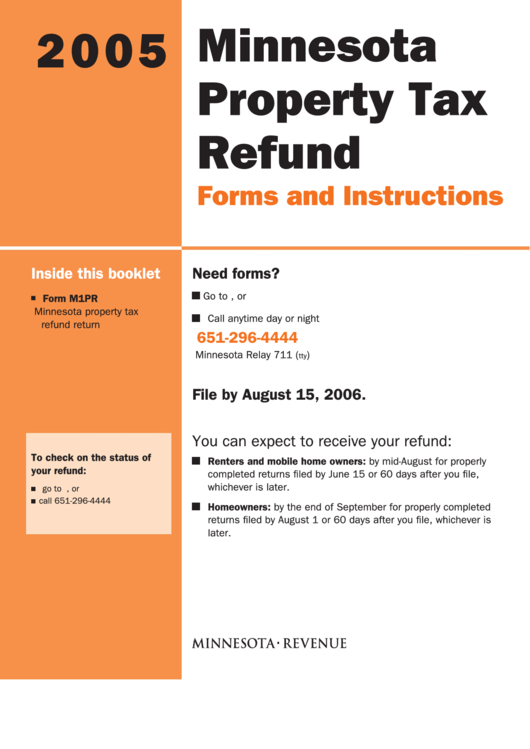

Printable Mn Property Tax Form M1pr Renter s Property Tax Refund Forms and Instructions Property Tax Refund Schedule M1PR AI Additions to Income www revenue state mn us 651 296 3781 1 800 652 9094 2 Do I qualify You may be eligible for a refund based on your household income see pages 8 and 9 and the property taxes or rent paid on your primary residence in

Download This Form Print This Form More about the Minnesota Form M1PR Instructions Individual Income Tax Tax Credit TY 2023 You may be eligible for a Minnesota tax refund based on your household income and the property taxes or rent paid on your primary residence in Minnesota Yes you can file your M1PR when you prepare your Minnesota taxes in TurboTax We ll make sure you qualify calculate your Minnesota property tax refund and fill out an M1PR form The M1PR can be mailed or e filed if qualified Follow these steps to begin your M1PR Filing instructions

Printable Mn Property Tax Form M1pr

Printable Mn Property Tax Form M1pr

https://data.formsbank.com/pdf_docs_html/245/2458/245863/page_1_thumb_big.png

Minnesota Tax Forms Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/459/663/459663853/large.png

Instructions For Minnesota Property Tax Refund Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/241/2418/241880/page_1_thumb_big.png

See the Minnesota Where s My Refund webpage to check the status of your property tax refund online If you prefer you can call the automated refund tracking line at 651 296 4444 Metro or 1 800 657 3676 Greater Minnesota See the Minnesota Property Tax Refund Instructions for additional information EFile your Minnesota tax return now eFiling is easier faster and safer than filling out paper tax forms File your Minnesota and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for Tax Brackets users File Now with TurboTax

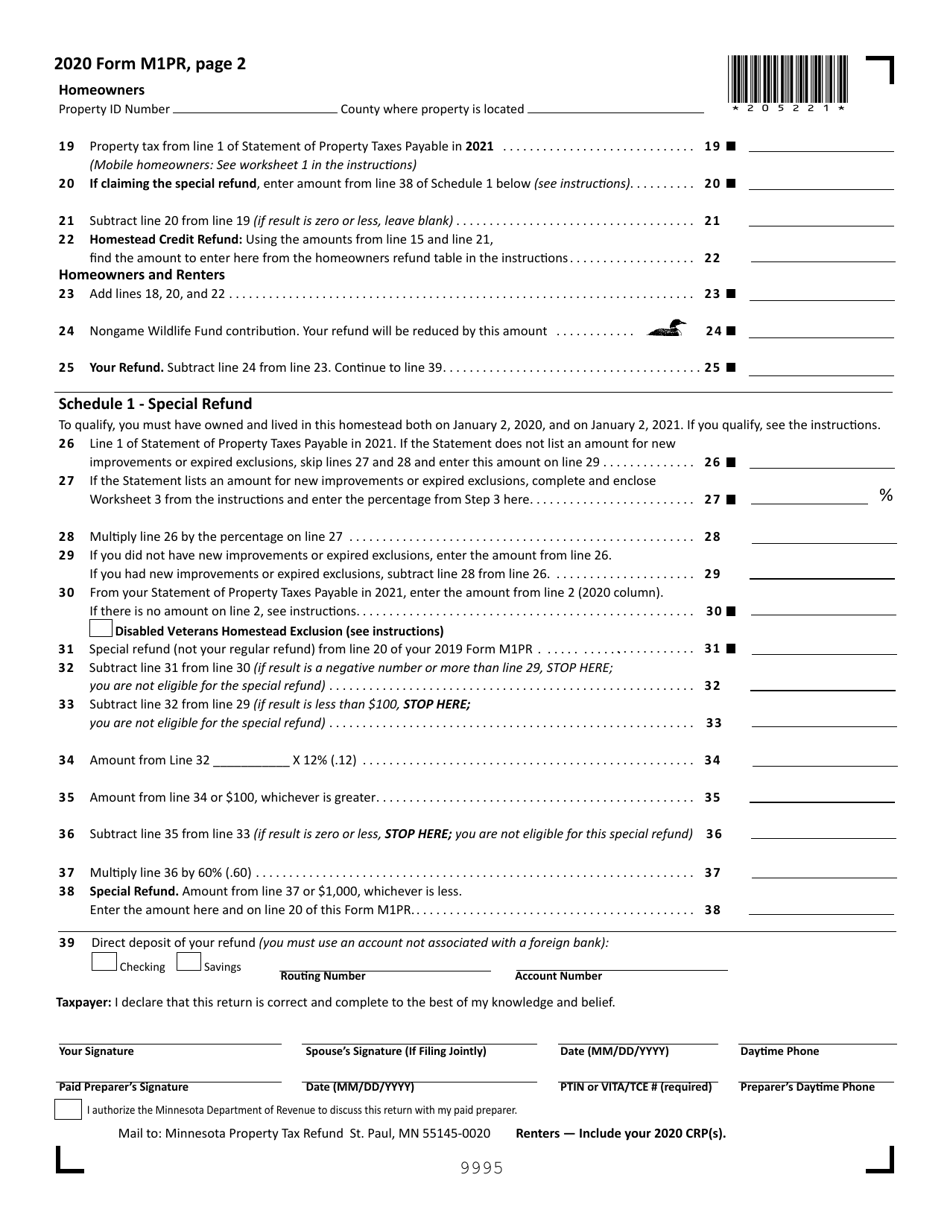

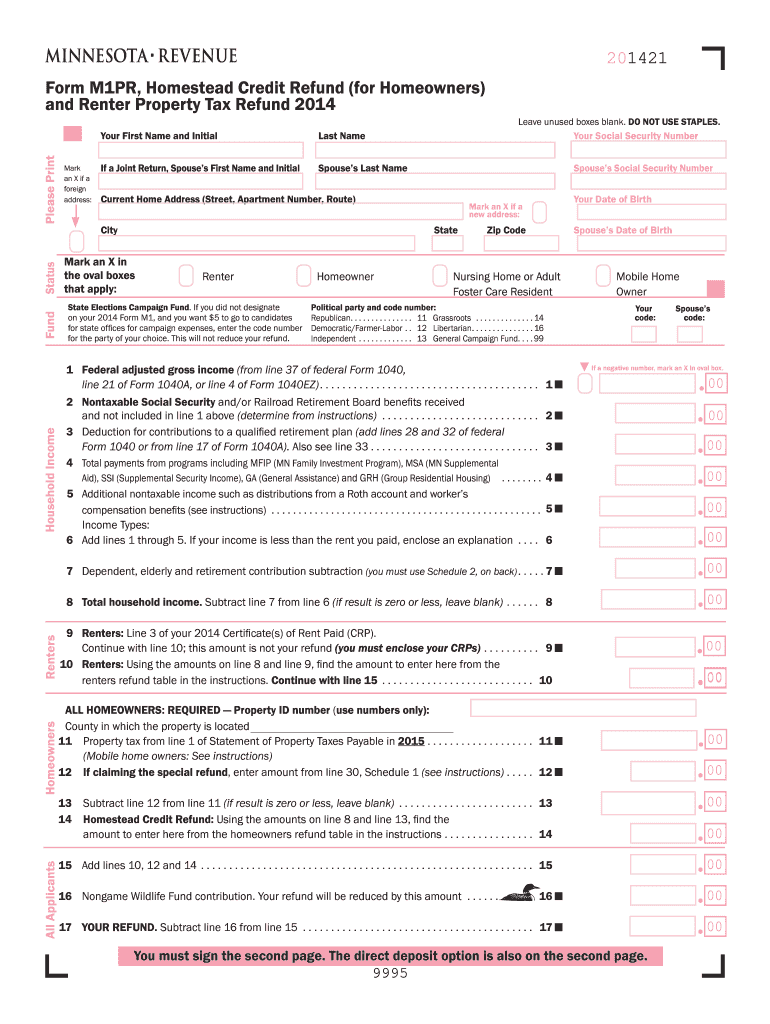

Renter s Property Tax Refund Forms and Instructions Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Schedule M1PR AI Additions to Income www revenue state mn us Questions We re here for you 651 296 3781 1 800 652 9094 Revised 7 16 21 The PDF can be found in the Summary Print section of your account Can I amend the M1PR form Yes you can amend the M1PR form but it cannot be e filed See our knowledgebase article for more information When is the last day I can file my M1PR For the 2023 tax year the M1PR is due by August 15 2024 The final deadline to claim a refund for

More picture related to Printable Mn Property Tax Form M1pr

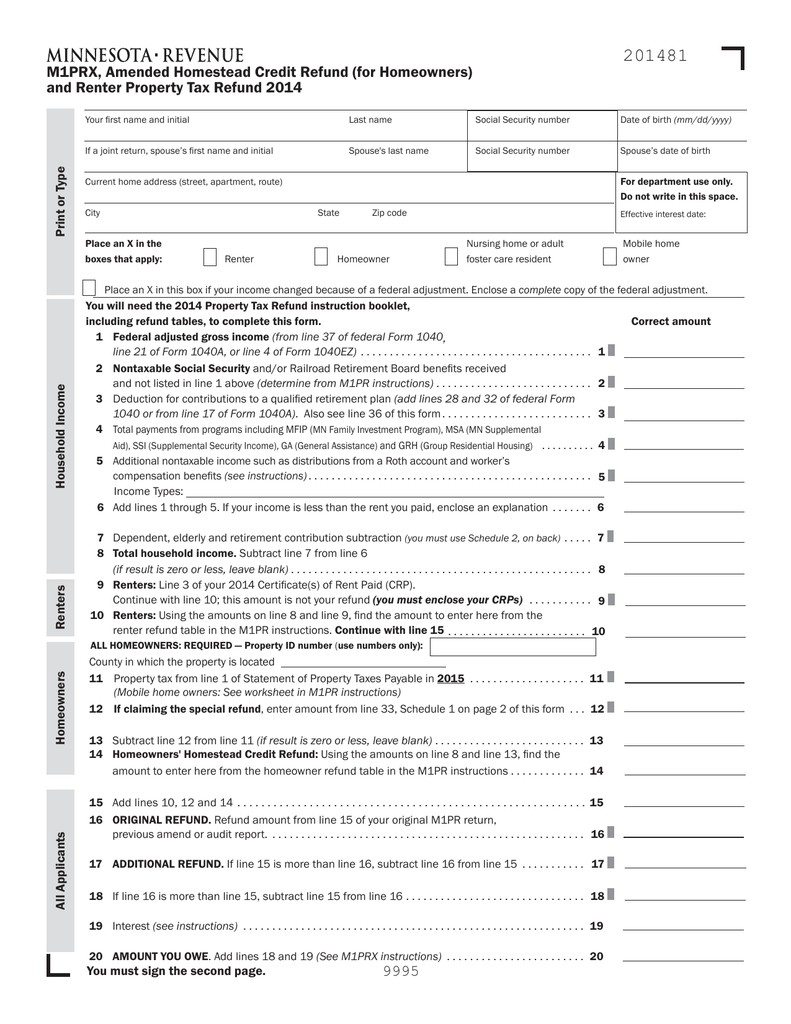

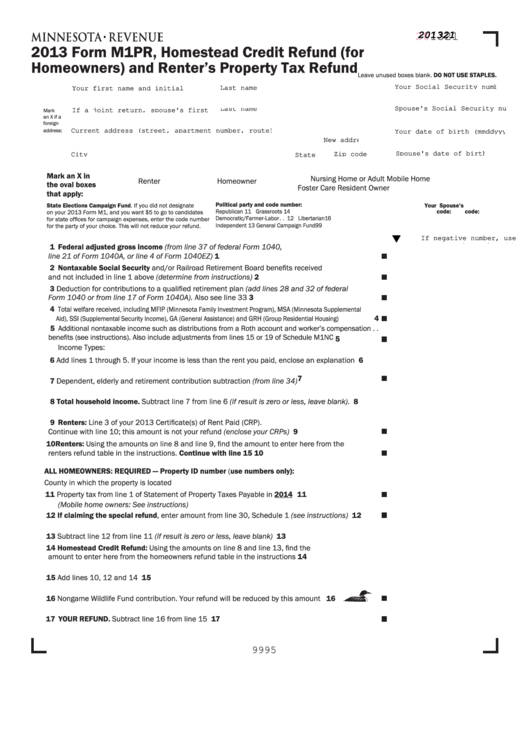

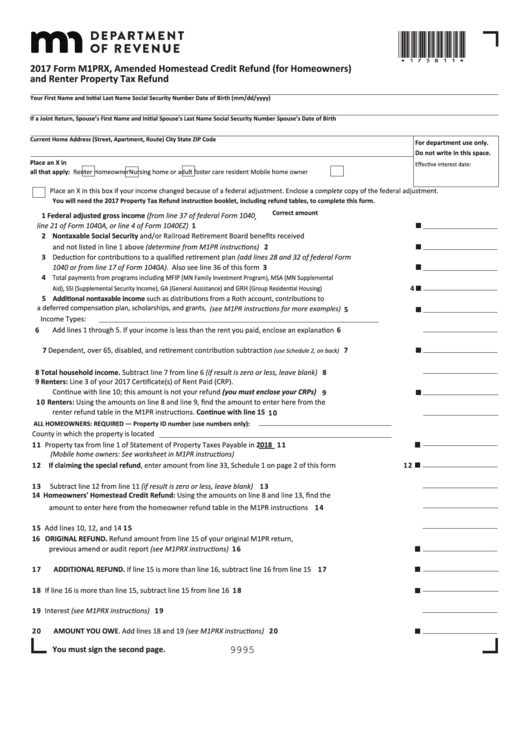

M1PRX Amended Property Tax Refund Return

https://s2.studylib.net/store/data/018572126_1-0e80564a8e118af79d699d3585d4e5ed.png

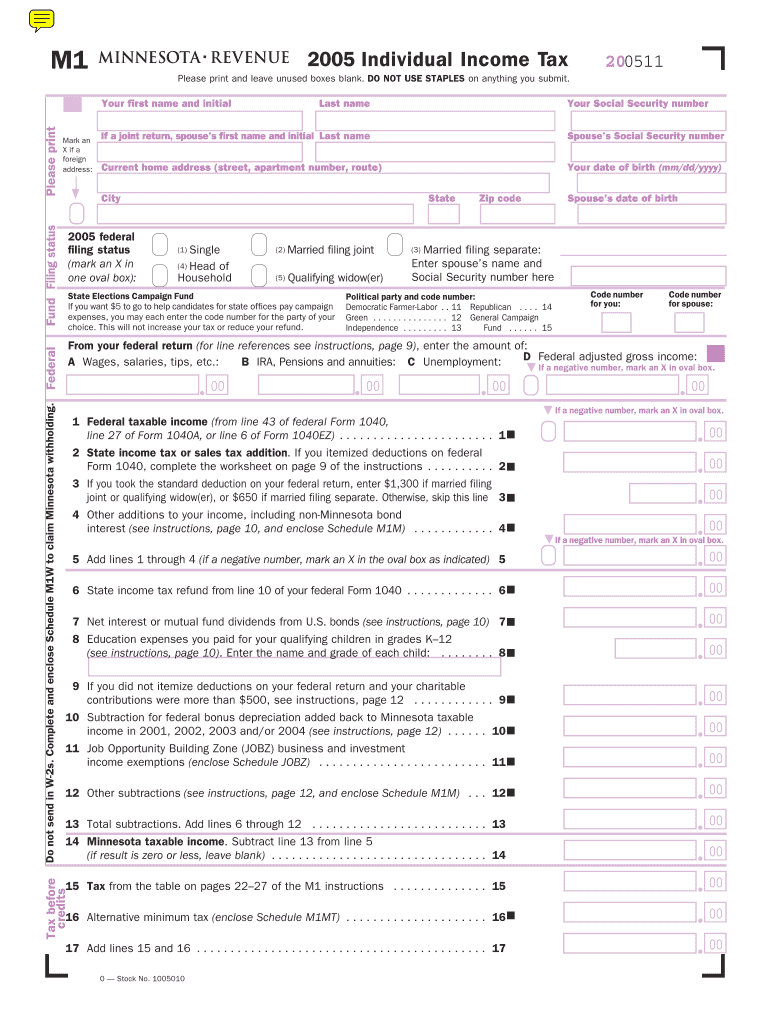

Minnesota State Tax Table M1 Brokeasshome

https://www.pdffiller.com/preview/402/804/402804333/large.png

2021 Mn Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/548/2/548002915/large.png

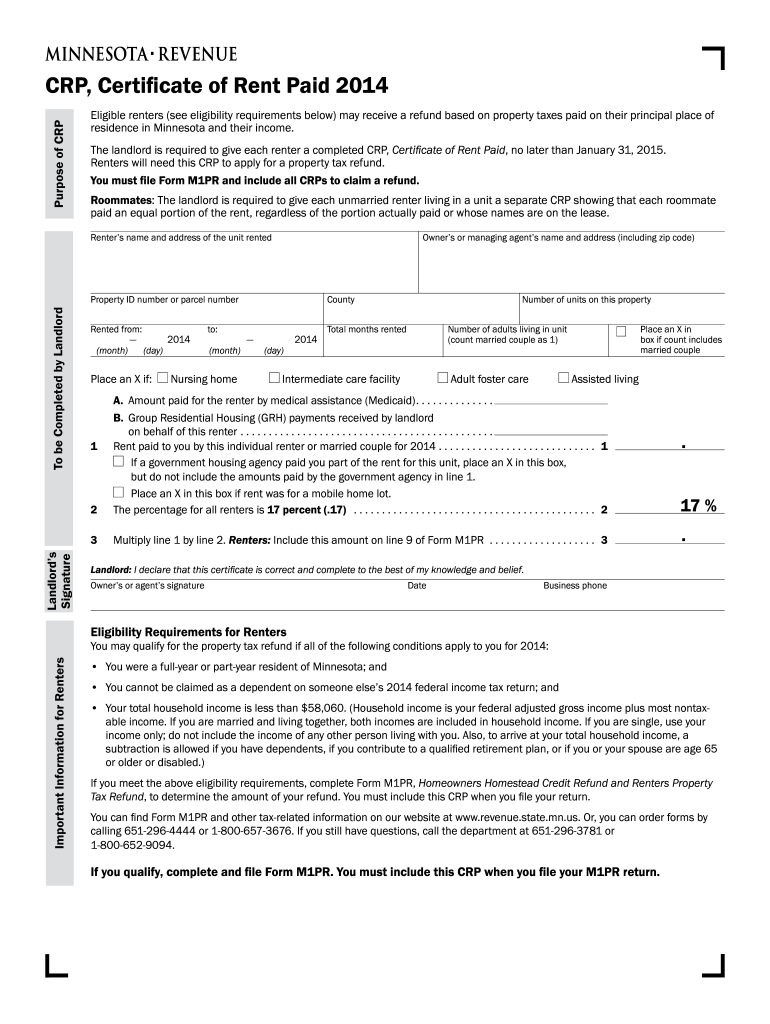

Form Sources Minnesota usually releases forms for the current tax year between January and April We last updated Minnesota Form M1PR from the Department of Revenue in January 2024 Show Sources Form M1PR is a Minnesota Individual Income Tax form Your net property tax increased by more than 12 from 2023 to 2024 AND The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Was accessed the property tax Paid a portion of the rent receipts instead of the property tax

Level 1 Minnesota M1PR Property Tax refund eFile and Property Tax Statement Worksheet Is the M1PR Property tax now eFiled along with the state eFile for 2020 Update Yes TurboTax Deluxe 2020 can now eFile the M1PR but it s tricky you have to go through the eFile process twice Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Schedule M1PR AI Additions to Income www revenue state mn us Questions We re here for you 651 296 3781 1 800 652 9094 Rev 6 23 2 Do I qualify You may be eligible for a refund based on your household income see pages 8 and 9

M1pr Form 2022 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/459/835/459835865/large.png

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund For Homeowners And

https://data.templateroller.com/pdf_docs_html/2219/22192/2219253/page_2_thumb_950.png

https://www.revenue.state.mn.us/sites/default/files/2023-12/m1pr-inst-23.pdf

Renter s Property Tax Refund Forms and Instructions Property Tax Refund Schedule M1PR AI Additions to Income www revenue state mn us 651 296 3781 1 800 652 9094 2 Do I qualify You may be eligible for a refund based on your household income see pages 8 and 9 and the property taxes or rent paid on your primary residence in

https://www.taxformfinder.org/minnesota/form-m1pr-instructions

Download This Form Print This Form More about the Minnesota Form M1PR Instructions Individual Income Tax Tax Credit TY 2023 You may be eligible for a Minnesota tax refund based on your household income and the property taxes or rent paid on your primary residence in Minnesota

Fillable Form M1pr Homestead Credit Refund For Homeowners And Renter S Property Tax Refund

M1pr Form 2022 Fill Out Sign Online DocHub

Minnesota Form M1 Instructions 2020 Fill Out Sign Online DocHub

Renter s Property Tax Refund Minnesota Department Of Revenue Fill Out And Sign Printable PDF

Fillable Form M1prx Amended Homestead Credit Refund For Homeowners And Renter Property Tax

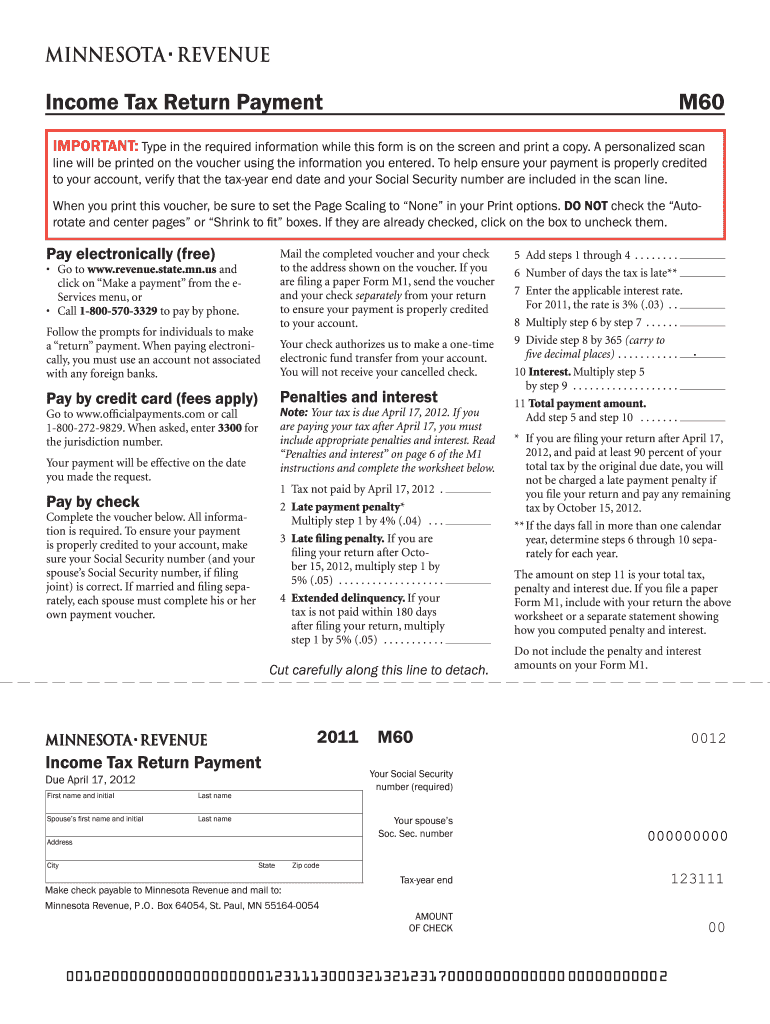

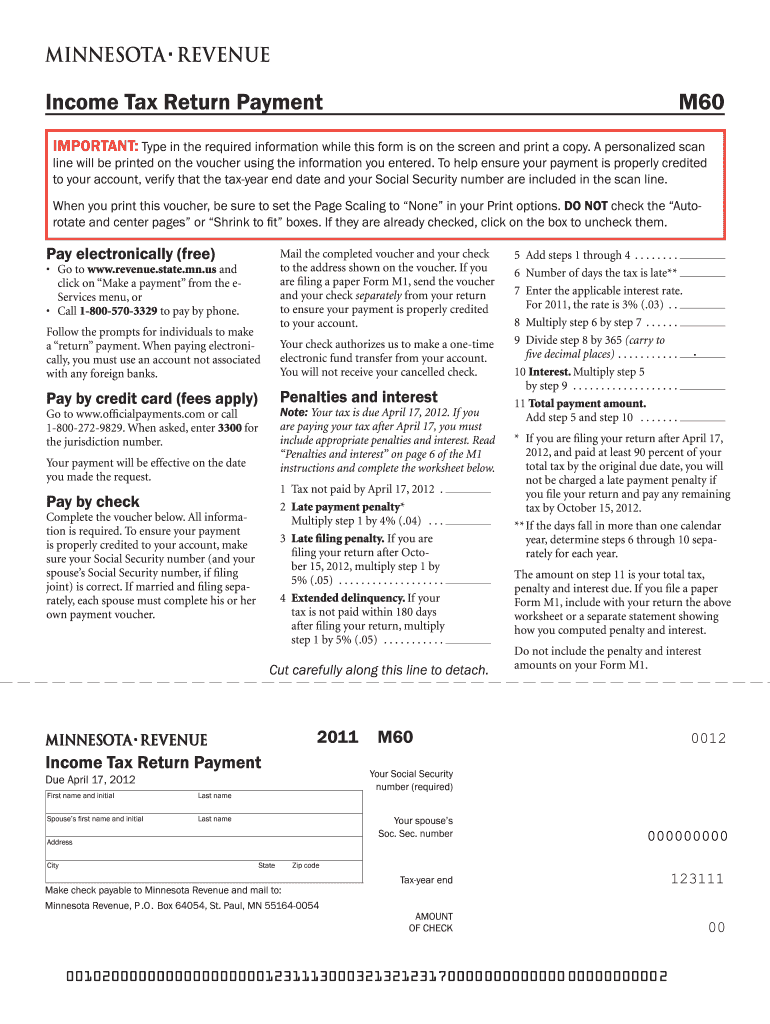

Minnesota Estimated Tax Voucher 2023 Fill Out Sign Online DocHub

Minnesota Estimated Tax Voucher 2023 Fill Out Sign Online DocHub

Fillable Form M1pr Homestead Credit Refund For Homeowners And Renter Property Tax Refund

2014 Form MN DoR M1PR Fill Online Printable Fillable Blank PdfFiller

M1 Mn State Tax Form Fill Out And Sign Printable PDF Template SignNow

Printable Mn Property Tax Form M1pr - See the Minnesota Where s My Refund webpage to check the status of your property tax refund online If you prefer you can call the automated refund tracking line at 651 296 4444 Metro or 1 800 657 3676 Greater Minnesota See the Minnesota Property Tax Refund Instructions for additional information