Printable Tax Deduction Form For Donations 1 For cash donations Receipts for cash donations must include the amount of the gift Nonprofits will often provide donors with tax receipts or written acknowledgments after receiving their gifts Donors can use the information from these receipts to fill out Schedule A on Form 1040 or 1040 SR

Form 8283 Rev December 2023 Form 8283 Rev 12 2023 Name s shown on your income tax return Page 2 Identifying number Part II Partial Interests and Restricted Use Property Other Than Qualified Conservation Contributions Charitable giving tax deduction limits are set by the IRS as a percentage of your income Cash contributions in 2023 and 2024 can make up 60 of your AGI The limit for appreciated assets in 2023 and 2024 including stock is 30 of your AGI Contributions must be made to a qualified organization

Printable Tax Deduction Form For Donations

Printable Tax Deduction Form For Donations

https://www.addictionary.org/g/000-simple-tax-deductible-donation-receipt-printable-example.jpg

Tax Deductible Donation Letter Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/8c1673e9-eb5e-4ac5-acdd-4bbd1b30a783_1.png

8 Tax Itemized Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/10/donation-itemized-list-template_449388.png

If you donate an item worth more than 50 000 you ll need to get a Statement of Value from the IRS which will cost you at least 7 500 Determining a Donated Item s Fair Market Value The IRS uses fair market value FMV to establish the amount you can deduct for almost all donated items TurboTax Live Assisted Basic Offer Offer only available with TurboTax Live Assisted Basic and for those filing Form 1040 and limited credits only Roughly 37 of taxpayers qualify Must file between November 29 2023 and March 31 2024 to be eligible for the offer Includes state s and one 1 federal tax filing

Nerdy takeaways Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes The The amount of charitable contributions you can deduct generally can t be more than 60 of your Adjusted Gross Income AGI but in some cases 20 30 or 50 limits may apply Table 1 of IRS Publication 526 Charitable Contributions has examples of what you can and cannot deduct

More picture related to Printable Tax Deduction Form For Donations

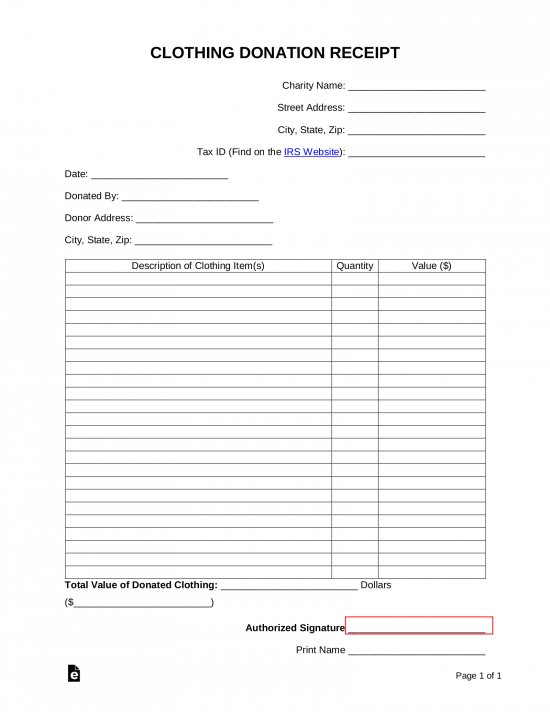

Free Clothing Donation Tax Receipt PDF Word EForms

https://eforms.com/images/2018/05/Clothing-Donation-Receipt-Template-550x712.png

Using Donation Receipt Forms For Tax Purposes In 2023 SampleTemplates

https://i0.wp.com/www.templatesdoc.com/wp-content/uploads/2016/04/donation-form-example-7941.jpg?fit=632%2C792

Explore Our Printable Salvation Army Donation Receipt Template Receipt Template Donation Form

https://i.pinimg.com/originals/da/ae/d7/daaed75f8d8d5b241342fc4a3c7af933.jpg

Maximum Tax Deduction IRS Lookup Verify a Charity 3 steps Sample 501 c 3 Donation Receipt How to Write a 501 c 3 Donation Receipt What is a 501 c 3 Non Profit A 501 c 3 is a type of organization or corporation classified as a charity that s able to accept charitable contributions The answer is yes cash and noncash charitable contributions are tax deductible The more you give the more you can deduct from your taxes Well up to a certain point You can deduct any amount of charitable giving up to 60 of your adjusted gross income AGI for cash contributions made to qualified charities more on that in a minute

Married filing separately 12 950 Head of household 19 400 Married filing jointly 25 900 To get any benefit from itemizing your deductible personal expenses have to be greater than your standard deduction amount A single person for example would have to spend more than 12 950 on these types of expenses Check The day you mailed the check is the date of the donation So if you mail it in 2023 and the nonprofit receives or cashes it in 2024 it still counts for 2023 Credit card The day your credit card company registers the charge usually this is the same day you make the donation When you pay the credit card bill doesn t affect the date of the donation

23 Donation Receipt Templates Sample Templates

https://images.sampletemplates.com/wp-content/uploads/2015/02/02071643/Tax-Deductible-Donation-Receipt-Template.jpeg

Tax Deductible Donation Letter Template DocTemplates

https://eforms.com/images/2018/04/501c3-Donation-Receipt-Template.png

https://donorbox.org/nonprofit-blog/charitable-donation-tax-forms

1 For cash donations Receipts for cash donations must include the amount of the gift Nonprofits will often provide donors with tax receipts or written acknowledgments after receiving their gifts Donors can use the information from these receipts to fill out Schedule A on Form 1040 or 1040 SR

https://www.irs.gov/pub/irs-pdf/f8283.pdf

Form 8283 Rev December 2023 Form 8283 Rev 12 2023 Name s shown on your income tax return Page 2 Identifying number Part II Partial Interests and Restricted Use Property Other Than Qualified Conservation Contributions

10 Donation Receipt Templates Free Samples Examples Format Sample Templates

23 Donation Receipt Templates Sample Templates

6 Free Donation Receipt Templates

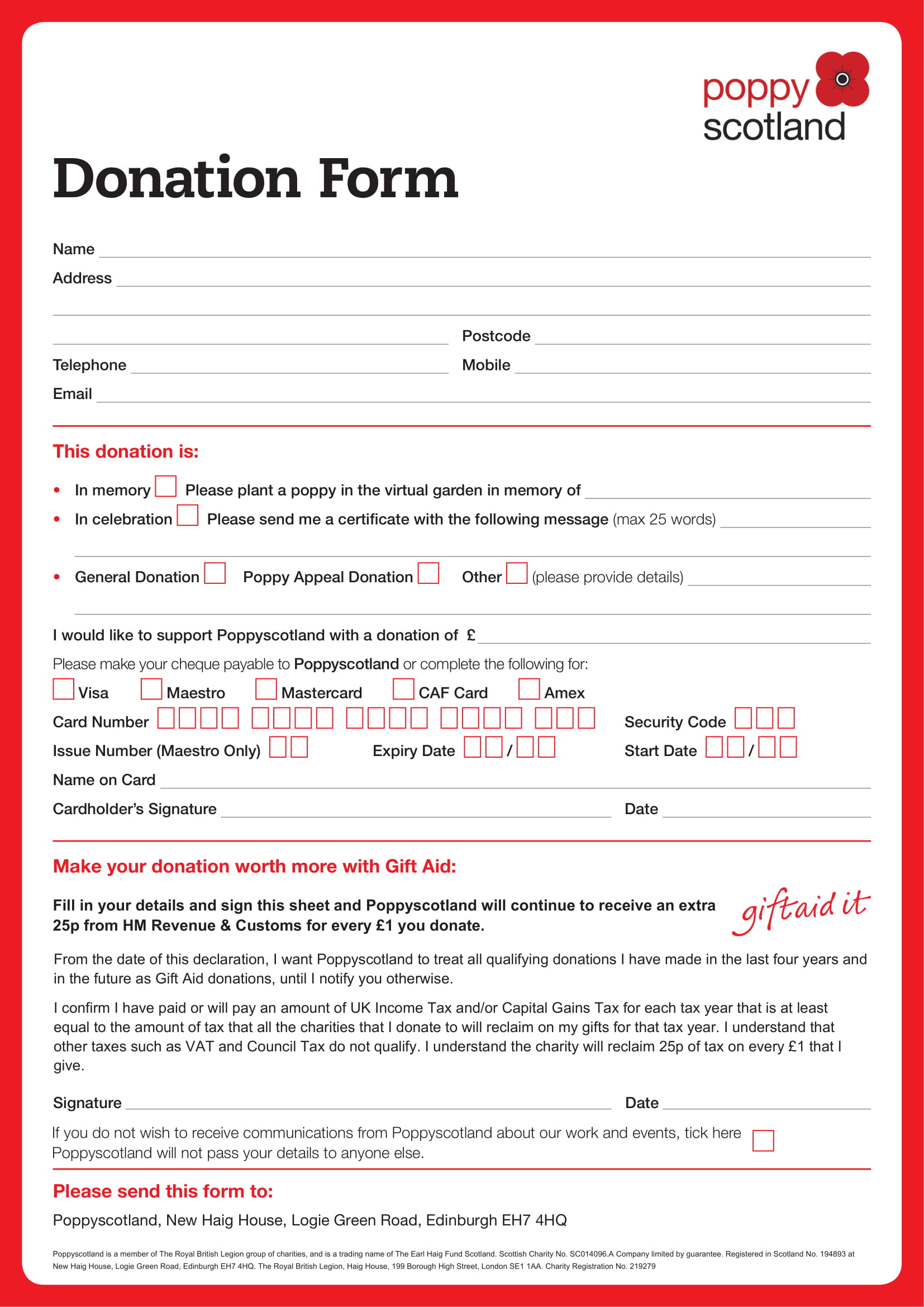

Donation Forms Template

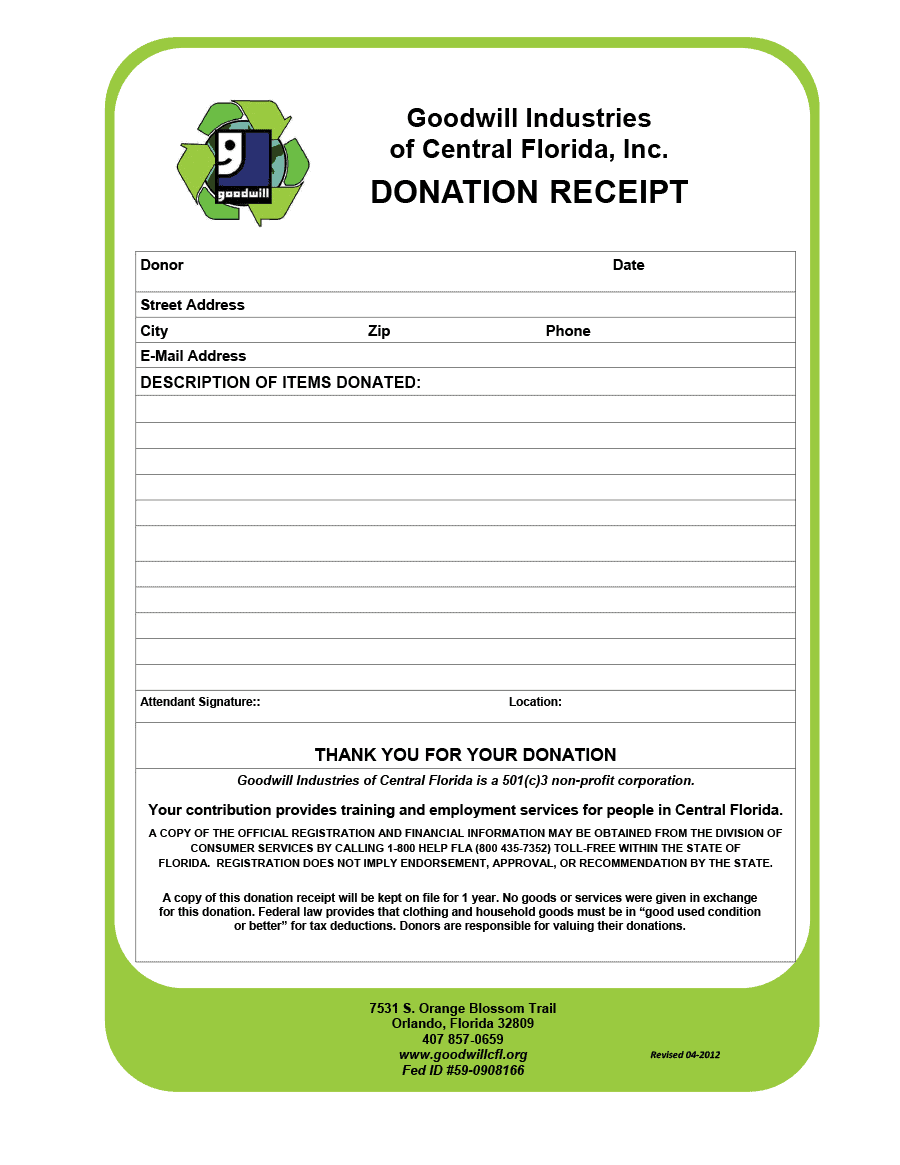

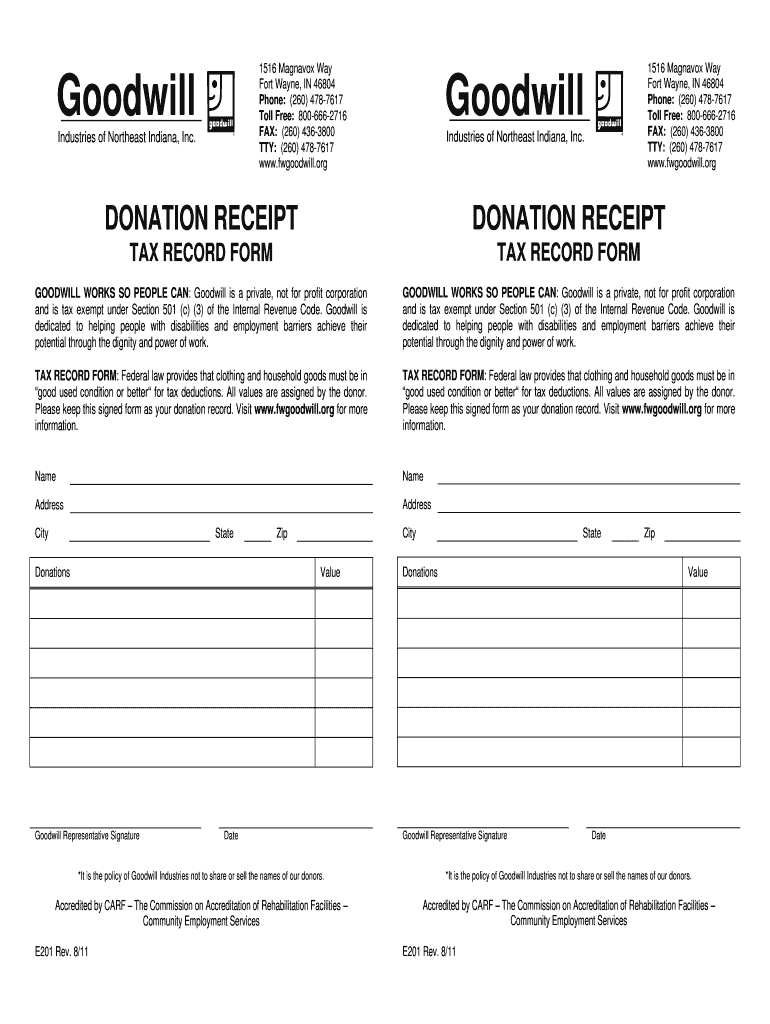

Goodwill Donation Receipt Fill Online Printable Fillable Db excel

Salvation Army Donation Receipt Form Fill Out And Sign Printable PDF Template SignNow

Salvation Army Donation Receipt Form Fill Out And Sign Printable PDF Template SignNow

10 Donation Receipt Templates Free Samples Examples Format Sample Templates

Tax Deductible Donation Receipt Printable Addictionary

FREE 36 Printable Receipt Forms In PDF MS Word

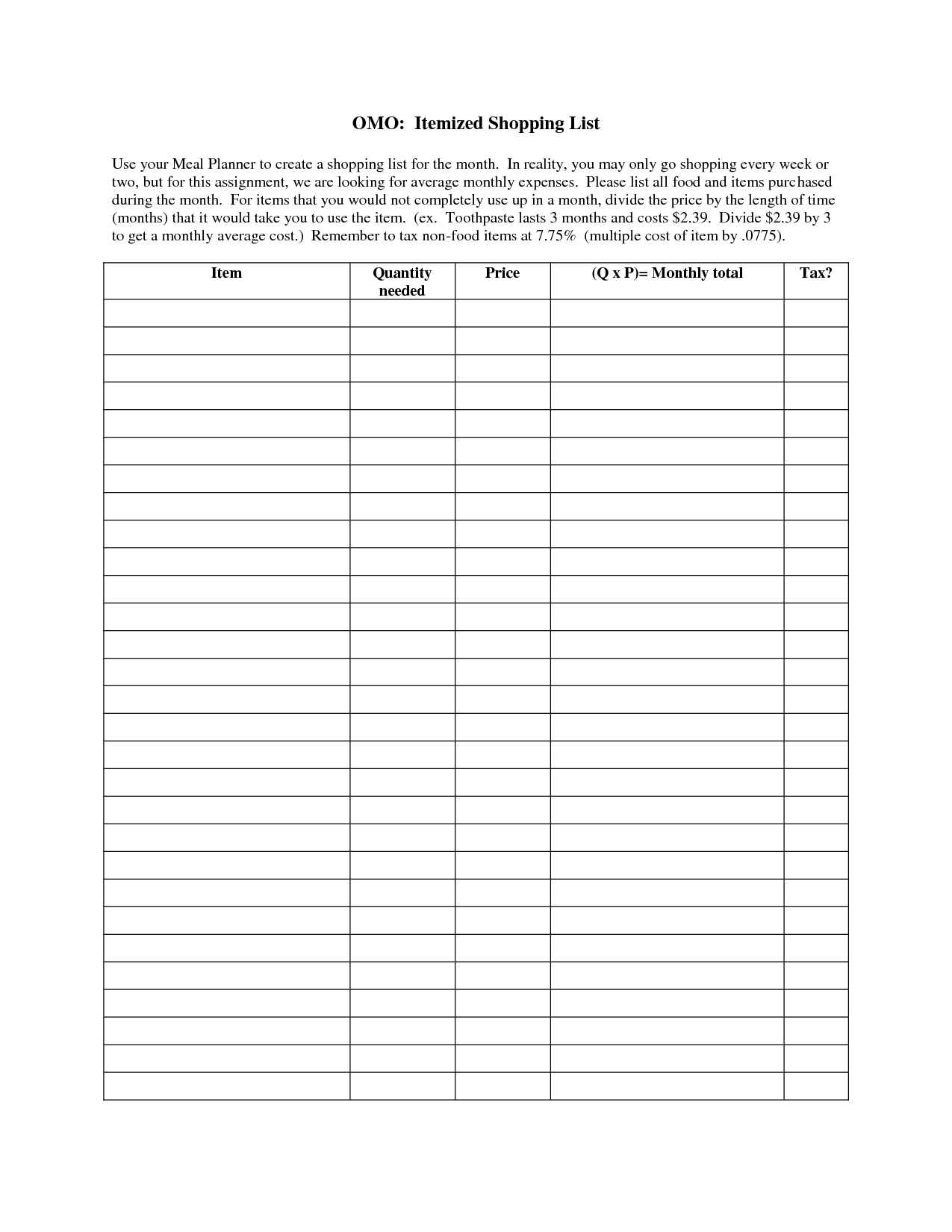

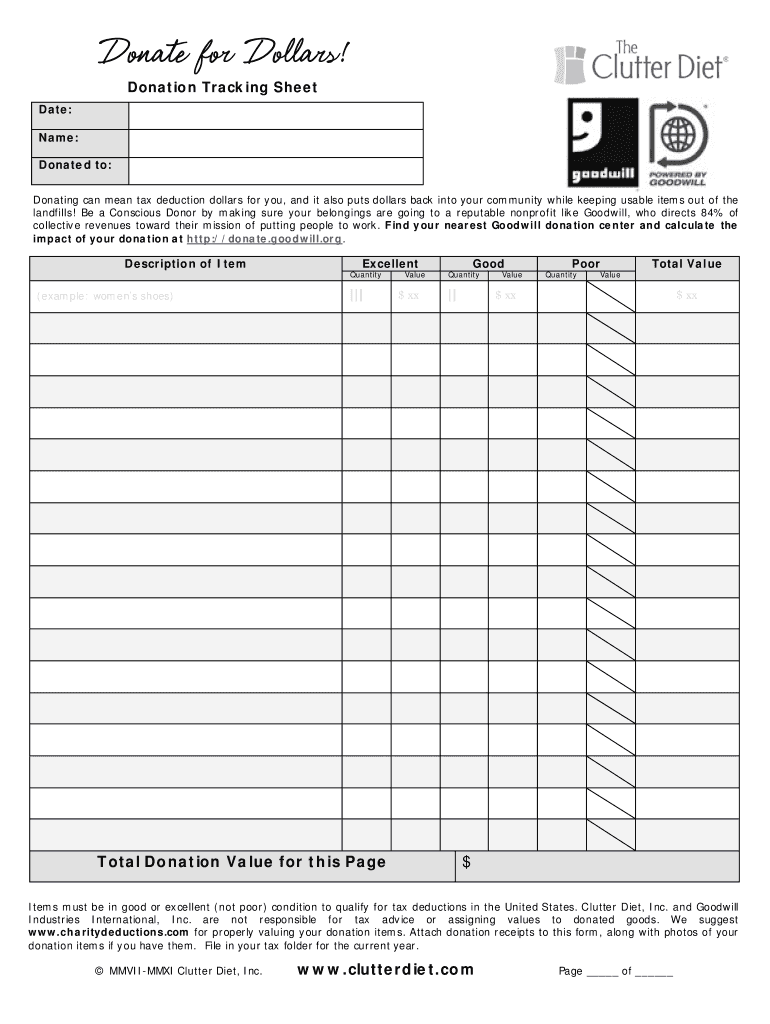

Printable Tax Deduction Form For Donations - What is a Donation Receipt A donation receipt is a written acknowledgment from a nonprofit organization for any monetary or non monetary contributions made by a donor This donation receipt will act as official proof of the contribution and help donors claim a tax deduction