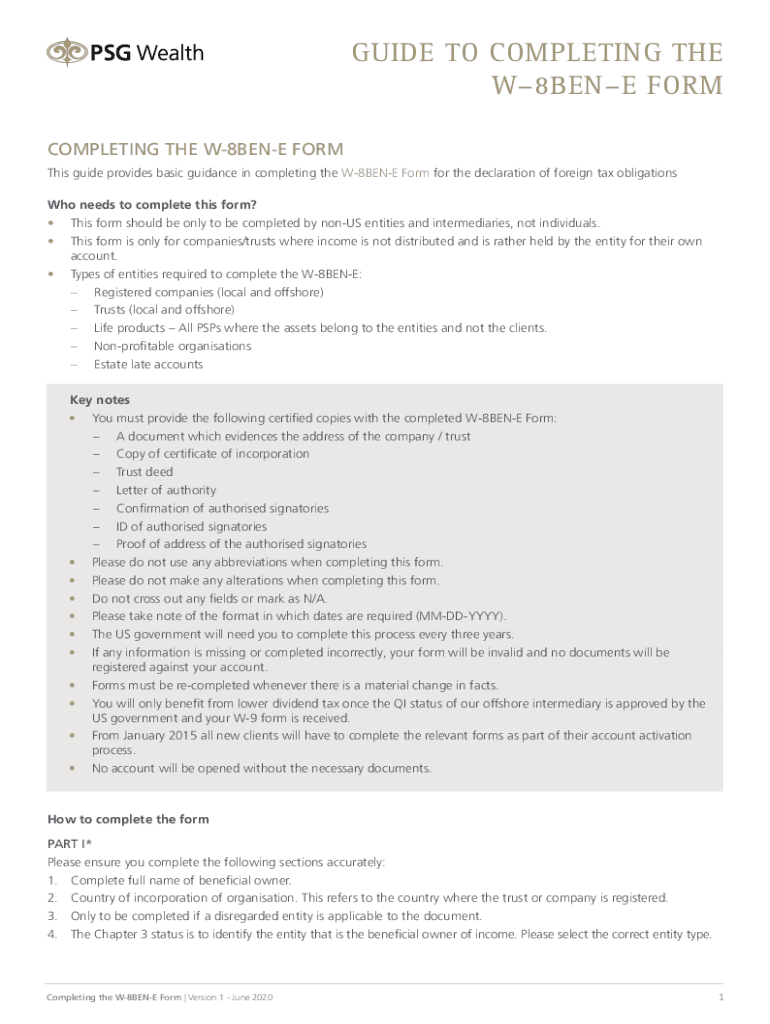

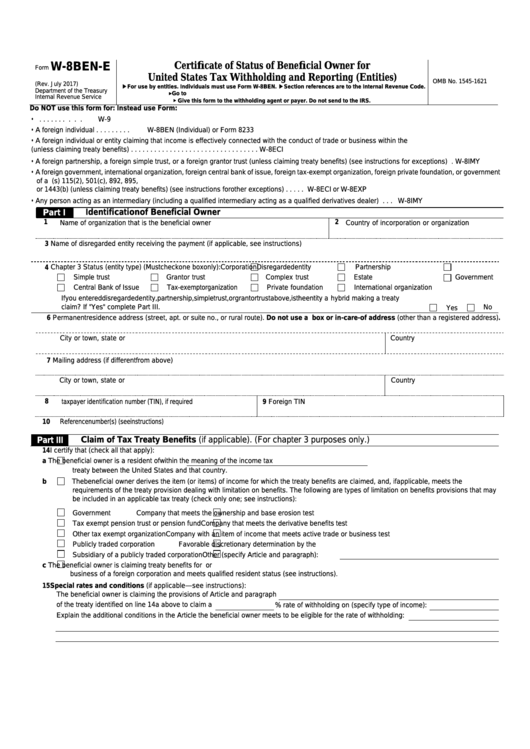

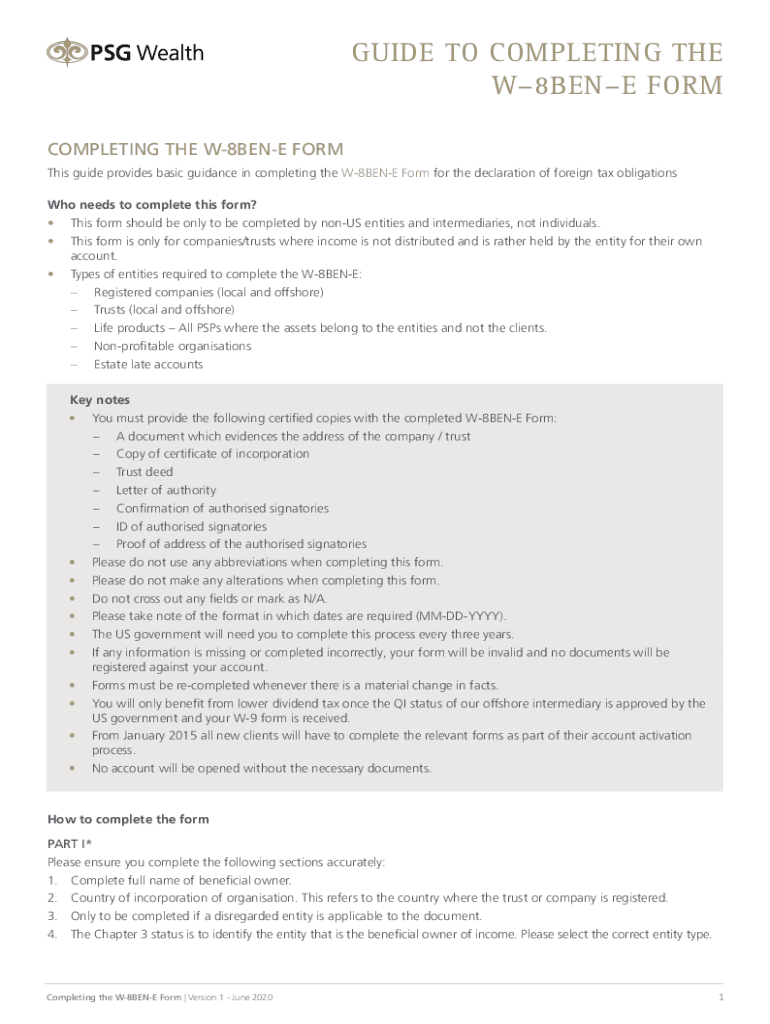

Printable W 8ben E Form For the Requester of Forms W 8BEN W 8BEN E W 8ECI W 8EXP and W 8IMY Who Must Provide Form W 8BEN E You must give Form W 8BEN E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent receiving a payment subject to chapter 3 withholding or if you are an entity

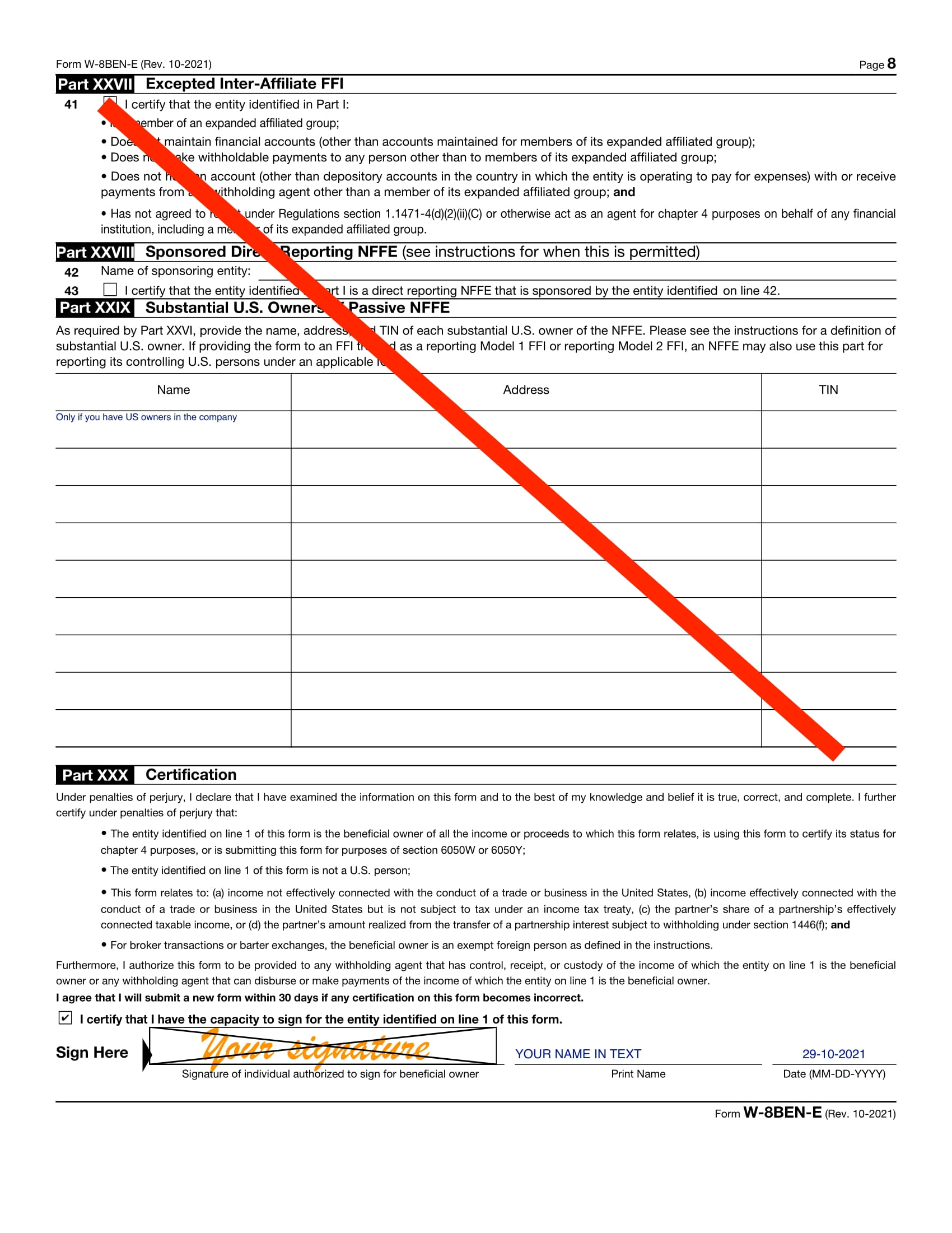

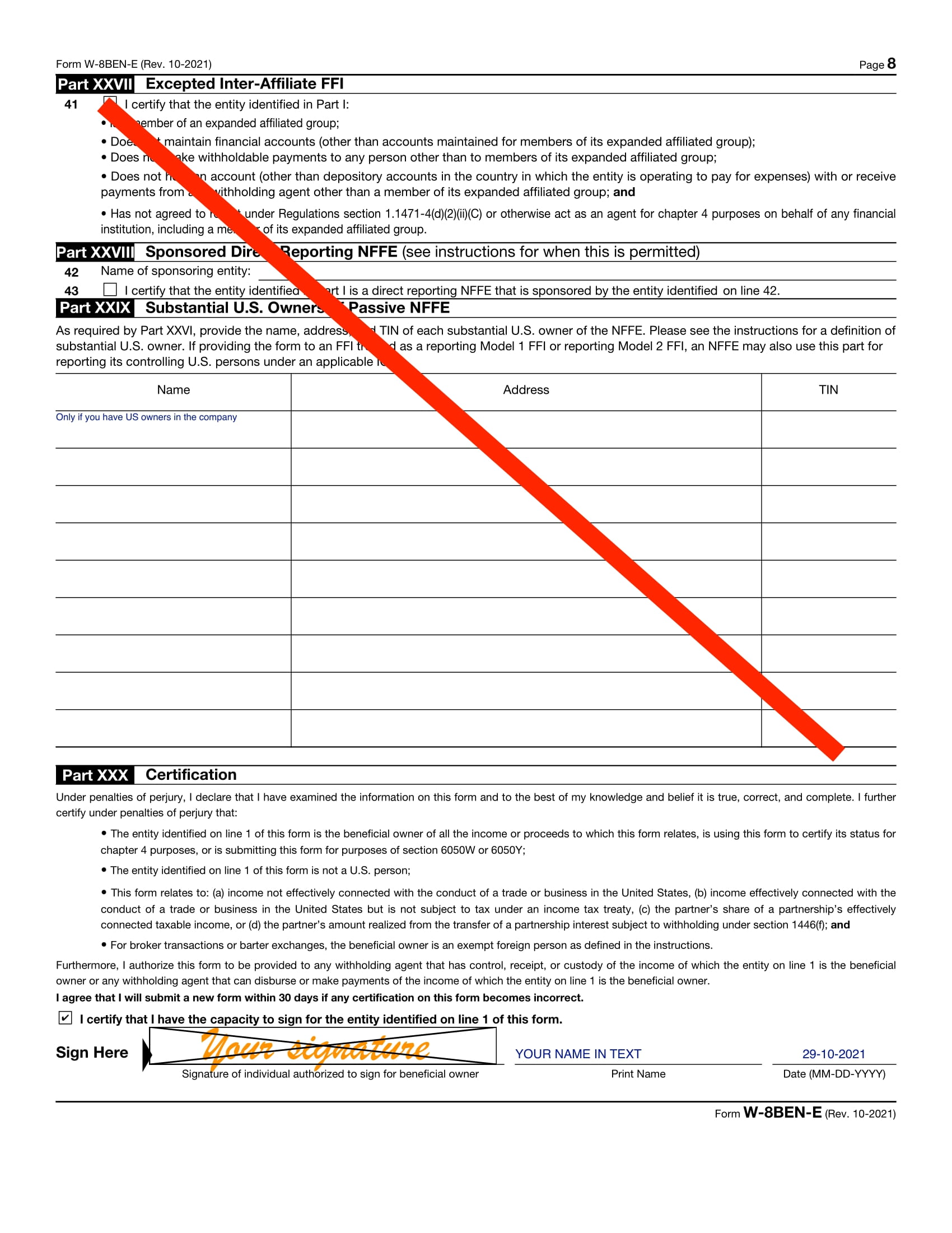

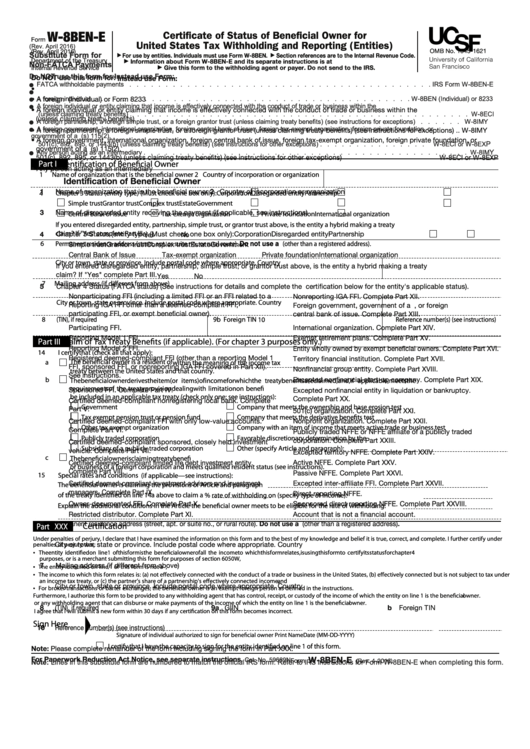

Form W 8BEN E Rev 10 2021 Page 2 Part III Certification Under penalties of perjury I declare that I have examined the information on this form and to the best of my knowledge and belief it is true correct and complete Signature of individual authorized to sign for beneficial owner Print Name Date MM DD YYYY I certify that I have Rev October 2021 Entities For use by entities Individuals must use Form W 8BEN Section references are to the Internal Revenue Code Substitute Form for Go to www irs gov FormW8BENE for instructions and the latest information Non FATCA Payments Give this form to the withholding agent or payer Do not send to the IRS

Printable W 8ben E Form

Printable W 8ben E Form

https://mr-eurodisco.com/finance/W8BENE/w8bene-completed-example-english-8.jpg

Form W 8BEN Explained Purpose And Uses

https://lh4.googleusercontent.com/Qan3B1jISHl5u3x0euesIi9r6X-jcmFOSW4komPcAWqJ7Epe2Sp7hGh30jDh95eu16UGmrU58QPCOulgQ-1pK007ibOOo9ta5IZPzPpQWiZjqR5zM6Oxmtvm8fxTZToLURssu8FK

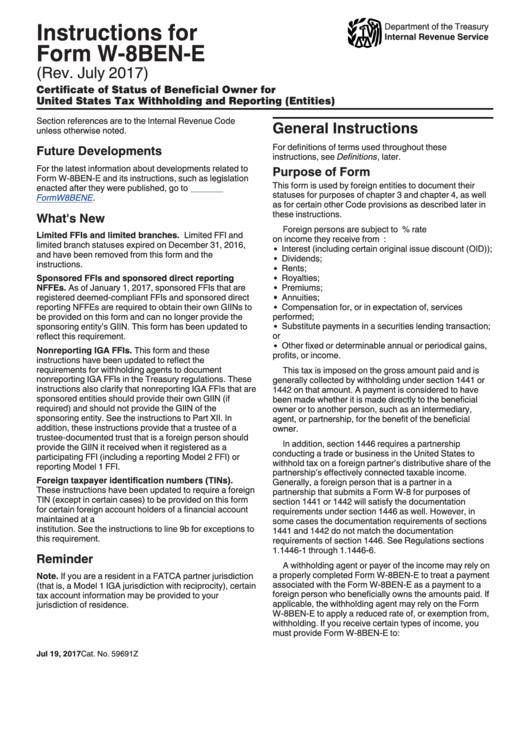

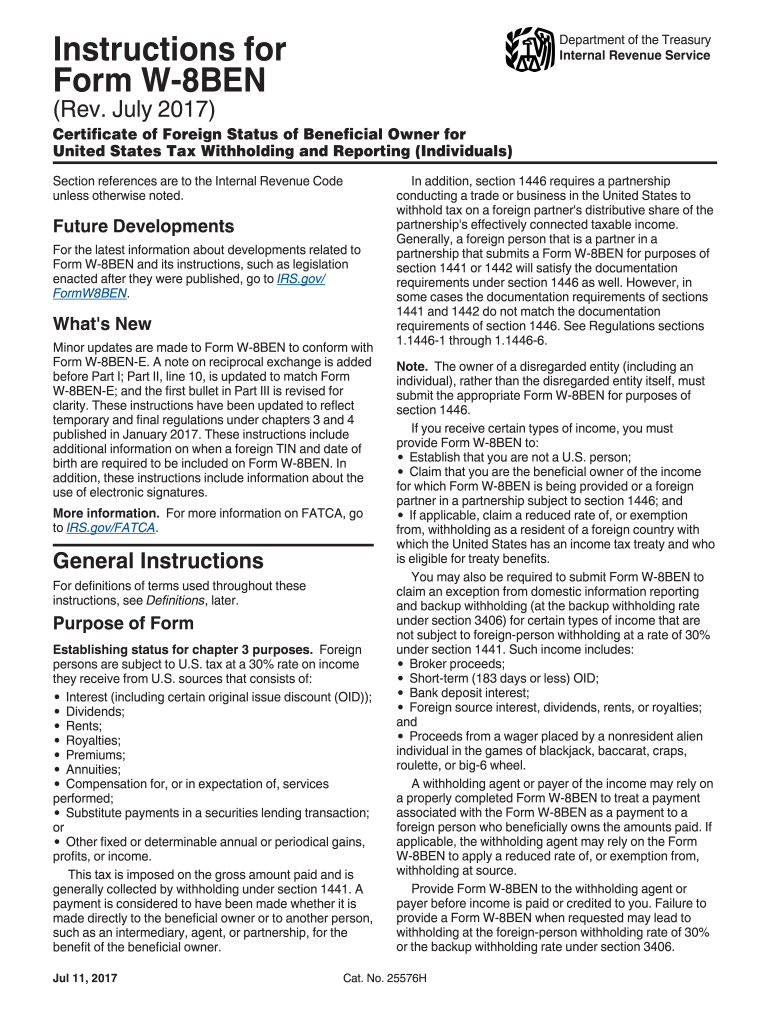

Instructions For Form W 8ben E Certificate Of Entities Status Of Beneficial Owner For United

https://data.formsbank.com/pdf_docs_html/295/2950/295052/page_1_thumb_big.png

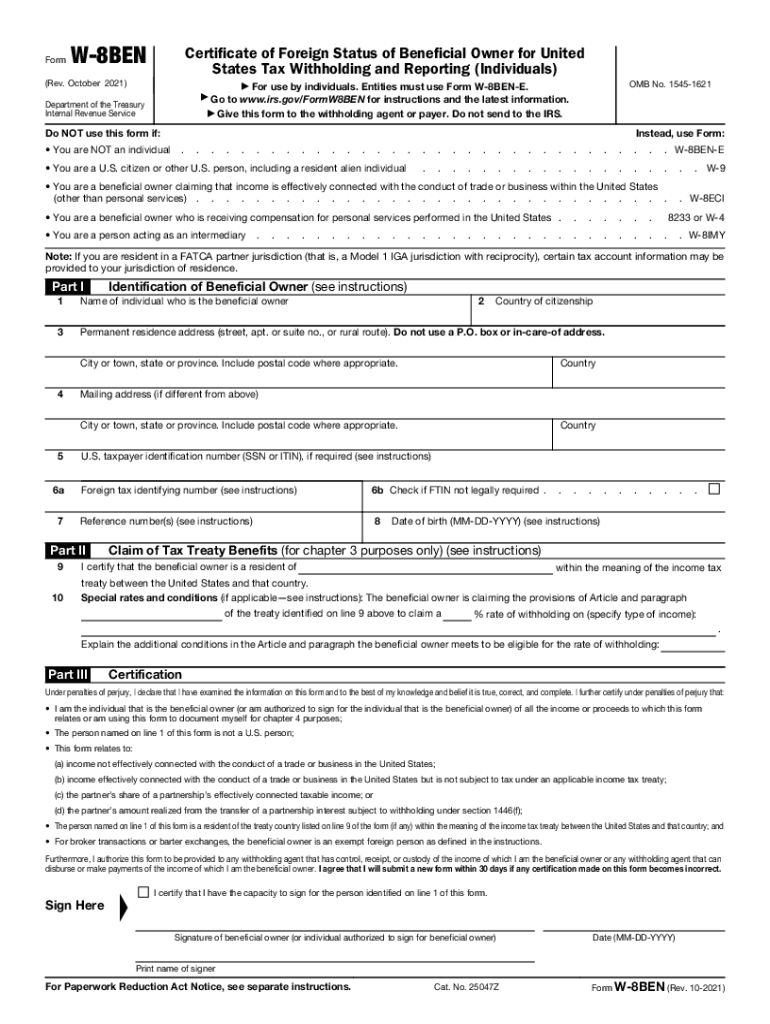

Entities must use Form W 8BEN E Give this form to the withholding agent or payer Do not send to the IRS OMB No 1545 1621 Instead use Form Print name of signer W For Paperwork Reduction Act Notice seeseparate instructions Cat No 25047Z Form 8BEN Rev 10 2021 1 Updated December 11 2023 A Form W 8BEN is a required IRS document for foreign individuals living outside the United States who earn income from a U S source The form verifies an individual s country of residence and can establish a lower tax withholding rate on income for people residing in qualifying countries

W 8BEN Form Rev October 2021 Department of the Treasury Internal Revenue Service Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals For use by individuals Entities must use Form W 8BEN E OMB No 1545 1621 Go to www irs gov FormW8BEN for instructions and the latest information Provide Form W 8BEN to U S Bank before income is paid or credited to you Failure to provide a Form W 8BEN when requested may lead to withholding at the foreign person withholding rate of 30 or the backup withholding rate under section 3406 Line 4 Do not use Form W 8BEN if you are described below

More picture related to Printable W 8ben E Form

How To Fill Out A W8 BEN Form JamesBachini

http://www.jamesbachini.com/wp-content/uploads/2014/11/w8ben_corporation.jpg

Download Form W 8ben At Charles Schwab Site Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/208/979/208979369/large.png

W 8ben Statement Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/0/913/913771/large.png

Under penalties of perjury I declare that I have examined and signed the Form W 8BEN E and that the information and certifications contained herein 1 for purposes of establishing tax status under Chapters 3 and 61 of the U S Internal Revenue Code have remained the same and unchanged from MM DD YYYY A Small Business Guide Form W 8BEN E is an Internal Revenue Service IRS form used by foreign companies that get paid by US companies For example if you hire a contractor not based in the US and contracting through a foreign entity the contracting company is required to submit the document to your business

To execute the Form W 8BEN E and attest to the correctness and completeness of the information and representations provided on the Form an authorized individual must sign the form and provide all the required information in the spaces indicated in Part XXIX Sign the form by hand Print the name of the signer The W 8BEN E is an IRS form used by foreign companies doing business in the United States Only corporations and partnerships need to file this form Individuals and sole proprietors need to file the W 8BEN form The W 8BEN E form is used to confirm that a vendor is a foreign company and must be filled out before the vendor can be paid

Fillable Online W 8BEN E FORM Fax Email Print PdfFiller

https://www.pdffiller.com/preview/538/800/538800160/large.png

Form W 8ben E Certificate Of Status Of Beneficial Owner For United States Tax Withholding And

https://data.formsbank.com/pdf_docs_html/379/3795/379515/page_1_thumb_big.png

https://www.irs.gov/pub/irs-pdf/iw8bene.pdf

For the Requester of Forms W 8BEN W 8BEN E W 8ECI W 8EXP and W 8IMY Who Must Provide Form W 8BEN E You must give Form W 8BEN E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent receiving a payment subject to chapter 3 withholding or if you are an entity

https://finance.emory.edu/home/_includes/documents/sections/accounting/nra/public/emory_w-8ben-e_short_form.pdf

Form W 8BEN E Rev 10 2021 Page 2 Part III Certification Under penalties of perjury I declare that I have examined the information on this form and to the best of my knowledge and belief it is true correct and complete Signature of individual authorized to sign for beneficial owner Print Name Date MM DD YYYY I certify that I have

2017 2021 Form IRS Instruction W 8BEN Fill Online Printable Fillable Blank PdfFiller

Fillable Online W 8BEN E FORM Fax Email Print PdfFiller

Form W 8BEN E Certificate Of Entities Status Of Beneficial Owner For Tax Withholding And

How To Fill Up W 8BEN Form For US Manulife REIT My Sweet Retirement

W 8BEN E Form Instructions For Canadian Corporations Cansumer

W8 Ben Download Fill Online Printable Fillable Blank PdfFiller

W8 Ben Download Fill Online Printable Fillable Blank PdfFiller

Fill Free Fillable W 8BEN PDF Form

2021 2023 Form IRS W 8BEN Fill Online Printable Fillable Blank PdfFiller

Fillable Form W 8ben E Certificate Of Status Of Beneficial Owner For United States Tax

Printable W 8ben E Form - There are five W 8 forms W 8BEN W 8BEN E W 8ECI W 8EXP and W 8IMY Form W 8IMY is used by intermediaries that receive withholding payments on behalf of a foreigner or as