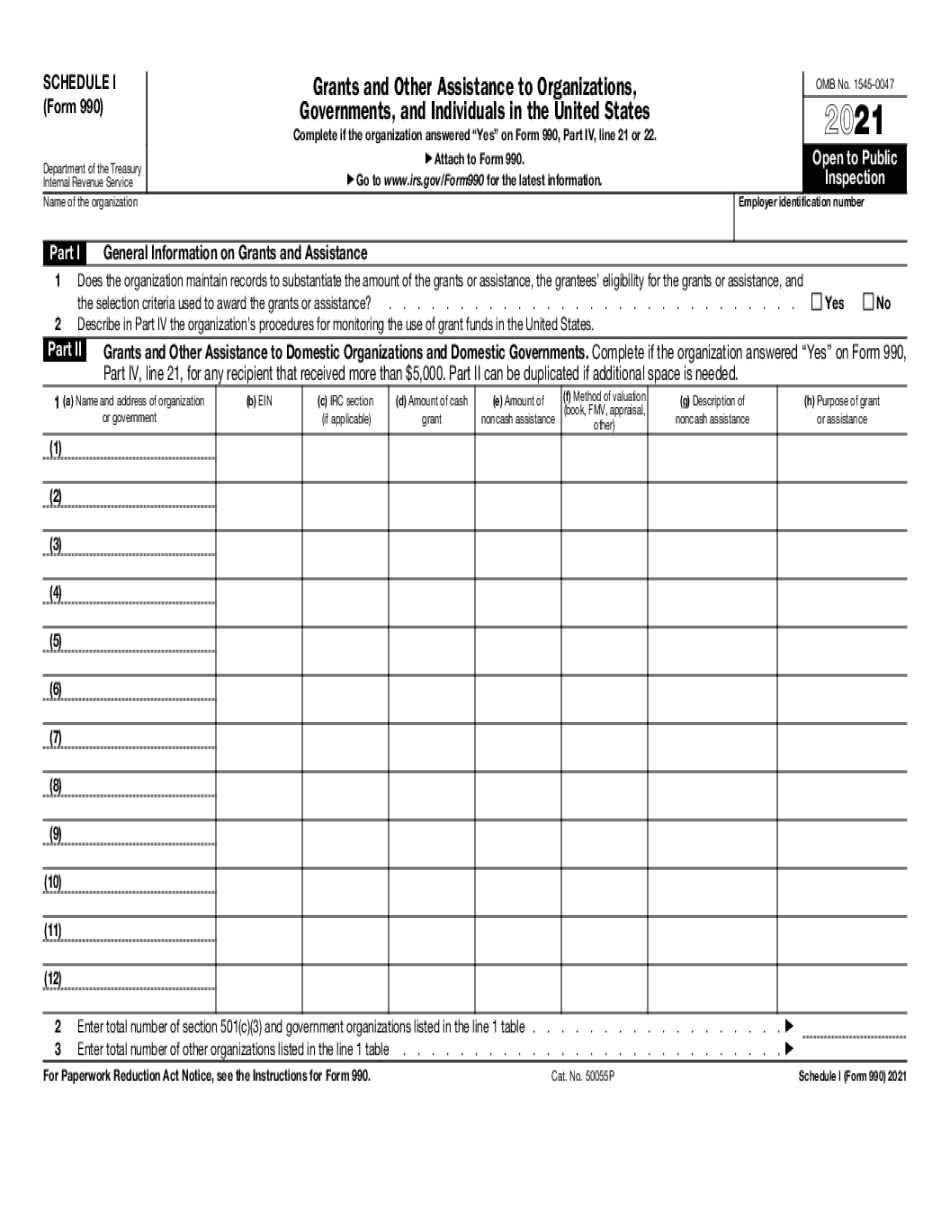

Printable Irs Form 990 Ez Schedule A Form 990 Schedule I Grants and Other Assistance to Organizations Governments and Individuals in the United States PDF Form 990 Schedule M Noncash Contributions PDF Form 990 or 990 EZ Sch N Liquidation Termination Dissolution or Significant Disposition of Assets PDF

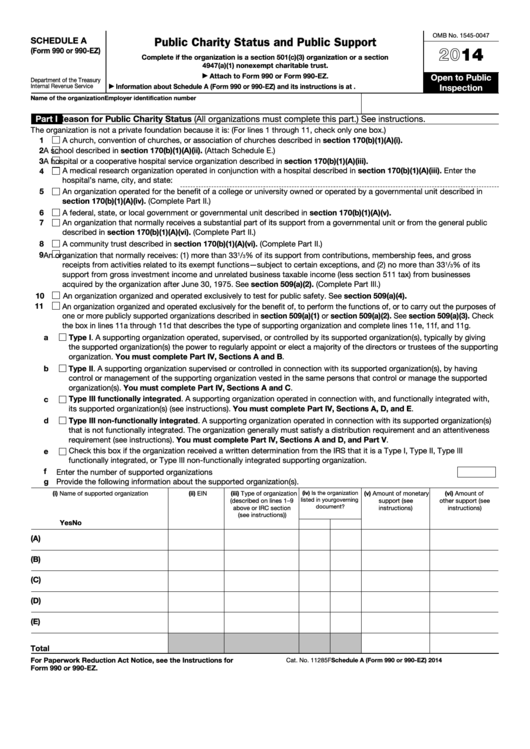

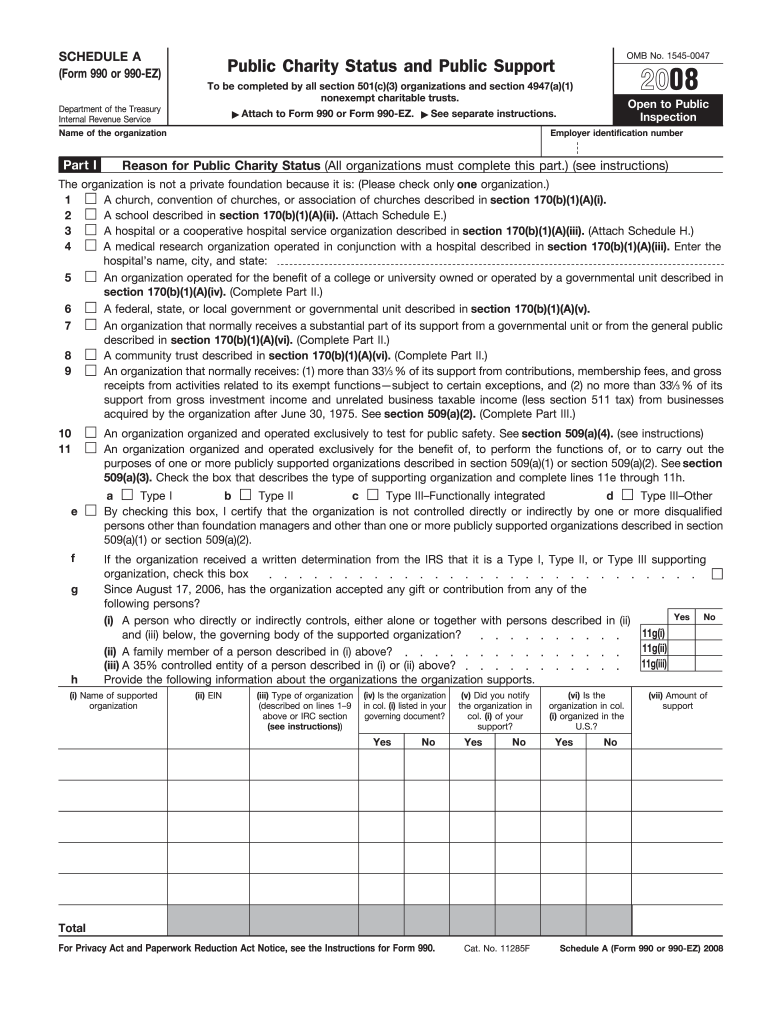

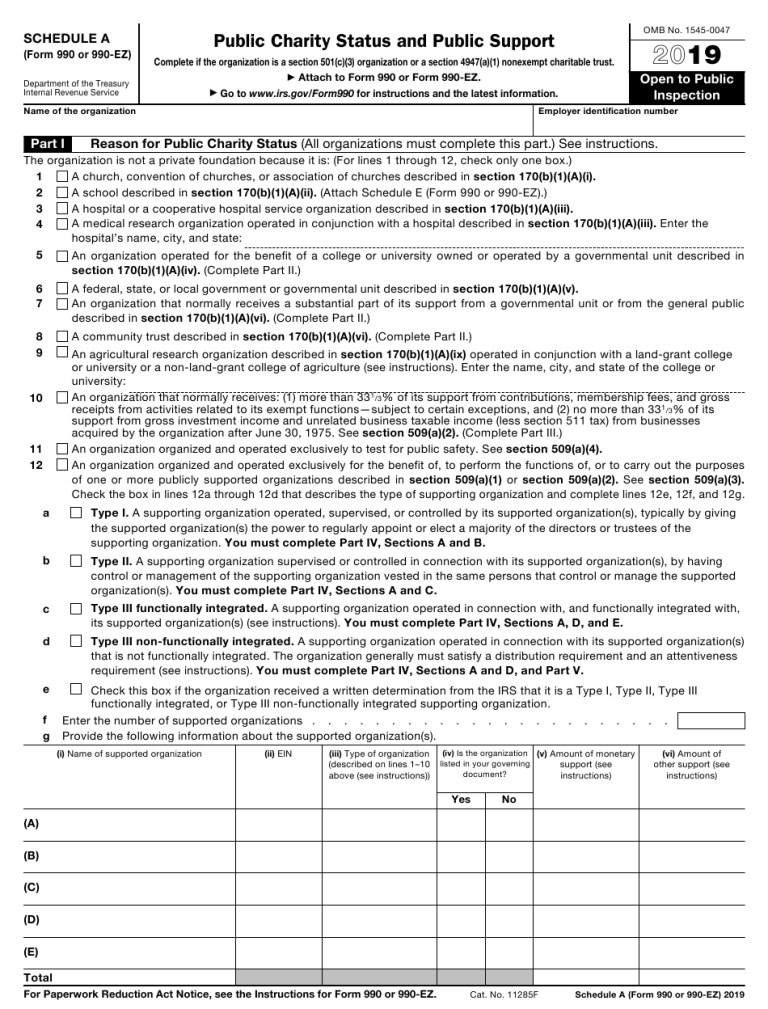

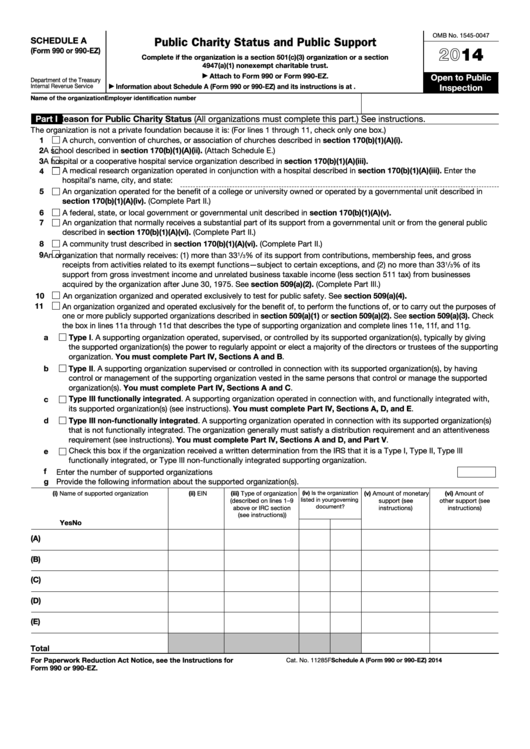

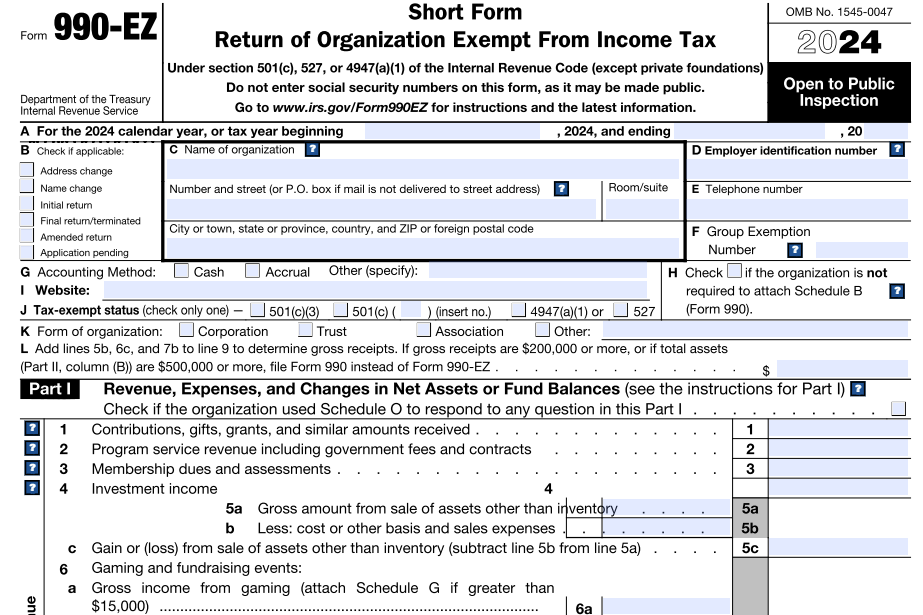

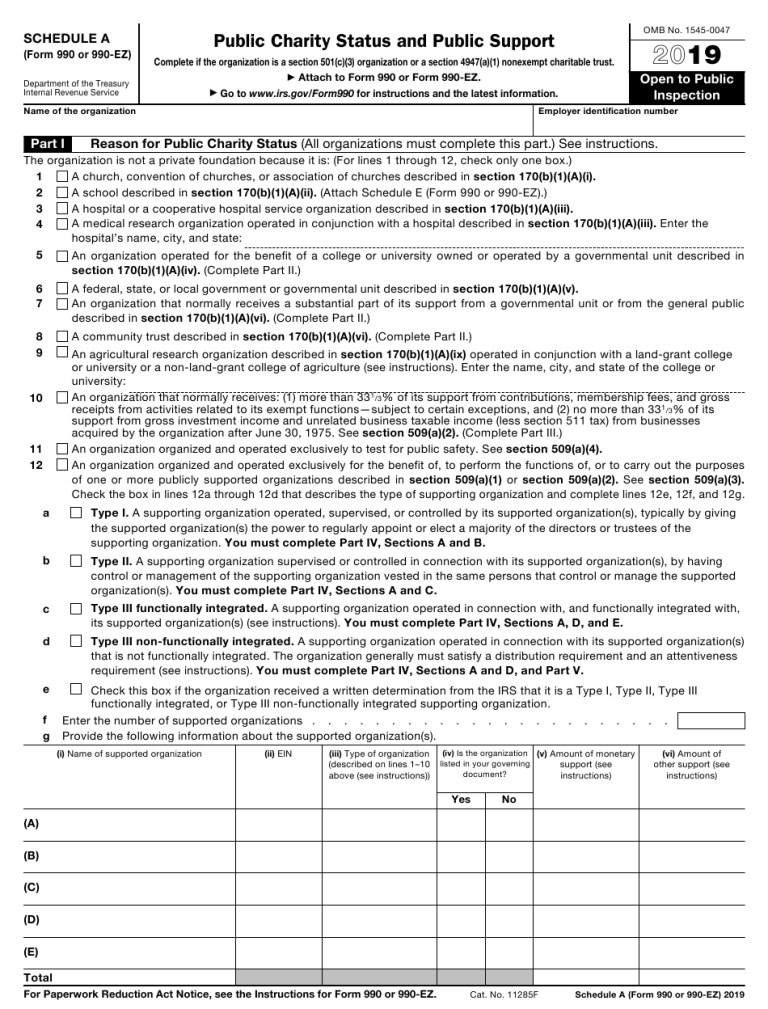

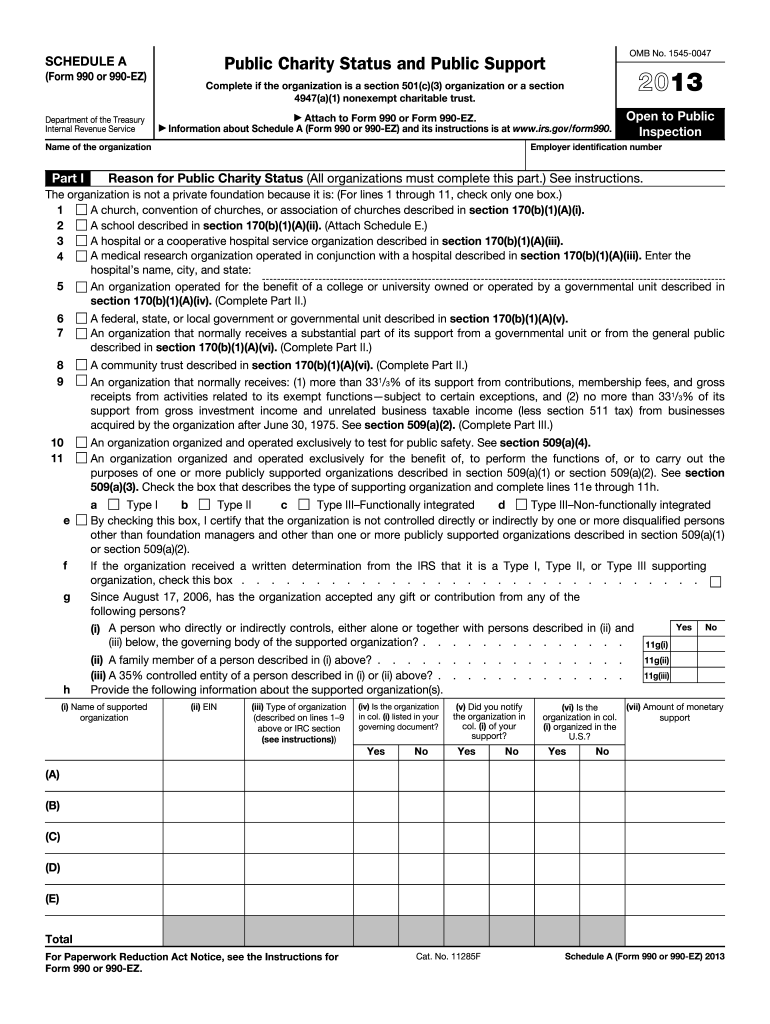

F Group Exemption Number G Accounting Method Cash AccrualOther specify H Check if the organization is not required to attach Schedule B Form 990 I Website J Tax exempt status check only one 501 c 3 501 c insert no 4947 a 1 or 527 K Form of organization CorporationTrust AssociationOther L Purpose of Schedule Schedule A Form 990 is used by an organization that files Form 990 Return of Organization Exempt From Income Tax or Form 990 EZ Short Form Return of Organization Exempt From Income Tax to provide the required information about public charity status and public support Who Must File

Printable Irs Form 990 Ez Schedule A

Printable Irs Form 990 Ez Schedule A

https://data.formsbank.com/pdf_docs_html/336/3369/336970/page_1_thumb_big.png

IRS 990 Schedule A 2008 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/1/628/1628441/large.png

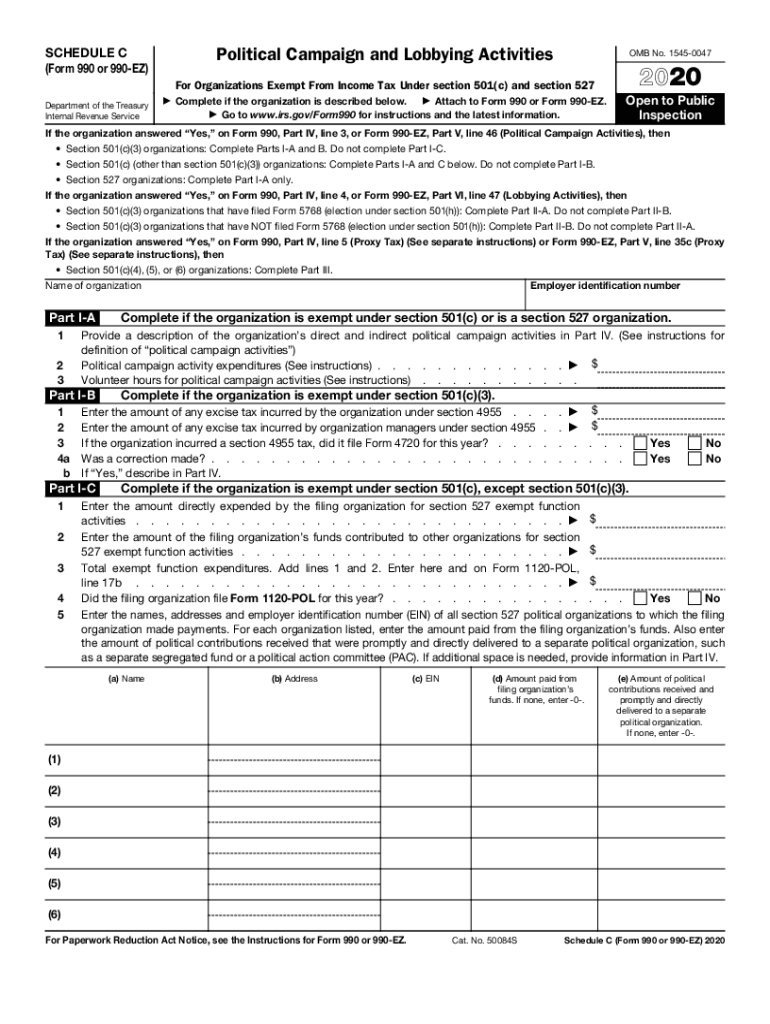

990 Part Ez Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/535/781/535781082/large.png

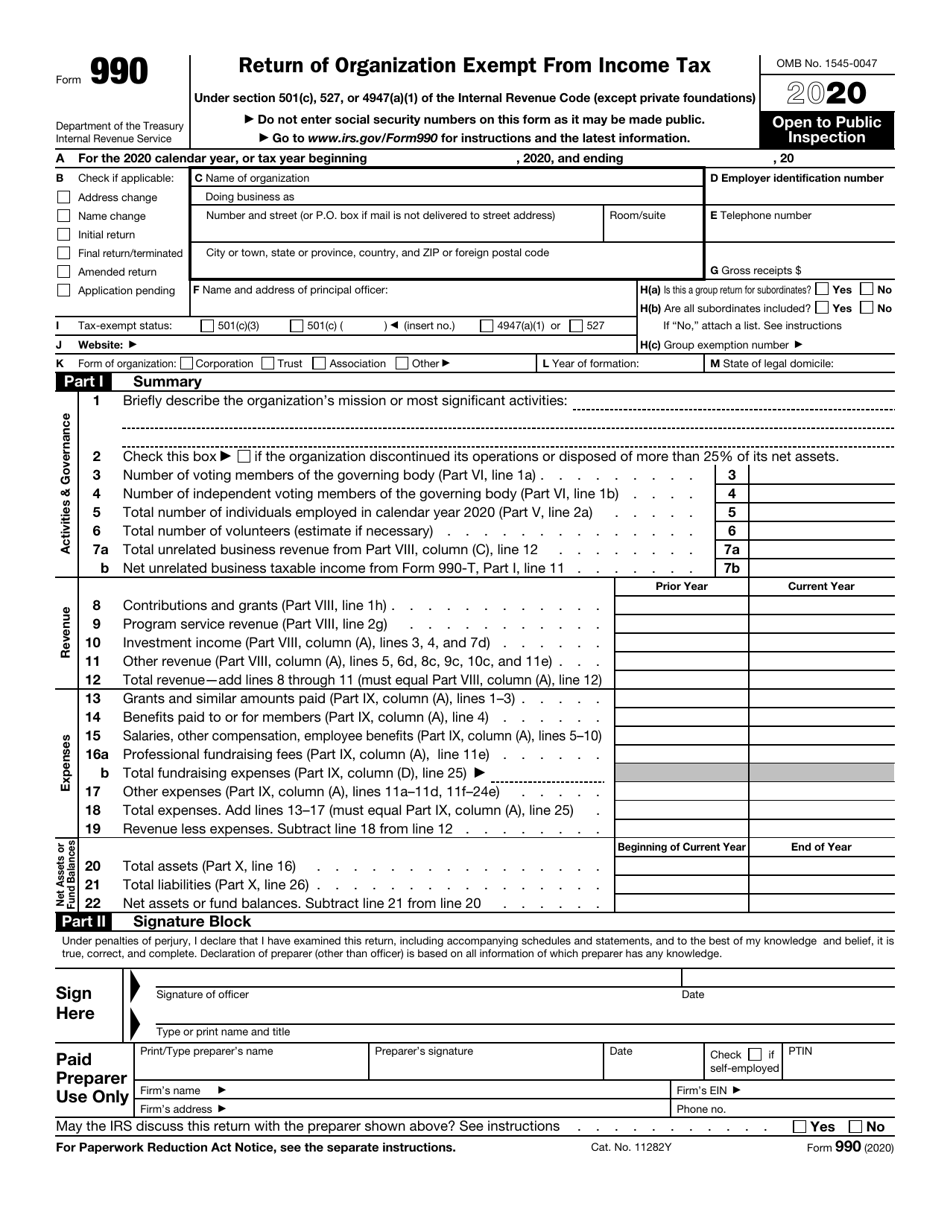

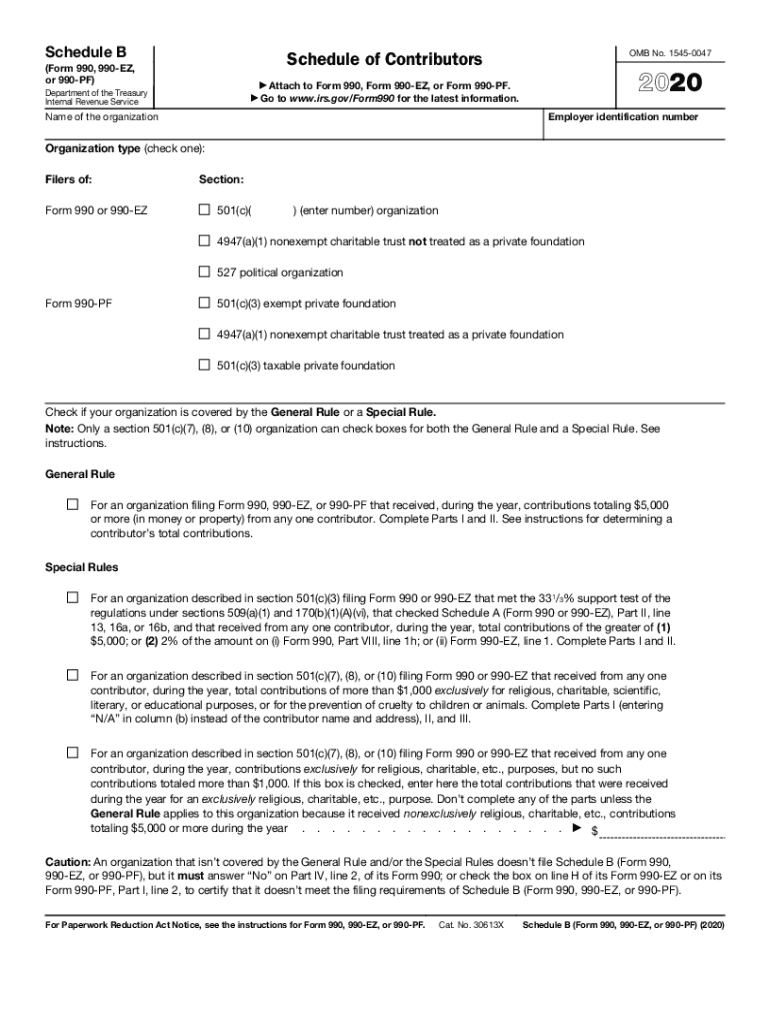

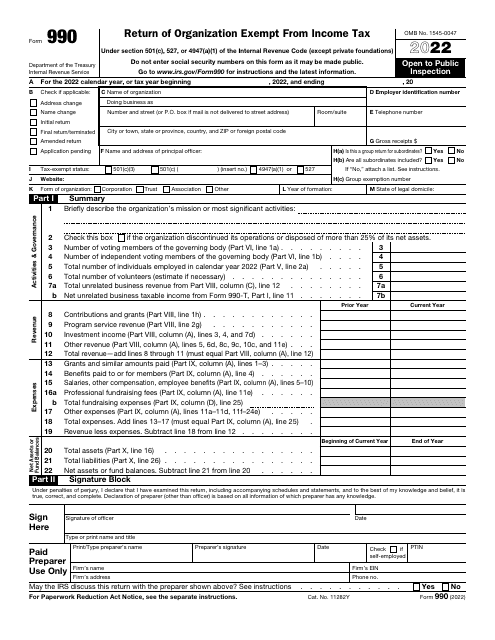

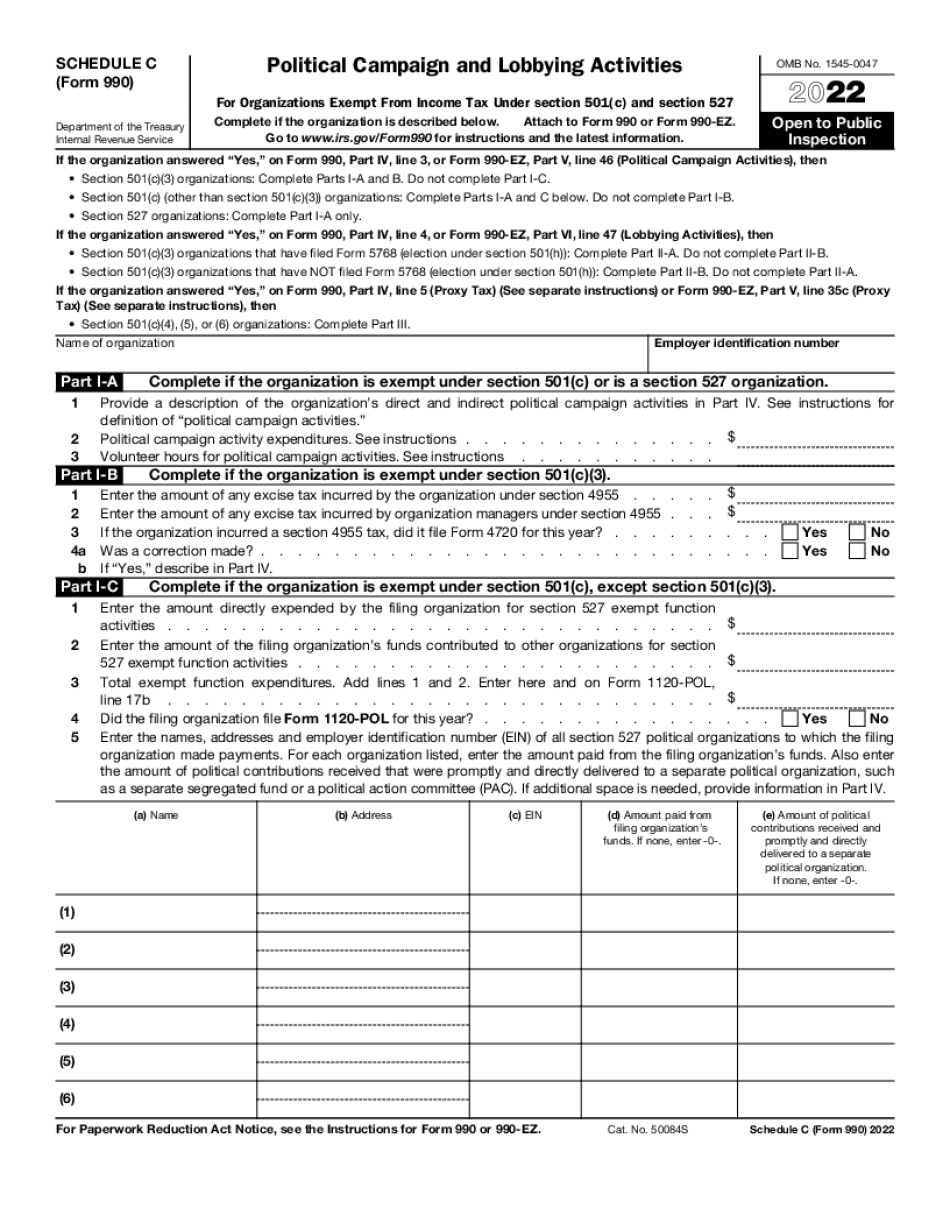

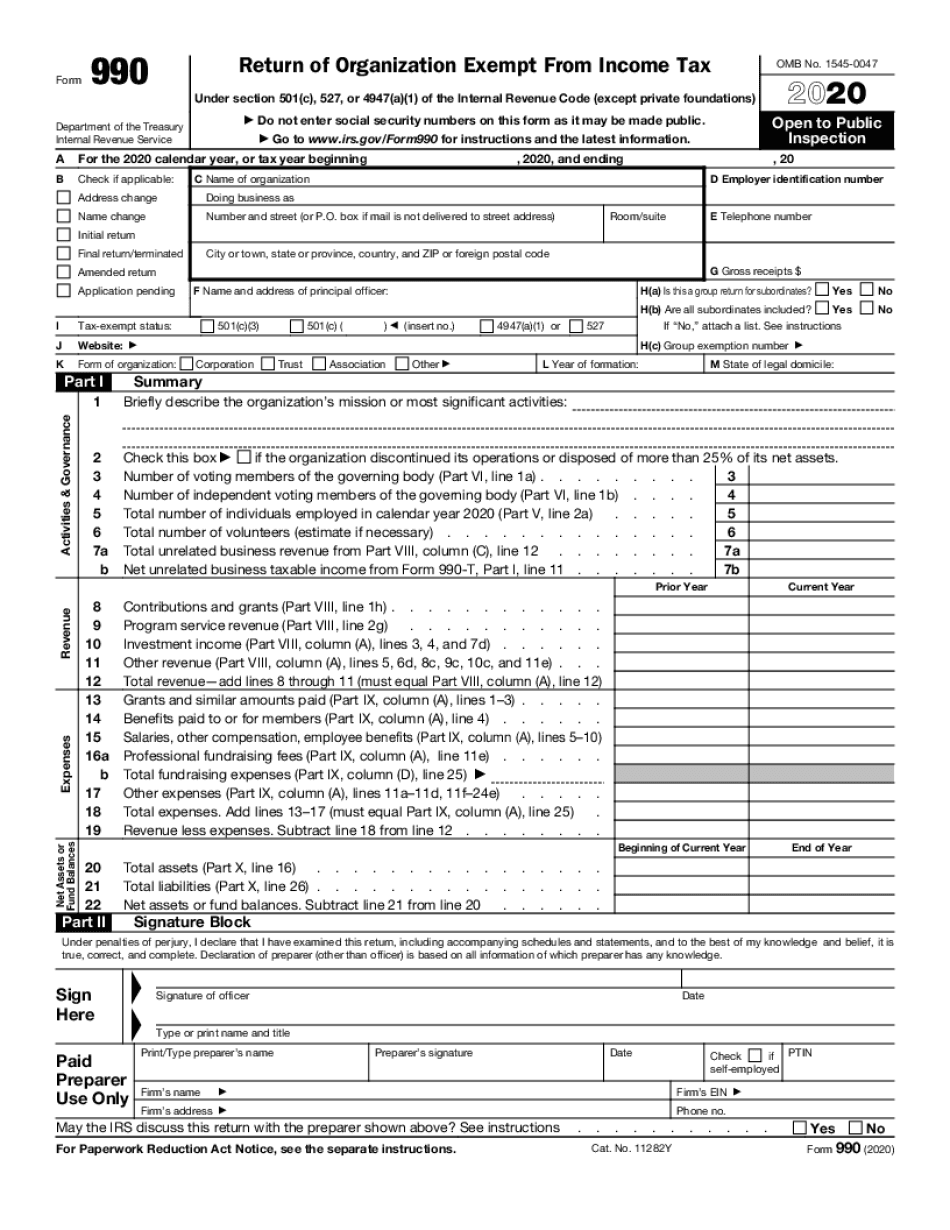

Ann 2021 18 revoked Ann 2001 33 Ann 2001 33 2001 17 I R B 1137 provided tax exempt organizations with reasonable cause for purposes of relief from the penalty imposed under section 6652 c 1 A ii if they reported compensation on their annual information returns in the manner described in Ann 2001 33 instead of accordance with certain form instructions Form 990 Return of Organization Exempt From Income Tax and Form 990 EZ are used by tax exempt organizations nonexempt charitable trusts that are not treated as private foundations and section 527 political organizations to provide the IRS with the information required by section 6033

Specific Instructions Use as many continuation sheets of Schedule O Form 990 or 990 EZ as needed Complete the required information on the appropriate line of Form 990 or 990 EZ prior to using Schedule O Form 990 or 990 EZ Identify clearly the specific part and line s of Form 990 or 990 EZ to which each response relates Go to www irs gov Form990EZ for instructions and the latest information Telephone number Group Exemption Number Accounting Method Cash Accrual Other specify Check if the organization is not required to attach Schedule B Tax exempt status check only one Form 990

More picture related to Printable Irs Form 990 Ez Schedule A

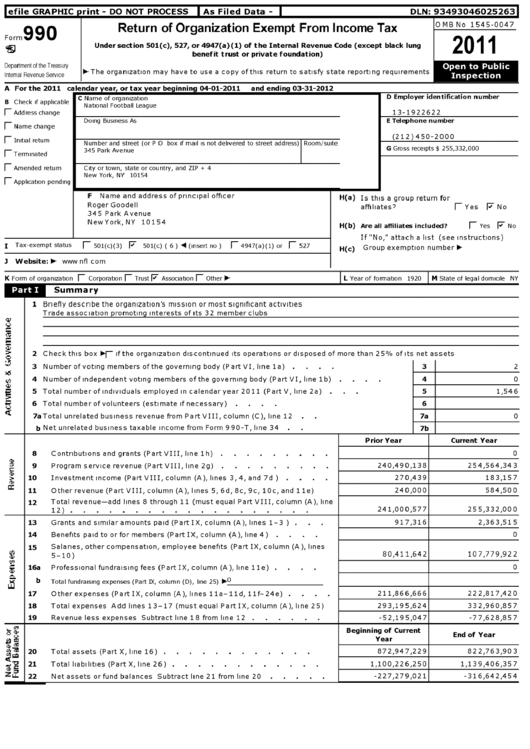

IRS Form 990 Download Fillable PDF Or Fill Online Return Of Organization Exempt From Income Tax

https://data.templateroller.com/pdf_docs_html/2125/21254/2125496/irs-form-990-return-of-organization-exempt-from-income-tax_print_big.png

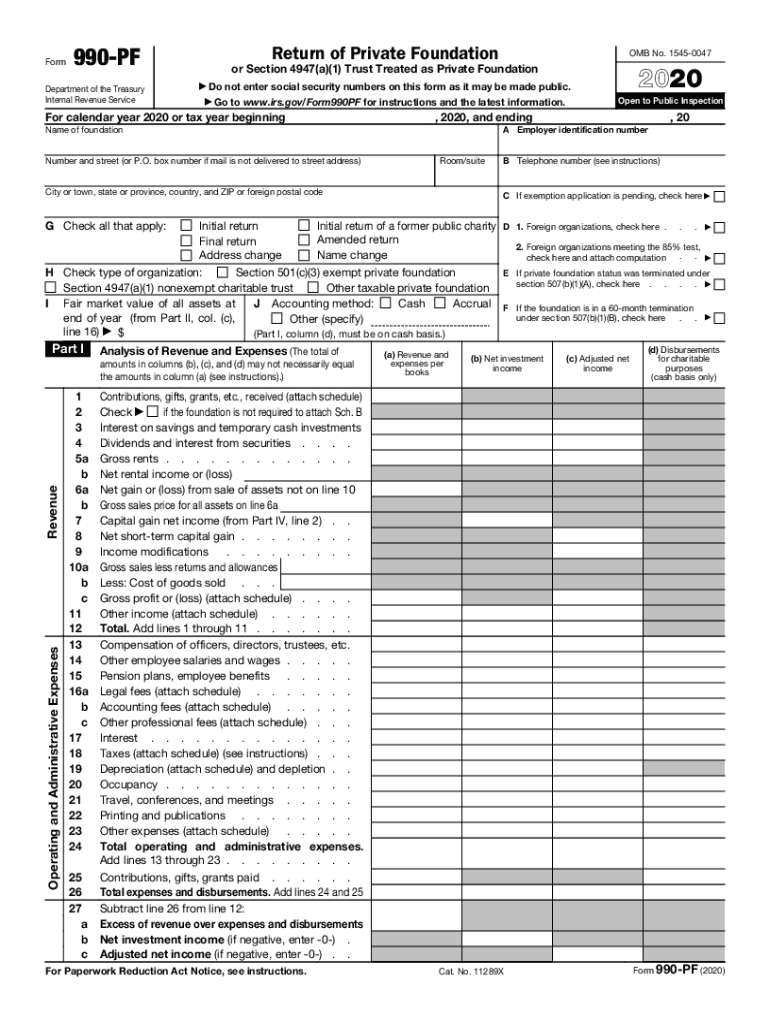

IRS 990 PF 2020 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/535/781/535781057/large.png

Form 990 Ez Printable Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/106/1064/106405/page_1_thumb_big.png

While filing Form 990 Schedule A with Form 990 990 EZ then the organization should use the same accounting method that is checked on the following lines IRS Form 990 Part XII line 1 IRS Form 990 EZ line G In some cases the organization s accounting method is changed from the prior year the organization must provide an explanation in Cat No 10642I Form 990 EZ 2021 Form 990 EZ Department of the Treasury Internal Revenue Service Short Form Return of Organization Exempt From Income Tax Under section 501 c 527 or 4947 a 1 of the Internal Revenue Code except private foundations Do not enter social security numbers on this form as it may be made public Go to www irs

Complete this part only if the organization reported more than 15 000 on Form 990 Part IX line 11e Form 990 EZ filers are not required to complete Part I Line 1 Check the box in front of each method of fundraising used by the organization to raise funds during the taxable year Line 2a Internal Revenue Service

Fillable 2022 Schedule A 990 Ez Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/07/fillable-2022-schedule-a-990-ez-768x1009.png

Printable 990 Ez Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/533/156/533156855/large.png

https://www.irs.gov/charities-non-profits/form-990-schedules-with-instructions

Form 990 Schedule I Grants and Other Assistance to Organizations Governments and Individuals in the United States PDF Form 990 Schedule M Noncash Contributions PDF Form 990 or 990 EZ Sch N Liquidation Termination Dissolution or Significant Disposition of Assets PDF

https://www.irs.gov/pub/irs-pdf/f990ez.pdf

F Group Exemption Number G Accounting Method Cash AccrualOther specify H Check if the organization is not required to attach Schedule B Form 990 I Website J Tax exempt status check only one 501 c 3 501 c insert no 4947 a 1 or 527 K Form of organization CorporationTrust AssociationOther L

2022 IRS Form 990 EZ Instructions How To Fill Out Form 990 EZ

Fillable 2022 Schedule A 990 Ez Fillable Form 2023

Instructions For Schedule A form 990 Or 990 Ez Public Charity Status And Public Support Form

IRS Form 990 Download Fillable PDF Or Fill Online Return Of Organization Exempt From Income Tax

Fillable Form 990 Ez Schedule A Printable Forms Free Online

IRS Form 990 Schedule L Instructions ExpressTaxExempt Fill Online Printable Fillable Blank

IRS Form 990 Schedule L Instructions ExpressTaxExempt Fill Online Printable Fillable Blank

990 Ez Form Fill Online Printable Fillable Blank Irs 990 form

Download Instructions For IRS Form 990 990 EZ Schedule A Public Charity Status And Public

990 EZ Form Fill Out And Sign Printable PDF Template SignNow

Printable Irs Form 990 Ez Schedule A - If you are filing Form 990 EZ or 990 using our form based filing option follow these steps to complete Schedule A Part I To complete Part I click Start or Edit to the right of Tax Exempt Status 2 Go to the tax exempt status box and select the organization s tax exempt status 3 Proceed with completing your 990 series form