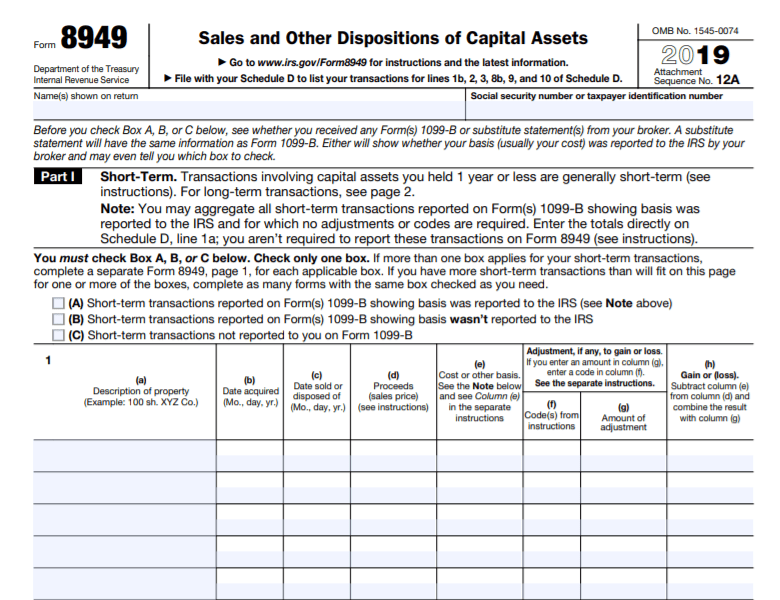

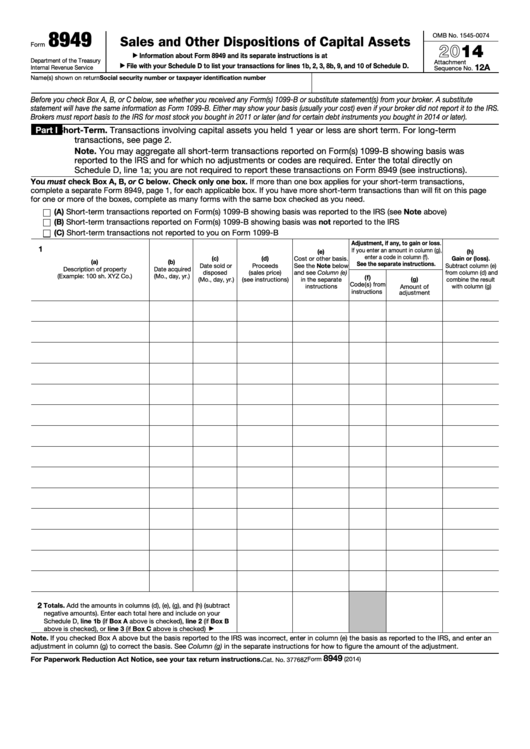

Printable Irs Tax Form 8949 IRS Form 8949 is a tax document you typically use to account for the difference in figures reported on Forms 1099 B and 1099 S and your tax return Form 8949 is filed along with Schedule D Key Takeaways The primary purpose of IRS Form 8949 is to report sales and exchanges of capital assets

Form 8949 Sales and Other Dispositions of Capital Assets is an Internal Revenue Service tax form used to report capital gains and losses from investments more Form 1099 B Proceeds From Broker Form 8949 An Internal Revenue Service form implemented in tax year 2011 for individual taxpayers to report capital gains and losses from investment activity Taxpayers must use form 8949 Sales

Printable Irs Tax Form 8949

Printable Irs Tax Form 8949

https://www.handytaxguy.com/wp-content/uploads/2020/07/IRS-Form-8949.png

Fillable IRS Form 8949 Printable PDF Sample FormSwift

https://formswift.com/seo-pages-assets/images/documents/form-8949/form-8949-sample.png

2016 Form 8949 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/397/838/397838561/large.png

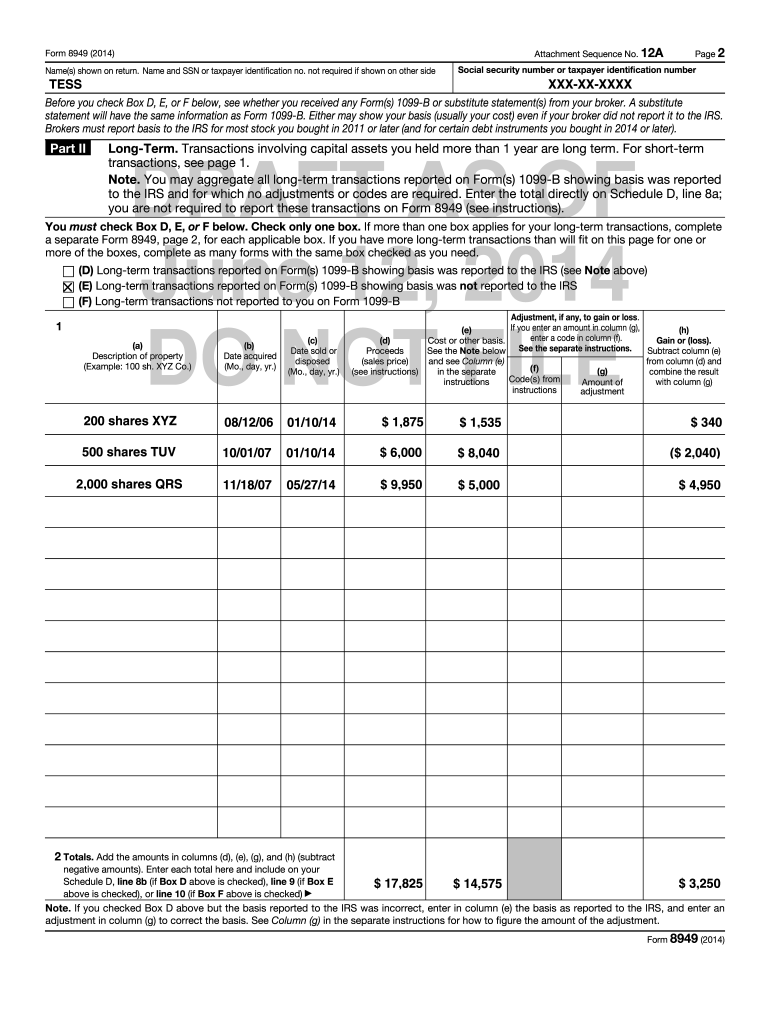

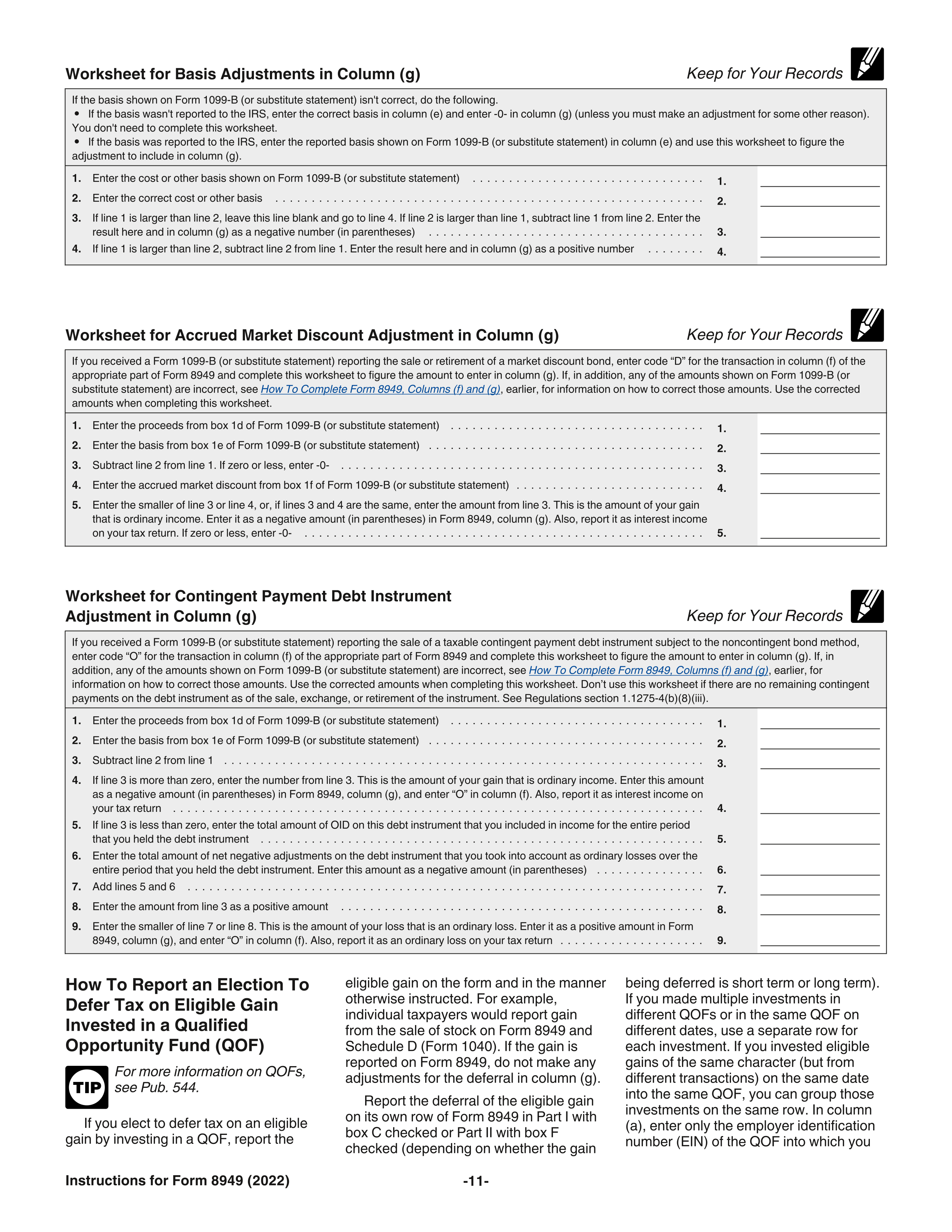

You will report the totals of Form 8949 on Schedule D of Form 1040 Here is more information on how Tax Form 8949 is used from the IRS If you receive Forms 1099 B or 1099 S or substitute statements always report the proceeds sales price shown on the form or statement in column d of Form 8949 If Form 1099 B or substitute statement Form 8949 tells the IRS all of the details about each stock trade you make during the year not just the total gain or loss that you report on Schedule D Form 8949 doesn t change how your stock sales are taxed but it does require a little more time to get your tax return done especially if you re more than just a casual investor

Form 8949 is a tax form used to report certain sales and dispositions of capital assets The taxpayer uses it to report capital gains and losses on certain types of transactions such as investment properties This form will help the taxpayer determine how much of a refund they may receive or the amount of money they owe as a tax Table of Contents Download This Form Print This Form More about the Federal Form 8949 Other TY 2023 We last updated the Sales and other Dispositions of Capital Assets in January 2024 so this is the latest version of Form 8949 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8949 directly from TaxFormFinder

More picture related to Printable Irs Tax Form 8949

Form 8949 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/47/798/47798141/large.png

Form 8949 Sales And Other Dispositions Of Capital Assets 2014 Free Download

http://www.formsbirds.com/formimg/tax-support-document/8259/form-8949-sales-and-other-dispositions-of-capital-assets-2014-l1.png

:max_bytes(150000):strip_icc()/8949-SalesandOtherDispositionsofCapitalAssets-1-44c0f523131349f6a207a148fb495962.png)

The Purpose Of IRS Form 8949

https://www.investopedia.com/thmb/QT4zXnvHJd53JNK1FTws3l8KvuQ=/2200x1700/filters:no_upscale():max_bytes(150000):strip_icc()/8949-SalesandOtherDispositionsofCapitalAssets-1-44c0f523131349f6a207a148fb495962.png

Form 8949 Sales and Other Dispositions of Capital Assets is used to report capital gains and losses from the sale or exchange of capital assets to the IRS This includes stocks bonds mutual funds and real estate investments Some key things to know about Form 8949 Click the printer sign at the top right corner of the screen to print Form 8949 after completing the template You can then keep a copy for your records or mail it to the IRS For further assistance consider downloading IRS Form 8949 in PDF format with detailed instructions

Report worthless securities on Form 8949 Per IRS rules when investment income and expenses stocks stock rights and bonds became worthless during the tax year they re treated as sold on the last day of the tax year Follow these steps to report worthless securities on Form 949 Go to the Filing Form 8949 is a legal requirement for taxpayers to accurately report capital gains and losses This detailed reporting is vital for the IRS to assess the correct tax liability The form ensures transparency in capital asset transactions and aids in the calculation of the taxpayer s capital gains tax

Form 8949 Instructions Information On Capital Gains Losses Form

https://www.communitytax.com/wp-content/uploads/2018/07/Form-8949.jpg

IRS Form 8949 Instructions Get 8949 Tax Form For 2022 Printable PDF Example To Fill Out

https://8949-form-instructions.com/images/uploads/2023-02-27/8949-rain1-main2.jpg?1678882239606

https://www.thebalancemoney.com/reporting-capital-gains-and-losses-form-8949-3192971

IRS Form 8949 is a tax document you typically use to account for the difference in figures reported on Forms 1099 B and 1099 S and your tax return Form 8949 is filed along with Schedule D Key Takeaways The primary purpose of IRS Form 8949 is to report sales and exchanges of capital assets

https://www.investopedia.com/articles/personal-finance/083015/purpose-irs-form-8949.asp

Form 8949 Sales and Other Dispositions of Capital Assets is an Internal Revenue Service tax form used to report capital gains and losses from investments more Form 1099 B Proceeds From Broker

Tax Form 8949 Instructions For Reporting Capital Gains And Losses

Form 8949 Instructions Information On Capital Gains Losses Form

Irs Form 8949 Instructions 2020 Fill Online Printable Fillable Blank Form 1065 schedule d

Online IRS Instructions 8949 2019 Fillable And Editable PDF Template

Online IRS Instructions 8949 2018 2019 Fillable And Editable PDF Template

2020 Form 8949 Fill Online Printable Fillable Blank Form 1040 schedule d instructions

2020 Form 8949 Fill Online Printable Fillable Blank Form 1040 schedule d instructions

Top Form 8949 Templates Free To Download In PDF Format

IRS Form 8949 Instructions Sales Dispositions Of Capital Assets

IRS Form 8949 Instructions

Printable Irs Tax Form 8949 - Download This Form Print This Form More about the Federal Form 8949 Other TY 2023 We last updated the Sales and other Dispositions of Capital Assets in January 2024 so this is the latest version of Form 8949 fully updated for tax year 2023 You can download or print current or past year PDFs of Form 8949 directly from TaxFormFinder