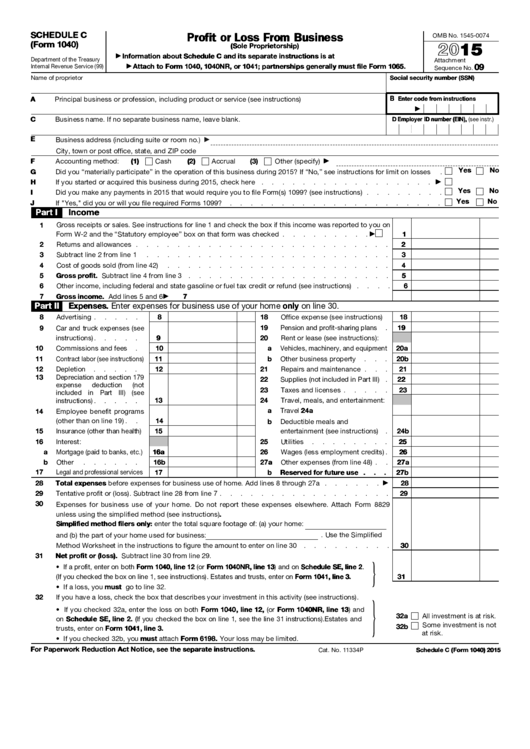

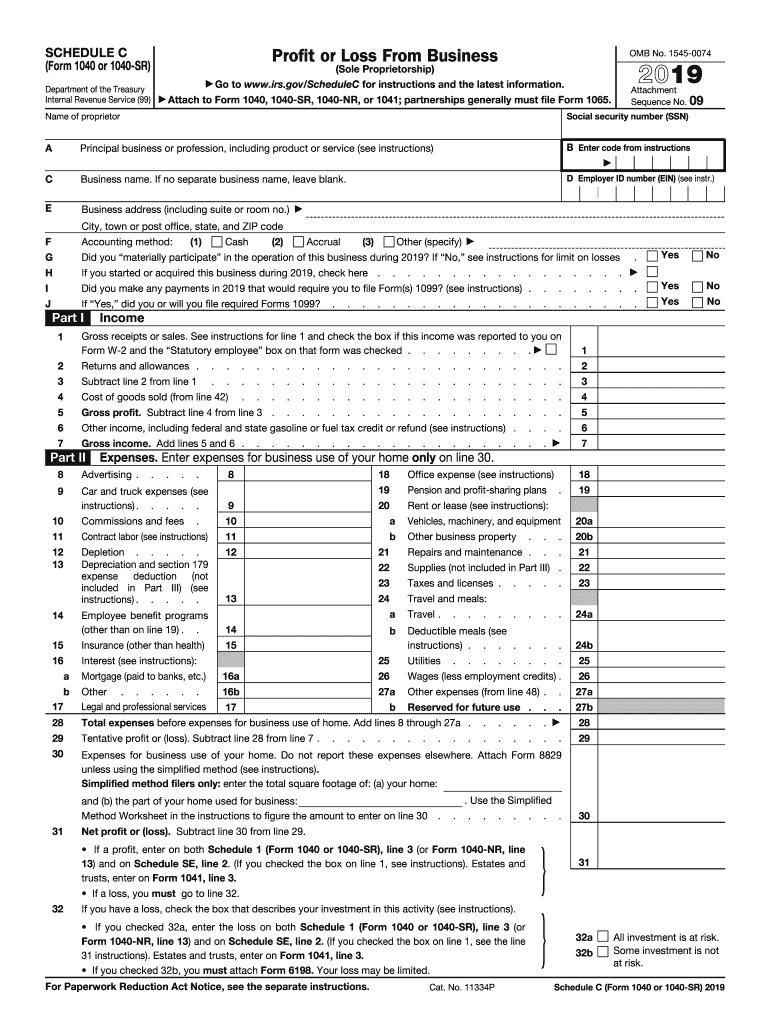

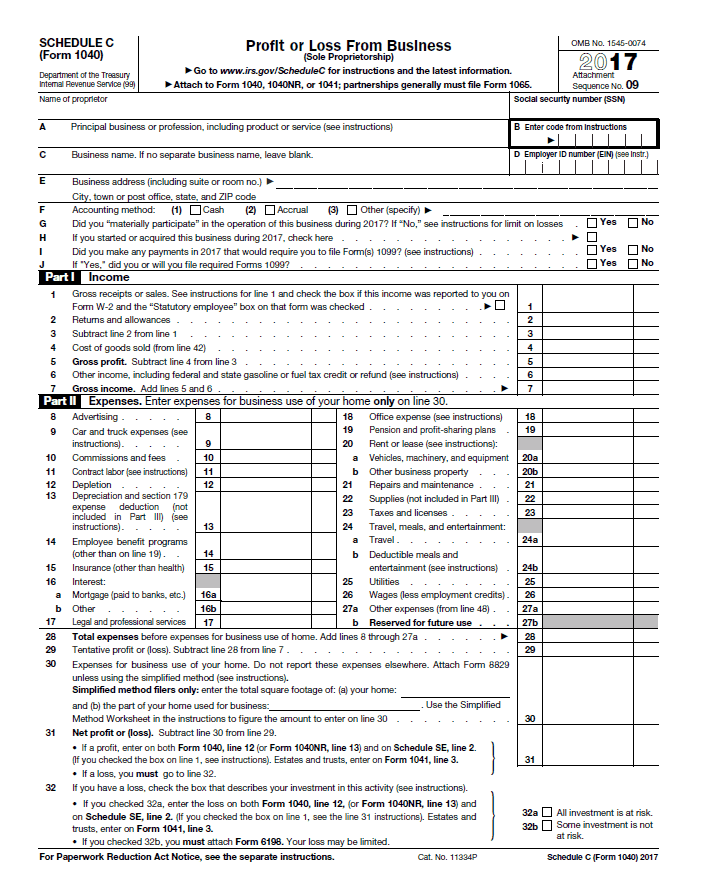

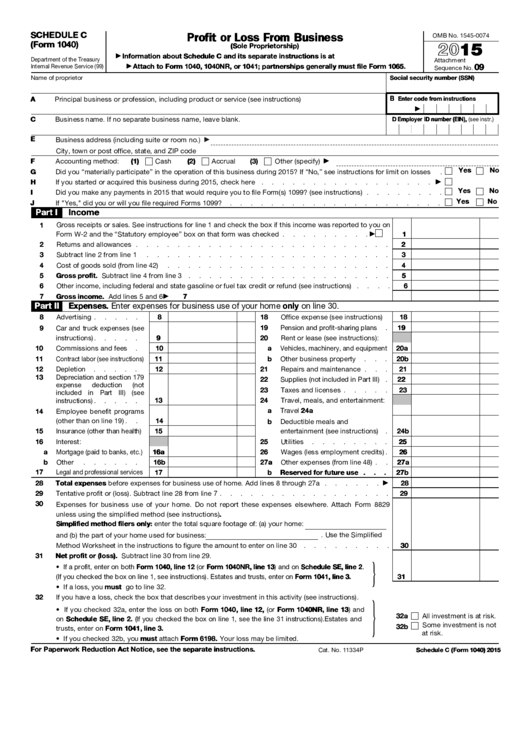

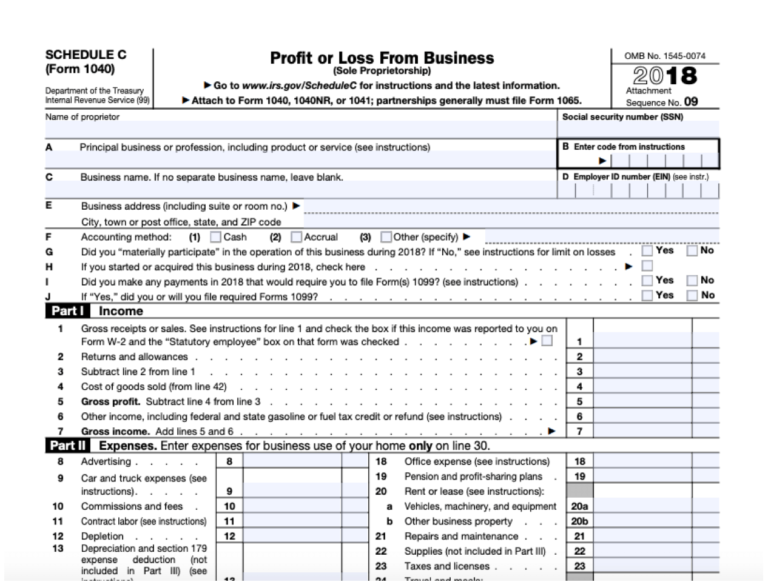

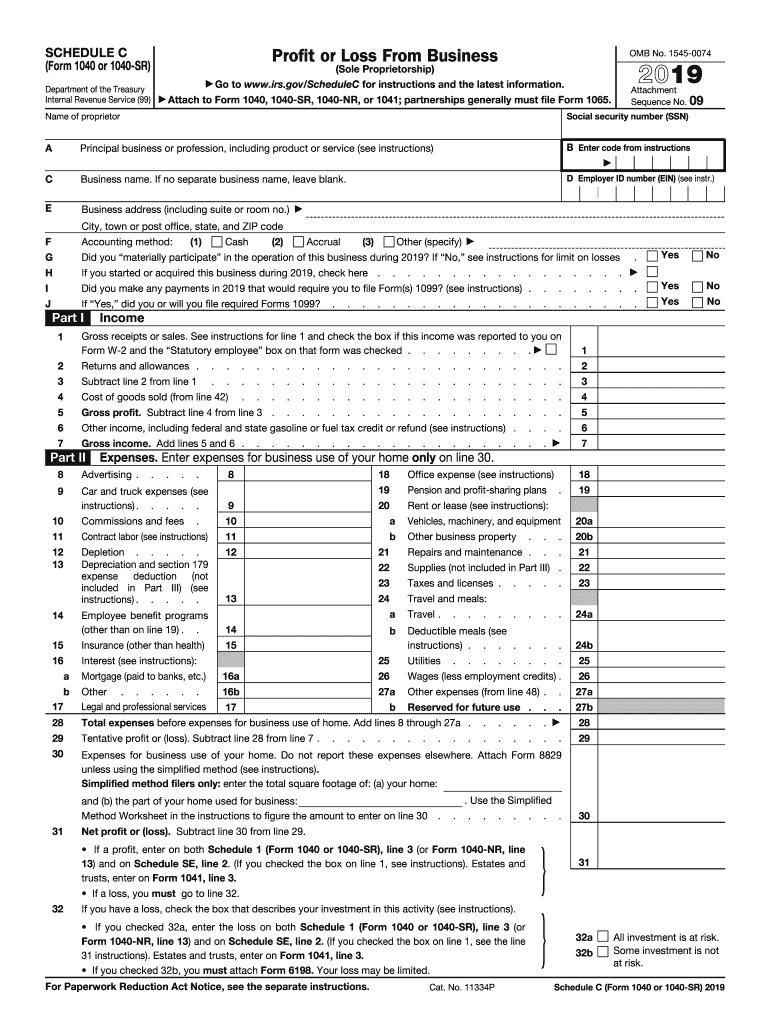

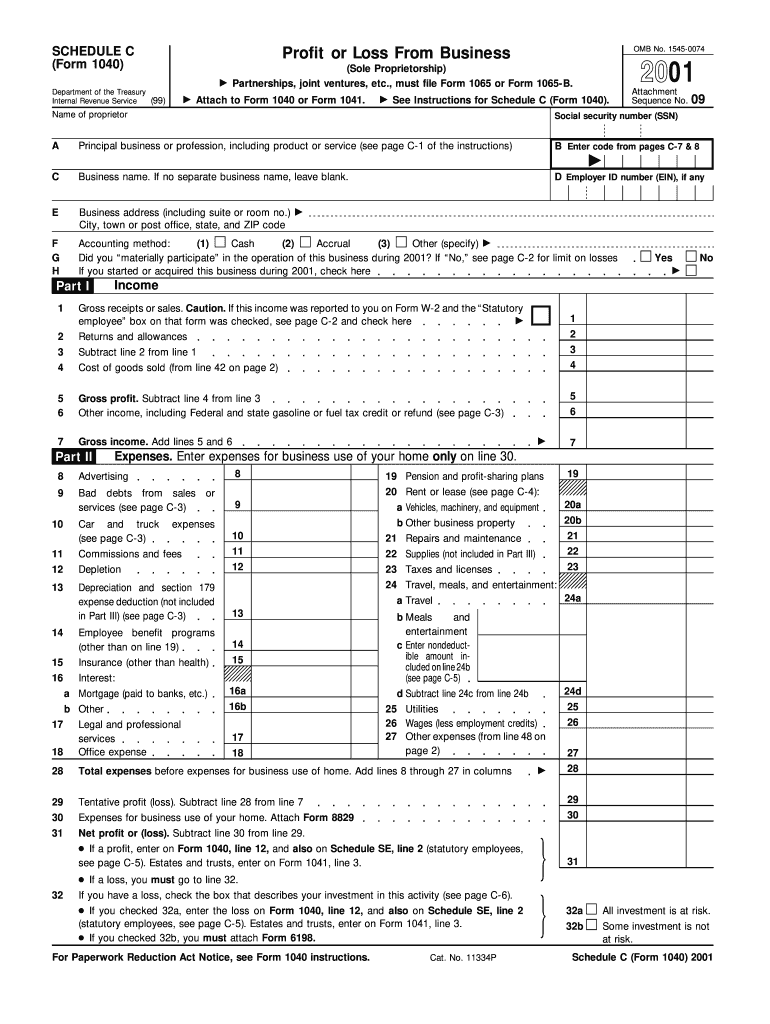

Printable Schedule C Tax Form Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

Instructions 2023 Instructions for Schedule C 2023 2023 Instructions for Schedule C 2023 2023 Profit or Loss From Business Introduction Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor Schedule E is used to report income from rental properties royalties partnerships S corporations estates trusts and residual interests in REMICs About Schedule EIC Form 1040 or 1040 SR Earned Income Credit

Printable Schedule C Tax Form

Printable Schedule C Tax Form

https://1044form.com/wp-content/uploads/2020/08/fillable-schedule-c-irs-form-1040-printable-pdf-download-2.png

1040 Schedule C 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/543/437/543437511/large.png

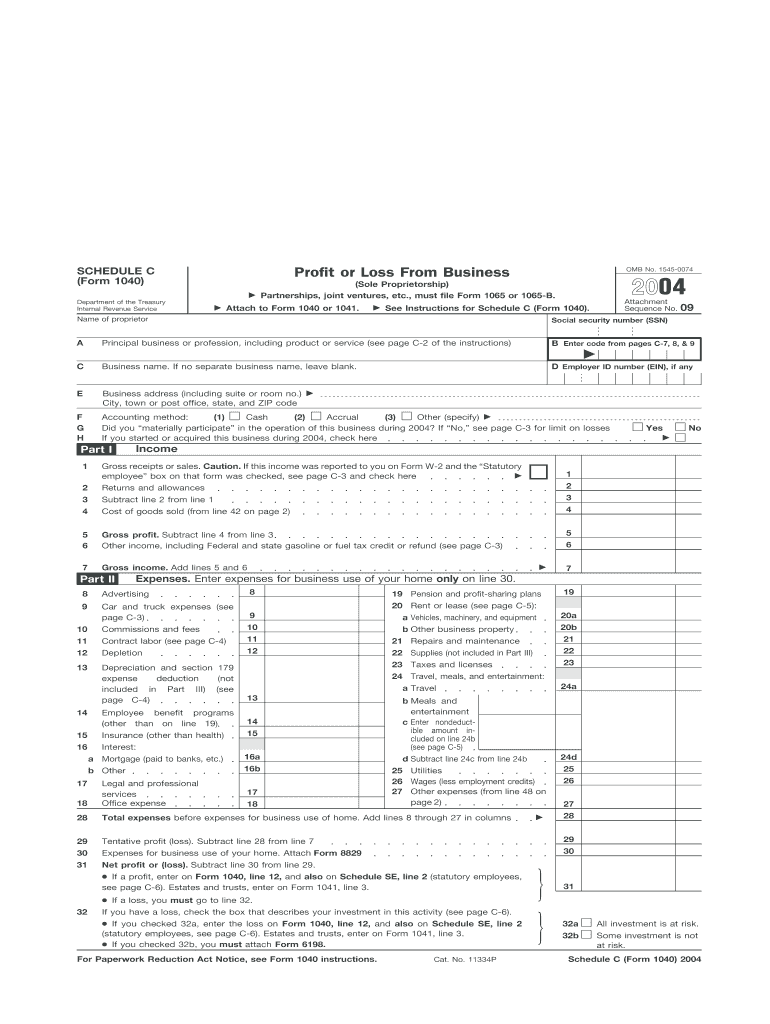

2004 1040 Schedule C Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/659/1659583/large.png

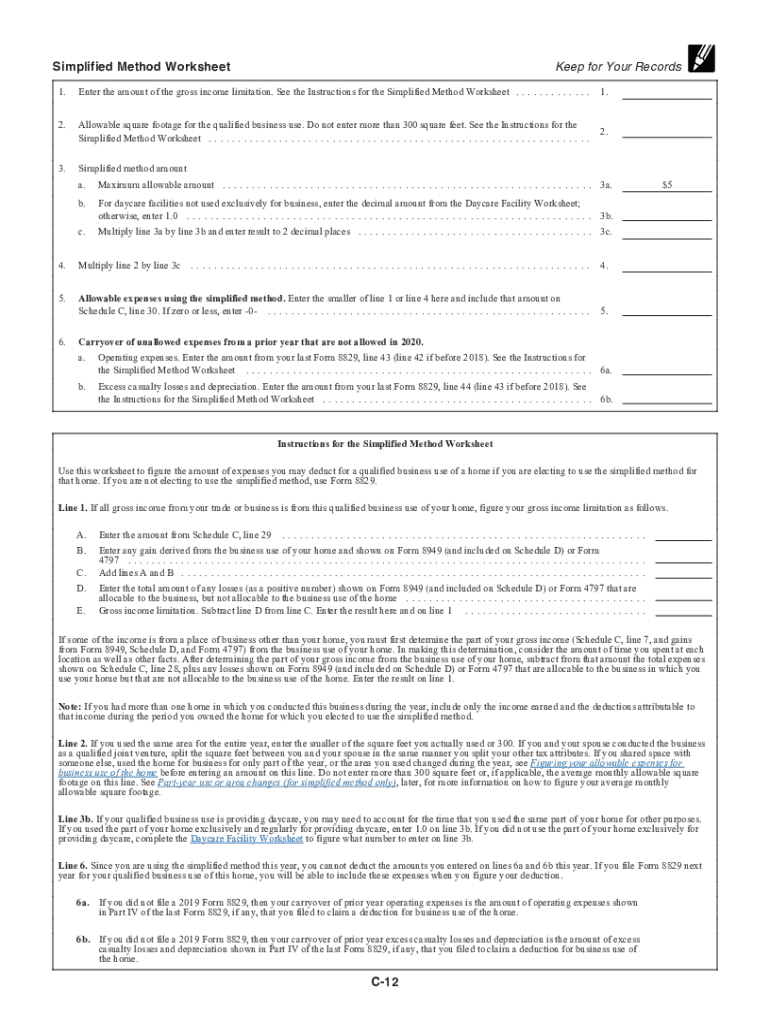

2021 Schedule C Instructions The Schedule C form is generally published in October of each year by the IRS Schedule C instructions follow later usually by the end of November If published the 2023 tax year PDF file will display the prior tax year 2022 if not What is Schedule C IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it electronically

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity 2020 Form 1040 Schedule C Document pdf Download PDF pdf SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information

More picture related to Printable Schedule C Tax Form

Free Printable Schedule C Tax Form

https://i2.wp.com/1044form.com/wp-content/uploads/2020/08/sample-schedule-c-form-examples-in-pdf-word-1.jpg

Schedule C Tax Form Schedule Form Blank Pdf Sample Nd Ward Forms Anacollege

https://images.sampleforms.com/wp-content/uploads/2016/11/Form-5500-Schedule-C1.jpg

2019 IRS Tax Form 1040 Schedule C 2019 Profit Or Losses From Business U S Government Bookstore

https://bookstore.gpo.gov/sites/default/files/styles/product_page_image/public/covers/048-004-02613-9.png?itok=9zQvSnRL

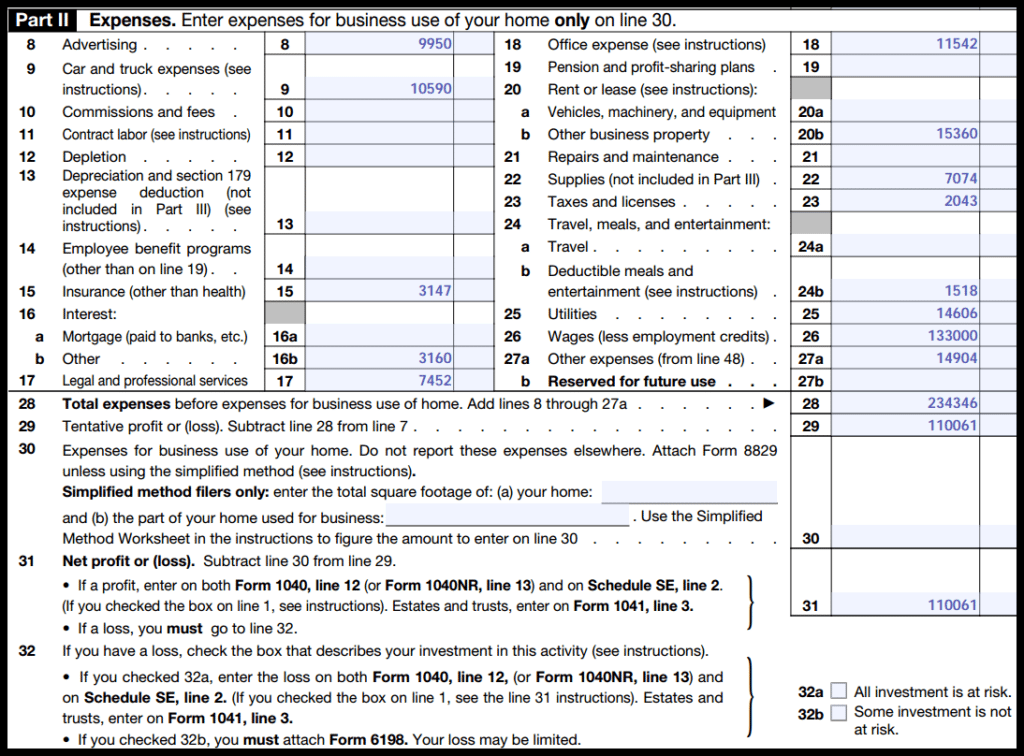

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is typically considered self employment income Usually if you fill out Schedule C you ll also have to fill out Schedule SE Self Employment Tax Profit or Loss from Business Sole Proprietorship 2023 Schedule C Form 1040 SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2023 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065

Income Tax Forms 1040 Schedule C Federal Profit or Loss from Business Sole Proprietorship Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal 1040 schedule c pdf and you can print it directly from your computer More about the Federal 1040 Schedule C Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity

IRS 1040 Schedule C 2019 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/484/966/484966746/large.png

Schedule C Form 1040 How To Complete It The Usual Stuff

https://theusualstuff.com/wp-content/uploads/2018/04/Schedule-C-Page-1.png

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

https://www.irs.gov/instructions/i1040sc

Instructions 2023 Instructions for Schedule C 2023 2023 Instructions for Schedule C 2023 2023 Profit or Loss From Business Introduction Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor

Schedule C Instructions With FAQs 2021 Tax Forms 1040 Printable

IRS 1040 Schedule C 2019 Fill And Sign Printable Template Online US Legal Forms

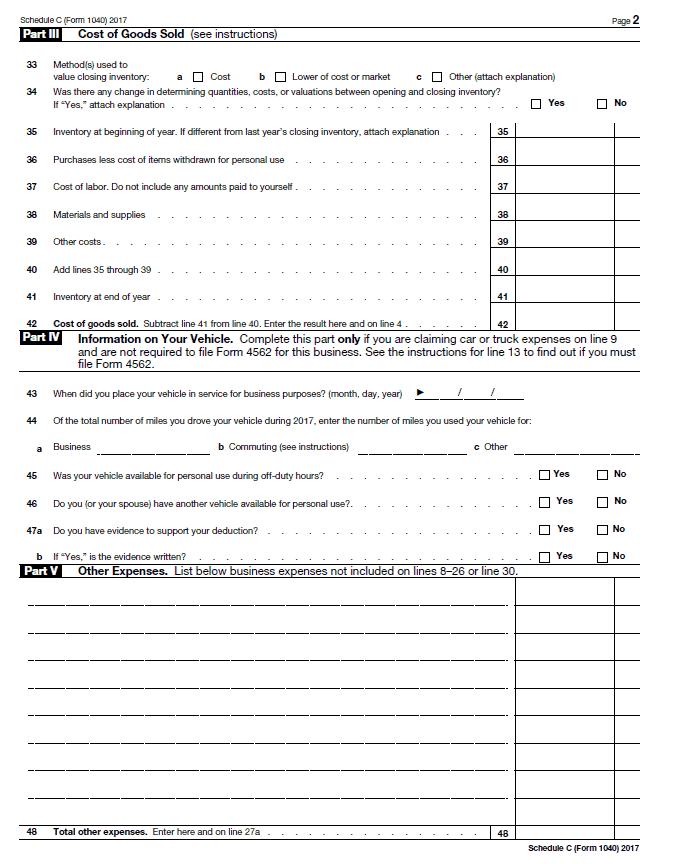

Schedule C Form 1040 Expense Cost Of Goods Sold

Schedule C Form 1040 How To Complete It The Usual Stuff

Printable Schedule C Tax Form FreePrintableTM FreePrintableTM

Sample Schedule C Form Examples In PDF Word 2021 Tax Forms 1040 Printable

Sample Schedule C Form Examples In PDF Word 2021 Tax Forms 1040 Printable

Schedule C Tax Form Fill Out And Sign Printable PDF Template SignNow

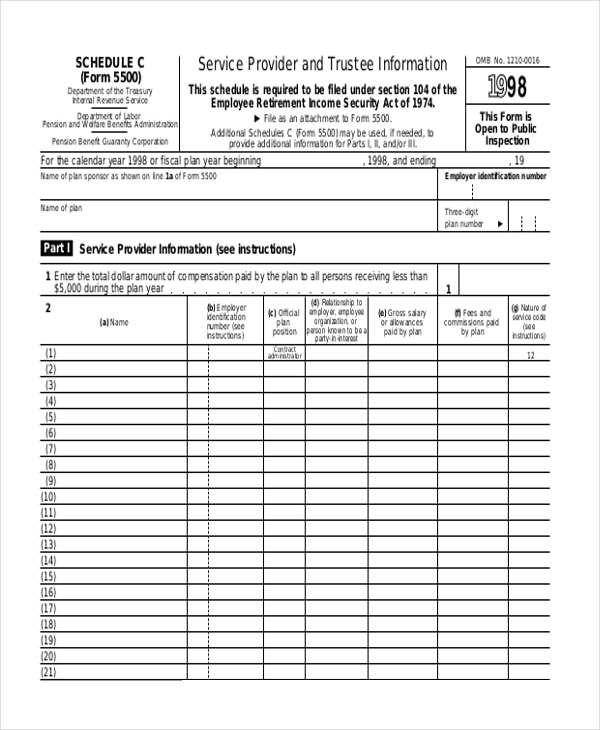

FREE 9 Sample Schedule C Forms In PDF MS Word

IRS Schedule C Instructions Step By Step Including C EZ 1040 Form Printable

Printable Schedule C Tax Form - What is a Schedule C Schedule C is used to report self employment income on a personal return Self employment income is how we describe all earned income derived from non W 2 sources This could be income from your small business freelance work or just extra cash earned through a side hustle