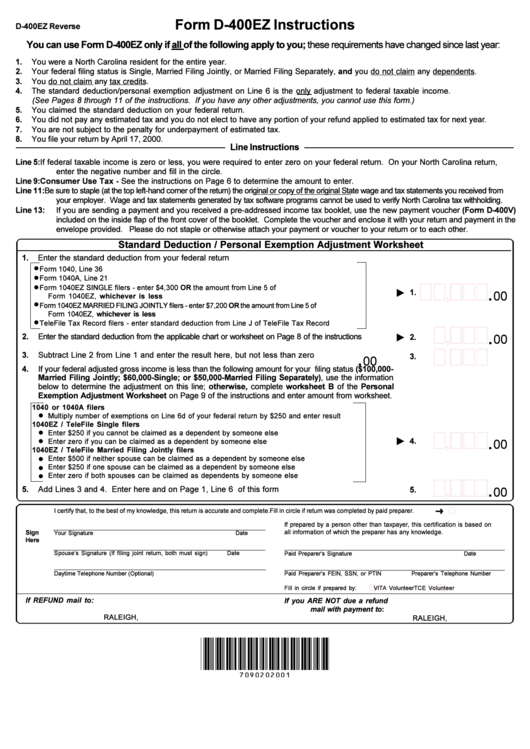

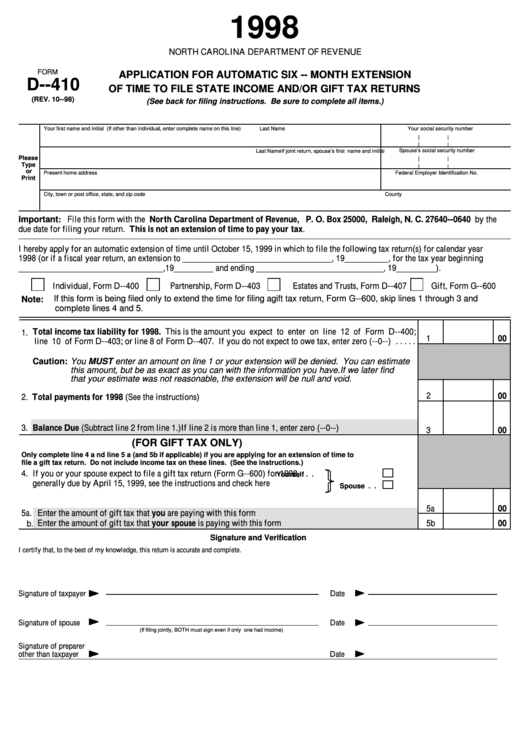

Printable Nc Form D 410 Form D 410 is used to extend the time for filing a North Carolina Individual Income tax return Form D 400 This form is not required if you were granted an automatic extension to file your federal income tax return If you were granted an automatic federal extension and need to make a payment for taxes due use Form D 410

Individual Income Tax Return and Form D 400TC Individual Tax Credits D 400 without TC 2010 Individual Income Tax Return no tax credits D 401 2010 North Carolina Individual Income Tax Instructions D 400X WS 2010 North Carolina Amended Schedule D 400V 2010 Payment Voucher Pay Online D 422 2010 Underpayment of Estimated Tax D 422A 2010 Form D 410 is a North Carolina Individual Income Tax form The IRS and most states will grant an automatic 6 month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form

Printable Nc Form D 410

Printable Nc Form D 410

https://www.signnow.com/preview/100/61/100061995/large.png

2014 Form NC DoR D 400TC Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/6/962/6962831/large.png

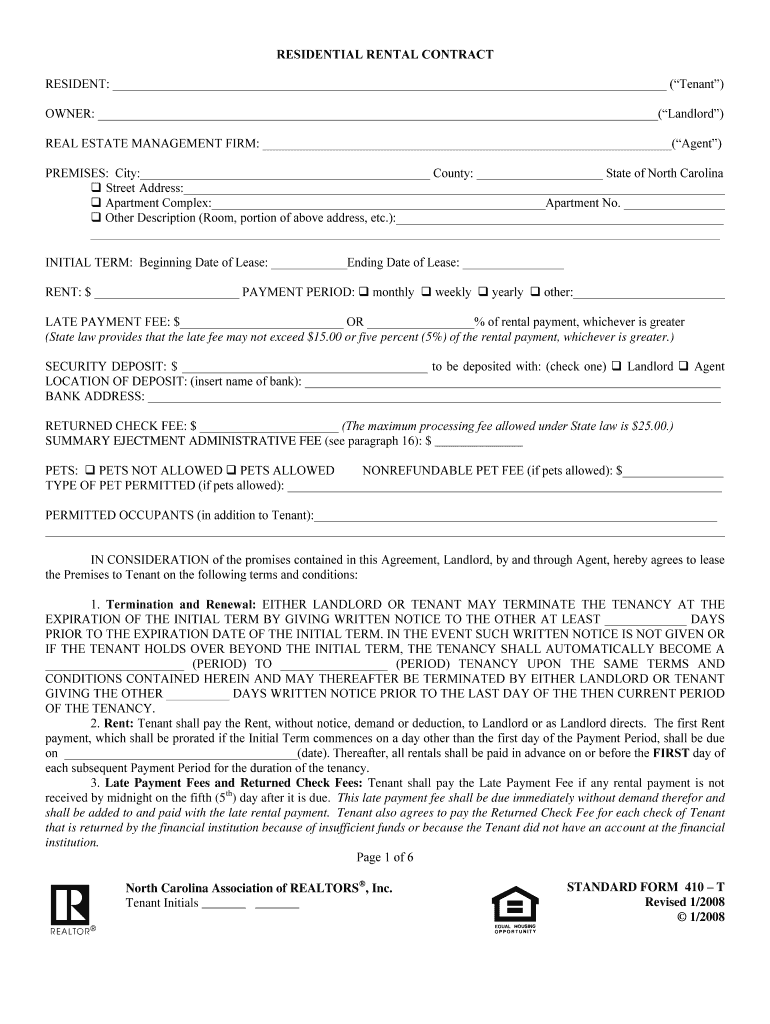

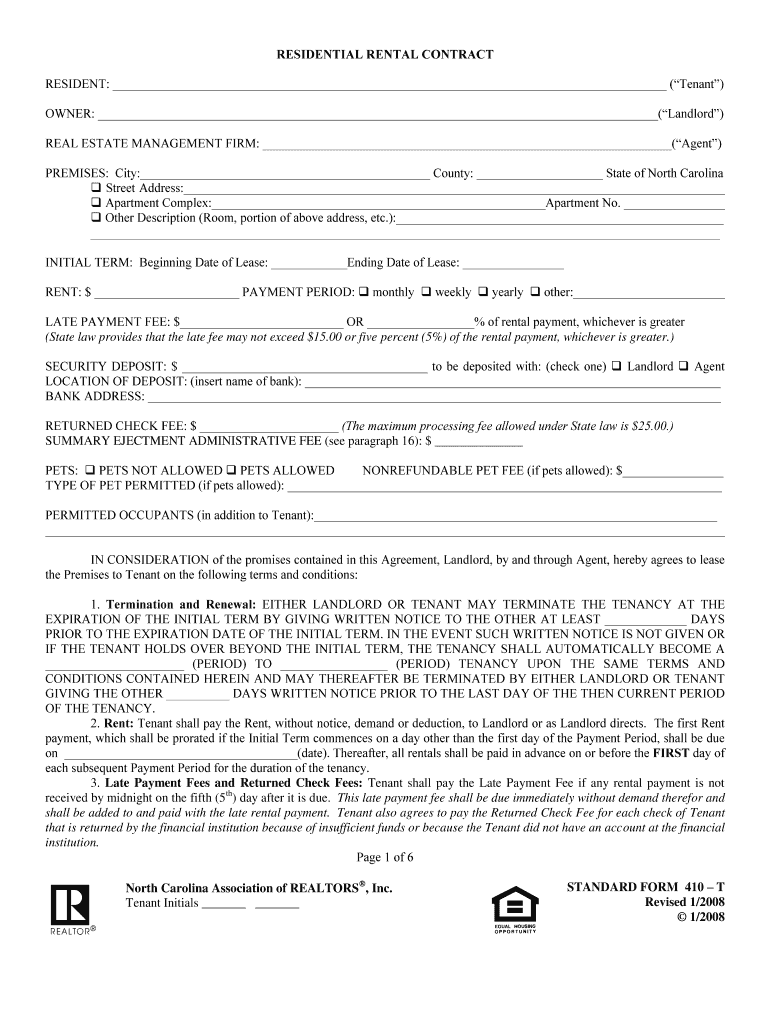

North Carolina Association Of Realtors Standard Form 410 T Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/112/100112044/large.png

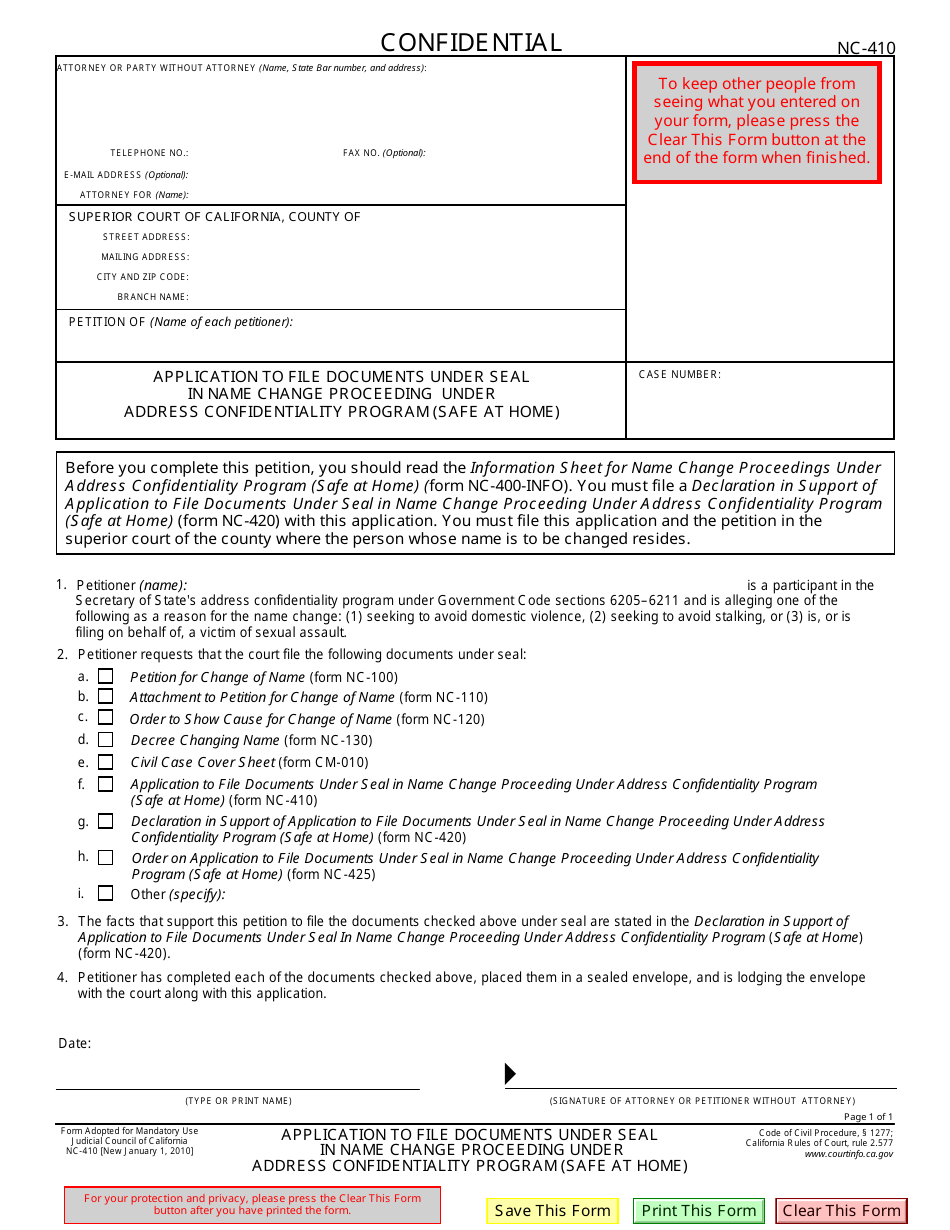

Extension for Filing Individual Income Tax Return Form D 410 eServices Resources Payment Options Benefits Maintenance Schedule Videos Contact Information North Carolina Department of Revenue PO Box 25000 Raleigh NC 27640 0640 General information 1 877 252 3052 Individual income tax refund inquiries 1 877 252 4052 North Carolina Department of Revenue D 410 Mail to N C Department of Revenue P O Box 25000 Raleigh N C 27640 0635 Fill in this circle if you were out of the country on the date that this application was due Instructions Purpose Use Form D 410 to ask for 6 more months to file the North Carolina Individual Income Tax Return Form D 400

North Carolina Department of Revenue D 410 Mail to N C Department of Revenue P O Box 25000 Raleigh N C 27640 0635 Fill in this circle if you were out of the country on the date that this application was due Instructions Purpose 8VH RUP WR DVN IRU PRUH PRQWKV WR OH WKH 1RUWK Carolina Individual Income Tax Return Form D 400 File Now with TurboTax We last updated North Carolina Form D 410 in January 2024 from the North Carolina Department of Revenue This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the North Carolina government

More picture related to Printable Nc Form D 410

Form 410 Fill Out Printable PDF Forms Online

https://formspal.com/pdf-forms/other/form-410/form-410-preview.webp

Nc D 400V Printable Form

https://data.formsbank.com/pdf_docs_html/242/2424/242489/page_1_thumb_big.png

North Carolina Association Of Realtors Standard Form 410 T Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/5/715/5715022/large.png

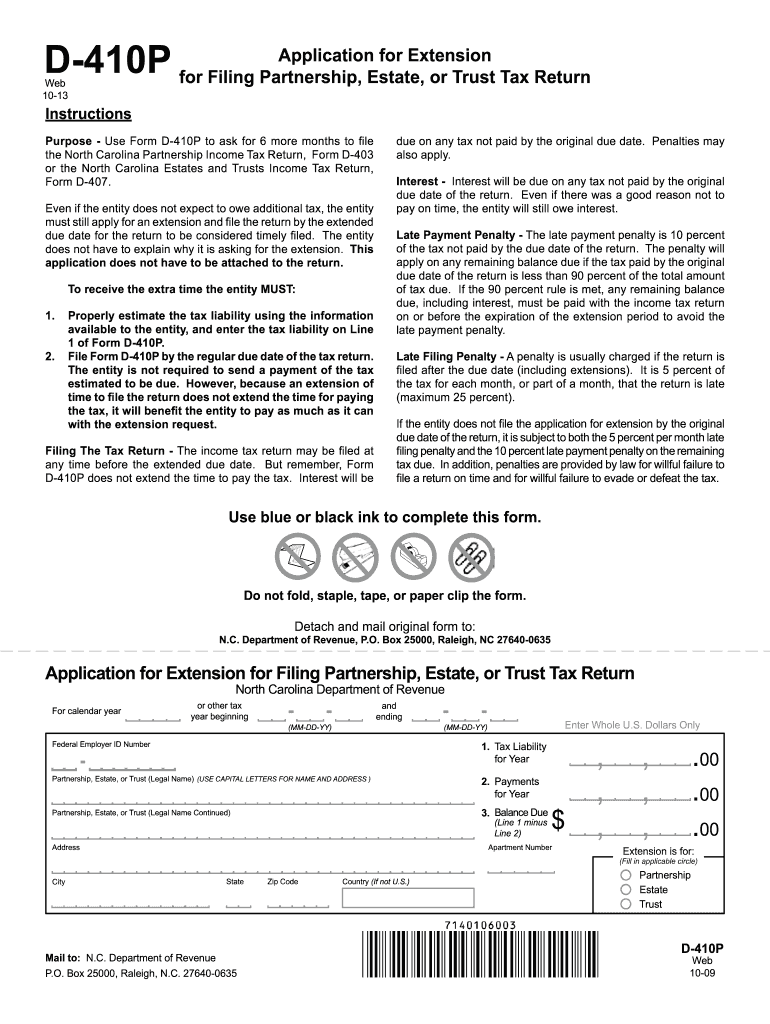

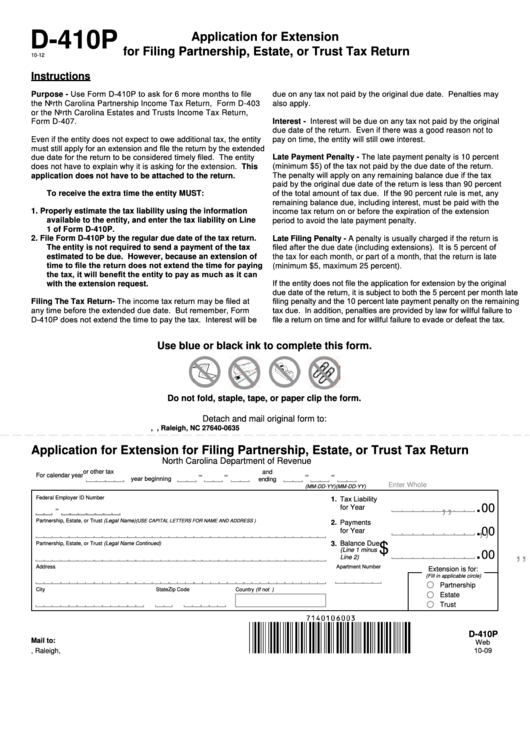

Individual Estimated Income Tax Form NC 40 Individual Income Tax Form D 400V The Refund Process Pay a Bill or Notice Notice Required North Carolina Department of Revenue PO Box 25000 Raleigh NC 27640 0640 General information 1 877 252 3052 Individual income tax refund inquiries 1 877 252 4052 Download or print the 2023 North Carolina Form D 410P Application for Extension for Filing Partnership Estate or Trust Tax Return for FREE from the North Carolina Department of Revenue We last updated North Carolina Form D 410P from the Department of Revenue in January 2024 Show Sources Original Form PDF is https

D 410 Filing Contact Payment Details Review Submit If you previously made an electronic payment but did not receive a confirmation page do not submit another payment Instead complete this web form for further assistance Close Cancel The information entered will not be saved if this transaction is canceled Then Click on Create Form to Create the Personalized Form D 410P Application for Extension for Filing Partnership Estate or Trust Tax Return Click here for help if the form does not appear after you click create form Do not print this page Use the Create Form button located below to generate the printable form

Printable Nc Form D 410

https://cdn.uslegal.com/uslegal-preview/US/US-BKR-F10/1.png

2011 Form NC D 410P Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/1/75/1075822/large.png

https://eservices.dor.nc.gov/vouchers/d410.jsp

Form D 410 is used to extend the time for filing a North Carolina Individual Income tax return Form D 400 This form is not required if you were granted an automatic extension to file your federal income tax return If you were granted an automatic federal extension and need to make a payment for taxes due use Form D 410

https://www.ncdor.gov/taxes-forms/individual-income-tax-forms-instructions

Individual Income Tax Return and Form D 400TC Individual Tax Credits D 400 without TC 2010 Individual Income Tax Return no tax credits D 401 2010 North Carolina Individual Income Tax Instructions D 400X WS 2010 North Carolina Amended Schedule D 400V 2010 Payment Voucher Pay Online D 422 2010 Underpayment of Estimated Tax D 422A 2010

Printable Nc Form D 410 Printable Word Searches

Printable Nc Form D 410

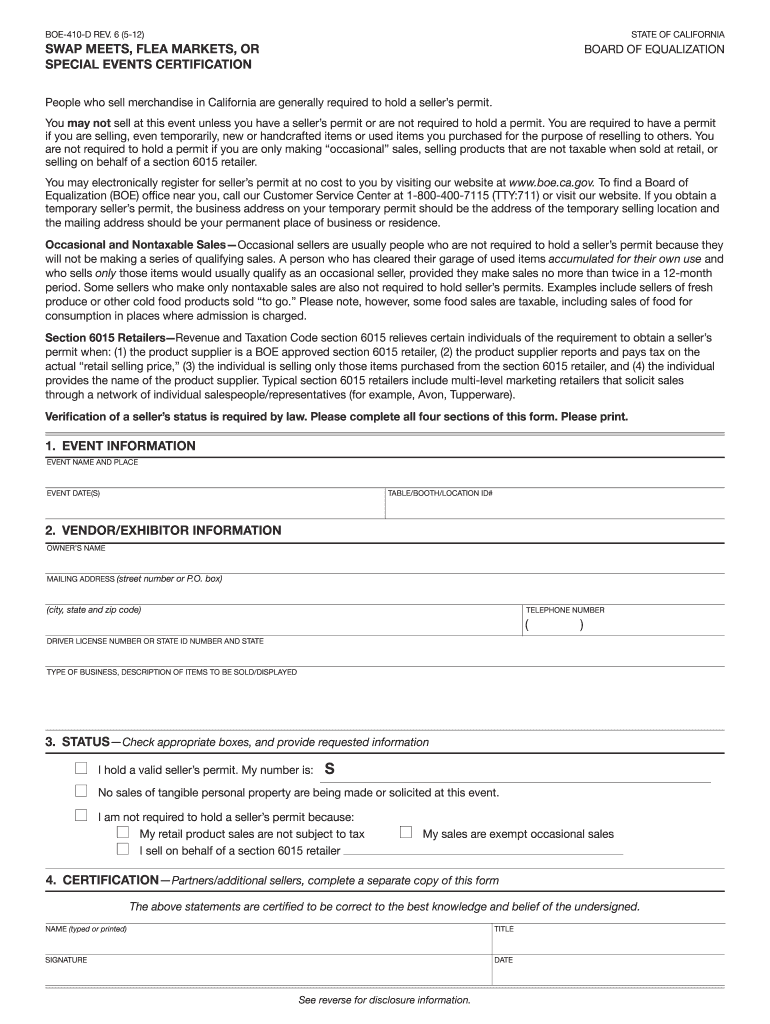

Form NC 410 Fill Out Sign Online And Download Fillable PDF California Templateroller

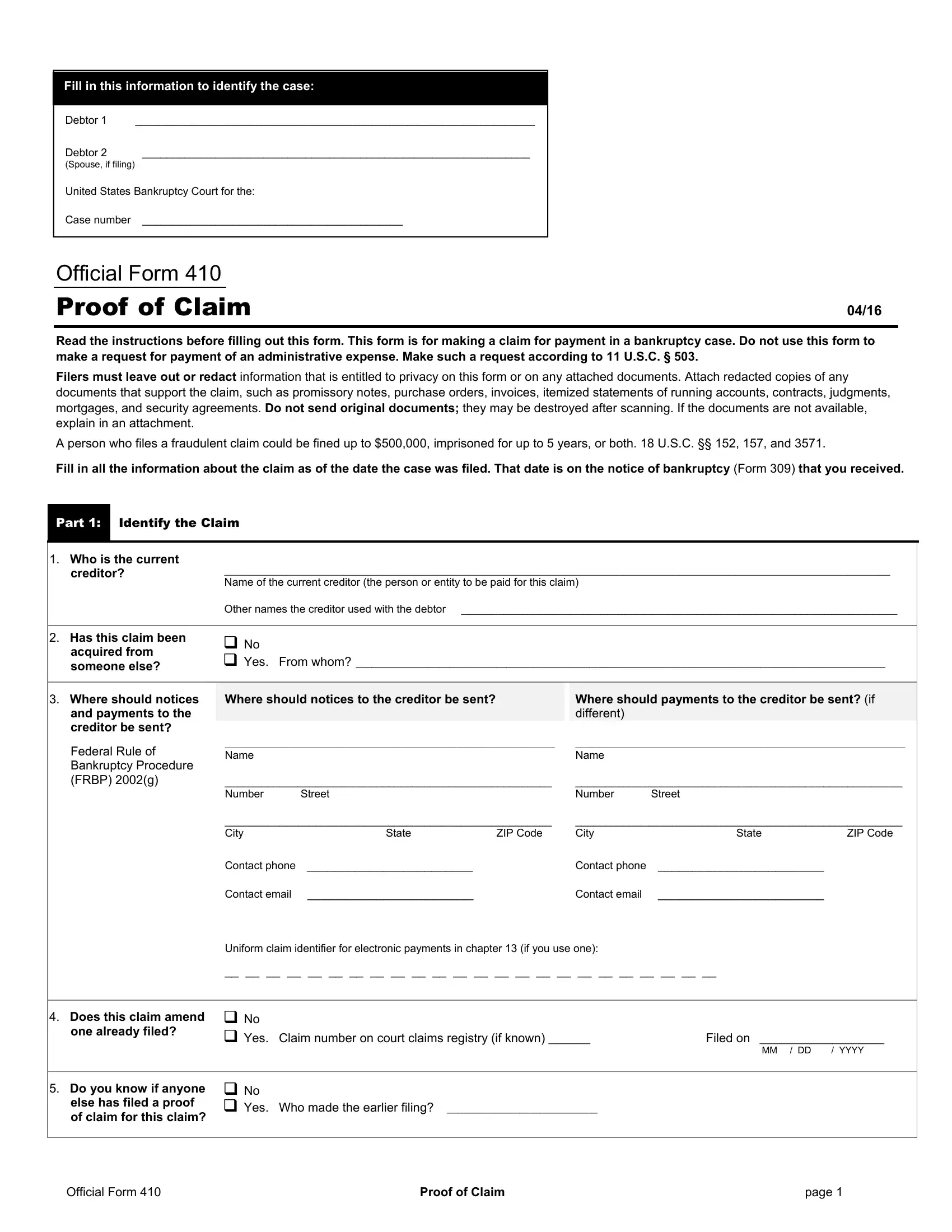

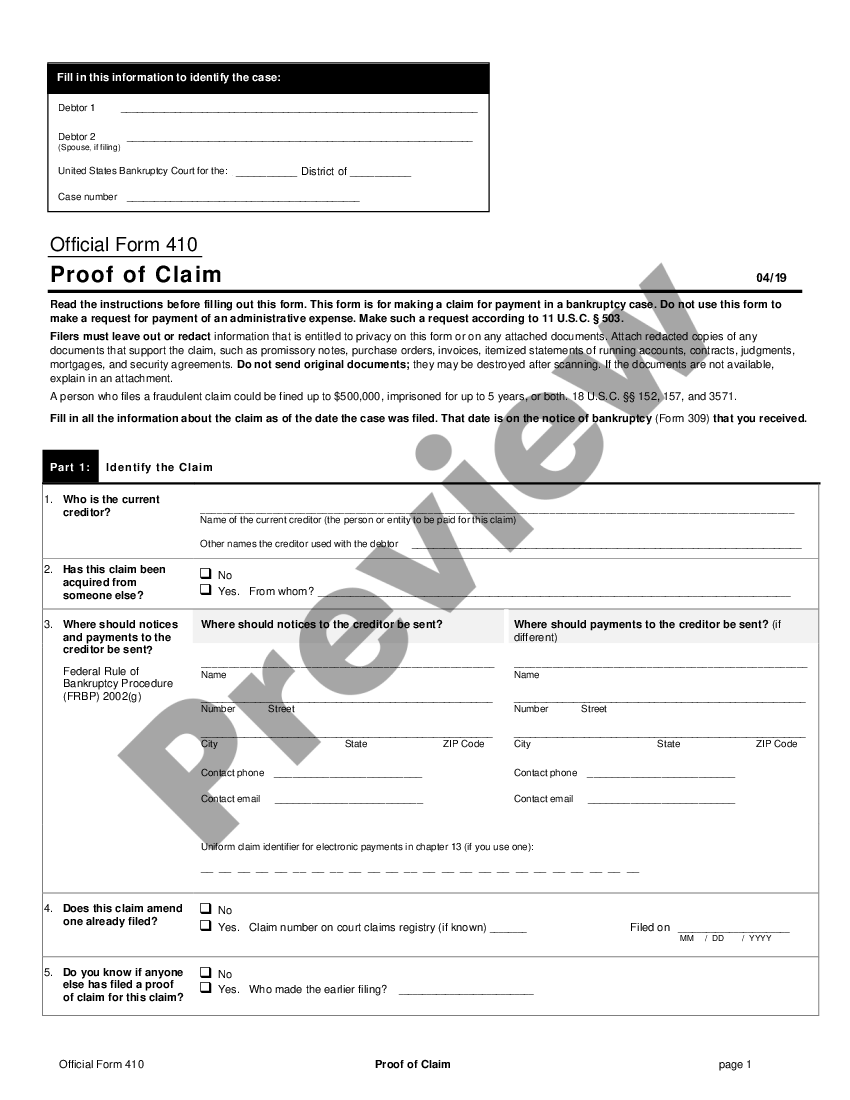

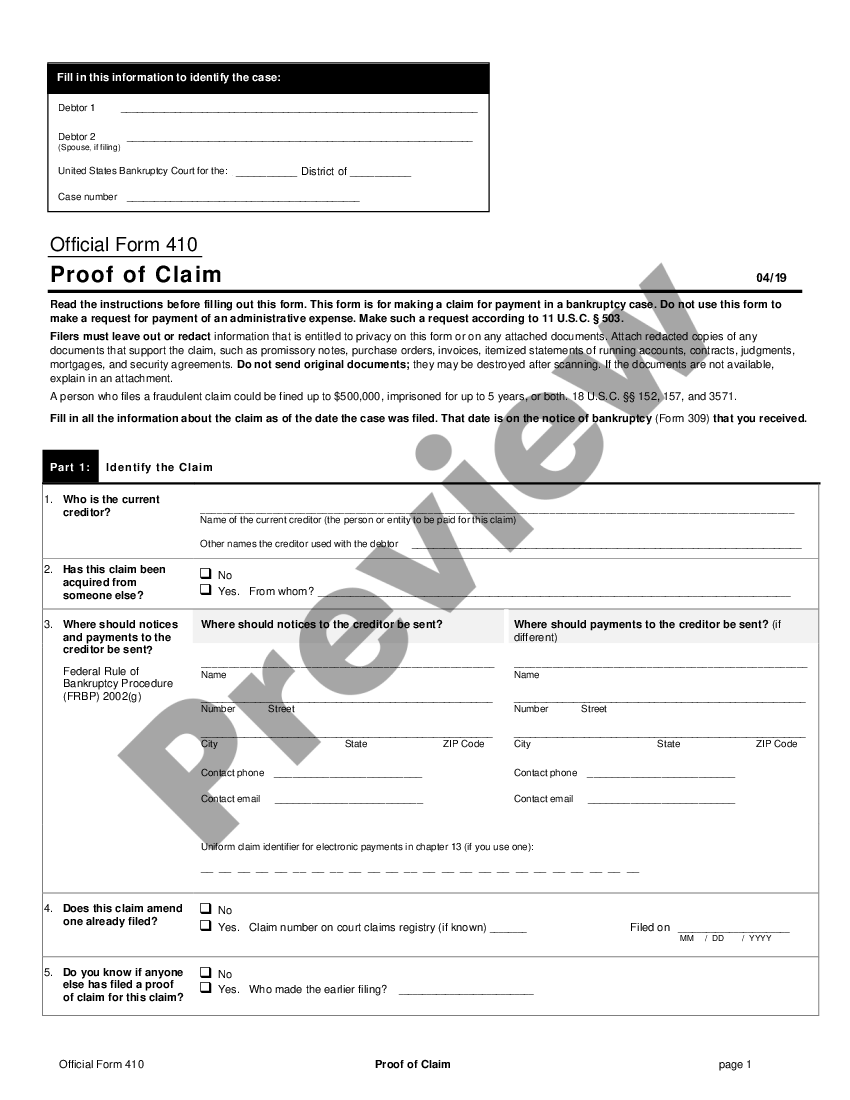

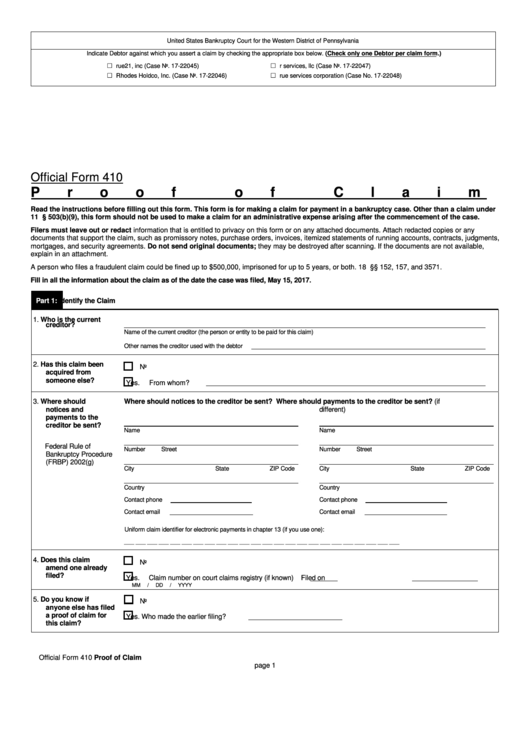

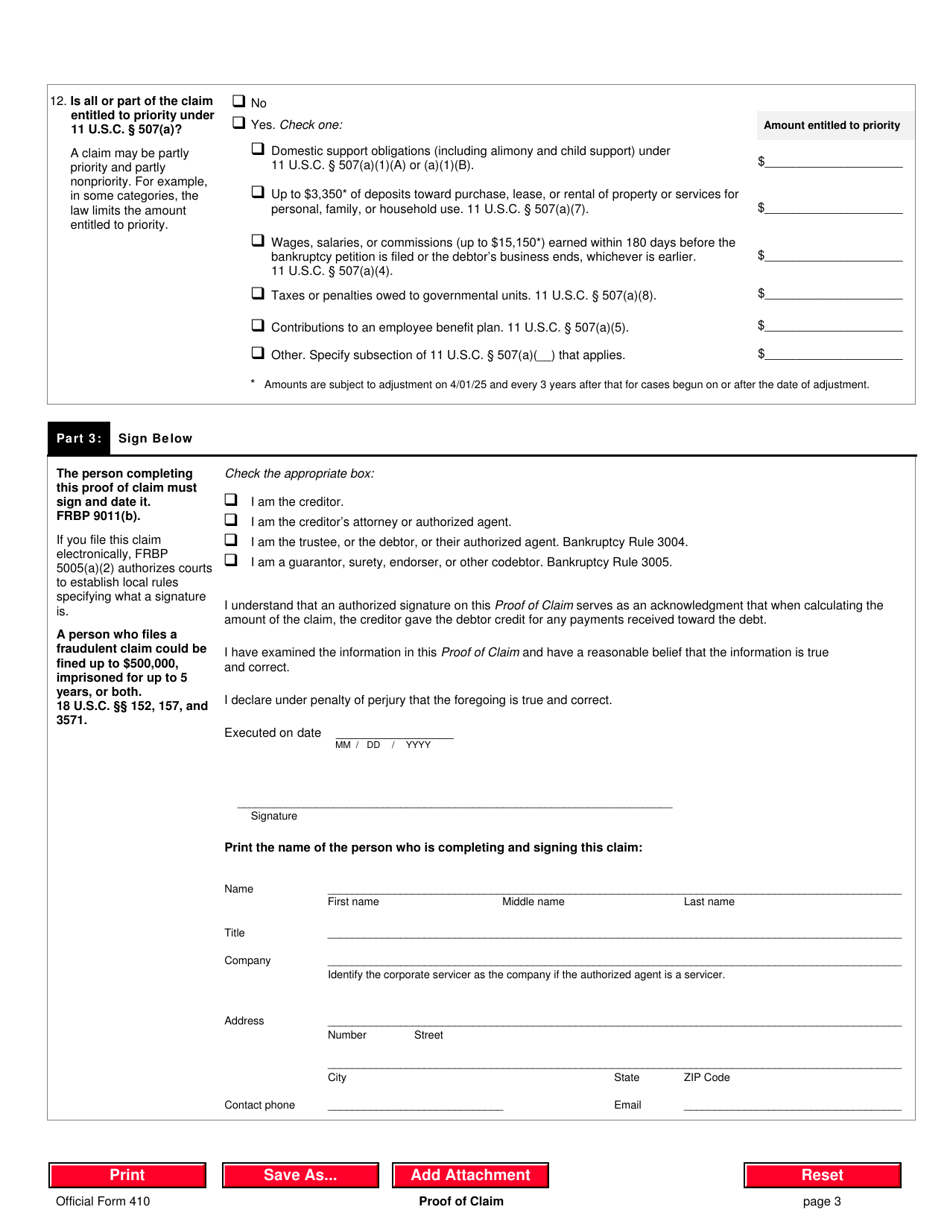

Official Form 410 Proof Of Claim Printable Pdf Download

Official Form 410 Download Fillable PDF Or Fill Online Proof Of Claim Templateroller

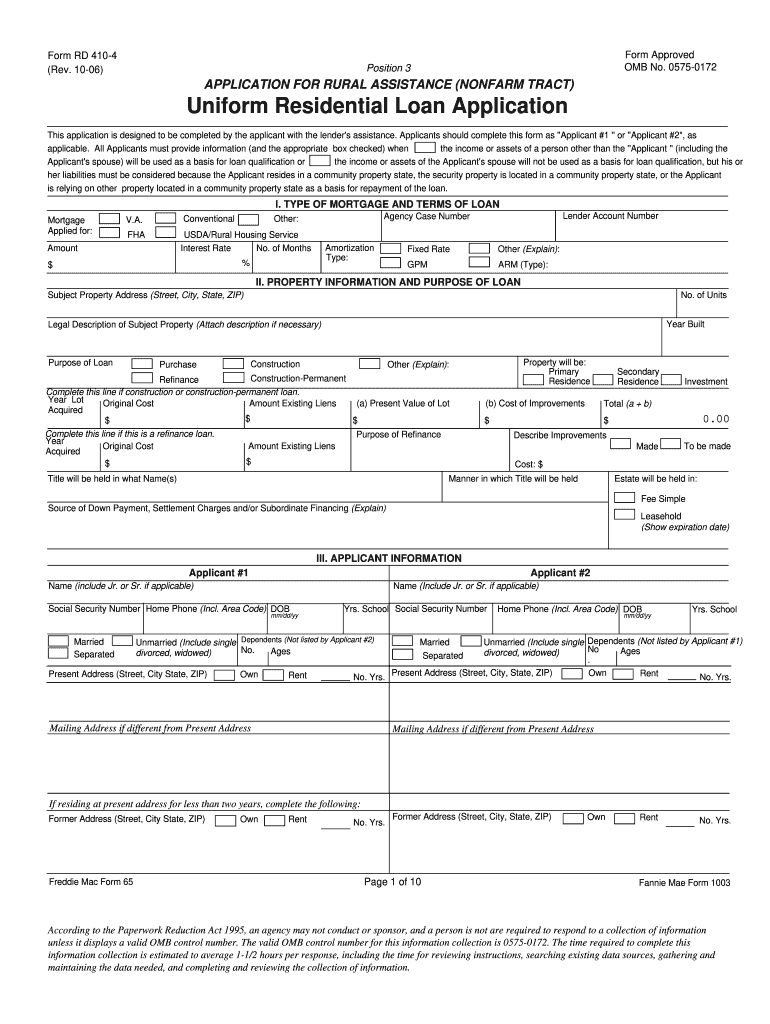

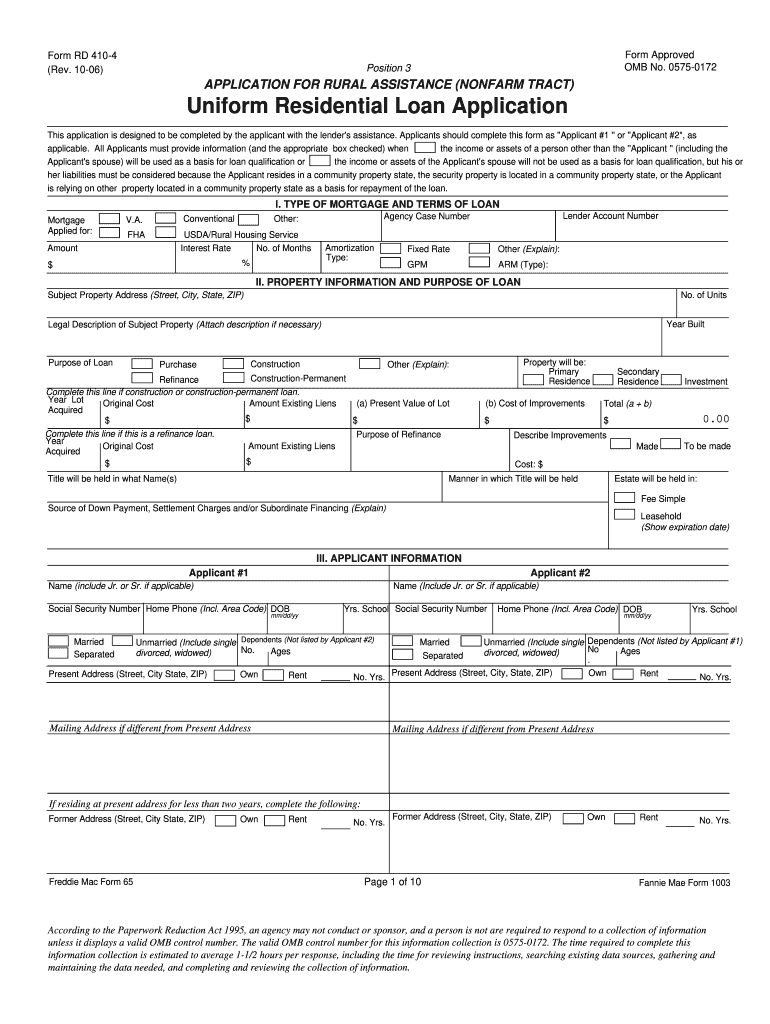

2006 2024 Form RD 410 4 Fill Online Printable Fillable Blank PdfFiller

2006 2024 Form RD 410 4 Fill Online Printable Fillable Blank PdfFiller

Printable Nc Form D 410

Printable Nc Form D 410 Printable Word Searches

Form D 410p Application For Extension For Filing Partnership Estate Or Trust Tax Return

Printable Nc Form D 410 - D 410 Application for Extension for Filing Individual Income Tax Return Form D 410 is used to extend the time for filing a North Carolina Individual Income tax return Form D 400 This form is not required if you were granted an automatic extension to file your federal income tax return