Printable Tax Id Form 1099 Form 1099 NEC Beginning with Tax Year 2020 you must use Form 1099 NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099 MISC The separate instructions for filers issuers for Form 1099 NEC are available in the Instructions for Forms 1099 MISC and 1099 NEC PDF

Form 1099 NEC box 2 Payers may use either box 2 on Form 1099 NEC or box 7 on Form 1099 MISC to report any sales totaling 5 000 or more of consumer products for resale on a buy sell a deposit commission or any other basis For further information see the instructions later for box 2 Form 1099 NEC or box 7 Form 1099 MISC Here are the instructions for how to complete a 1099 NEC line by line Box 1 Nonemployee compensation Post the nonemployee compensation and Payer s TIN List your company s taxpayer identification number TIN as Payer s TIN Payer s information List your business s name and address in the top left section of the form

Printable Tax Id Form 1099

Printable Tax Id Form 1099

http://www.depauwtax.com/blog/content/uploads/2016/08/Form-1099Misc-Full.jpg

1099 MISC Form Printable And Fillable PDF Template

https://www.pdffiller.com/preview/456/108/456108087/big.png

IRS Employee 1099 Form Free Download

https://www.formsbirds.com/formimg/more-tax-forms/1132/irs-employee-1099-form-l3.png

File your state 1099 forms by mid January so you can print Keep in mind the IRS filing and contractor delivery deadlines Step 2 Print your 1099s or 1096 Choose your product below to see the steps to print your 1099s About Form 1096 Annual Summary and Transmittal of U S Information Returns The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to

1099 INT reports interest income typically of 10 or more from your bank credit union or other financial institution The form reports the interest income you received any federal income taxes A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in a financial year you ll need to complete a 1099 NEC Note that the 600 threshold that was enacted

More picture related to Printable Tax Id Form 1099

Irs Printable 1099 Form Printable Form 2023

https://www.printableform.net/wp-content/uploads/2021/06/what-is-irs-form-1099-q-turbotax-tax-tips-videos.jpg

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1099-misc-tax-basics.png

Tax Form 1099 MISC Instructions How To Fill It Out Tipalti

https://lh4.googleusercontent.com/k2lr2QLf9OvFdt0aPeTtU_t9ryklux-DLzsAEo7vztZzgeWxWNS_bp3Jfmd7RXXBkfSp08oMB_5HICrBpvPTBvPnx0jNx1omGKS0qhbKog9ZnHRxa-ojwuj7dEv81zXye_n3IJKW

A 1099 form is a tax record that an entity or person not your employer gave or paid you money See how various types of IRS Form 1099 work NerdWallet Compare Inc NMLS ID 1617539 IRS 1099 Form IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types 1099s fall into a group of tax documents called

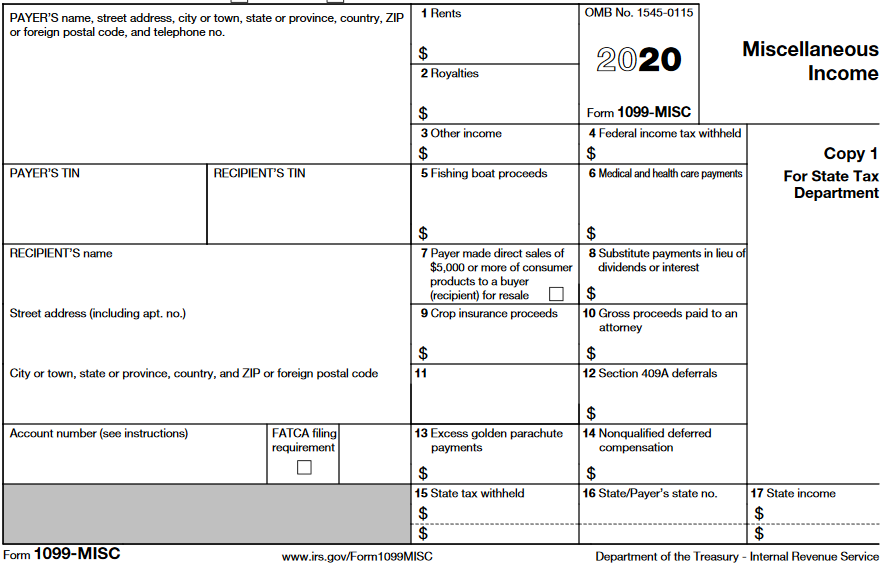

IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form Here you ll be able to easily view your tax forms for the current tax year Within the dashboard your 1099 Composite forms will appear as they become available If your account was recently converted from TD Ameritrade your Consolidated 1099 and 1099 R forms will also be included on the 1099 Dashboard Once you ve located the documents you

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

https://gusto.com/wp-content/uploads/2020/12/1099-MISC-1024x663.png

Ssa 1099 Form 2020 2022 Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/100/15/100015446/large.png

https://www.irs.gov/businesses/small-businesses-self-employed/forms-and-associated-taxes-for-independent-contractors

Form 1099 NEC Beginning with Tax Year 2020 you must use Form 1099 NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099 MISC The separate instructions for filers issuers for Form 1099 NEC are available in the Instructions for Forms 1099 MISC and 1099 NEC PDF

https://www.irs.gov/instructions/i1099mec

Form 1099 NEC box 2 Payers may use either box 2 on Form 1099 NEC or box 7 on Form 1099 MISC to report any sales totaling 5 000 or more of consumer products for resale on a buy sell a deposit commission or any other basis For further information see the instructions later for box 2 Form 1099 NEC or box 7 Form 1099 MISC

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 DIV Dividends And Distributions Definition

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

Printable 1099 Tax Forms Free Printable Form 2024

Form 1099 R Instructions Information Community Tax

Microsoft Word 1099 Tax Form Printable Template Printable Templates

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R What It s Used For And Who Should File It

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

Form 1099 R What It s Used For And Who Should File It

Qu Es Un Formulario 1099 Del IRS Qu Significa Y C mo Funciona

IRS Form 1099 R How To Fill It Right And Easily

1099 Form

Printable Tax Id Form 1099 - The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to