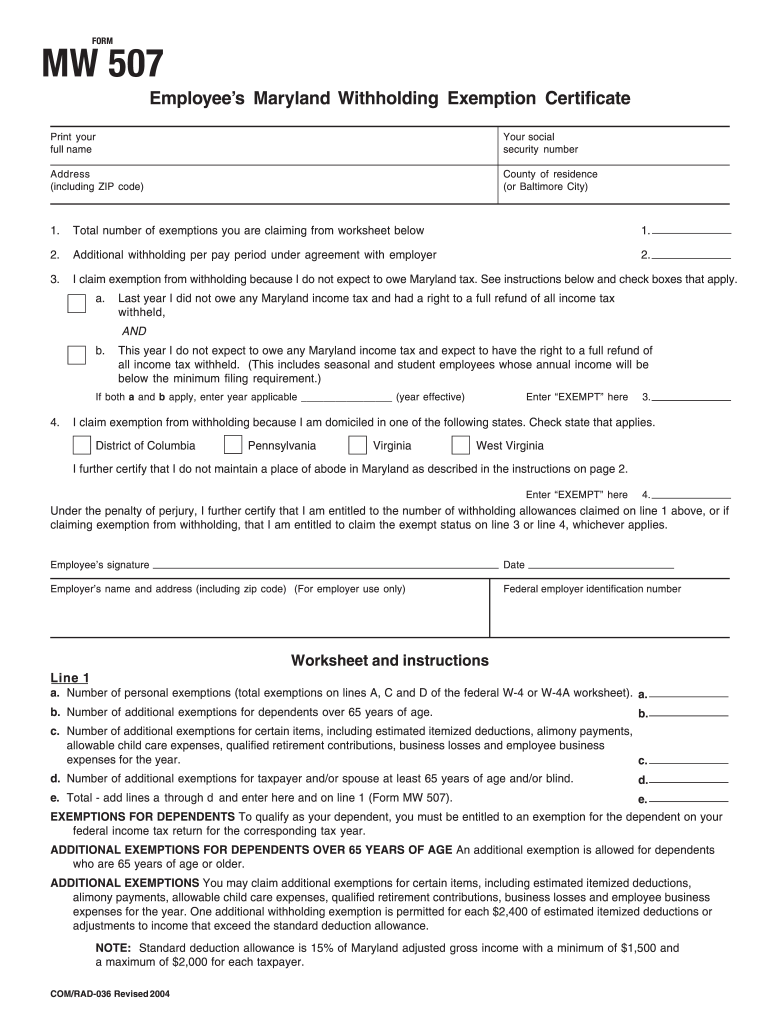

Printable Maryland State Tax Form Mw507 Form used by employers who have discontinued or sold their business To be mailed with the MW506 or MW506M Mail separately if filed electronically MW507 Employee s Maryland Withholding Exemption Certificate Form used by individuals to direct their employer to withhold the correct amount of Maryland income tax from their pay MW507P

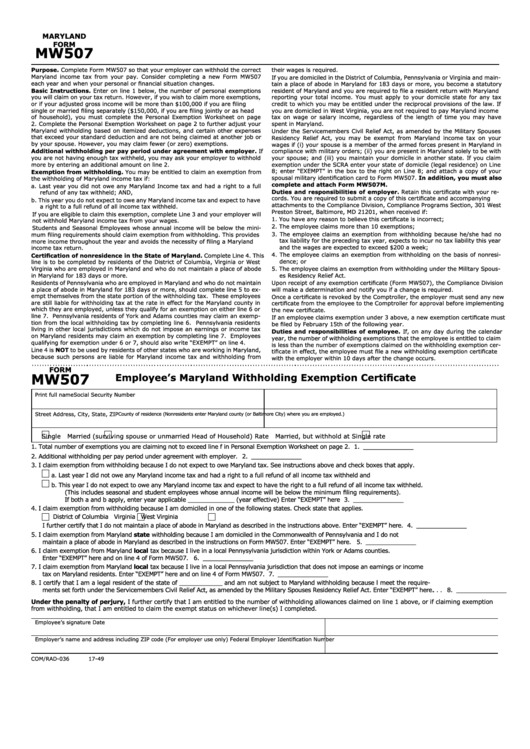

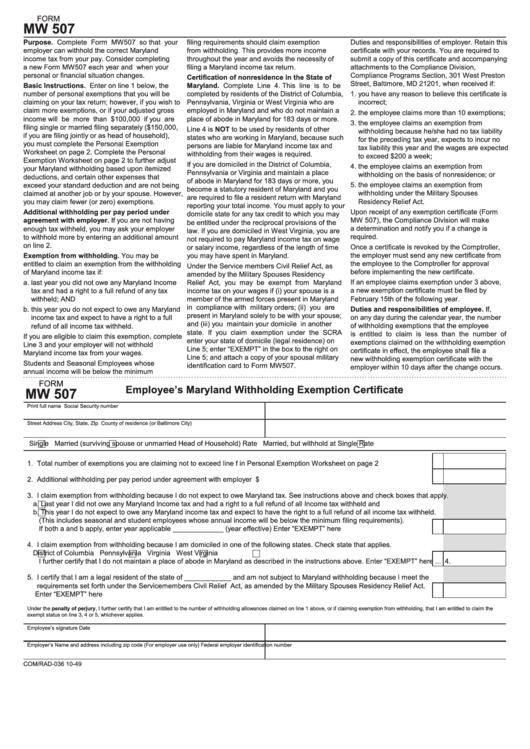

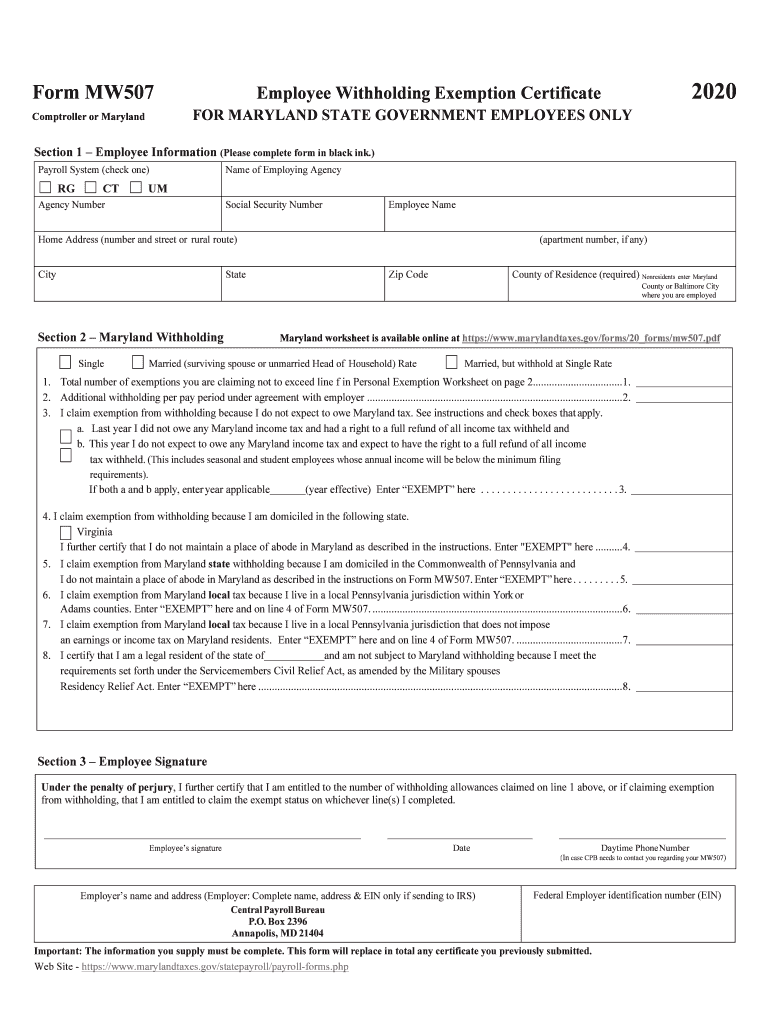

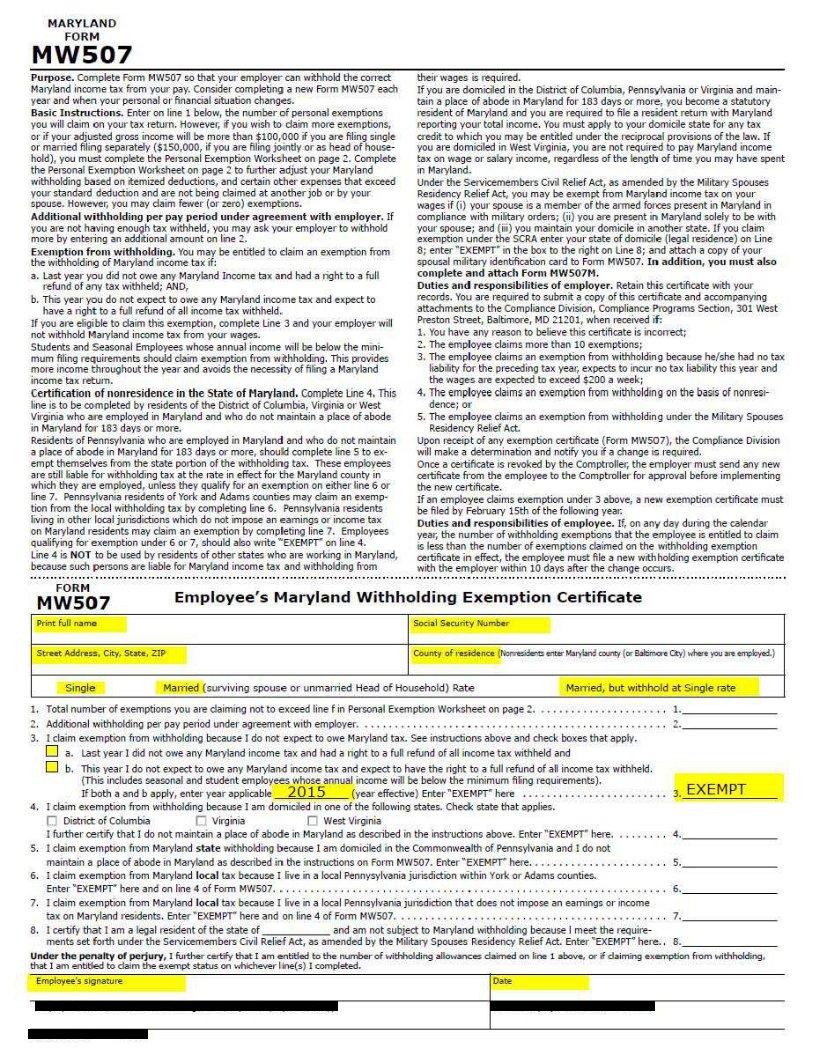

I claim exemption from withholding because I do not expect to owe Maryland tax See instructions and check boxes that apply a Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax withheld and 2024 Form MW507 MD tax witholding form For MD State Government Employees Only Created Date 1 11 I declare under penalties of perjury that the wages I earn for my services performed in Maryland are exempt from Maryland income tax because I meet the conditions of the Military Spouses Residency Relief Act 50 U S C 4001 and the information I provided on this form is accurate to the best of my knowledge and belief

Printable Maryland State Tax Form Mw507

Printable Maryland State Tax Form Mw507

https://data.formsbank.com/pdf_docs_html/304/3047/304712/page_1_thumb_big.png

Top 6 Mw507 Form Templates Free To Download In PDF Format

https://data.formsbank.com/pdf_docs_html/272/2726/272612/page_1_thumb_big.png

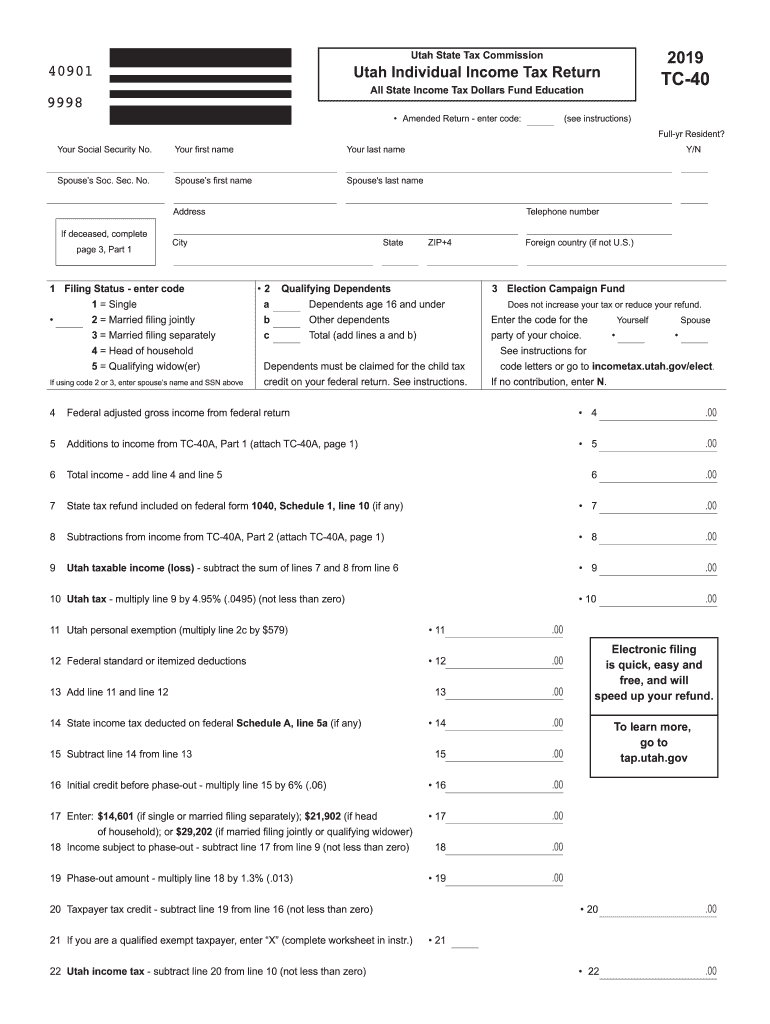

Printable State Tax Forms

https://www.pdffiller.com/preview/100/101/100101112/large.png

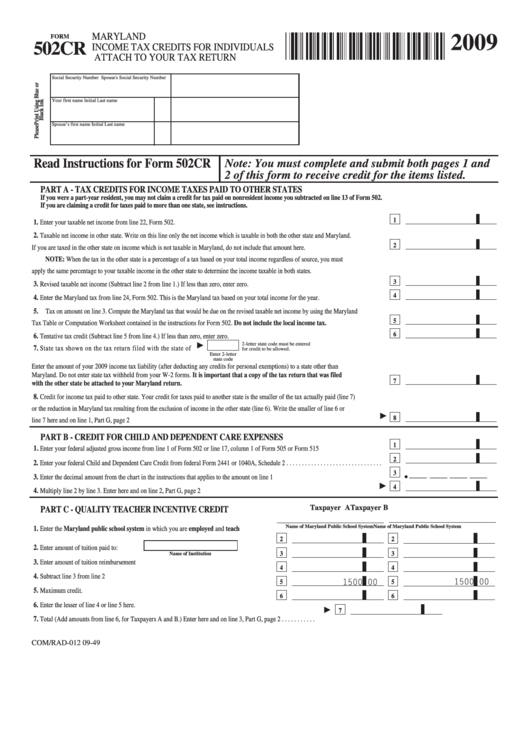

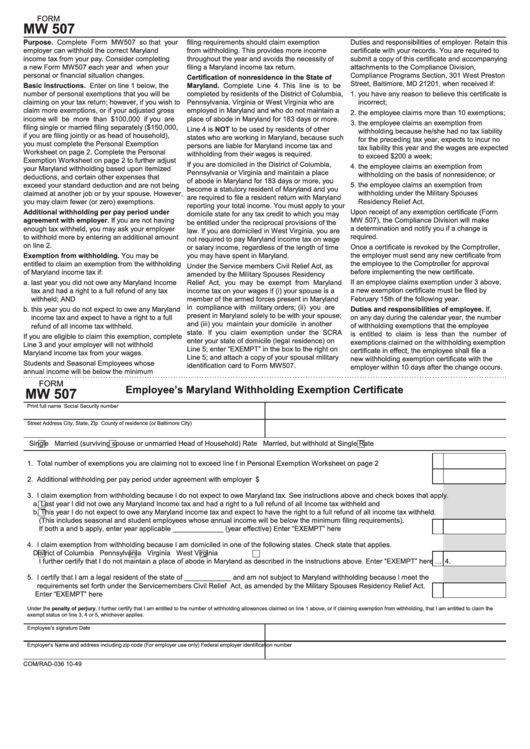

MW506R Application for Tentative Refund of Withholding on 2023 Sales of Real Property by Nonresidents Form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of Maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor seller s tax liability for Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay Consider completing a new Form MW507 each year and when your personal or financial situation changes Basic Instructions Enter on line 1 below the number of personal exemptions you will claim on your tax return

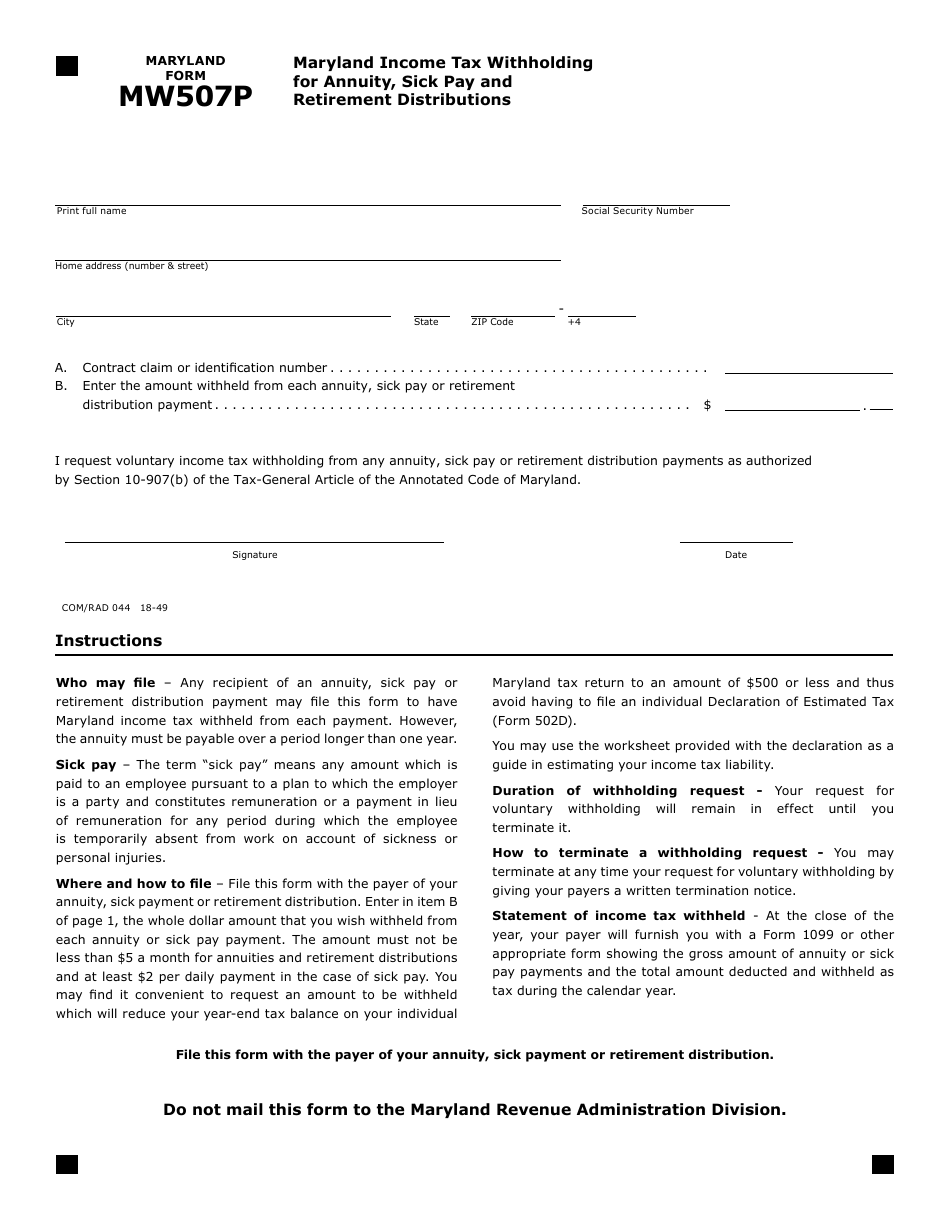

Download This Form Print This Form More about the Maryland MW507 Individual Income Tax TY 2023 Form used by individuals to direct their employer to withhold Maryland income tax from their pay Instructions Date Who may file Any recipient of an annuity sick pay or retirement distribution payment may file this form to have Maryland income tax withheld from each payment However the annuity must be payable over a period longer than one year Sick pay The term sick pay means any amount which is paid to an employee

More picture related to Printable Maryland State Tax Form Mw507

Maryland State Tax Withholding Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/491/475/491475654/large.png

Maryland Online Fillable Tax Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/254/2546/254654/page_1_thumb_big.png

2023 Maryland State Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/11/66/11066848/large.png

Business Income Tax Employer Withholding 2023 Withholding Forms 2023 Employer Withholding Forms Instruction Booklets Note The instruction booklets listed here do not include forms Forms are available for downloading in the Employer Withholding Forms section below Employer Withholding Forms Marylandtaxes gov The employee claims exemptions from withholding on the basis of nonresidence Upon receipt of any exemption certificate Form MW 507 the Compliance Division will make a determination and notify you if a change is required Once a certificate is revoked by the Comptroller the employer must send any new certificate from the employee to the

8 I certify that I am a legal resident of thestate of and am not subject to Maryland withholding because I meet the requirements set forth under the Servicemembers Civil Relief Act as amended by the Military spouses Form MW507 Employee Withholding Exemption Certificate 202 2 Comptroller of Maryland FOR MARYLAND STATE GOVERNMENT Line 1 The first line of Form MW507 is used for the total amount of personal exemptions To learn how many exemptions you re entitled to continue to the personal exemptions worksheet section below Example Rodney is single and filing a Form MW507 for a tax exemption since he makes 46 000 a year

Mw507 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/0/56/56402/large.png

Mw507 Example Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/48/668/48668761/large.png

https://www.marylandtaxes.gov/business/income/withholding/2024-employer-withholding-forms.php

Form used by employers who have discontinued or sold their business To be mailed with the MW506 or MW506M Mail separately if filed electronically MW507 Employee s Maryland Withholding Exemption Certificate Form used by individuals to direct their employer to withhold the correct amount of Maryland income tax from their pay MW507P

https://www.mdot.maryland.gov/OHR/2024-MD-Withholding-Form-MW507.pdf

I claim exemption from withholding because I do not expect to owe Maryland tax See instructions and check boxes that apply a Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax withheld and 2024 Form MW507 MD tax witholding form For MD State Government Employees Only Created Date 1 11

Form Mw 507 Example Fill Out Printable PDF Forms Online

Mw507 Fill Online Printable Fillable Blank PdfFiller

Form MW507P Fill Out Sign Online And Download Fillable PDF Maryland Templateroller

Printable State Tax Forms

Maryland State Tax Fill Out Sign Online DocHub

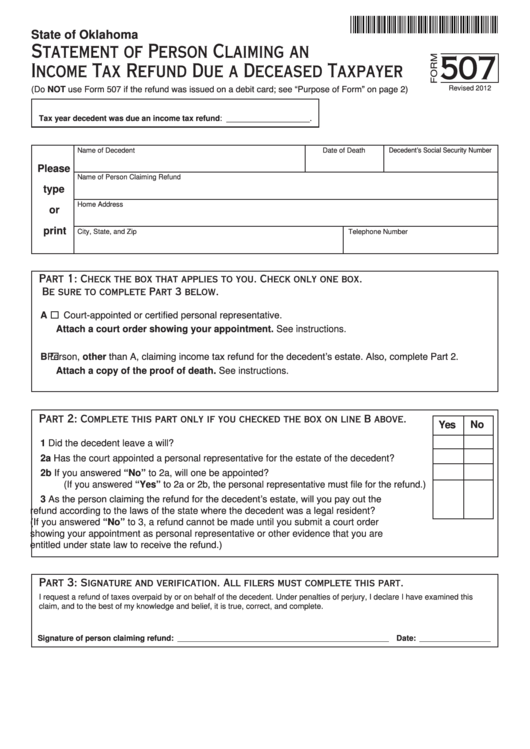

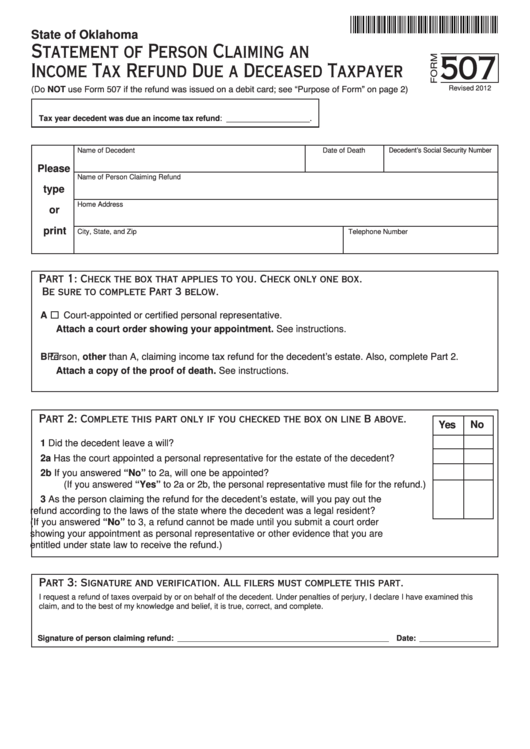

Fillable Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer

Fillable Form 507 Statement Of Person Claiming An Income Tax Refund Due A Deceased Taxpayer

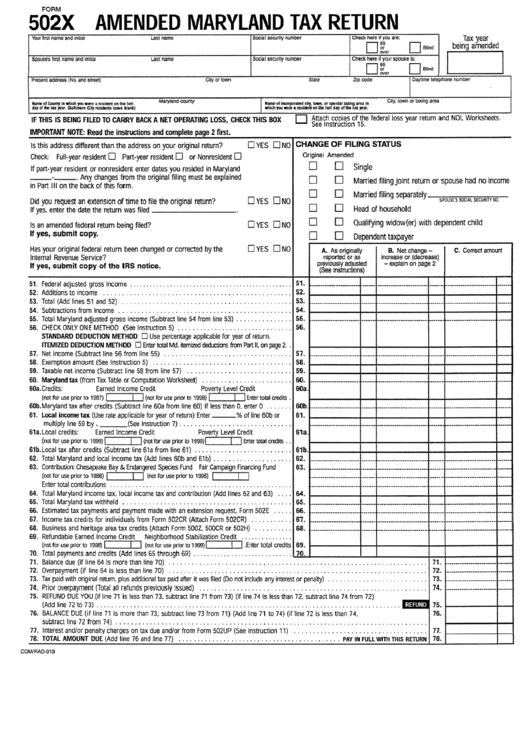

Form 502x Amended Maryland Tax Return Printable Pdf Download

Form Mw507 Example Fill Out And Sign Printable PDF Template SignNow

Maryland Withholding Tax Form WithholdingForm

Printable Maryland State Tax Form Mw507 - MW506R Application for Tentative Refund of Withholding on 2023 Sales of Real Property by Nonresidents Form used to apply for a refund of the amount of tax withheld on the 2023 sale or transfer of Maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor seller s tax liability for