Printable Puerto Rico Income Tax Forms INCOME TAX RETURN 2020 INFORMATION FOR PUERTO RICO FILE YOUR RETURN BEFORE MAY 17 2021 whose gross income from Puerto Rico sources for the taxable year net of and Total of W 2 Forms with this return under a qualified physician decree respectively In Part 1 line 2K a space is provided to indicate the total gross

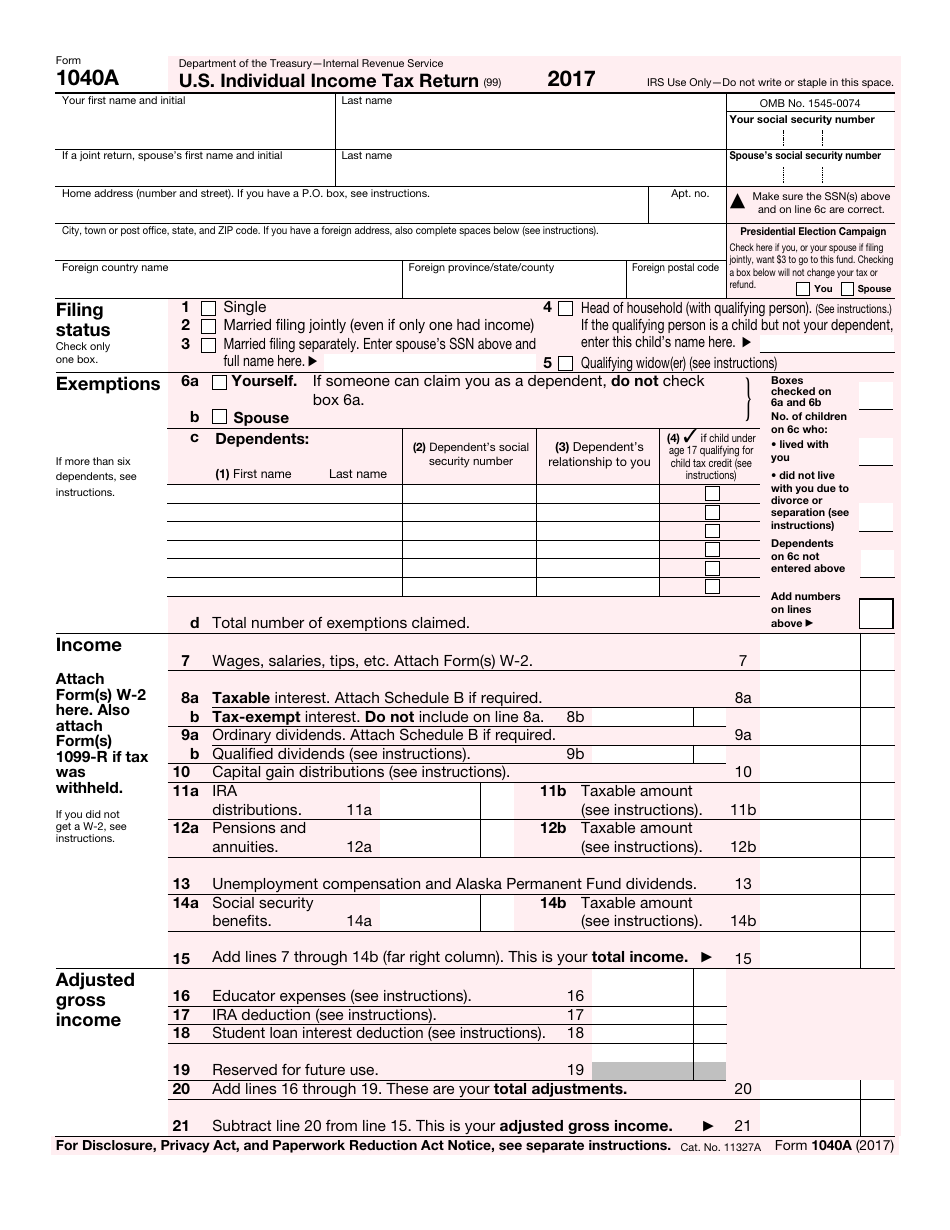

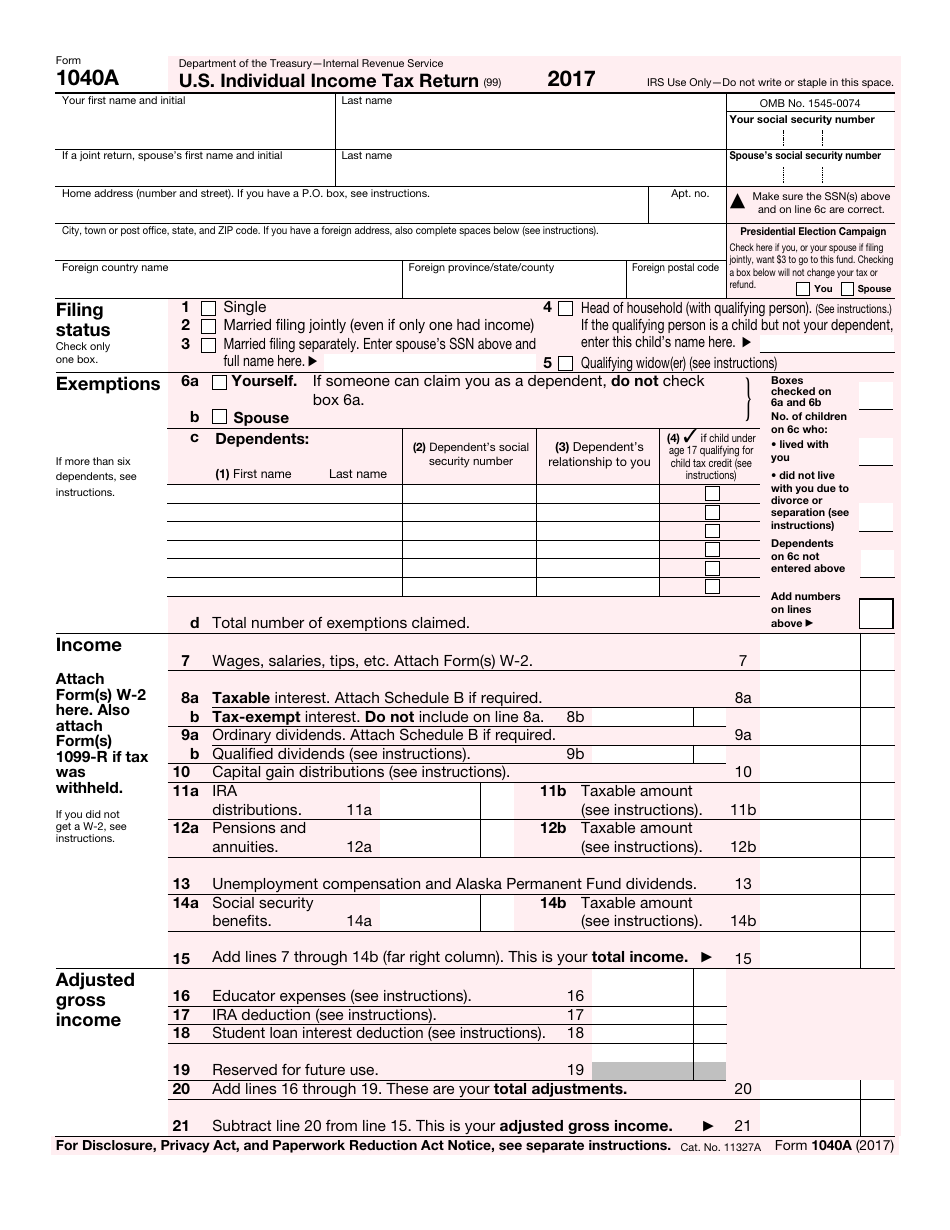

However if you need to complete a federal income tax return you can do this on eFile but you need to print it sign it and mail it to the IRS since the IRS does not accept e filed returns with Puerto Rico and other U S Territory Protectorate addresses Form 1040 PR is for residents of the Commonwealth of Puerto Rico PR who are not required to file a United States US Form 1040 Form 1040A or Form 1040EZ income tax return Form 1040 PR is generally used to report and pay self employment income tax to the US

Printable Puerto Rico Income Tax Forms

Printable Puerto Rico Income Tax Forms

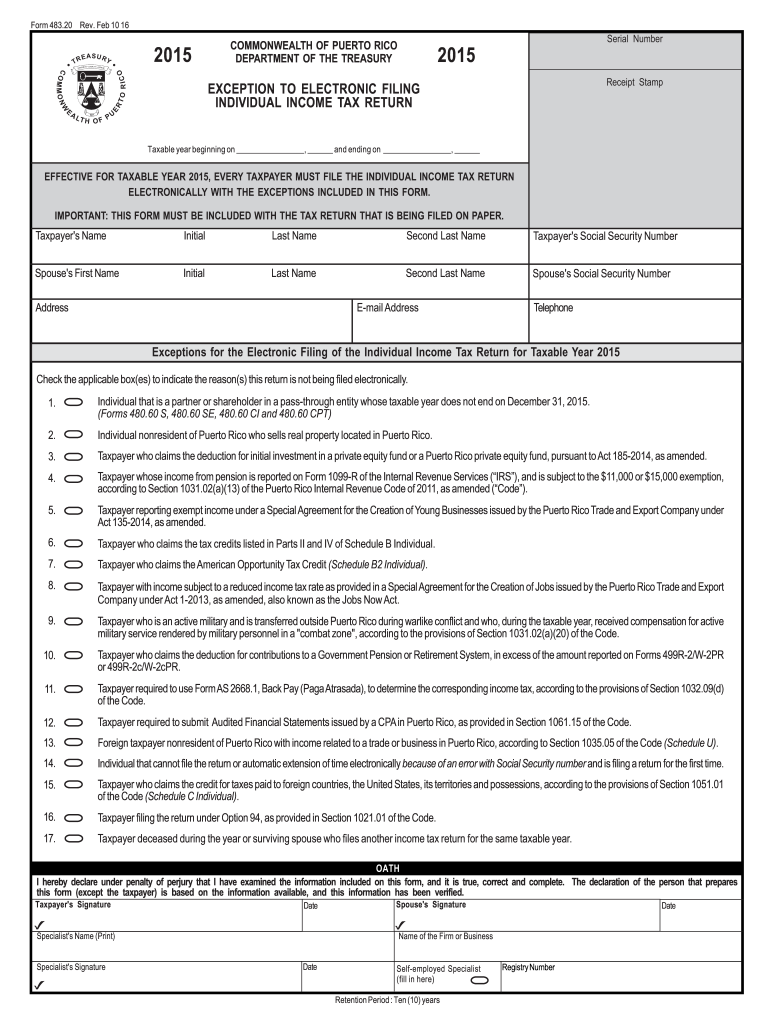

https://www.pdffiller.com/preview/100/108/100108534/large.png

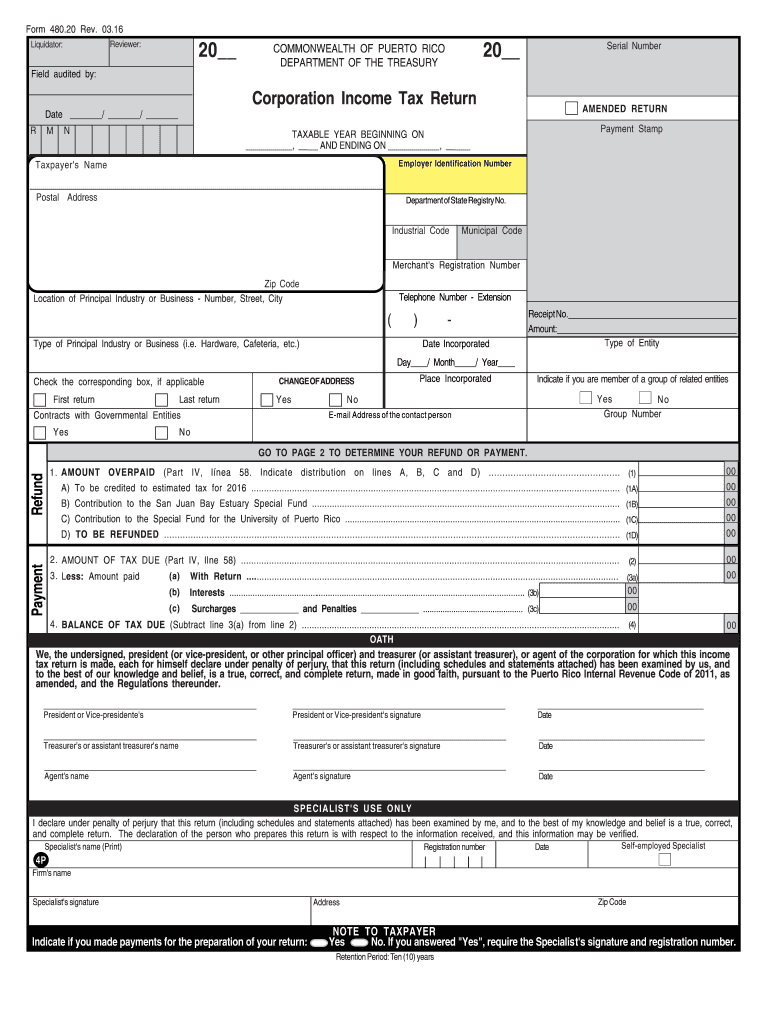

Form 48020 Puerto Rico Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/951/100951343/large.png

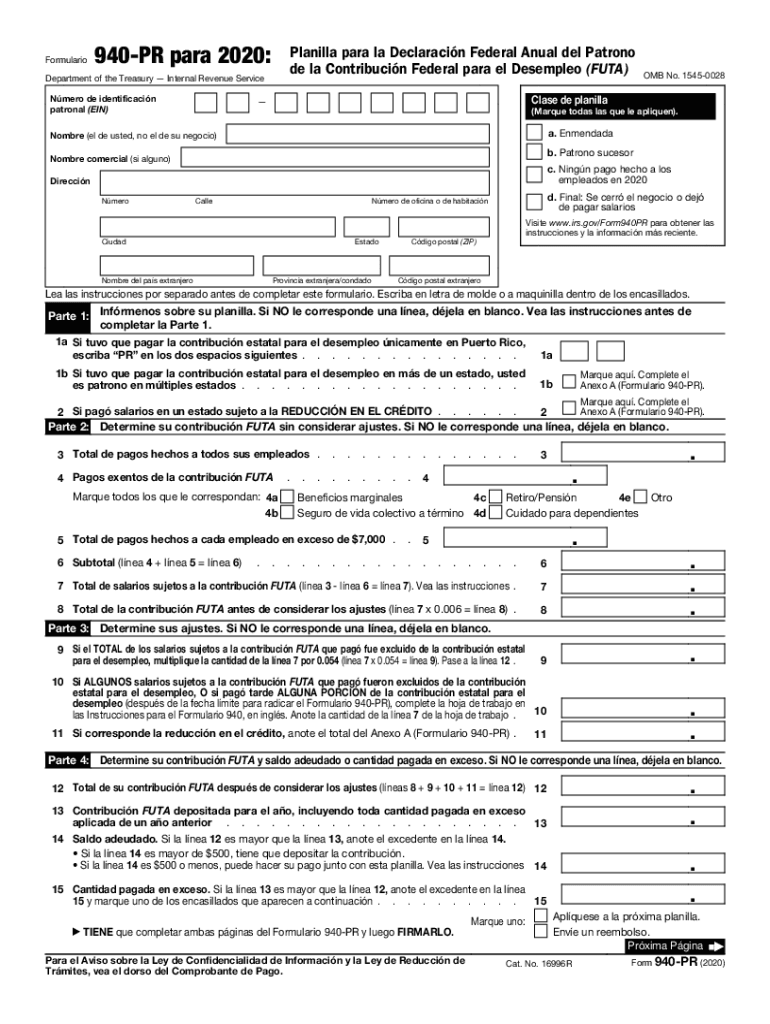

940 Pr Form 2020 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/537/592/537592093/large.png

TAX 1 Tax Table 2 Preferential rates Schedule A2 Individual 3 Nonresident alien 4 Form AS 2668 1 5 Optional Tax Schedule X Individual Gradual Adjustment Amount Determine adjustment if the amount indicated on line 13 or Schedule A2 Ind line 11 is more than 500 000 Schedule P Ind line 7 GOVERNMENT OF PUERTO RICO DEPARTMENT OF THE TREASURY 4 Form AS 2668 1 5 Optional Tax Schedule X Individual Gradual Adjustment Amount Determine adjustment if the amount indicated on line 13 or Schedule A2 Ind line 11 is more than 500 000 Schedule P Ind line 7 Income Tax Withheld 1 Wages Commissions Allowances and Tips

Download Forma Corta PDF Puerto Rico Individual Income Tax Return Updated 11 0001 Printable Puerto Rico Income Tax Forma Corta Forma Corta is the general income tax form for Puerto Rico residents For more information about the Puerto Rico Income Tax see the Puerto Rico Income Tax page Department of the Treasury Internal Revenue Service Para el a o correspondiente del 1 de enero al 31 de diciembre de 2022 o cualquier otro a o tributario comenzando el de 2022 y terminando el de 20 Visite www irs gov Form1040PR para obtener las instrucciones y la informaci n m s reciente OMB No 1545 0074

More picture related to Printable Puerto Rico Income Tax Forms

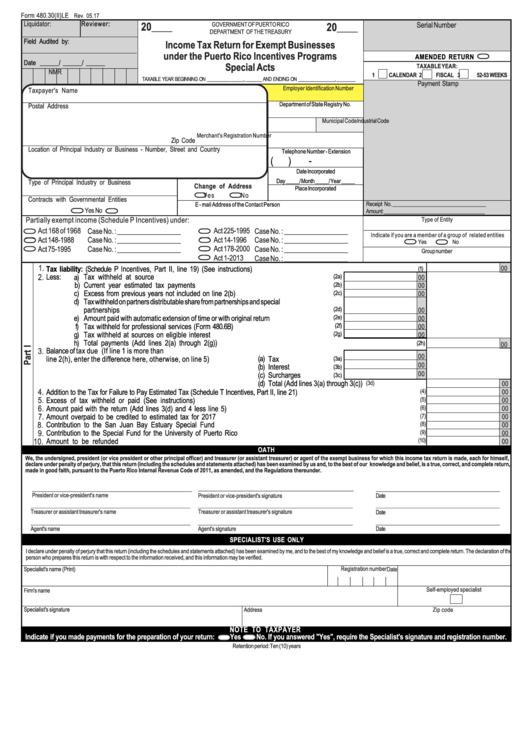

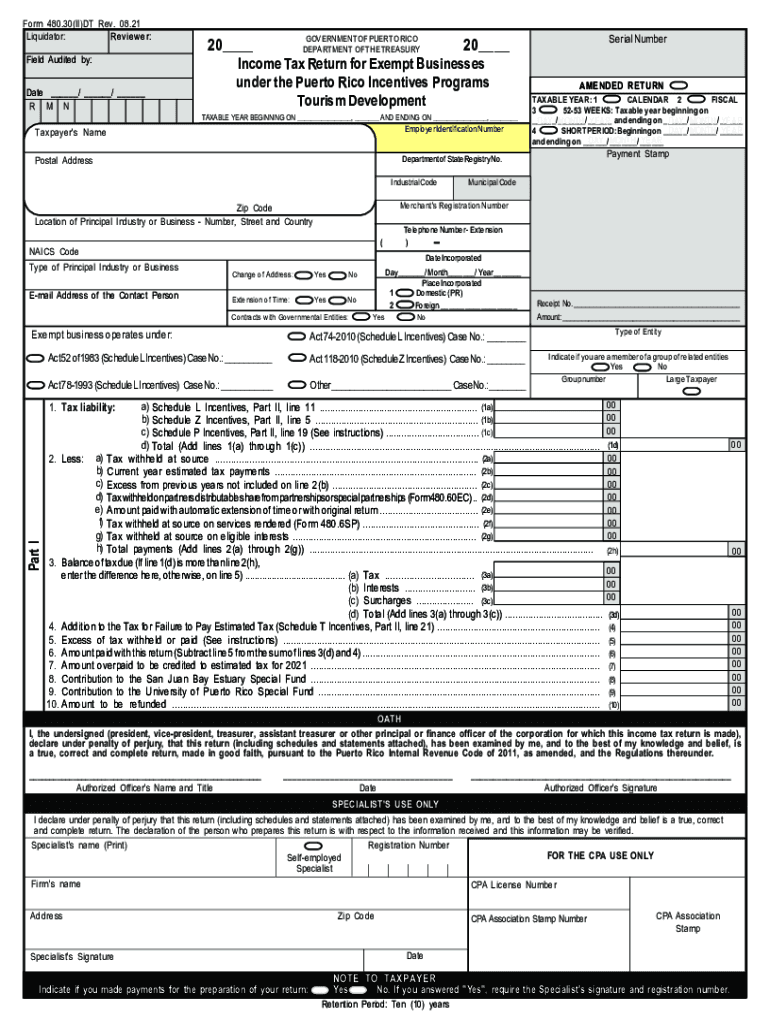

Form 480 30 Ii le Income Tax Return For Exempt Businesses Under The Puerto Rico Incentives

https://data.formsbank.com/pdf_docs_html/213/2139/213930/page_1_thumb_big.png

Income Tax Forms Puerto Rico Income Tax Forms

http://www.formsbirds.com/formimg/corporate-income-tax/2572/corporate-income-tax-return-north-dakota-d1.png

2006 Form PR AS 2916 1 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/40/100040028/large.png

For tax years after 31 December 2018 the obligation to file a Puerto Rico income tax return will be triggered when gross income minus the exemptions allowed under the Code is more than USD 0 unless the total income tax was withheld at source Taxpayers are also required to file a tax return if the net income subject to ABT is USD 25 000 or more For tax years after 31 December 2019 an individual s total tax will be 95 of one s total tax determined regular tax plus gradual adjustment if gross income exceeds USD 100 000 If gross income is USD 100 000 or less then the individuals total tax will be 92 of one s total tax determined

Government of Puerto Rico Department of the Treasury WITHHOLDING EXEMPTION CERTIFICATE Form 499 R 4 1 Rev Aug 9 11 Employee s social security number Spouse s social security number PERSONAL EXEMPTIONHalf None more withholding There are varying personal tax rates that Puerto Rican residents must pay 7 percent for earnings of 9 001 25 000 14 percent plus 1 120 for earnings of 25 001 41 500 25 percent plus 3 430 for earnings of 41 501 61 500 33 percent plus 8 430 for earnings of 60 501 and up

480 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/589/170/589170280/large.png

Puerto Rico Tax Forms Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/210/260/210260181/large.png

https://hacienda.pr.gov/sites/default/files/inst_individuals_2020.pdf

INCOME TAX RETURN 2020 INFORMATION FOR PUERTO RICO FILE YOUR RETURN BEFORE MAY 17 2021 whose gross income from Puerto Rico sources for the taxable year net of and Total of W 2 Forms with this return under a qualified physician decree respectively In Part 1 line 2K a space is provided to indicate the total gross

https://www.efile.com/state-tax/puerto-rico-state-tax/puerto-rico-state-tax/

However if you need to complete a federal income tax return you can do this on eFile but you need to print it sign it and mail it to the IRS since the IRS does not accept e filed returns with Puerto Rico and other U S Territory Protectorate addresses

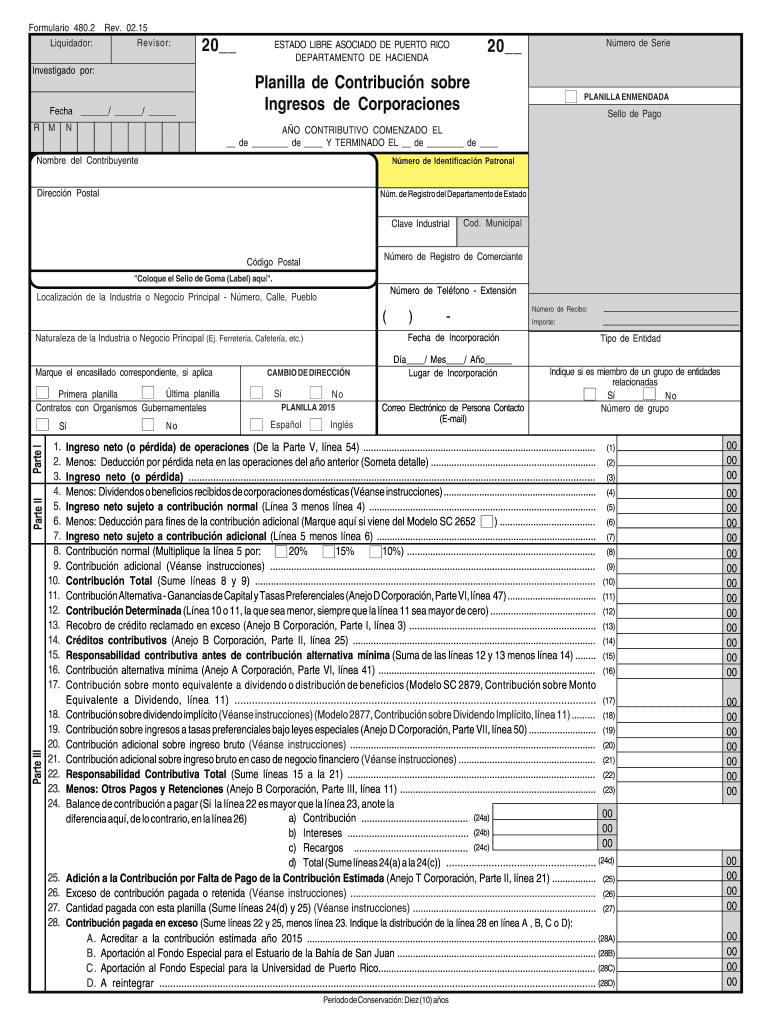

Puerto Rico 480 2 Form Fill Out And Sign Printable PDF Template SignNow

480 Form Fill Out And Sign Printable PDF Template SignNow

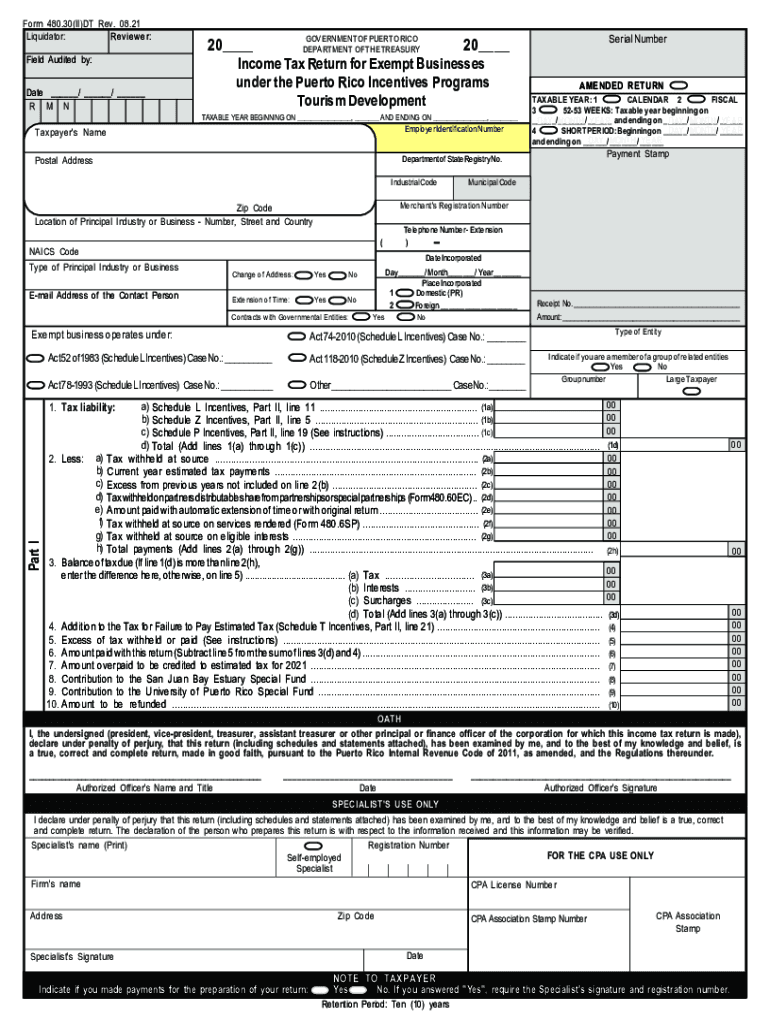

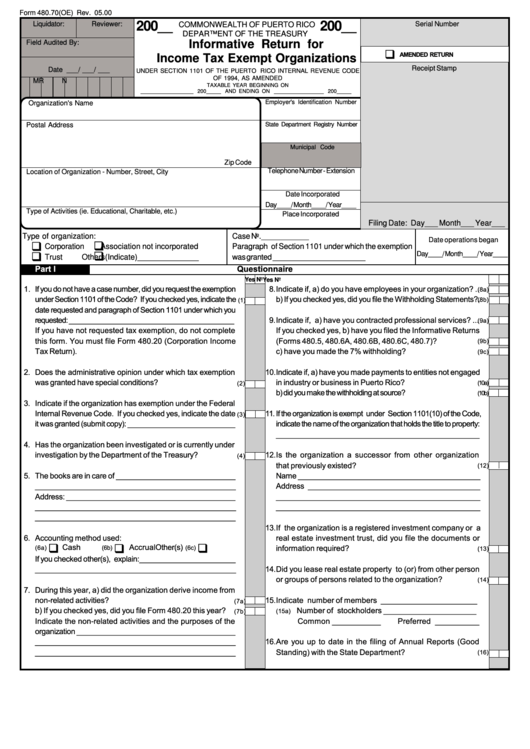

Form 480 70 Oe Informative Return For Income Tax Exempt Organizations Puerto Rico

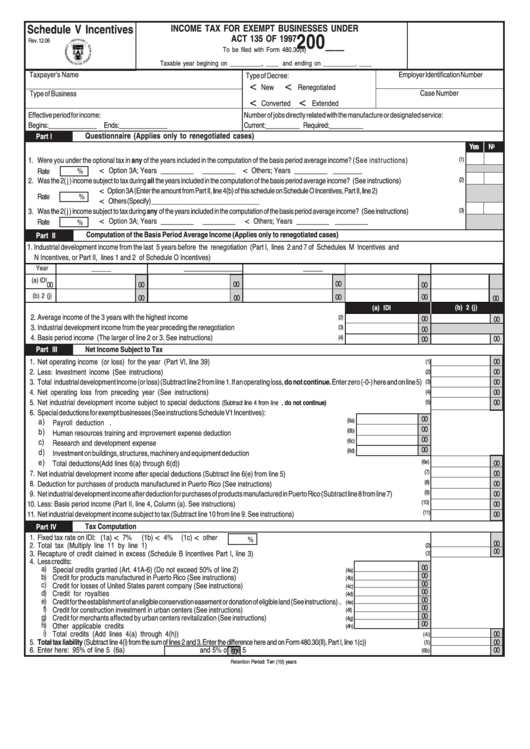

Schedule V Incentives Income Tax Form For Exempt Businesses Under Act 135 Of 1997 Puerto

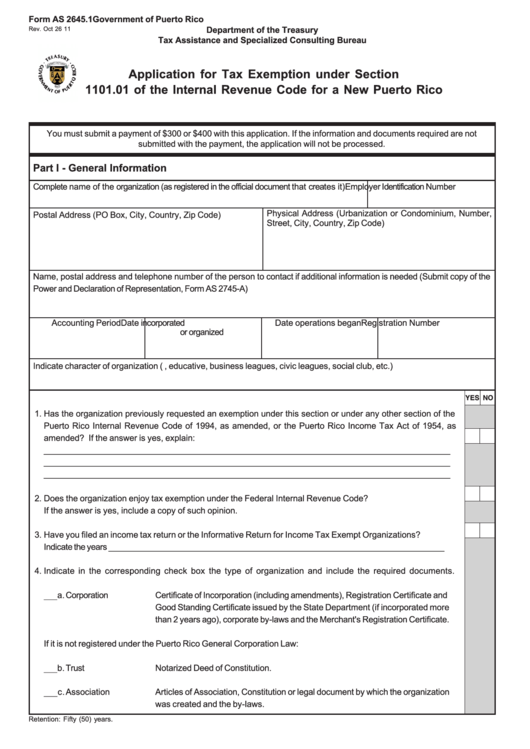

Form As 2645 1 Application For Tax Exemption Under Section 1101 01 Of The Internal Revenue

Printable Income Tax Forms

Printable Income Tax Forms

Puerto Rico Tax Return Form 482 Fill Online Printable Fillable Blank Form 1040 pr

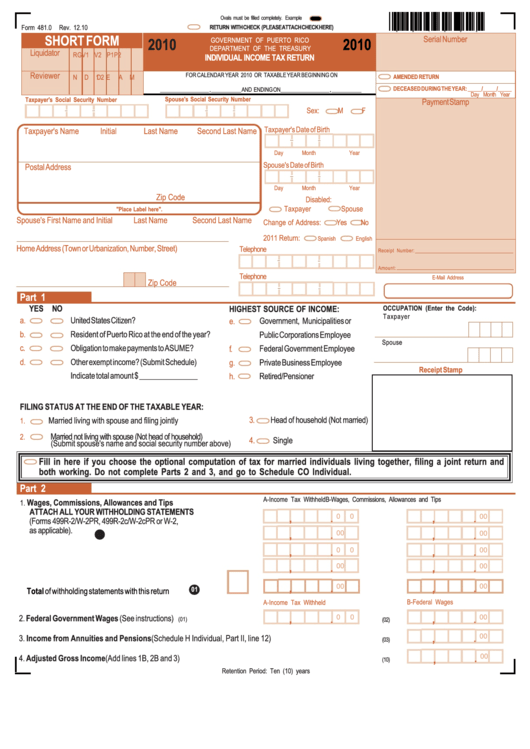

Form 481 0 Individual Income Tax Return Department Of Treasury Of Puerto Rico 2010

2018 2024 Con Los Campos En Blanco PR 480 2 El Formulario Se Puede Rellenar En L nea Imprimir

Printable Puerto Rico Income Tax Forms - Download Forma Corta PDF Puerto Rico Individual Income Tax Return Updated 11 0001 Printable Puerto Rico Income Tax Forma Corta Forma Corta is the general income tax form for Puerto Rico residents For more information about the Puerto Rico Income Tax see the Puerto Rico Income Tax page