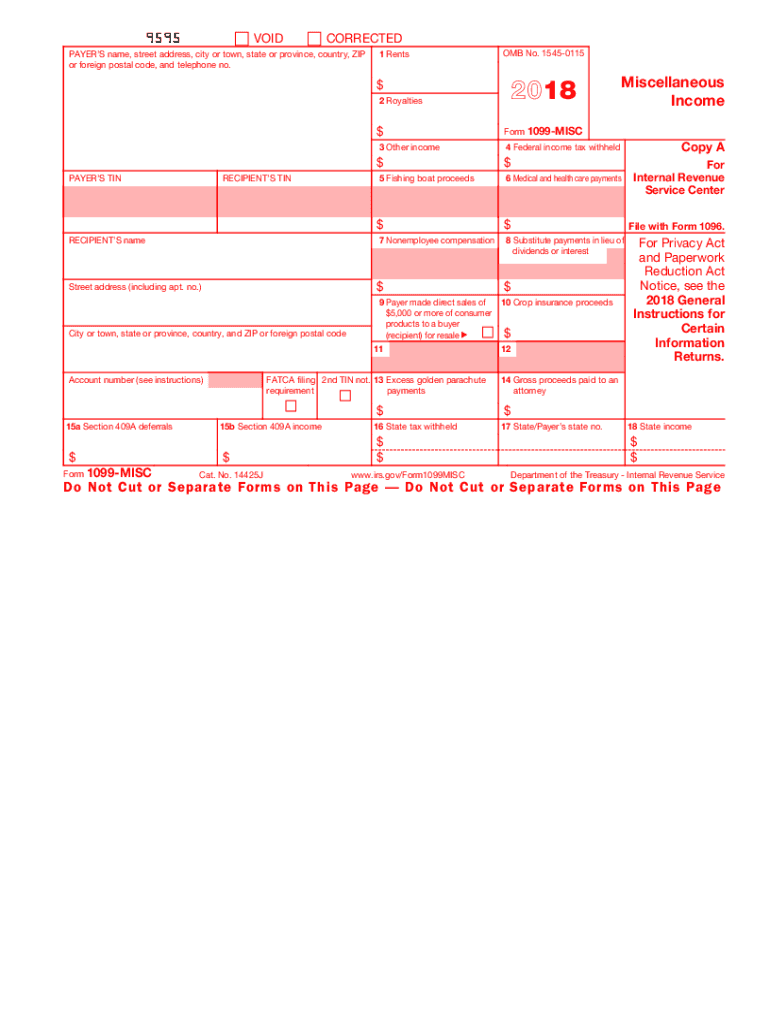

Printable Irs Tax Form 1099 Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New E filing returns

Printable Irs Tax Form 1099

Printable Irs Tax Form 1099

https://www.pdffiller.com/preview/421/116/421116584/large.png

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/7njQnBtOe3zLbzG3V4rWHE/de7ada497a46a667e012a996afc8b7d1/1099_Sample_IRS.gif

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

IRS 1099 Form Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more Form 1099 NEC Rev January 2024 Nonemployee Compensation Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No 1545 0116 For calendar year VOID CORRECTEDPAYER S name street address city or town state or province country ZIP or foreign postal code and telephone no PAYER S TIN RECIPIENT

Form 1099 is a collection of forms used to report payments that typically aren t from an employer There are a variety of incomes reported on a 1099 form including independent contractor income and payments like gambling winnings rents or royalties gains and losses in brokerage accounts dividend and interest payments and more A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC

More picture related to Printable Irs Tax Form 1099

Free Irs Form 1099 Printable Printable Templates

https://www.pdffiller.com/preview/445/723/445723799/big.png

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

Form 1099 Misc Irs Gov Fill Out And Sign Printable Pdf

https://i.pinimg.com/originals/84/39/25/8439251aed2f493ff6de85d44058d911.gif

Copy 1 For State Tax Department www irs gov Form1099INT if checked Copy B For Recipient Federal income tax withheld This is important tax information and is being furnished to the 7 Foreign country or U S territory Copy 1 For your state if you live in a state that requires a copy most do 1099 Copy A uses specific red inked paper that the IRS computers can scan All Copy A forms must be printed on this paper It s not just a matter of using a color printer loaded with red For Copies B C and 1 however feel free to use whatever paper you like

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form A 1099 form is a tax record that an entity or person not your employer gave or paid you money See how various types of IRS Form 1099 work Credit cards Credit cards

Printable 1099 Tax Forms Free Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/07/free-printable-1099-form-2019-1099-form-printable.png

Irs Printable 1099 Form

https://www.formsbirds.com/formimg/more-tax-forms/1132/irs-employee-1099-form-l3.png

https://www.irs.gov/forms-pubs/about-form-1099-misc

Home About Form 1099 MISC Miscellaneous Information File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

Blank 1099 Form Blank 1099 Form 2021 ESign Genie

Printable 1099 Tax Forms Free Printable Form 2024

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

What Is A 1099 Misc Form Financial Strategy Center

2020 Form IRS 1099 NEC Fill Online Printable Fillable Blank PdfFiller

IRS Form 1099 R 2023 Forms Docs 2023

IRS Form 1099 R 2023 Forms Docs 2023

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

Printable IRS Form 1099 MISC For Tax Year 2017 For 2018 Income Tax Season CPA Practice Advisor

IRS 1099 S 2020 Fill And Sign Printable Template Online US Legal Forms

Printable Irs Tax Form 1099 - Filing due dates for 1099 MISC forms have also been updated for the 2023 tax year The 1099 MISC must be sent To recipients by January 31 2024 To the IRS by February 28 2024 if filing by mail To the IRS by April 1 2024 if e filing The deadline for the 1099 MISC is different from the deadline for the 1099 NEC