Printable Tax Form 1040 Schedule C Form 1041 line 3 If a loss you must go to line 32 31 32 If you have a loss check the box that describes your investment in this activity See instructions If you checked 32a enter the loss on both Schedule 1 Form 1040 line 3 and on Schedule SE line 2 If you checked the box on line 1 see the line 31 instructions

You can download or print current or past year PDFs of 1040 Schedule C directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes IRS Form 1040 Schedule C Profit or Loss From Business Reporting form sequence number 09 for attachment to IRS Form 1040 Profit or Loss from a Sole Proprietorship business OMB 1545 0074 OMB report IRS OMB 1545 0074 2020 Form 1040 Schedule C Document pdf Download PDF pdf

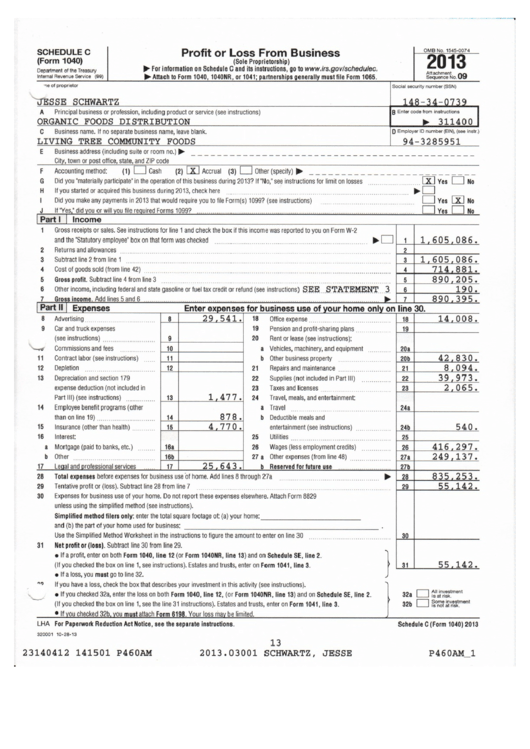

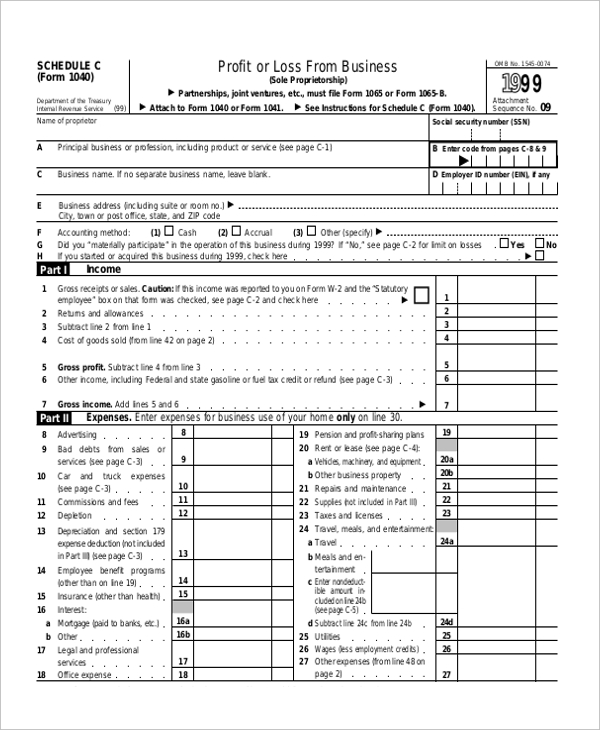

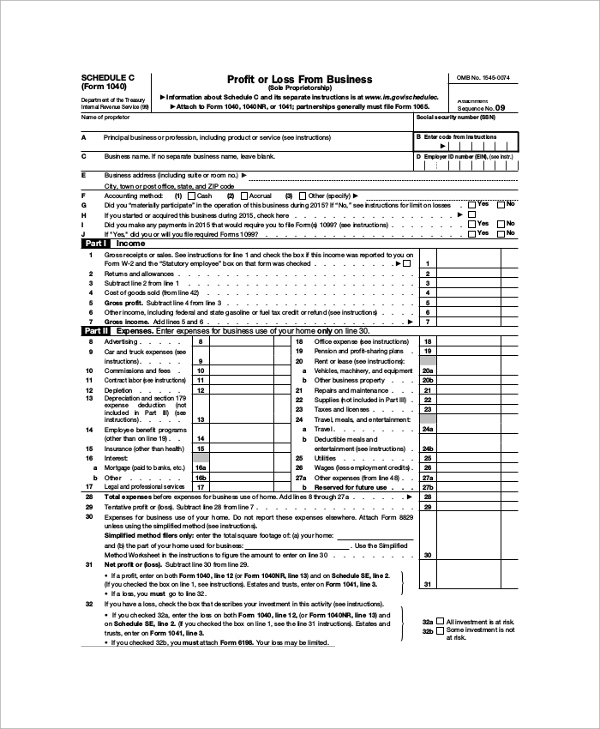

Printable Tax Form 1040 Schedule C

Printable Tax Form 1040 Schedule C

https://images.sampleforms.com/wp-content/uploads/2016/11/SCHEDULE-C-1040-Form.jpg

Sample Schedule C Form Examples In PDF Word 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/sample-schedule-c-form-examples-in-pdf-word.jpg

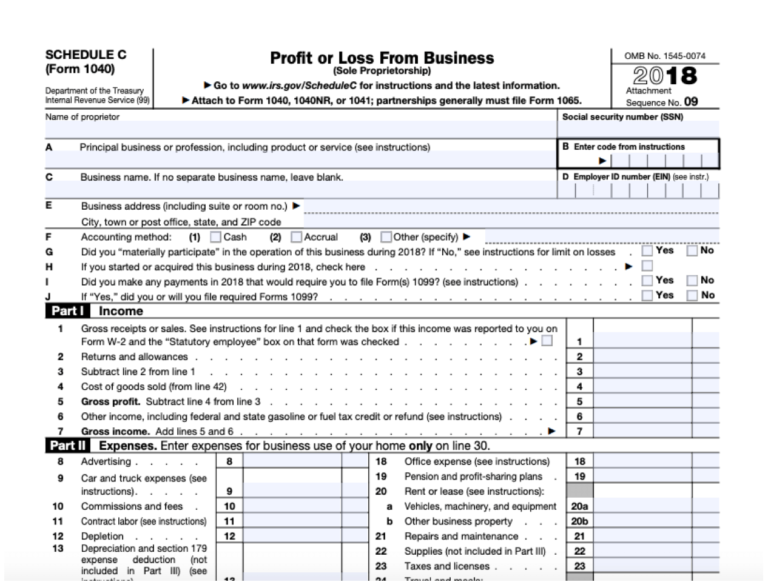

2018 2023 Form IRS 1040 Schedule C EZ Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/454/878/454878824/large.png

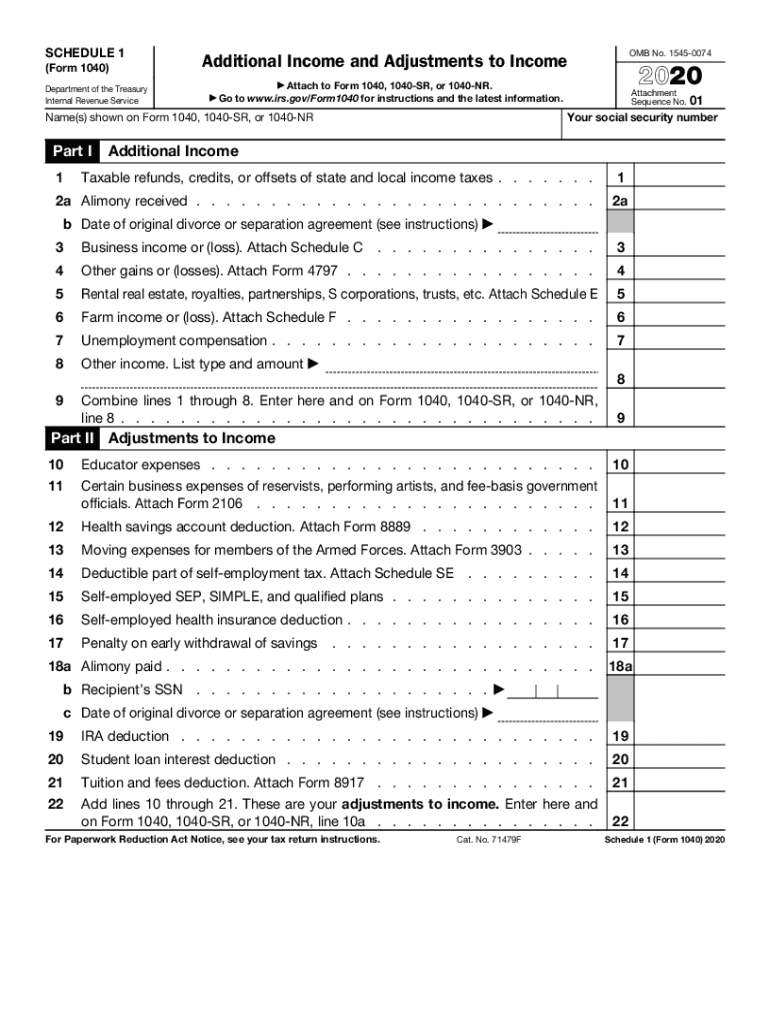

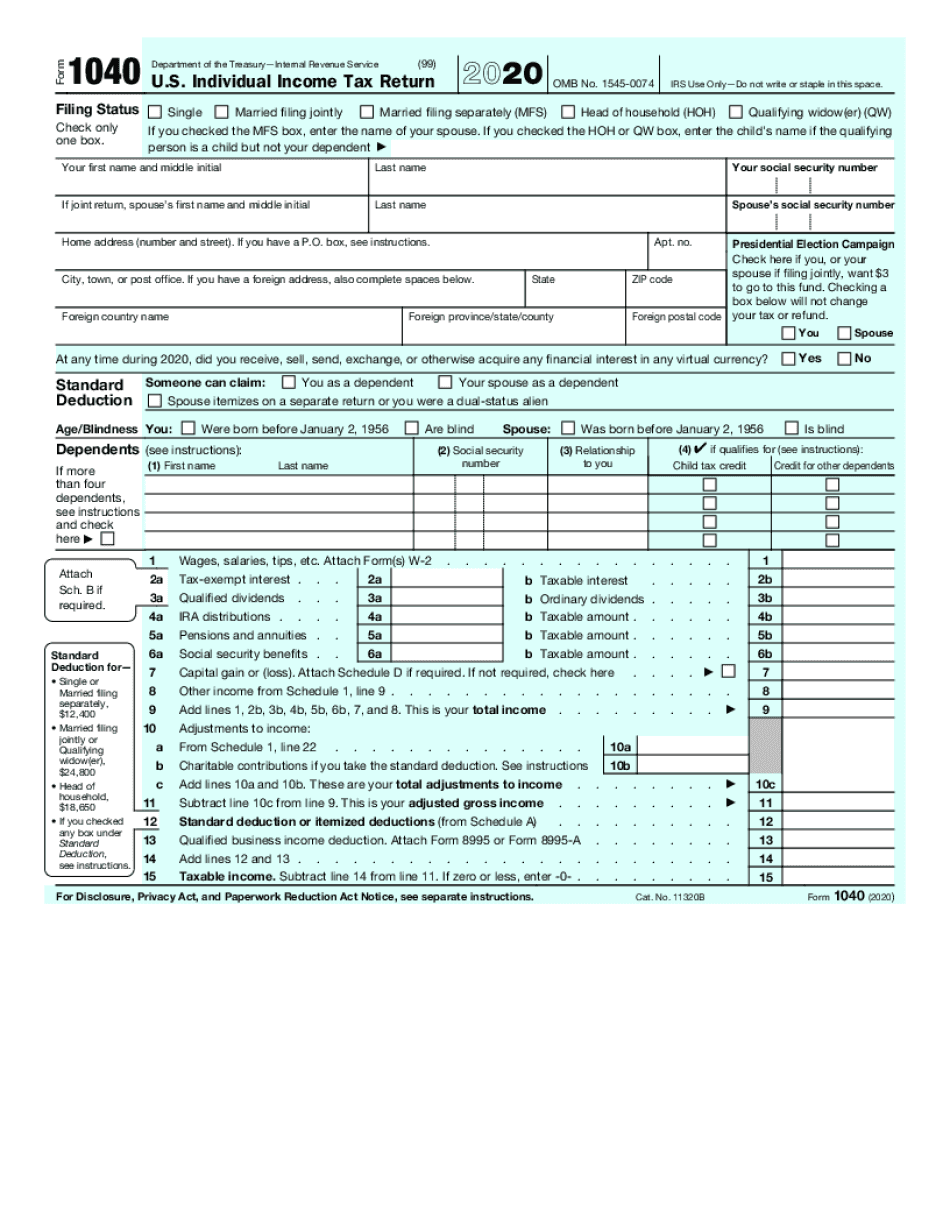

What Is Form 1040 Schedule C Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule C or Schedule C EZ to report a business income or loss You can not file Schedule C with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule C is the long version of the simplified easy Schedule C EZ form What is Schedule C IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it electronically with

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is typically considered self employment income Usually if you fill out Schedule C you ll also have to fill out Schedule SE Self Employment Tax If you received any 1099 NEC 1099 MISC or 1099 K tax forms reporting money you earned working as a contractor or selling stuff you ll have to report that as income on Line 1 of Schedule C You ll also need to add any other money you earned while being self employed Unfortunately you have to pay taxes on it all

More picture related to Printable Tax Form 1040 Schedule C

Form 1040 Schedule C Sample Profit Or Loss From Business Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/307/3078/307844/page_1_thumb_big.png

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)

What Is Schedule C Of Form 1040

https://www.thebalancemoney.com/thmb/Ck-DUlTknMMfhD3IjwG9_Kz-oU0=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png

Schedule C Instructions With FAQs 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/schedule-c-instructions-with-faqs-768x582.png

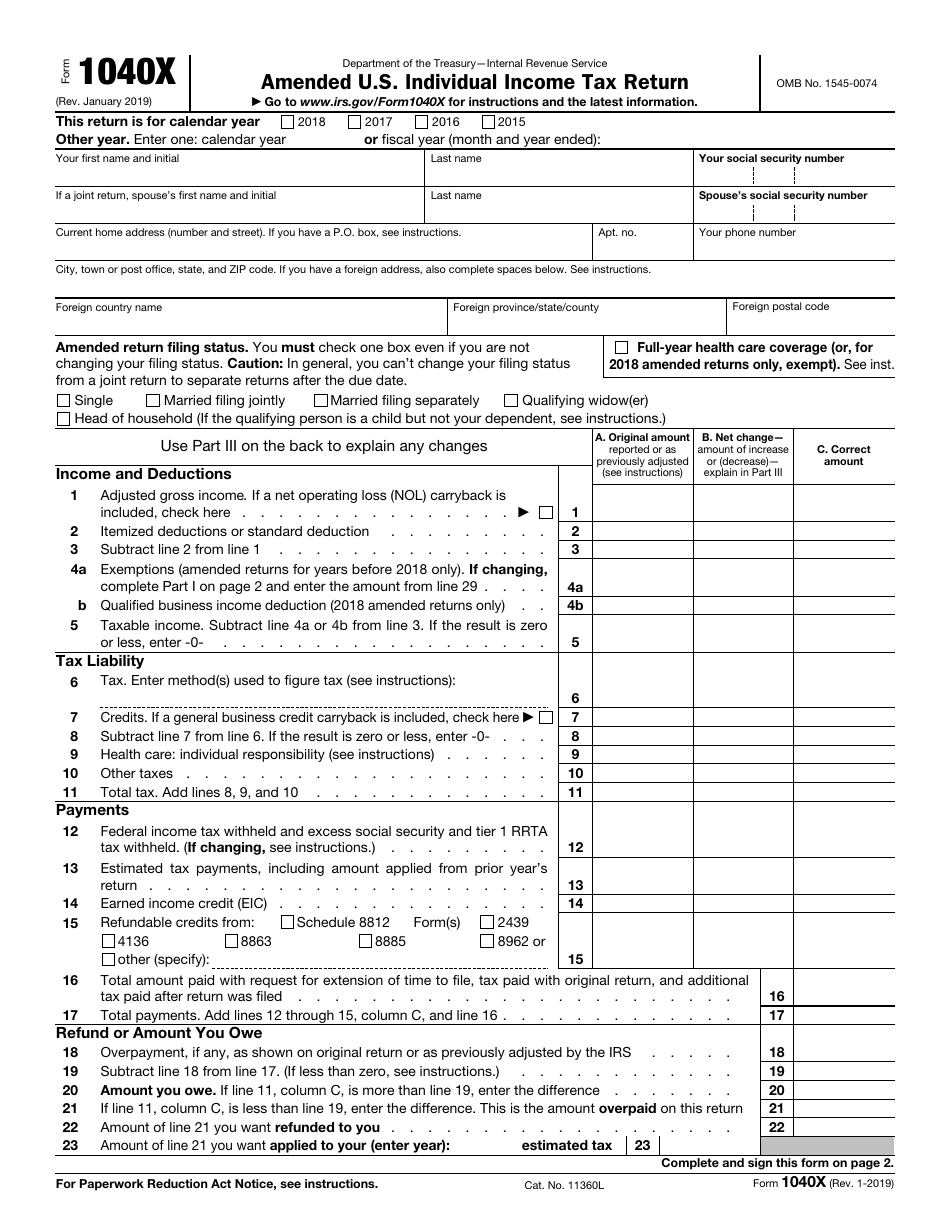

This booklet includes instructions for filling out and filling by mail or efile your 1040 federal tax return 11 0001 Individual Income Tax Form 1040A is the U S Federal Individual Income Tax Return It itemizes allowable deductions in respect to income rather than standard deductions Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form Self Employment Tax You may also need Form 4562 to claim depreciation or Form 8829 to claim actual expenses from business use of your home Get Help With Small Business Taxes and Filing IRS Schedule C Business tax forms like the IRS Schedule C can

Income Tax Forms 1040 Schedule C Federal Profit or Loss from Business Sole Proprietorship Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal 1040 schedule c pdf and you can print it directly from your computer More about the Federal 1040 Schedule C Access IRS forms instructions and publications in electronic and print media Skip to main content An official website of the United States Government English Espa ol Form 1040 ES is used by persons with income not subject to tax withholding to figure and pay estimated tax Form 1040 ES PDF

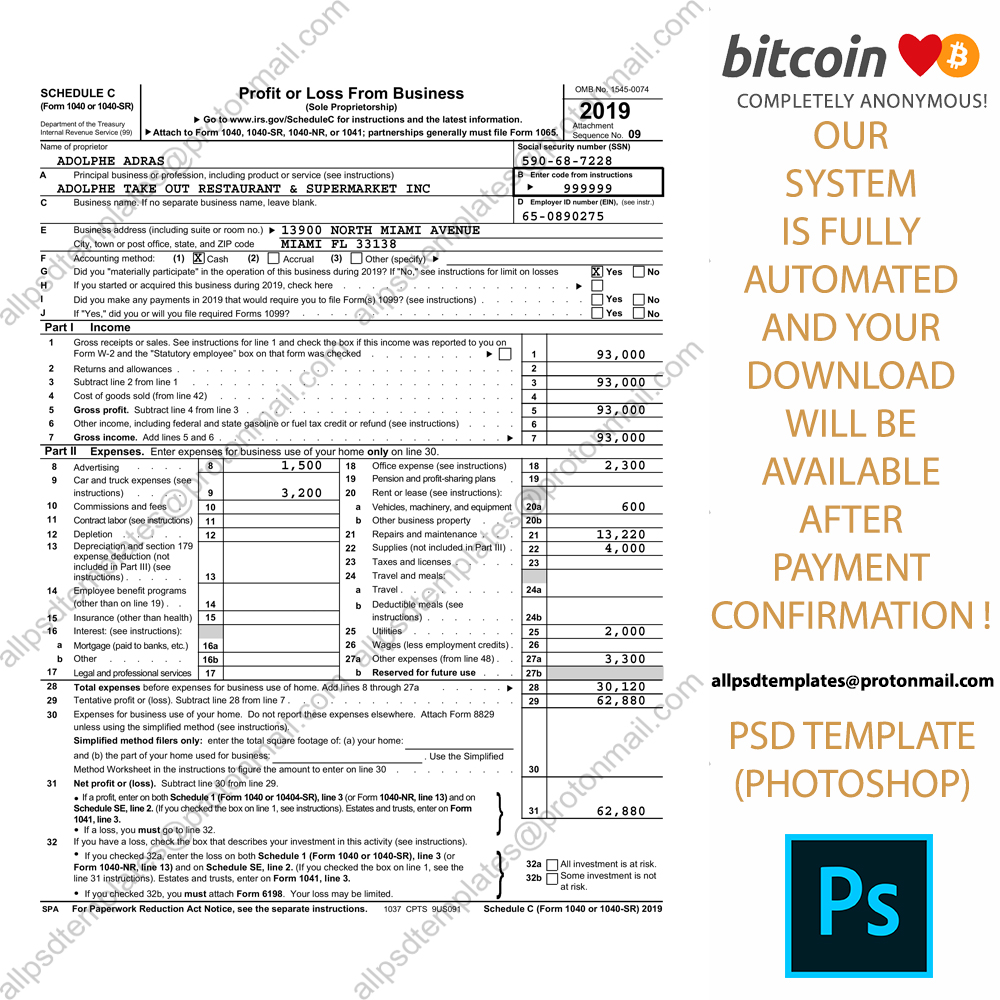

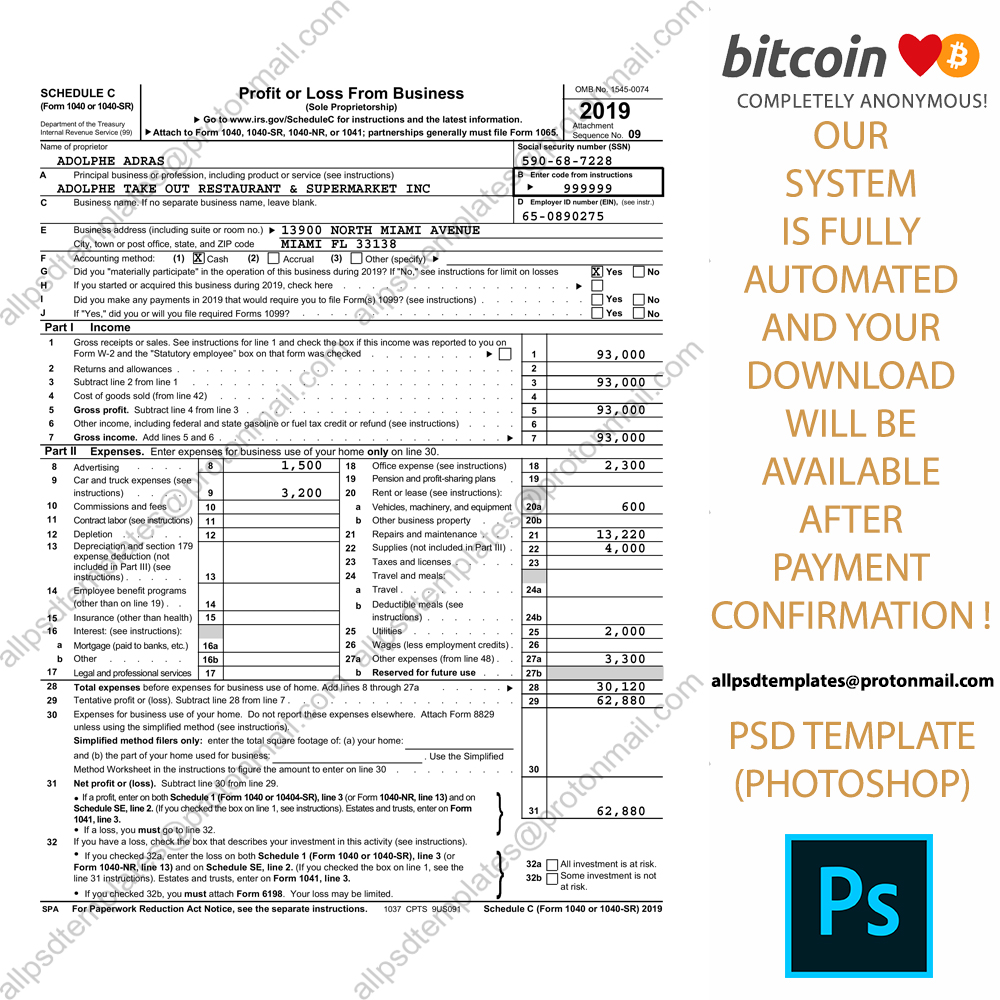

USA 1040 Schedule C Form Template ALL PSD TEMPLATES

https://allpsdtemplates.com/wp-content/uploads/2020/09/3.jpg

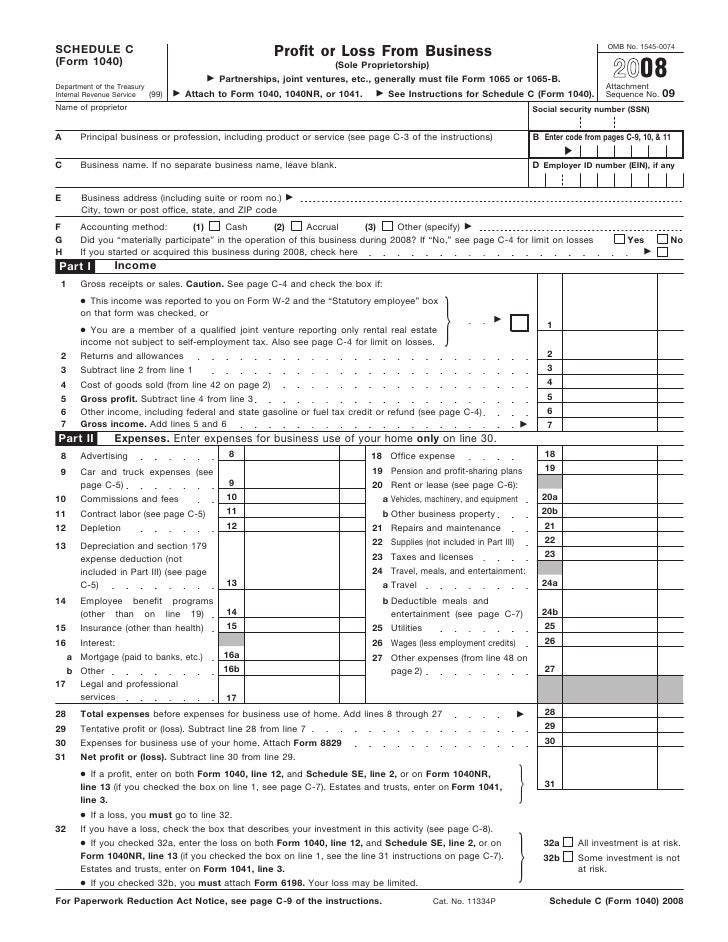

Form 1040 Schedule C Profit Or Loss From Business

http://image.slidesharecdn.com/1273106/95/form-1040-schedule-cprofit-or-loss-from-business-1-728.jpg?cb=1239367643

https://www.irs.gov/pub/irs-prior/f1040sc--2021.pdf

Form 1041 line 3 If a loss you must go to line 32 31 32 If you have a loss check the box that describes your investment in this activity See instructions If you checked 32a enter the loss on both Schedule 1 Form 1040 line 3 and on Schedule SE line 2 If you checked the box on line 1 see the line 31 instructions

https://www.taxformfinder.org/federal/1040-schedule-c

You can download or print current or past year PDFs of 1040 Schedule C directly from TaxFormFinder You can print other Federal tax forms here eFile your Federal tax return now eFiling is easier faster and safer than filling out paper tax forms File your Federal and Federal tax returns online with TurboTax in minutes

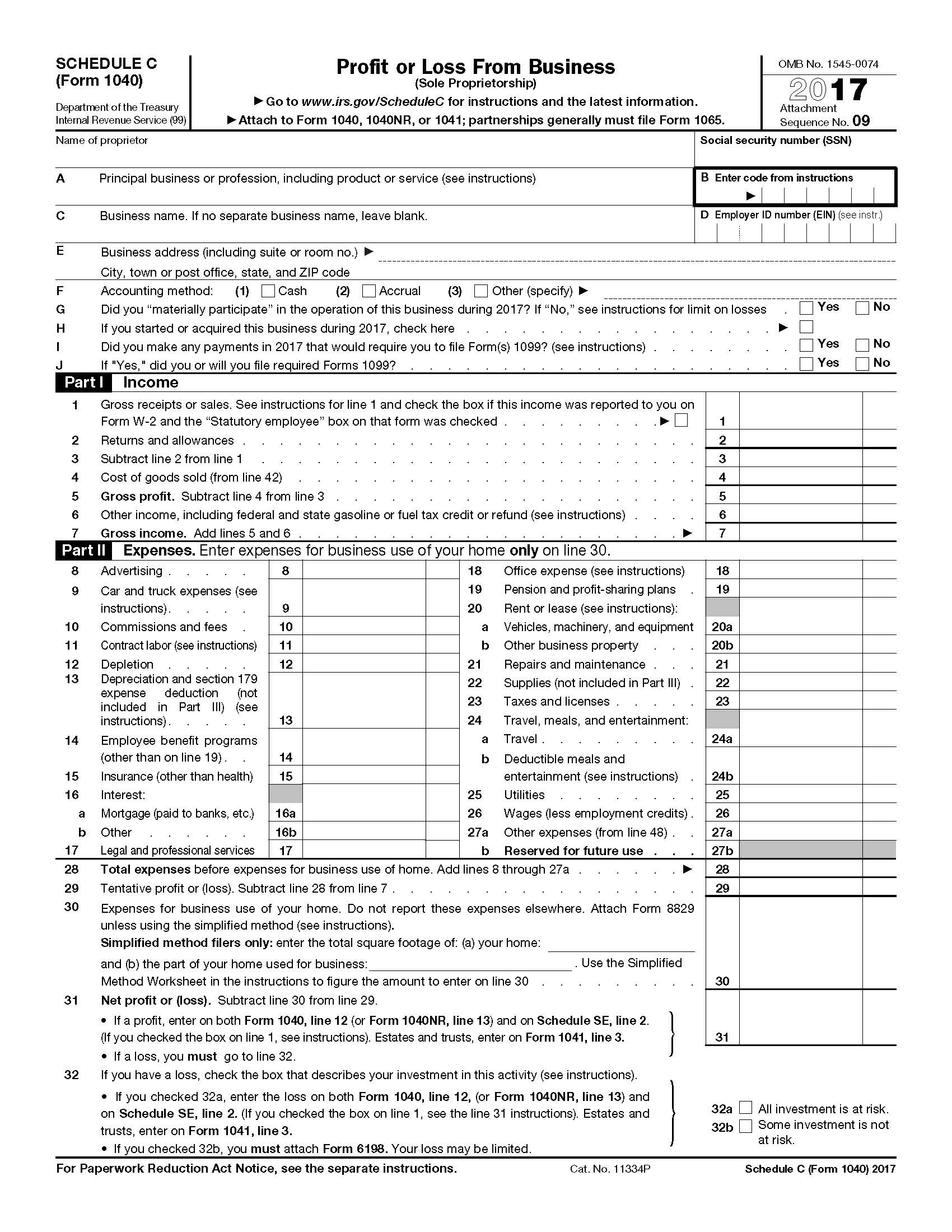

2017 Irs Tax Forms 1040 Schedule C profit Or Loss From Business U S Government Bookstore

USA 1040 Schedule C Form Template ALL PSD TEMPLATES

1040 Schedule C 2021

Fillable Schedule C Irs Form 1040 Printable Pdf Download Gambaran

2019 Form 1040 Schedule C Download Dsadetroit

1040 Form 2022 Schedule C Season Schedule 2022

1040 Form 2022 Schedule C Season Schedule 2022

Irs Form 1040 Printable

Irs Printable Form 1040

2014 Tax Forms 1040 Schedule C Papers And Forms Tax Forms Irs Tax Forms Net Profit

Printable Tax Form 1040 Schedule C - A Schedule C Profit or Loss from Business Sole Proprietorship is the IRS form you use to report self employed earnings to the IRS You include Schedule C with your Form 1040 tax return at tax time to report your business income and expenses as a sole proprietor for that tax year It s for businesses that are either unincorporated sole