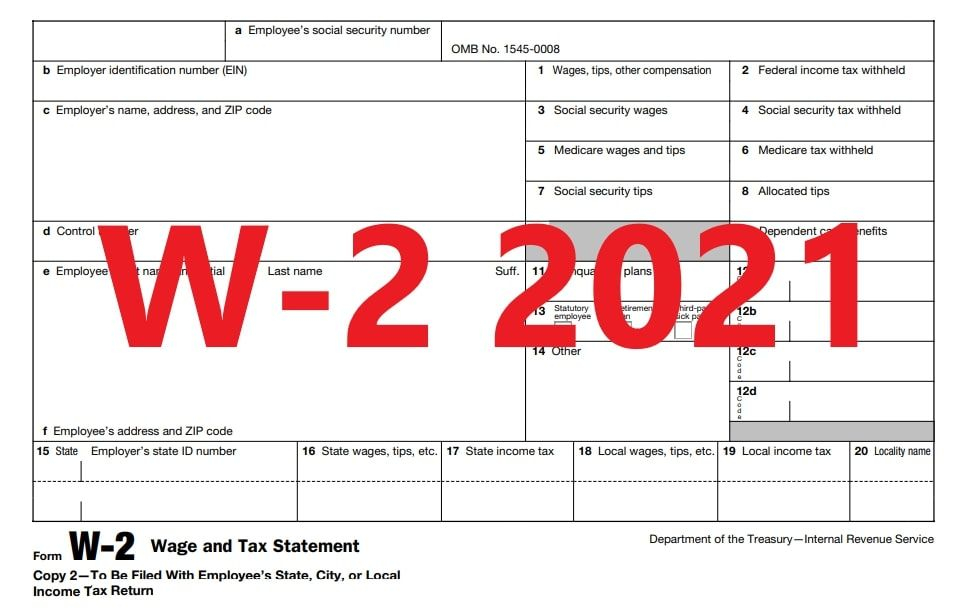

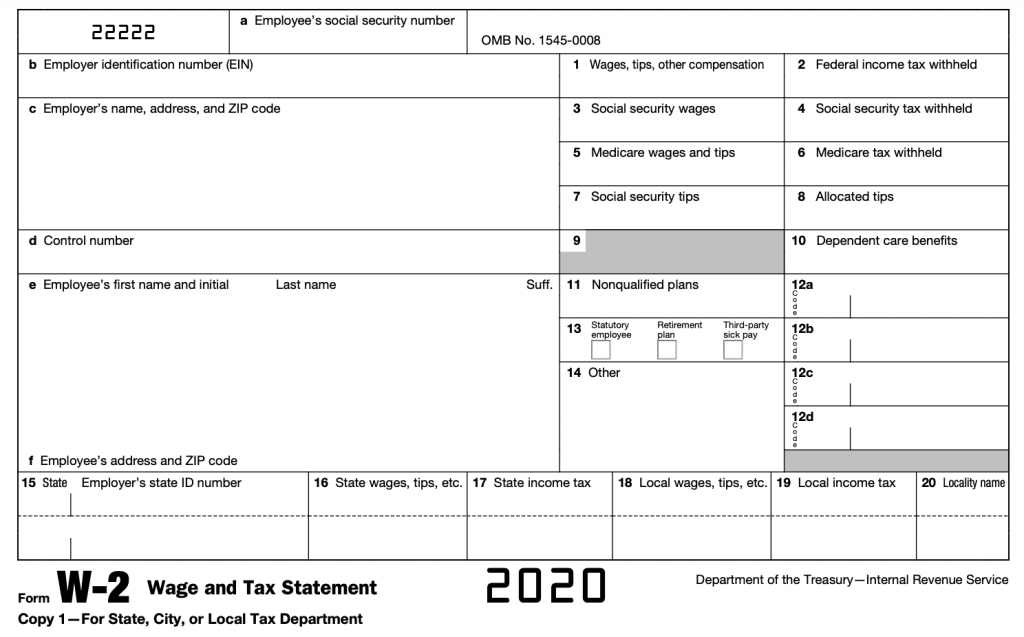

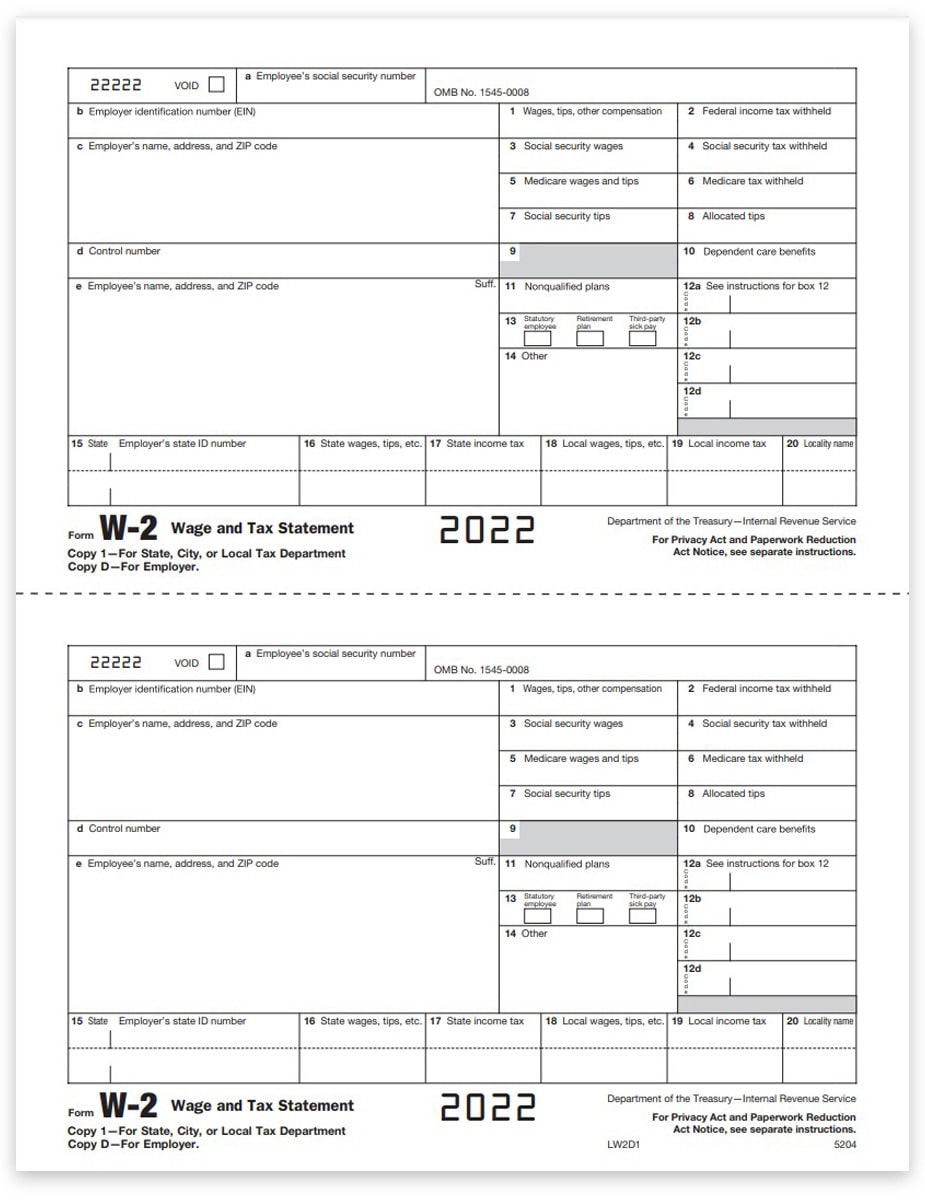

Printable Oregon State W2 Form The state of Oregon follows the Social Security Administration SSA guidelines for the filing of W 2 wage and tax statements with Oregon specific requirements for the RS and RV records OAR 150 316 0359

2024 Forms and Publications Important Download and save the form to your computer then open it in Adobe Reader to complete and print We don t recommend using your web browser to complete the form as problems may occur Cigarette Tobacco Combined Payroll Corporation Corporate Activity Tax Deferral Programs Electronic Services E911 988 What is iWire The iWire online portal is for employers and businesses to upload their W2 or 1099 information do not submit personal W2 or 1099s to iWire W 2s and 1099s Businesses and payroll service providers must submit all W 2s electronically using iWire Businesses that issue 1099s must also submit their information returns using iWire

Printable Oregon State W2 Form

Printable Oregon State W2 Form

https://formspal.com/data/LandingPageImages/Image/1/150/150872.JPEG

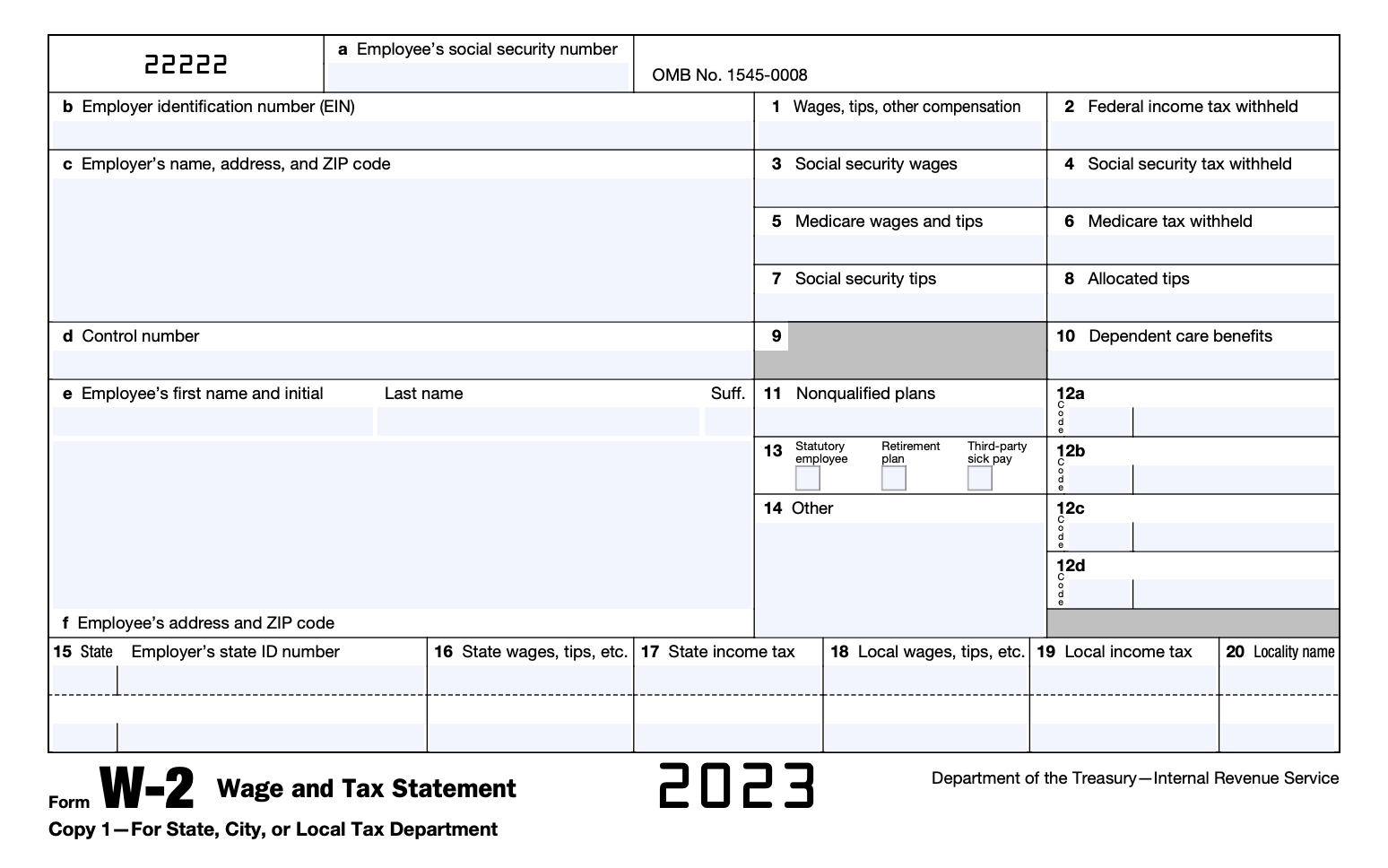

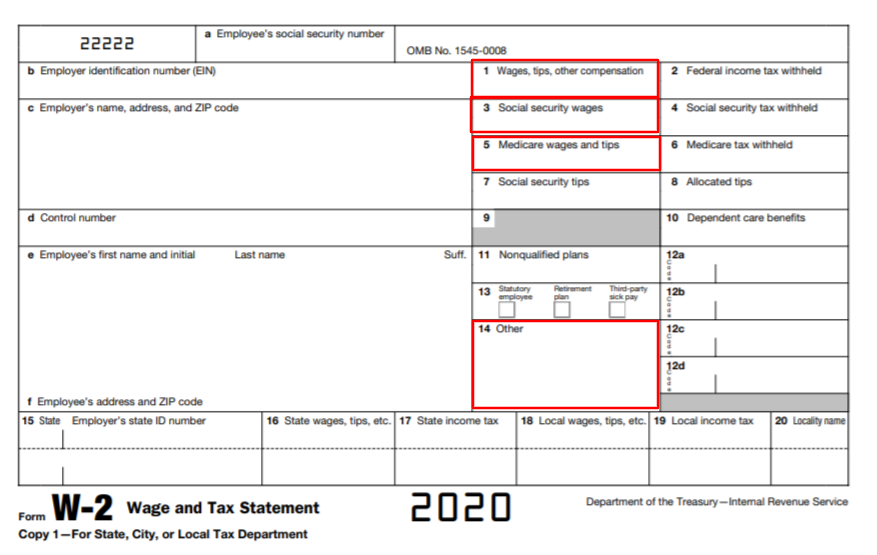

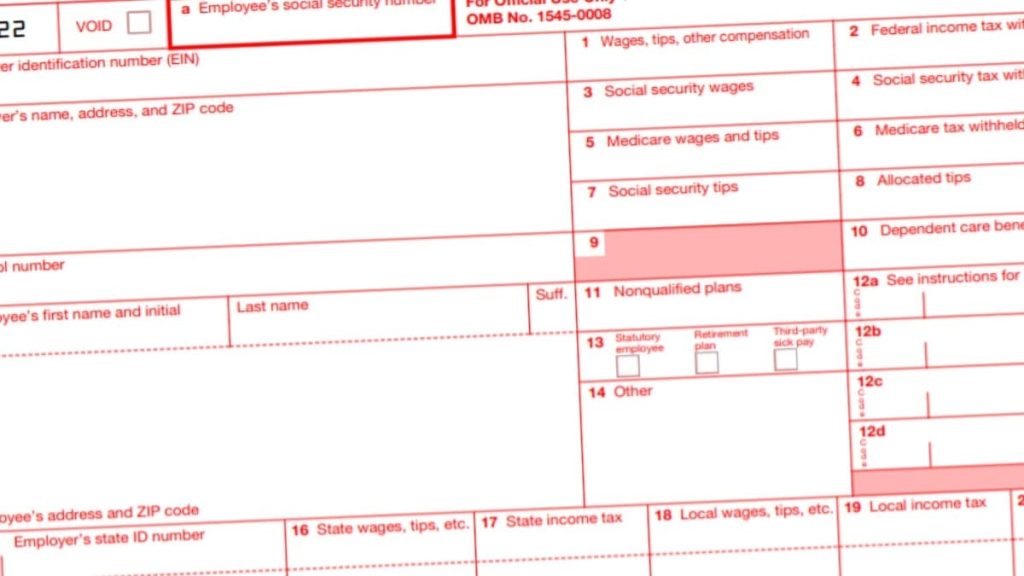

What Is Form W 2 An Employer s Guide To The W 2 Tax Form Gusto

https://gusto.com/wp-content/uploads/2019/12/Form-W-2-Box-12.jpg

How To Fill Out A W 2 Form Everything Else Employers Need To Know

https://fitsmallbusiness.com/wp-content/uploads/2022/07/Screenshot_of_W2_Form_2022.jpg

Oregon income tax withholding refers to the amount of Oregon personal income taxes that are withheld from the employees paychecks to cover the anticipated Oregon tax liability for the year Due dates Oregon withholding taxes are due the same time as your federal taxes W 2 File Specifications The state of Oregon follows the Social Security Administration SSA guidelines for the filing of W 2 wage and tax statements with Oregon specific requirements for the RS and RV records OAR 150 316 0359

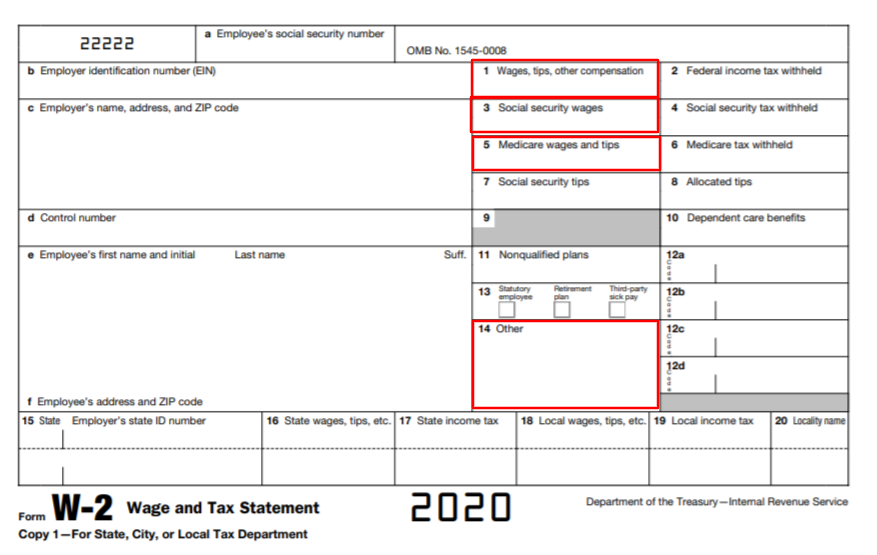

They will order a corrected W 2 Box 4 Social Security tax withheld Box 3 times 6 2 for 2021 The State paid an additional 6 2 to your account for 2021 Box b The State of Oregon Employer Identification Number EIN Box 5 The amount of your wage that was subject to the Medicare tax There is no maximum wage base for this tax What The W2 is a summary of Taxable Wages Paid Taxes Withheld and certain benefits provided during a calendar year Who Any OSU employee paid through Payroll during the calendar year When W2s are required to be in the mail to employees by January 31st

More picture related to Printable Oregon State W2 Form

Form W2 Everything You Ever Wanted To Know

https://i0.wp.com/blog.checkmark.com/wp-content/uploads/2016/12/Form-W2.jpg?fit=840%2C567&ssl=1

Printable W2 Forms

https://www.signnow.com/preview/6/962/6962046/large.png

Printable Form W 2

https://jumbotron-production-f.squarecdn.com/assets/5771c3f67ecf46fe6b42.jpg

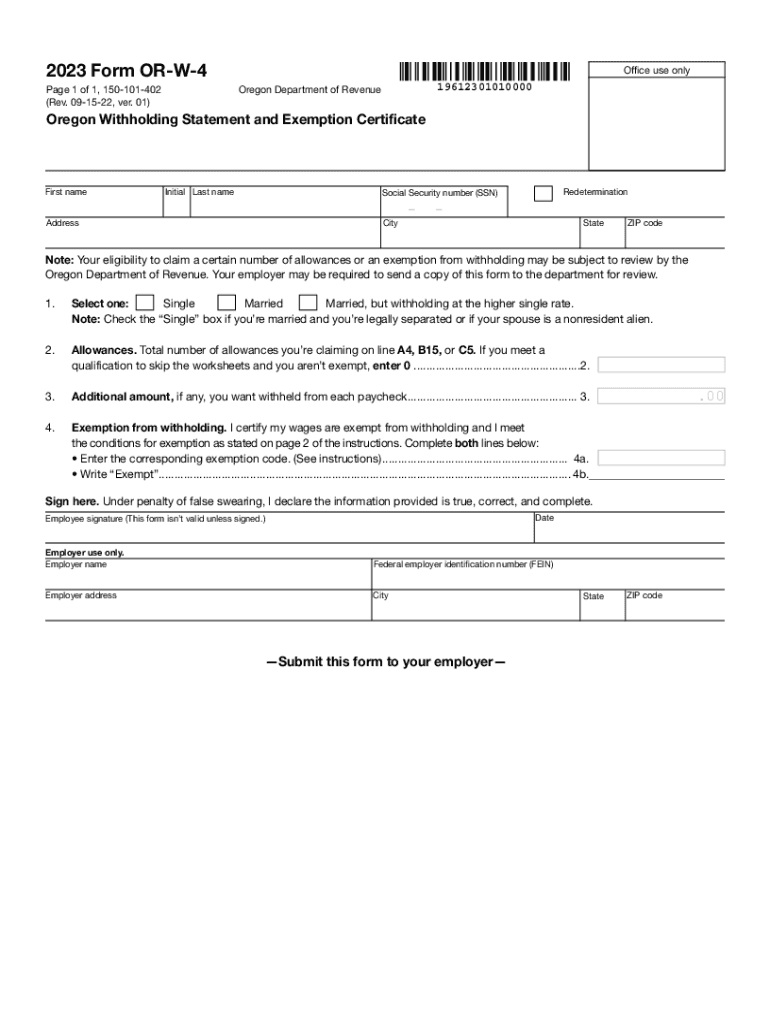

Federal form no longer calculates Oregon withholding correctly Form s W 4 that are submitted to your employer after January 1 2020 can t be used to calculate Oregon with holding Instead use Form OR W 4 to help you calculate allowances for Oregon income tax withholding Form OR W 4 is designed to estimate the amount of tax you ll need 2022 Form OR W 4 Oregon Withholding Statement and Exemption Certificate Office use only Page 1 of 1 150 101 402 Rev 09 30 21 ver 01 Employer s address City City State State ZIP code ZIP code Note Your eligibility to claim a certain number of allowances or an exemption from withholding may be subject to review by the Oregon

The worksheets in these instructions are designed to help you estimate the amount of Oregon tax your employer should withhold from your pay For a more accurate esti mate use the Oregon Withholding Calculator at www oregon gov dor before you complete Form OR W 4 Pension and annuity withholding W2 tax statements are available online for the prior tax year starting in early February Non Resident Alien s do not have a W2 available on line If you are a NRA and need a duplicate copy you can request that from the central payroll office at paymaster oregonstate edu Step one Navigate to myosu oregonstate edu

Printable Form W 2 Copy A Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2020/11/Form-w-2-with-boxes-circled.png

Printable W 2 Form 2021 Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/03/w-2-form-2021.jpg

https://www.oregon.gov/dor/programs/businesses/Pages/w-2-file-specifications.aspx

The state of Oregon follows the Social Security Administration SSA guidelines for the filing of W 2 wage and tax statements with Oregon specific requirements for the RS and RV records OAR 150 316 0359

https://www.oregon.gov/dor/forms/Pages/2024.aspx

2024 Forms and Publications Important Download and save the form to your computer then open it in Adobe Reader to complete and print We don t recommend using your web browser to complete the form as problems may occur Cigarette Tobacco Combined Payroll Corporation Corporate Activity Tax Deferral Programs Electronic Services E911 988

What Is A W2 Form Wage And Tax Statement Guide

Printable Form W 2 Copy A Printable Forms Free Online

Printable W2 Forms

W2 Tax Forms Copy D 1 For Employer State File DiscountTaxForms

Oregon Small Businesses Struggling To File W 2s Electronically Get More Time From State

How To Print W2 Forms On White Paper

How To Print W2 Forms On White Paper

Printable W2 Form For New Employee

W2 Form 2022 Fillable Form 2023

Oregon W 4 2023 2024 Form Fill Out And Sign Printable PDF Template SignNow

Printable Oregon State W2 Form - Oregon State W 2 Filing Requirements The Form W 2 Wage and Tax Statement should be filed with the State of Oregon for 2023 Tax Year The State of Oregon also mandates the filing of Form OR WR Oregon Annual Withholding Tax Reconciliation Report for 2023 January 31 2024 TaxBandits is here to help you with both Federal and State filing of