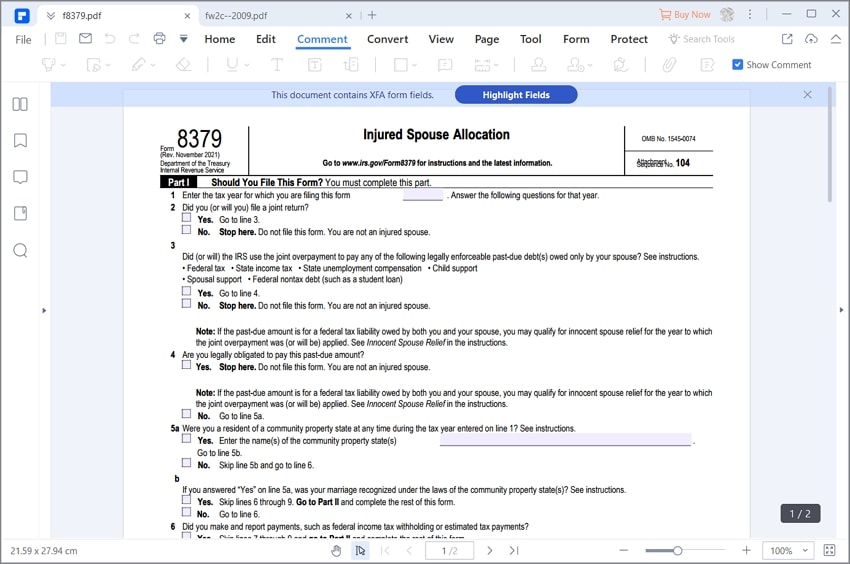

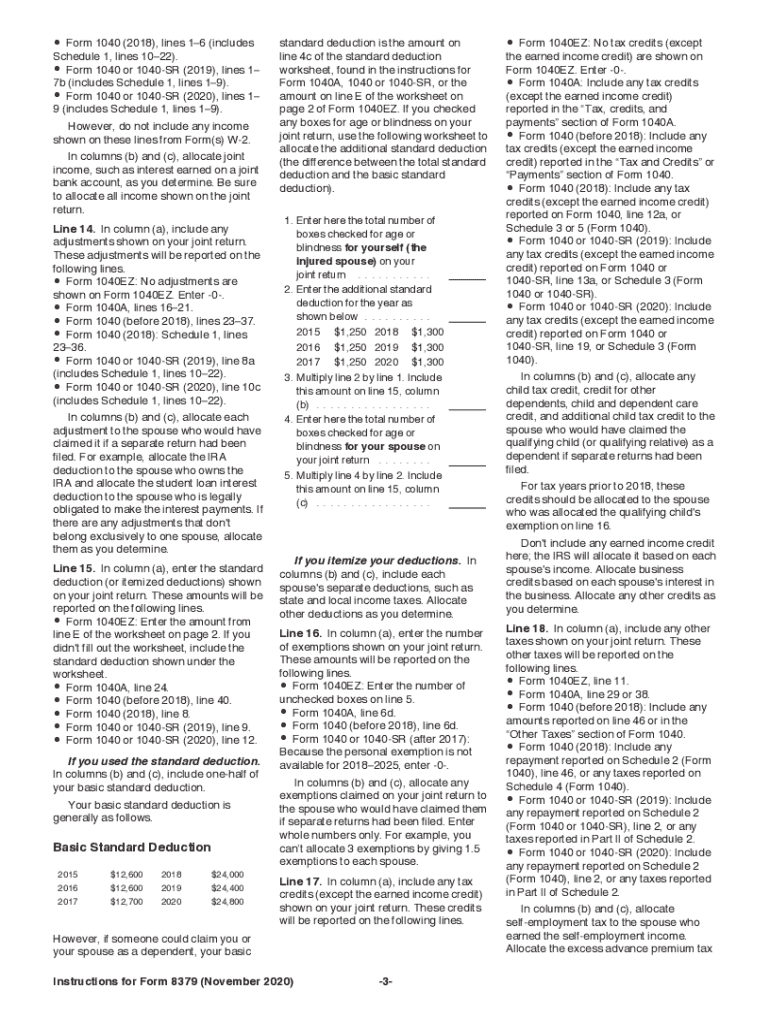

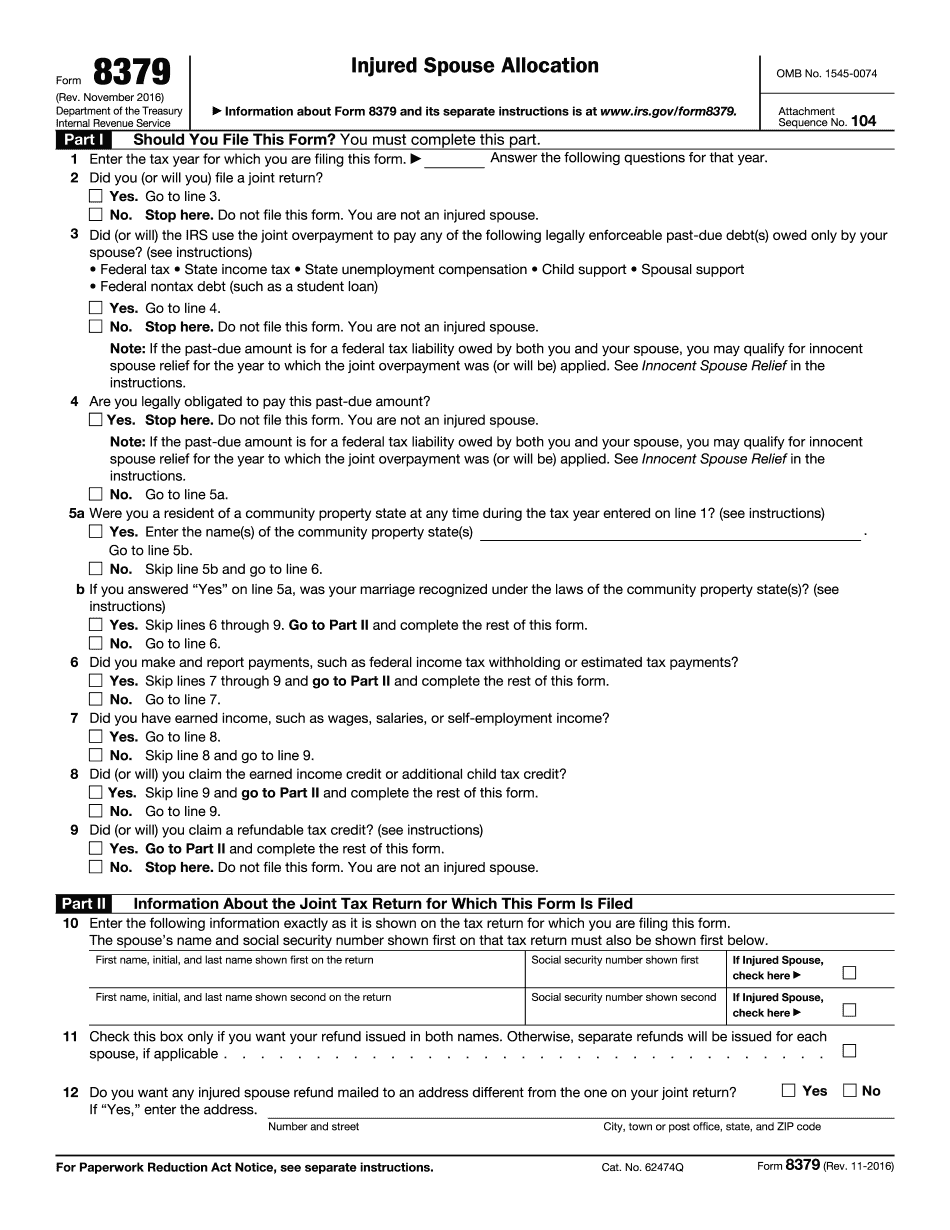

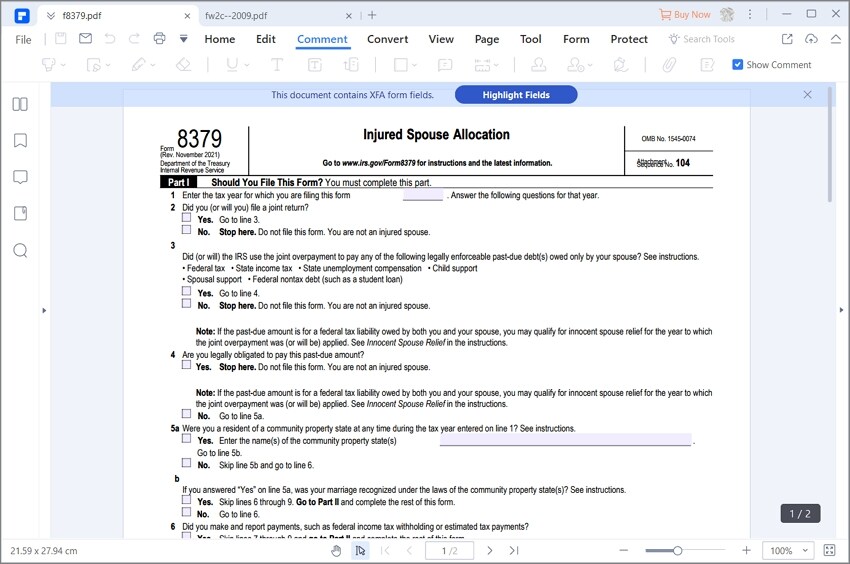

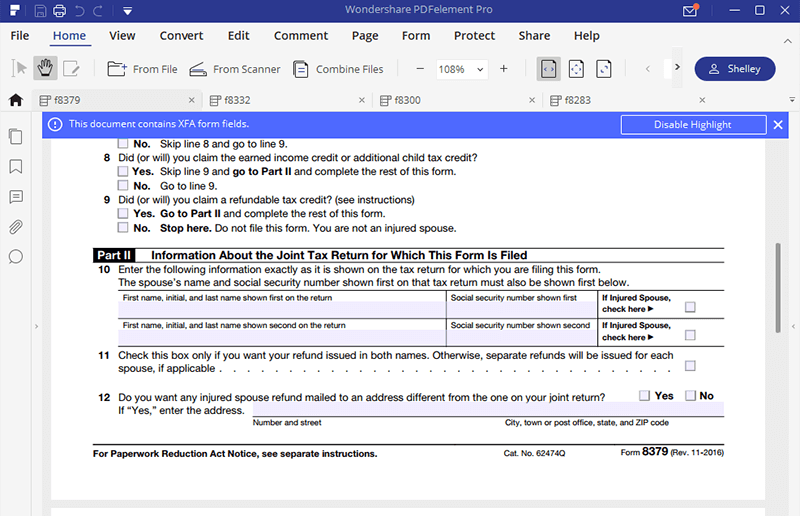

Printable Irs Tax Form 8379 The injured spouse on a jointly filed tax return files Form 8379 to get back their share of the joint refund when the joint overpayment is applied to a past due obligation of the other spouse Current Revision Form 8379 PDF Instructions for Form 8379 Print Version PDF Recent Developments None at this time Other Items You May Find Useful

Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund Which Revision To Use Purpose of Form Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund

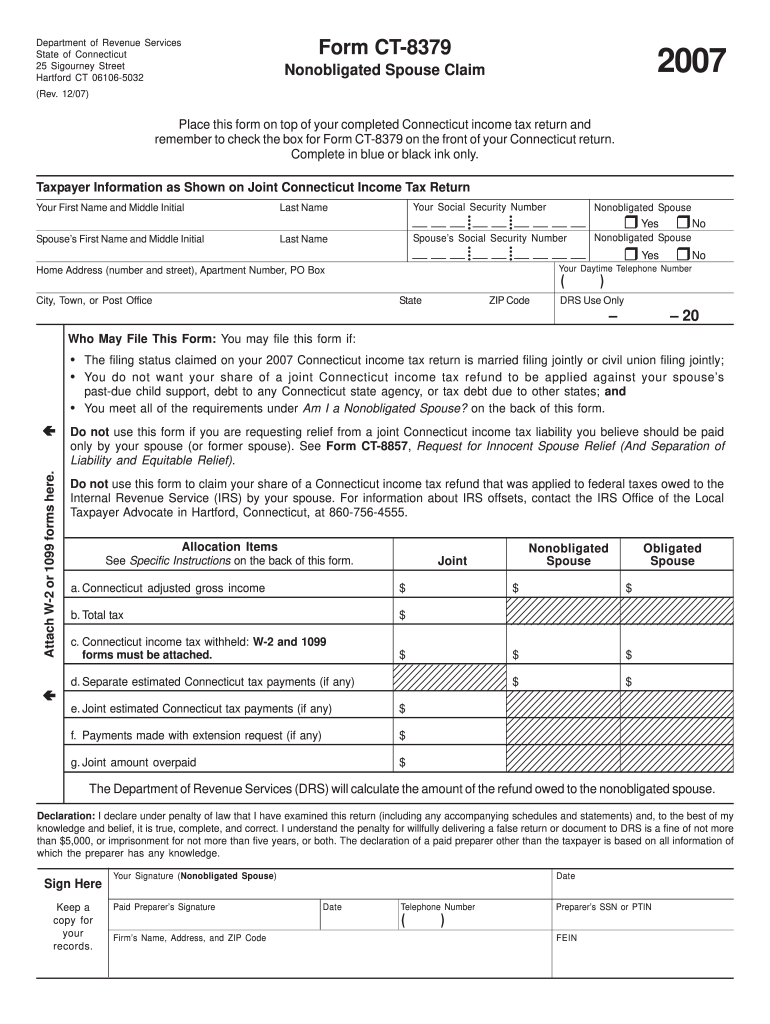

Printable Irs Tax Form 8379

Printable Irs Tax Form 8379

https://www.pdffiller.com/preview/100/12/100012342/large.png

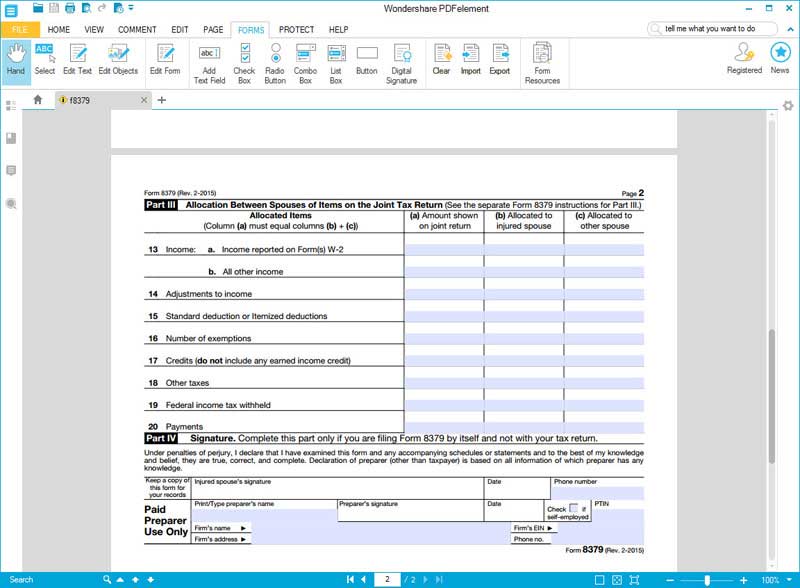

Formulaire 8379 De L IRS Bien Le Remplir

https://images.wondershare.com/pdfelement/forms-templates/article/irs-form-8379-part1.jpg

Get Irs 8379 Print 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/533/156/533156803/large.png

Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund Are You an Injured Spouse Form 8379 essentially asks the IRS to release the injured spouse s portion of the refund Filling out the form A couple can file Form 8379 along with their joint tax return if they expect their refund to be seized Alternatively the injured spouse can file it separately from the return if they find out after they file that a refund was seized

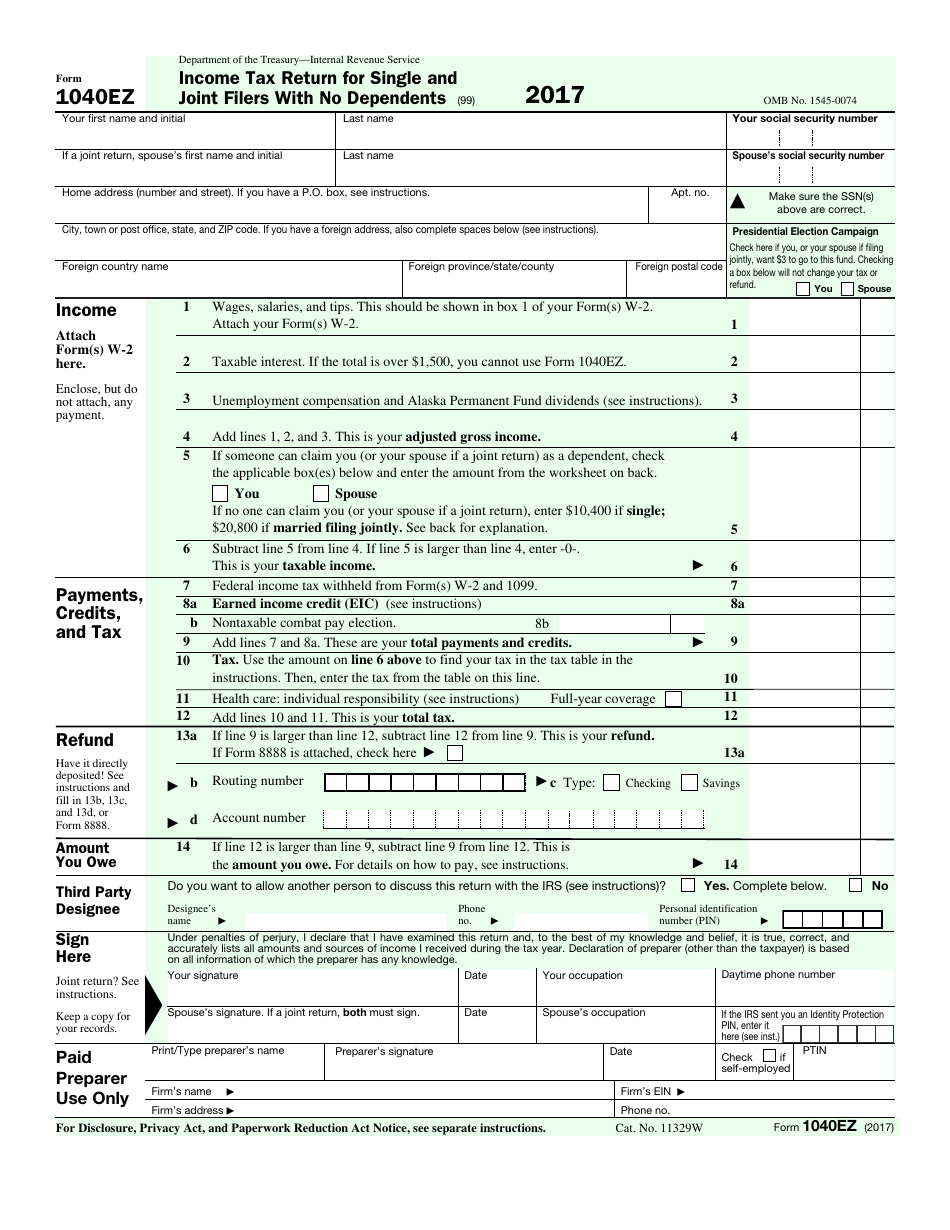

You may file Form 8379 to claim your part of the refund if all three of the following apply 1 You are not required to pay the past due amount 2 You received and reported income such as wages taxable interest etc on the joint return OR your main home was in a community property state see line 6 other than Arizona 3 Form 8379 lets you the injured spouse get back your portion of a refund from a jointly filed tax return if it s seized or offset to pay your spouse s debt You must file jointly to use this form Filing an 8379 will delay your federal refund by up to 14 weeks To file this form in TurboTax Open or continue your return

More picture related to Printable Irs Tax Form 8379

Irs Form 8379 Line 20 Universal Network

https://www.universalnetworkcable.com/wp-content/uploads/2019/03/irs-form-8379-online.jpg

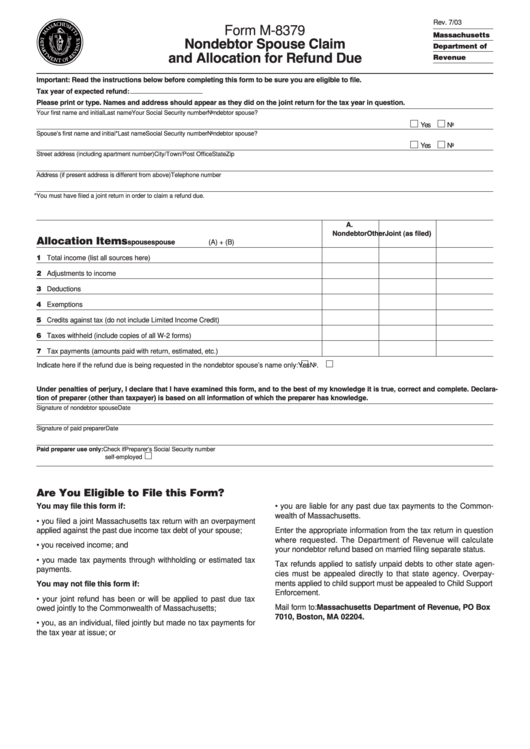

2018 2020 Form MA DoR M 8379 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/464/741/464741891/large.png

Irs Form 8379 Line 20 Universal Network

https://www.universalnetworkcable.com/wp-content/uploads/2018/12/tax-form-1040ez-line-11.jpg

Form 8379 allows you to get back your share of a joint tax refund if it was garnished to pay a debt or obligation owed by your spouse These obligations might include child support payments past due student loan payments or overdue state tax payments This provision in the tax code is called injured spouse allocation where the injured Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal form 8379 pdf and you can print it directly from your computer More about the Federal Form 8379 eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms

The Instructions for Form 8379 explain Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund IRS Form 8379 Injured Spouse Allocation is a form that allows an injured spouse to claim their share of a joint tax refund By filing this form the injured spouse can request their portion of the refund to be protected from seizure by the IRS to satisfy the other spouse s debts What to Do If You Receive a Notice

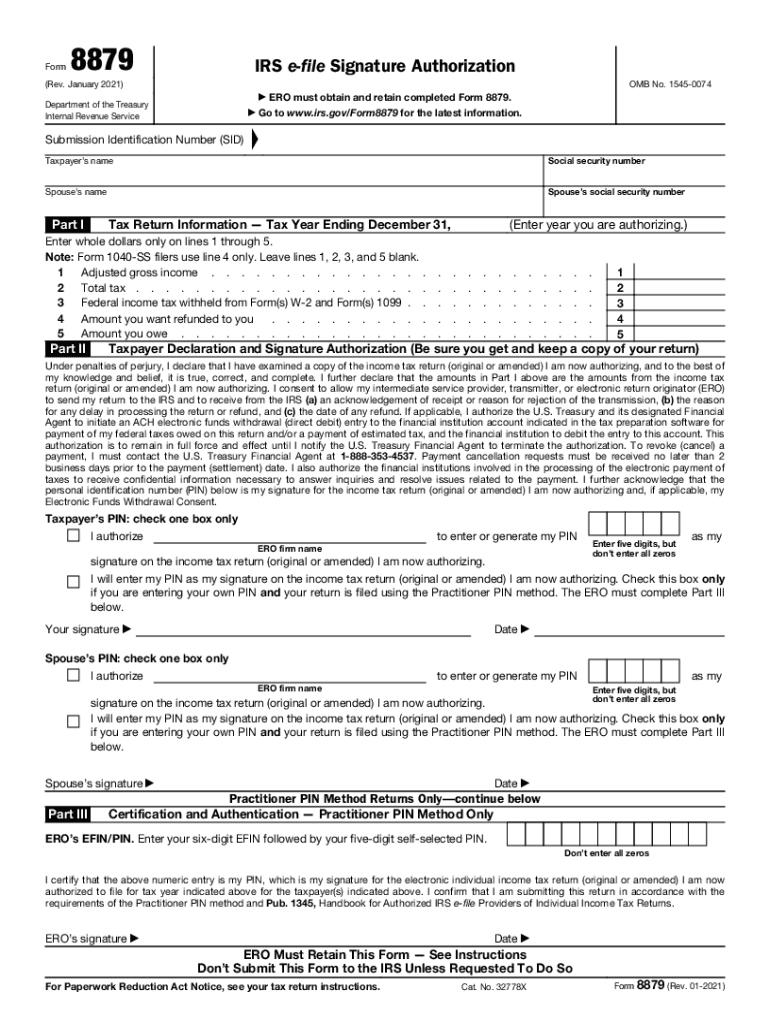

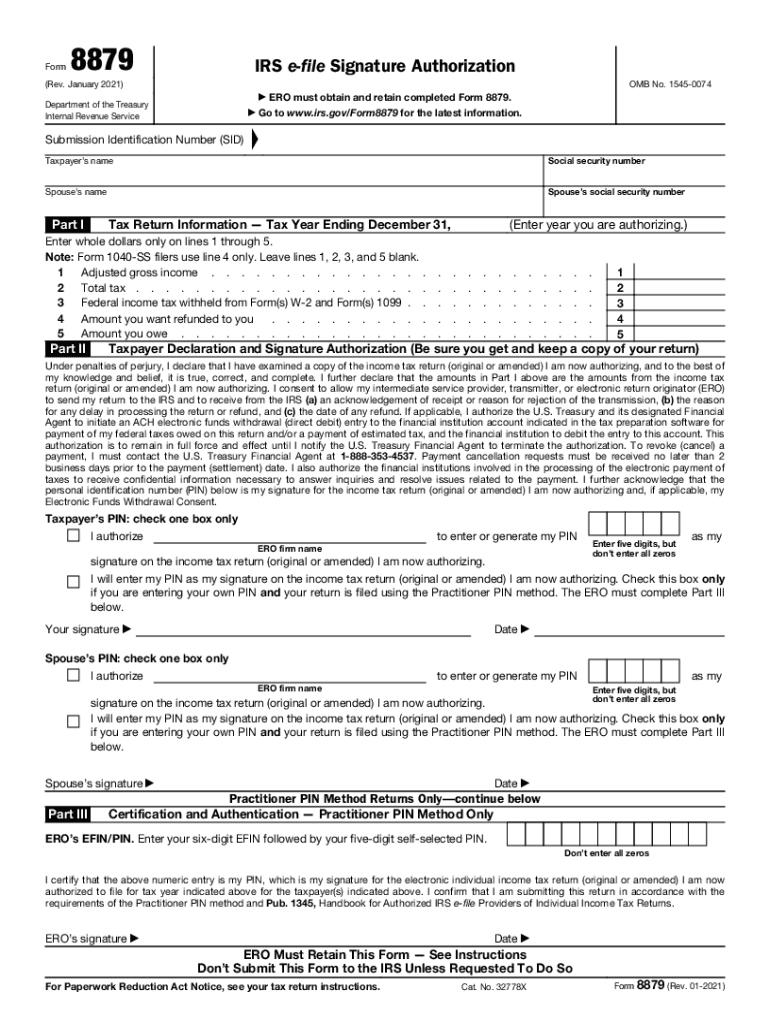

IRS 8879 2021 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/547/525/547525816/large.png

Irs Form 8379 Fill Out And Edit Online PDF Template

https://www.pdffiller.com/preview/392/322/392322440/big.png

https://www.irs.gov/forms-pubs/about-form-8379

The injured spouse on a jointly filed tax return files Form 8379 to get back their share of the joint refund when the joint overpayment is applied to a past due obligation of the other spouse Current Revision Form 8379 PDF Instructions for Form 8379 Print Version PDF Recent Developments None at this time Other Items You May Find Useful

https://www.irs.gov/instructions/i8379

Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund Which Revision To Use

Irs Form 8379 File Online Universal Network

IRS 8879 2021 Fill And Sign Printable Template Online US Legal Forms

IRS Form 8379 Printable

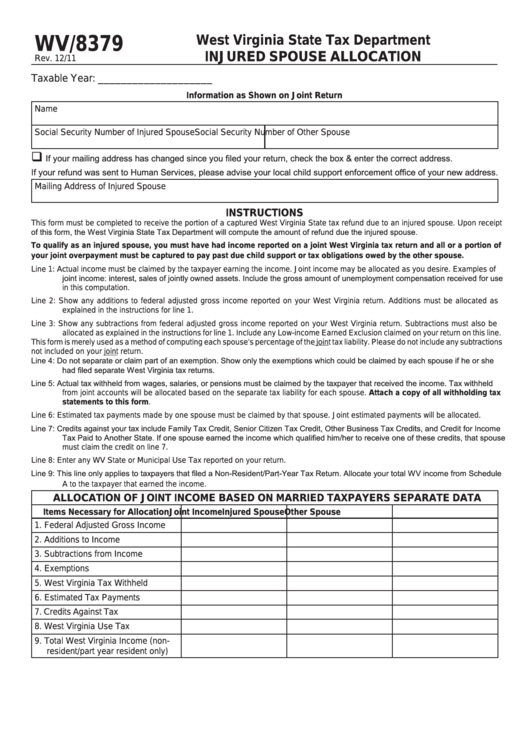

Form Wv 8379 Injured Spouse Allocation Printable Pdf Download

Irs Tax Forms Printable

Free Printable Irs Tax Forms Printable Templates

Free Printable Irs Tax Forms Printable Templates

Tax Form 8379 Printable Printable Forms Free Online

Irs Form 8379 Fillable Printable Forms Free Online

Fillable Form M 8379 Nondebtor Spouse Claim And Allocation For Refund Due Printable Pdf Download

Printable Irs Tax Form 8379 - Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund Are You an Injured Spouse