Printable Mi Tax Withholding Form 446 Rev 01 24 2024 Michigan Income Tax Withholding Guide Withholding Rate 4 25 Personal Exemption Amount 5 600 INCOME TAX WITHHOLDING Every Michigan employer required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax

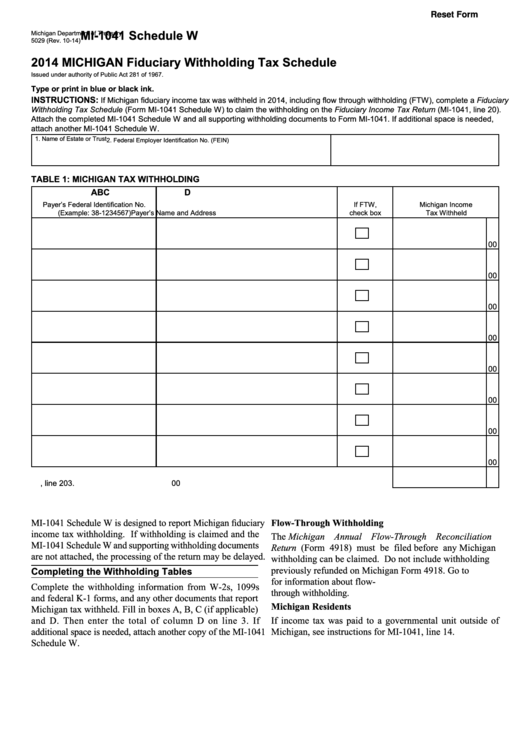

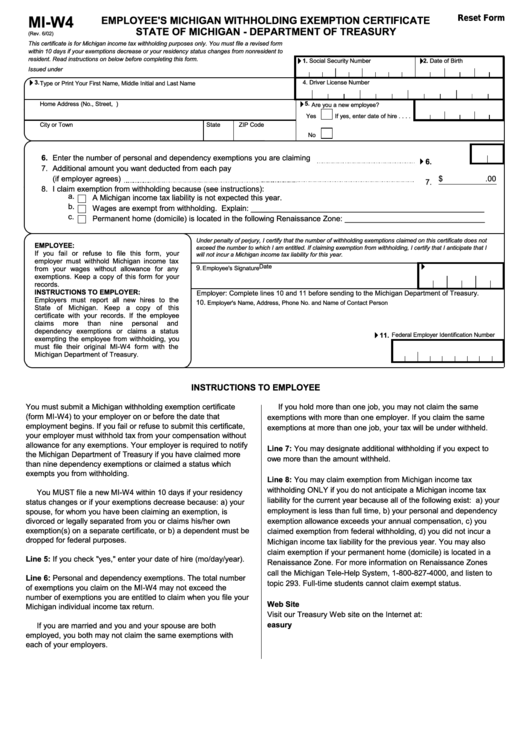

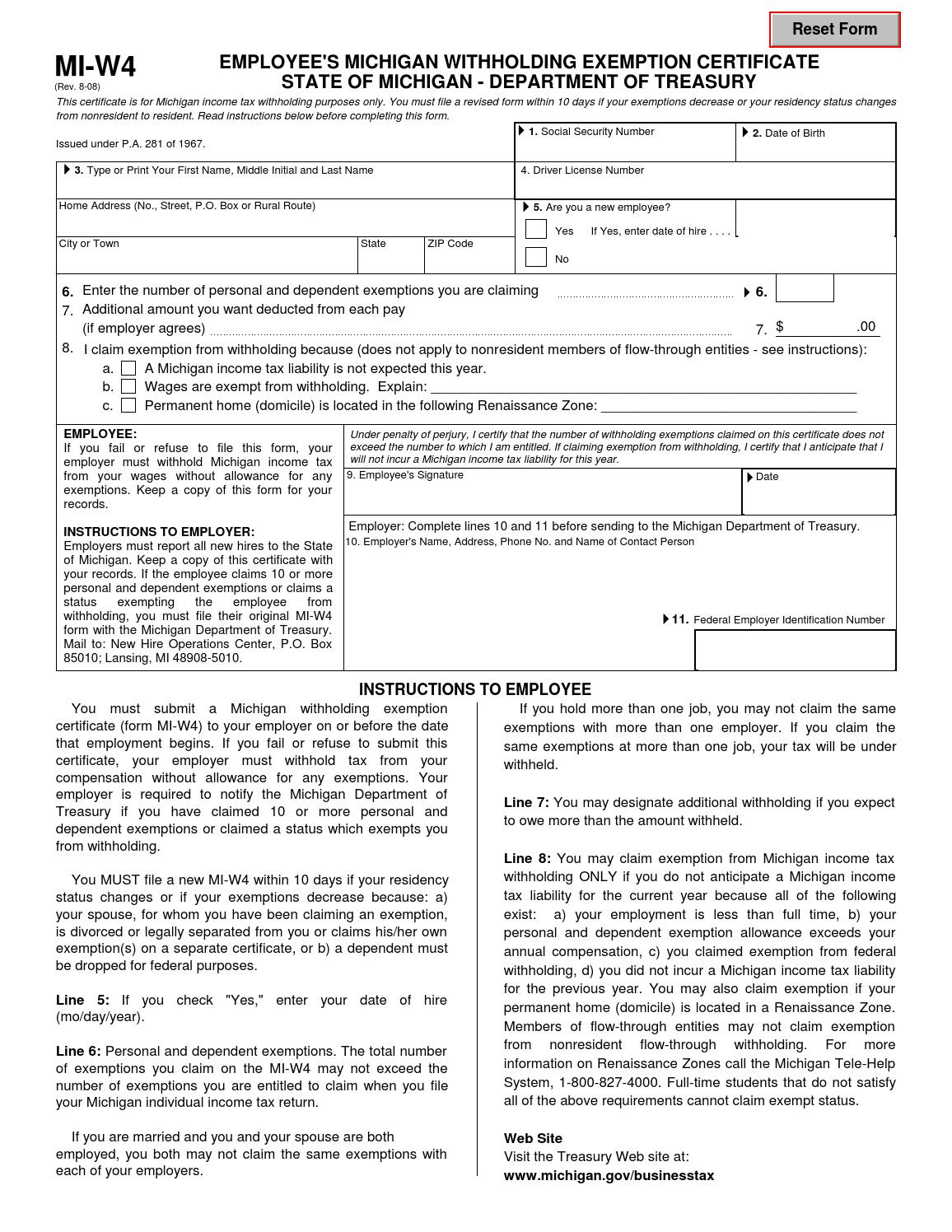

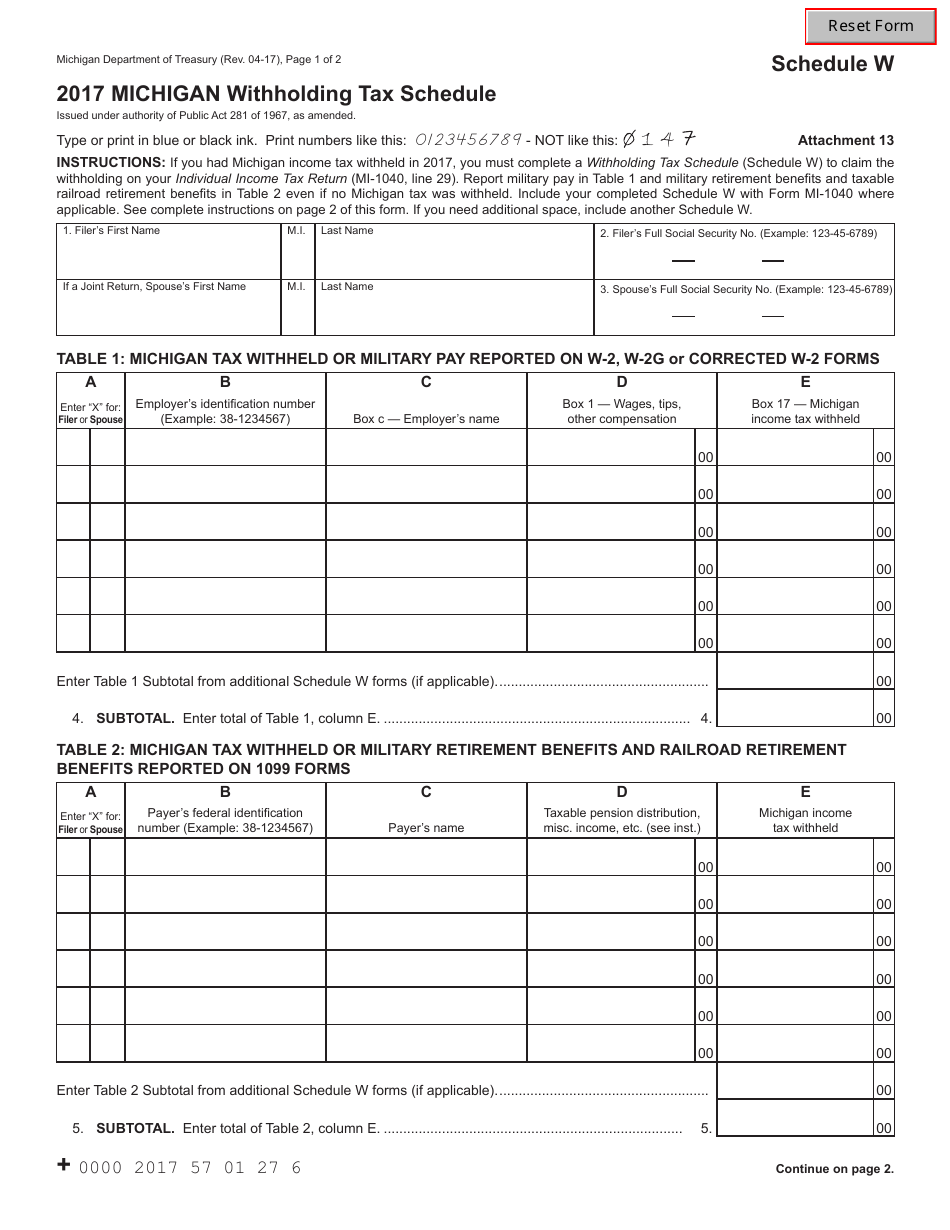

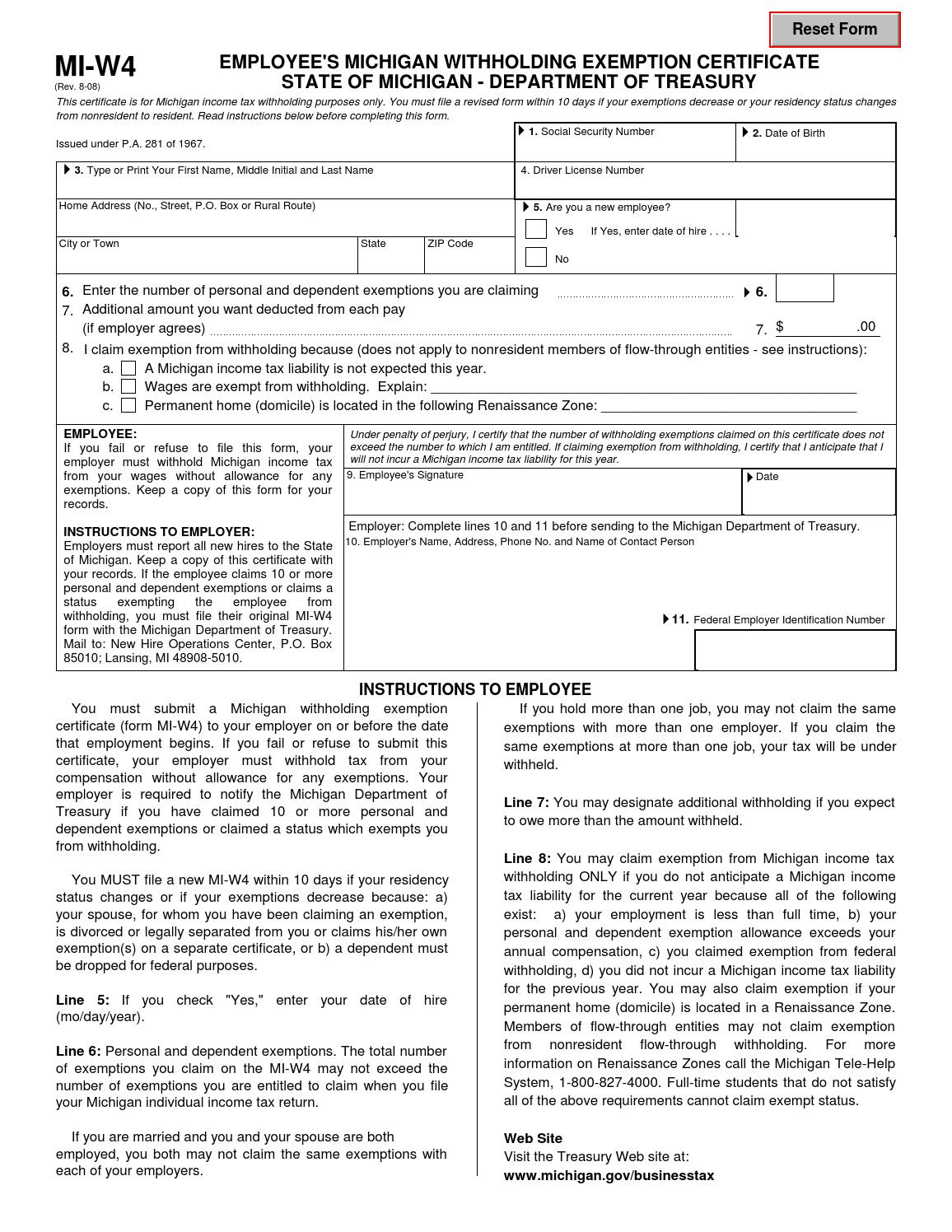

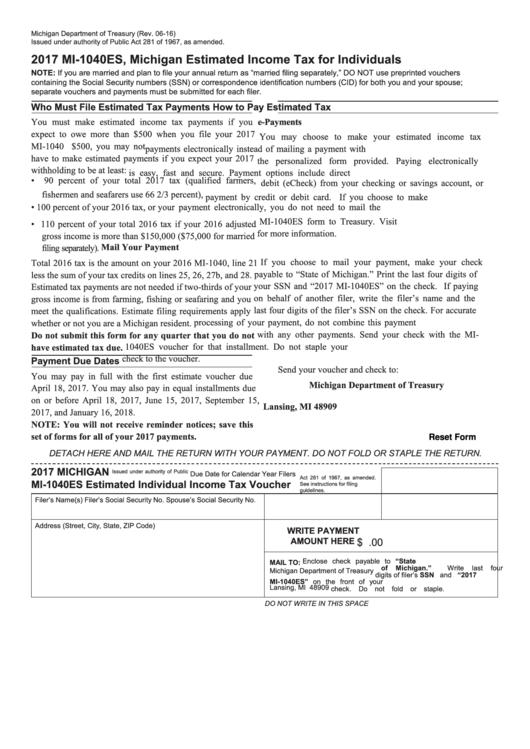

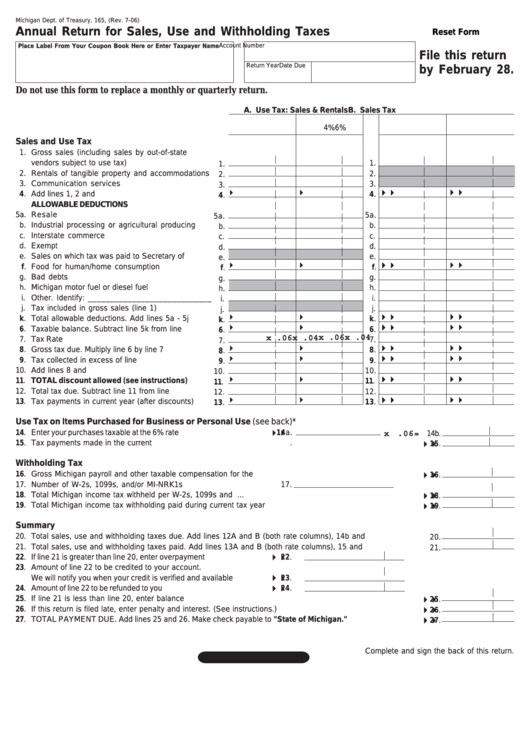

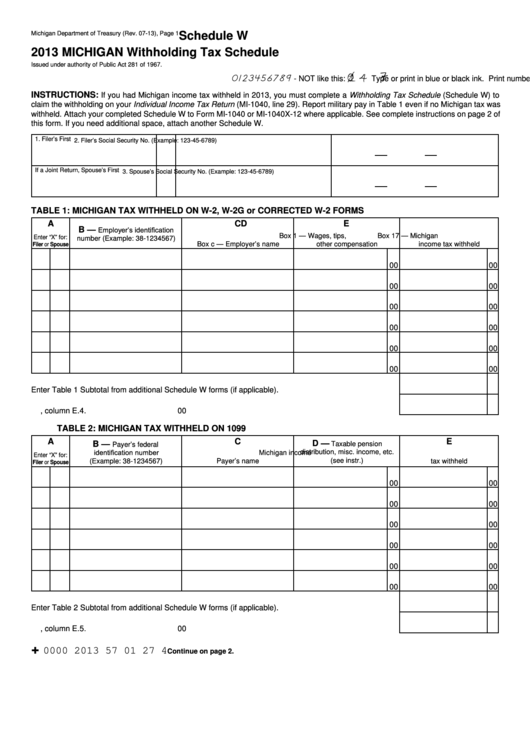

You must submit a Michigan withholding exemption certificate form MI W4 to your employer on or before the date that employment begins If you fail or refuse to submit this certificate your employer must withhold tax from your compensation without allowance for any exemptions If you had Michigan income tax withheld in 2017 you must complete a Withholding Tax Schedule Schedule W to claim the withholding on your Individual Income Tax Return MI 1040 line 29 We last updated the Withholding Tax Schedule in January 2024 so this is the latest version of Schedule W fully updated for tax year 2023

Printable Mi Tax Withholding Form

Printable Mi Tax Withholding Form

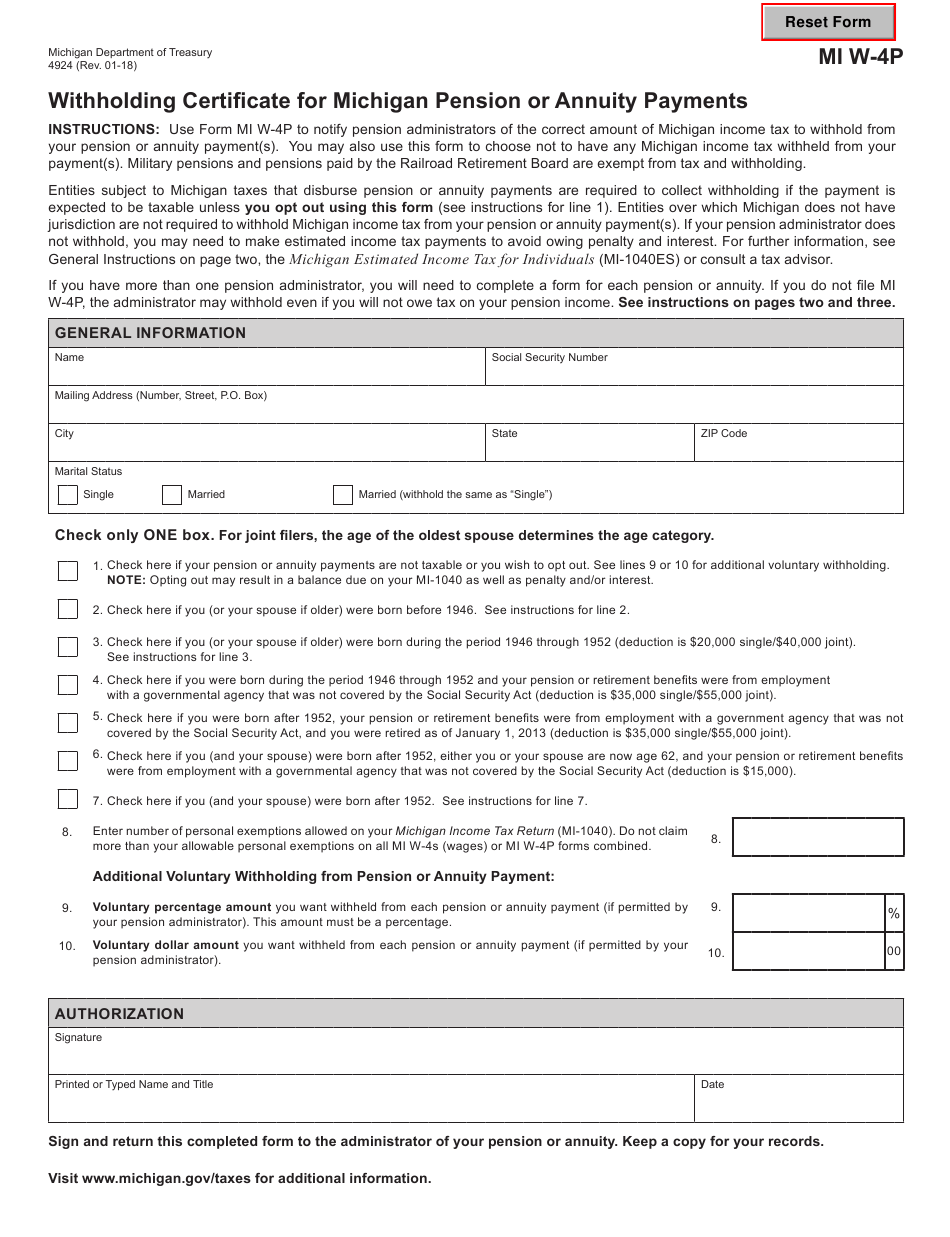

https://www.withholdingform.com/wp-content/uploads/2022/10/form-miw-4p-download-fillable-pdf-or-fill-online-withholding-4.png

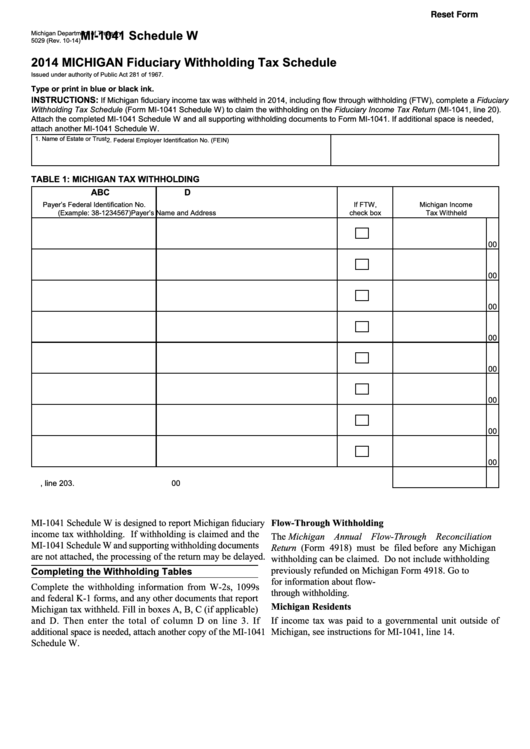

Fillable Form Mi 1041 2014 Michigan Fiduciary Withholding Tax Schedule Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/229/2291/229155/page_1_thumb_big.png

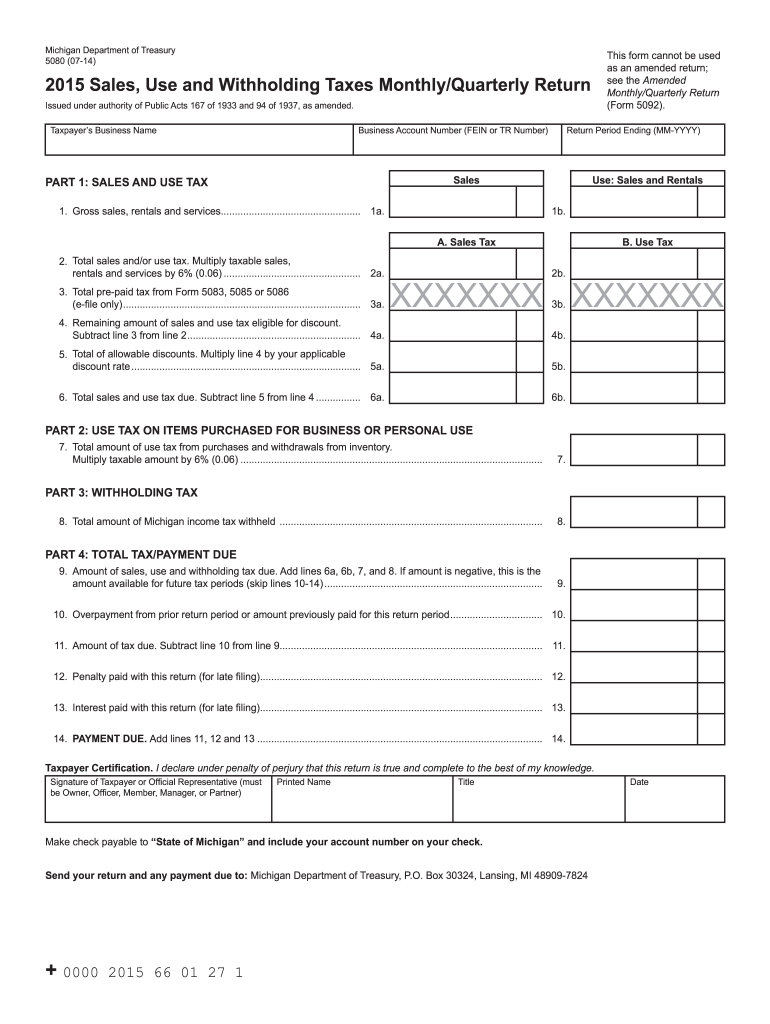

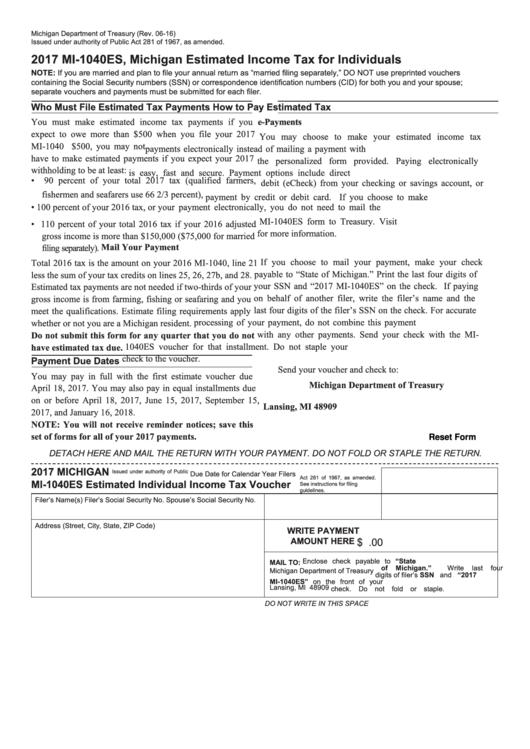

Michigan Sales Use And Withholding Tax Form 5081 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/5080-form-2021-fill-online-printable-fillable-blank-pdffiller-1.png

If your total income will be 200 000 or less 400 000 or less if married filing jointly Multiply the number of qualifying children under age 17 by 2 000 Multiply the number of other dependents by 500 Add the amounts above for qualifying children and other dependents You may add to this the amount of any other credits You must submit a Michigan withholding exemption certificate form MI W4 to your employer on or before the date that employment begins If you fail or refuse to submit this certificate your employer must withhold tax from your compensation without allowance for any exemptions

Download or print the 2023 Michigan Withholding Tax Schedule 2023 and other income tax forms from the Michigan Department of Treasury Toggle navigation Here s a list of some of the most commonly used Michigan tax forms Form Code Form Name Form MI 1040CR 7 Home Heating Credit Claim Tax Credit Form MI 1040CR Form MI W4 is a state level equivalent of IRS Form W 4 the withholding form for federal income tax Explore our W 4 guide if you need help filling out your IRS withholding documents Do I Need to Fill Out MI W4 You must submit a completed Form MI W4 to your employer on or before your first day on the job

More picture related to Printable Mi Tax Withholding Form

State Of Michigan Tax Form Mi 1041 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/0/120/120054/large.png

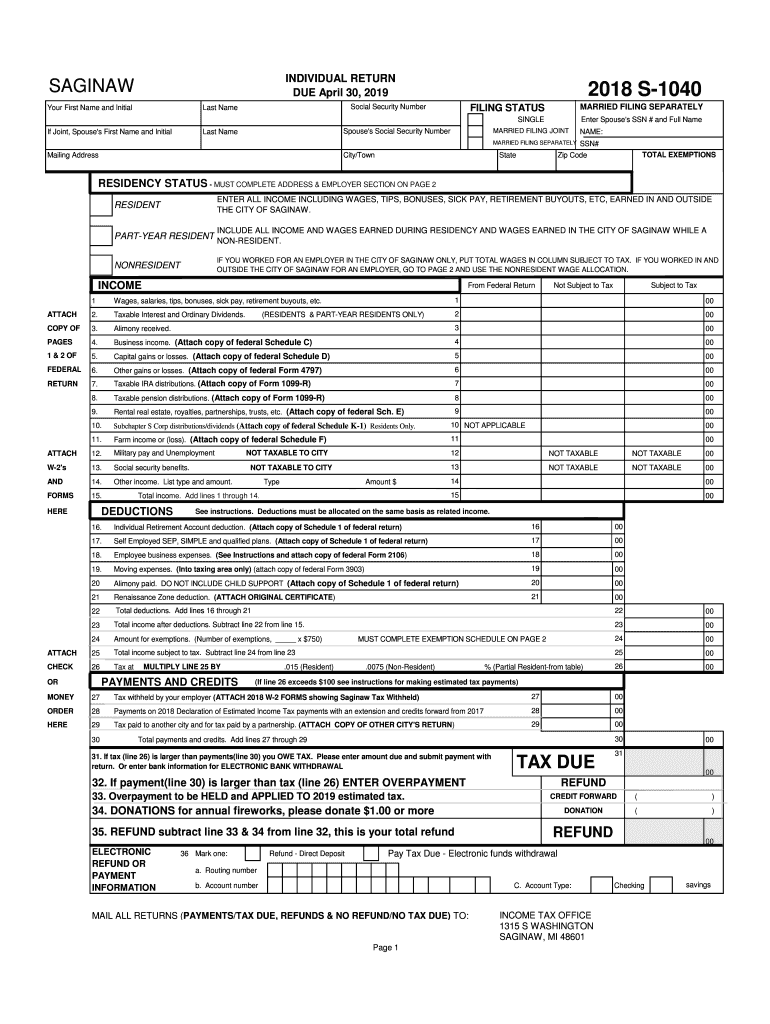

2014 2024 Form MI D 1040 R Detroit Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/6/962/6962734/large.png

Fillable Form Mi W4 Employee S Michigan Withholding Exemption Certificate Department Of

https://data.formsbank.com/pdf_docs_html/347/3478/347815/page_1_thumb_big.png

You can print other Michigan tax forms here eFile your Michigan tax return now eFiling is easier faster and safer than filling out paper tax forms File your Michigan and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax South Carolina Form WH 1601 Withholding Tax Coupon South Carolina Form WH 1605 SC Withholding Quarterly Tax Return MI Form 5092 Sales Use and Withholding Taxes Amended Monthly Quarterly Return New York Form NYS 45 X Amended Quarterly Combined W H Wage Reporting and UI Return Forms print on both sides of the paper Importing Data

2024 Form W 4 Complete Steps 2 4 ONLY if they apply to you otherwise skip to Step 5 See page 2 for more information on each step who can claim exemption from withholding and when to use the estimator at www irs gov W4App Step 2 Multiple Jobs or Spouse Works The IRS recently released an updated version of Form W 4 for 2024 which can be used to adjust withholdings on income earned in 2024 The main difference between the 2023 and 2024 W 4 is Step 2

State Of Michigan Withholding 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/state-of-michigan-w-4-income-tax-witholding-form-by-2.jpg

Mi 1040 2020 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/467/236/467236034/large.png

https://www.michigan.gov/taxes/-/media/Project/Websites/taxes/Forms/2024/2024-SUW/446_Withholding-Guide_2024.pdf?rev=02ab6746680541668159c12601924665&hash=4C55F706CEDA63C1768E2F6FA9C10299

446 Rev 01 24 2024 Michigan Income Tax Withholding Guide Withholding Rate 4 25 Personal Exemption Amount 5 600 INCOME TAX WITHHOLDING Every Michigan employer required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax

https://www.michigan.gov/-/media/Project/Websites/taxes/Forms/MIW4.pdf?rev=6c0f949e0b924ecb83405f7f7535e215

You must submit a Michigan withholding exemption certificate form MI W4 to your employer on or before the date that employment begins If you fail or refuse to submit this certificate your employer must withhold tax from your compensation without allowance for any exemptions

2017 Michigan Michigan Withholding Tax Schedule Fill Out Sign Online And Download PDF

State Of Michigan Withholding 2022 W4 Form

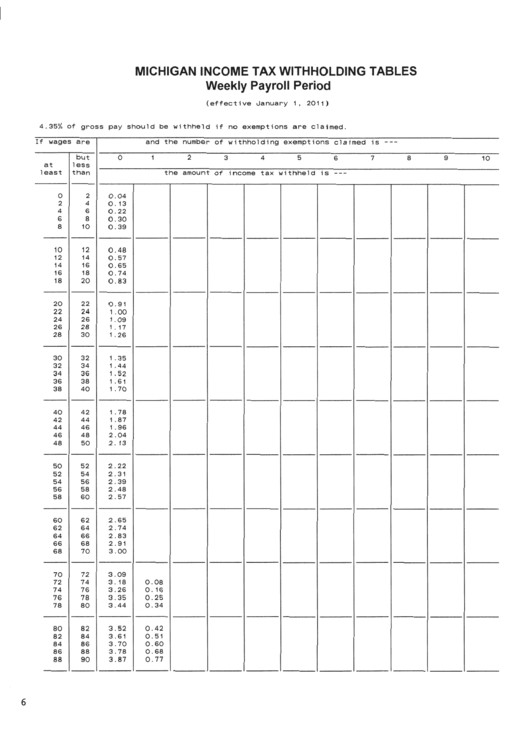

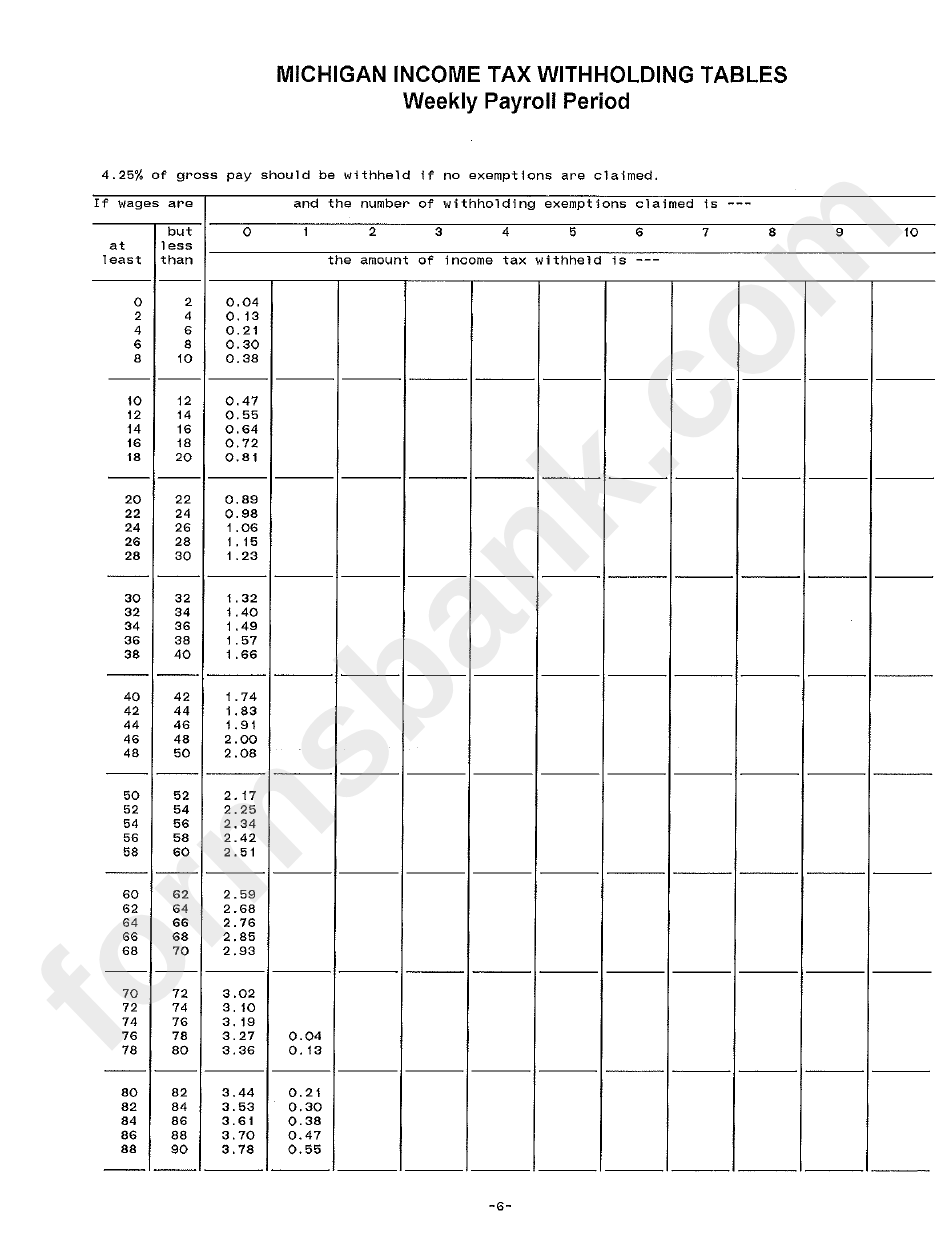

Michigan Income Tax Withholding Tables Printable Pdf Download

Michigan Income Tax Withholding Tables Printable Pdf Download

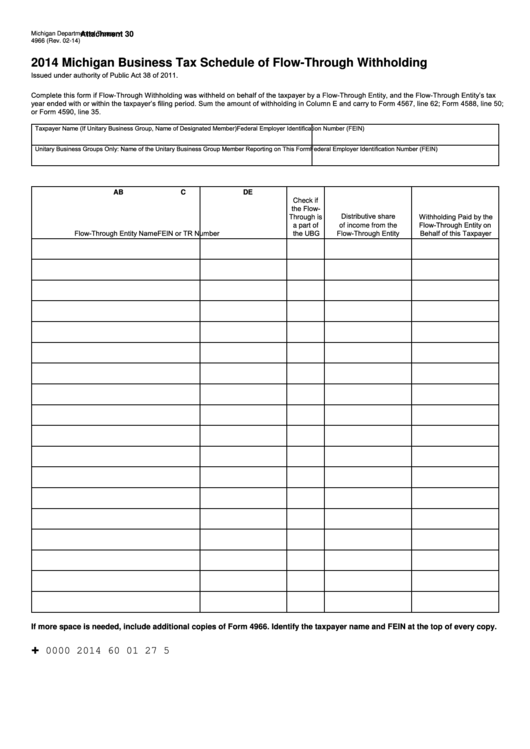

Form 4966 Michigan Business Tax Schedule Of Flow Through Withholding 2014 Printable Pdf Download

Printable Michigan Tax Forms

Printable Michigan Tax Forms

Michigan Sales Use And Withholding Tax Form 5081 WithholdingForm

Fillable Form 165 Annual Return For Sales Use And Withholding Taxes Michigan Department Of

Fillable Schedule W Michigan Withholding Tax Schedule 2013 Printable Pdf Download

Printable Mi Tax Withholding Form - You must submit a Michigan withholding exemption certificate form MI W4 to your employer on or before the date that employment begins If you fail or refuse to submit this certificate your employer must withhold tax from your compensation without allowance for any exemptions