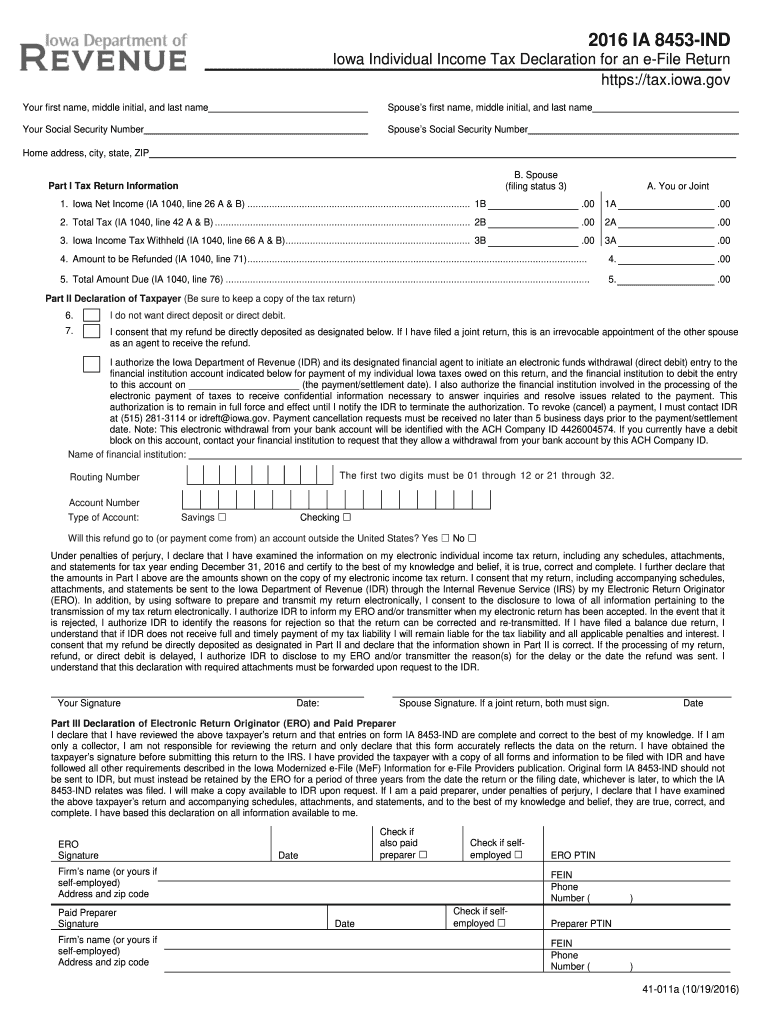

Printable Tax Form Ia 8453 General Instructions Purpose of Form Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 don t send Form s W 2 W 2G or 1099 R Don t attach any form or document that isn t shown on Form 8453 next to the checkboxes If you are required to mail in any documentation

TaxFormFinder provides printable PDF copies of 44 current Iowa income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 22 Corporate Income Tax 36 Other 11 Show entries Showing 1 to 22 of 22 entries Previous 1 Next O Make sure that the name and SSN FEIN print correctly on the IA 8453 and that the information matches corresponding fields on the electronic return o Retain the IA 8453 and all attachments for three years from the due date or filing date whichever is later o Send the IA 8453 and all supporting documents within five working days of any

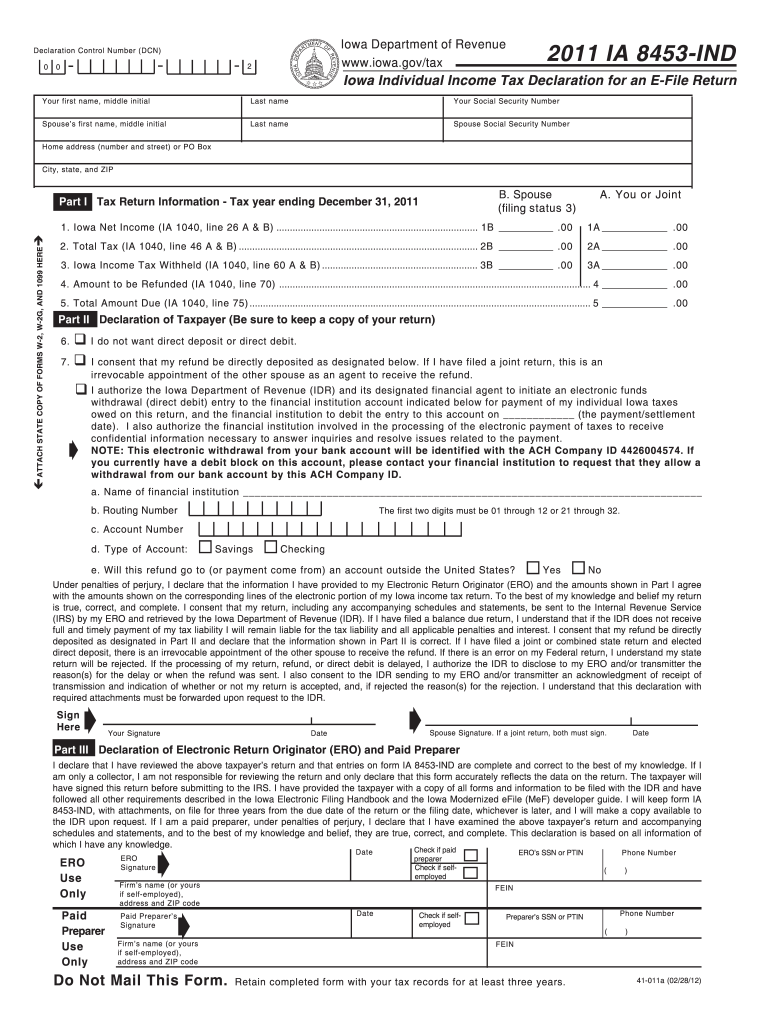

Printable Tax Form Ia 8453

Printable Tax Form Ia 8453

https://www.pdffiller.com/preview/578/574/578574636/large.png

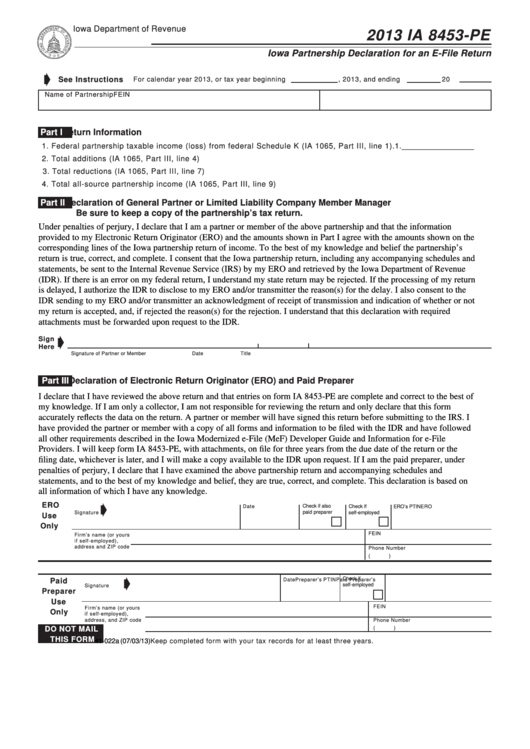

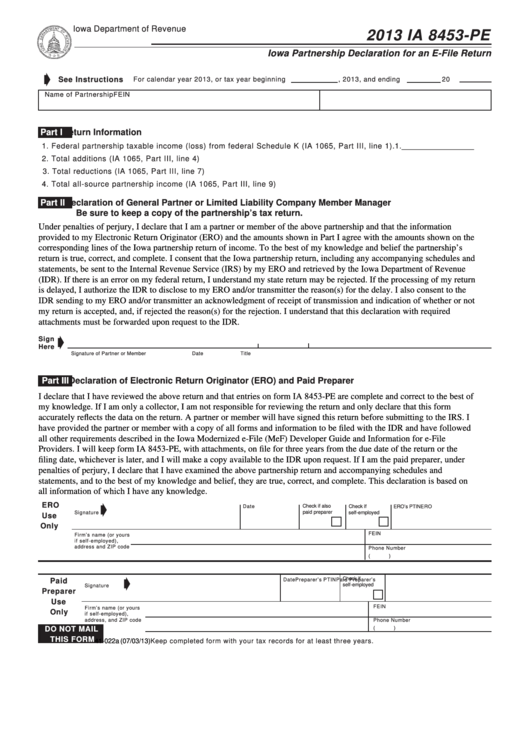

Form Ia 8453 Pe Iowa Partnership Declaration For An E File Return 2013 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/324/3245/324577/page_1_thumb_big.png

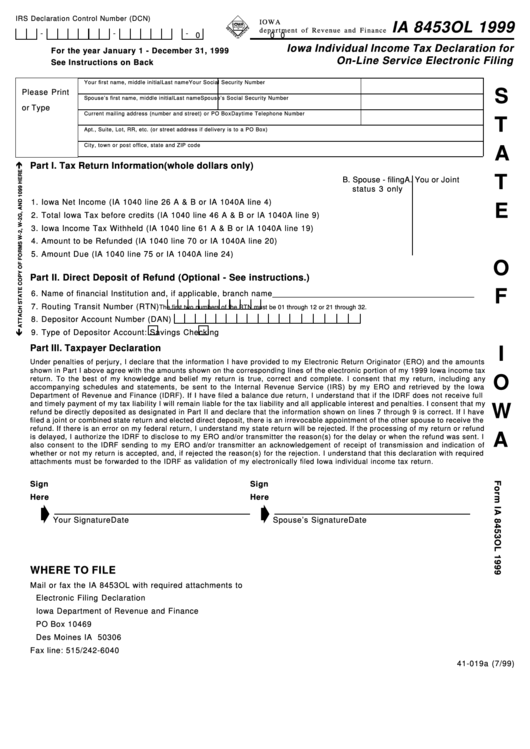

Form Ia 8453ol Iowa Individual Income Tax Declaration For On Line Service Electronic Filing

https://data.formsbank.com/pdf_docs_html/286/2866/286644/page_1_thumb_big.png

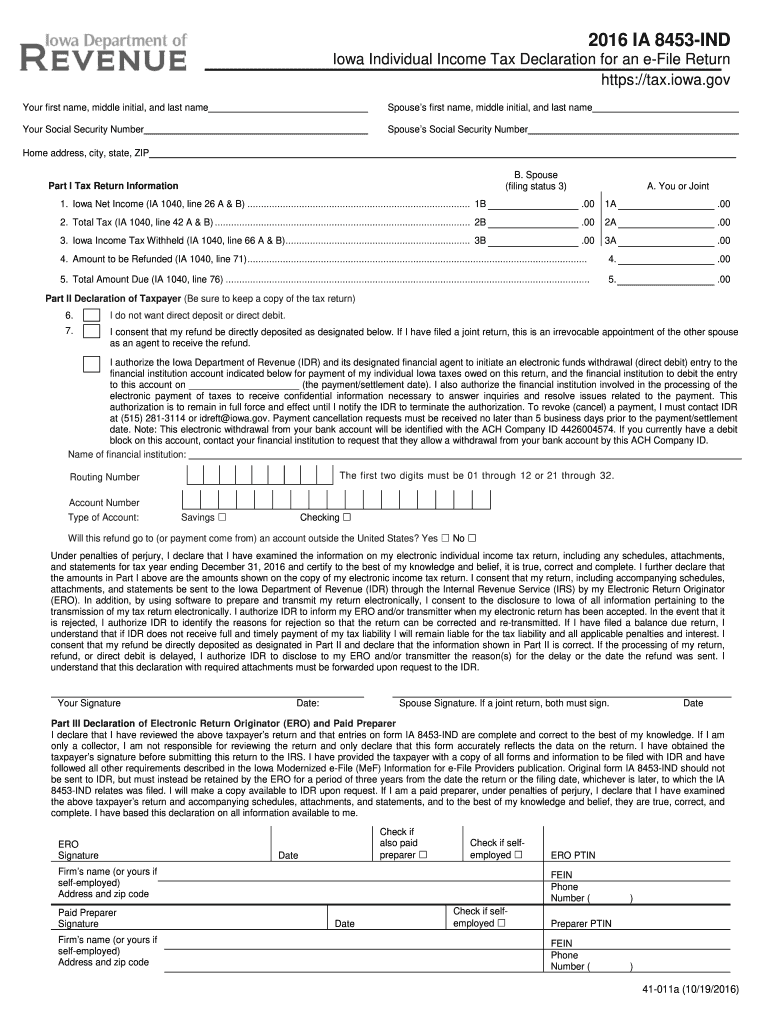

Request Tax Guidance Tax Forms Tax Forms Index IA 1040 Instructions Resources Education Tax Guidance Tax Research Library Iowa Tax Reform Adopted and Filed Rules Need Help Common Questions Form 2022 Expanded Instructions 022023 pdf Tax Type Individual Income Tax Form Year 2022 Print Stay informed subscribe to receive Print E file Form 8582 Passive Activity Loss Limitations Form IA 148 Tax Credits Schedule Taxpayer 02 22 2024 02 22 2024 Form IA 100F Capital Gain Deduction ESOP Form IA 101 Nonconformity Adjustments available available Form IA 1040 ES Estimated Payment available unsupported Form IA 8453 IND Declaration for an E File

Once the IRS accepts your return you ll need to print Form 8453 sign it and mail it into the IRS with the appropriate forms and documents attached Forms and Supporting Documents Requiring a Federal Tax Signature Form You ll need to file this federal tax signature form if you re attaching the following forms and documents View download and print Instructions For Ia 8453 pdf template or form online 1 Iowa Form Ia 8453 Templates are collected for any of your needs Financial United States Tax Forms and 2B of form IA 8453 Iowa Income Tax can contain up to 17 alphanumeric characters and the ERO must abide by the remaining Withheld lines 3A and 3B of

More picture related to Printable Tax Form Ia 8453

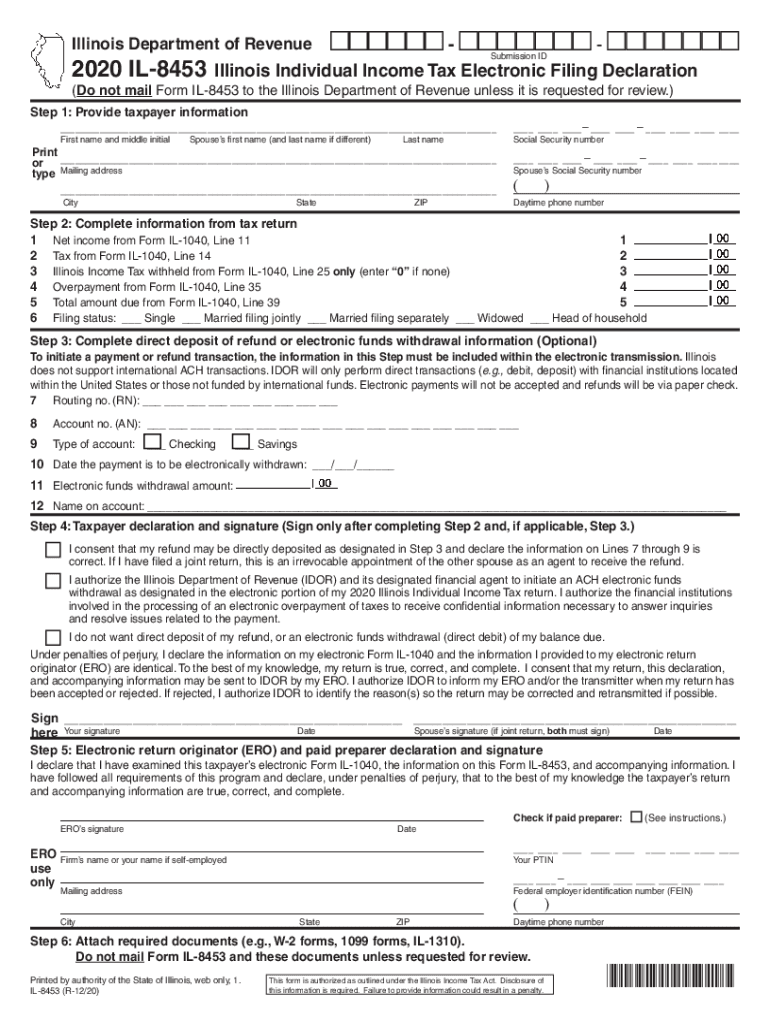

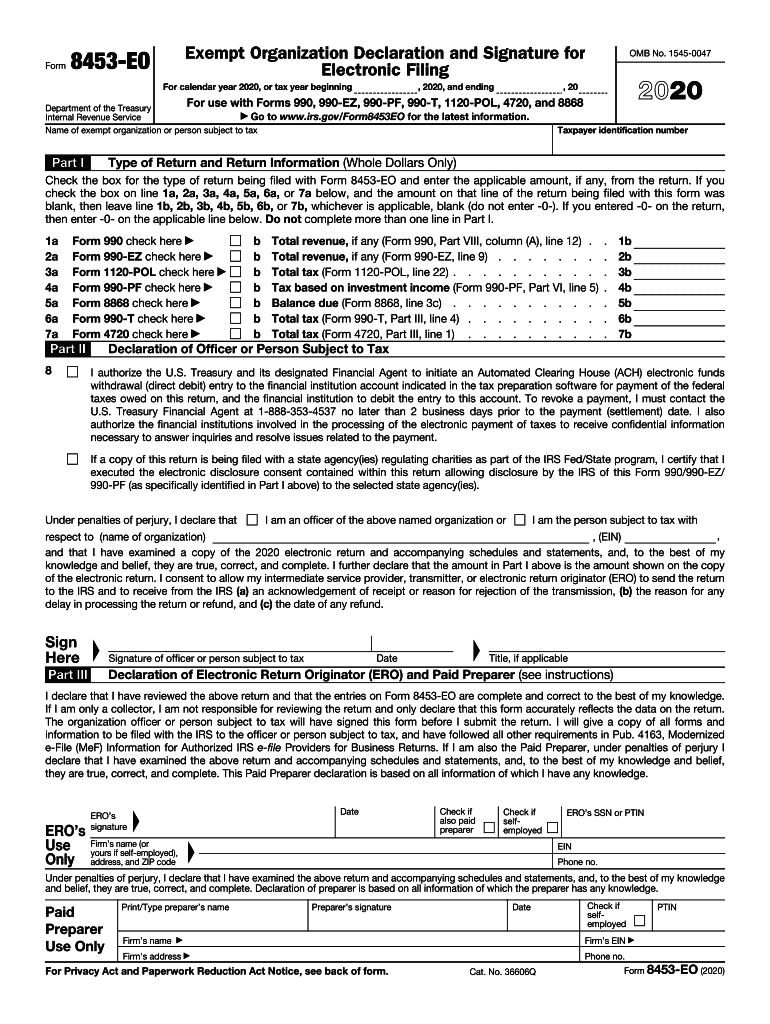

2020 Form IL DoR IL 8453 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/536/253/536253179/large.png

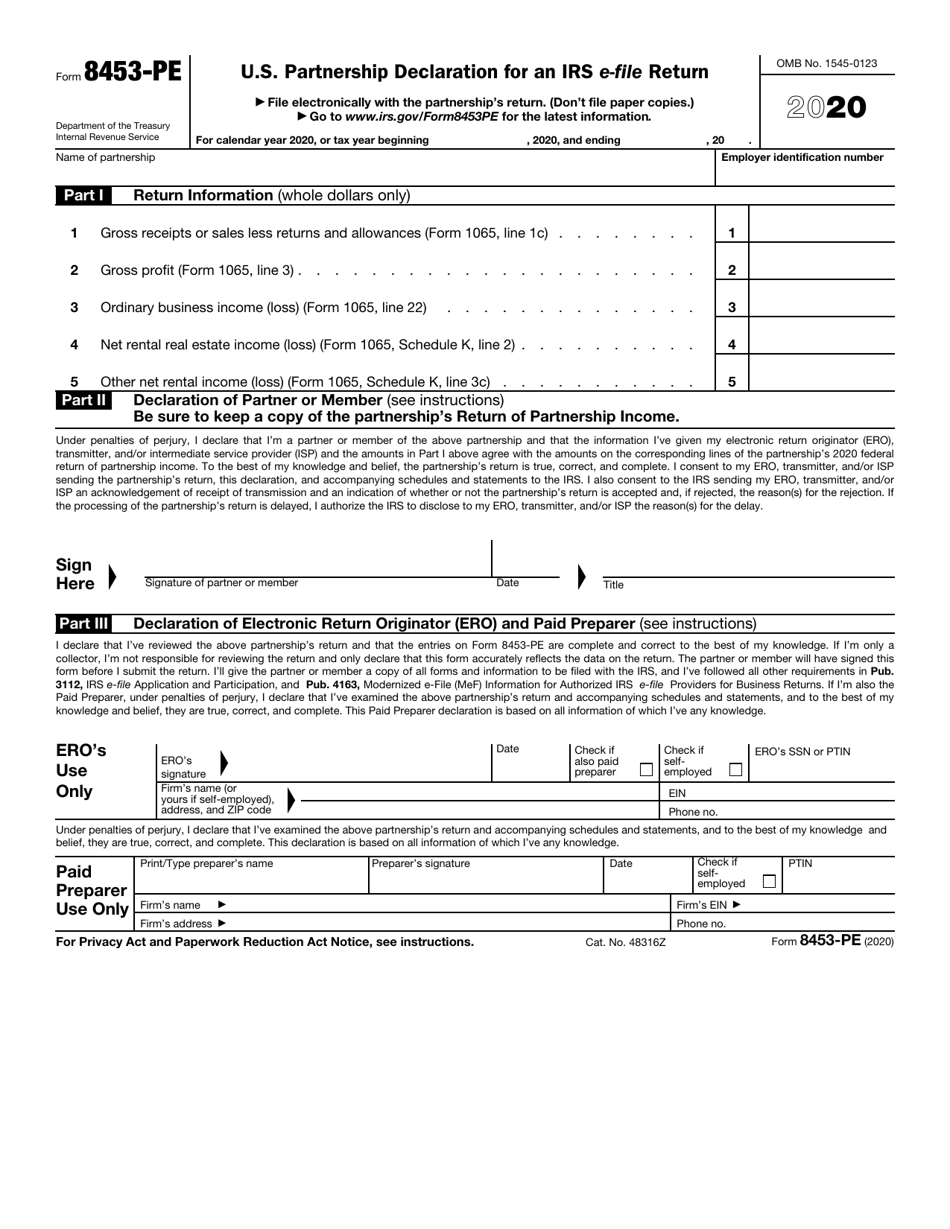

IRS Form 8453 PE Download Fillable PDF Or Fill Online U S Partnership Declaration For An IRS E

https://data.templateroller.com/pdf_docs_html/2121/21213/2121349/irs-form-8453-pe-u-s-partnership-declaration-for-an-irs-e-file-return_print_big.png

Iowa Department Of Revenue Ia 8453 Ind Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/630/1630933/large.png

2022 IA 8453 PTEC Instructions The IA 8453 PTEC must be completed and then signed by an authorized person or pass through representative In lieu of an in person handwritten signature otherwise required on form IA 8453 PTEC the Iowa Department of Revenue IDR allows a paid preparer at the discretion of the pass through entity to collect Taxpayers and Electronic Return Originators EROs use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form Form 8453 is used solely to transmit the forms listed on the front of the form Do not send Forms W 2 W 2G or 1099 R Current Revision Form 8453 PDF

Use Form 8453 S to Authenticate an electronic Form 1120 S U S Income Tax Return for an Corporation Authorize the electronic return originator ERO if any to transmit via a third party transmitter Authorize the intermediate service provider ISP to transmit via a third party transmitter if you re filing online not using an ERO and Ia 8453 Ind 2016 2023 We are not affiliated with any brand or entity on this form W2 Example 2016 2023 Form Use a w2 example 2016 template to make your document workflow more streamlined Show details How it works Browse for the w2 form 2023 Customize and eSign w2 form printable Send out signed iowa w2 form 2022 printable or print it

Ia 8453 Ind Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/397/787/397787591/large.png

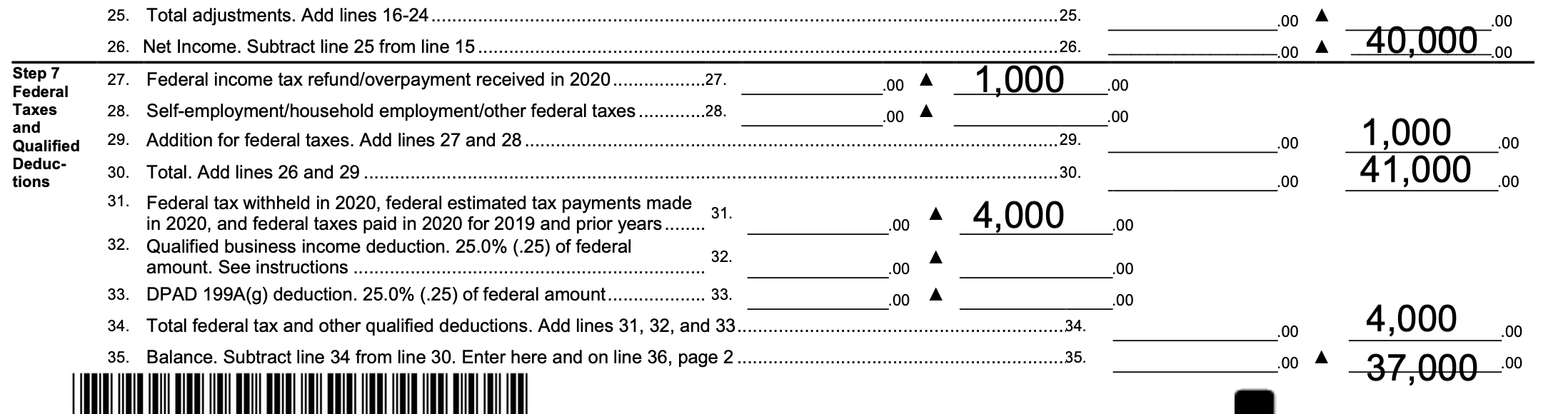

Interpreting An Iowa Form 8453 The E filing Authorization Form Dinesen Tax

https://www.dinesentax.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-01-at-10.19.48-AM.png

https://www.irs.gov/pub/irs-pdf/f8453.pdf

General Instructions Purpose of Form Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 don t send Form s W 2 W 2G or 1099 R Don t attach any form or document that isn t shown on Form 8453 next to the checkboxes If you are required to mail in any documentation

https://www.taxformfinder.org/iowa/form_ia_8453-ind

TaxFormFinder provides printable PDF copies of 44 current Iowa income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 22 Corporate Income Tax 36 Other 11 Show entries Showing 1 to 22 of 22 entries Previous 1 Next

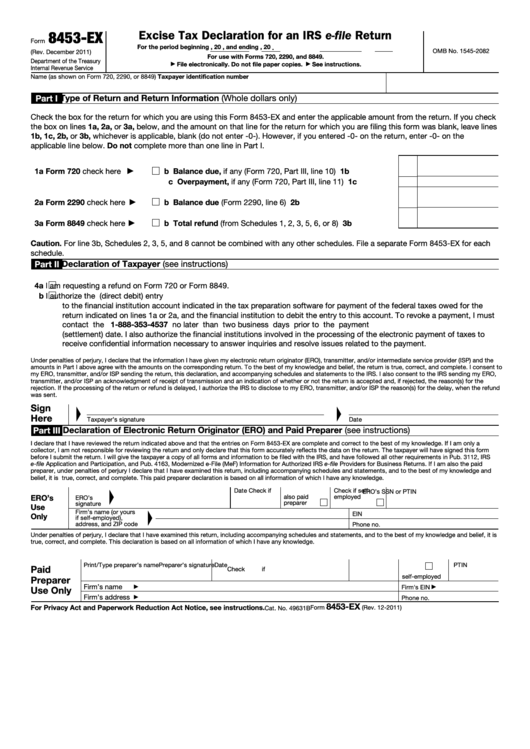

Fillable Form 8453 Ex Excise Tax Declaration For An Irs E File Return Printable Pdf Download

Ia 8453 Ind Fill Out Sign Online DocHub

Form 8453 Fill Out And Sign Printable PDF Template SignNow

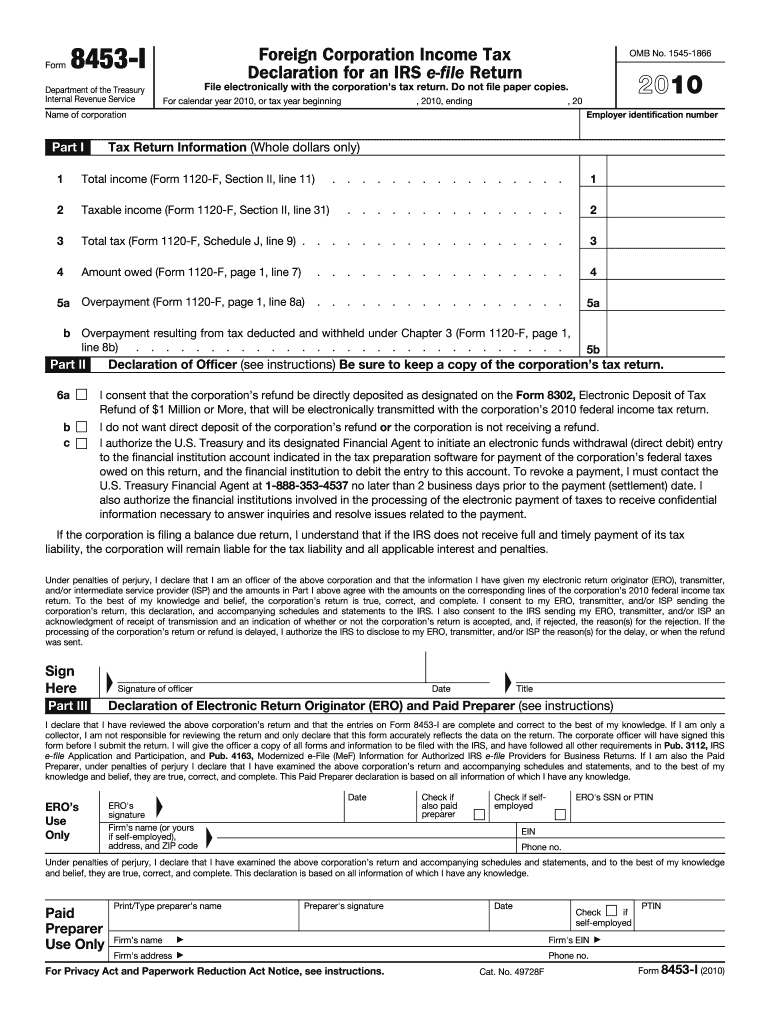

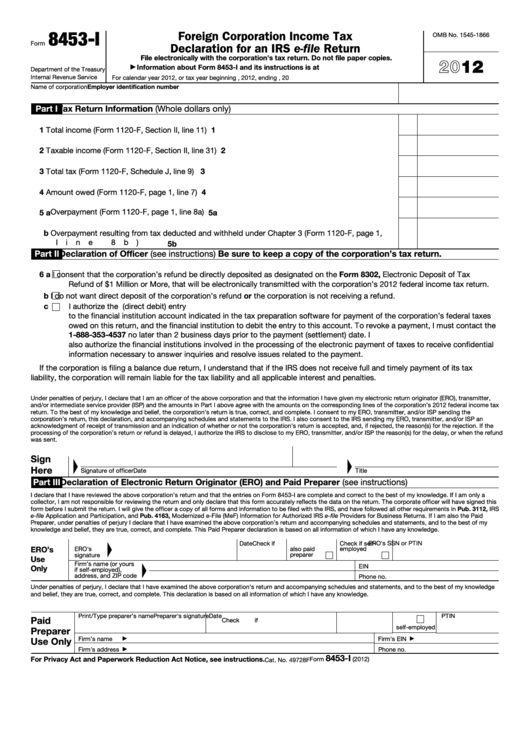

Fillable Form 8453 I Foreign Corporation Income Tax Declaration For An Irs E File Return

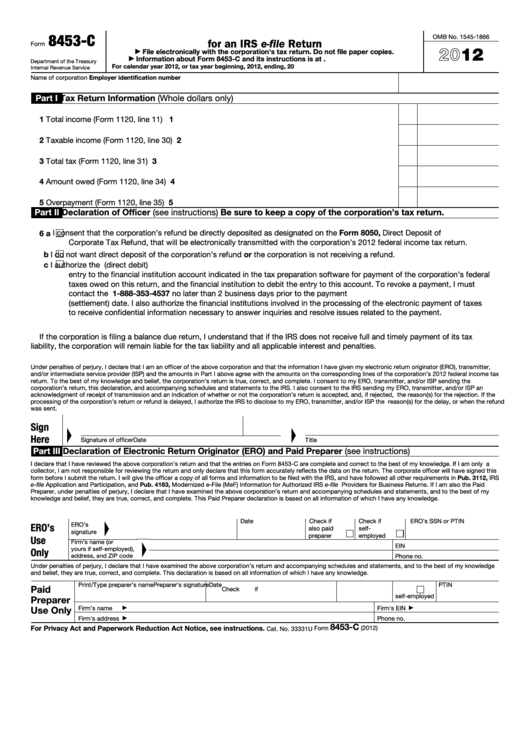

Fillable Form 8453 C U s Corporation Income Tax Declaration For An Irs E File Return 2012

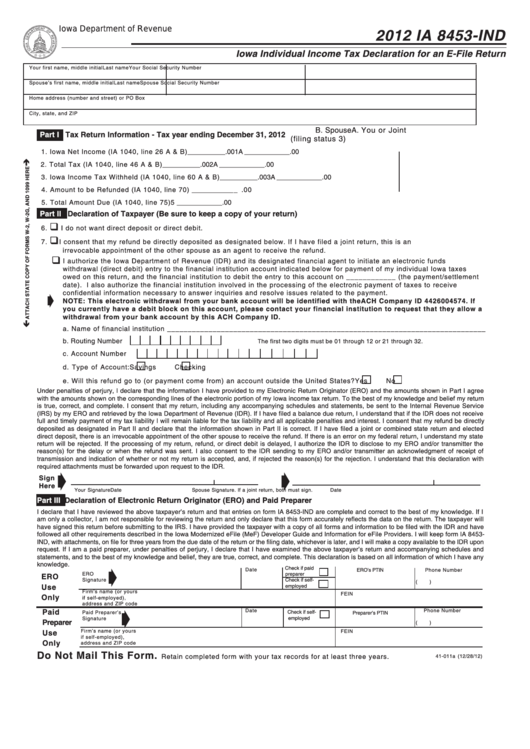

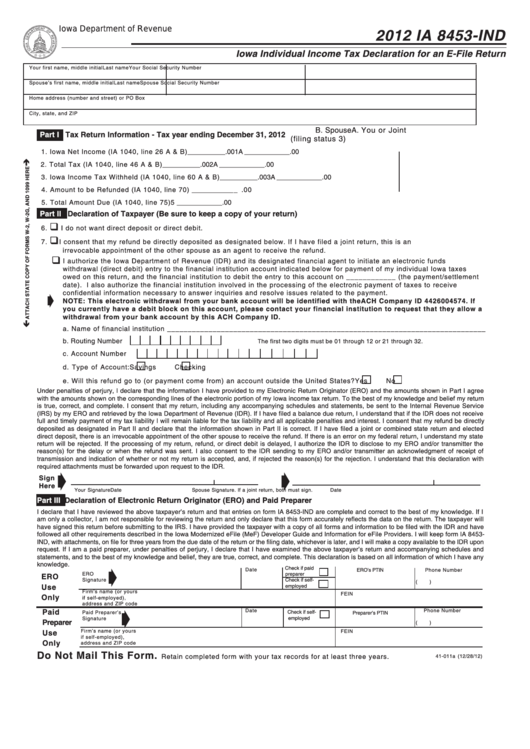

Form Ia 8453 Ind Iowa Individual Income Tax Declaration For An E File Return 2012 Printable

Form Ia 8453 Ind Iowa Individual Income Tax Declaration For An E File Return 2012 Printable

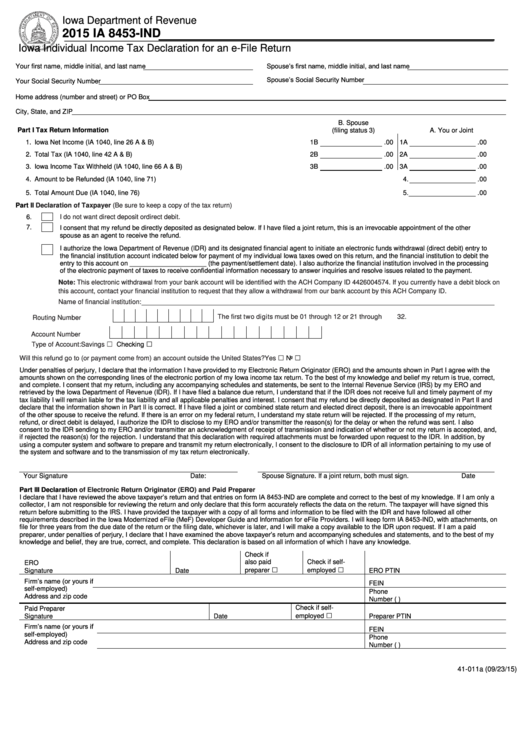

Form Ia 8453 Ind Iowa Individual Income Tax Declaration For An E File Return 2015 Printable

8453 Fill Out Sign Online DocHub

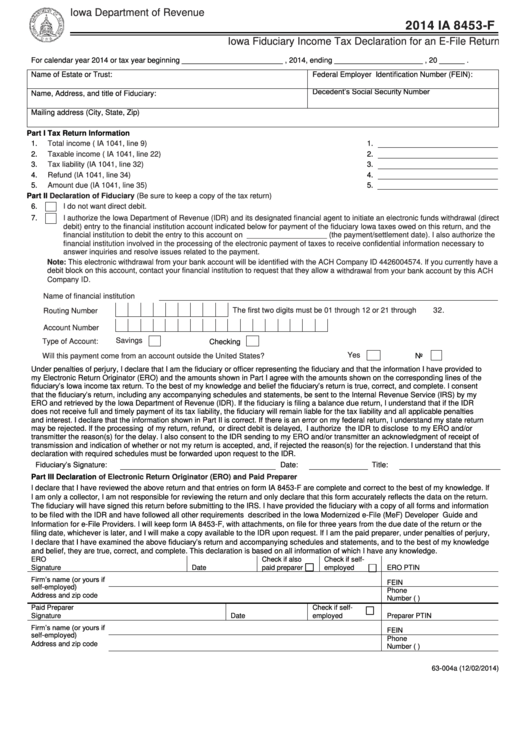

Form 8453 F Iowa Fiduciary Income Tax Declaration For An E File Return 2014 Printable Pdf

Printable Tax Form Ia 8453 - Form 8453 CORP December 2022 Corporate Tax Refund or Form 8302 Electronic Deposit of Tax Refund of 1 Million or More that will be electronically transmitted with the corporation s federal income tax return I do not want direct deposit of the corporation s refund or the corporation is not receiving a refund