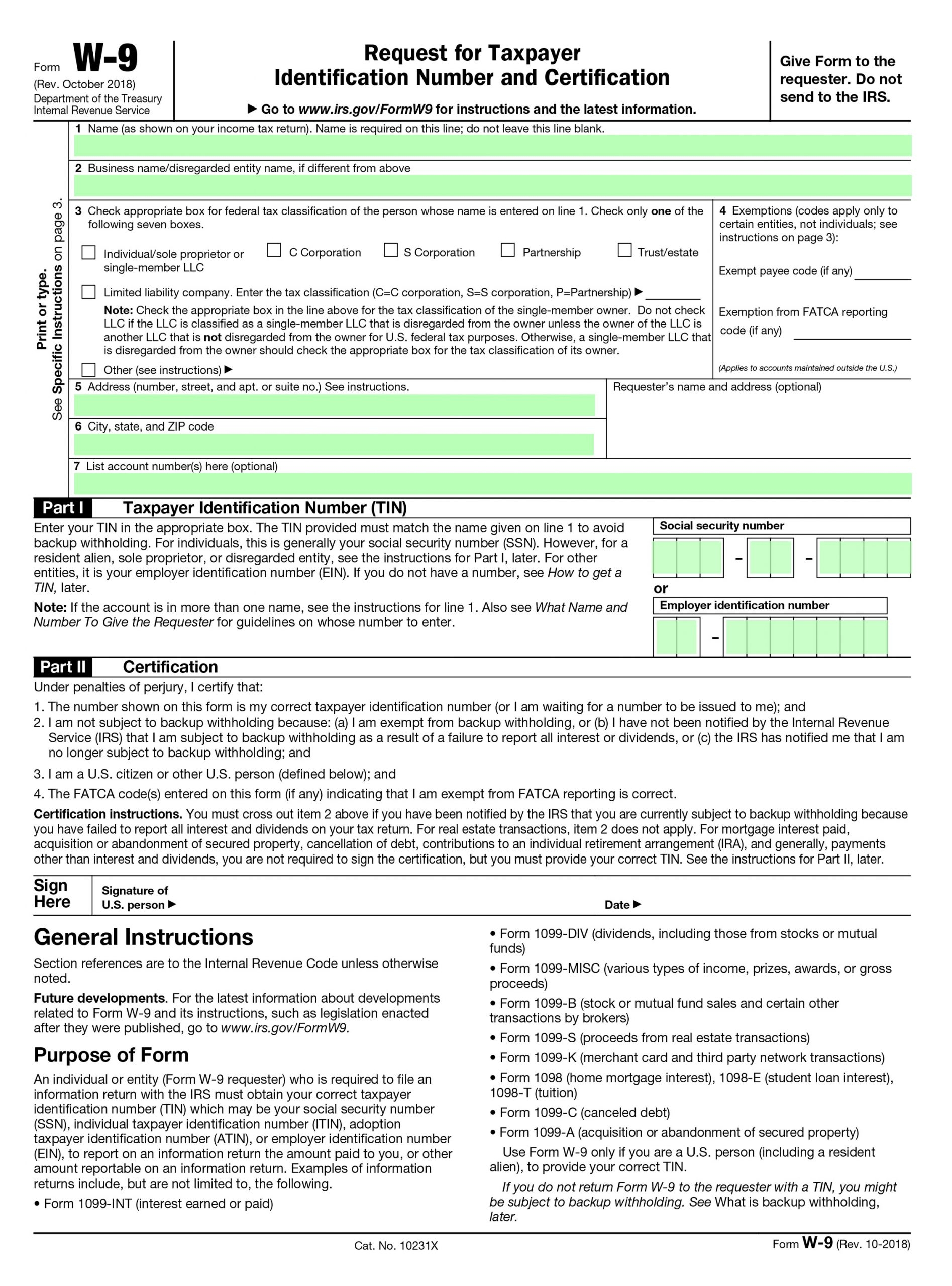

Printable Self Employment Tax Forms Businesses Self Employed Standard mileage and other information Popular Earned Income Credit EITC Advance Child Tax Credit Standard Deduction Health Coverage Retirement Plans Forms Instructions Overview Popular Forms Instructions Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9

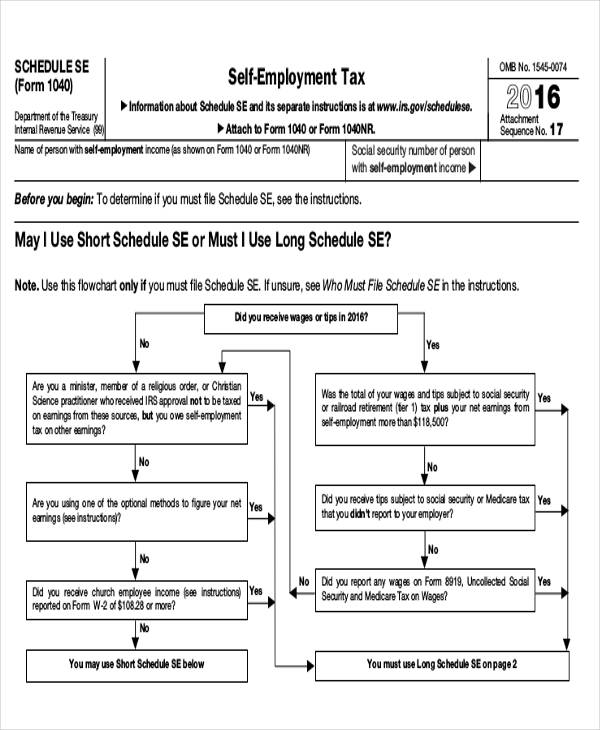

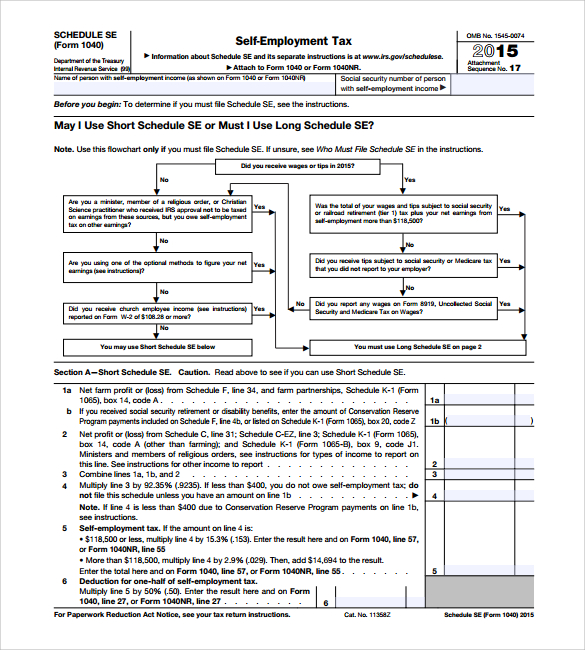

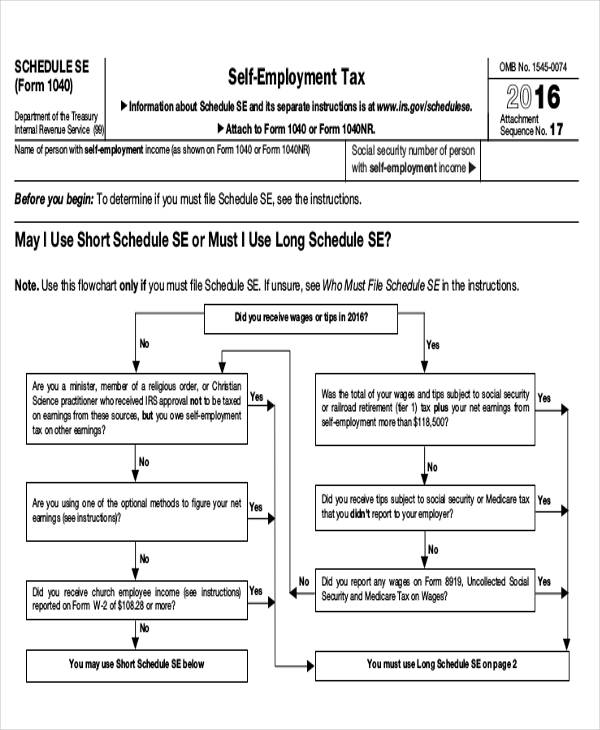

New to Intuit Create an account If you re self employed it is important to remember that your tax situation will be different from those who just have an employer meaning that you will need to use some different forms to file your taxes Print This Form More about the Federal 1040 Schedule SE Individual Income Tax TY 2023 Taxpayers who have received 400 or more in income from a Schedule C business or self employment must file Schedule SE to determine their self employment tax liability

Printable Self Employment Tax Forms

Printable Self Employment Tax Forms

https://www.employementform.com/wp-content/uploads/2022/10/2022-self-employed-tax-form.jpg

FREE 9 Sample Employee Tax Forms In MS Word PDF

https://images.sampletemplates.com/wp-content/uploads/2017/02/16004713/Self-Employee-Tax-Form-Example.jpg

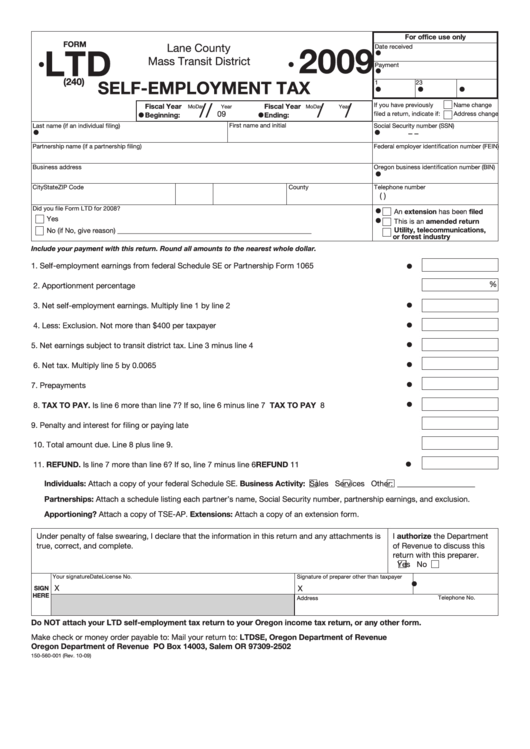

Fillable Form Ltd Self Employment Tax 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/199/1995/199580/page_1_thumb_big.png

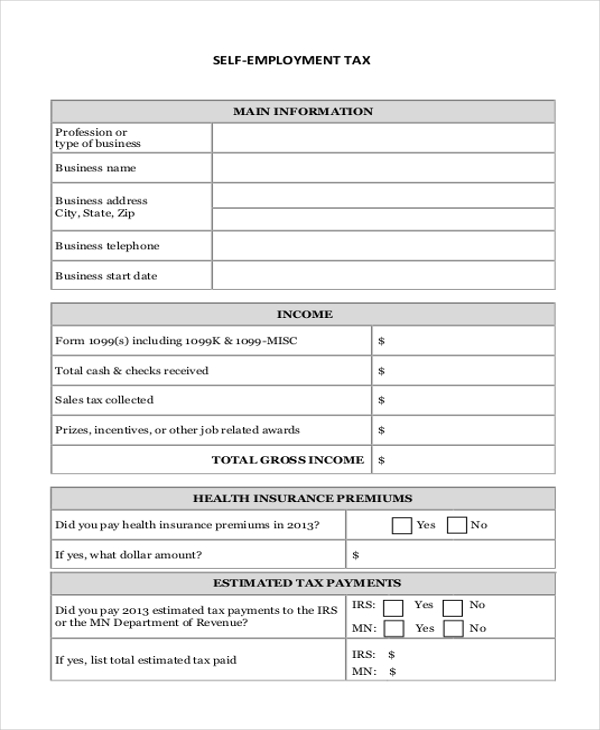

1 Form 1040 U S Individual Tax Return Most U S tax filers use Form 1040 even when they re not self employed This form is comprised of different sections where you can report your income and claim tax deductions Whether or not you owe taxes you might qualify for certain tax credits What Is Form 1040 Schedule SE Schedule SE is used to calculate both your self employment tax due and your one half self employment tax deduction on IRS Form 1040 and Form 1040NR Schedule SE is generally required if you file Schedule C EZ Schedule C Schedule F or Schedule K 1 Form 1065

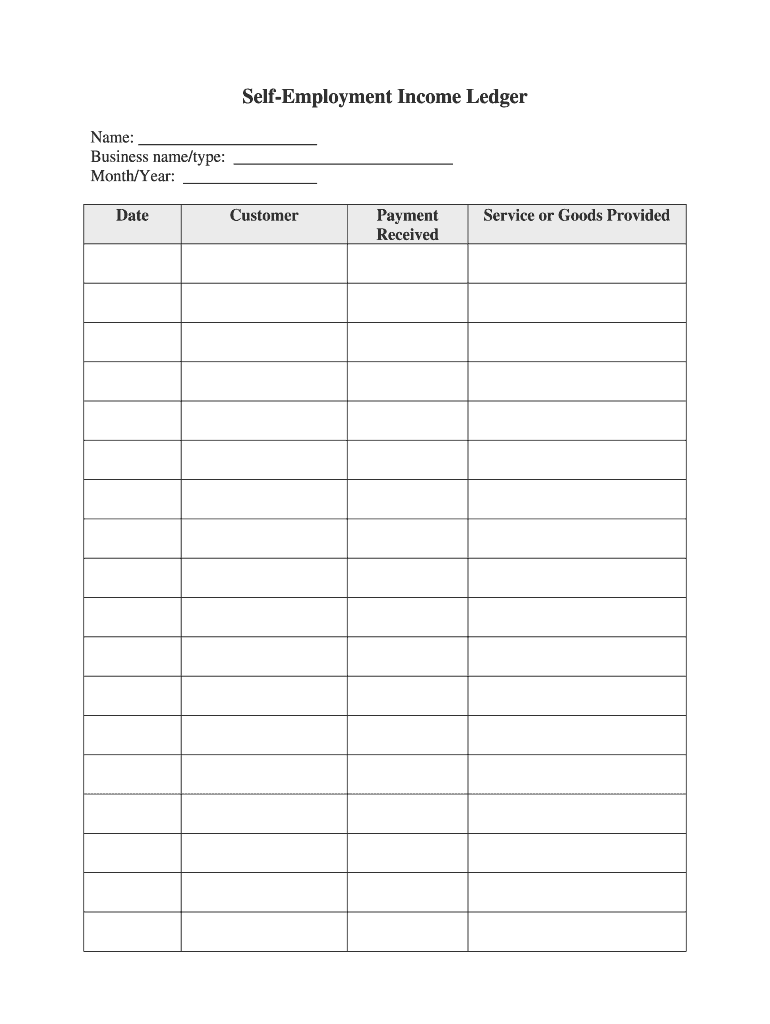

6 Common Law and Employment Agreements 7 Self employment Ledger Templates Create own personal self employment ledger template and self employment ledger forms in seconds with our fantastic templates This info sheet offers answers to frequently asked questions about filing taxes as a self employed worker Expand All Collapse All Click a topic or press the enter key on a topic to reveal its answer What are my most important responsibilities as a self employed worker Let s talk about deductions What can I take as a business expense

More picture related to Printable Self Employment Tax Forms

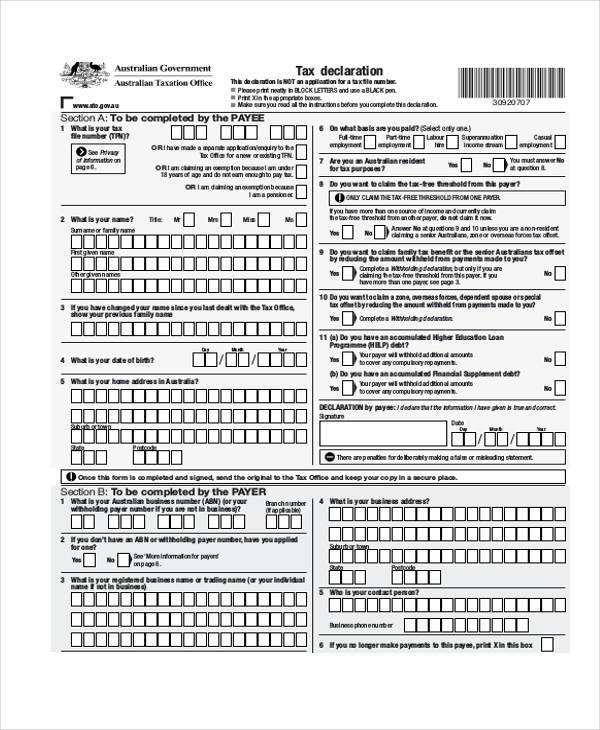

FREE 10 Employment Declaration Form Samples In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/02/Tax-Employment-Declaration-Form.jpg

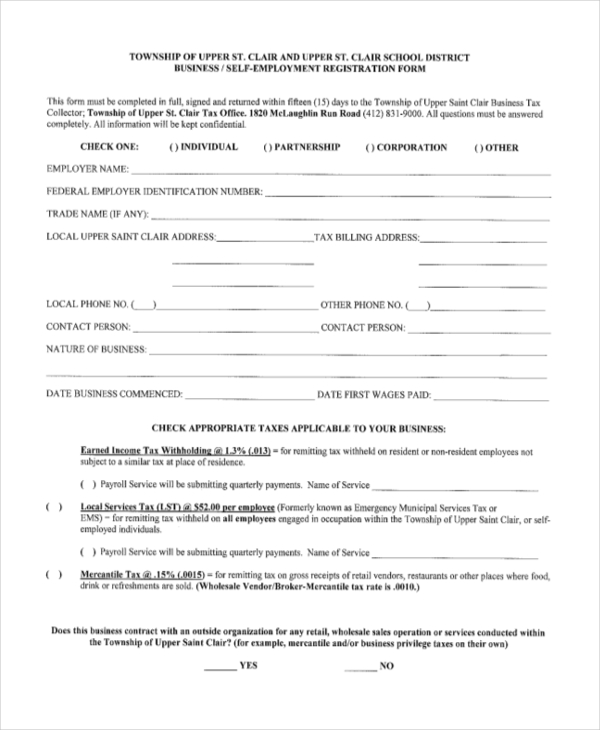

FREE 11 Sample Self Employment Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/09/Self-Employment-Registration-Form.jpg

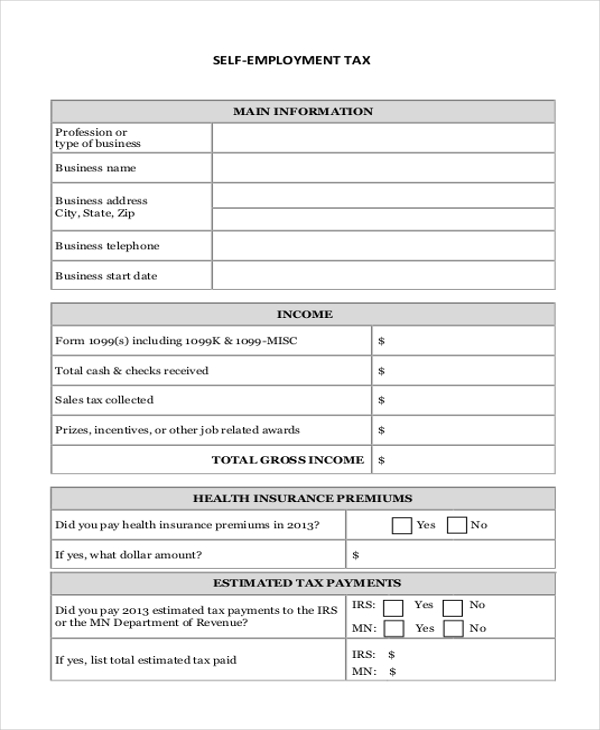

FREE 6 Sample Self Employment Tax Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2016/01/18163109/Sample-Self-Employment-Tax.jpg

Withholding Forms Local Tax Rate Changes There are no local tax rates increase for calendar year 2023 however one county Cecil s has decreased their local tax rate for calendar year 2024 For calendar year 2024 Federick and Anne Arundel counties tax rates were adjusted by adding new local tax brackets based on filing statuses and taxable income The deduction is based on how much you use your phone or internet for business use versus personal use For example if you use your cellphone 50 of the time for business then you ll deduct 50 of your phone bill If your monthly phone bill is 100 then the deductible portion is 50

Ways to get the form Download and fill out with Acrobat Reader You must download and open fillable PDFs in Acrobat Reader 10 or higher Fillable PDF t2125 fill 23e pdf Previous years Fillable PDFs Print and fill out by hand Standard print PDF t2125 23e pdf Previous years Standard print PDFs Ask for an alternate format T2125 Statement of Business or Professional Activities T4003 Farming and Fishing Income T4004 Fishing Income Date modified 2023 03 10 The T4002 contains information for self employed business persons commission sales persons and for professionals on how to calculate the income to report on your income tax return

FREE 22 Sample Tax Forms In PDF Excel MS Word

https://images.sampleforms.com/wp-content/uploads/2016/10/Self-Employment-Tax-Form.jpg

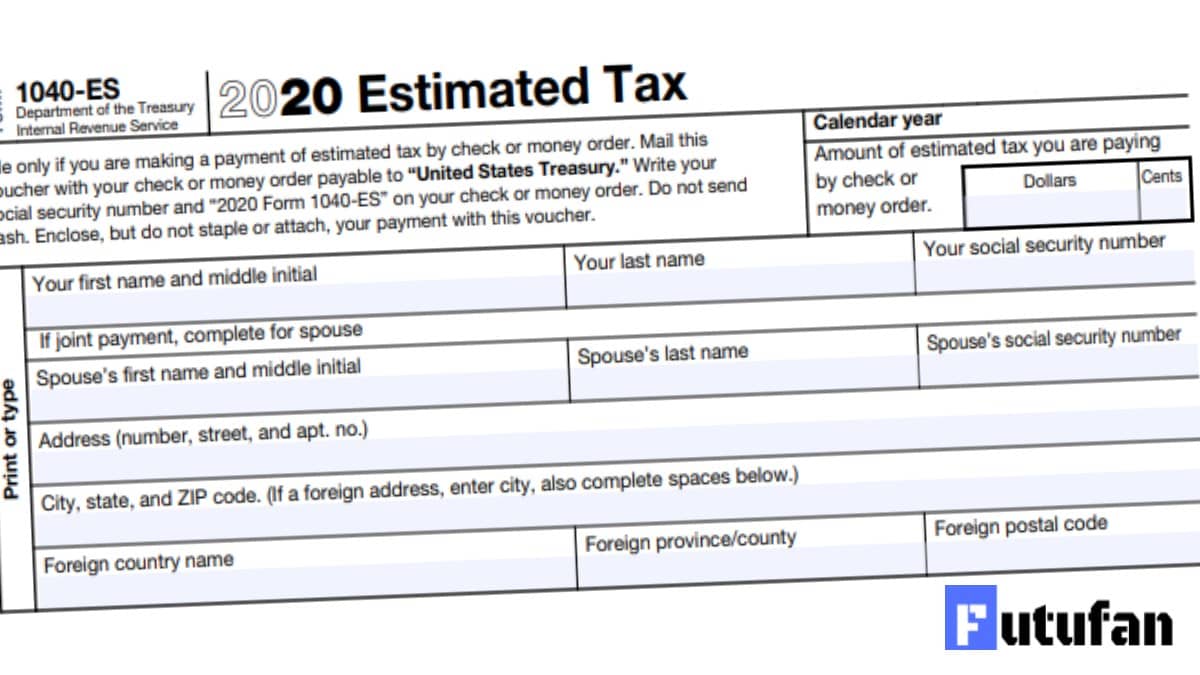

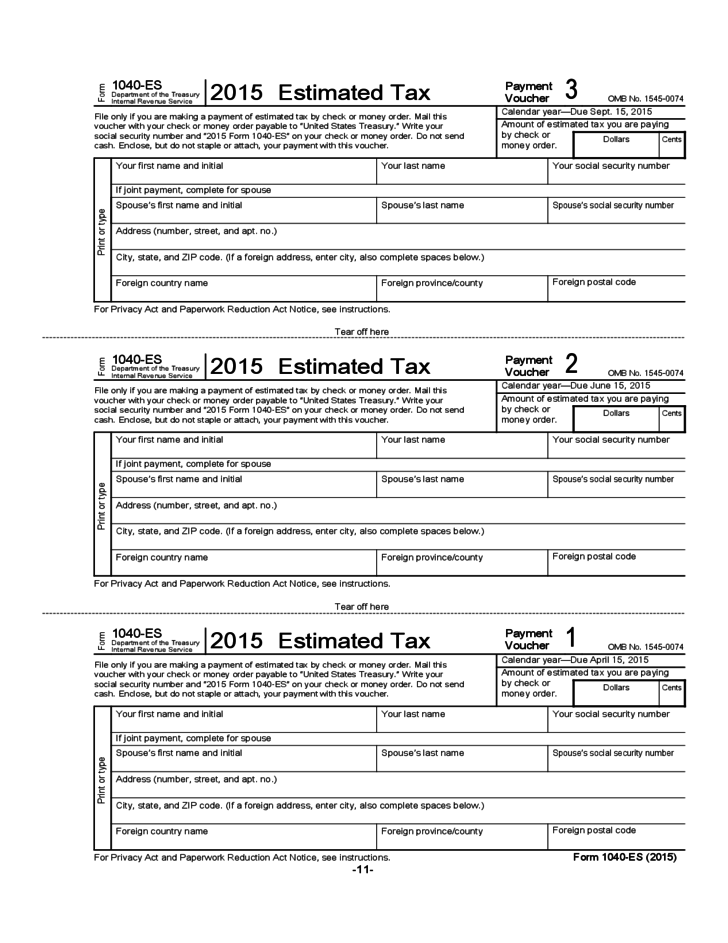

2023 Form 1040 Es Printable Forms Free Online

https://www.taxuni.com/wp-content/uploads/2020/09/1040-ES-Form.jpg

https://apps.irs.gov/app/freeFile/general/

Businesses Self Employed Standard mileage and other information Popular Earned Income Credit EITC Advance Child Tax Credit Standard Deduction Health Coverage Retirement Plans Forms Instructions Overview Popular Forms Instructions Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9

https://blog.turbotax.intuit.com/self-employed/tax-forms-for-the-self-employed-25094/

New to Intuit Create an account If you re self employed it is important to remember that your tax situation will be different from those who just have an employer meaning that you will need to use some different forms to file your taxes

Free Self Employment Ledger Template PRINTABLE TEMPLATES

FREE 22 Sample Tax Forms In PDF Excel MS Word

2005 Self Employment Tax Form Employment Form

Form 1040 Schedule SE Self Employment Tax Form 2015 Free Download

Self Employed Tax Form Estimate Employment Form

Self Employment Tax Form Editable Forms

Self Employment Tax Form Editable Forms

Printable Self Employment Tax Forms Employment Form

Self Employment Income Form 2 Free Templates In PDF Word Excel Download

Self Employment Form Fill Online Printable Fillable Blank PdfFiller

Printable Self Employment Tax Forms - 6 Common Law and Employment Agreements 7 Self employment Ledger Templates Create own personal self employment ledger template and self employment ledger forms in seconds with our fantastic templates