Printable Tax Forms For Employees To Fill Out 2024 Form W 4 Complete Steps 2 4 ONLY if they apply to you otherwise skip to Step 5 See page 2 for more information on each step who can claim exemption from withholding and when to use the estimator at www irs gov W4App Step 2 Multiple Jobs or Spouse Works

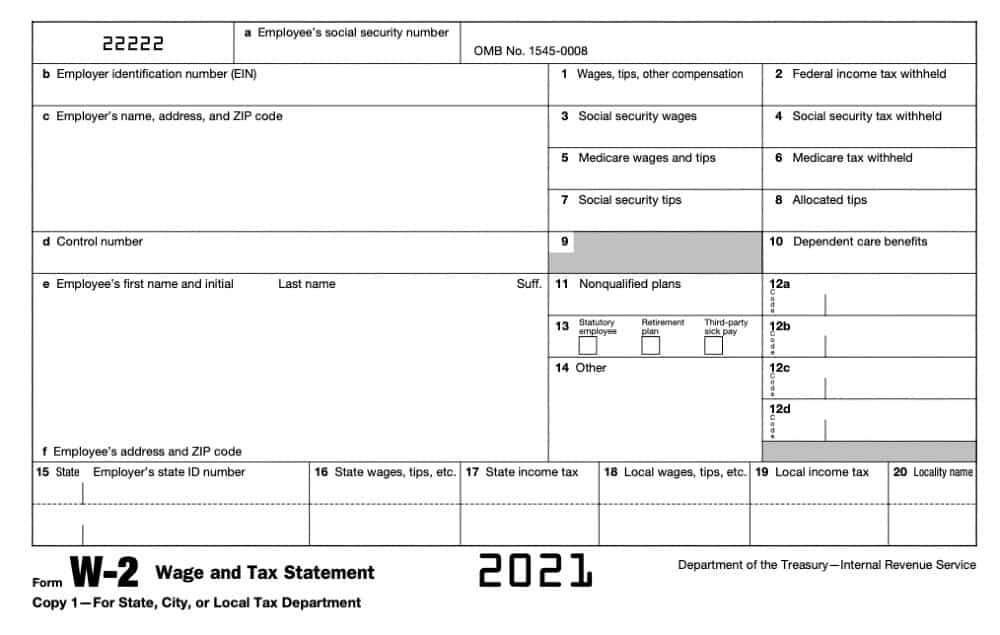

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF A Form W 4 is a tax document that employees fill out when they begin a new job It tells the employer how much to withhold from an employee s paycheck for taxes How a W 4 form is

Printable Tax Forms For Employees To Fill Out

Printable Tax Forms For Employees To Fill Out

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/07/the-irs-has-developed-a-new-form-w-4-employee-s-withholding-3.jpg

W4 Form 2023 Printable Employee s Withholding Certificate

https://free-online-forms.com/wp-content/uploads/2023/01/W-4-Form-2023-768x860.jpg

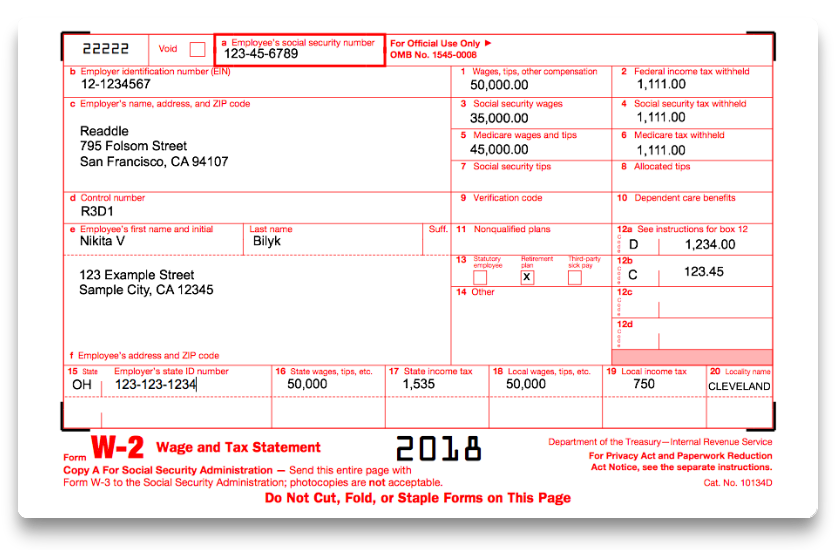

How To Fill Out IRS Form W 2 2017 2018 PDF Expert

https://pdfexpert.com/img/howto/fill-w2-form/how-to-fill-w2-filledform.png

Here are some of the key changes to the W 4 for this year Elimination of allowances You will now need to enter more specific information about income and deductions Additional withholding options Additional options for taxpayers such as for multiple jobs or non wage income Tax withholding estimator The IRS has developed a new The W 4 also called the Employee s Withholding Certificate tells your employer how much federal income tax to withhold from your The form was redesigned for the 2020 tax year The biggest change is that it no longer talks about allowances which many people found confusing Instead if you want an additional amount withheld you

What Is a W 4 Form The W 4 form is completed by an employee so that the employer can withhold the correct amount of federal income tax from your pay When you are hired for a new job you will be required to complete a W 4 form to let your employer know how much tax to withhold Tax year 2023 guide to the employer s quarterly federal tax Form 941 Learn filing essentials get instructions deadlines mailing info and more This guide provides the basics of the 941 form instructions to help you fill it out and where you can get help meeting all your payroll tax obligations The signer must also print their

More picture related to Printable Tax Forms For Employees To Fill Out

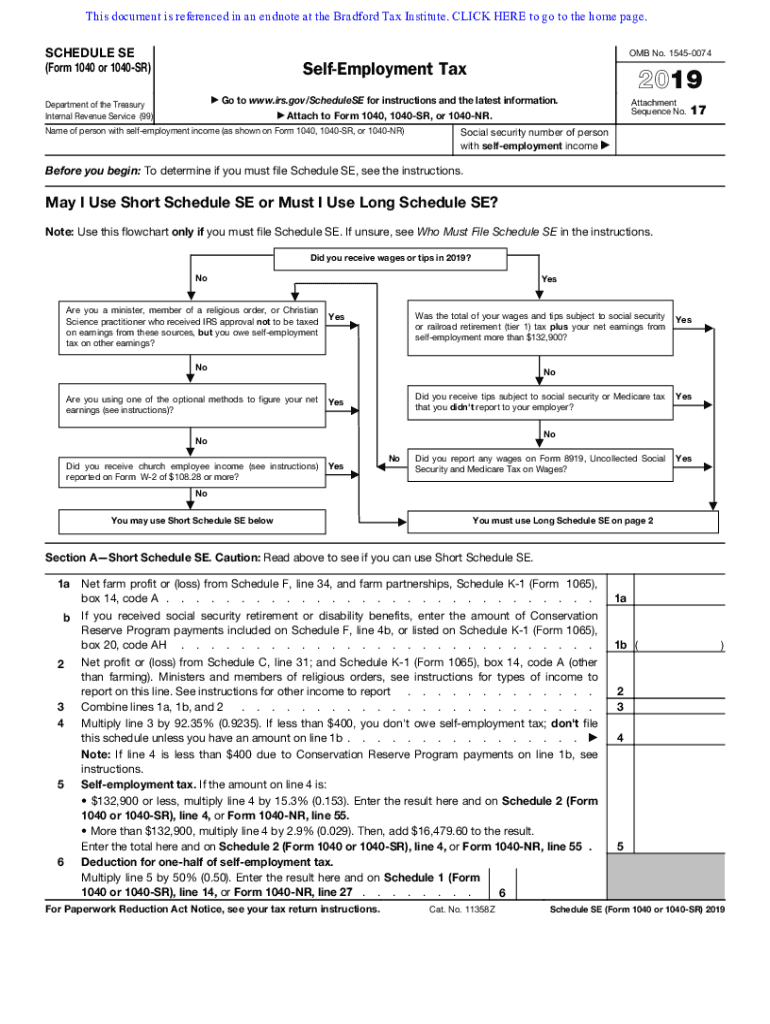

Schedule SE Form 1040 Self Employment Tax Fill And Sign Printable Template Online US Legal

https://www.pdffiller.com/preview/535/579/535579439/large.png

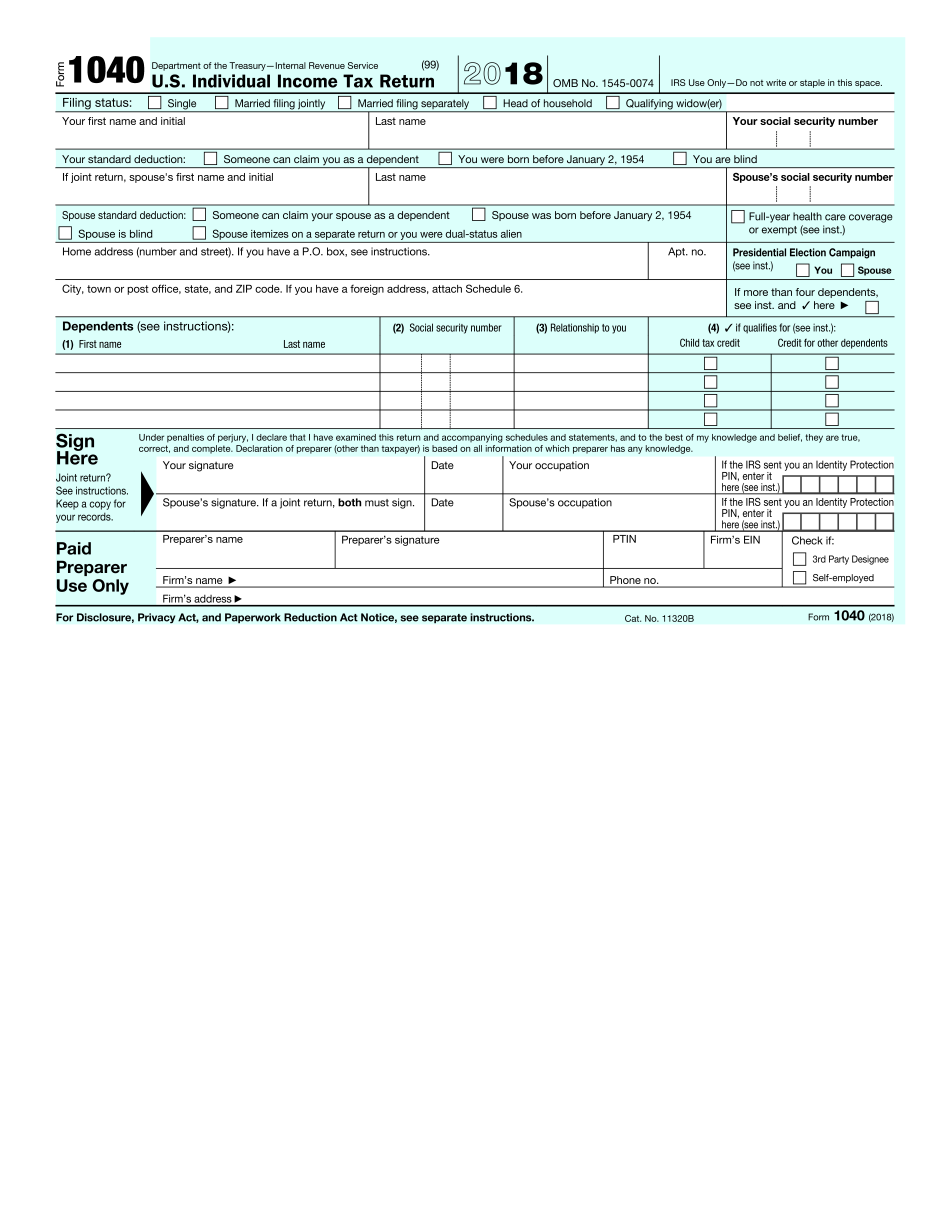

Irs Fillable Form 1040 IRS 1040 Schedule 8812 2020 Fill Out Tax Template Online US Legal

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

FREE 9 Sample Employee Tax Forms In MS Word PDF

https://images.sampletemplates.com/wp-content/uploads/2017/02/16004739/Employee-Tax-Withholding-Form.jpg

Form 1099 NEC Form 1099 NEC Nonemployee Compensation is a tax document you may receive from clients who have paid you 600 or more during the tax year Unlike traditional employees who receive Form W 2 Wage and Tax Statement you ll receive a Form 1099 NEC as a gig economy worker The form provides the IRS information on the income you The forms and paperwork you ll need for your new hire fall into the following four categories Federal and state government forms Internal new hire forms and paperwork Employee benefits

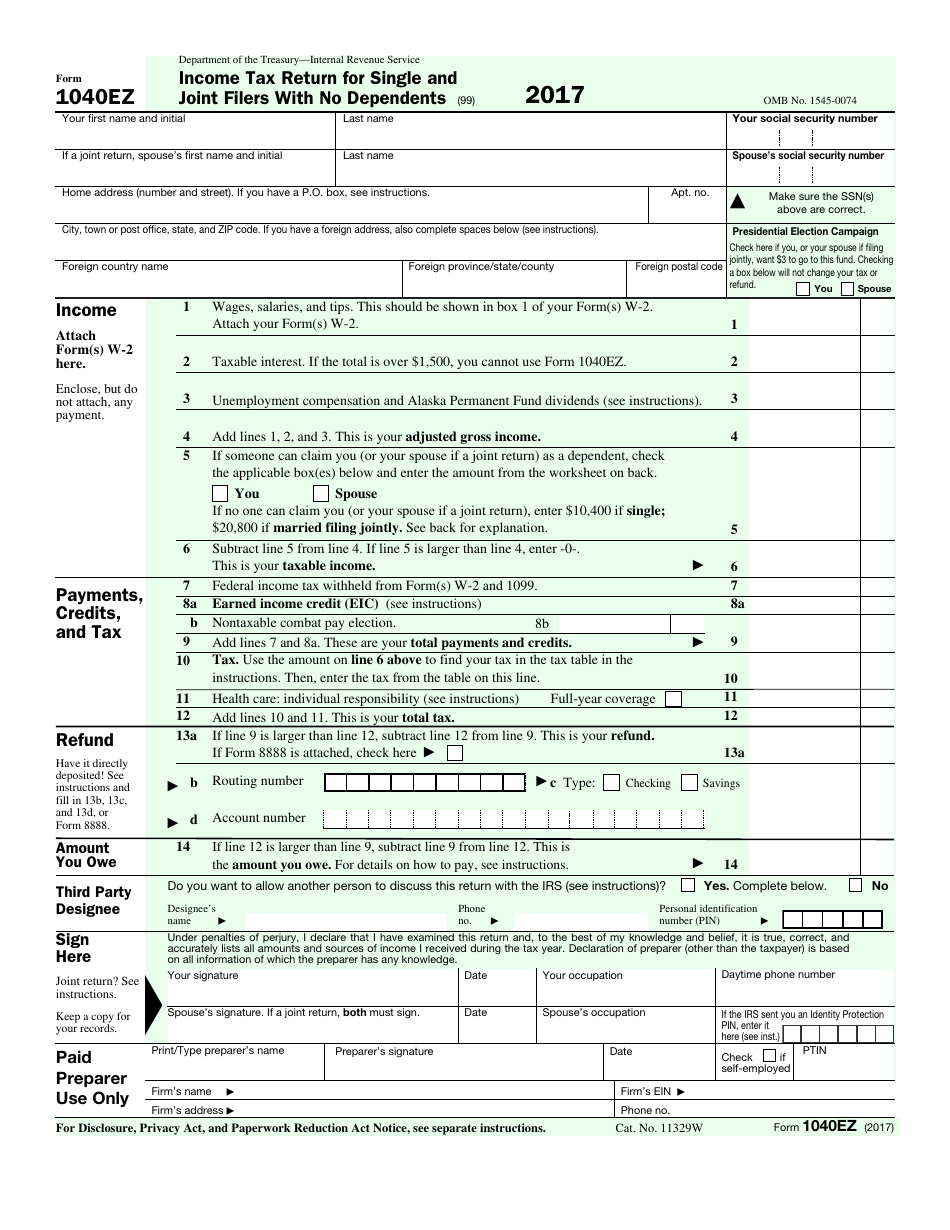

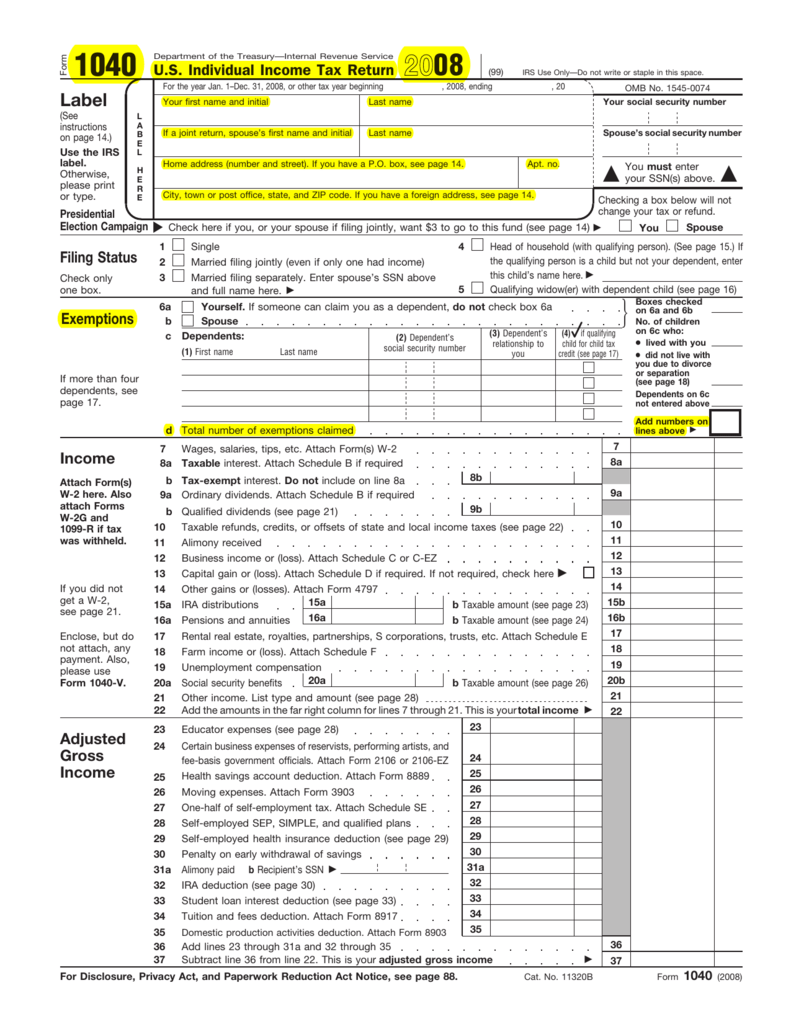

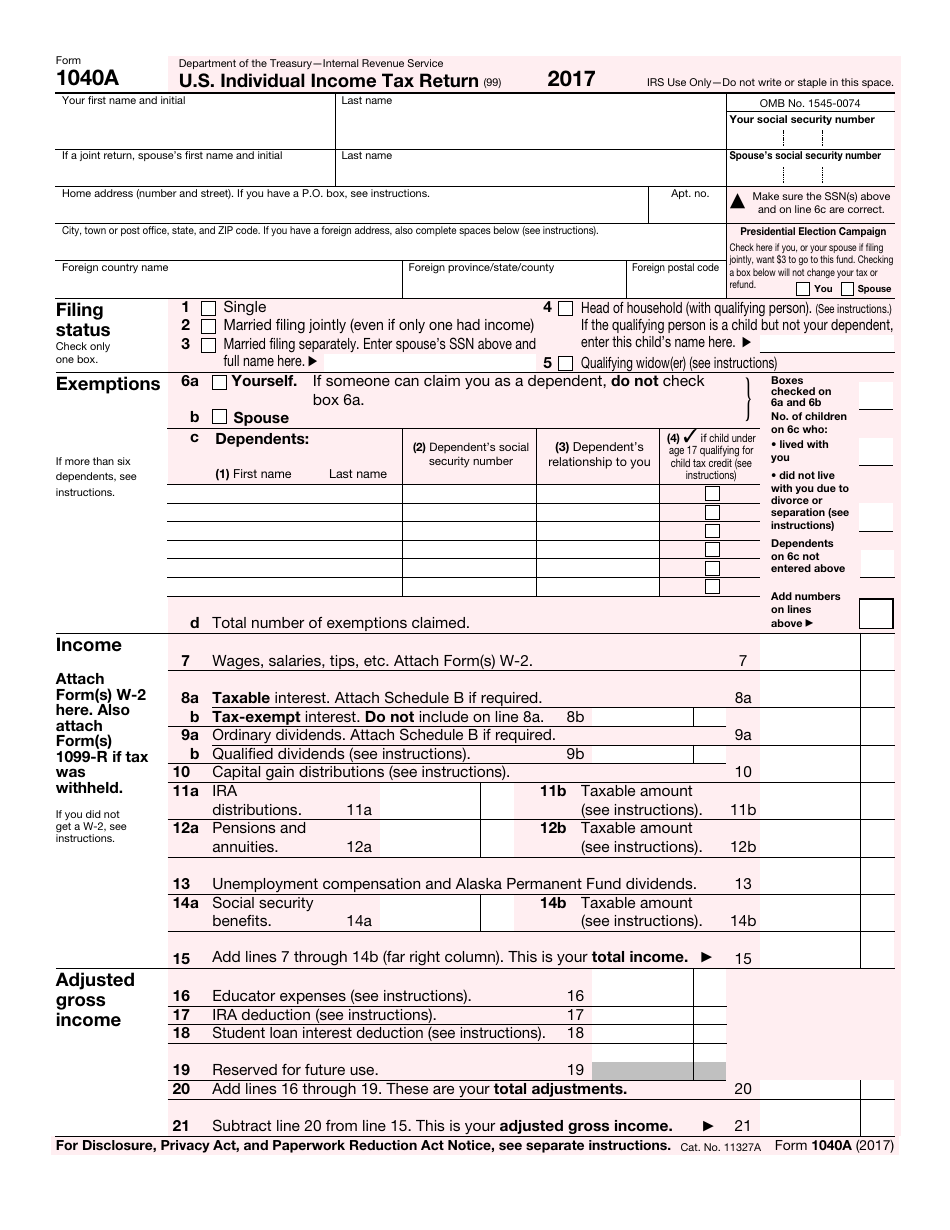

Form forms and more tax forms There are a lot of tax documents There s the W 2 your company sends you assorted 1099 forms for other income a 1098 form for mortgage interest and many others If you are searching for federal tax forms from previous years look them up by form number or year New 1040 form for older adults The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart

FREE 9 Sample Employee Tax Forms In MS Word PDF

https://images.sampletemplates.com/wp-content/uploads/2017/03/Employee-Tax-Withholding-Allowance-Form.jpg

IRS 1040 Form Fillable Printable In PDF 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/irs-1040-form-fillable-printable-in-pdf-3.png

https://www.irs.gov/pub/irs-pdf/fw4.pdf

2024 Form W 4 Complete Steps 2 4 ONLY if they apply to you otherwise skip to Step 5 See page 2 for more information on each step who can claim exemption from withholding and when to use the estimator at www irs gov W4App Step 2 Multiple Jobs or Spouse Works

https://www.irs.gov/forms-instructions

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF

Free Printable Irs Tax Forms Printable Templates

FREE 9 Sample Employee Tax Forms In MS Word PDF

1099 Printable Forms

1040 U S Individual Income Tax Return Filing Status 2021 Tax Forms 1040 Printable

Income Tax Form Completing Form 1040 The Face Of Your Tax Return US Be Sure To Use

IRS Form W 4 Download Fillable PDF Or Fill Online Employee s Withholding Certificate 2023

IRS Form W 4 Download Fillable PDF Or Fill Online Employee s Withholding Certificate 2023

IRS Form 1040A 2017 Fill Out Sign Online And Download Fillable PDF Templateroller

Tax Declaration Form Printable Blank PDF Online

How To Fill Out A W 2 Form

Printable Tax Forms For Employees To Fill Out - Here are some of the key changes to the W 4 for this year Elimination of allowances You will now need to enter more specific information about income and deductions Additional withholding options Additional options for taxpayers such as for multiple jobs or non wage income Tax withholding estimator The IRS has developed a new