Printable Maryland State Tax Forms This form maybe used by taxpayers to report income modifications and credits applicable to tax year 2023 that are enacted after December 31 2023 502R Maryland Retirement Income Form Form for reporting retirement income as per enacted House Bill 1148 by the Maryland General Assembly during the 2016 Session

Account Form 588 allows income tax refunds to be deposited to more than one account See Instruction 22 for more information Check with your financial institution to make sure your direct deposit will be accepted and to get the correct routing and account numbers The State of Maryland is not responsible for a lost refund if you enter Maryland has a state income tax that ranges between 2 and 5 75 which is administered by the Maryland Comptroller of Maryland TaxFormFinder provides printable PDF copies of 42 current Maryland income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024

Printable Maryland State Tax Forms

Printable Maryland State Tax Forms

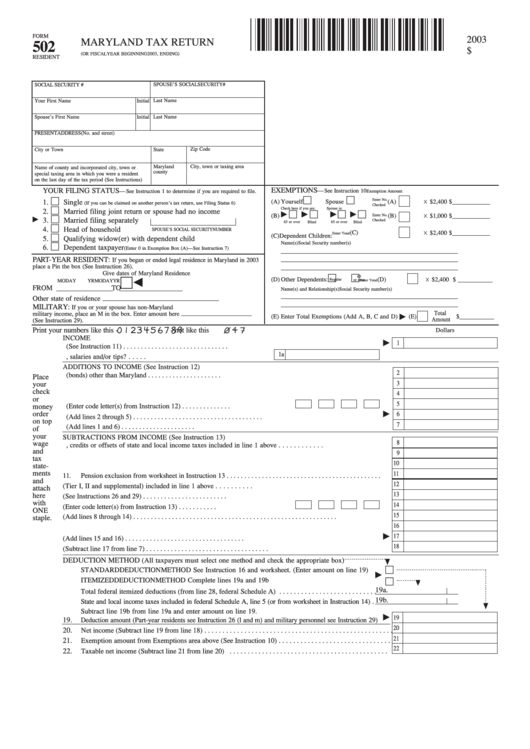

https://fillableforms.net/wp-content/uploads/2022/07/blank-fillable-maryland-tax-return-502.png

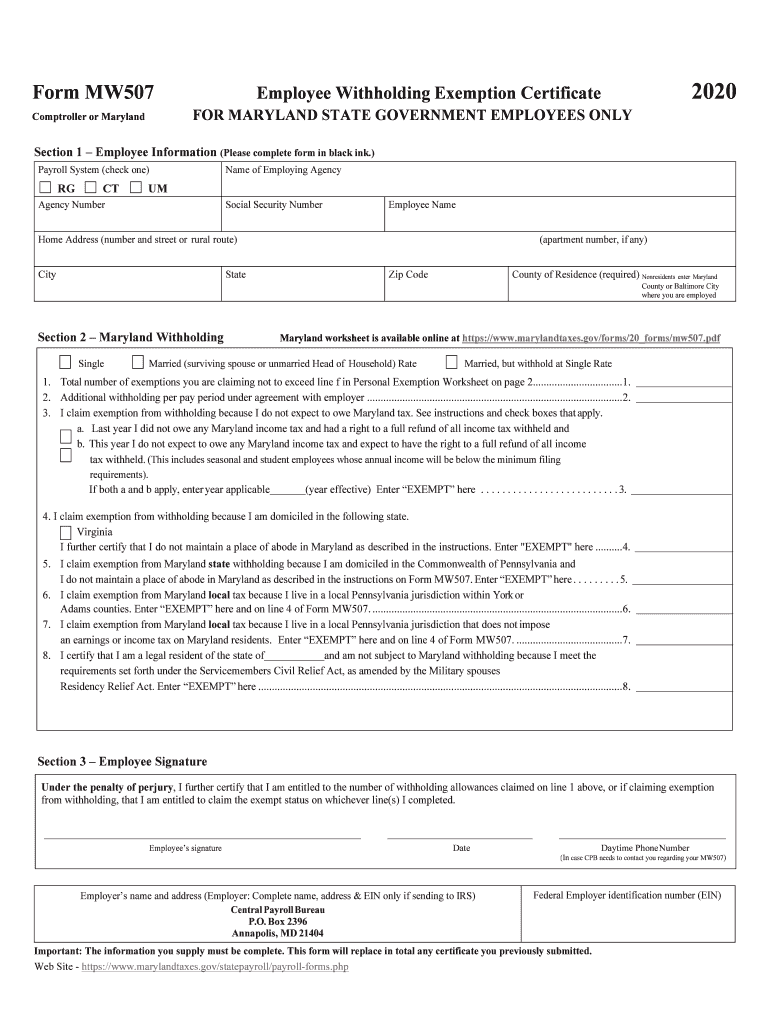

Maryland State Tax Withholding Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/491/475/491475654/large.png

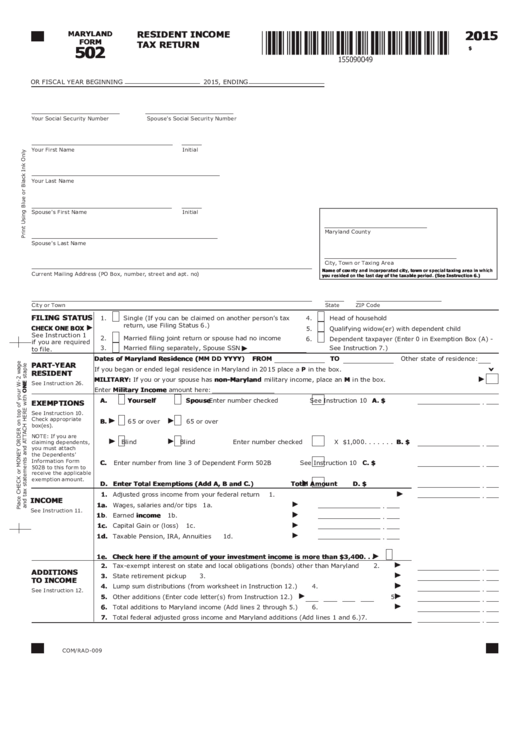

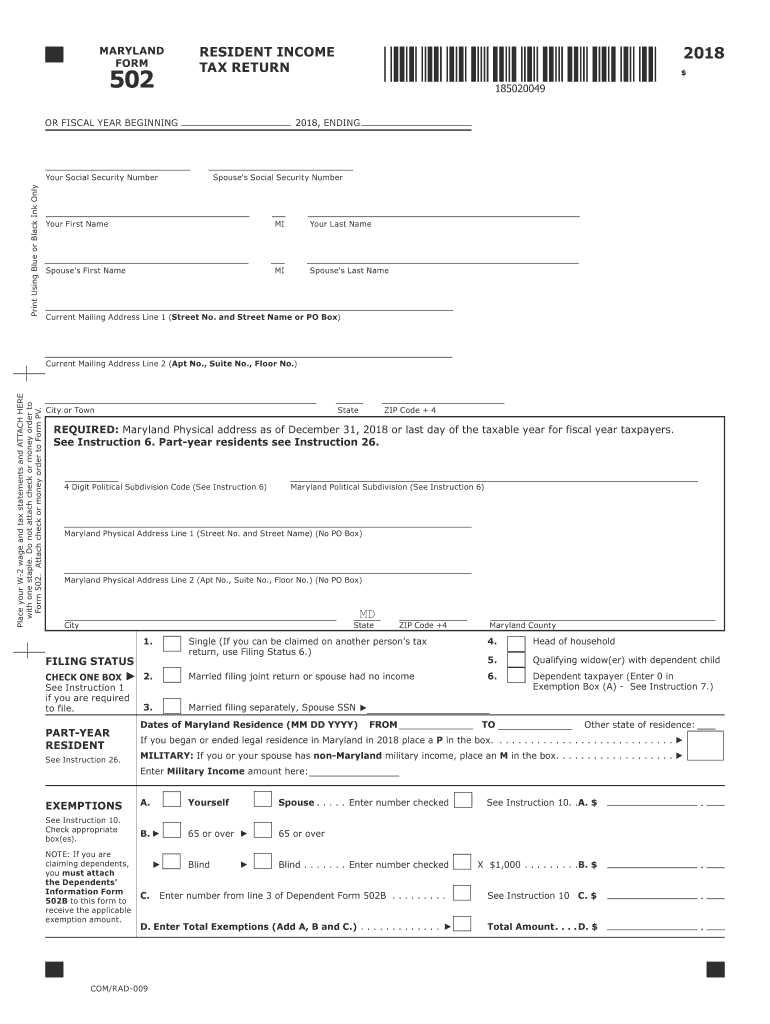

Fillable Maryland Form 502 Resident Income Tax Return 2015 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/7/72/7260/page_1_thumb_big.png

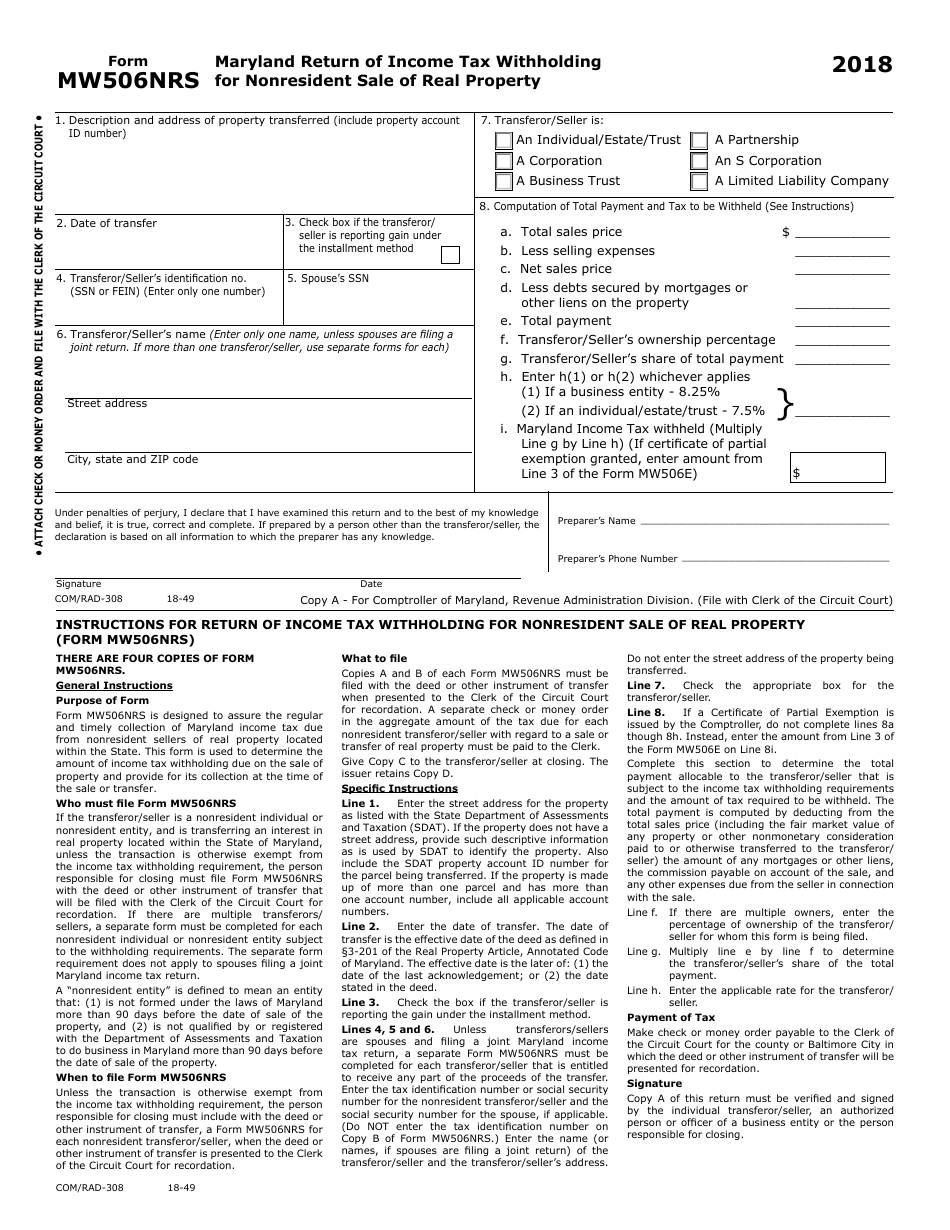

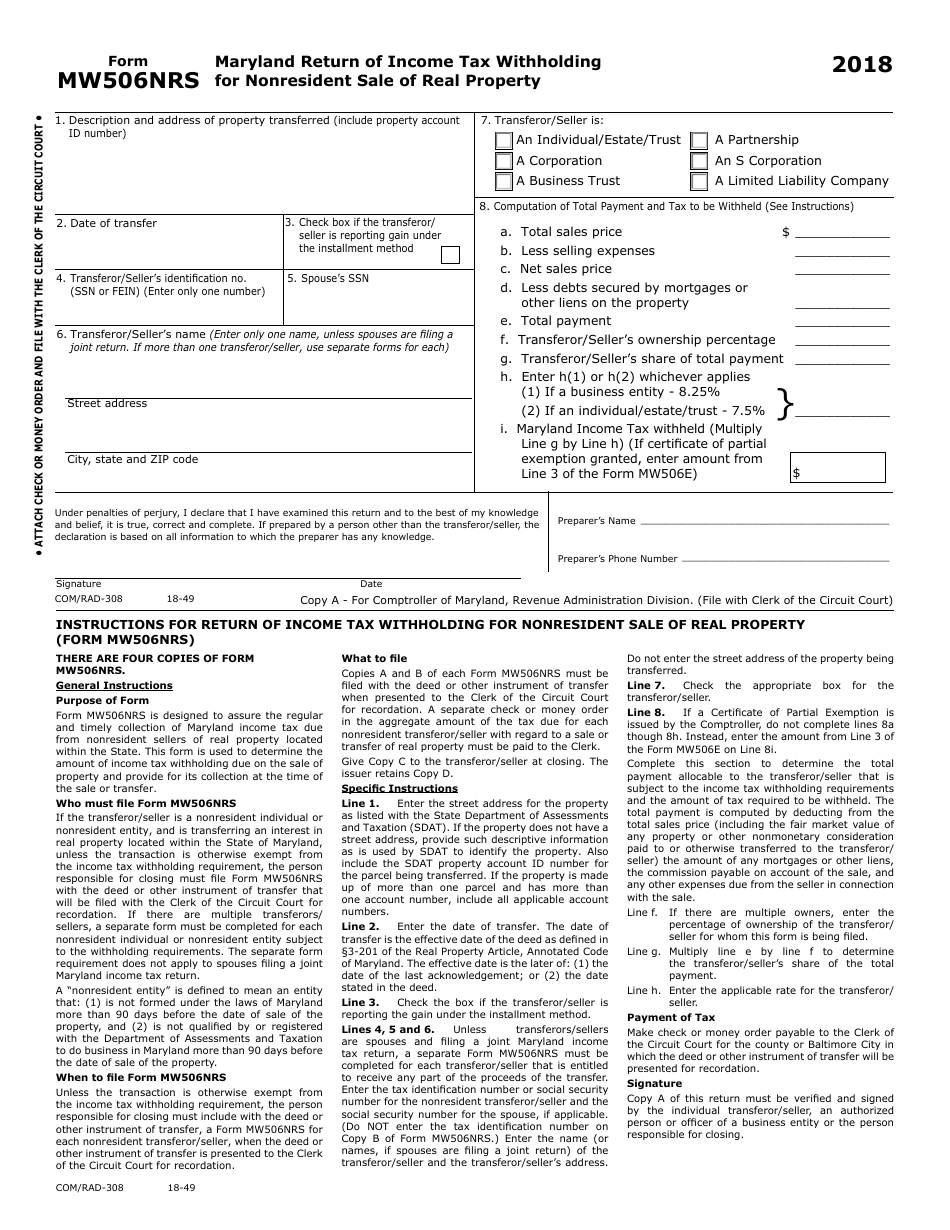

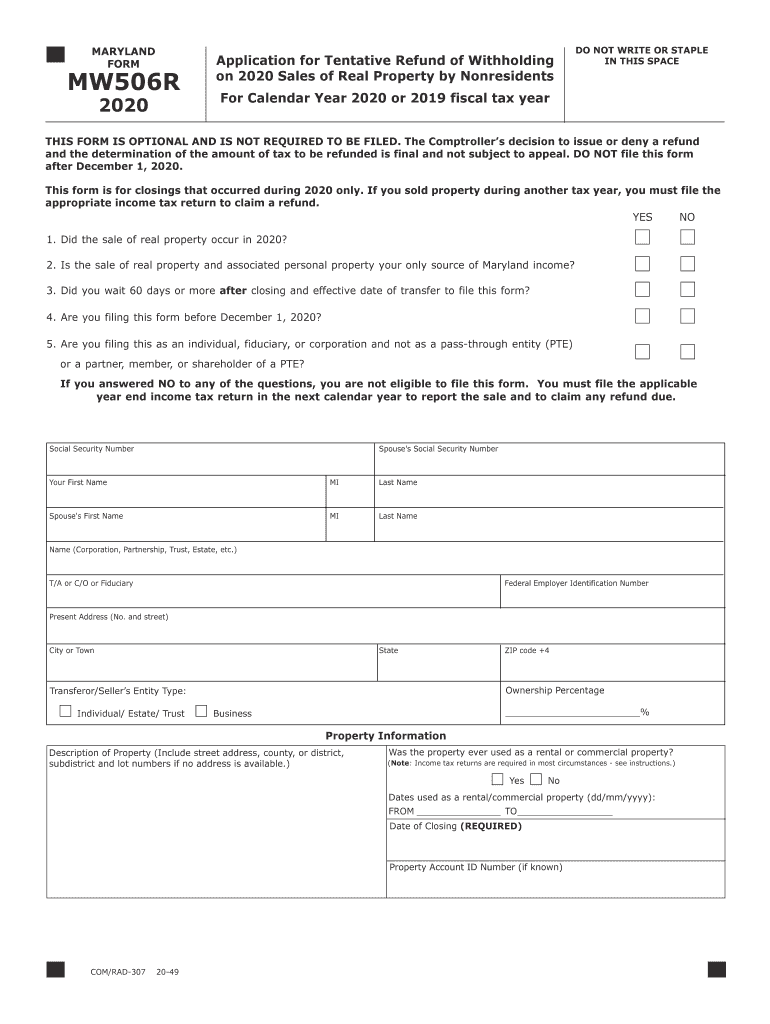

Resident Individuals Income Tax Forms Number Title Description PV Personal Tax Payment Voucher for Form 502 505 Estimated Tax and Extensions Payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a Form 502 or Form 505 estimated tax payments or extension payments MW506R Application for Tentative Refund of Withholding on 2024 Sales of Real Property by Nonresidents Form used to apply for a refund of the amount of tax withheld on the 2024 sale or transfer of Maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor seller s tax liability for

Maryland Physical Address Line 2 Apt No Suite No Floor No No PO Box MD City State ZIP Code 4 Maryland County REQUIRED 99981231160000 08 00 Maryland Physical address of taxing area as of December 31 2023 or last day of the taxable year for fiscal year taxpayers See Instruction 6 Income Tax Forms Instructions Booklet 2023 Resident Tax Forms and Instructions MARYLAND 2023 State Local Tax Forms Instructions For filing personal state and local income taxes for full or part year Maryland residents Maryland Ice Cream Trail You can follow the Maryland Ice Cream Trail around the state and indulge in delicious desserts while also supporting Maryland s dairy farms

More picture related to Printable Maryland State Tax Forms

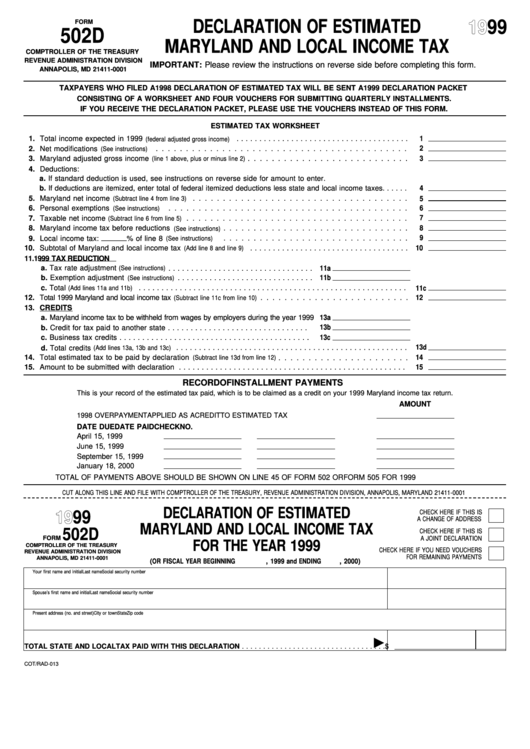

Fillable Form 502 D Declaration Of Estimated Maryland And Local Income Tax 1999 Printable

https://data.formsbank.com/pdf_docs_html/274/2740/274023/page_1_thumb_big.png

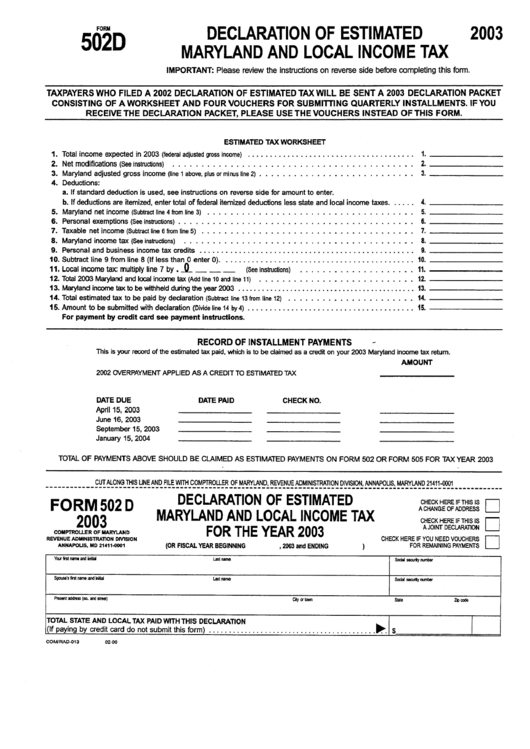

Form 502d Declaration Of Estimated Maryland And Lockal Income Tax 2003 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/263/2635/263581/page_1_thumb_big.png

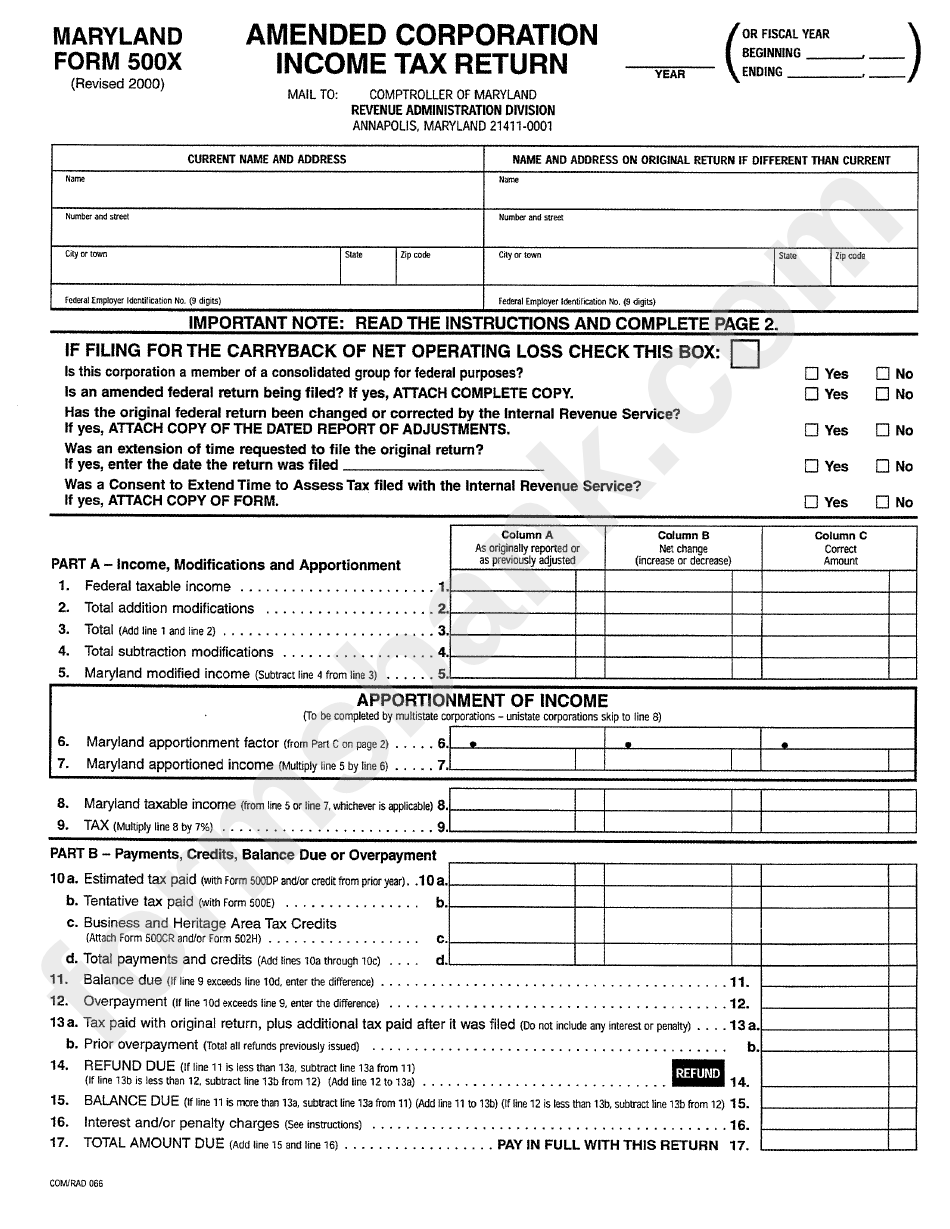

Maryland Form 500x Amended Corporation Income Tax Return 2000 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/266/2666/266621/page_1_bg.png

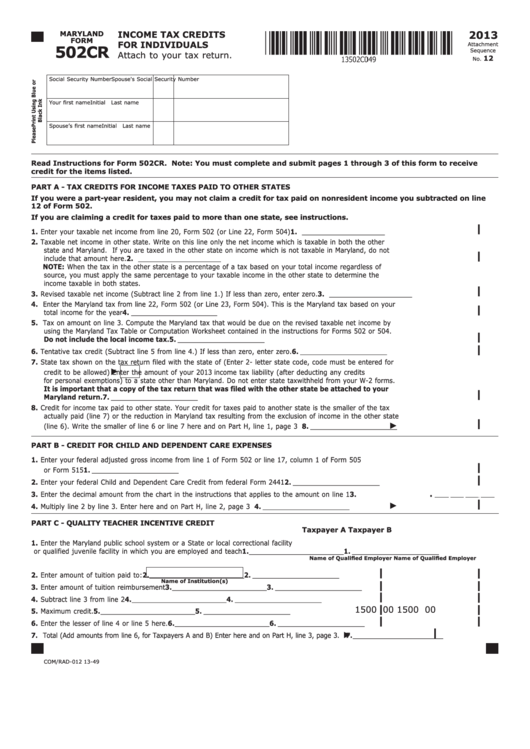

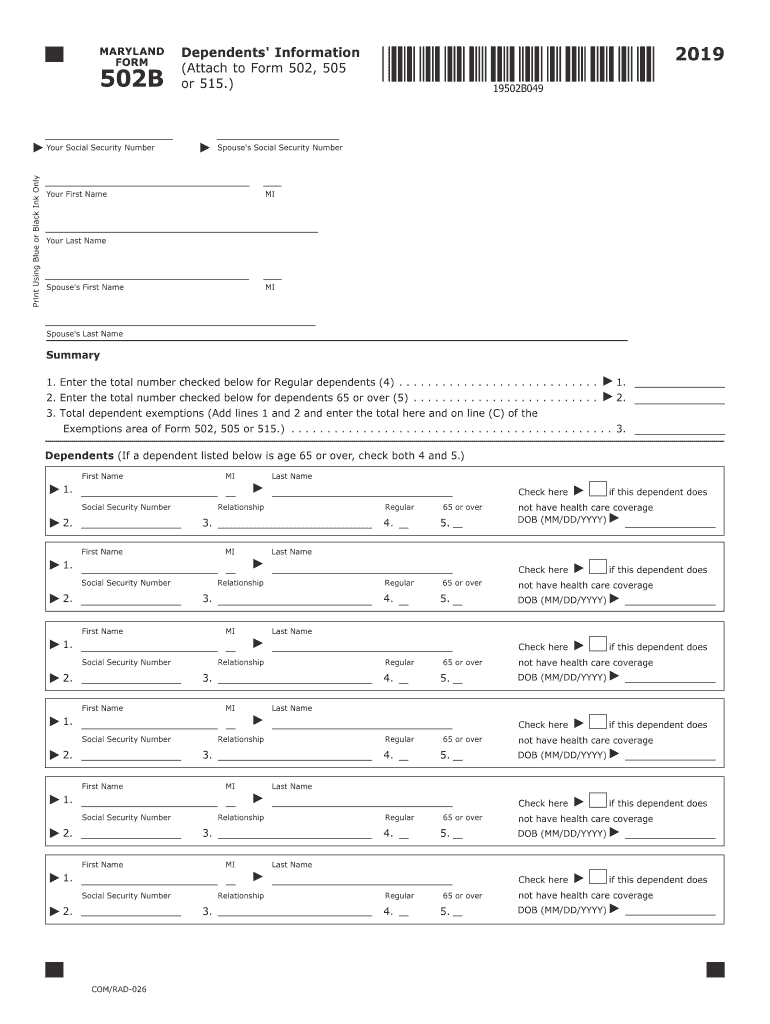

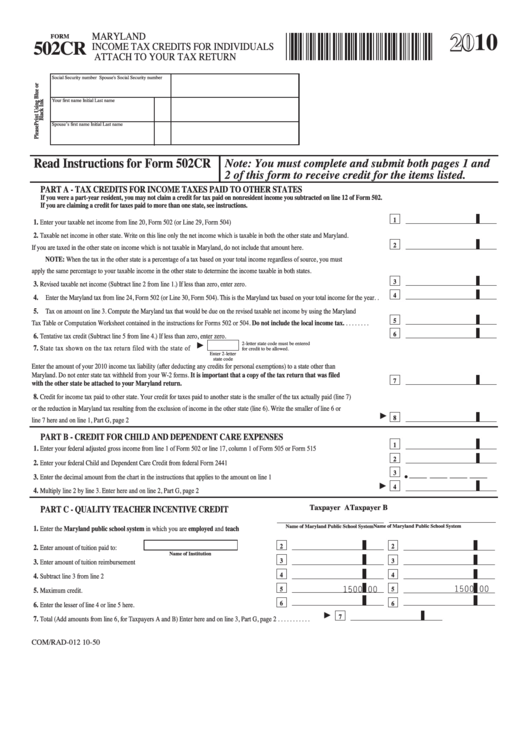

Maryland State and Local Nonresident Tax Forms and Instructions for filing nonresident personal state and local income taxes Forms 502 and 502B for full or part year residents claiming dependents Form 502CR Form and instructions for individuals claiming personal income tax credits including taxes paid to other states Welcome to the Comptroller of Maryland s Internet tax filing system This system allows online electronic filing of resident personal income tax returns along with the most commonly associated schedules and forms The online iFile application is supporting tax years 2021 2022 2023 and estimated payments for tax year 2024

2021 Individual Income Tax Instruction Booklets Instructions for filing personal state and local income taxes for full or part year Maryland residents Instructions for filing personal income tax returns for nonresident individuals Instructions for filing fiduciary income tax returns Instructions for nonresidents who are required to file Maryland has a state income tax that ranges between 2 and 5 75 For your convenience Tax Brackets provides printable copies of 42 current personal income tax forms from the Maryland Comptroller of Maryland The current tax year is 2023 with tax returns due in April 2024 Most states will release updated tax forms between January and April

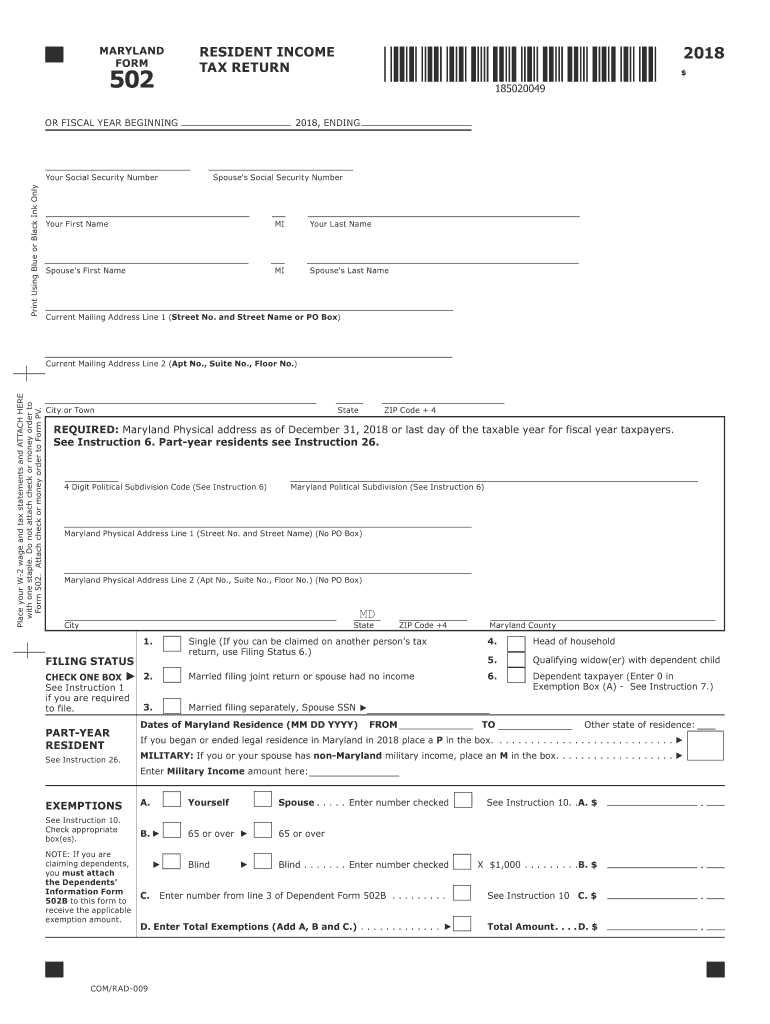

Md 502 Instructions 2018 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/463/563/463563238/large.png

2012 Form MD 502D Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/5/893/5893168/large.png

https://www.marylandtaxes.gov/individual/income/forms/2023_Income_Tax_Forms.php

This form maybe used by taxpayers to report income modifications and credits applicable to tax year 2023 that are enacted after December 31 2023 502R Maryland Retirement Income Form Form for reporting retirement income as per enacted House Bill 1148 by the Maryland General Assembly during the 2016 Session

https://www.marylandtaxes.gov/forms/23_forms/Resident-Booklet.pdf

Account Form 588 allows income tax refunds to be deposited to more than one account See Instruction 22 for more information Check with your financial institution to make sure your direct deposit will be accepted and to get the correct routing and account numbers The State of Maryland is not responsible for a lost refund if you enter

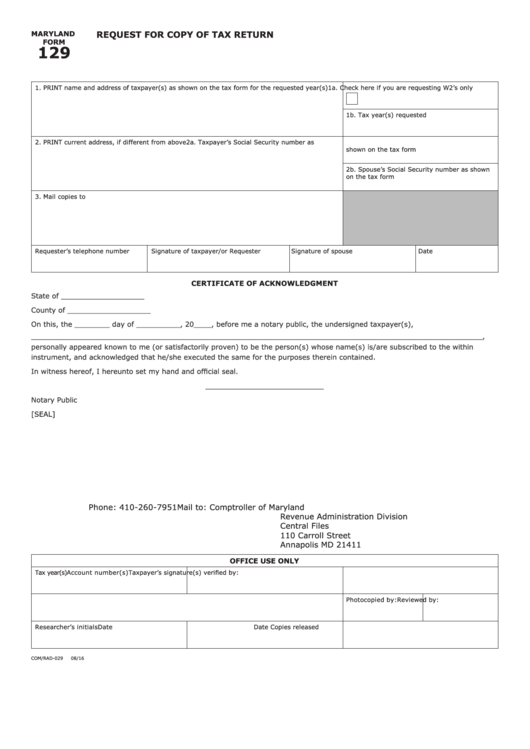

MD Form 129 2020 Fill Out Tax Template Online US Legal Forms

Md 502 Instructions 2018 Fill Out And Sign Printable PDF Template SignNow

Fillable Maryland Form 502cr Income Tax Credits For Individuals 2013 Printable Pdf Download

2021 Form MD Comptroller 500D Fill Online Printable Fillable Blank PdfFiller

MD Comptroller 502B 2019 Fill Out Tax Template Online US Legal Forms

Form MW506NRS 2018 Fill Out Sign Online And Download Fillable PDF Maryland Templateroller

Form MW506NRS 2018 Fill Out Sign Online And Download Fillable PDF Maryland Templateroller

2023 Maryland State Tax Form Printable Forms Free Online

Form 129 Maryland Tax Forms And Instructions Printable Pdf Download

Fillable Form 502cr Maryland Income Tax Credits For Individuals 2010 Printable Pdf Download

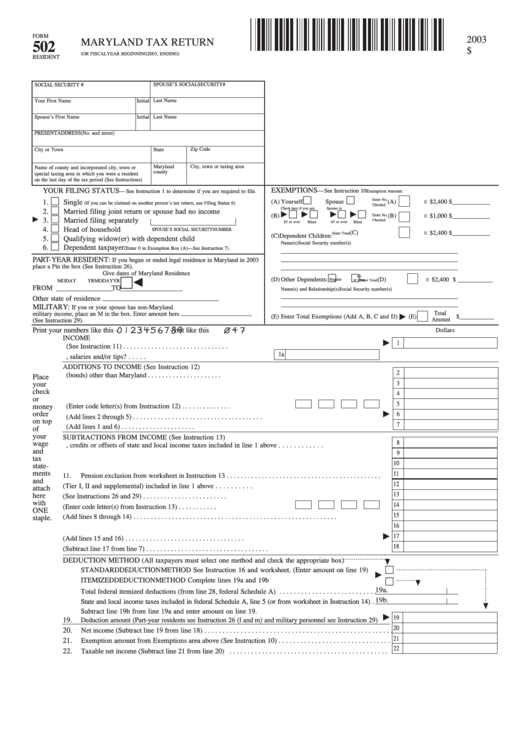

Printable Maryland State Tax Forms - Form 502 and form 502B filed together are the individual income tax return forms for Maryland residents claiming any dependants 11 0001 Form 502 Individual Income Tax Return Form 502 is the individual income tax return form for residents that are not claiming any dependants If you are claiming any dependants use form 502B