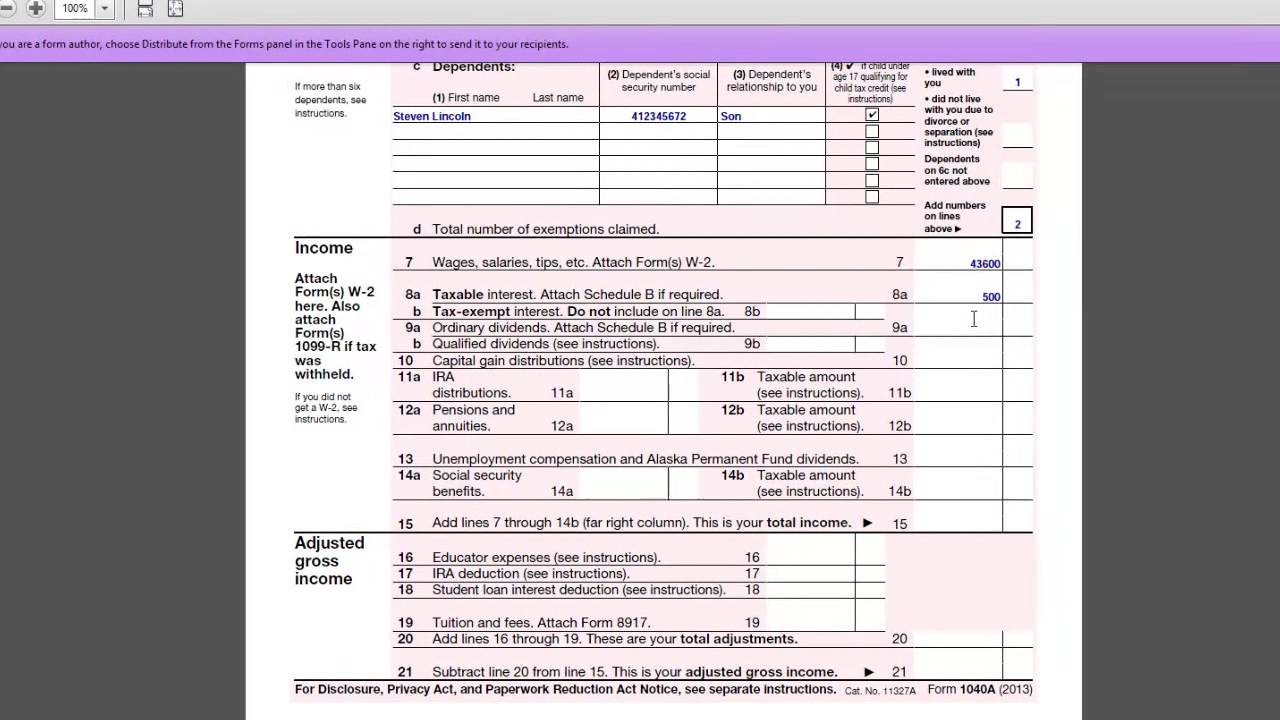

Printable Social Security Worksheet For Irs Form 1040a 7 Form 1040 filers Enter the amounts from Schedule 1 lines 11 through 20 and 23 and 25 8 Is the amount on line 7 less than the amount on line 6 No STOP None of your social security benefits are taxable Enter 0 on Form 1040 or 1040 SR line 6b Yes Subtract line 7 from line 6 8 9 If you are Married filing jointly enter 32 000

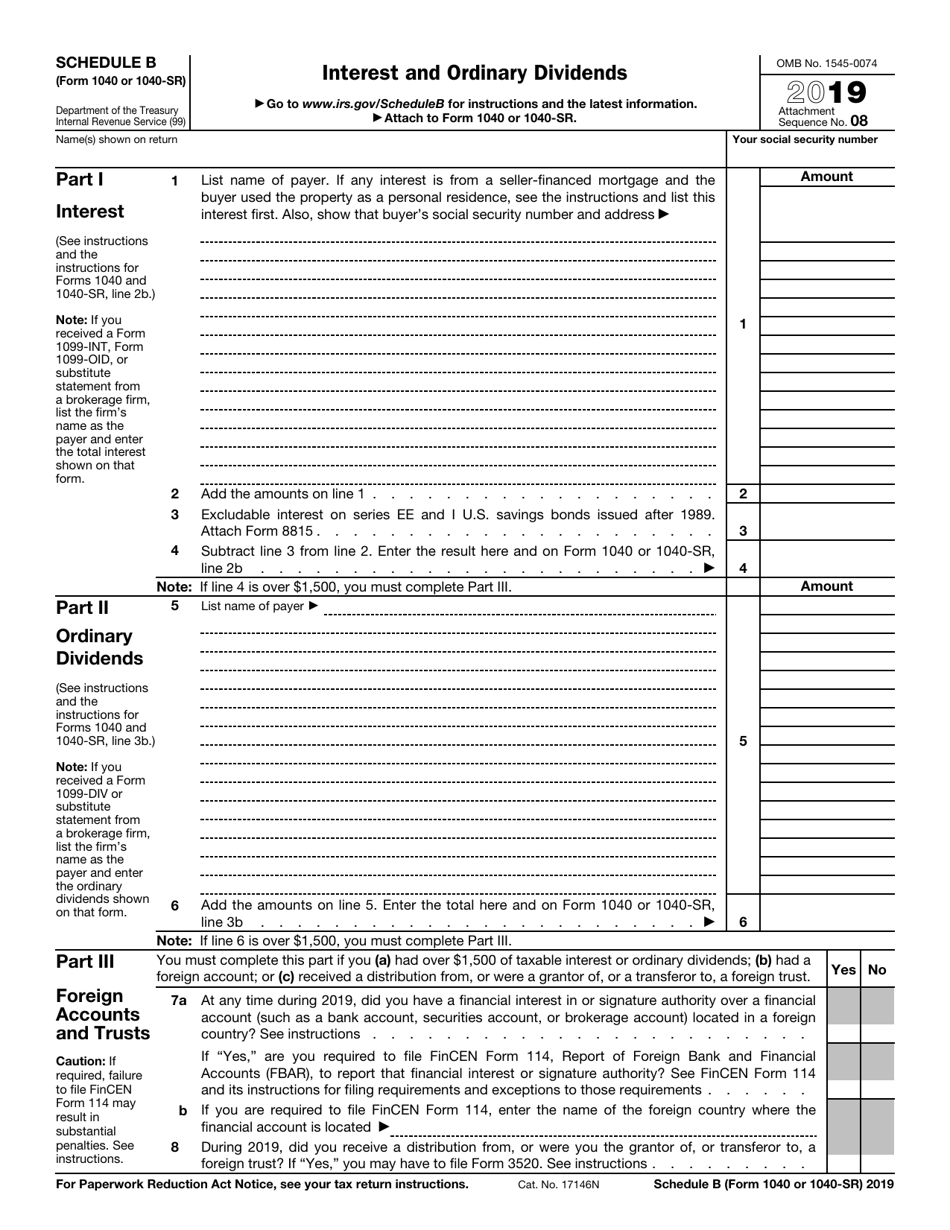

Form 8959 Additional Medicare Tax After viewing if Form 8959 Line by Line instructions do not answer your question s you may contact us only if you are using the Free File Fillable Forms program Line 1 is a manual entry Line 2 transfers from Form 4137 line 6 Line 3 transfers from Form 8919 line 6 Information about Notice 703 Read This To See If Your Social Security Benefits May Be Taxable including recent updates related forms and instructions on how to file Complete this worksheet to see if any of your Social Security and or SSI supplemental security income benefits may be taxable

Printable Social Security Worksheet For Irs Form 1040a

Printable Social Security Worksheet For Irs Form 1040a

https://www.pdffiller.com/preview/6/963/6963800/large.png

1040 Social Security Worksheet 2022 Printable Word Searches

https://traders.studio/wp-content/uploads/2021/05/ScreenShot2021-01-22at11.47.38AM-a4136c55ec6c45e58dcca62bddb1e2d2.jpeg

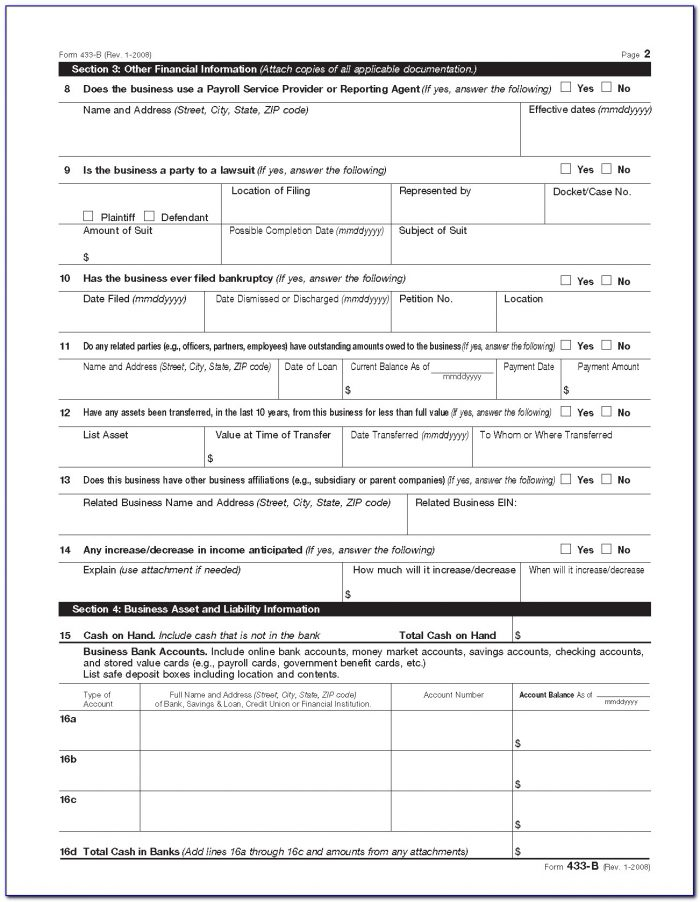

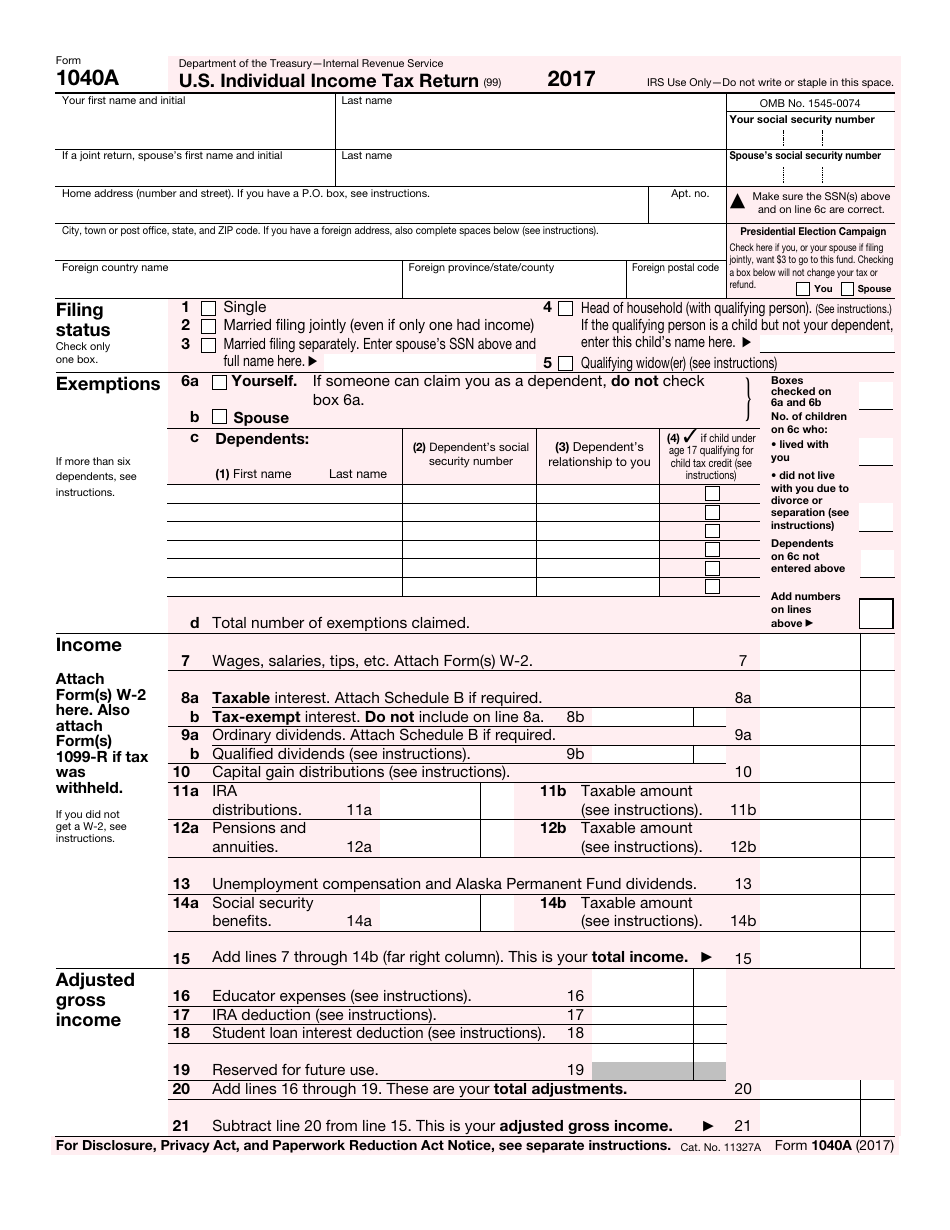

Printable Irs Tax Form 1040a Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/07/irs-fillable-form-1040a-mbm-legal.jpg

Railroad Retirement Benefits RRBs are benefits paid to railroad employees working in jobs that are covered by the Railroad Retirement Act RRA The RRA benefits have two components tier 1 Social Security equivalent benefits and tier 2 treated as a qualified employee plan The tier 2 benefits are reported on Form RRB 1099 R It is prepared through the joint efforts of the IRS the Social Security Administration SSA and the U S Railroad Retirement Board RRB Student loan interest for 2020 2019 and 2018 Schedule 1 Form 1040 for years before 2018 Form 1040 or Form 1040A page 1 Tuition and fees for 2020 2019 and 2018 Schedule 1 Form 1040 for

Maximum income subject to social security tax for 2022 For 2022 the maximum amount of self employment income subject to social security tax is 147 000 Estimated tax payments If you expect to owe self employment SE tax of 1 000 or more for 2022 you may need to make estimated tax payments Use Form 1040 ES Enter the amount if any from Form 1040 or 1040 SR line 2a Enter the total of any exclusions adjustments for Adoption benefits Form 8839 line 28 Foreign earned income or housing Form 2555 lines 45 and 50 and Certain income of bona fide residents of American Samoa Form 4563 line 15 or Puerto Rico 2

More picture related to Printable Social Security Worksheet For Irs Form 1040a

Social Security Benefits Worksheet Line 6a And 6b

https://focusplanninggroup.net/wp-content/uploads/2022/03/How-Uncle-Sam-Taxes-Your-Social-Security-Benefits.jpg

IRS 1040 Form Fillable Printable In PDF Printable Form 2021

https://www.printableform.net/wp-content/uploads/2021/07/irs-1040-form-fillable-printable-in-pdf-1-791x1024.png

Irs Fillable Form 1040 IRS Form 1040 ES NR Download Fillable PDF Or Fill Online U S

https://data.templateroller.com/pdf_docs_html/2017/20173/2017321/irs-form-1040-1040-sr-schedule-b-interest-and-ordinary-dividends_print_big.png

We developed this worksheet for you to see if your benefits may be taxable for 2023 Fill in lines A through E Do not use the worksheet below if any of the following apply to you instead go directly to IRS Pub 915 Social Security and Equivalent Railroad Retirement Benefits You received Form RRB 1099 Form SSA 1042S or Form RRB 1042S An extension to le or excess social security tax withheld Owe alternative minimum tax AMT or need to make an excess advance premium tax credit epayment r Can claim a nonrefundable credit other than the child tax c edit r or the cedit for other dependents such as the for eign tax cr edit r education credits or general business cedit r

From within your TaxAct return Desktop click Forms in the options bar to view Forms Explorer if it is not already visible Click Federal from the dropdown in Forms Explorer then click the Worksheets dropdown if it is not already expanded Scroll down and click Form 1040 Taxable Social Security Social Security Benefits Worksheet 1 and it will appear in Forms View Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2024 Step 1 Enter Personal Information a First name and middle initial Last name Address City or town state and ZIP code b Social

Irs Form 1040 Social Security Worksheet 2021

https://i.pinimg.com/originals/81/ed/4b/81ed4b3bd4f8018c79ee99728f33f5b3.jpg

2021 Social Security Tax Worksheet Form 1040

https://i.pinimg.com/originals/ee/f6/7c/eef67ccc96d061e790449a1d04328ed7.jpg

https://media.hrblock.com/media/KnowledgeDevelopment/ITC/2023Forms/2022_Social_Security_Taxable_Benfits_Worksheet_fillable.pdf

7 Form 1040 filers Enter the amounts from Schedule 1 lines 11 through 20 and 23 and 25 8 Is the amount on line 7 less than the amount on line 6 No STOP None of your social security benefits are taxable Enter 0 on Form 1040 or 1040 SR line 6b Yes Subtract line 7 from line 6 8 9 If you are Married filing jointly enter 32 000

https://www.irs.gov/e-file-providers/line-by-line-instructions-free-file-fillable-forms

Form 8959 Additional Medicare Tax After viewing if Form 8959 Line by Line instructions do not answer your question s you may contact us only if you are using the Free File Fillable Forms program Line 1 is a manual entry Line 2 transfers from Form 4137 line 6 Line 3 transfers from Form 8919 line 6

Social Security Taxable Income Worksheet 2023 TaxableSocialSecurity

Irs Form 1040 Social Security Worksheet 2021

Social Security Worksheet For 1040a Promotiontablecovers

10 Social Security Tax Worksheet Worksheets Decoomo

Irs Social Security Worksheet Irs Social Security Worksheet Homeschooldressage Social

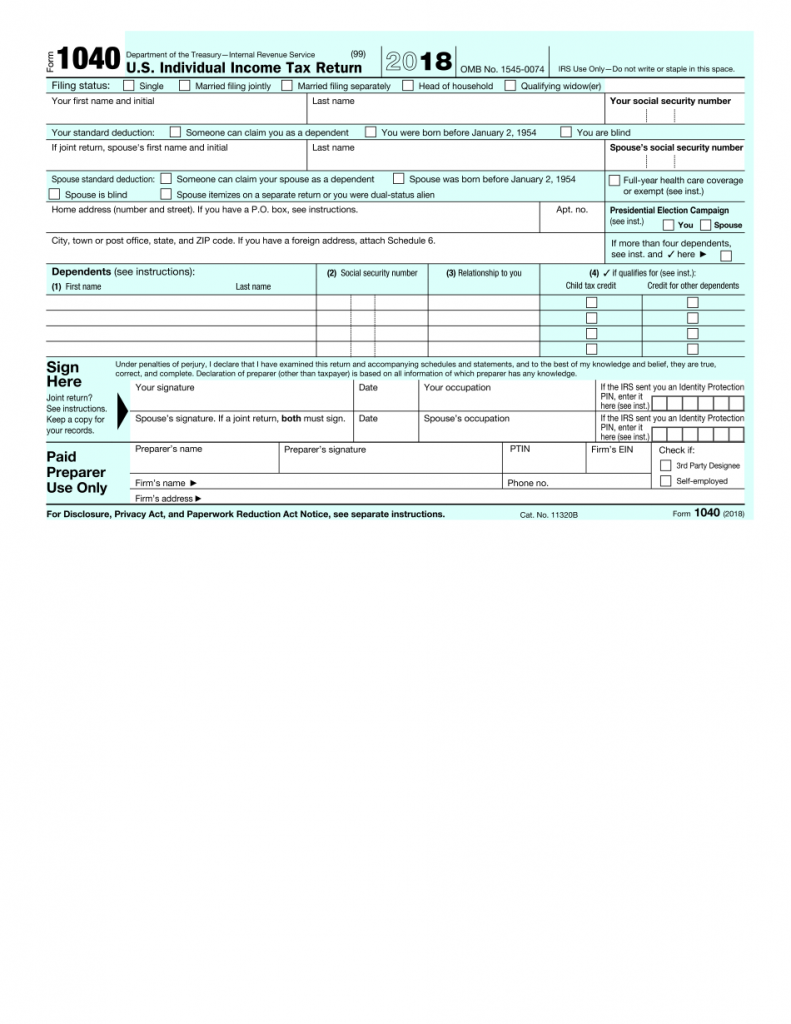

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

IRS Releases Form 1040 For 2020 Tax Year Taxgirl

Irs Printable Form 1040

Form 1040 Social Security United States Individual Retirement Account

2020 Tax Forms 1040a Printable Fillable And Editable PDF Template

Printable Social Security Worksheet For Irs Form 1040a - Stead of 500 Their income used to determine if Social Security benefits are taxable 37 500 is greater than the taxable Social Security base amount 32 000 for joint filers Therefore some of their Social Security benefits are taxable Worksheet to Determine if Benefits May Be Taxable A Amount of Social Security or Railroad