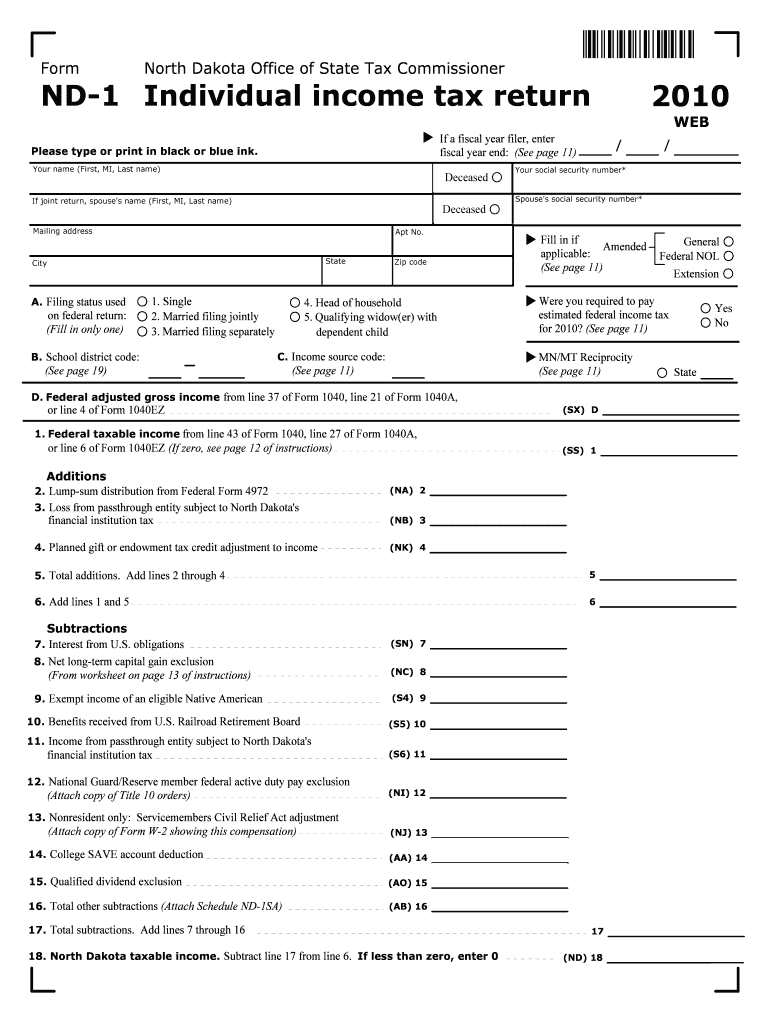

Printable North Dakota Tax Form Form ND 1 2023 If a fiscal year filer enter fiscal year end See instructions 1 a Federal adjusted gross income from Form 1040 or 1040 SR line 11 If zero enter zero b Federal taxable income from Form 1040 or 1040 SR line 15 If zero see instructions SX 1a SS 1b Additions Subtractions 5

Free printable and fillable 2023 North Dakota Form ND 1 and 2023 North Dakota Form ND 1 Instructions booklet in PDF format to fill in print and mail your state income tax return due April 15 2024 North Dakota state income tax Form ND 1 must be postmarked by April 15 2024 in order to avoid penalties and late fees TaxFormFinder provides printable PDF copies of 45 current North Dakota income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 27 Corporate Income Tax 33 Other 18 Show entries Search Showing 1 to 25 of 27 entries Previous 1 2 Next

Printable North Dakota Tax Form

Printable North Dakota Tax Form

https://imgv2-1-f.scribdassets.com/img/document/176329123/original/3cb8b00471/1588944714?v=1

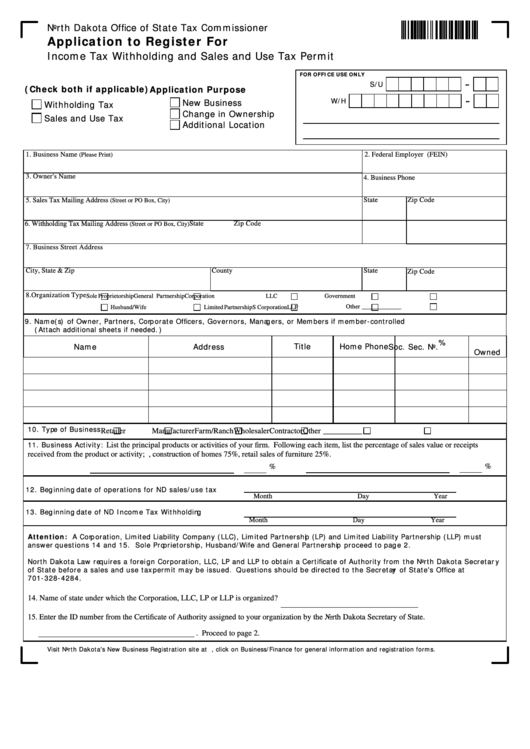

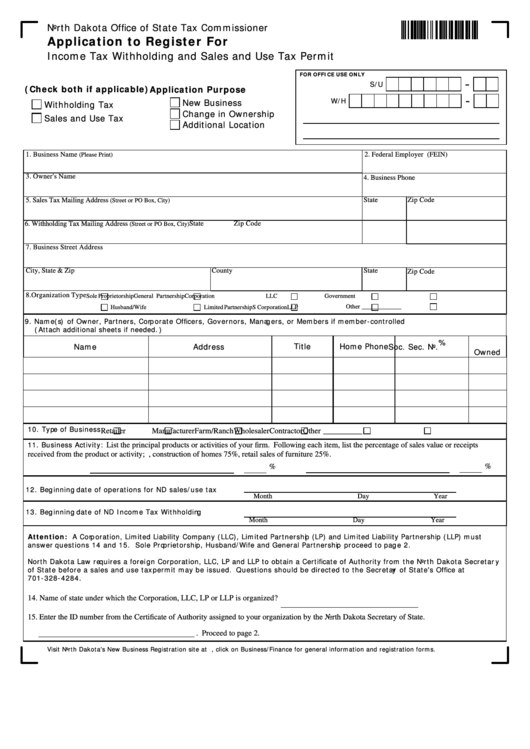

Fillable Application To Register For Income Tax Withholding And Sales And Use Tax Permit North

https://data.formsbank.com/pdf_docs_html/259/2590/259097/page_1_thumb_big.png

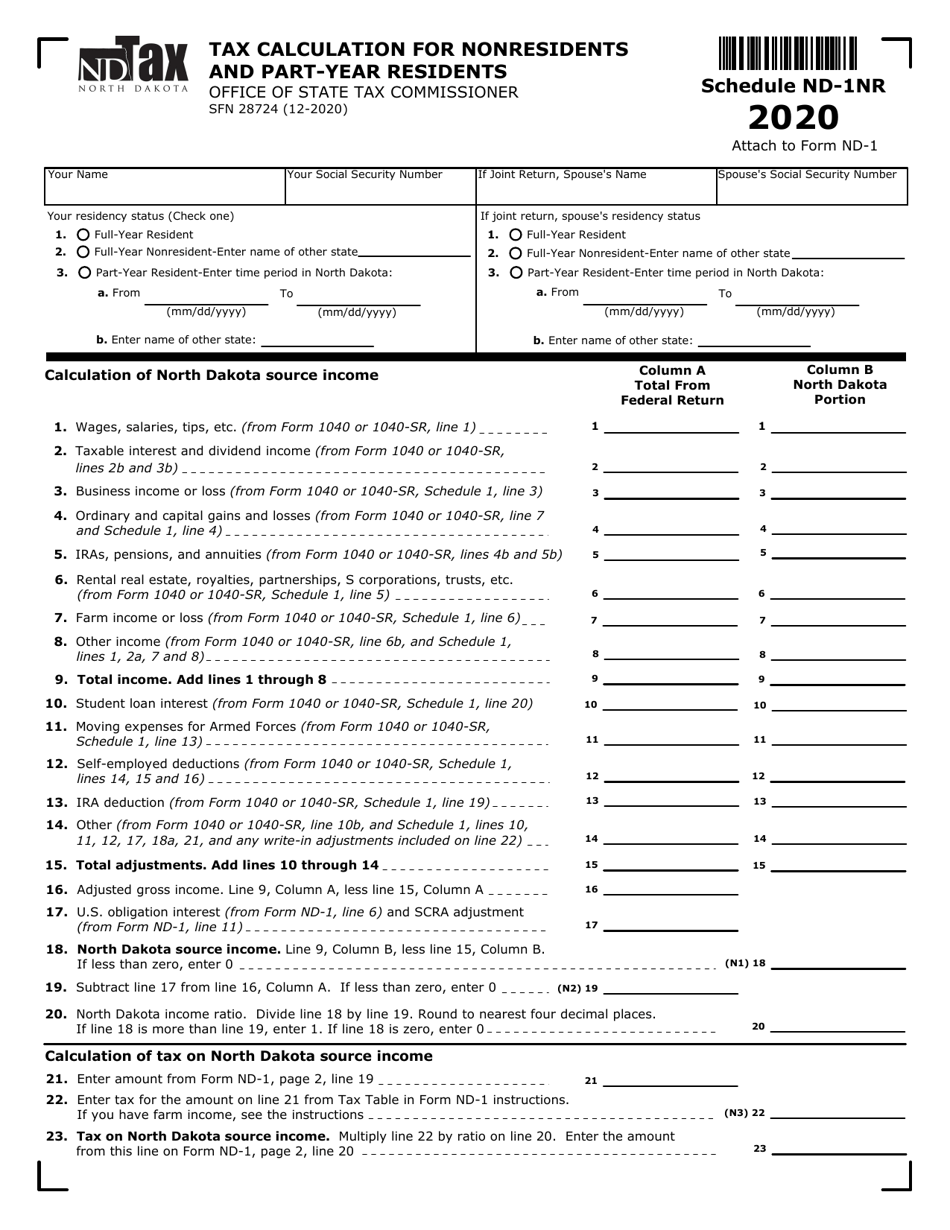

Form SFN28724 Schedule ND 1NR Download Fillable PDF Or Fill Online Tax Calculation For

https://data.templateroller.com/pdf_docs_html/2134/21340/2134078/form-sfn28724-schedule-nd-1nr-tax-calculation-for-nonresidents-and-part-year-residents-north-dakota_print_big.png

You can print other North Dakota tax forms here eFile your North Dakota tax return now eFiling is easier faster and safer than filling out paper tax forms File your North Dakota and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax North Dakota income tax withheld from wages and other payments Attach Forms W 2 and 1099 and ND Sch K 1 SF 26 27 Estimated tax paid on 2023 Forms ND 1ES and ND 1EXT plus an overpayment if any applied from your 2022 return S 27 AJ 28 28

Printable North Dakota Income Tax Form ND 1 Form ND 1 is the general income tax return for North Dakota residents ND 1 can be eFiled or a paper copy can be filed via mail For more information about the North Dakota Income Tax see the North Dakota Income Tax page For your convenience Tax Brackets provides printable copies of 45 current personal income tax forms from the North Dakota Office of State Tax Commissioner The current tax year is 2023 with tax returns due in April 2024 Most states will release updated tax forms between January and April Show entries Showing 1 to 25 of 27 entries Previous 1

More picture related to Printable North Dakota Tax Form

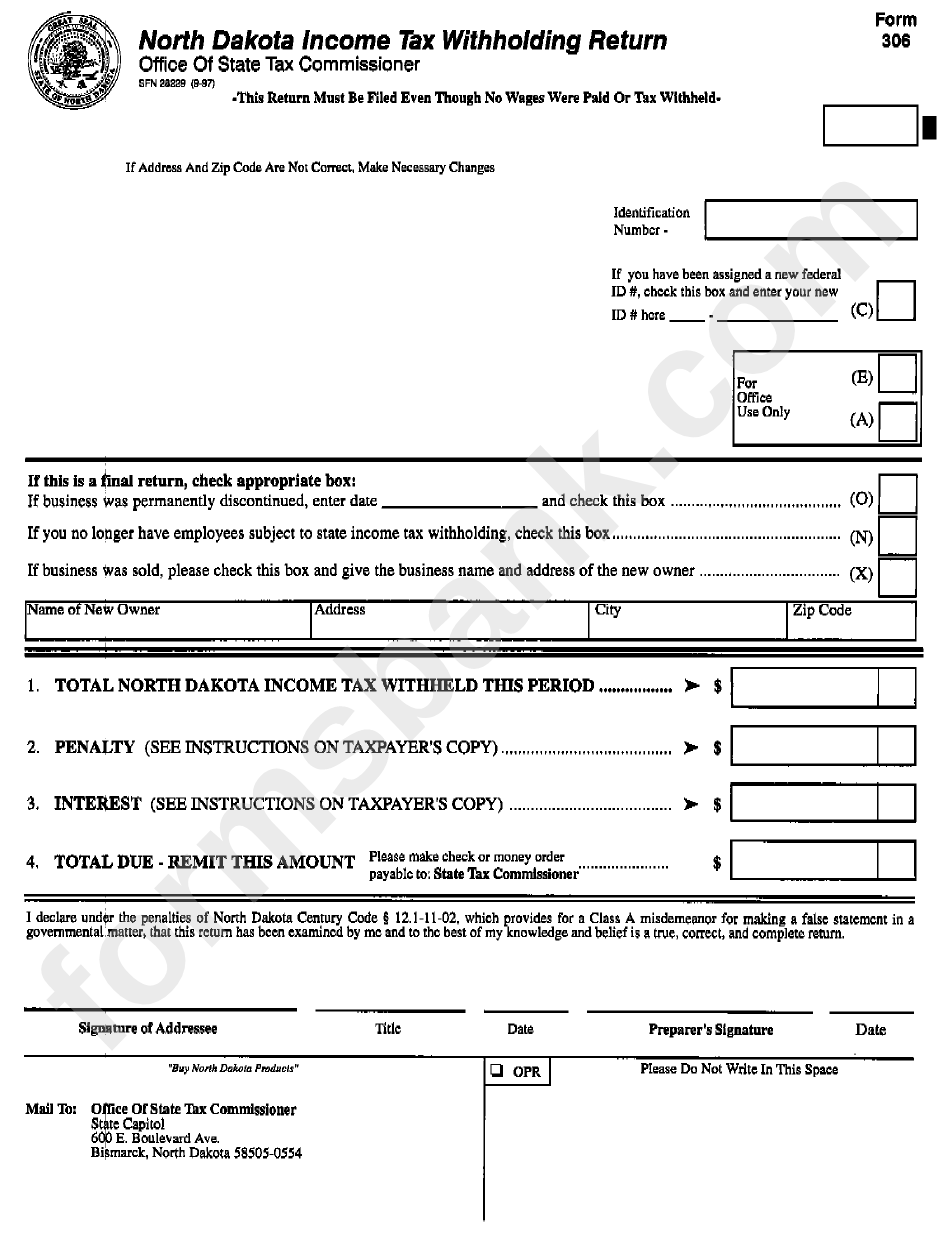

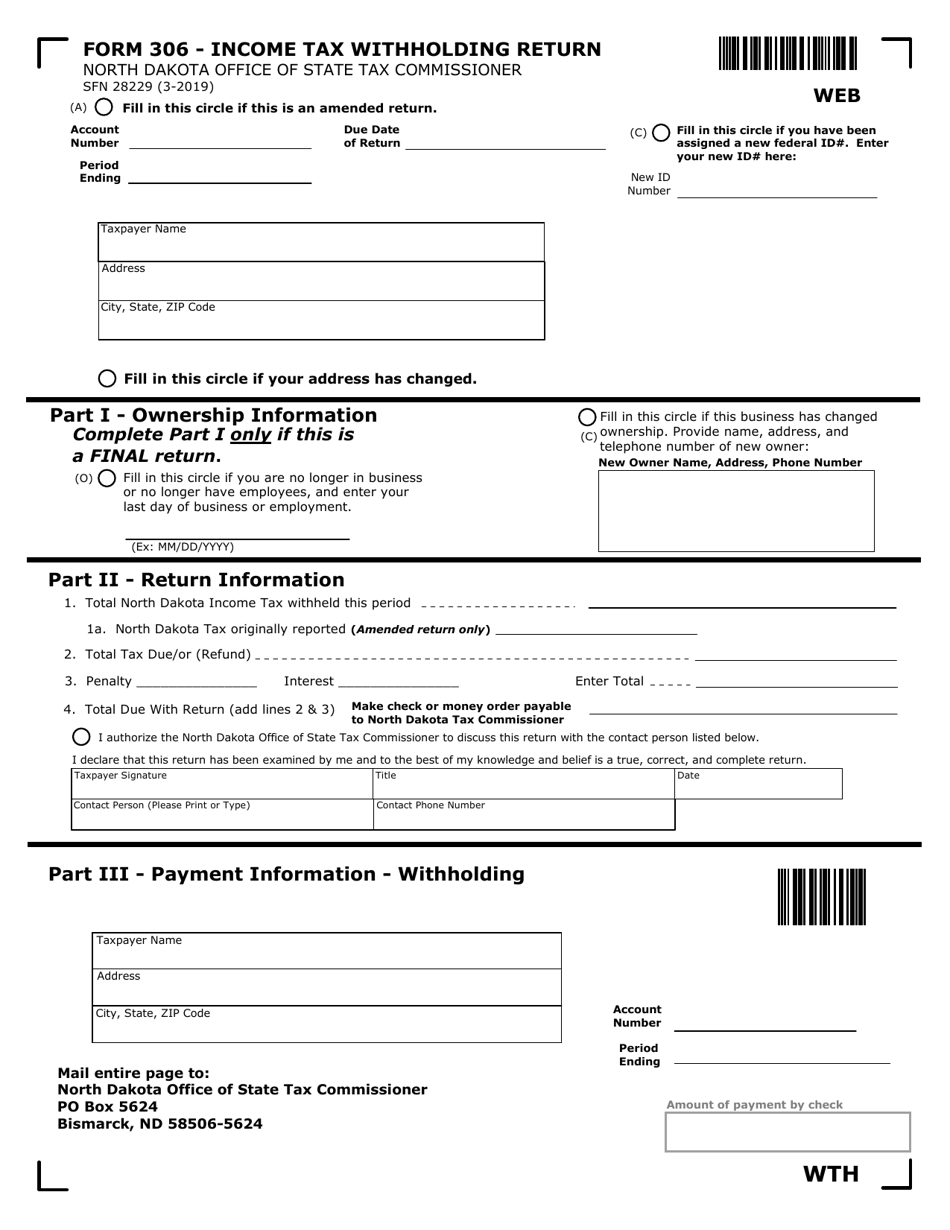

Form 306 North Dakota Income Tax Withholding Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/297/2971/297137/page_1_bg.png

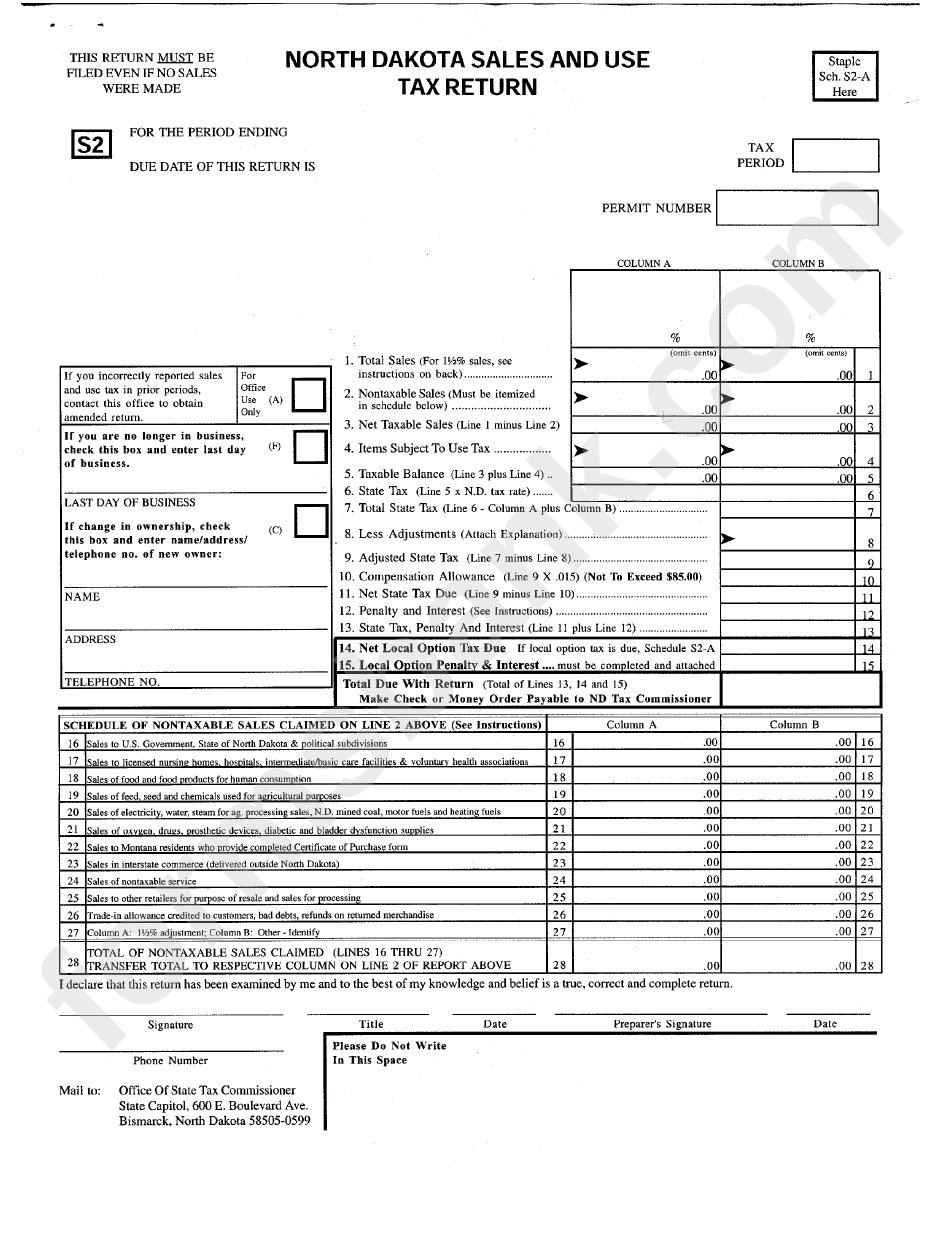

Form S2 North Dakota Sales And Use Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/271/2716/271604/page_1_bg.png

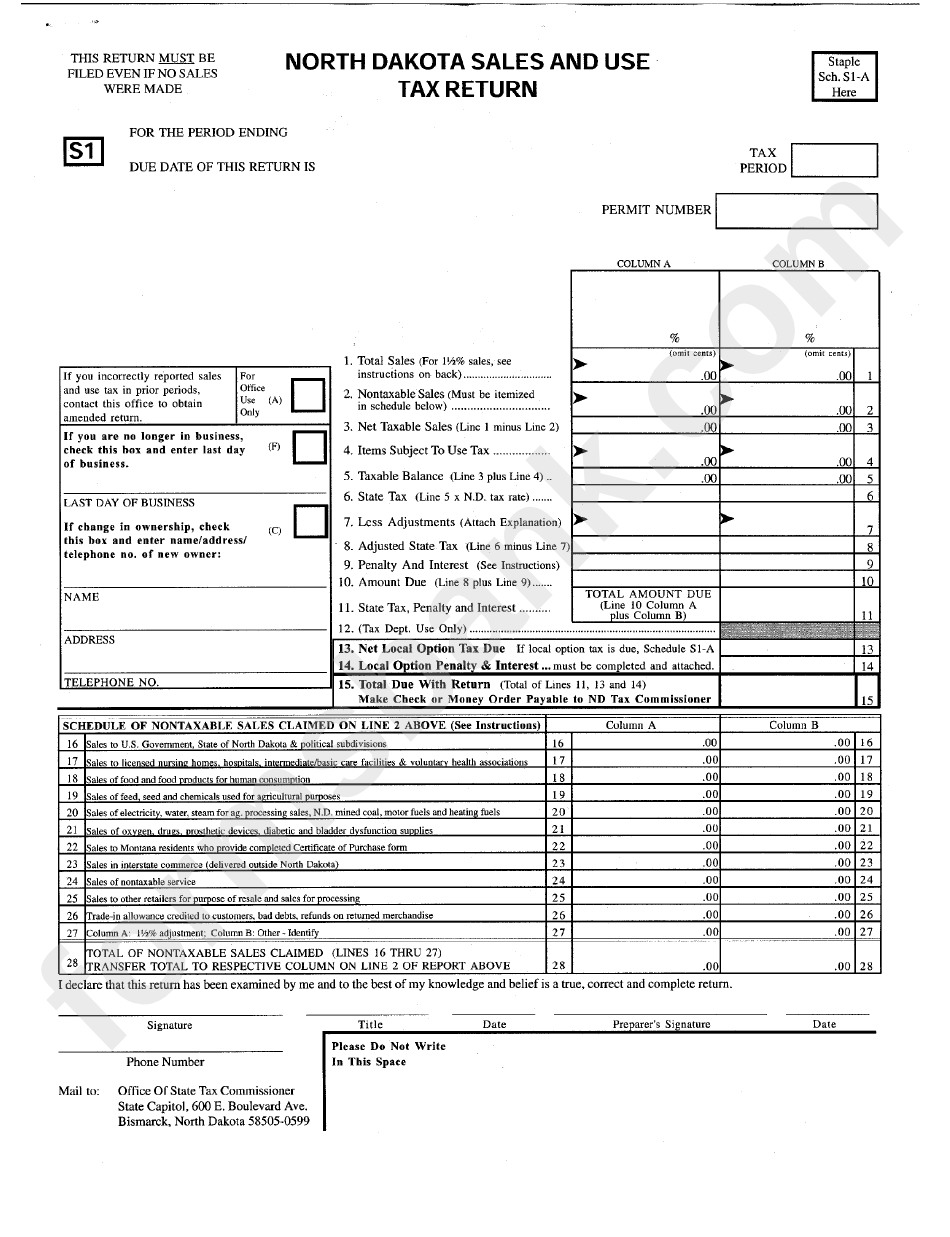

Schedule S1 A North Dakota Sales And Use Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/276/2766/276675/page_1_bg.png

This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the North Dakota government Other North Dakota Individual Income Tax Forms You can print other North Dakota tax forms here eFile your North Dakota tax return now eFiling is easier faster and safer than filling out paper tax forms File your North Dakota and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax

Form North Dakota Office of State Tax Commissioner WEB ST Sales Use and Gross Receipts Tax A Fill in this circle if this is an amended return Account Number Required Ex 999999 00 Due Date of Return Period Ending Required Ex MM DD YYYY Taxpayer Name Address City State ZIP Code Fill in this circle if your address has changed Do I Need to File Filing Amending Returns Tax Forms Estimated Payments Extensions Tax Exemptions Credits Income Tax Resources Need a Copy of a Return Other Tax Information Find A Form We Have Plenty Make a Payment Fast Easy Done Tax Deadlines Where s My Refund Check Your Refund Status

Corporate Income Tax Return North Dakota Free Download

https://www.formsbirds.com/formimg/corporate-income-tax/2572/corporate-income-tax-return-north-dakota-l6.png

Download North Dakota Form W 4 2013 For Free FormTemplate

https://cdn.formtemplate.org/images/600/north-dakota-form-w-4-2013-1.png

https://www.tax.nd.gov/sites/www/files/documents/forms/individual/2023-iit/form-nd-1-2023.pdf

Form ND 1 2023 If a fiscal year filer enter fiscal year end See instructions 1 a Federal adjusted gross income from Form 1040 or 1040 SR line 11 If zero enter zero b Federal taxable income from Form 1040 or 1040 SR line 15 If zero see instructions SX 1a SS 1b Additions Subtractions 5

https://www.incometaxpro.net/tax-forms/north-dakota.htm

Free printable and fillable 2023 North Dakota Form ND 1 and 2023 North Dakota Form ND 1 Instructions booklet in PDF format to fill in print and mail your state income tax return due April 15 2024 North Dakota state income tax Form ND 1 must be postmarked by April 15 2024 in order to avoid penalties and late fees

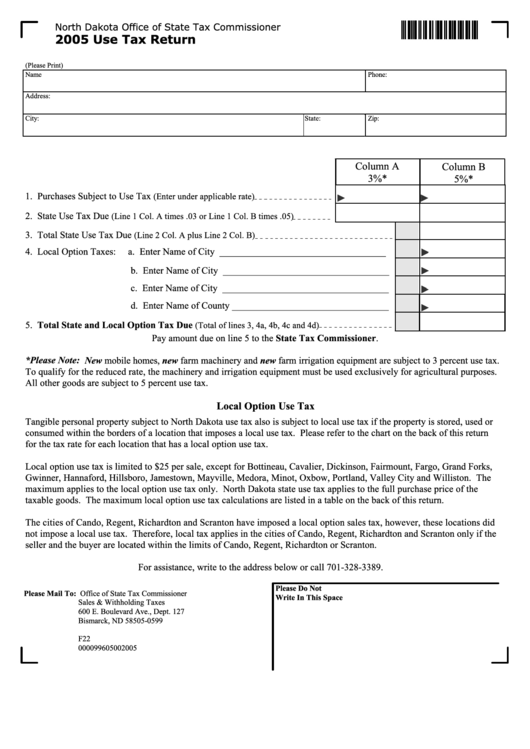

Fillable Use Tax Return North Dakota Office Of State Tax Commissioner 2005 Printable Pdf

Corporate Income Tax Return North Dakota Free Download

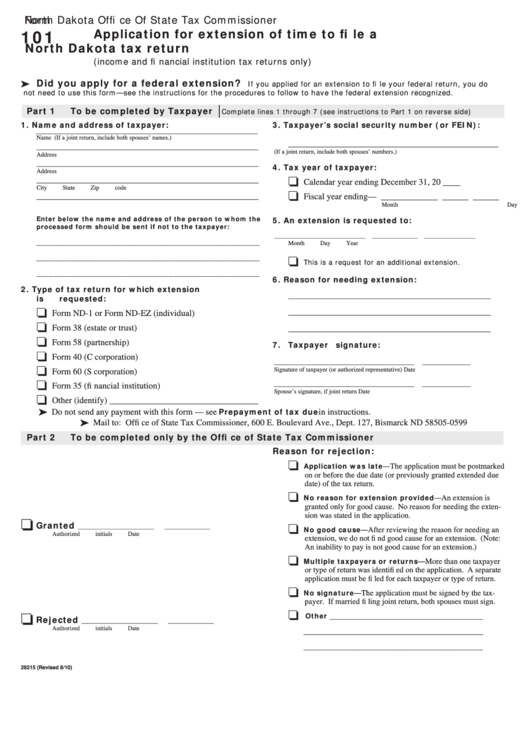

Fillable Form 101 Application For Extension Of Time To File A North Dakota Tax Return 2010

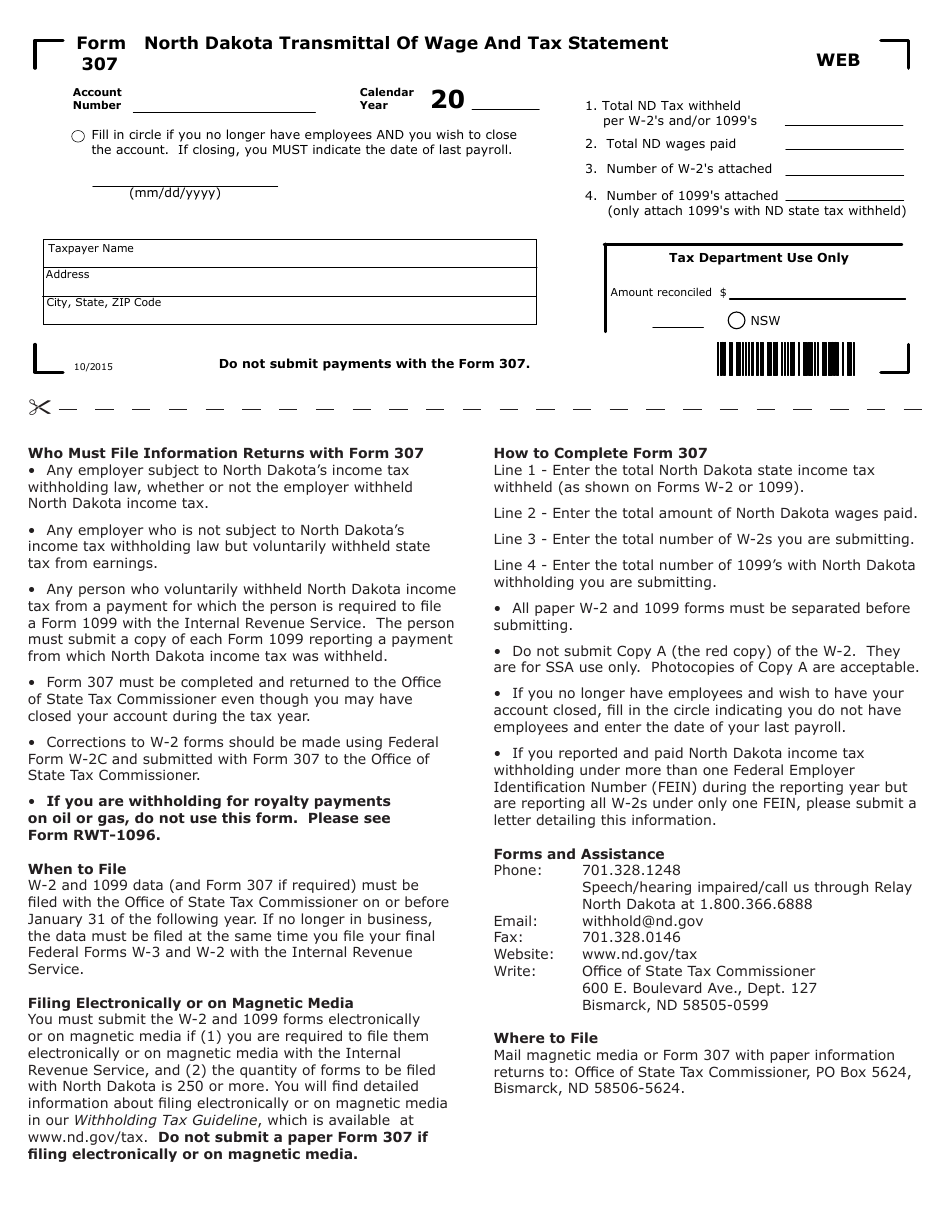

Form 307 Fill Out Sign Online And Download Fillable PDF North Dakota Templateroller

North Dakota Income Tax Form Fill Out And Sign Printable PDF Template SignNow

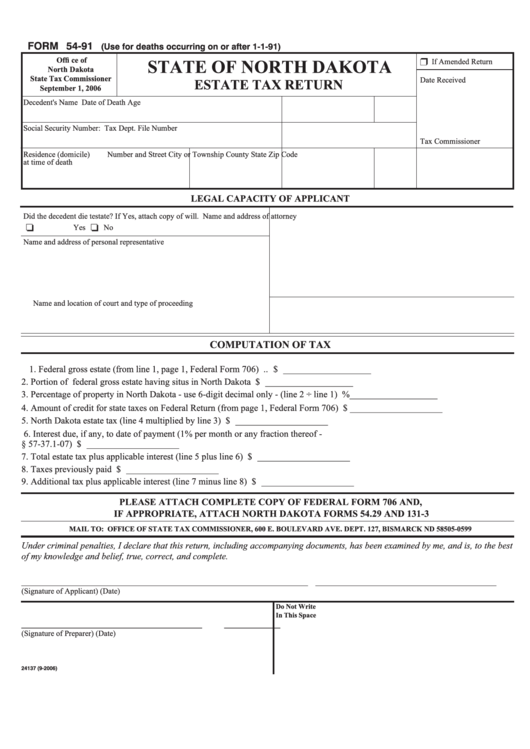

Fillable Form 54 91 Estate Tax Return State Of North Dakota Printable Pdf Download

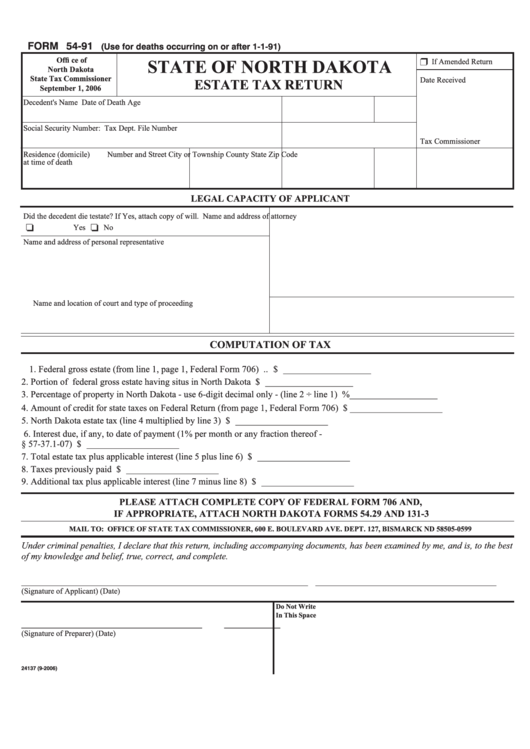

Fillable Form 54 91 Estate Tax Return State Of North Dakota Printable Pdf Download

Form 306 SFN28229 Fill Out Sign Online And Download Fillable PDF North Dakota Templateroller

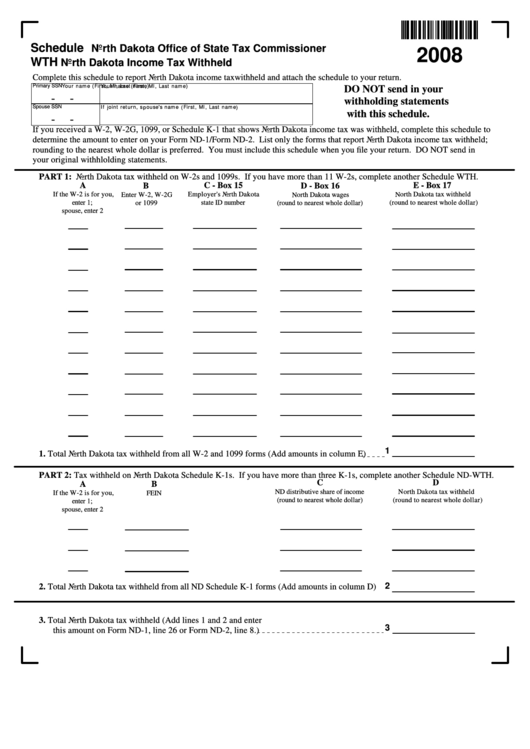

Schedule Wth North Dakota Income Tax Withheld Form North Dakota Office Of State Tax

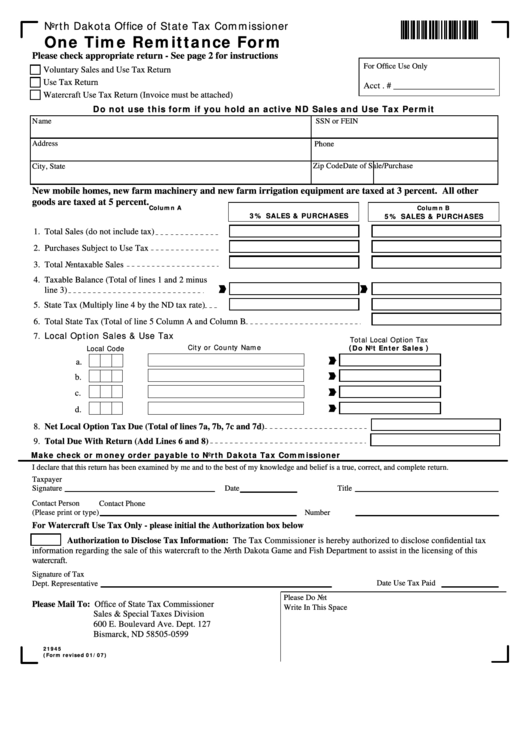

Fillable One Time Remittance Form North Dakota Office Of State Tax Commissioner 2007 Printable

Printable North Dakota Tax Form - You can print other North Dakota tax forms here eFile your North Dakota tax return now eFiling is easier faster and safer than filling out paper tax forms File your North Dakota and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for TaxFormFinder users File Now with TurboTax