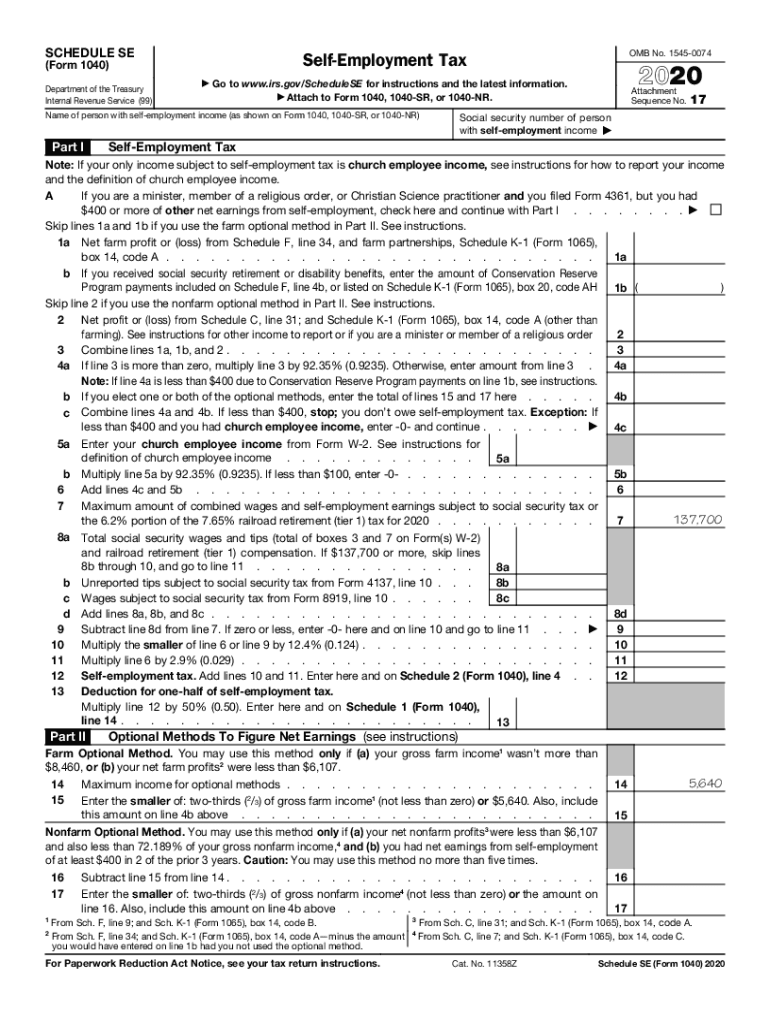

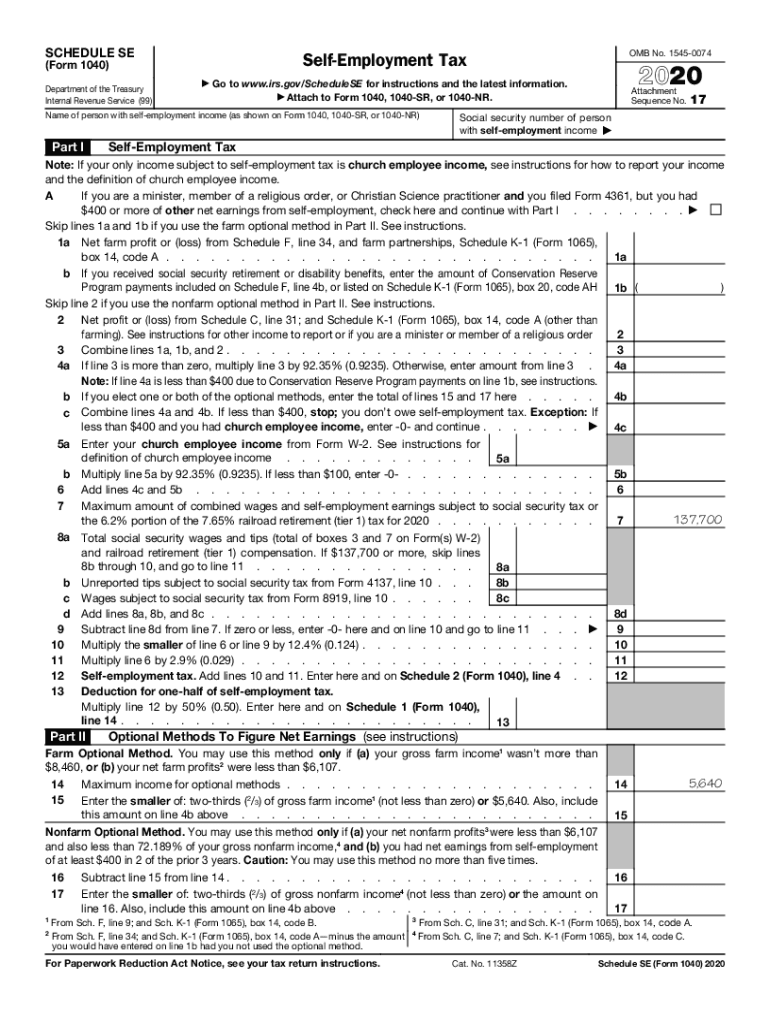

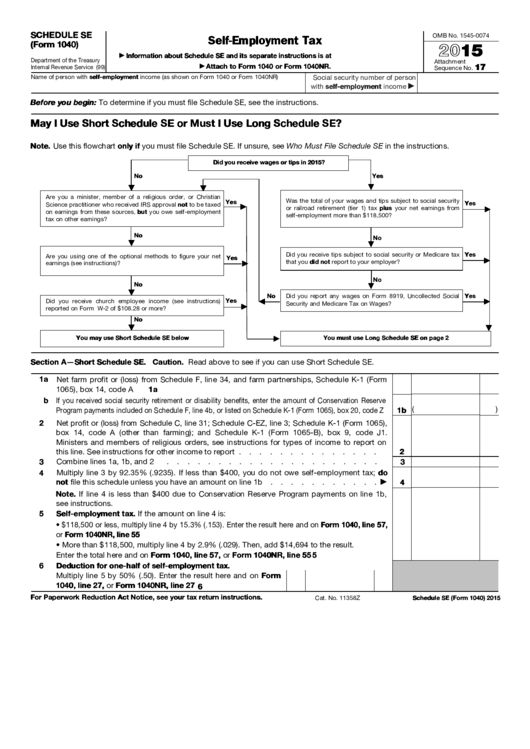

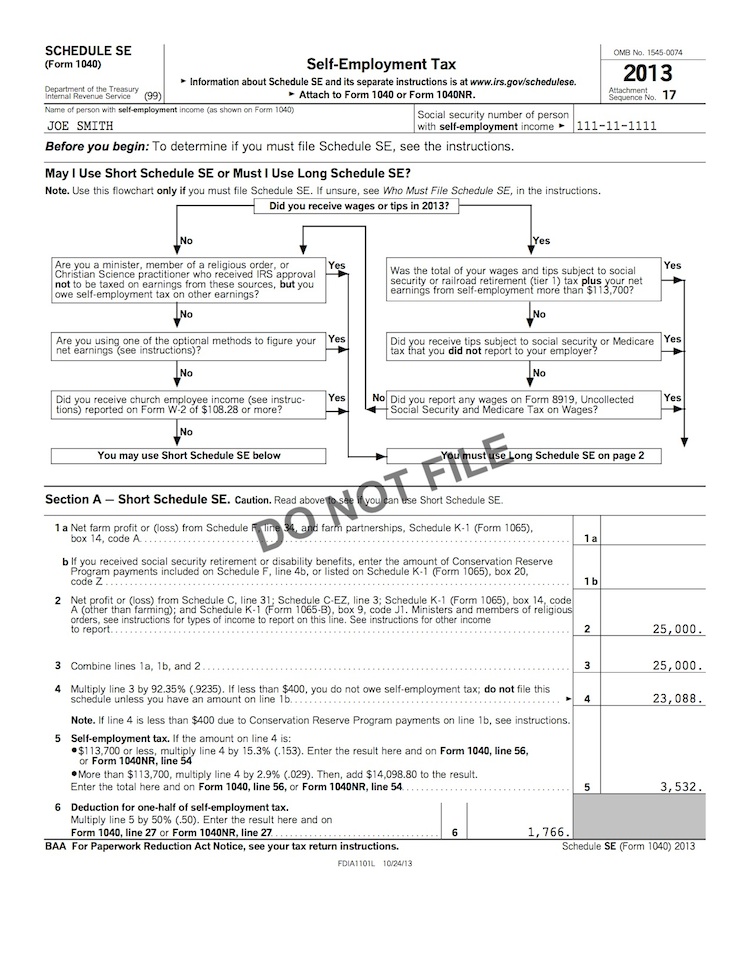

Printable Schedule Se Tax Form 2021 Schedule SE Form 1040 Note If your only income subject to self employment tax is church employee income see instructions for how to report your income and the definition of church employee income

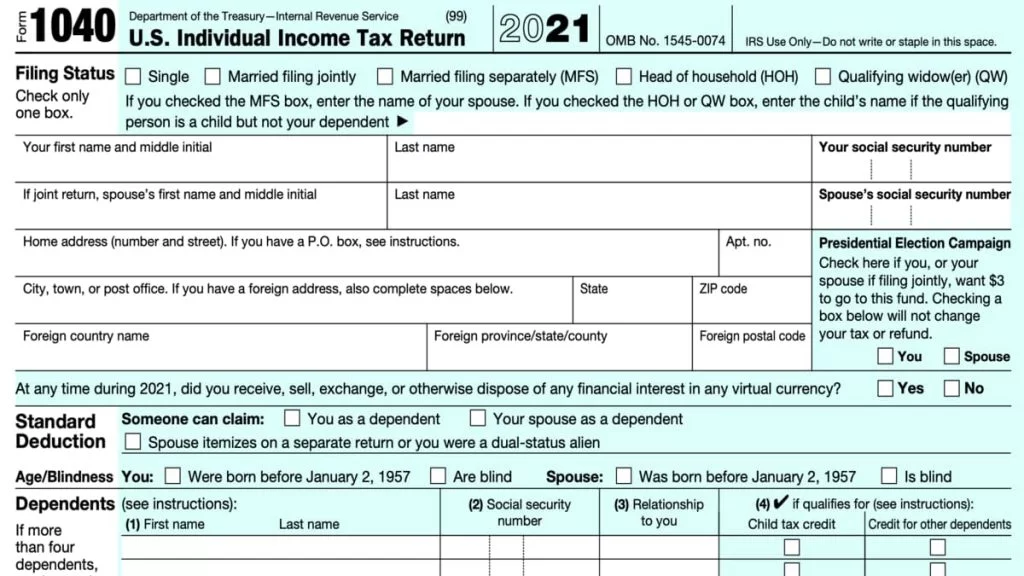

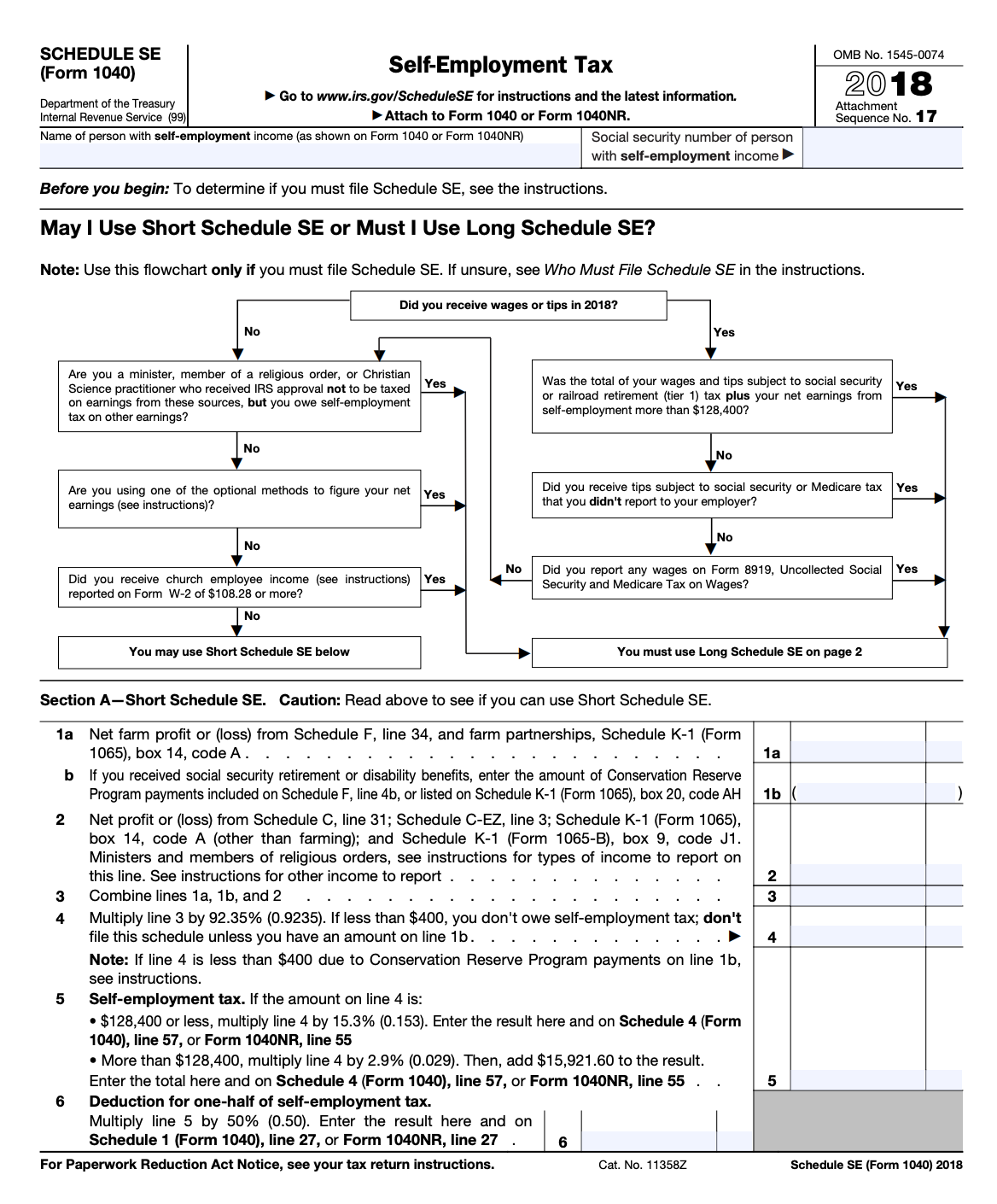

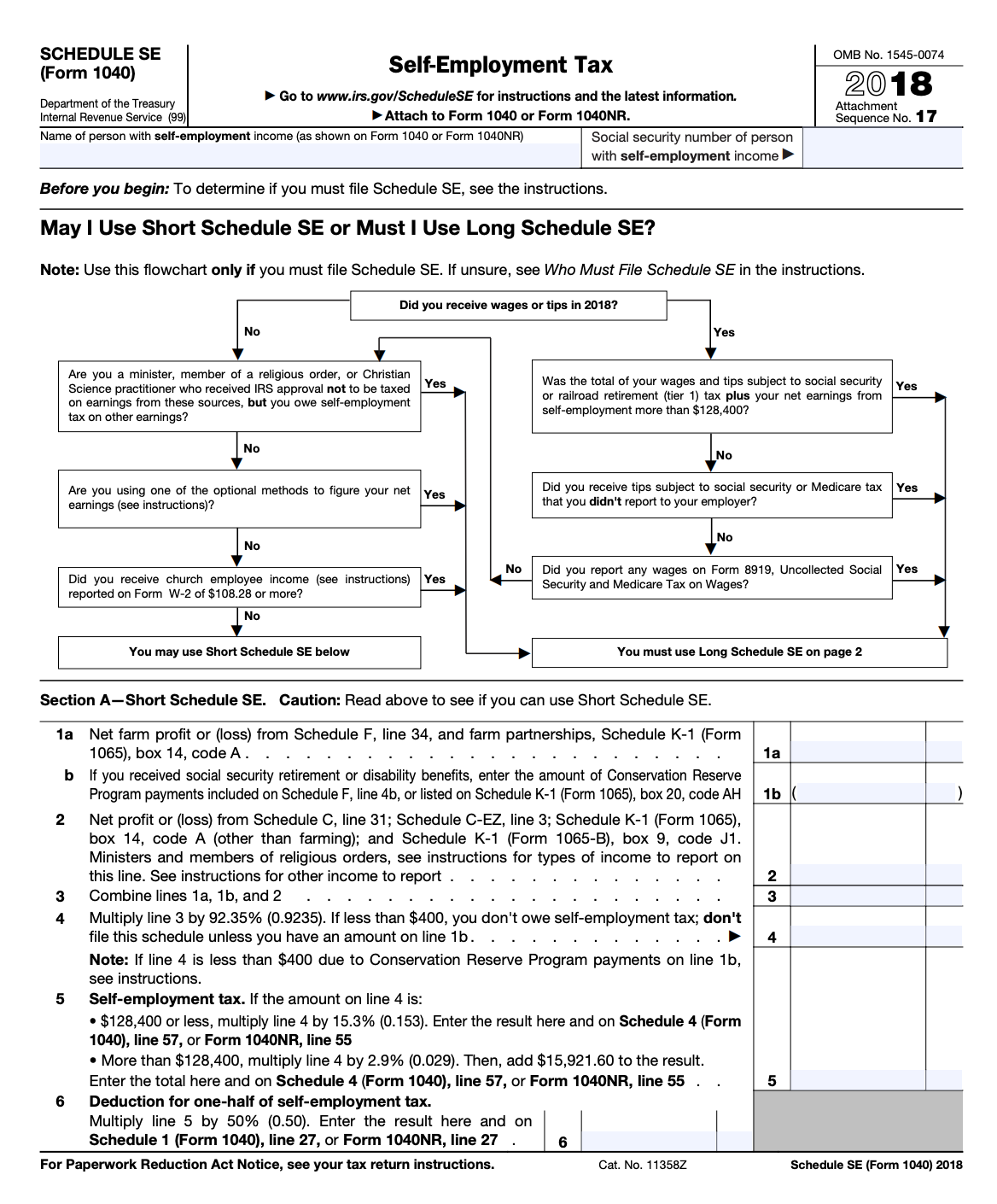

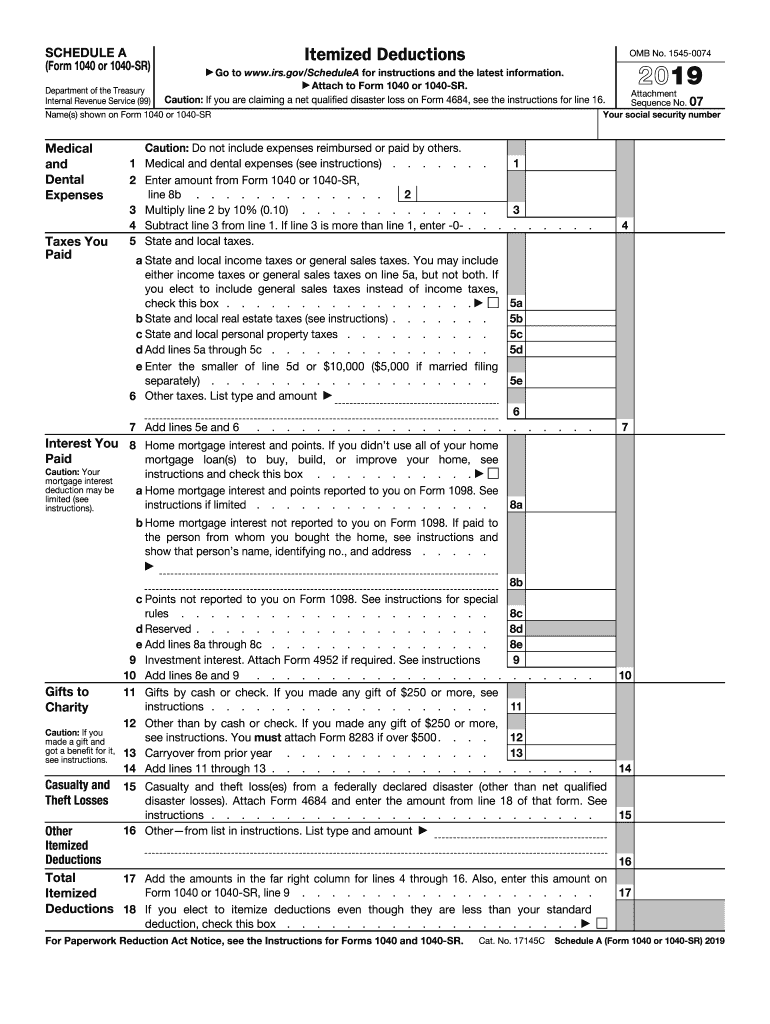

Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return You use it to calculate your total self employment tax which you must report on another schedule of Form 1040 Schedule 2 Part II line 4 Self employment tax is calculated using Schedule SE a part of your personal tax return Form 1040 1040 SR Self employment tax is based on your business income The amount you must pay for self employment tax depends on the profit or loss of your business for the tax year Note

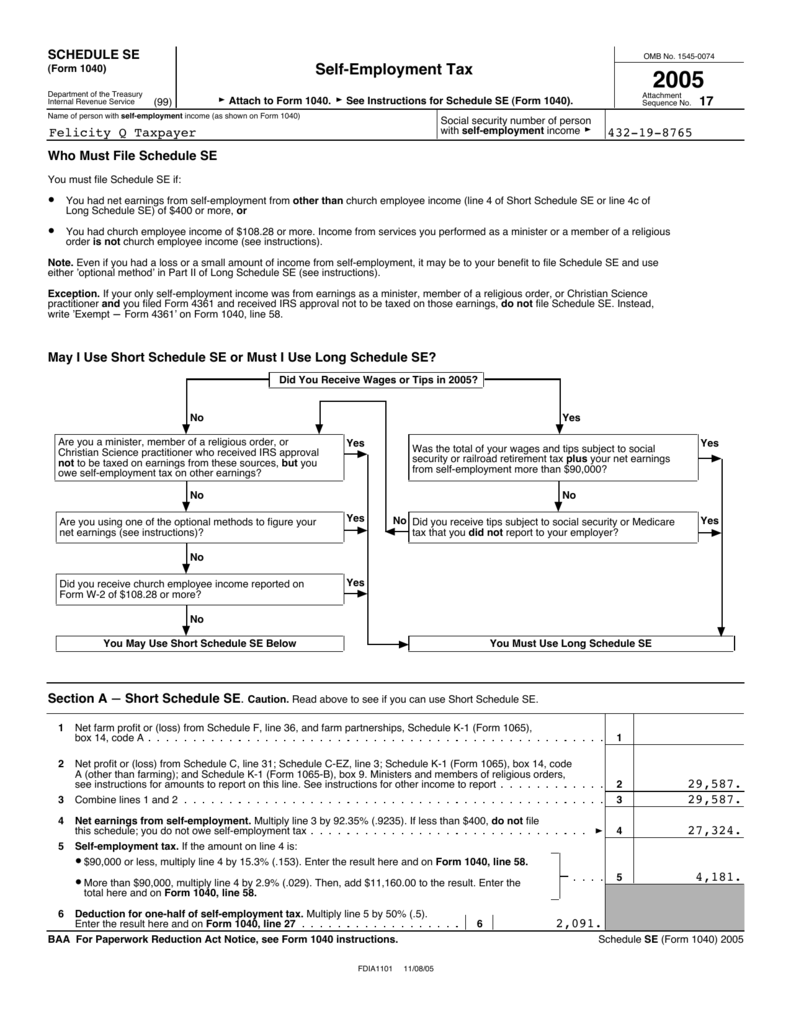

Printable Schedule Se Tax Form

Printable Schedule Se Tax Form

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e9b9e5062816ec3f6caf30_schedule-se.png

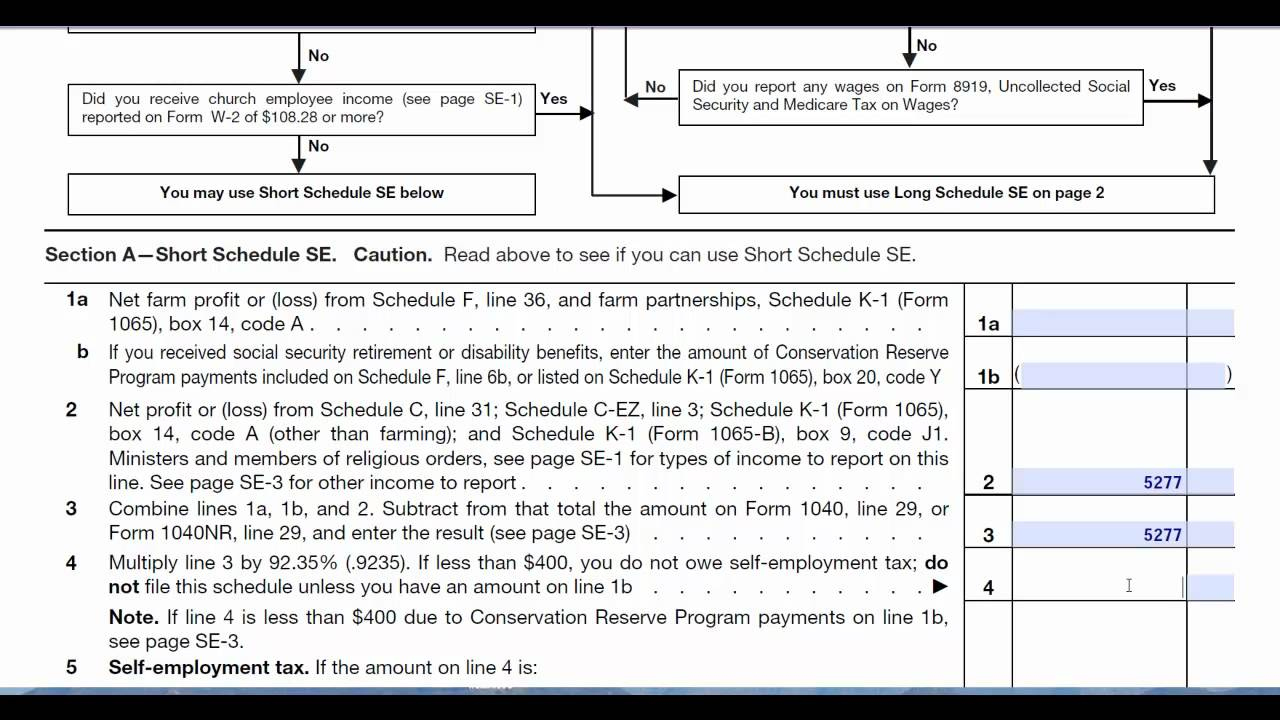

2019 Form 1040 Schedule Se 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/schedule-se-self-employment-form-1040-tax-return-7.jpg

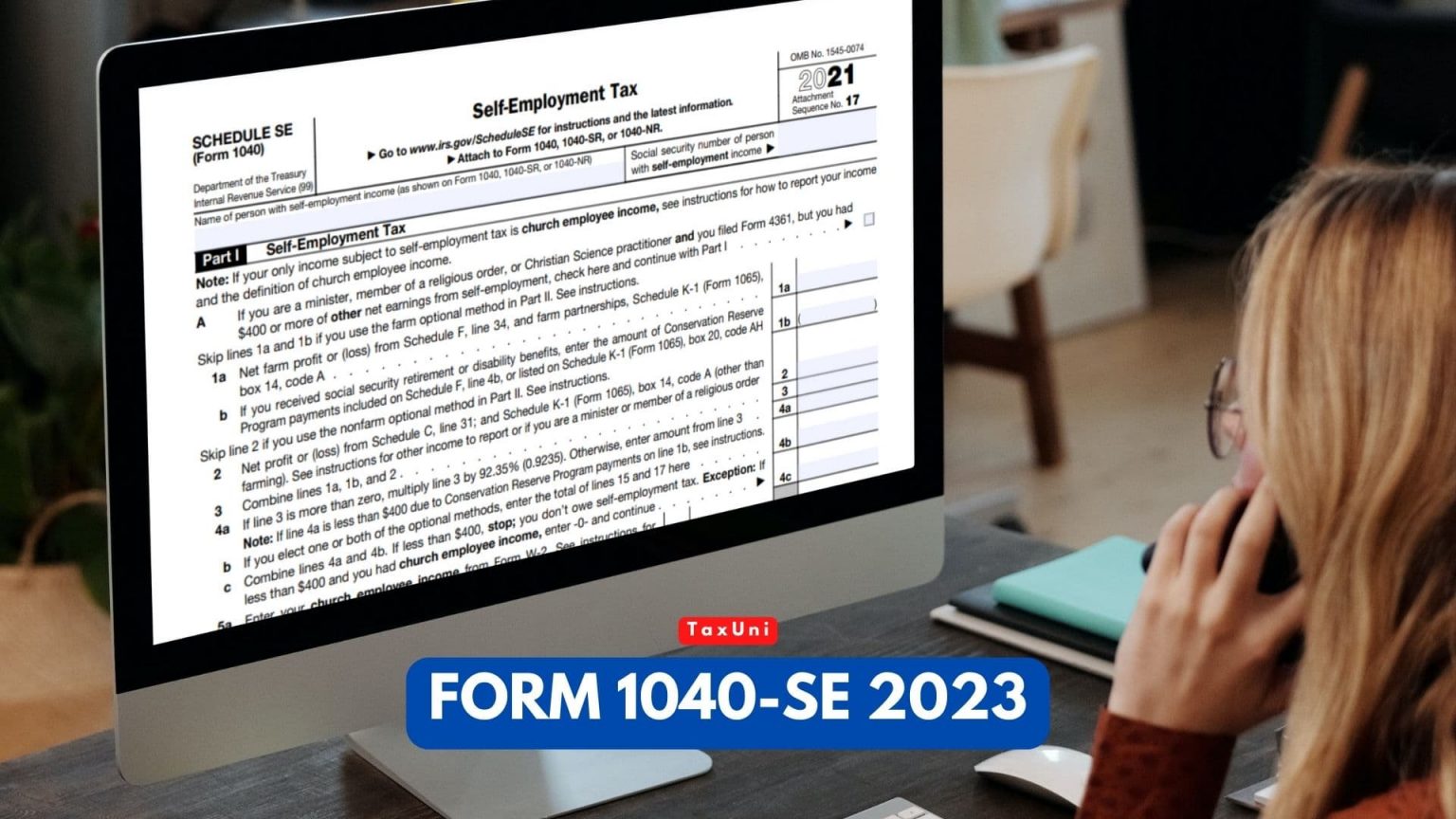

Form 1040 SE 2023

https://www.taxuni.com/wp-content/uploads/2022/01/1040-form-2022-instructionst-o-file--1024x576.jpg

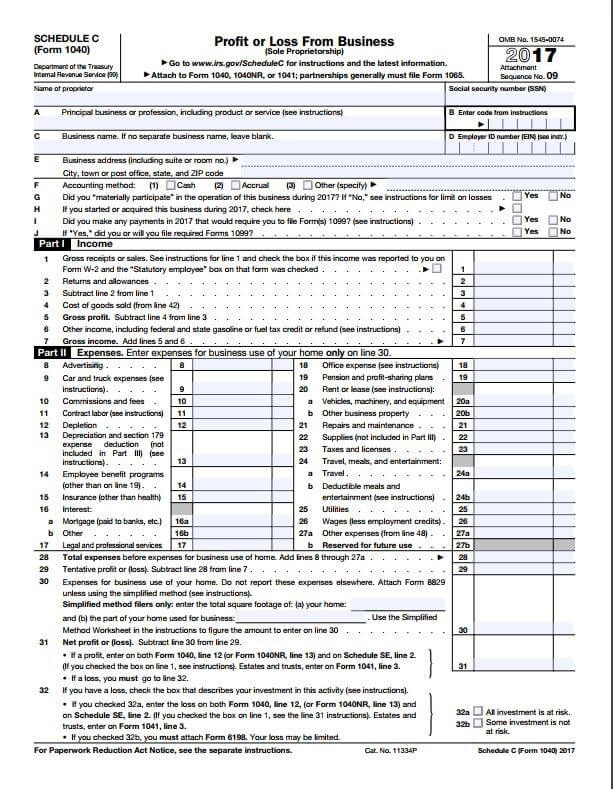

You can download or print current or past year PDFs of 1040 Schedule SE directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes What Is Form 1040 Schedule SE Schedule SE is used to calculate both your self employment tax due and your one half self employment tax deduction on IRS Form 1040 and Form 1040NR Schedule SE is generally required if you file Schedule C EZ Schedule C Schedule F or Schedule K 1 Form 1065

Use IRS Form Schedule SE to calculate self employed taxes Freelancers pay 15 3 SECA tax on net income over 400 Deduct 50 of SECA tax as an income adjustment Lines 10 and Line 11 are probably the most important on your self employment tax form because this is where you calculate some of the most significant parts of the payment you ll EFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for Tax Brackets users File Now with TurboTax

More picture related to Printable Schedule Se Tax Form

Form 1040 SE 2023

https://www.taxuni.com/wp-content/uploads/2022/10/Form-1040-SE-2023-TaxUni-Cover-1-1536x864.jpg

2018 Form 1040 Schedule 1 Se 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/your-complete-guide-to-self-employment-taxes-in-2018.jpg

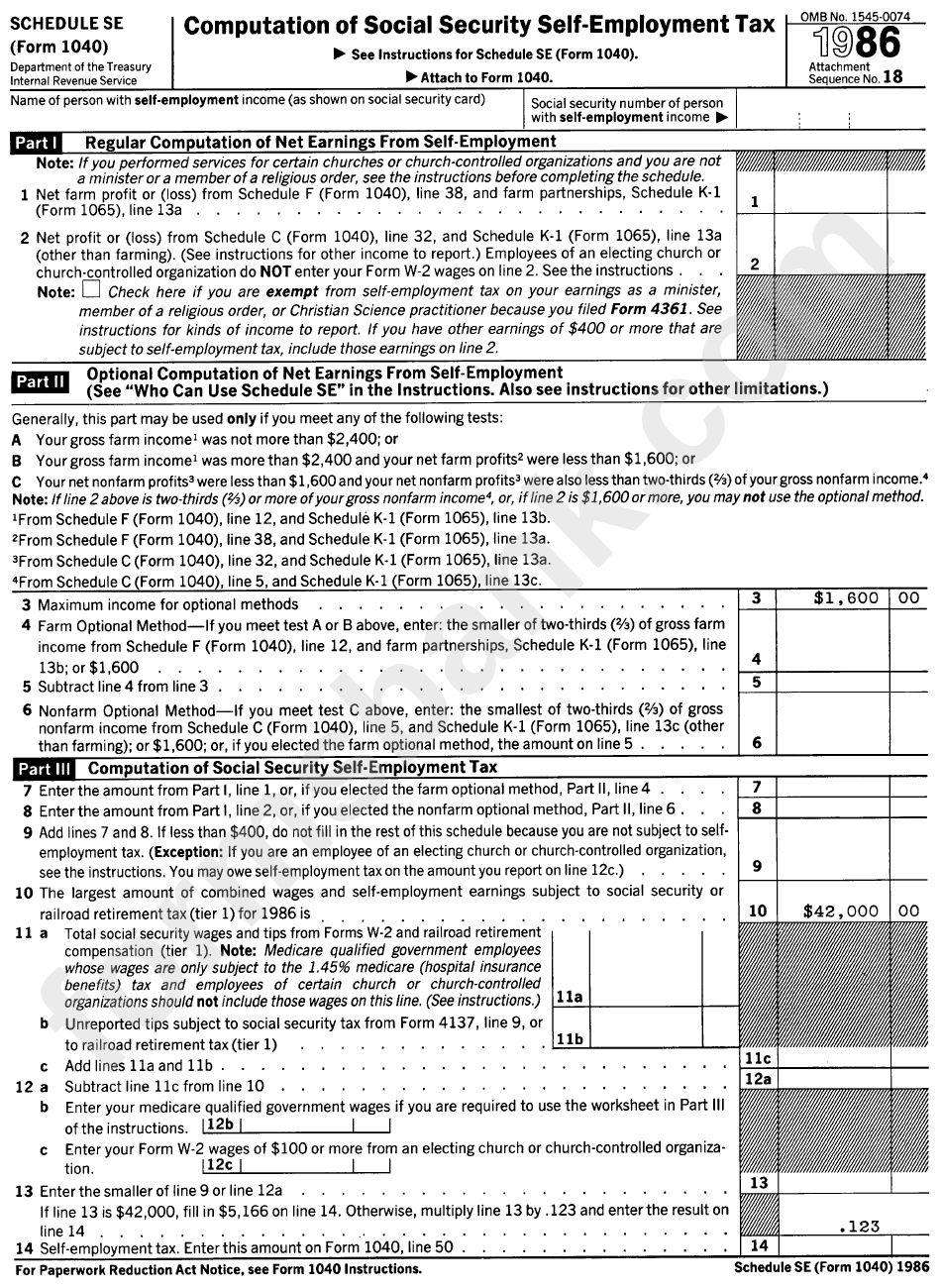

Schedule Se Form 1040 Computation Of Social Security Self Employement Tax 1986 Printable

https://data.formsbank.com/pdf_docs_html/279/2793/279358/page_1_bg.png

You must file Schedule SE if The amount on line 4c of Schedule SE is 400 or more or You had church employee income of 108 28 or more Income from services you performed as a minister member of a religious order or Christian Science practitioner isn t church employee income See Employees of Churches and Church Organizations later Schedule SE is a crucial form for those who are self employed as it is used to calculate and report self employment taxes which include contributions to Social Security and Medicare This form must be completed and attached to the individual s Form 1040 1040 SR 1040 SS or 1040 NR when filing their annual tax return It is essential for

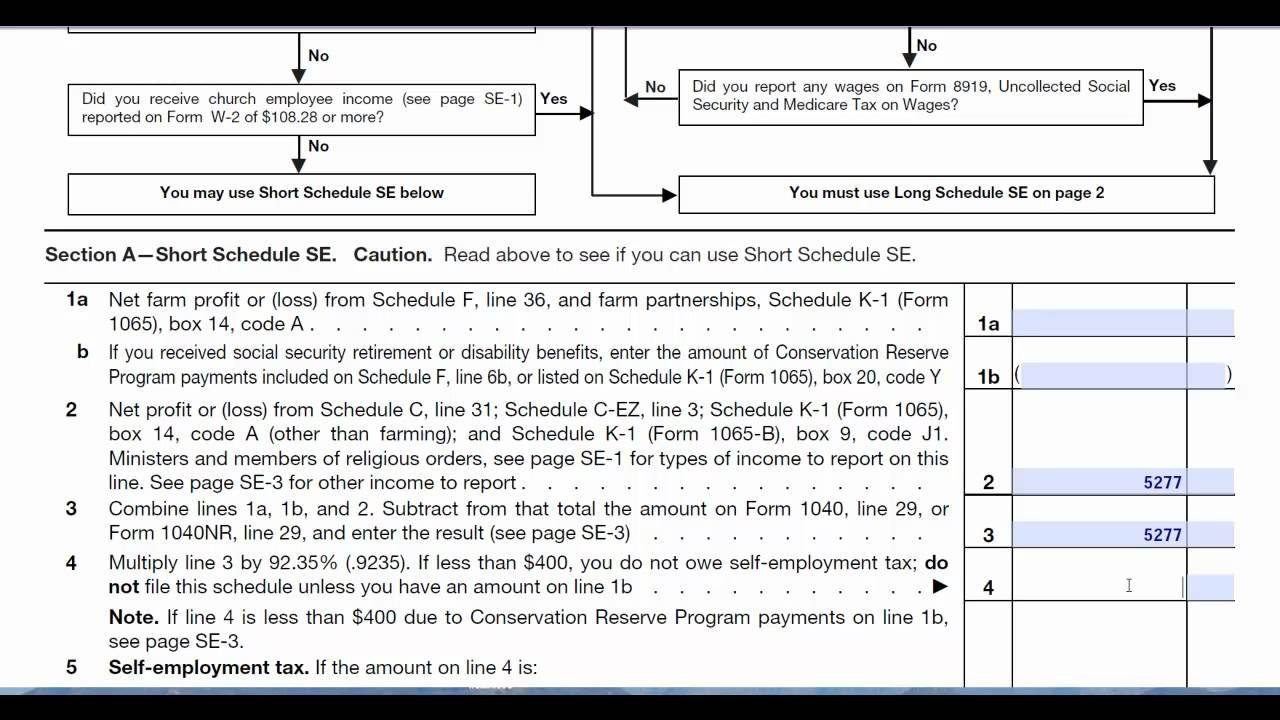

So what exactly is Schedule SE Well it s your self employment tax form where you can calculate and report the amount of self employment taxes you owe based on your earnings Here s a summary of how to fill out Schedule SE Top of the form Enter your name and Social Security number Part 1 Self employment tax Part 2 Optional methods to figure net earnings Part 3 Maximum deferral of self employment tax payments View the IRS instructions for Schedule SE

Schedule SE A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/17zhg38CumTeUXKDfcX5Qu/abc03c80de48c9cc8271a738ef7815c3/Schedule_SE__Form_1040_.png

Form 1040 Schedule Se Fillable Selfemployment Tax

https://image.slidesharecdn.com/1273141/95/form-1040-schedule-se-selfemployment-tax-1-728.jpg?cb=1239368547

https://www.taxformfinder.org/forms/2021/2021-federal-1040-schedule-se.pdf

2021 Schedule SE Form 1040 Note If your only income subject to self employment tax is church employee income see instructions for how to report your income and the definition of church employee income

https://www.bench.co/blog/tax-tips/schedule-se

Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return You use it to calculate your total self employment tax which you must report on another schedule of Form 1040 Schedule 2 Part II line 4

1040 Schedule SE Form Printable

Schedule SE A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

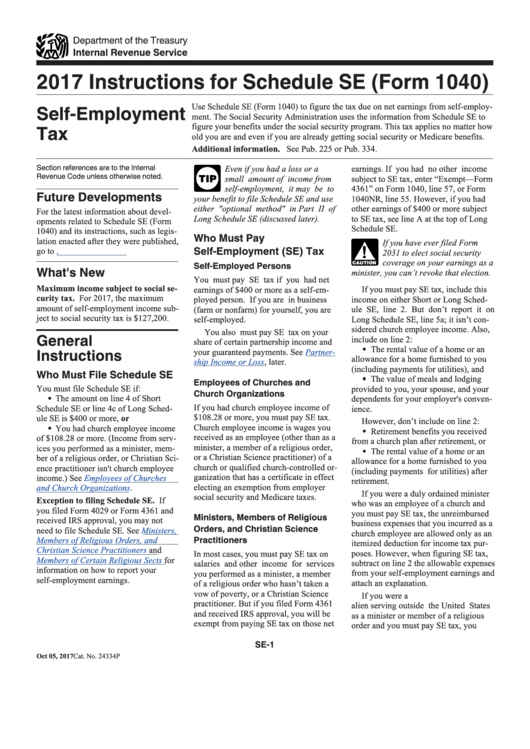

Instructions For Schedule Se Form 1040 2017 Printable Pdf Download

Schedule SE

Schedule Se Fillable Form Printable Forms Free Online

2020 Form IRS 1040 Schedule SE Fill Online Printable Fillable Blank PdfFiller

2020 Form IRS 1040 Schedule SE Fill Online Printable Fillable Blank PdfFiller

USA 1040 Schedule SE Form Template ALL PSD TEMPLATES

Fillable Schedule Se Form 1040 Self Employment Tax 2015 Printable Pdf Download

Book Form 1040 Schedule SE Tax Goddess Publishing

Printable Schedule Se Tax Form - You must complete a Schedule SE if You have Self Employment income of 400 or more You have church employee not clergy income of 108 28 or more The maximum amount of income subject to social security tax is 147 000 The program automatically generates this form when filing a Schedule C unless you have Statutory Income listed on the W 2