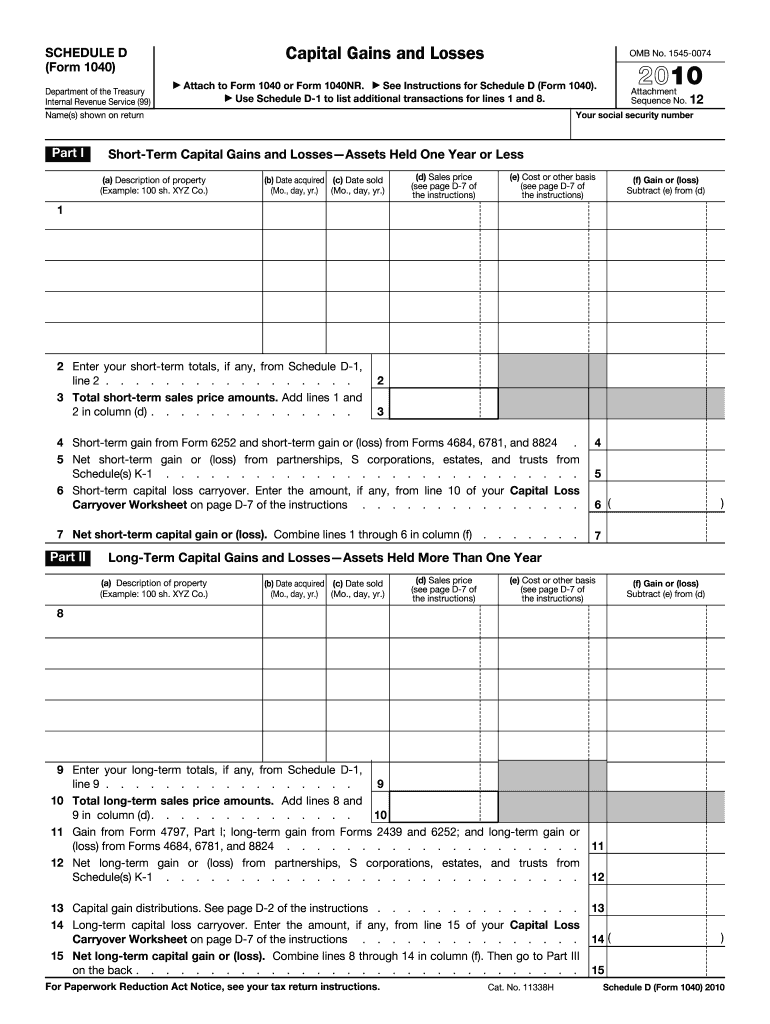

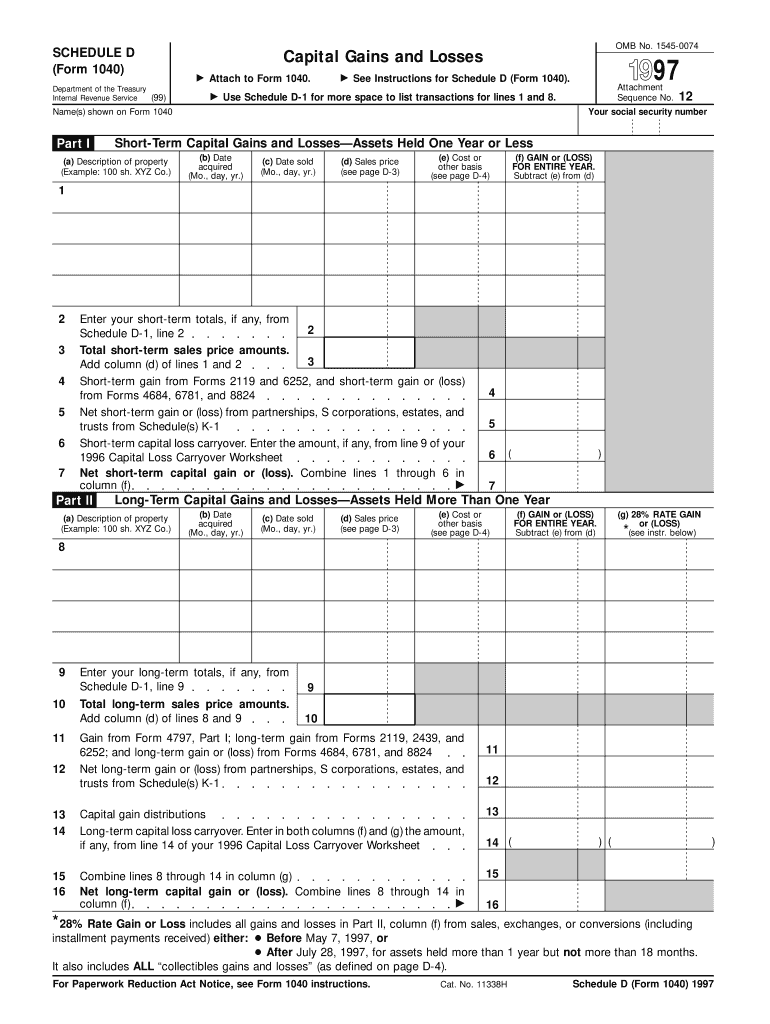

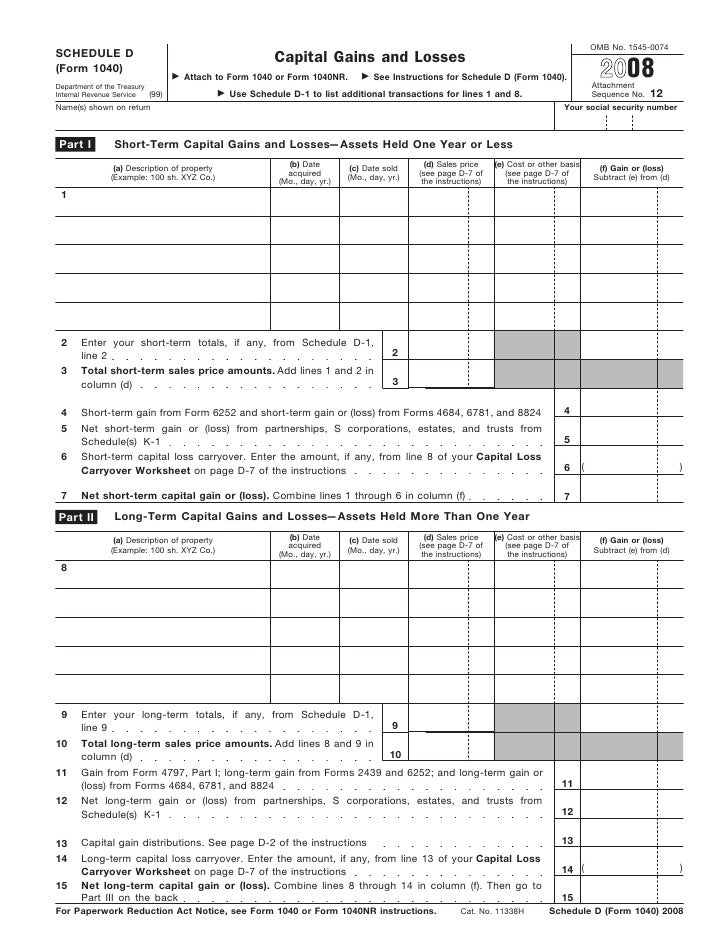

Printable Irs Schedule D Form Use Schedule D Form 1040 to report the following The sale or exchange of a capital asset not reported on another form or schedule Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit

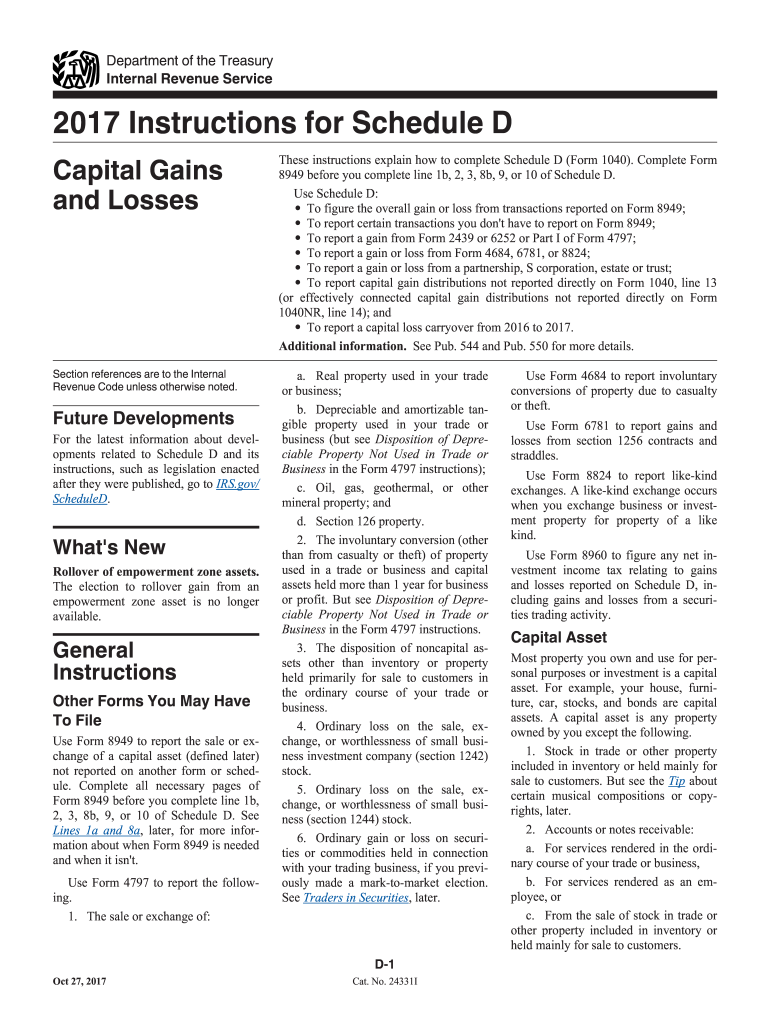

These instructions explain how to complete Schedule D Form 1040 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use Schedule D To figure the overall gain or loss from transactions reported on Form 8949 To report certain transactions you don t have to report on Form 8949 Schedule SE Form 1040 is used by self employed persons to figure the self employment tax due on net earnings About Schedule 8812 Form 1040 Credits for Qualifying Children and Other Dependents Information about Schedule 8812 Form 1040 Additional Child Tax Credit including recent updates related forms and instructions on how to file

Printable Irs Schedule D Form

Printable Irs Schedule D Form

https://www.pdffiller.com/preview/1/651/1651564/large.png

Form 1040 Schedule D Capital Gains And Losses Ir s Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/10/2/10002350/large.png

Form 1040 Schedule D Capital Gains And Losses

http://image.slidesharecdn.com/1273107/95/form-1040-schedule-dcapital-gains-and-losses-1-728.jpg?cb=1239367651

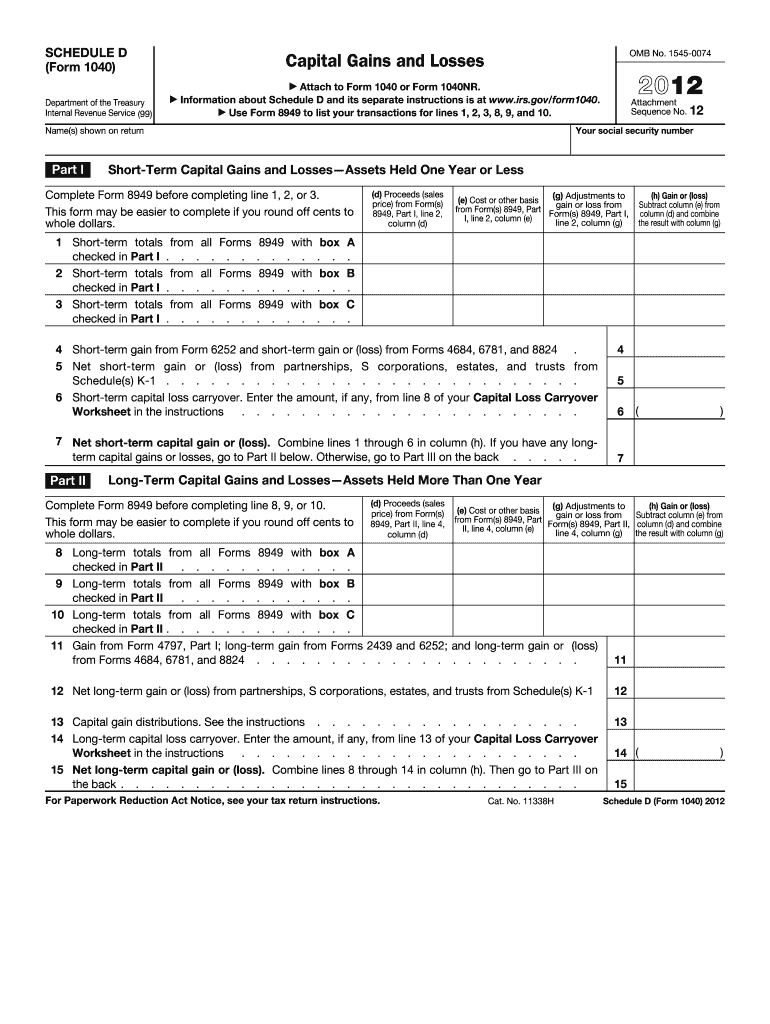

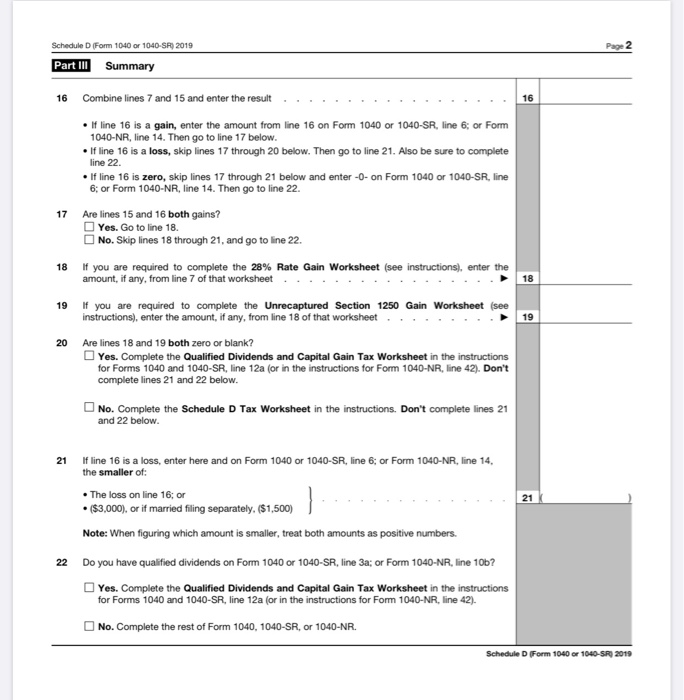

What Is Form 1040 Schedule D Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule D to report a capital gain or loss of income if required You can not file Schedule D with one of the shorter IRS forms such as Form 1040A or Form 1040EZ The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year TABLE OF CONTENTS Schedule D Capital asset transactions Short term gains and losses Click to expand Schedule D

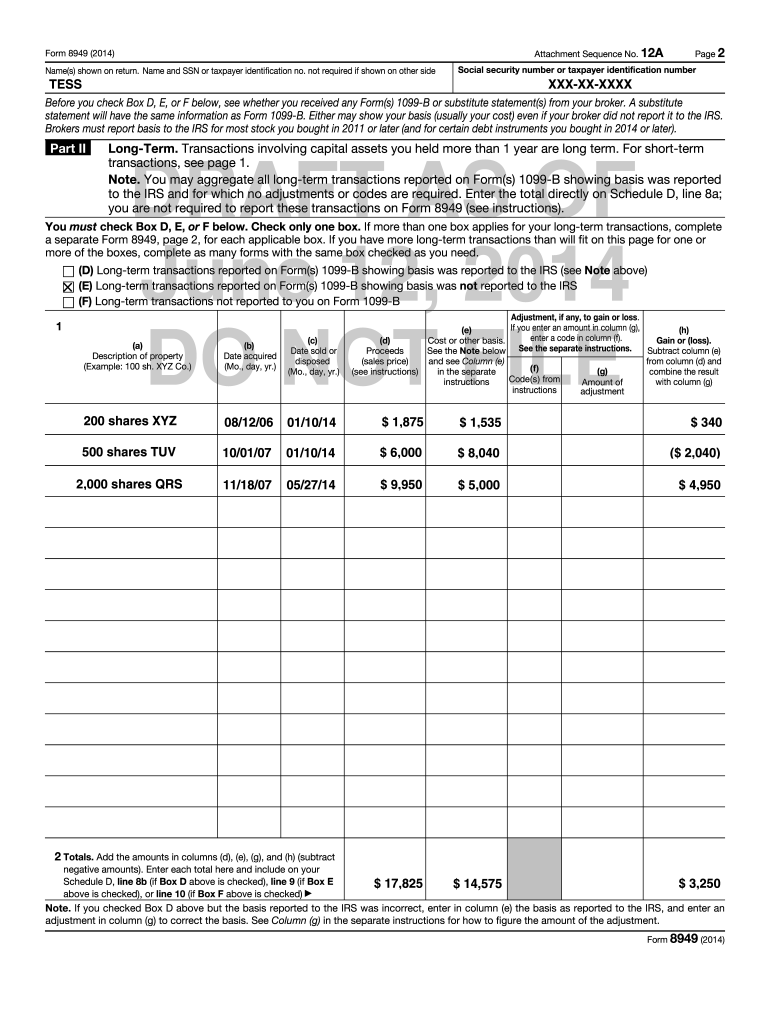

You must check Box DRAFT D E or F below Check only one box If more than AS July 23 one box applies for your OF 2021 long term transactions complete a separate Form 8949 page 2 for each applicable box If you have more long term transactions than will fit on this page for one or Schedule D is the form used to report capital gains and losses from the sale or exchange of capital assets The IRS has made the Schedule D form instructions and printable forms available on their website making it easier for taxpayers to complete their tax returns The instructions provide detailed guidance on how to fill out the form and

More picture related to Printable Irs Schedule D Form

Form 8949 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/47/798/47798141/large.png

2017 Form IRS 1040 Schedule D Instructions Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/422/211/422211398/large.png

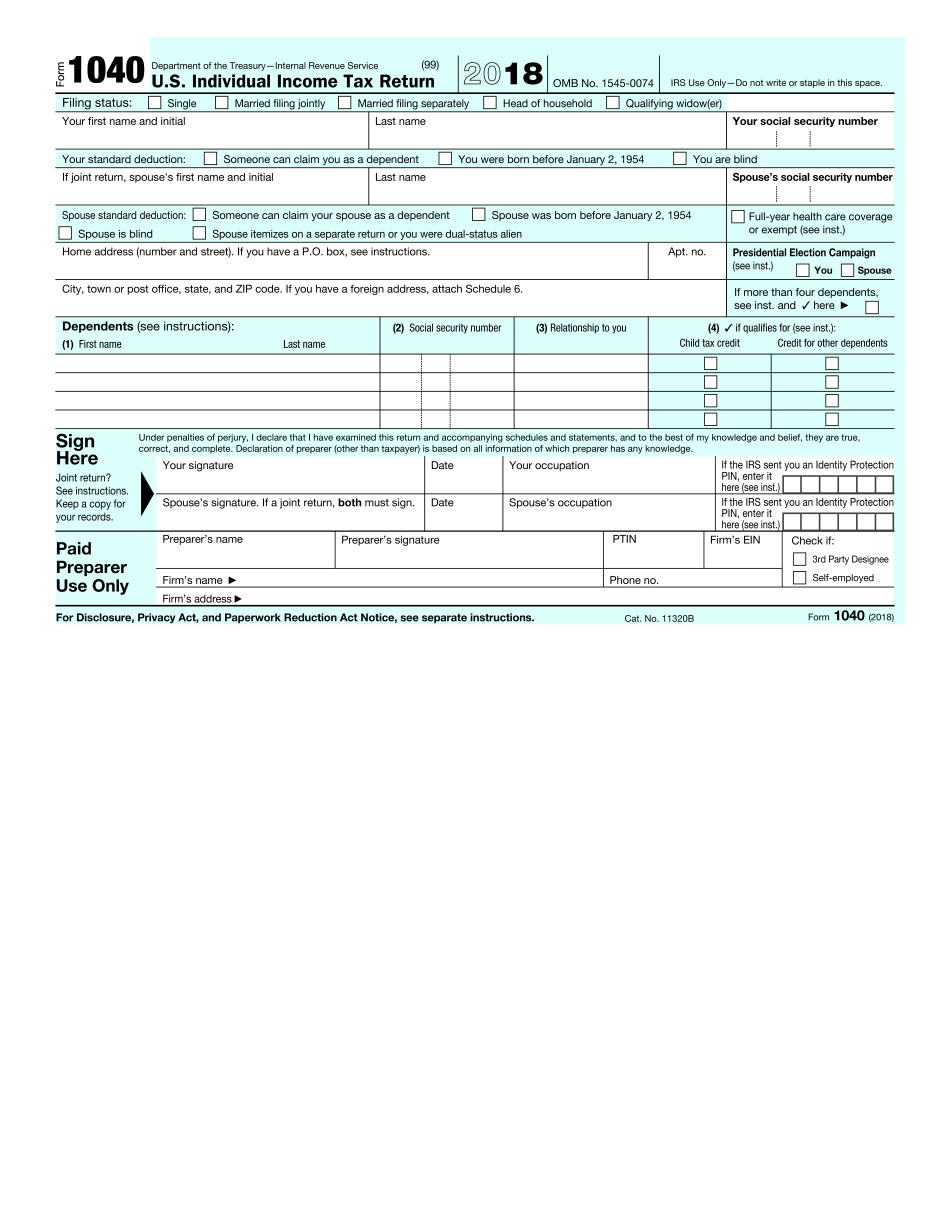

IRS Releases Draft Form 1040 Here s What s New For 2020

https://specials-images.forbesimg.com/imageserve/5f3ed50b6c322baa3b67a319/960x0.jpg?fit=scale

Schedule D is an IRS tax form that reports your realized gains and losses from capital assets that is investments and other business interests It includes relevant information such as the total Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 U S Individual Income Tax Return Form 1040 SR or Form 1040NR It is used to help you calculate their capital gains or losses and the amount of taxes owed Computations from Schedule D are reported on the Form 1040 affecting your adjusted gross income

Access IRS forms instructions and publications in electronic and print media You can download or print current or past year PDFs of 1040 Schedule D directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes

IRS 8949 2023 Form Printable Blank PDF Online

https://www.pdffiller.com/preview/458/73/458073386/big.png

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

Schedule D

https://www.investopedia.com/thmb/mS1dDZJEF2COzxNPk04fLYLAM_4=/2200x1700/filters:no_upscale():max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png

https://www.irs.gov/forms-pubs/about-schedule-d-form-1040

Use Schedule D Form 1040 to report the following The sale or exchange of a capital asset not reported on another form or schedule Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit

https://www.irs.gov/instructions/i1040sd

These instructions explain how to complete Schedule D Form 1040 Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use Schedule D To figure the overall gain or loss from transactions reported on Form 8949 To report certain transactions you don t have to report on Form 8949

2021 Form IRS 1120 S Schedule D Fill Online Printable Fillable Blank PdfFiller

IRS 8949 2023 Form Printable Blank PDF Online

1040 Schedule D Instructions Fill Online Printable Fillable Blank Form 1040 schedule a

IRS 1040 Schedule D 2012 Fill And Sign Printable Template Online US Legal Forms

2012 Form IRS 1120 Schedule D Fill Online Printable Fillable Blank PdfFiller

Solved Complete A 1040 Schedule D For This Assignment You Chegg

Solved Complete A 1040 Schedule D For This Assignment You Chegg

2023 Irs Tax Form 1040 Printable Forms Free Online

Irs Gov Printable Forms

2020 Schedule D 1040 Fill Online Printable Fillable Blank Form 1065 schedule d

Printable Irs Schedule D Form - Schedule D is the form used to report capital gains and losses from the sale or exchange of capital assets The IRS has made the Schedule D form instructions and printable forms available on their website making it easier for taxpayers to complete their tax returns The instructions provide detailed guidance on how to fill out the form and