Printable Nebraska State Income Tax Forms Form 1120N 2023 Nebraska Corporation Income Tax Return with Schedules and Instructions Booklet Business Classification Codes Form Form 7004N Application for Automatic Extension of Time to File Nebraska Corporation Fiduciary or Partnership Return Form Form 1120XN Amended Nebraska Corporation Income Tax Return for Tax Years After 2022

Previous Years Income Tax Forms Select Year2023 Income Tax Forms2022 Income Tax Forms2021 Income Tax Forms2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax Forms2015 Income Tax Forms2014 Income Tax Forms2013 Income Tax Forms2012 Income Tax Forms2011 Income Tax Forms2010 Income Tax Forms Numeric Printable Nebraska state tax forms for the 2023 tax year will be based on income earned between January 1 2023 through December 31 2023 The Nebraska income tax rate for tax year 2023 is progressive from a low of 2 46 to a high of 6 64 The state income tax table can be found inside the Nebraska Form 1040N instructions booklet

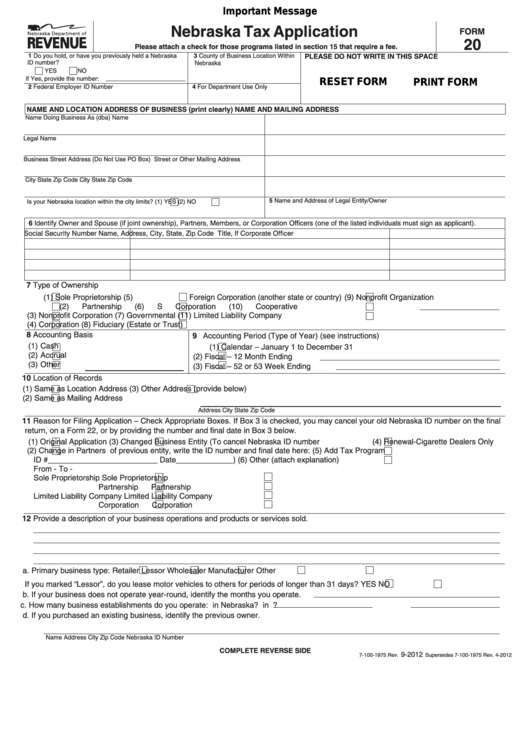

Printable Nebraska State Income Tax Forms

Printable Nebraska State Income Tax Forms

https://data.formsbank.com/pdf_docs_html/349/3492/349208/page_1_thumb_big.png

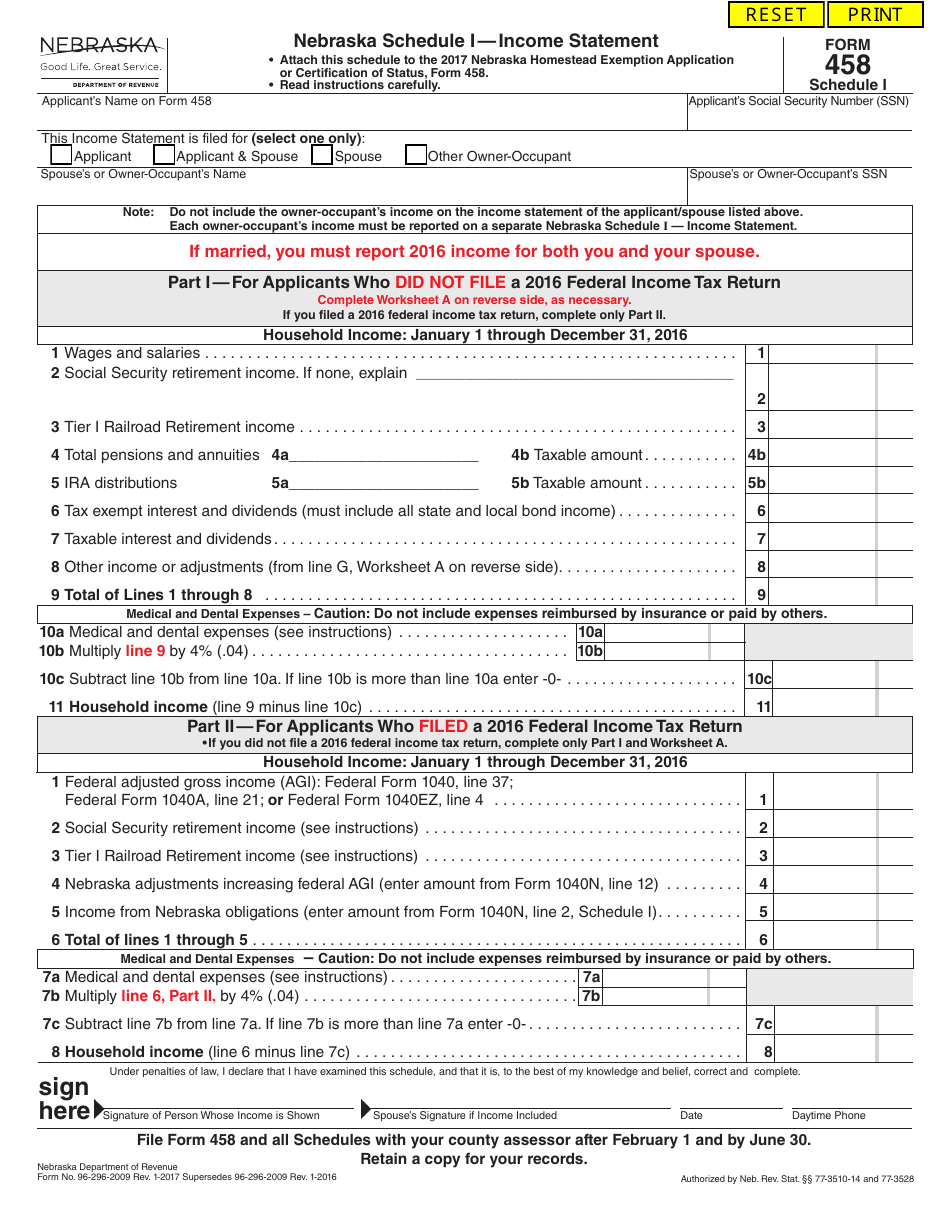

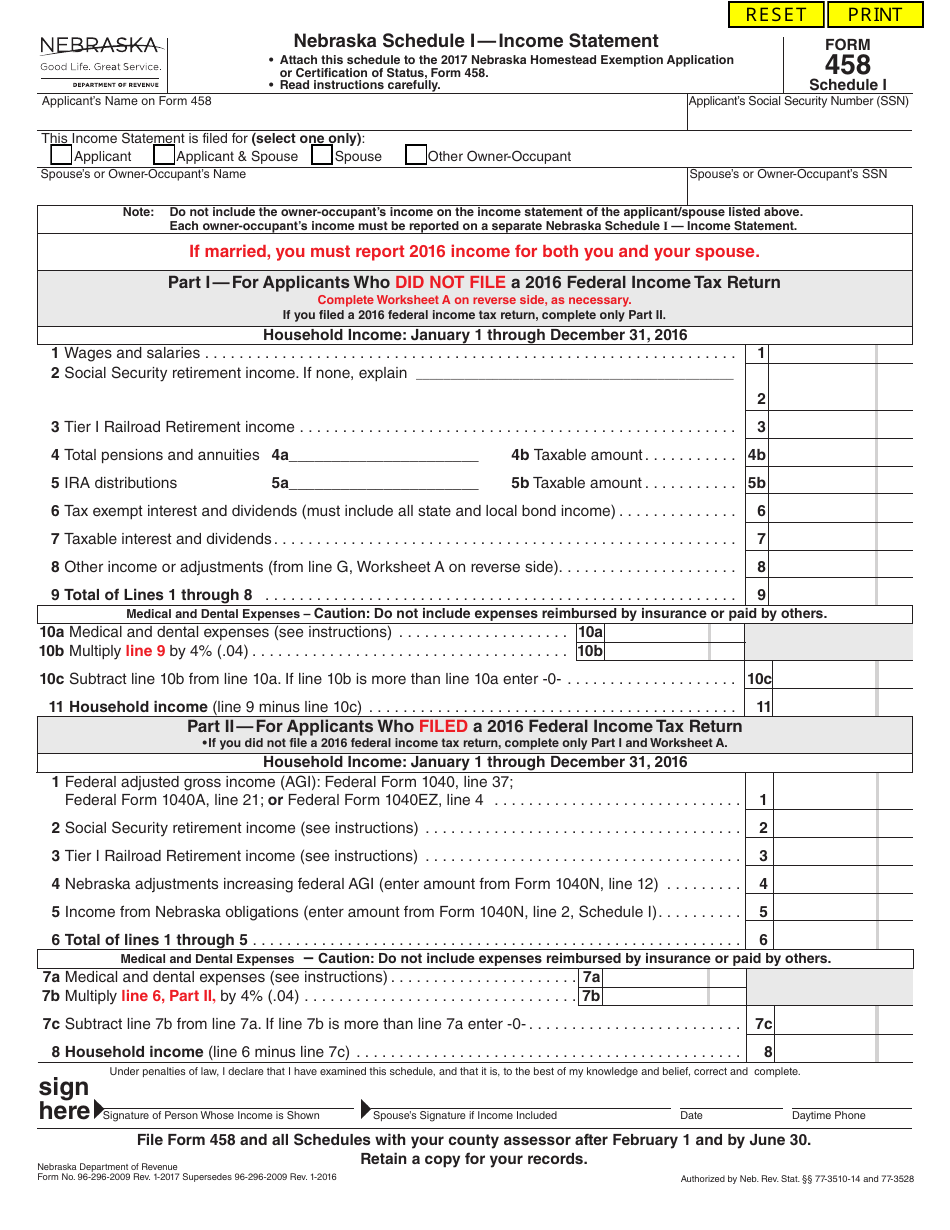

Form 458 Schedule I Fill Out Sign Online And Download Fillable PDF Nebraska Templateroller

https://data.templateroller.com/pdf_docs_html/416/4168/416872/form-458-schedule-i-income-statement-nebraska_print_big.png

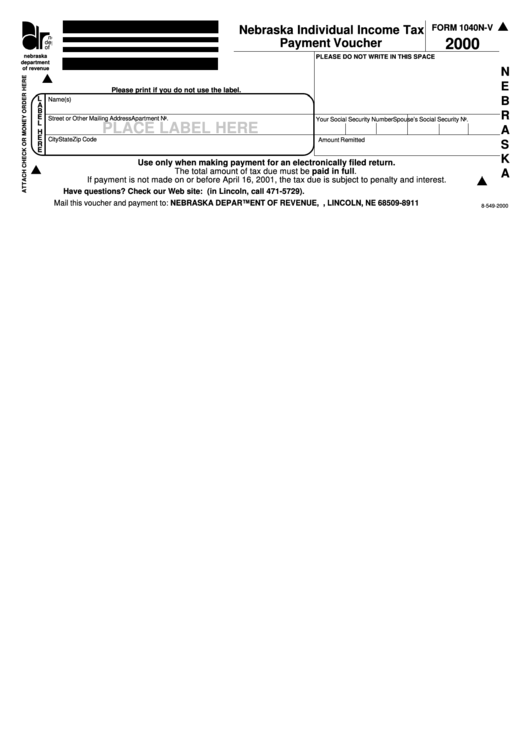

Form 1040n V Nebraska Individual Income Tax Payment Voucher 2000 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/266/2669/266977/page_1_thumb_big.png

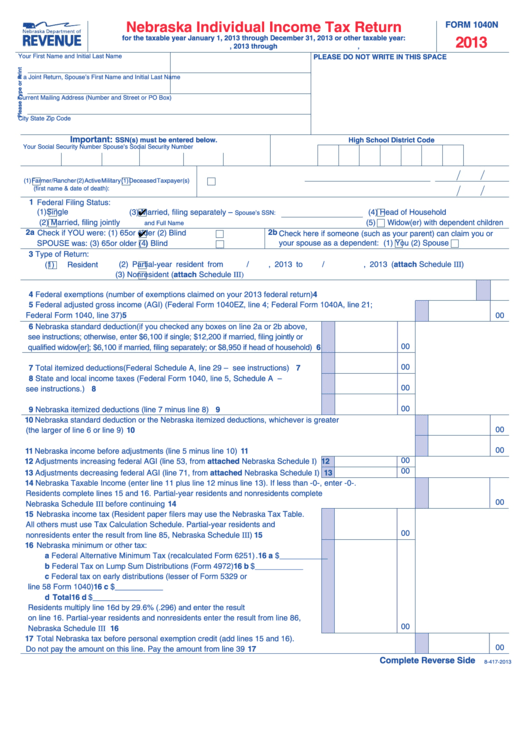

6 Nebraska standard deduction if you checked any boxes on line 2a or 2b above see instructions otherwise enter 7 900 if single 15 800 if married filing jointly or qualifying surviving spouse 7 900 if married filing separately or 11 600 if head of Nebraska has a state income tax that ranges between 2 46 and 6 64 which is administered by the Nebraska Department of Revenue TaxFormFinder provides printable PDF copies of 35 current Nebraska income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024

Nebraska has a state income tax that ranges between 2 46 and 6 64 For your convenience Tax Brackets provides printable copies of 35 current personal income tax forms from the Nebraska Department of Revenue The current tax year is 2023 with tax returns due in April 2024 Download This Form Print This Form More about the Nebraska Form 1040N Individual Income Tax Tax Return TY 2023 Form 1040N is the general income tax return for Nebraska residents You must file it on a yearly basis to calculate and pay any money dur to the Nebraska Department of Revenue

More picture related to Printable Nebraska State Income Tax Forms

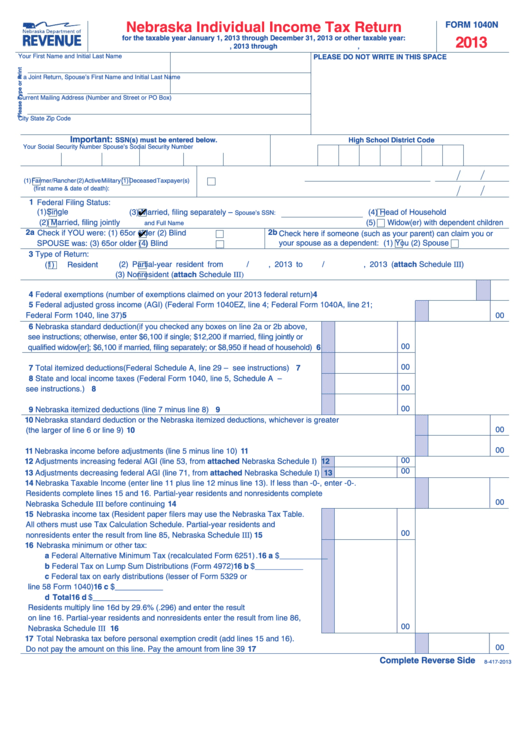

Nebraska Individual Income Tax Return Form 1040n For The By Lordsofts18 Issuu

https://image.isu.pub/180109064052-e0ff052021a477b999c79d028aad6e30/jpg/page_1.jpg

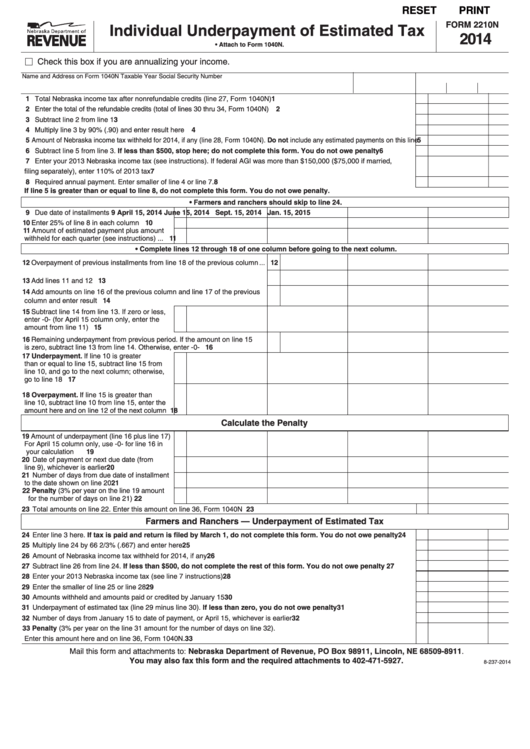

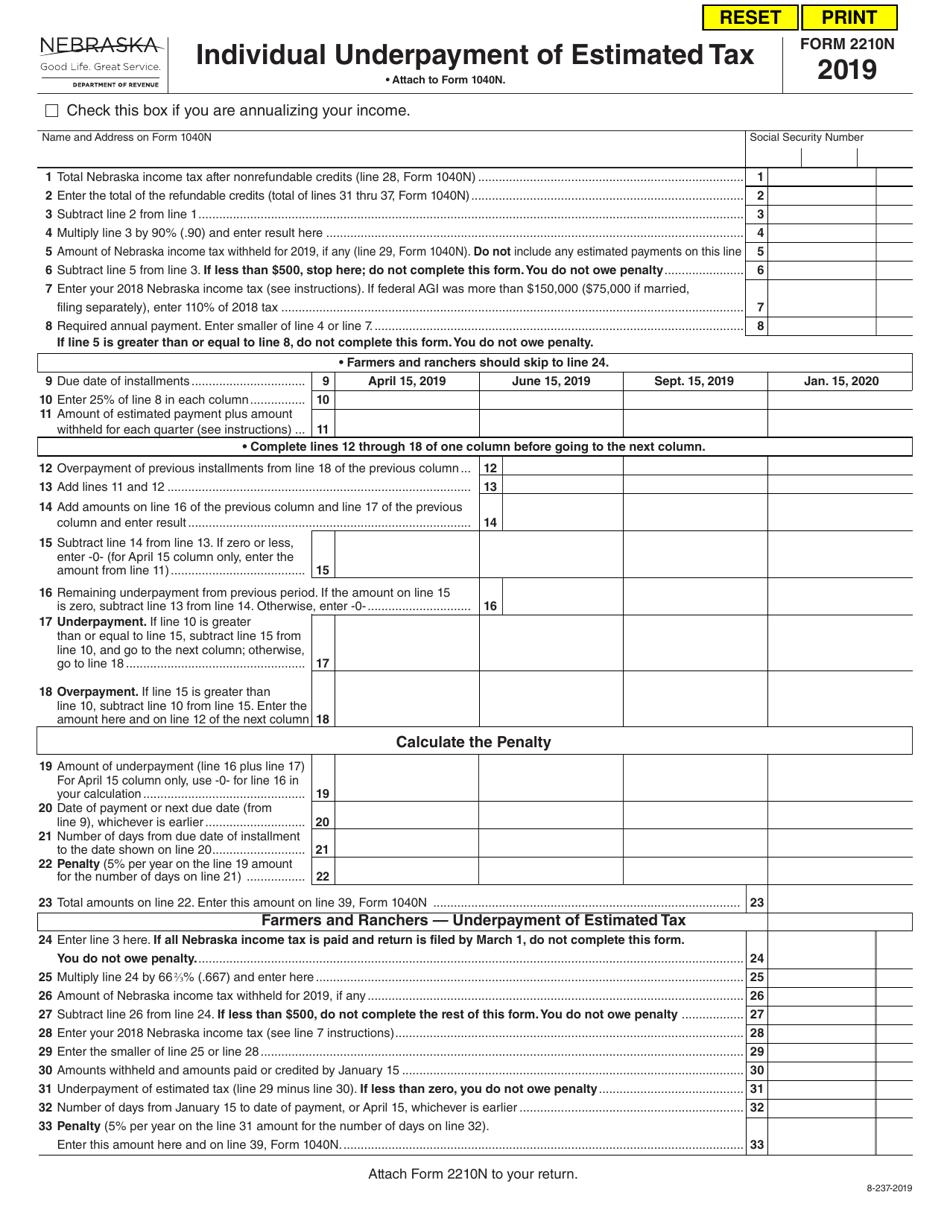

Fillable Form 2210n Nebraska Individual Underpayment Of Estimated Tax 2014 Printable Pdf

https://data.formsbank.com/pdf_docs_html/331/3313/331395/page_1_thumb_big.png

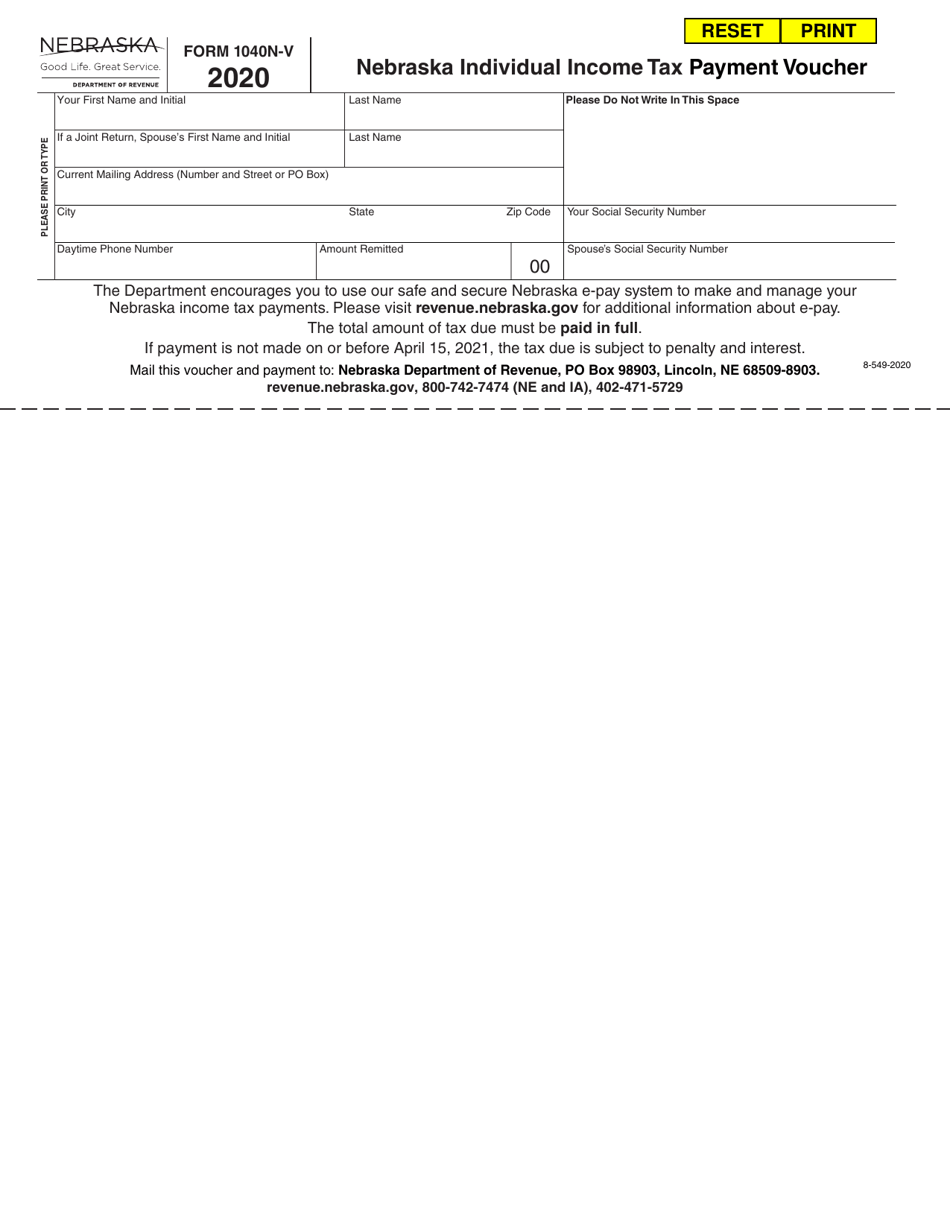

Form 1040N V Download Fillable PDF Or Fill Online Nebraska Individual Income Tax Payment Voucher

https://data.templateroller.com/pdf_docs_html/2131/21315/2131510/form-1040n-v-nebraska-individual-income-tax-payment-voucher-nebraska_print_big.png

Download This Form Print This Form More about the Nebraska Form 1040N ES Individual Income Tax TY 2024 You must pay estimated tax if you don t have your tax withholding taken out by an employer or if you are self employed Use the estimated income tax vouchers in form 1040N ES to submit your quarterly payments Tax Calculator Instructions Nebraska State Income tax forms for current and previous tax years Current Nebraska income taxes can be prepared but ONLY be e Filed in conjunction with an IRS Income Tax Return as the IRS and the state of NE share tax data

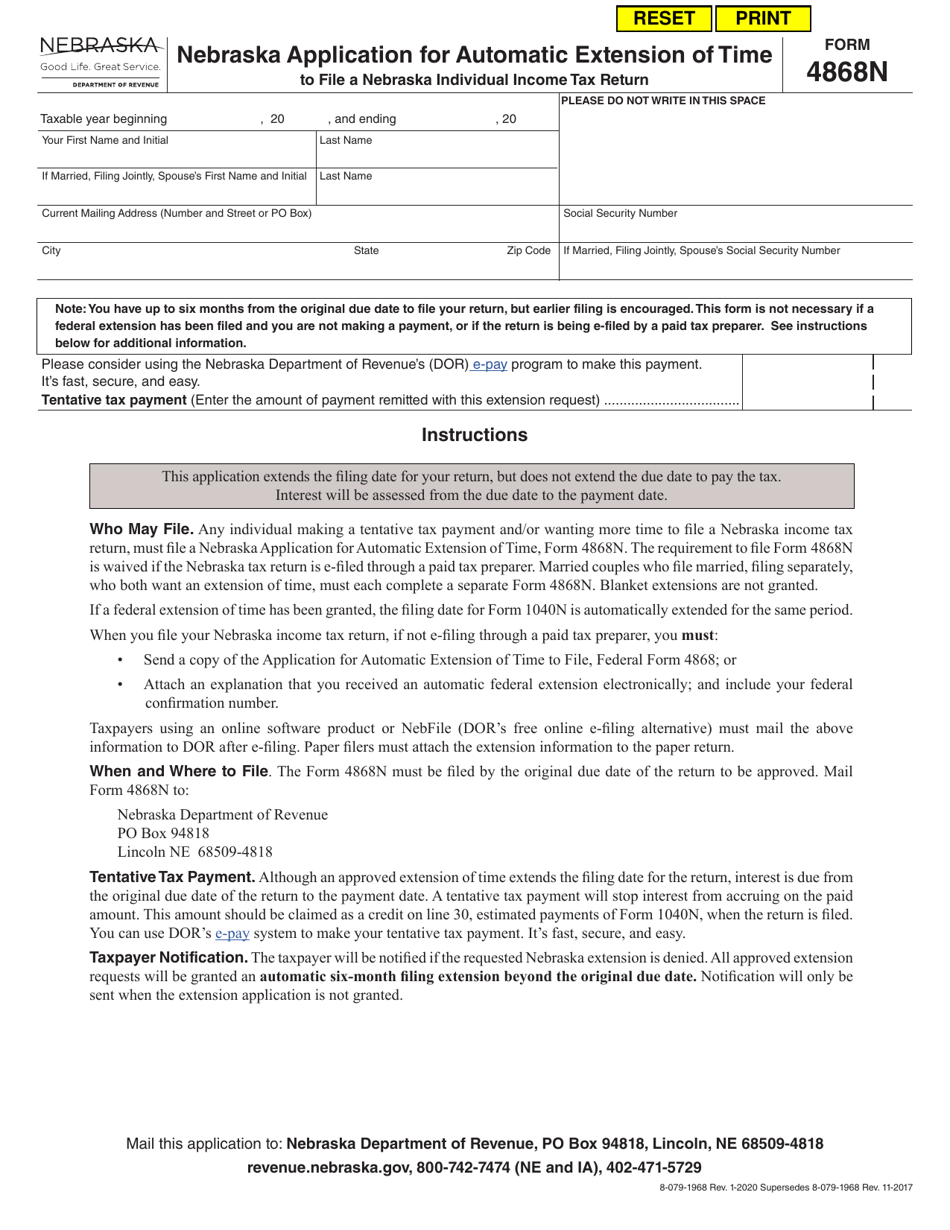

Select a different state E file your Nebraska personal income tax return online with 1040 These 2022 forms and more are available Nebraska Form 1040N Personal Income Tax Return for Residents Nebraska Form 2210 Underpayment of Estimated Tax Nebraska Form 2441N Child and Dependent Care Expenses Nebraska Form 4868N Extension Use the estimated income tax vouchers in form 1040N ES to submit your quarterly payments 11 0001 Form 1040N Individual Income Tax Return Form 1040N is the general income tax return for Nebraska residents You must file it on a yearly basis to calculate and pay any money dur to the Nebraska Department of Revenue

Fillable Nebraska State Income Tax Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/323/3231/323170/page_1_thumb_big.png

Form 1040N Nebraska Individual Income Tax Return YouTube

https://i.ytimg.com/vi/WKBzfzXL_vw/maxresdefault.jpg

https://revenue.nebraska.gov/about/2023-income-tax-forms

Form 1120N 2023 Nebraska Corporation Income Tax Return with Schedules and Instructions Booklet Business Classification Codes Form Form 7004N Application for Automatic Extension of Time to File Nebraska Corporation Fiduciary or Partnership Return Form Form 1120XN Amended Nebraska Corporation Income Tax Return for Tax Years After 2022

https://revenue.nebraska.gov/about/forms

Previous Years Income Tax Forms Select Year2023 Income Tax Forms2022 Income Tax Forms2021 Income Tax Forms2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax Forms2015 Income Tax Forms2014 Income Tax Forms2013 Income Tax Forms2012 Income Tax Forms2011 Income Tax Forms2010 Income Tax Forms Numeric

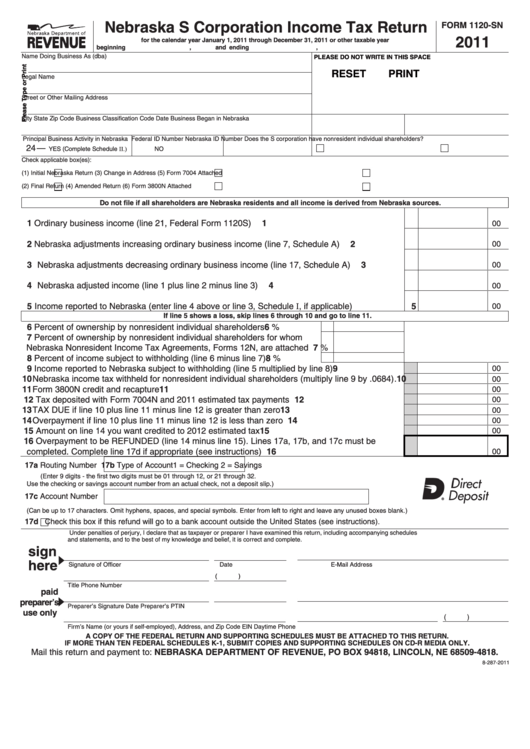

Fillable Form 1120 Sn Nebraska S Corporation Income Tax Return 2011 Printable Pdf Download

Fillable Nebraska State Income Tax Forms Printable Forms Free Online

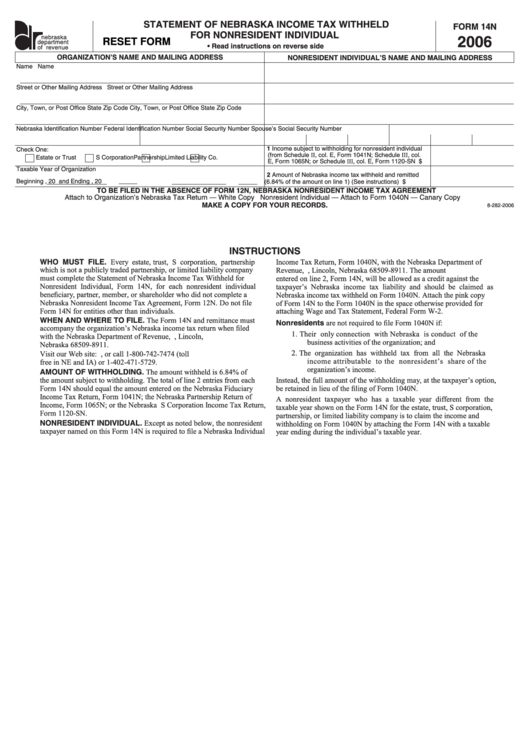

Fillable Form 14n 2006 Statement Of Nebraska Income Tax Withheld For Nonresident Individual

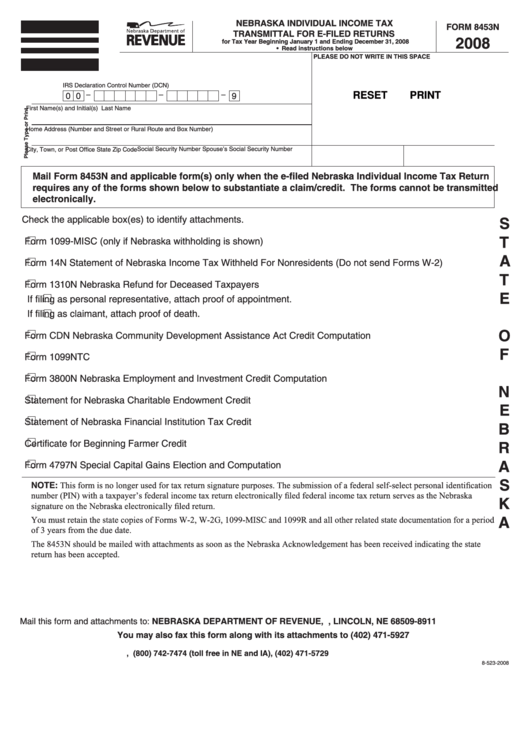

Fillable Form 8453n Nebraska Individual Income Tax Transmittal For E Filed Returns 2008

Form 2210N 2019 Fill Out Sign Online And Download Fillable PDF Nebraska Templateroller

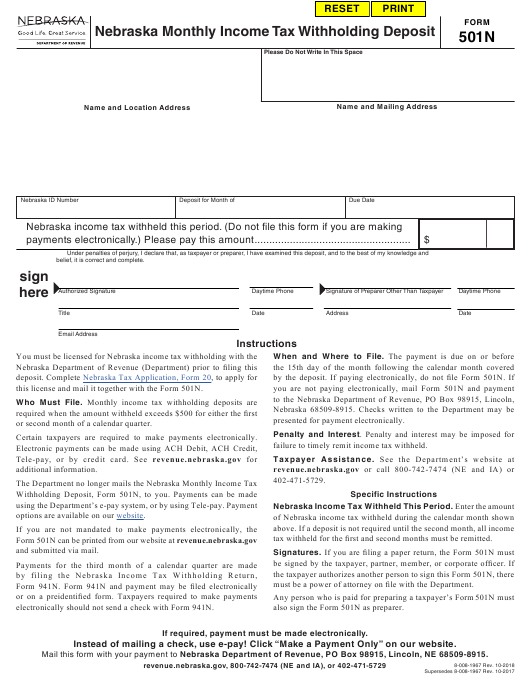

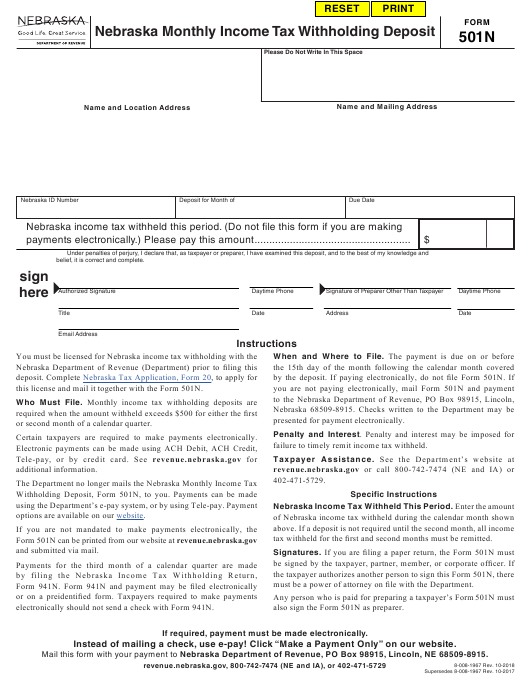

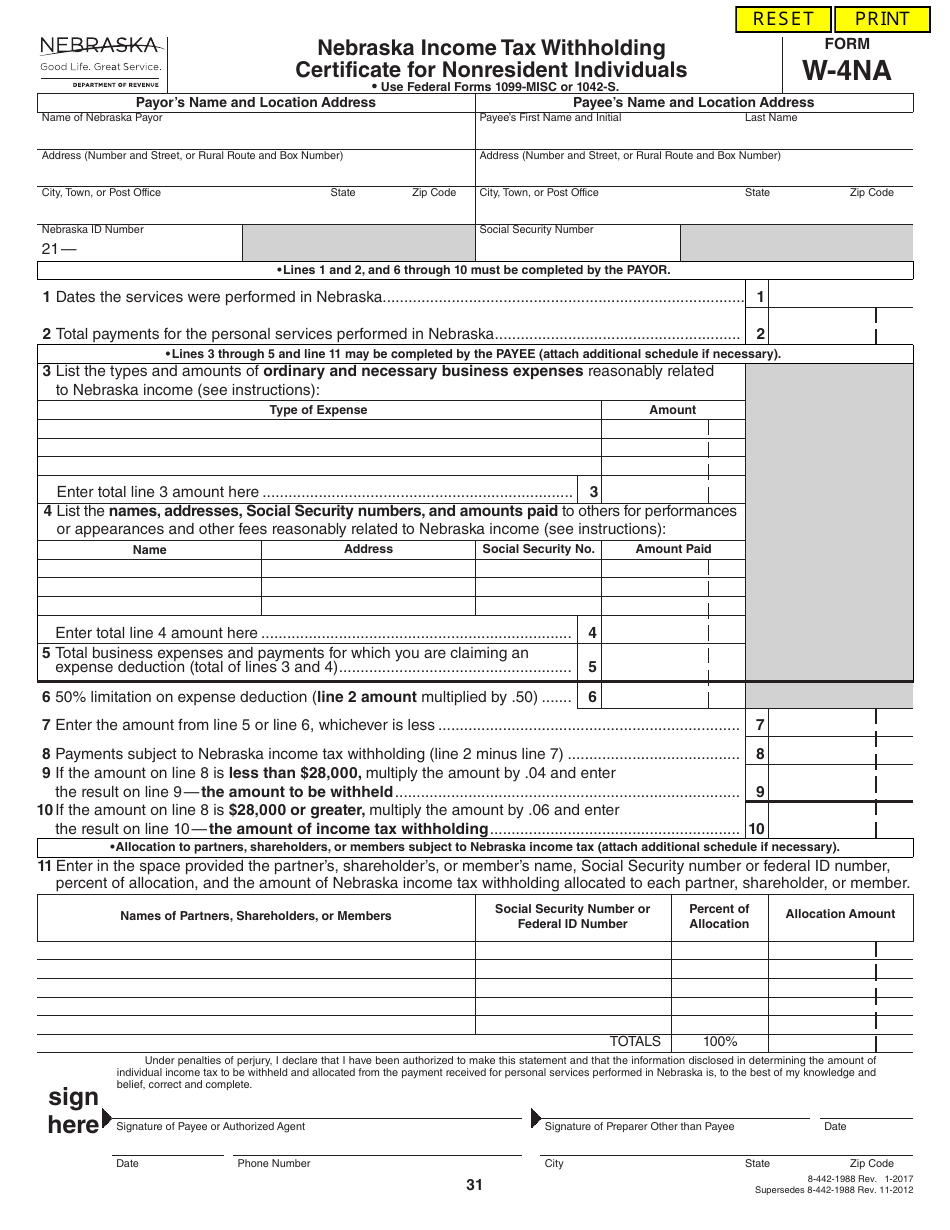

Nebraska State Tax Form For Employee Withholding 2023 Employeeform

Nebraska State Tax Form For Employee Withholding 2023 Employeeform

Form 4868N Fill Out Sign Online And Download Fillable PDF Nebraska Templateroller

Nebraska Fillable Tax Forms Printable Forms Free Online

Form 1040N ES 2023 Fill Out Sign Online And Download Fillable PDF Nebraska Templateroller

Printable Nebraska State Income Tax Forms - Download This Form Print This Form More about the Nebraska Form 1040N Individual Income Tax Tax Return TY 2023 Form 1040N is the general income tax return for Nebraska residents You must file it on a yearly basis to calculate and pay any money dur to the Nebraska Department of Revenue