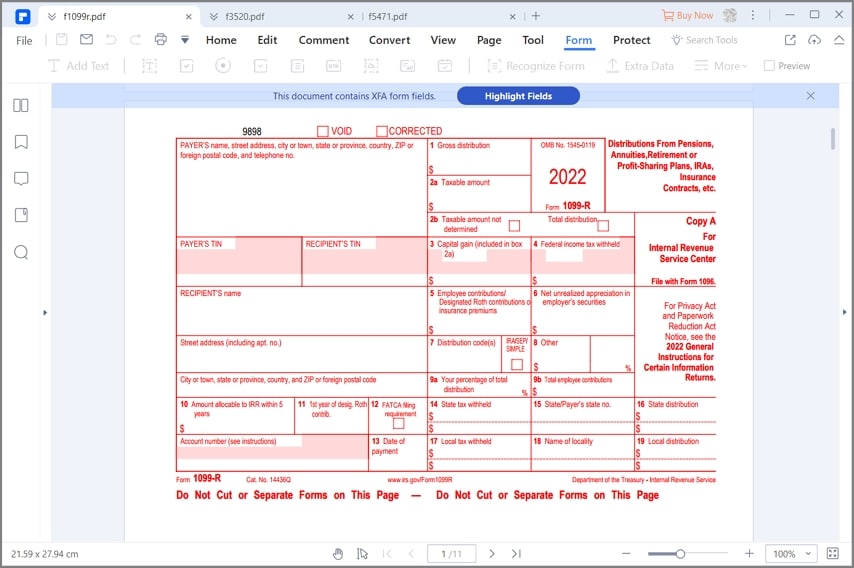

Printable Tax Form 1099 R A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution

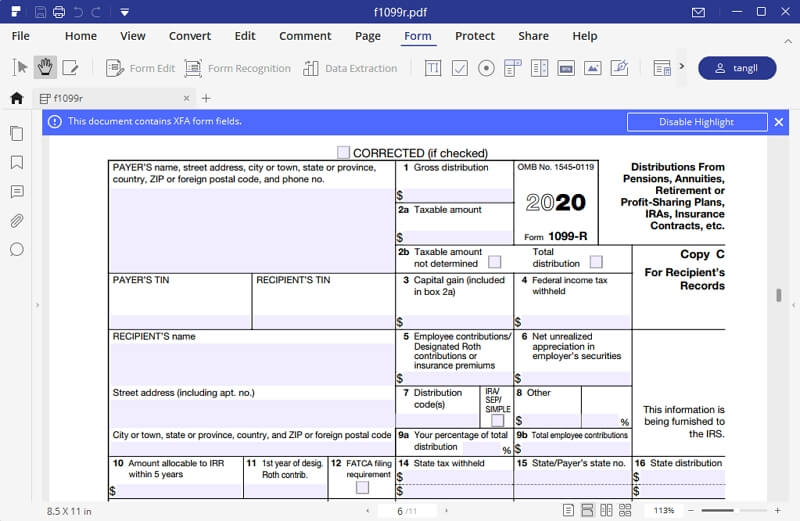

Get your 1099 R tax form Learn how to view download print or request by mail your annual 1099 R tax form that reports how much income you earned from your annuity How to request your 1099 R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099 R tile Form 1099 R Form 1099 R is used to report the distribution of retirement benefits such as pensions annuities or other retirement plans Additional variations of Form 1099 R include Form CSA 1099R Form CSF 1099R and Form RRB 1099 R Most public and private pension plans that aren t part of the Civil Service system use the standard Form 1099 R

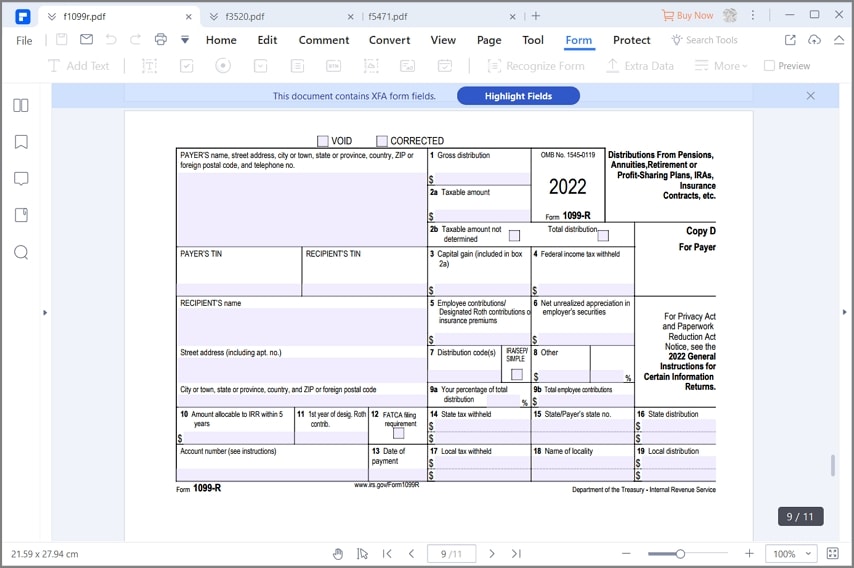

Printable Tax Form 1099 R

Printable Tax Form 1099 R

https://legaldocfinder.com/images/jumbotron/1099-r-sample.png

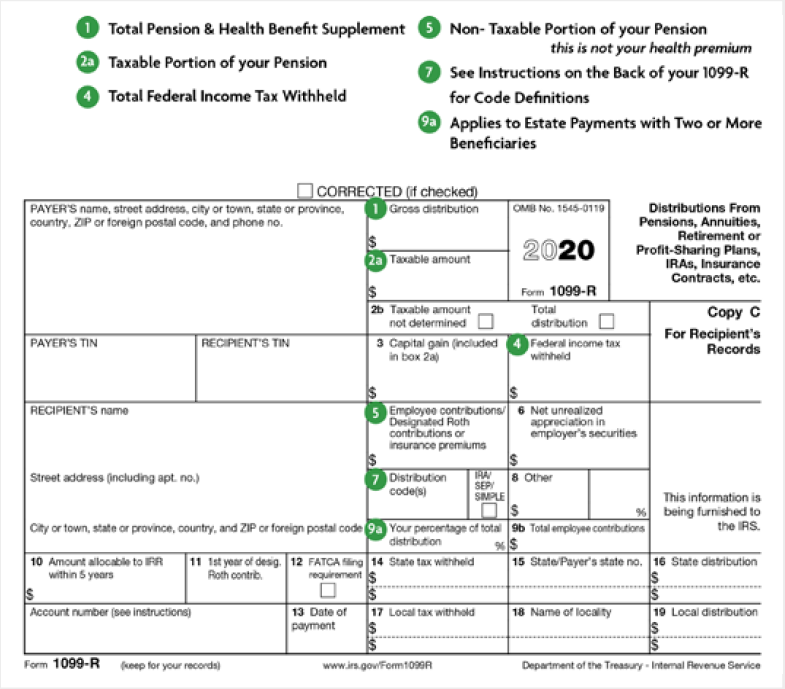

Understanding Your Form 1099 R MSRB Mass gov

https://www.mass.gov/files/styles/embedded_full_width/public/images/2021-01/1099-r_2020.jpg?itok=lqdGyU3i

File Form 1099 R 2015 jpg Wikipedia

https://upload.wikimedia.org/wikipedia/commons/0/05/Form_1099-R%2C_2015.jpg

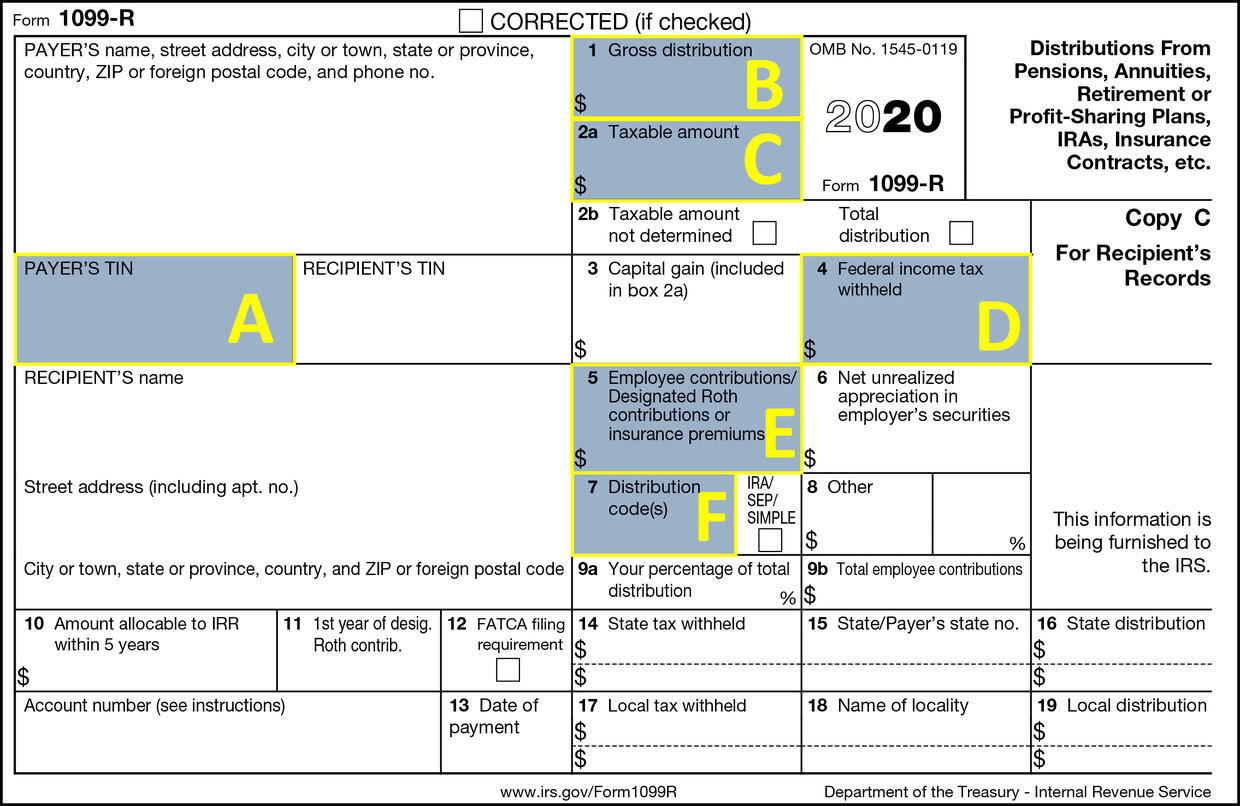

Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans is an Internal Revenue Service IRS tax form used for reporting passive income and distributions A 1099 R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts You ll generally receive one for distributions of 10 or more The plan or account custodian completing the 1099 R must fill out three copies of every 1099 R they issue One for the IRS

The 1099 R form is an informational return which means you ll use it to report income on your federal tax return If the form shows federal income tax withheld in Box 4 attach a copy Copy B to your tax return It s sent to you no later than January 31 after the calendar year of the retirement account distribution Military retirees and annuitants receive a 1099 R tax statement either electronically via myPay or as a paper copy in the mail each year and print your 1099R out in the comfort of your own home Telephone Self Service Not a myPay user yet No need to wait on the phone use a computer or speak to anyone If you receive a Form 1042 S

More picture related to Printable Tax Form 1099 R

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R What It s Used For And Who Should File It

https://www.investopedia.com/thmb/d-i0C26TsRY0uGEBGccg-y-EziU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg

Formulario 1099 R Del IRS C mo Rellenarlo Bien Y F cilmente

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-1099r-05.jpg

IRS Form 1099 R How To Fill It Right And Easily

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-1099r-01.jpg

1099 R and W 2 Tax Statement Requests Here is information you need to quickly provide your constituents information on obtaining a DFAS provided 1099 R W2 or 1042 S form PLEASE NOTE 1099R Tax Statements for 2022 will be available for reissue on AskDFAS beginning February 10 2023 How do I get a copy of my 1099R Use Services Online Retirement Services to start change or stop Federal and State income tax withholdings request a duplicate tax filing statement 1099R change your Personal Identification Number PIN for accessing our automated systems establish change or stop an allotment to an organization

The 1099 R form is a tax form that s used to report any money withdrawn from a retirement account like your Later account to the IRS Taking money out of a retirement account is known as a distribution It s one of a few different kinds of 1099 forms which generally report different kinds of income you earned in a year to the IRS Form 5498 IRA SEP or Simple Retirement Plan Information Why you may receive this form You own a Prudential Investments IRA Roth IRA SEP IRA or Education IRA Coverdell Education savings Account This form summarizes the status of your individual retirement plan accounts

Form 1099 R Instructions Information Community Tax

https://www.communitytax.com/wp-content/uploads/2016/04/Tax-Form-1099-R.jpg

IRS Form 1099 R How To Fill It Right And Easily

https://pdfimages.wondershare.com/pdfelement/guide/irs-form-1099r-03.jpg

https://eforms.com/irs/form-1099/r/

A 1099 R form is used by payers trustees and plan administrators to report designated distributions from profit sharing and retirement plans when the distribution has a value of 10 or more Distributions are reported by filing this form with the Internal Revenue Service IRS and providing a copy to the recipient of the distribution

https://www.opm.gov/support/retirement/how-to/get-your-1099-r-tax-form/

Get your 1099 R tax form Learn how to view download print or request by mail your annual 1099 R tax form that reports how much income you earned from your annuity How to request your 1099 R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099 R tile

Formulaire IRS 1099 R Comment Le Remplir Correctement Et Facilement

Form 1099 R Instructions Information Community Tax

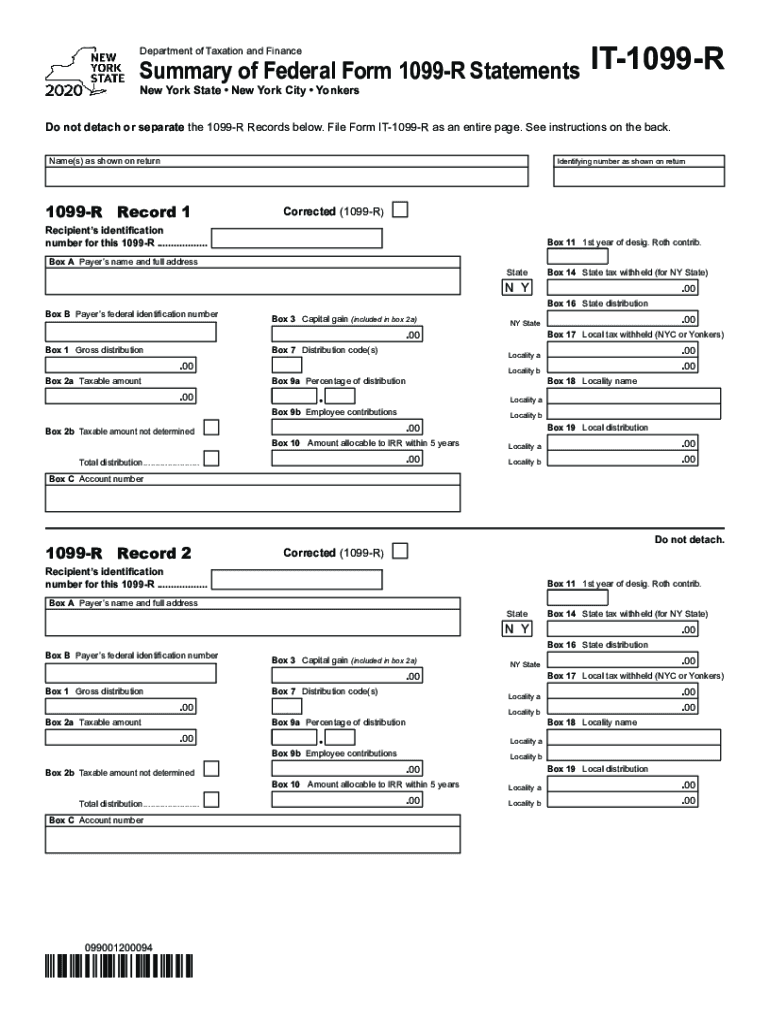

It 1099 R 2020 2024 Form Fill Out And Sign Printable PDF Template SignNow

Understanding Your 1099 R Dallaserf

How To Print And File 1099 R

IRS Form 1099 R How to Guide Distributions From Pensions

IRS Form 1099 R How to Guide Distributions From Pensions

SDCERS Form 1099 R Explained

FPPA 1099R Forms

How To Read Your 1099 R And 5498 Robinhood

Printable Tax Form 1099 R - Military retirees and annuitants receive a 1099 R tax statement either electronically via myPay or as a paper copy in the mail each year and print your 1099R out in the comfort of your own home Telephone Self Service Not a myPay user yet No need to wait on the phone use a computer or speak to anyone If you receive a Form 1042 S