Printable Schedule D Tax Form The IRS Schedule D form and instructions booklet are generally published in December of each year If published the 2023 tax year PDF file will display the prior tax year 2022 if not Last year many of the federal income tax forms were published late in December with instructions booklet following in early January due to last minute

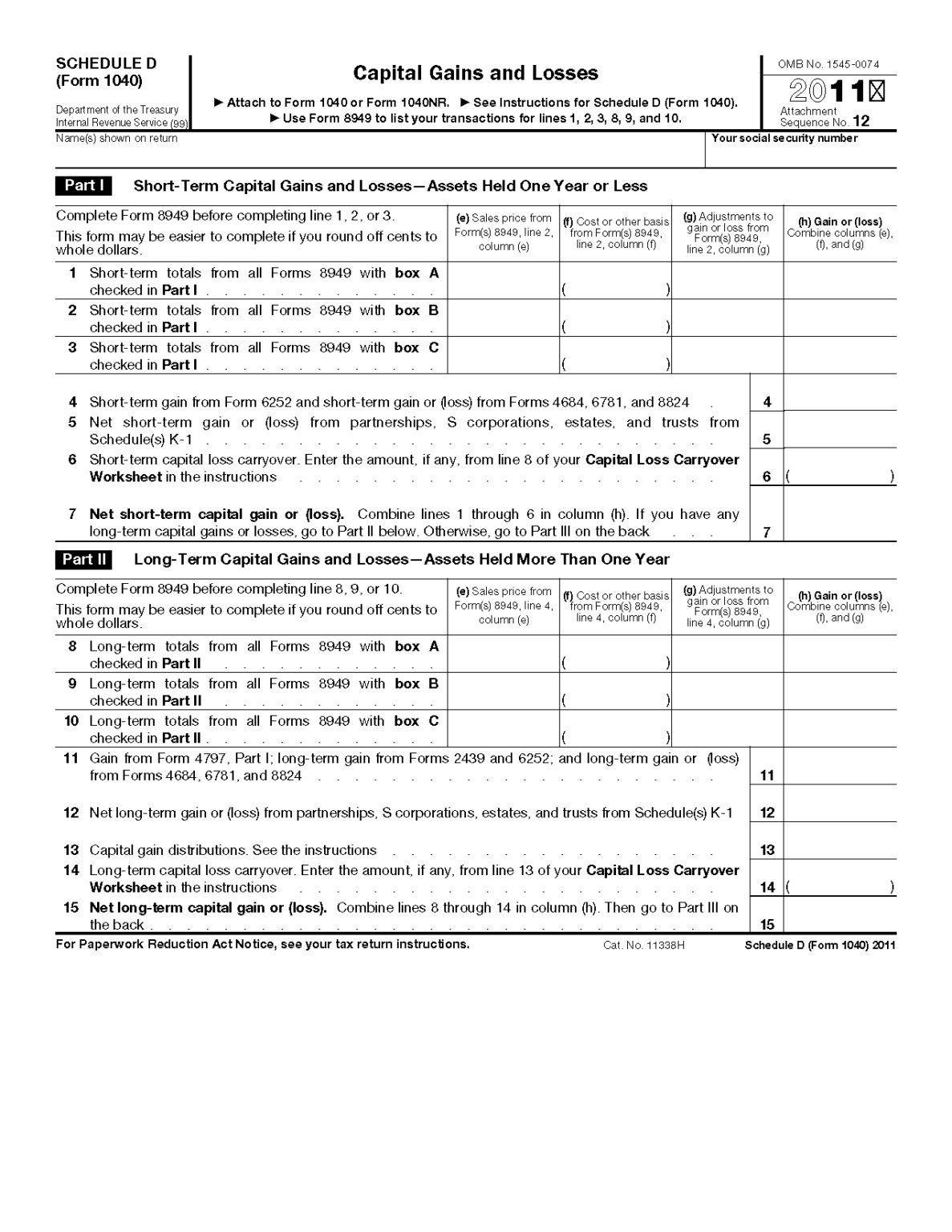

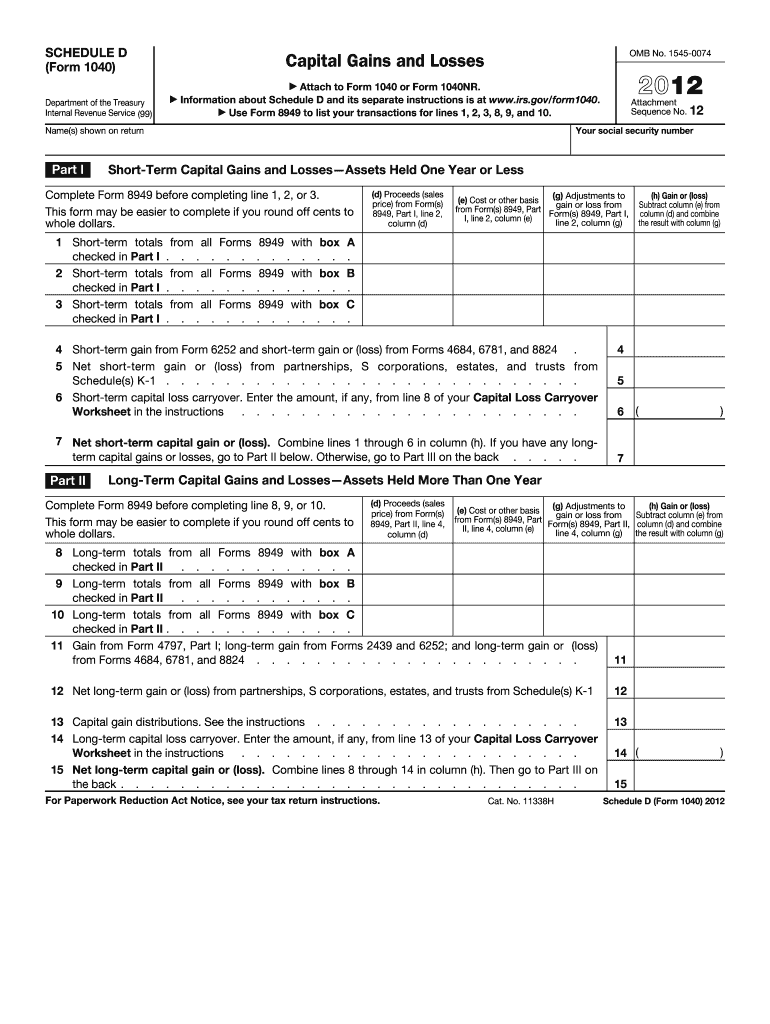

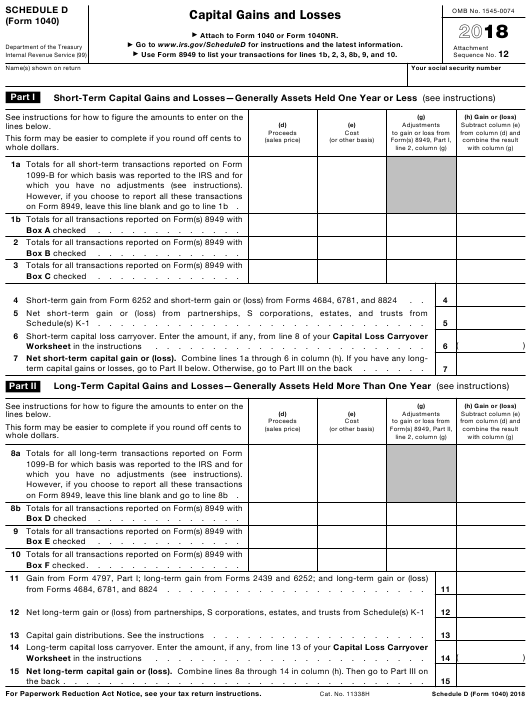

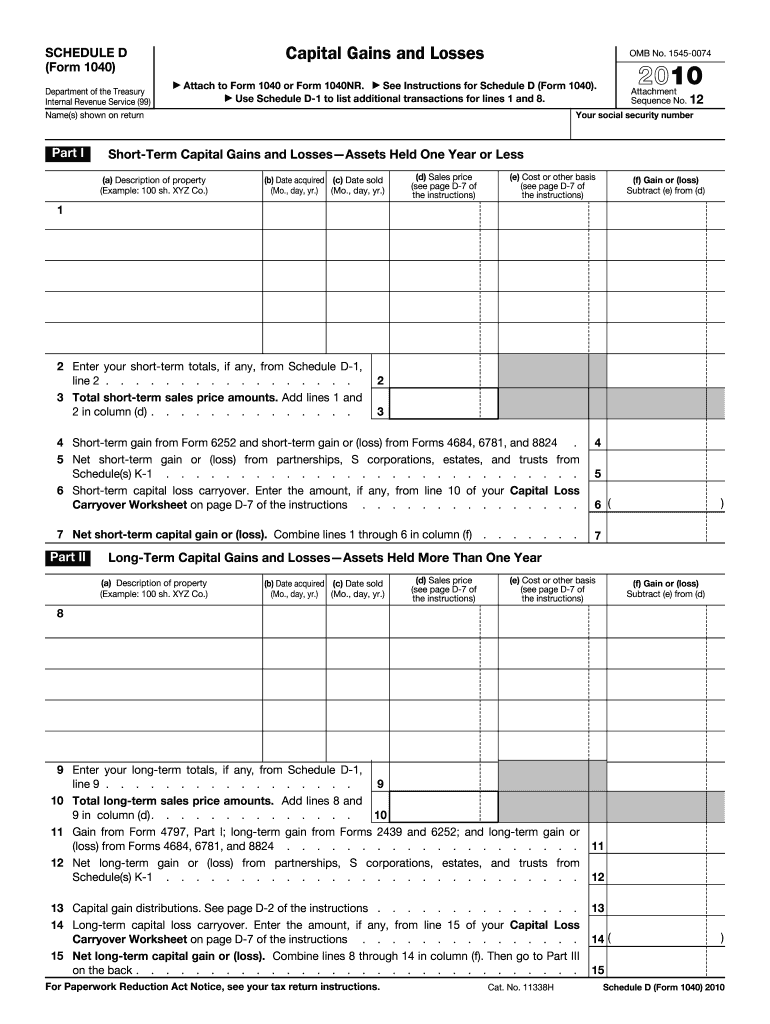

The initial section of Schedule D is used to report your total short term gains and losses Any asset you hold for one year or less at the time of sale is considered short term by the IRS For example if you purchase 100 shares of Disney stock on April 1 and sold them on August 8 of the same year you report the transaction on Schedule D File Now with TurboTax We last updated Federal 1040 Schedule D in December 2022 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023 We will update this page with a new version of the form for 2024 as soon as it is made available by the Federal government

Printable Schedule D Tax Form

Printable Schedule D Tax Form

https://1044form.com/wp-content/uploads/2020/08/form-1040-schedule-d-capital-gains-and-losses-2-1187x1536.png

Schedule D Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/948/6948283/large.png

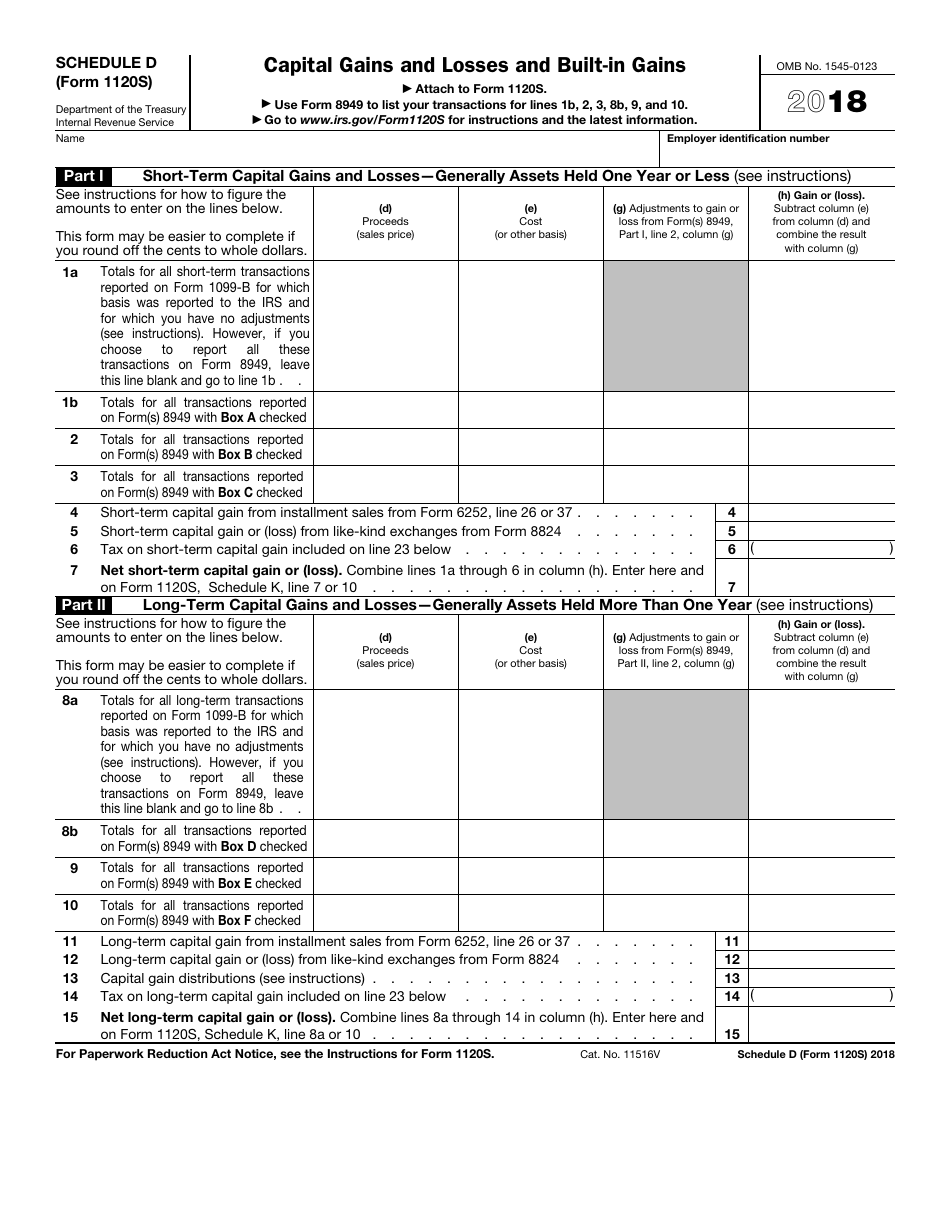

IRS Form 1120S Schedule D 2018 Fill Out Sign Online And Download Fillable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/1862/18622/1862282/irs-form-1120s-2018-schedule-d-capital-gains-and-losses-and-built-in-gains_print_big.png

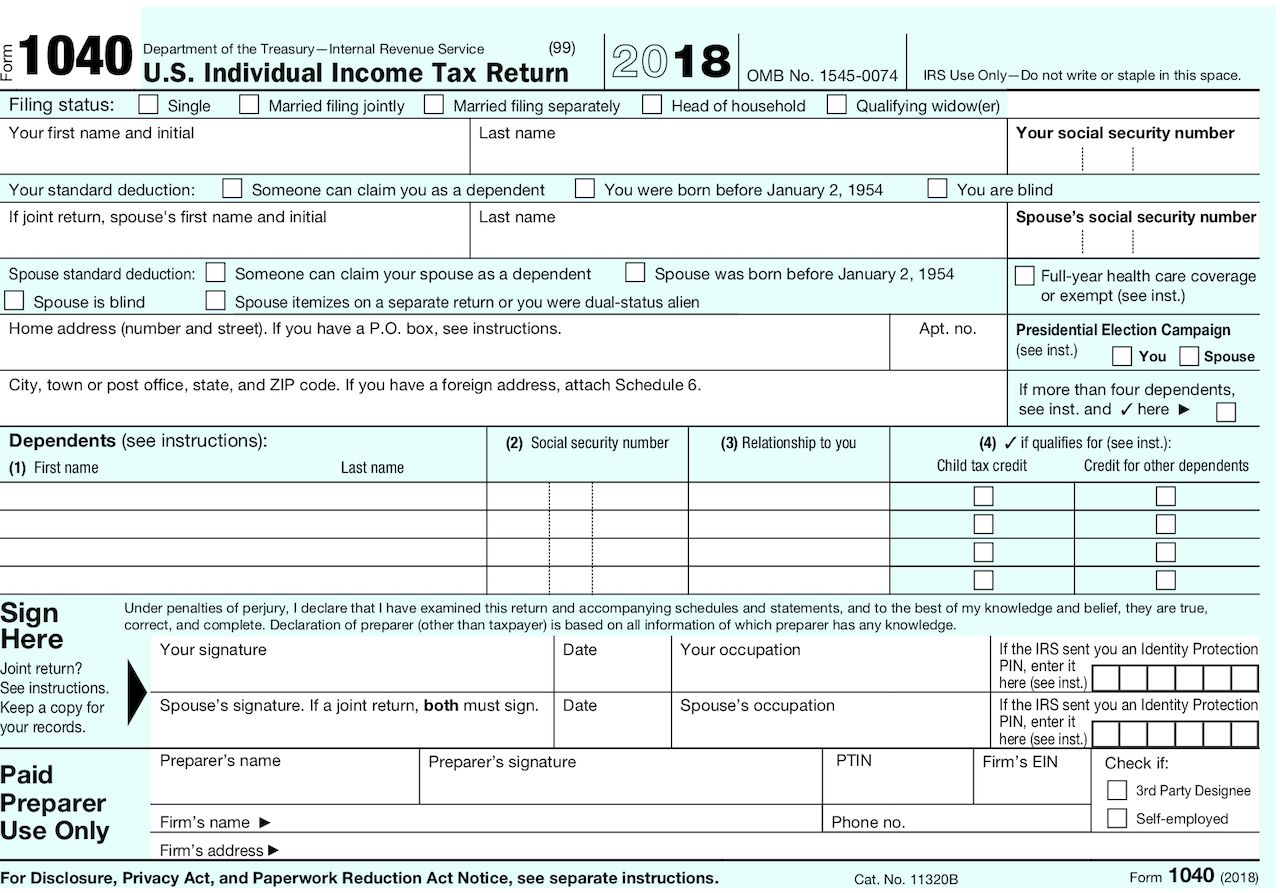

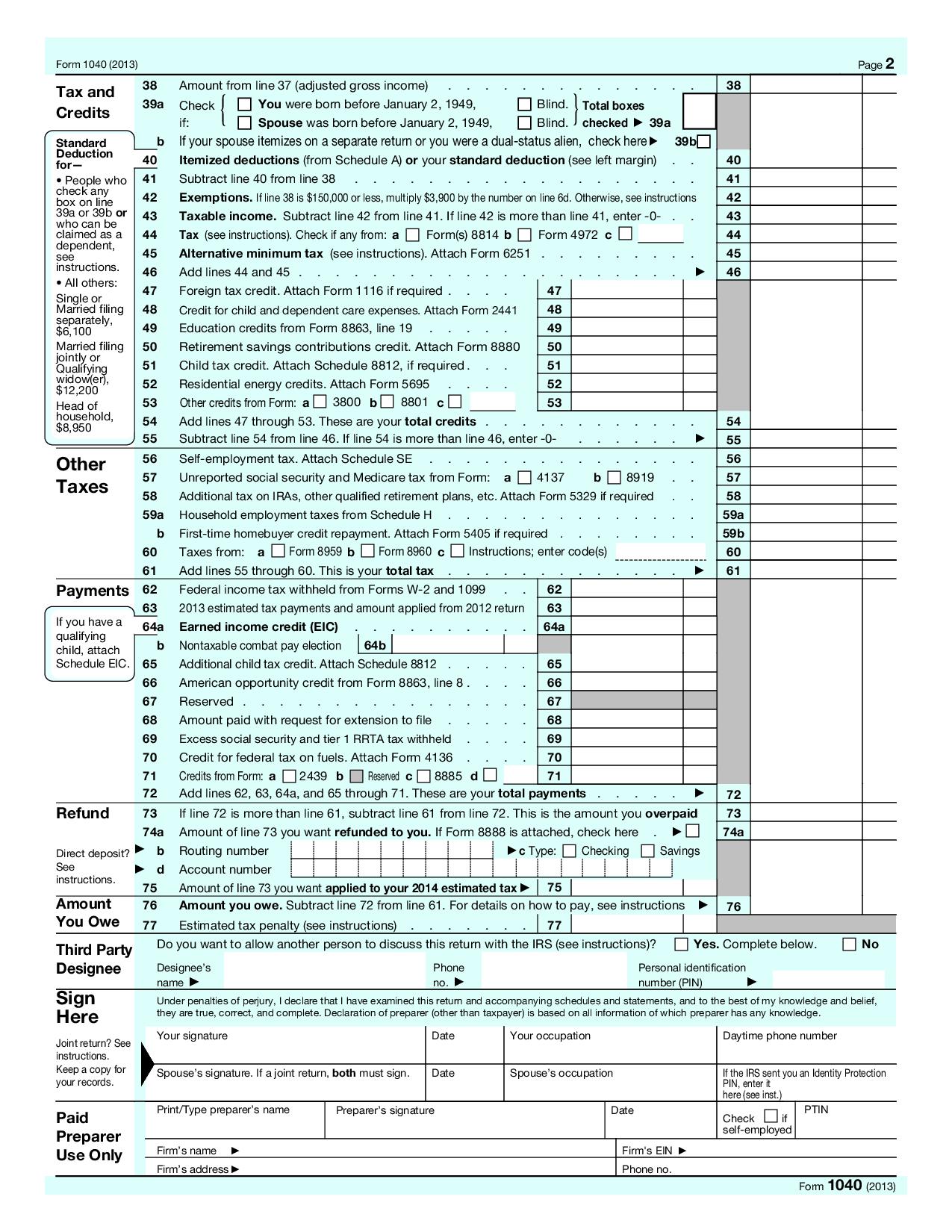

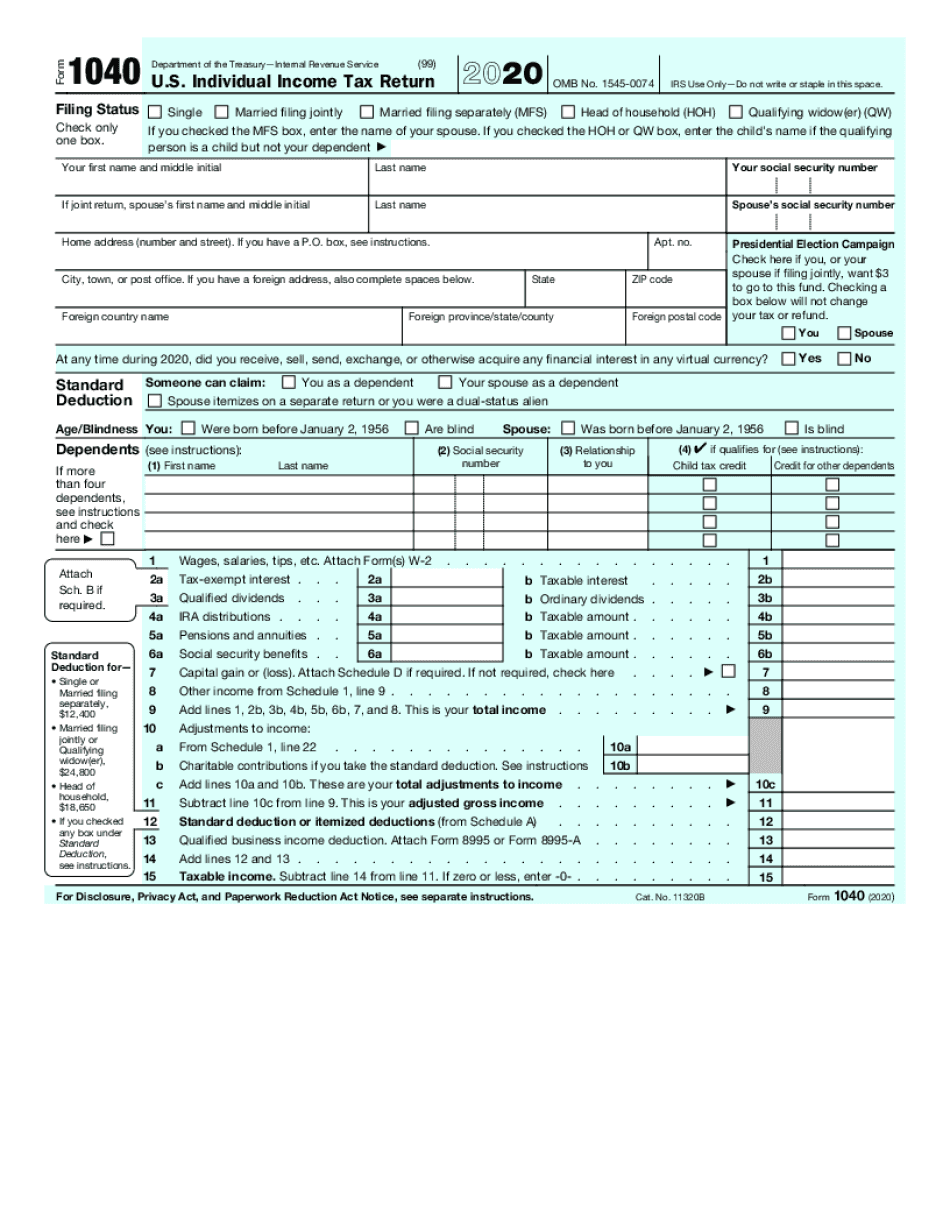

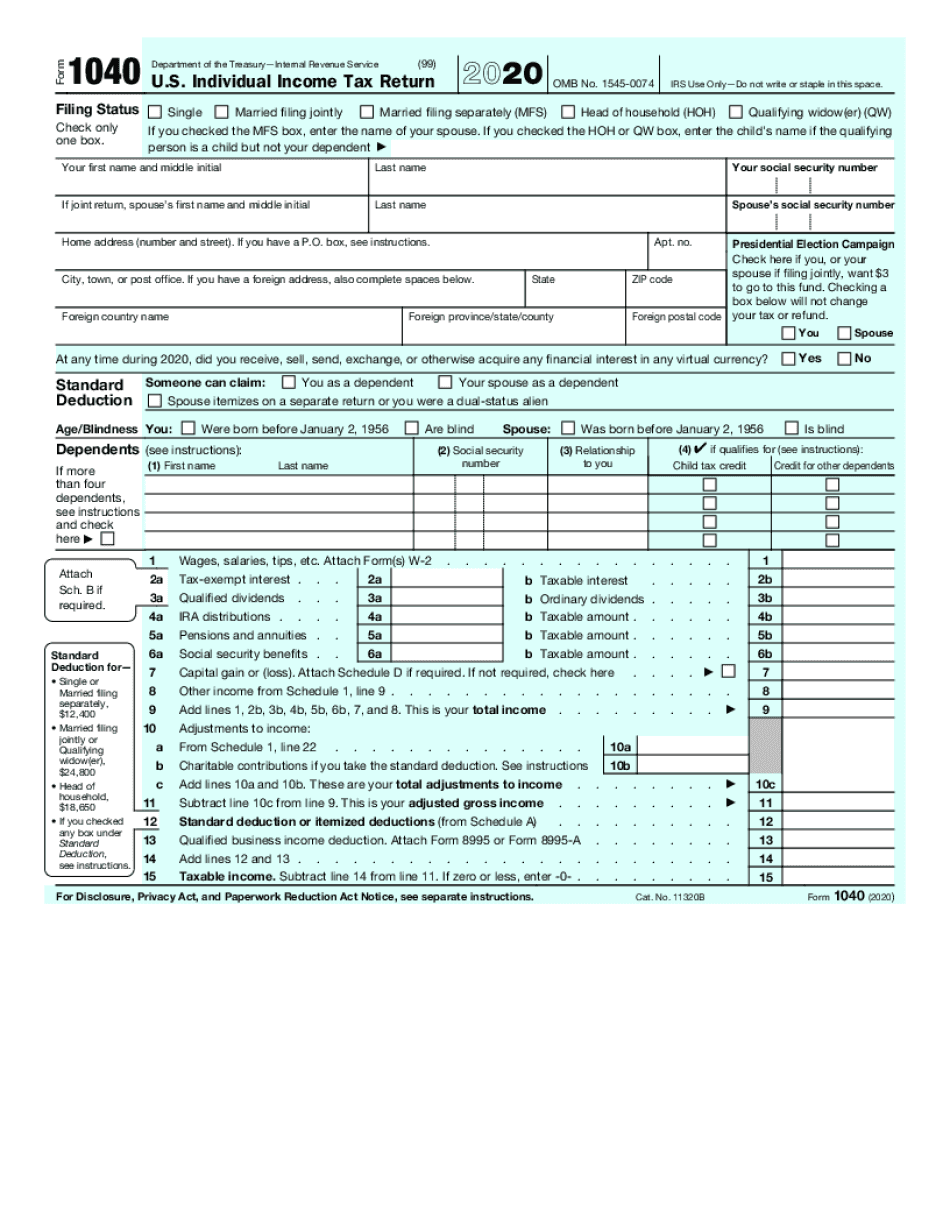

2020 Schedule D Form 1040 or 1040 SR Form 8949 2021 Name s shown on return Name and SSN or taxpayer identification no not required if shown on other side Attachment Sequence No 12A Page 2 Social security number or taxpayer identification number Before you check Box D E or F below see whether you received any Form s 1099 B or Schedule D Form 1040 is a tax schedule from the IRS that attaches to the Form 1040 U S Individual Income Tax Return Form 1040 SR or Form 1040NR It is used to help you calculate their capital gains or losses and the amount of taxes owed Computations from Schedule D are reported on the Form 1040 affecting your adjusted gross income

Capital Gains and Losses 2023 Schedule D Form 1040 SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service Capital Gains and Losses OMB No 1545 0074 2023 Attach to Form 1040 1040 SR or 1040 NR Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10 Schedule D is an IRS tax form that reports your realized gains and losses from capital assets that is investments and other business interests It includes relevant information such as the total

More picture related to Printable Schedule D Tax Form

Fill Out A 2017 IRS TAX Form 1040 Schedule D Based On Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/86e/86e86531-22ac-4593-a56b-fa998876ee2b/phpd4sRIo.png

Capital Gains And Losses Schedule D When Filing US Taxes Abroad

http://greenbacktaxservices.com/wp-content/uploads/2011/11/Example-for-Part-2-Schedule-D.png

Sch D 1 P1 Describes New Form 1040 Schedules Tax Tables p Means part Of The Sow i e

https://images.squarespace-cdn.com/content/v1/579a29a5414fb501f0e42ef7/1544798304694-KI8WSC8TEICLT0O9J12Z/ke17ZwdGBToddI8pDm48kCMsQkN2o9YaAWNdGLnuVYAUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcvdTAJ63aKvA4R51IW-5hO7szhHTvs8RhJsDuYxxD6Fpmu-4BzFaiCNxZKNBvrUhn/f1040+p1.png

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g even if you don t need to file Schedule D Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line The print PDF of the Schedule D Tax Worksheet will show the calculation of the tax which flows to line 6 on Form 1040 or line 14 on Form 1040 NR Note that any link in the information above is updated each year automatically and will take you to the most recent version of the webpage or document at the time it is accessed

Use this free informational booklet to help you fill out and file your Schedule C form for Profit or Loss from Business 11 0001 Capital Gains and Losses You should use Schedule D to report Sale or exchange of a capital asset not reported elsewhere Gains from involuntary conversions of capital assets not held for business or profit The Schedule D is known as a Capital Gains and Losses form This form is used in conjunction with Form 1040 This form will be used to report certain sales exchanges gains distributions or debts It will be required by certain parties for a complete income tax return Different financial information is required for this form

2020 Schedule D 1040 Fill Online Printable Fillable Blank Form 1065 schedule d

https://www.pdffiller.com/preview/536/160/536160332/big.png

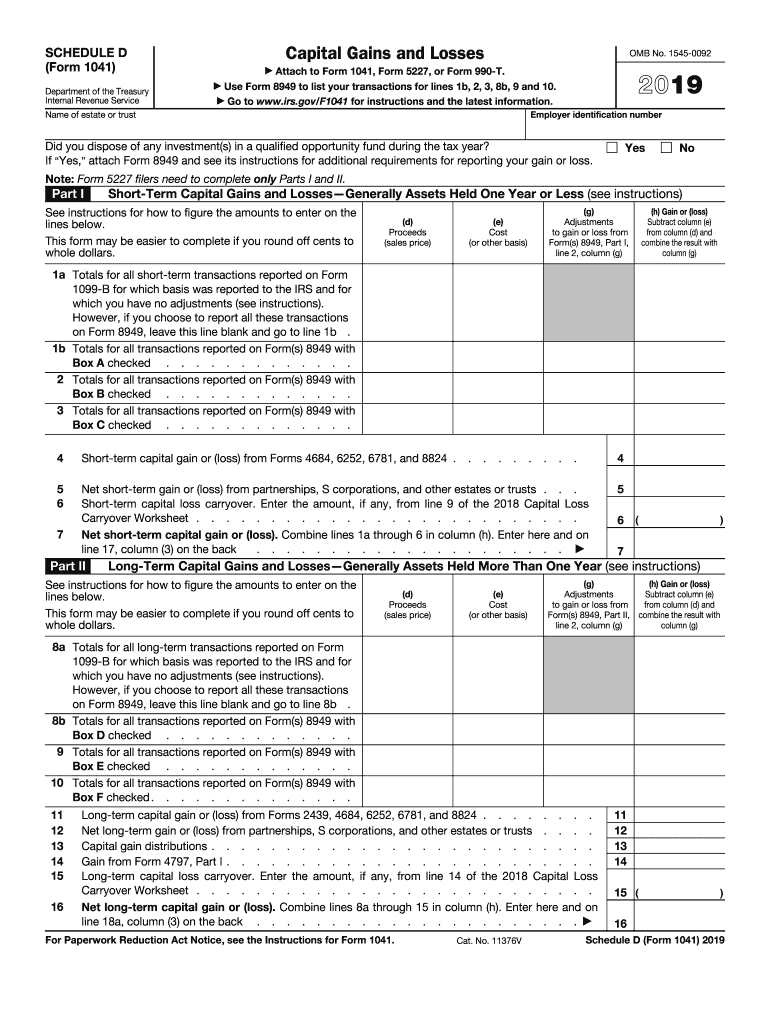

2019 Form IRS 1041 Schedule D Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/489/169/489169014/large.png

https://www.incometaxpro.net/tax-form/schedule-d.htm

The IRS Schedule D form and instructions booklet are generally published in December of each year If published the 2023 tax year PDF file will display the prior tax year 2022 if not Last year many of the federal income tax forms were published late in December with instructions booklet following in early January due to last minute

https://turbotax.intuit.com/tax-tips/investments-and-taxes/guide-to-schedule-d-capital-gains-and-losses/L1bKWgPea

The initial section of Schedule D is used to report your total short term gains and losses Any asset you hold for one year or less at the time of sale is considered short term by the IRS For example if you purchase 100 shares of Disney stock on April 1 and sold them on August 8 of the same year you report the transaction on Schedule D

Form 1040 Schedule D 1 2021 Tax Forms 1040 Printable

2020 Schedule D 1040 Fill Online Printable Fillable Blank Form 1065 schedule d

Form 1040 Schedule D Capital Gains And Losses

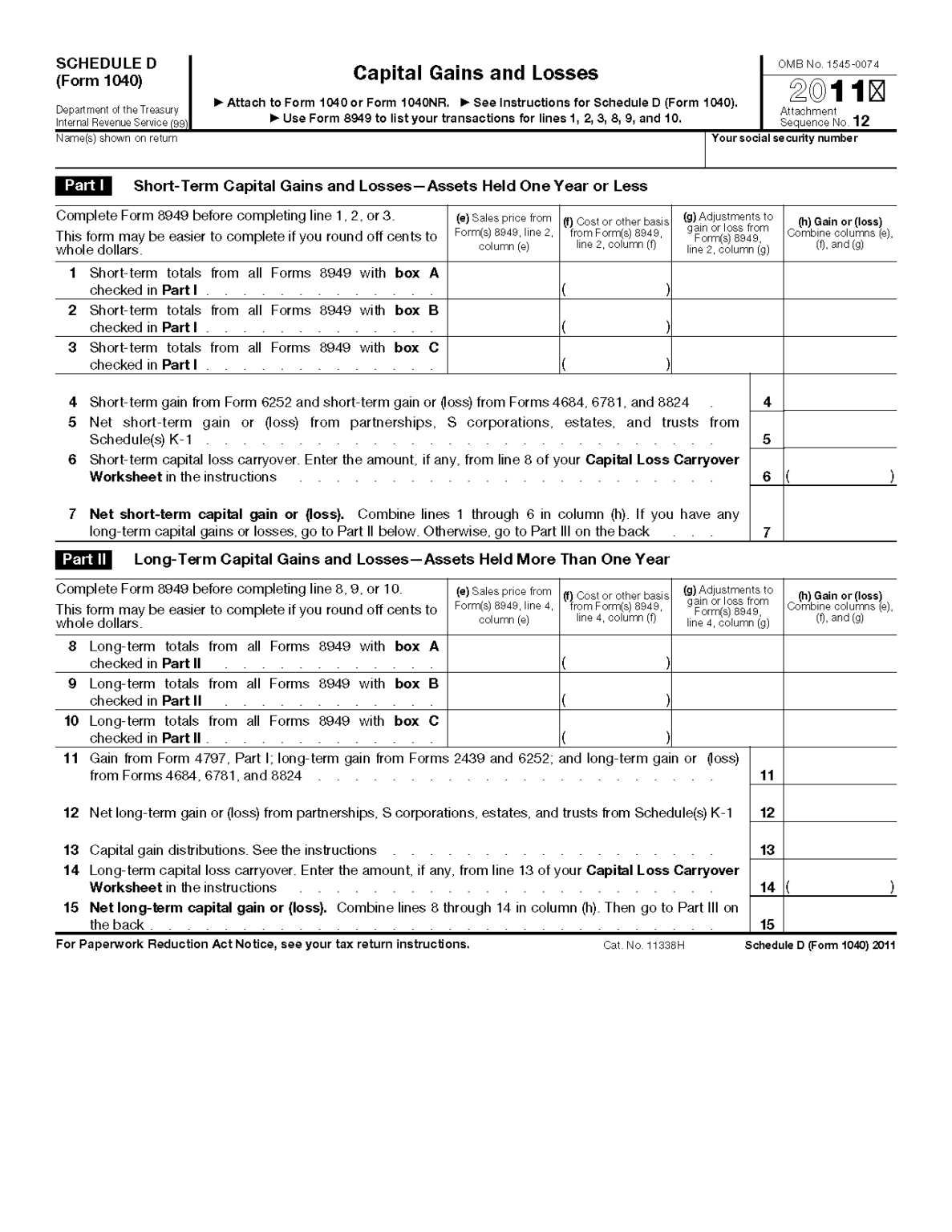

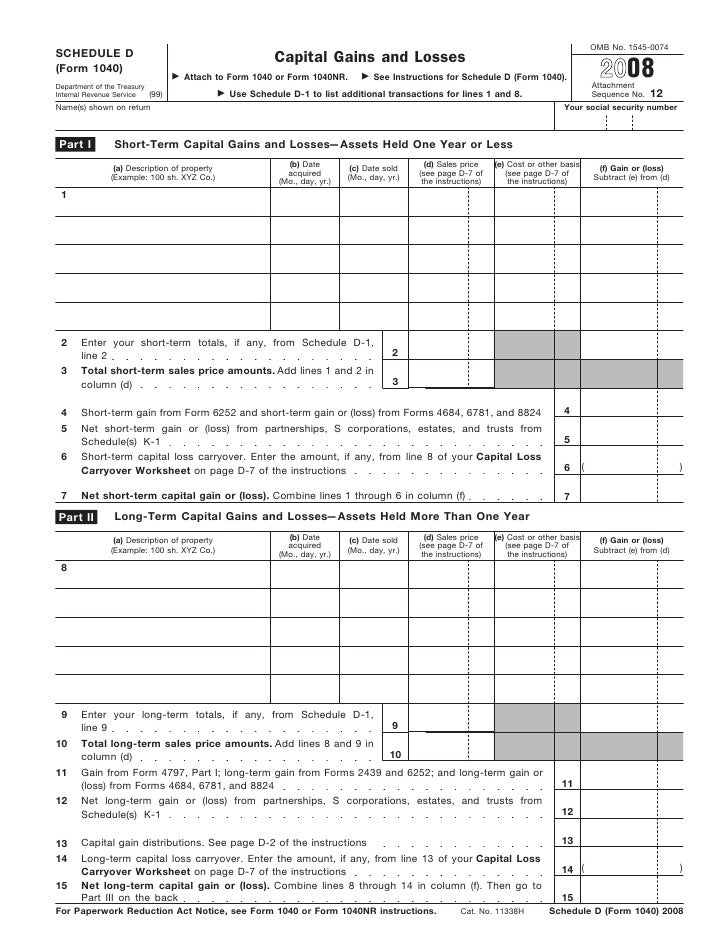

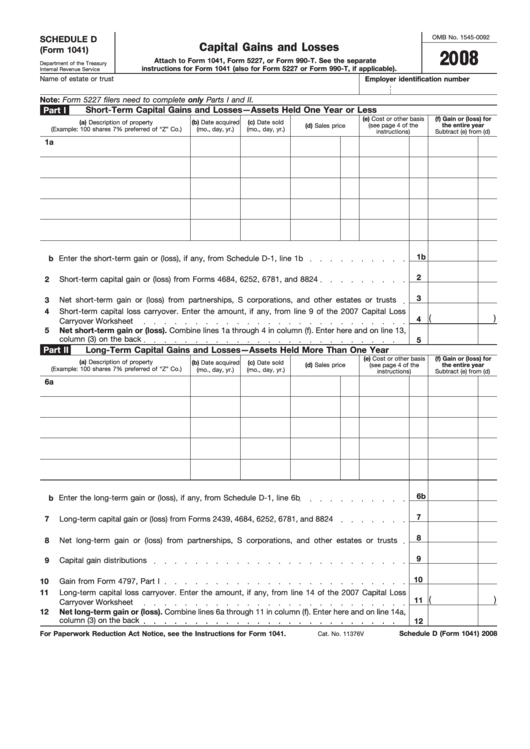

Fillable Form 1041 Schedule D Capital Gains And Losses 2008 Printable Pdf Download

1040 U S Individual Income Tax Return With Schedule D

Irs Form 1040 2020 2021 Fill Online Printable Fillable Blank Irs form 1040

Irs Form 1040 2020 2021 Fill Online Printable Fillable Blank Irs form 1040

IRS Tax Form 1040 Schedule D 1040 Form Printable

2010 Form IRS 1040 Schedule D Fill Online Printable Fillable Blank PdfFiller

1040 U S Individual Income Tax Return With Schedule D 2021 Tax Forms 1040 Printable

Printable Schedule D Tax Form - SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Capital Gains and Losses Schedule D Tax Worksheet in the instructions Don t complete lines 21 and 22 below 21 If line 16 is a loss enter here and on Form 1040 1040 SR or 1040 NR line 7 the