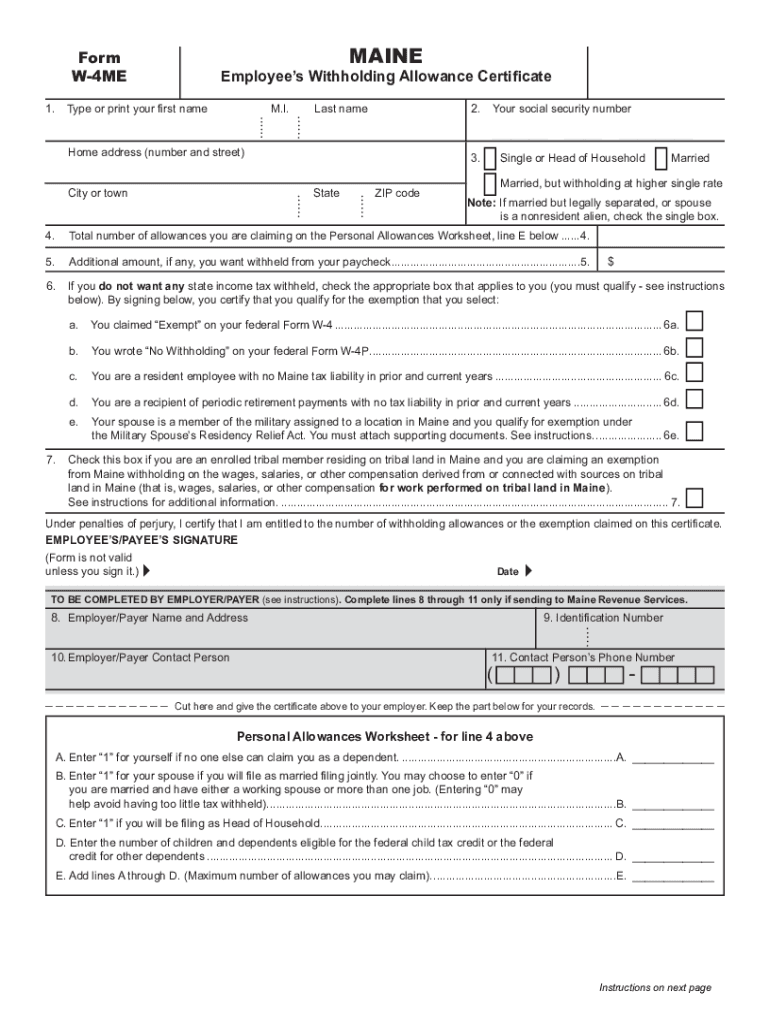

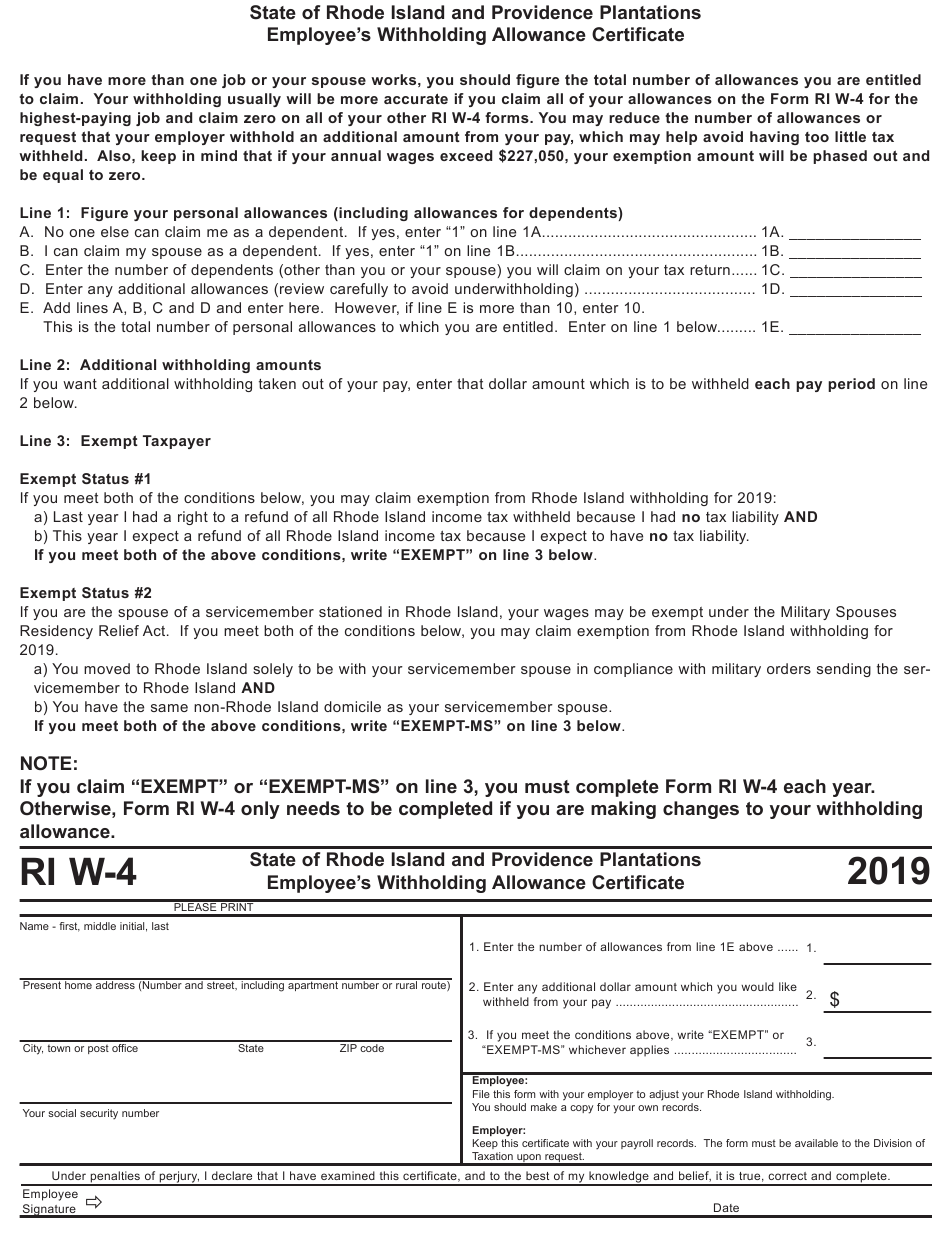

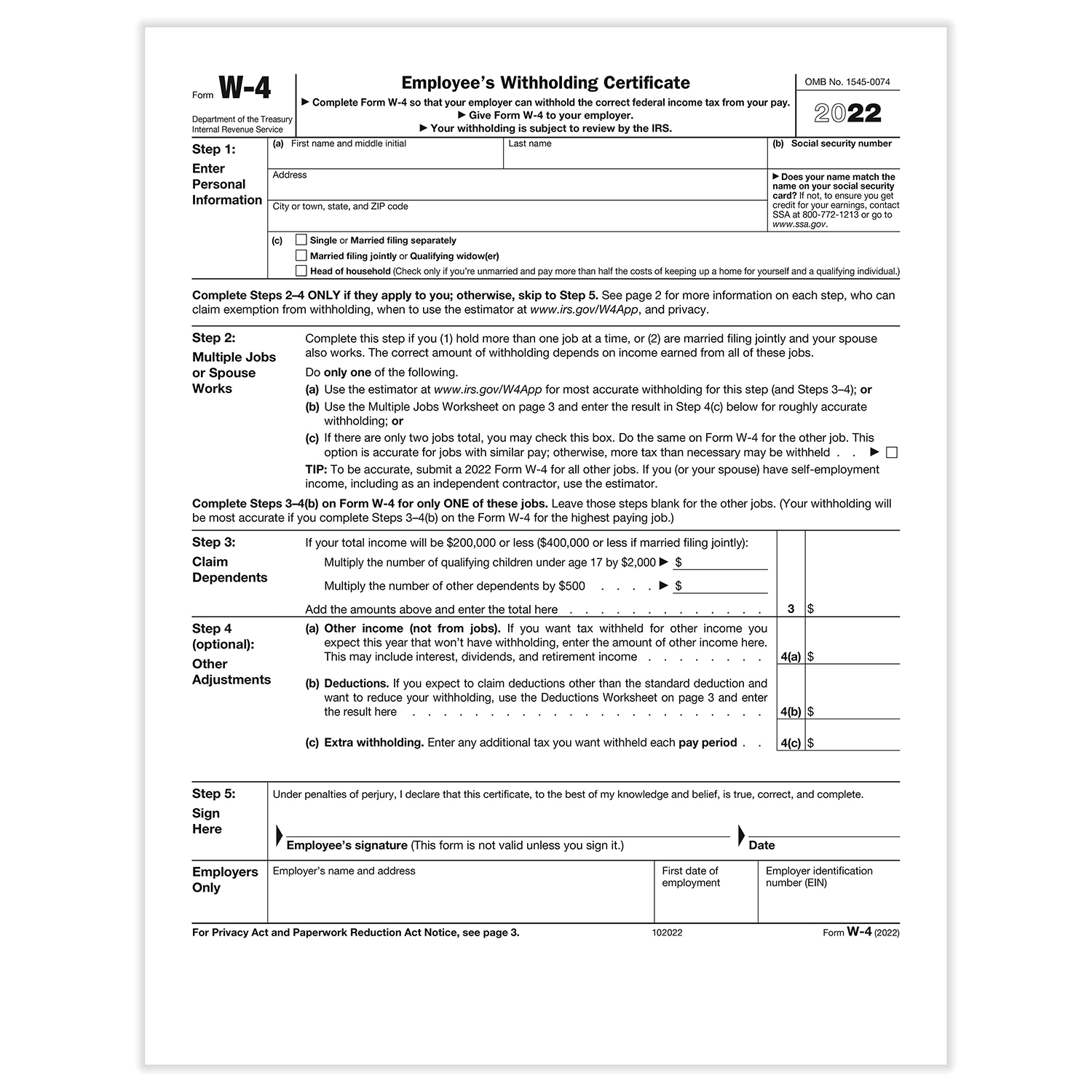

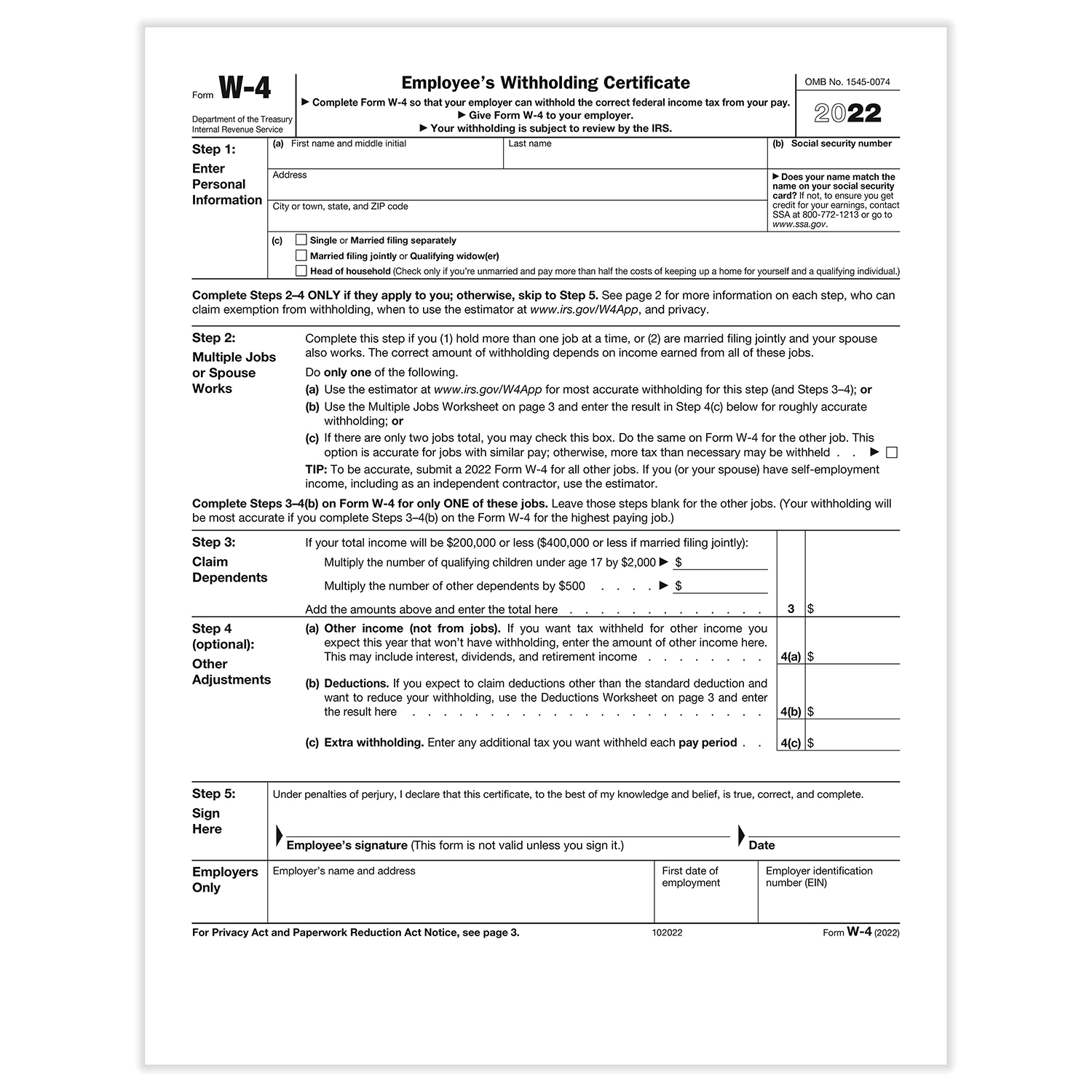

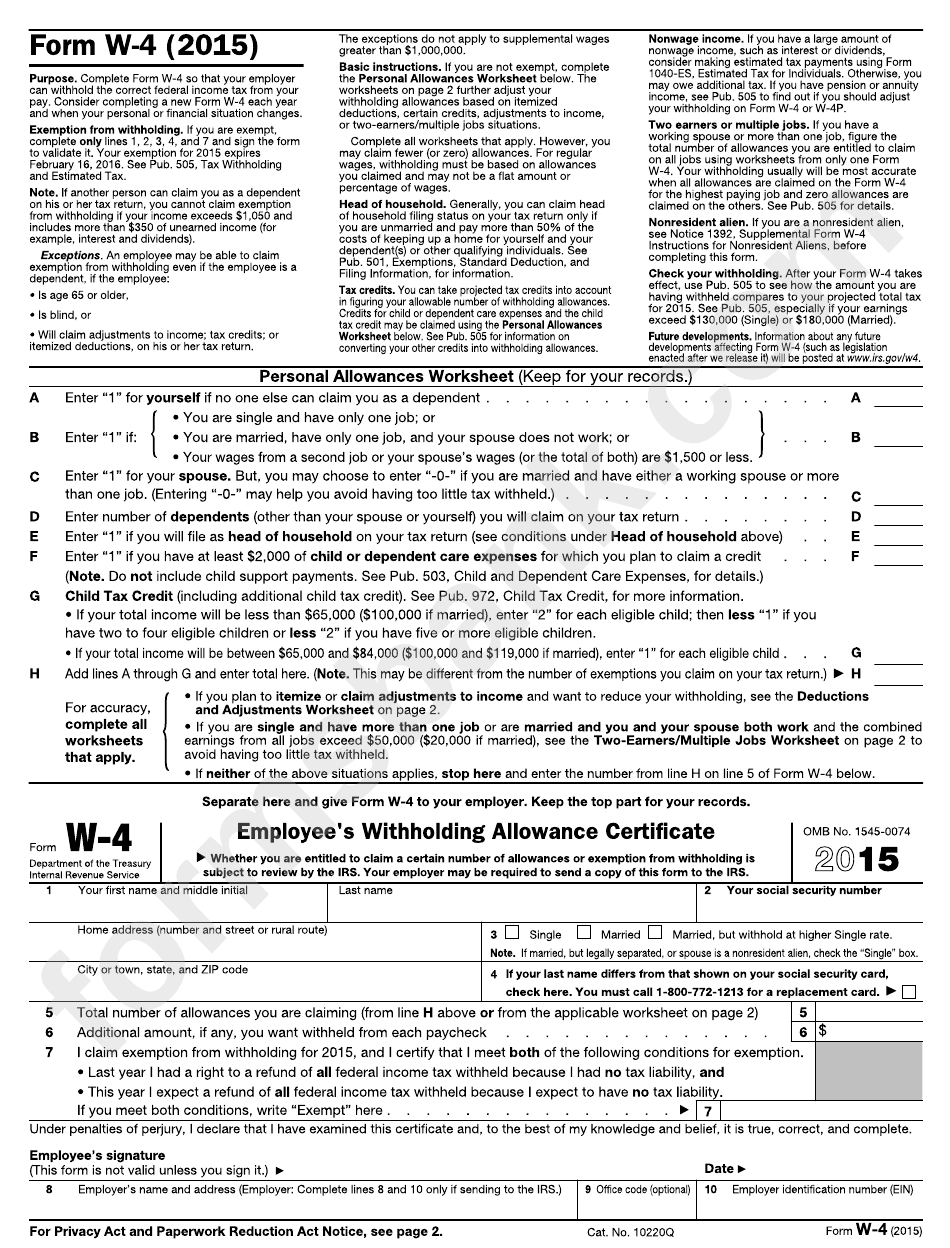

Printable Schedule W Withholding Form Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each year and when your personal or financial situation changes Current Revision Form W 4 PDF Recent Developments Additional Guidance for Substitute Submissions of Form W 4 29 NOV 2022

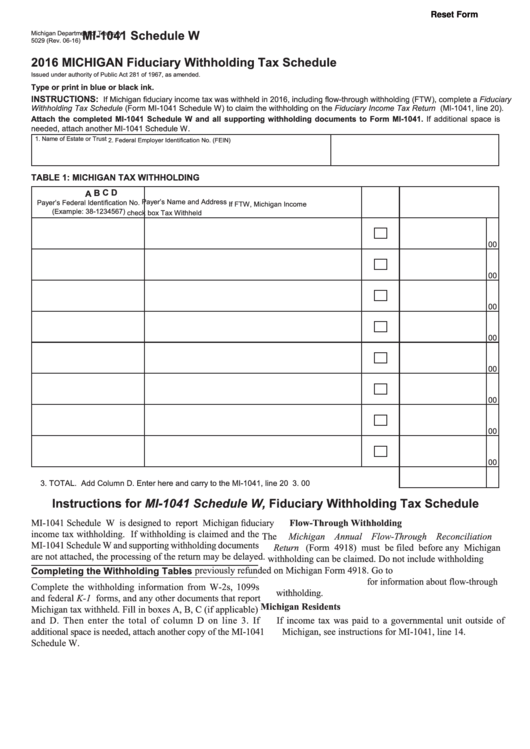

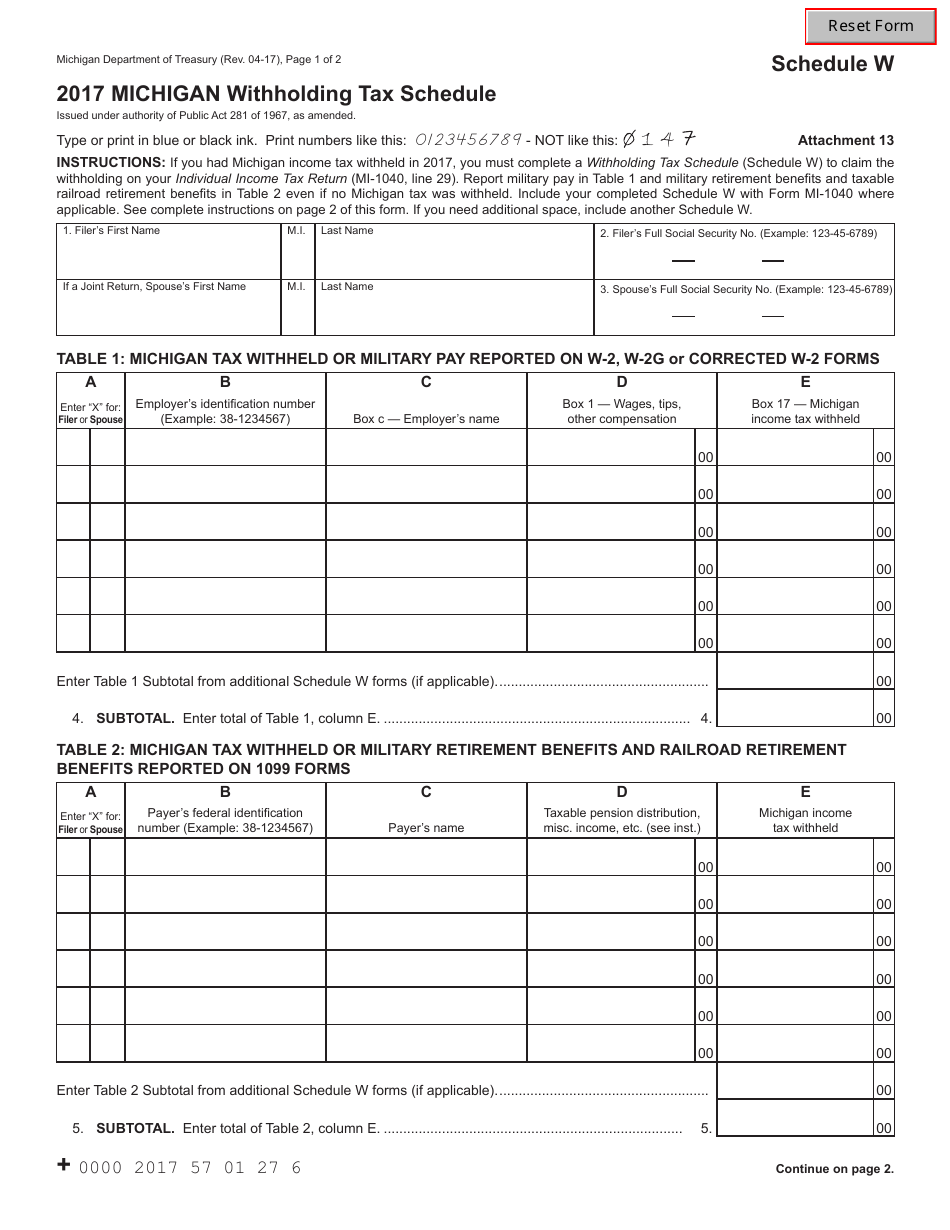

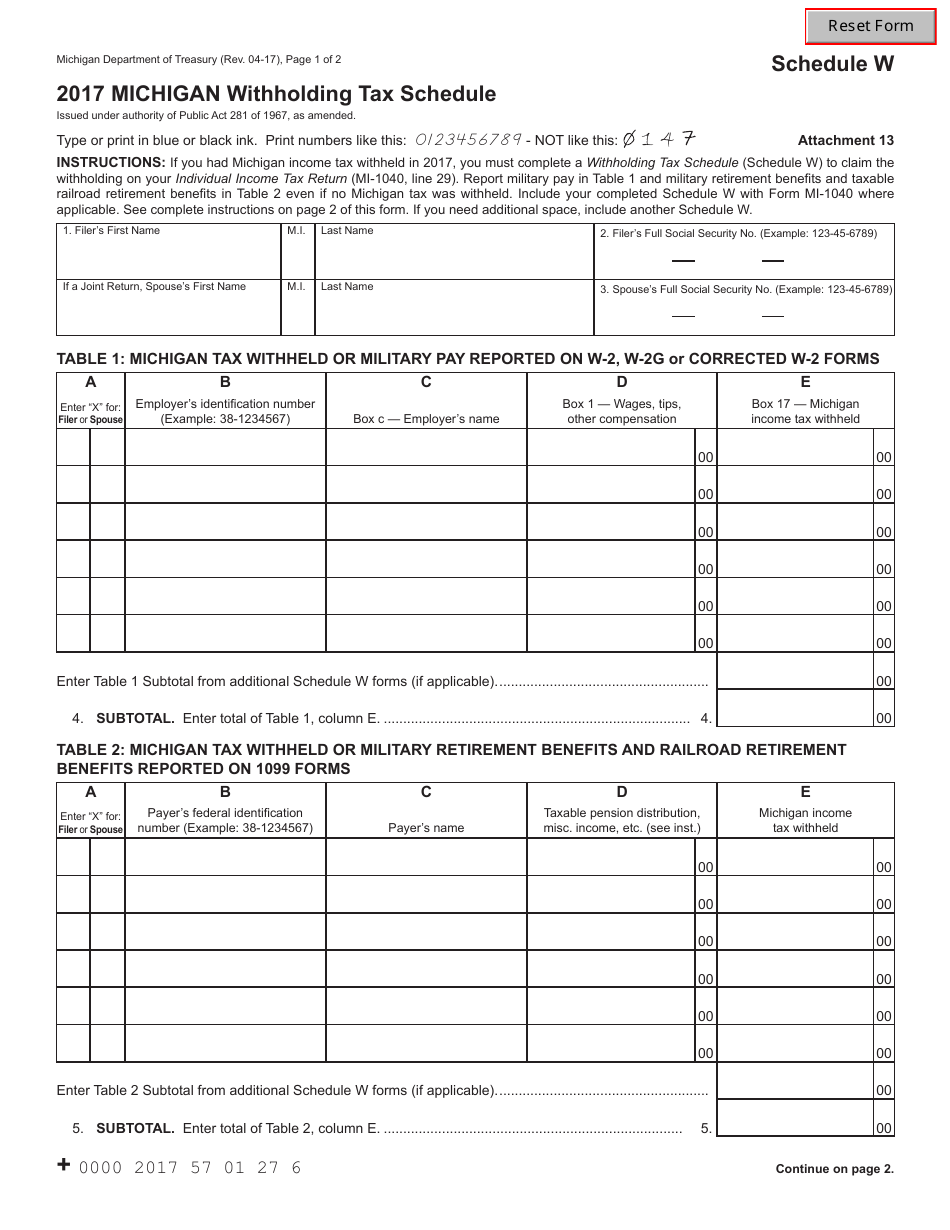

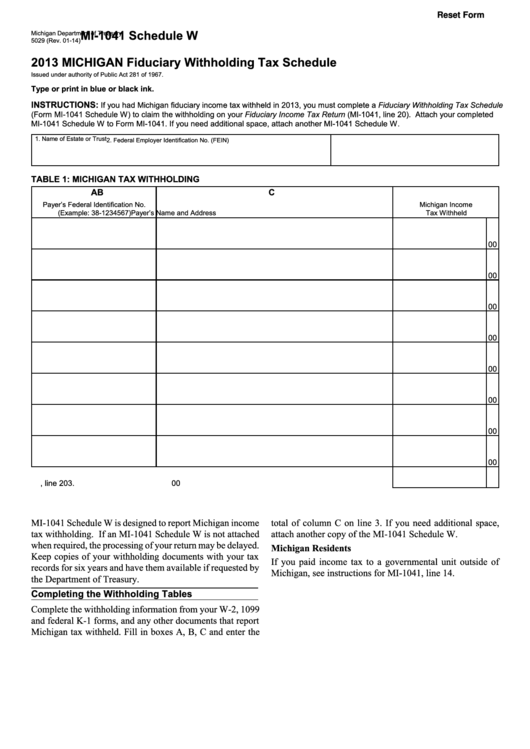

Schedule W Type or print in blue or black ink Attachment 13 INSTRUCTIONS If you had Michigan income tax withheld in 2021 you must complete a Withholding Tax Schedule Schedule W to claim the withholding on your Individual Income Tax Return MI 1040 line 30 The IRS recently released an updated version of Form W 4 for 2024 which can be used to adjust withholdings on income earned in 2024 The main difference between the 2023 and 2024 W 4 is Step 2

Printable Schedule W Withholding Form

Printable Schedule W Withholding Form

https://data.formsbank.com/pdf_docs_html/264/2647/264768/page_1_thumb_big.png

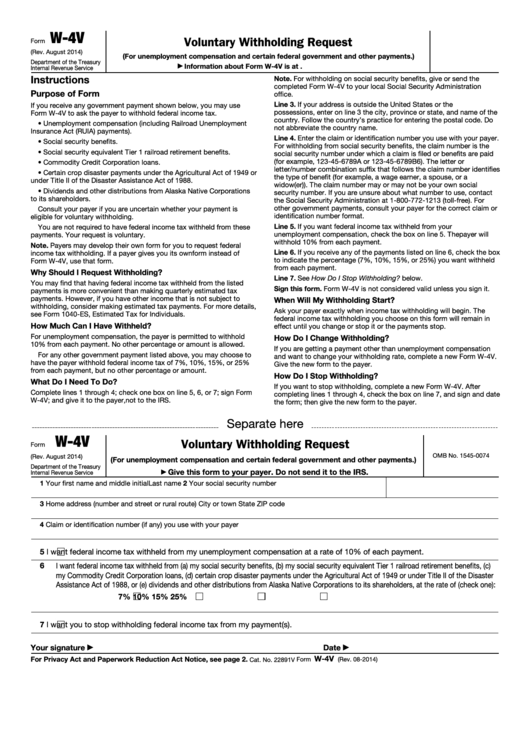

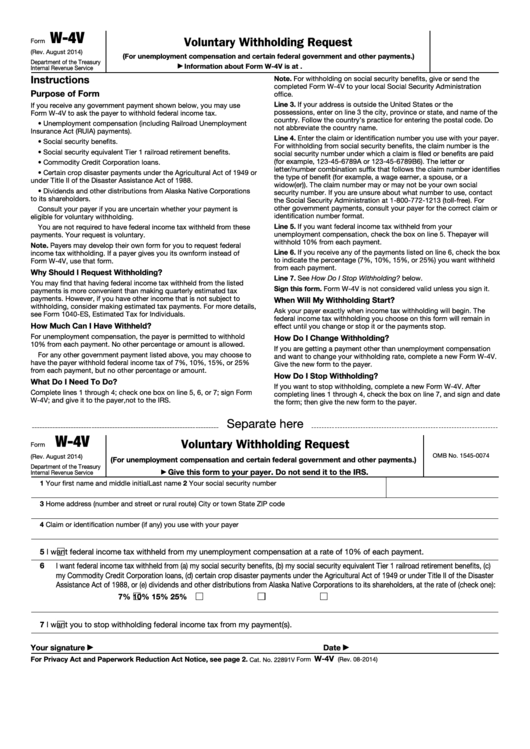

Fillable Form W 4v Voluntary Withholding Request Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/374/3748/374890/page_1_thumb_big.png

W4 2023 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/628/466/628466338/large.png

a Other income not from jobs If you want tax withheld for other income you expect this year that won t have withholding enter the amount of other income here This may include interest dividends and retirement income b Deductions Here are some of the key changes to the W 4 for this year Elimination of allowances You will now need to enter more specific information about income and deductions Additional withholding options Additional options for taxpayers such as for multiple jobs or non wage income Tax withholding estimator The IRS has developed a new

Form 941 Employer s Quarterly Federal Tax Return reports wage withholding to the IRS for income taxes the employees share of Social Security and Medicare FICA taxes and the employer s share of FICA The form serves as a summary of the employer s quarterly payroll tax liabilities and payments including Wages you as the employer paid Form 590 does not apply to payments for wages to employees Wage withholding is administered by the California Employment Development Department EDD For more information go to edd ca gov or call 888 745 3886 Do not use Form 590 to certify an exemption from withholding if you are a seller of California real estate

More picture related to Printable Schedule W Withholding Form

Federal Withholding Tables 2024 Federal Income Tax

https://www.taxuni.com/wp-content/uploads/2020/04/tax-withholding-table-example.jpg

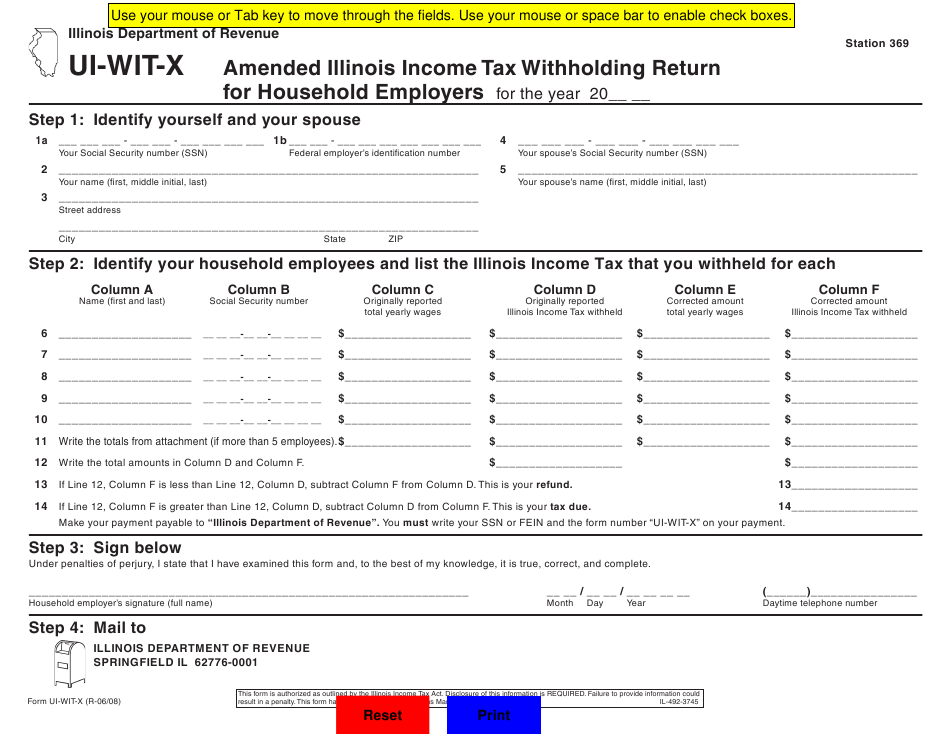

Illinois Income Tax Withholding Forms 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/form-ui-wit-x-download-fillable-pdf-or-fill-online-amended.png

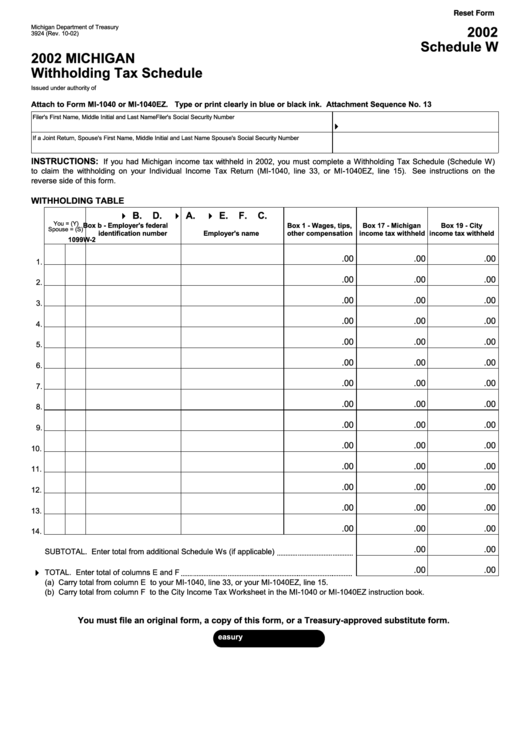

Fillable Form 3924 Schedule W Michigan Withholding Tax Schedule 2002 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/274/2745/274585/page_1_thumb_big.png

EFile your Michigan tax return now eFiling is easier faster and safer than filling out paper tax forms File your Michigan and Federal tax returns online with TurboTax in minutes FREE for simple returns with discounts available for Tax Brackets users File Now with TurboTax You can download or print current or past year PDFs of Schedule W directly from TaxFormFinder You can print other Michigan tax forms here eFile your Michigan tax return now eFiling is easier faster and safer than filling out paper tax forms File your Michigan and Federal tax returns online with TurboTax in minutes

View more information here Withholding Tax Forms for 2024 Filing Season Tax Year 2023 2024 File the FR 900A if you are an annual wage filer whose threshold is less than 200 per year Note The 2023 FR 900A is due January 31 2024 Deposits are due by January 20 2024 for the preceding calendar year File the FR 900Q if you are required to Payroll Tax Withholding Update On August 8 2020 President Trump issued a Presidential Memo directing the IRS to allow the optional deferral of withholding from employee s 2020 taxes between September 1 2020 and December 31 2020 The paper enrollment form is available on the CDSS website for those who want to use it IHSS Provider

2017 Michigan Michigan Withholding Tax Schedule Fill Out Sign Online And Download PDF

https://data.templateroller.com/pdf_docs_html/1728/17289/1728912/schedule-w-michigan-withholding-tax-schedule-michigan_print_big.png

W4 Employee Withholding Allowance Certificate 2021 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/form-w-4-download-printable-pdf-or-fill-online-employee-s.png

https://www.irs.gov/forms-pubs/about-form-w-4

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each year and when your personal or financial situation changes Current Revision Form W 4 PDF Recent Developments Additional Guidance for Substitute Submissions of Form W 4 29 NOV 2022

https://www.michigan.gov/taxes/-/media/Project/Websites/taxes/Forms/2021-IIT-Forms/Schedule-W.pdf?rev=f9bb14b4c3504707aea353c8f90a8dea&hash=5B018D005B25209A7778EEB0CC6C4891

Schedule W Type or print in blue or black ink Attachment 13 INSTRUCTIONS If you had Michigan income tax withheld in 2021 you must complete a Withholding Tax Schedule Schedule W to claim the withholding on your Individual Income Tax Return MI 1040 line 30

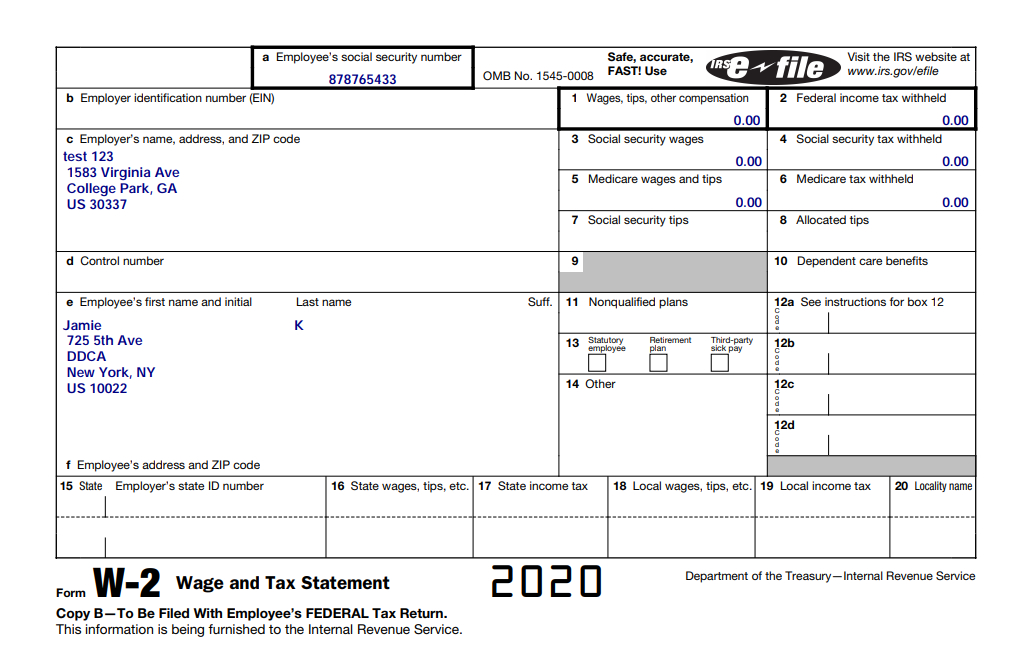

How To Download Employee W 2 Withholding Form Using Deskera People

2017 Michigan Michigan Withholding Tax Schedule Fill Out Sign Online And Download PDF

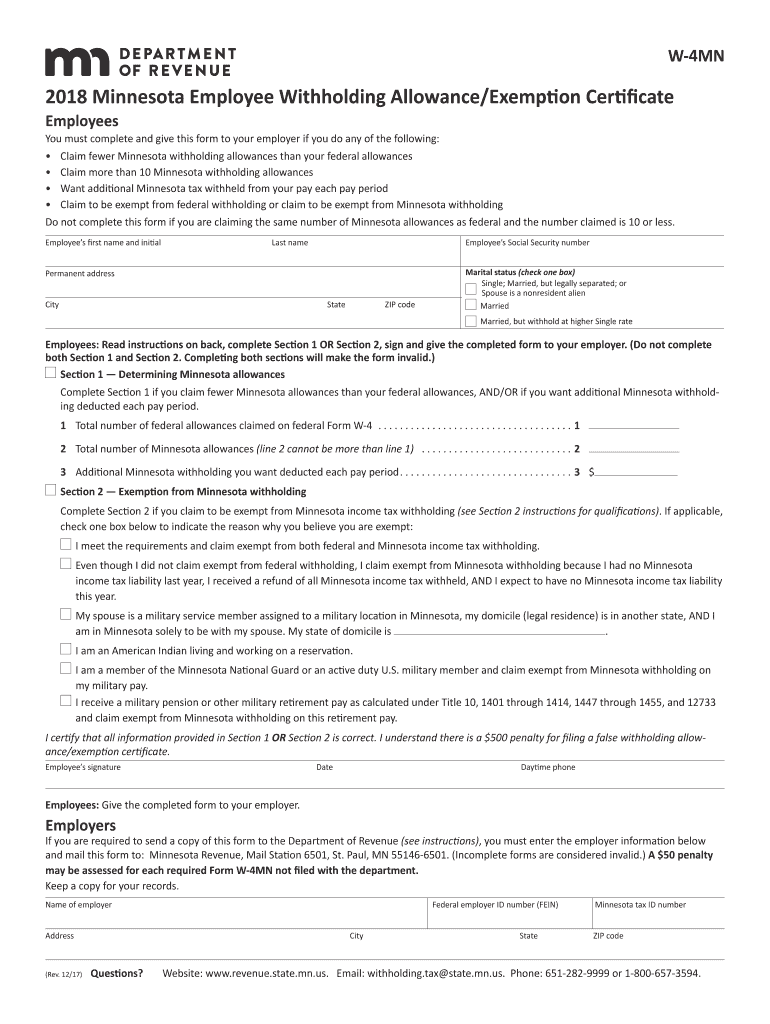

Form W 4 MN Minnesota Employee Withholding Allowance Fill Out And Sign Printable PDF Template

Withholding Form For Employee 2023 Employeeform

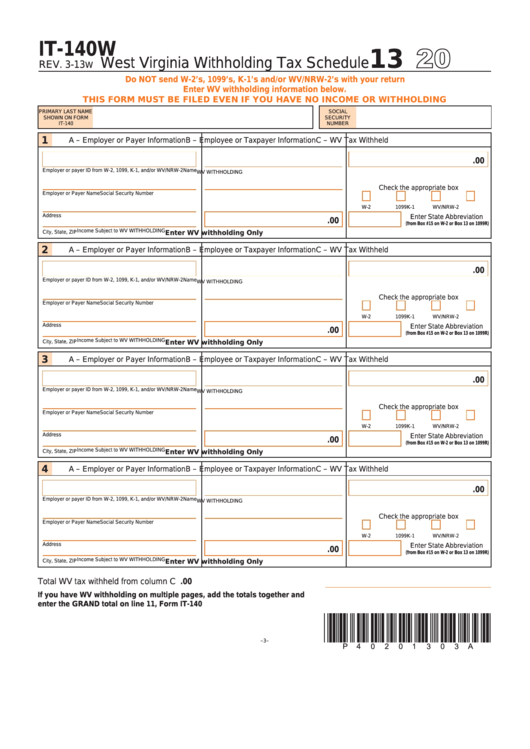

Fillable Form It 140w West Virginia Withholding Tax Schedule 2013 Printable Pdf Download

2023 IRS W 4 Form HRdirect Fillable Form 2023

2023 IRS W 4 Form HRdirect Fillable Form 2023

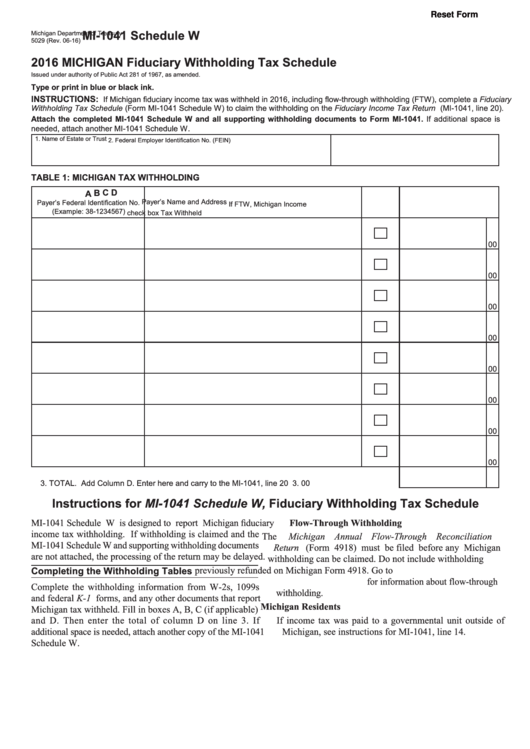

Fillable Form 5029 Mi 1041 Schedule W 2013 Michigan Fiduciary Withholding Tax Schedule

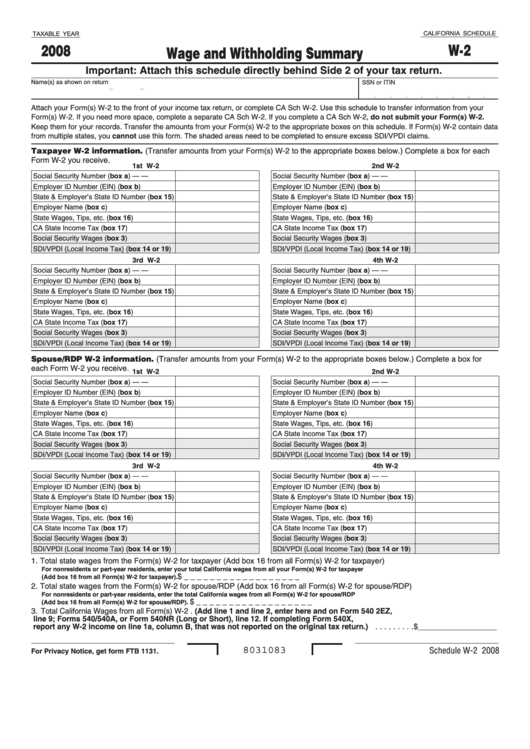

Fillable California Schedule W 2 Wage And Withholding Summary 2008 Printable Pdf Download

Form W 4 Employee S Withholding Allowance Certificate 2015 Printable Pdf Download

Printable Schedule W Withholding Form - If you receive any government payment shown below you may use this form to ask the payer to withhold federal income tax Unemployment compensation including Railroad Unemployment Insurance Act RUIA payments Social security benefits Social security equivalent Tier 1 railroad retirement benefits Commodity Credit Corporation loans