Record Keeping Forms To Printable For Retirement What Are Important Documents Important documents are certain legal tax medical property and personal records you should hold on to in case you need to reference or use them down the road You know the stuff you keep around just in case

FAMILY RECORDS WORKSHEET Asset Inventory and Personal Information This document will help you to organize information that will be helpful if there is an emergency or you become incapacitated and you need someone to step in suddenly to manage your financial affairs You have the option of Printing out this form and writing your information in or Step 1 Get access You or the person holding durable power of attorney will need access to computer accounts and financial records Start by asking your loved one these questions What is your computer login Do you bank pay bills or handle investments online If so what are the passwords

Record Keeping Forms To Printable For Retirement

Record Keeping Forms To Printable For Retirement

https://www.inpaspages.com/wp-content/uploads/2015/03/retirement_form.png

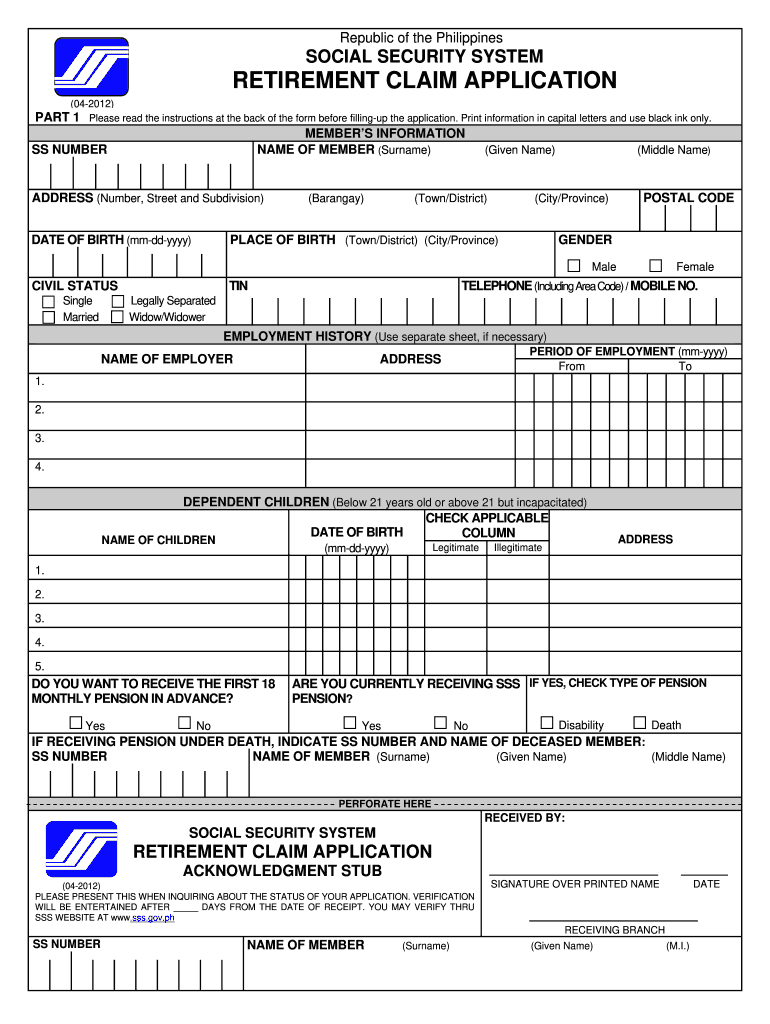

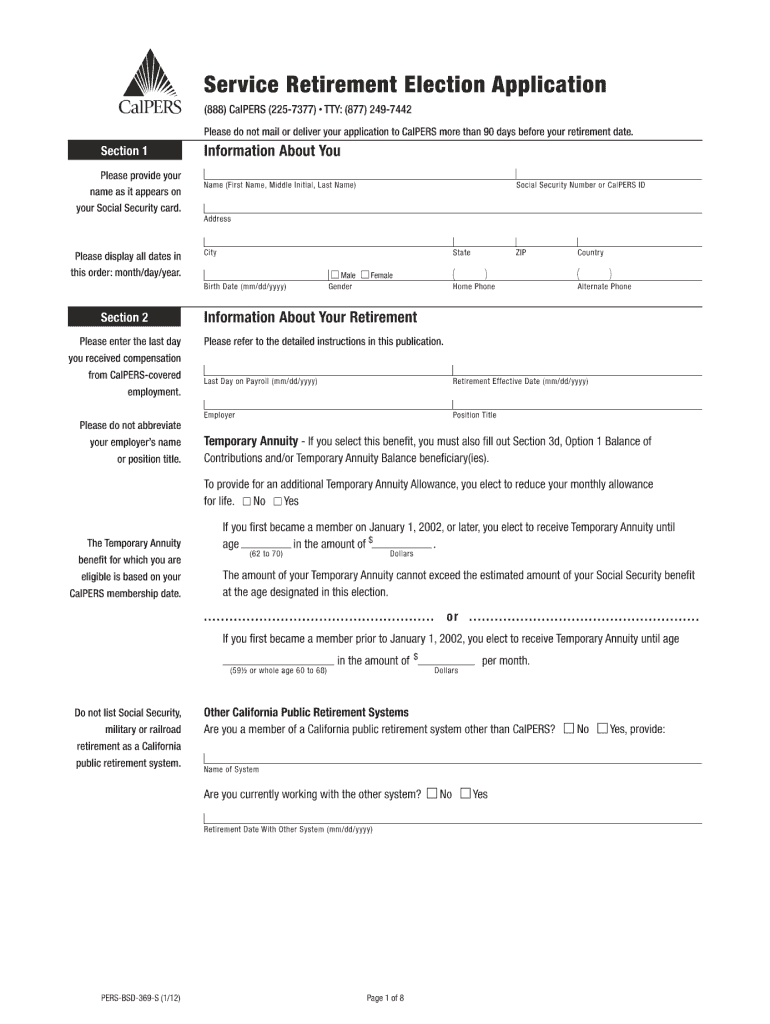

Social Security Retirement Application Form PDF Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/588/6588750/large.png

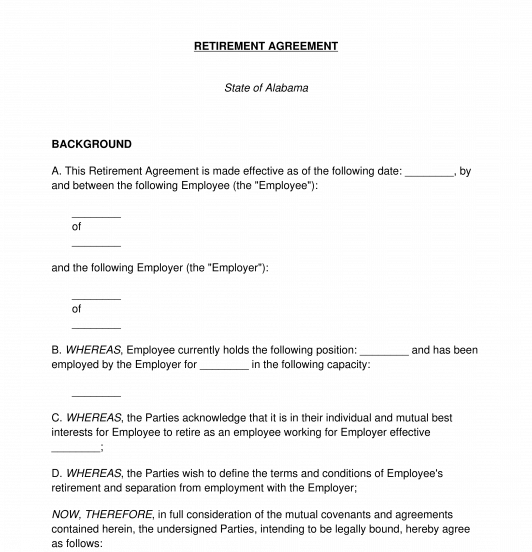

Retirement Agreement Sample Template Word And PDF

https://www.wonder.legal/Les_thumbnails/retirement-agreement.png

Record Retention Guide for Individuals Good recordkeeping can cut your taxes and make your financial life easier How long to keep records is a combination of judgment and state and federal statutes of limitations Indefinitely Retirement Plan Statements Keep 3 6 years Keep year end statements permanently Social Security Statements Discard as you receive current records of payments into the Social Security System Warranties and Receipts Discard warranties when they are clearly expired Use your judgment when discarding receipts

Property records Keep records relating to property until the period of limitations expires for the year in which you dispose of the property in a taxable disposition You must keep these records to figure your basis for computing gain or loss when you sell or otherwise dispose of the property Healthcare insurance You conduct a variety of business transactions many of which require supportive records Birth certificates proof of ownership location of property income tax returns savings and investment records insurance policies guarantees and warranties are probably among your important papers These are but a few of the important records needed

More picture related to Record Keeping Forms To Printable For Retirement

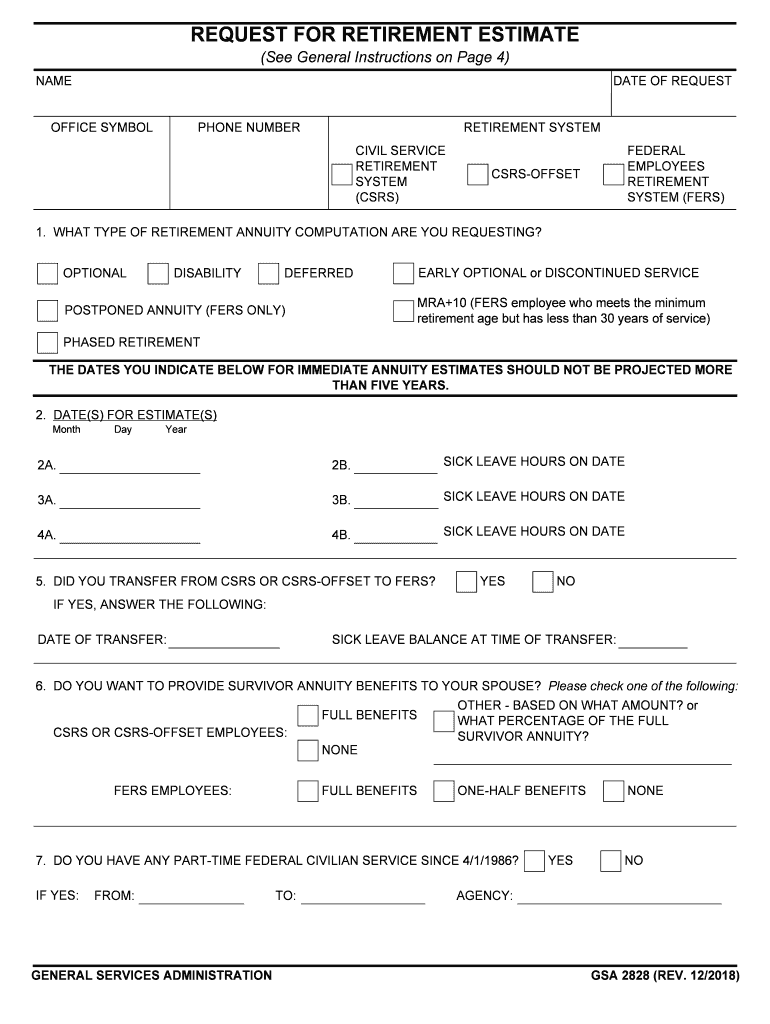

Gsa Retirement Calculator Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/487/787/487787432/large.png

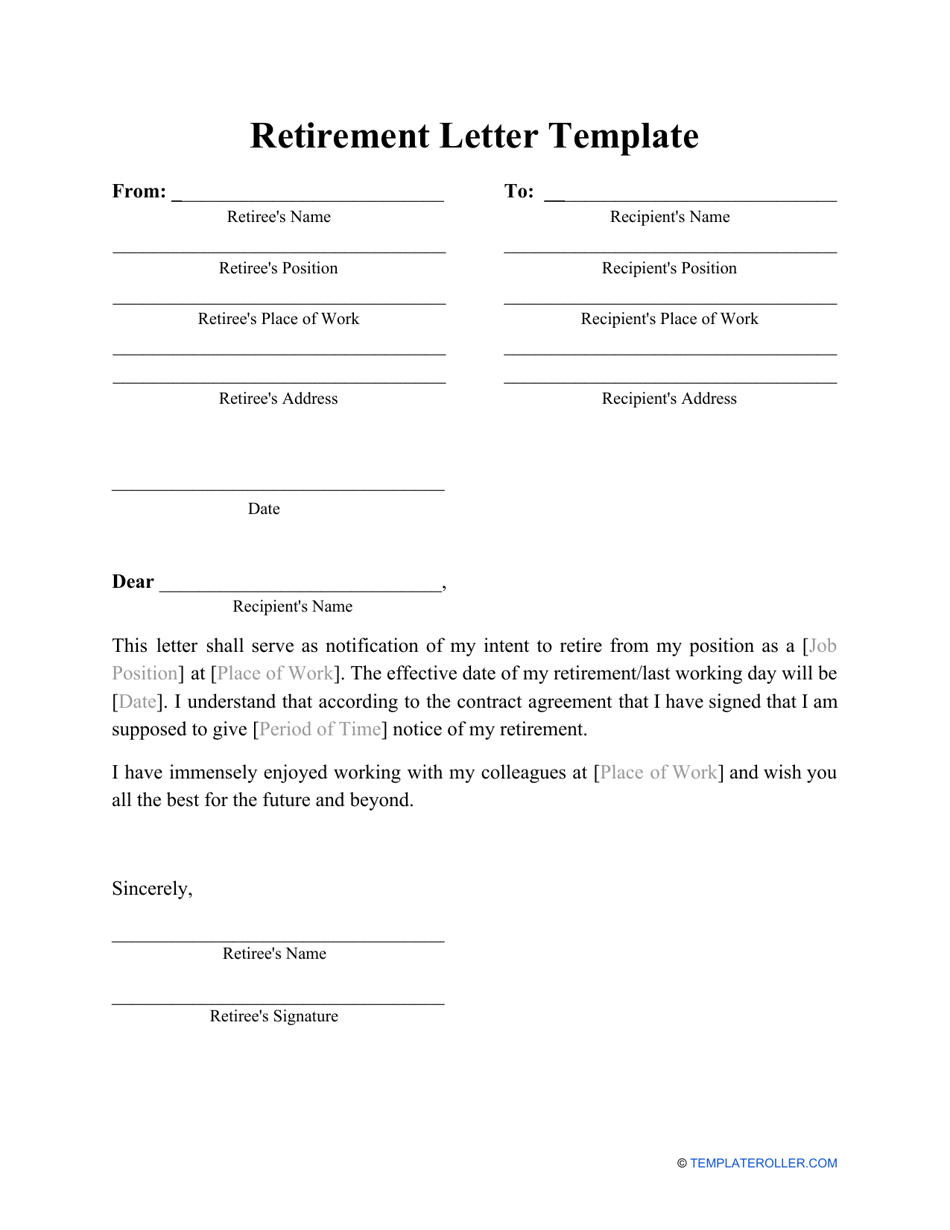

Retirement Letter Template Download Printable PDF Templateroller

https://data.templateroller.com/pdf_docs_html/2075/20756/2075675/retirement-letter-template_print_big.png

Farm Record Keeping Excel Template New Free Farm Record Keeping Spreadsheets Spreadsheet Downloa

https://i.pinimg.com/originals/87/4d/49/874d4911bf784bd43be35f65b6dfa682.jpg

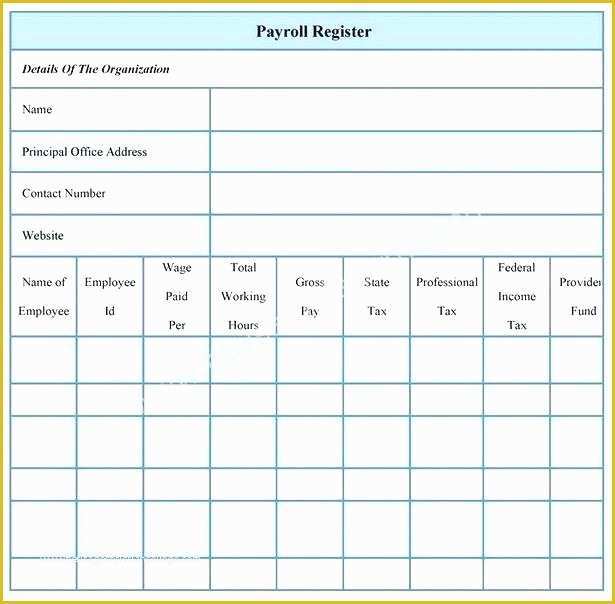

Example The Federal Retirement Thrift Investment Board is the sponsoring agency for TSP 1 Thrift Savings Plan Election Form The sponsoring agency establishes procedures for approving electronic processing systems These systems allow records to be generated approved and stored by electronic means Why should I keep records Good records will help you monitor the progress of your business prepare your financial statements identify sources of income keep track of deductible expenses keep track of your basis in property prepare your tax returns and support items reported on your tax returns What kinds of records should I keep

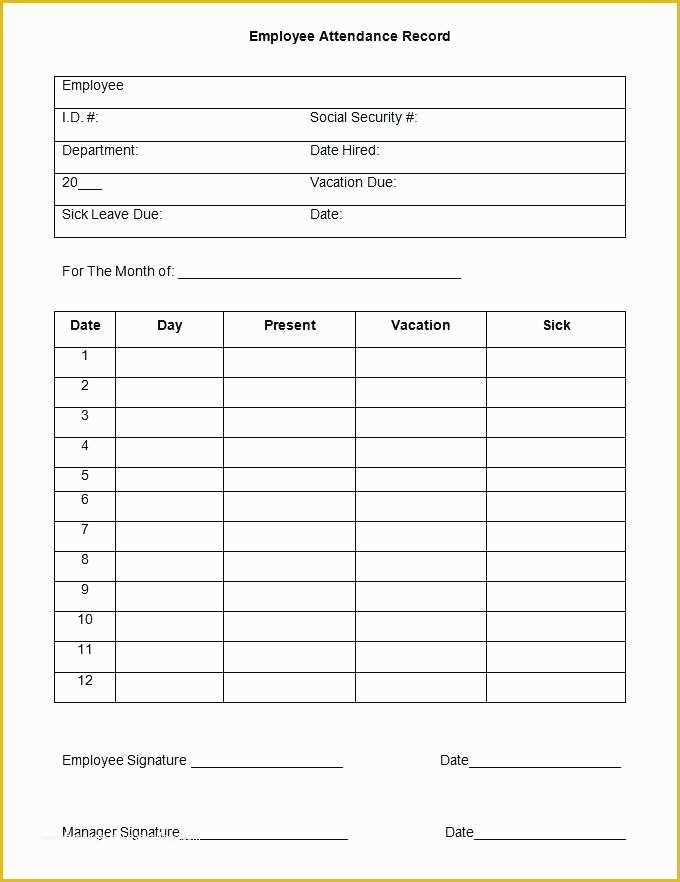

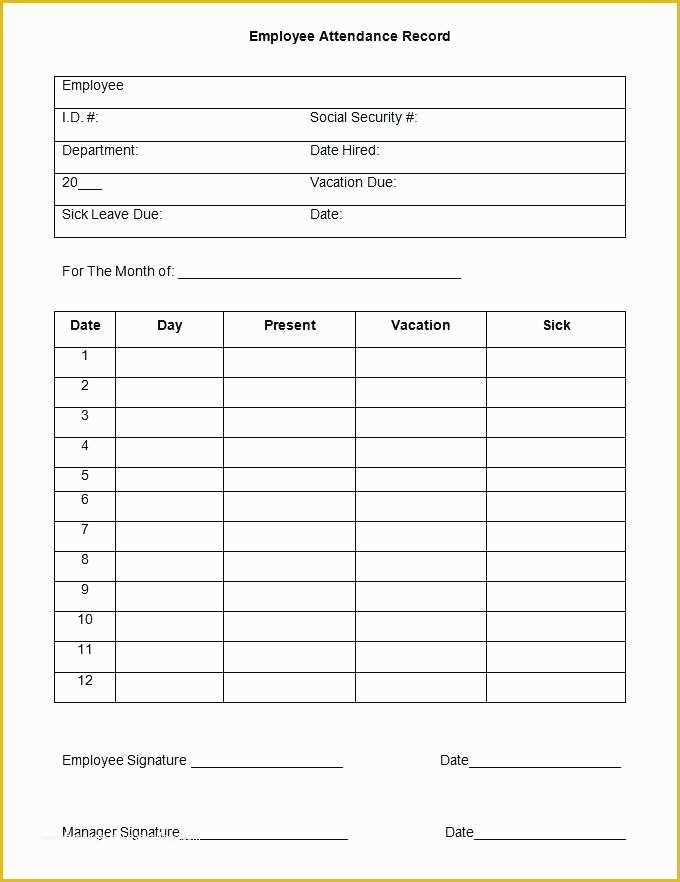

Retirement and Pension Records Special Circumstances Car Records keep until the car is sold Credit Card Receipts keep until verified on your statement Insurance Policies keep for the life of the policy Mortgages Deeds Leases keep 6 years beyond the agreement Pay Stubs keep until reconciled with your W 2 Property Records What to keep for 1 year Paycheck Stubs You can get rid of once you have compared to your W2 annual social security statement Utility Bills You can throw out after one year unless you re using these as a deduction like a home office then you need to keep them for 3 years after you ve filed that tax return Cancelled Checks Unless

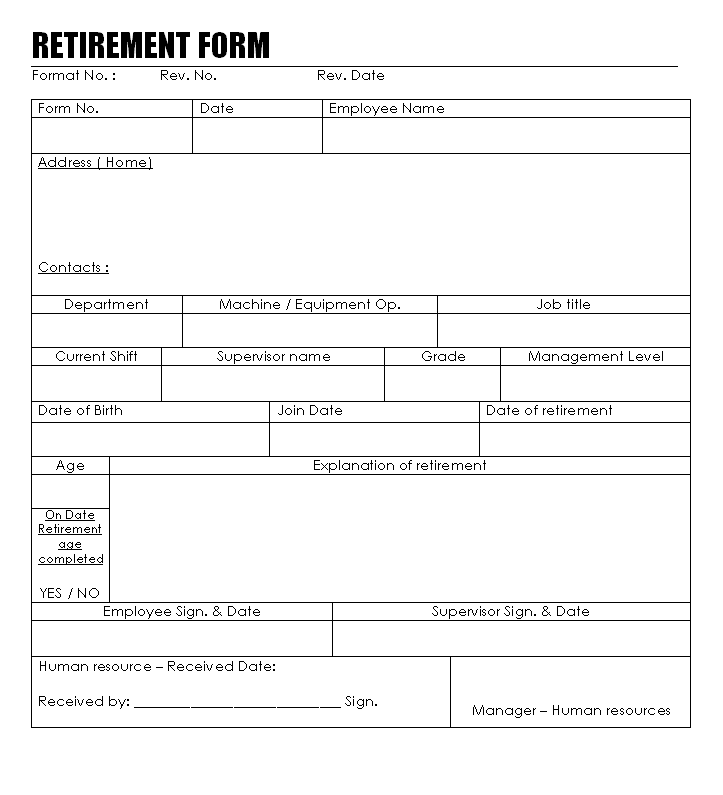

Retirement Form DOCX Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/502/647/502647904/large.png

How To Fill Out Social Security Retirement Form Printable Form Templates And Letter

https://www.pdffiller.com/preview/558/284/558284726/large.png

https://www.ramseysolutions.com/retirement/organizing-your-important-documents

What Are Important Documents Important documents are certain legal tax medical property and personal records you should hold on to in case you need to reference or use them down the road You know the stuff you keep around just in case

https://www.troweprice.com/content/dam/iinvestor/Forms/family-records-worksheet.pdf

FAMILY RECORDS WORKSHEET Asset Inventory and Personal Information This document will help you to organize information that will be helpful if there is an emergency or you become incapacitated and you need someone to step in suddenly to manage your financial affairs You have the option of Printing out this form and writing your information in or

Retirement Income Planning Spreadsheet Db excel

Retirement Form DOCX Fill Out And Sign Printable PDF Template SignNow

Free Printable Record Keeping Charts

Calpers S 2012 2024 Form Fill Out And Sign Printable PDF Template SignNow

Free Printable Record Keeping Forms Classroom Rules Printable Grade Vrogue

Record Keeping Forms To Printable For Retirement Printable Forms Free Online

Record Keeping Forms To Printable For Retirement Printable Forms Free Online

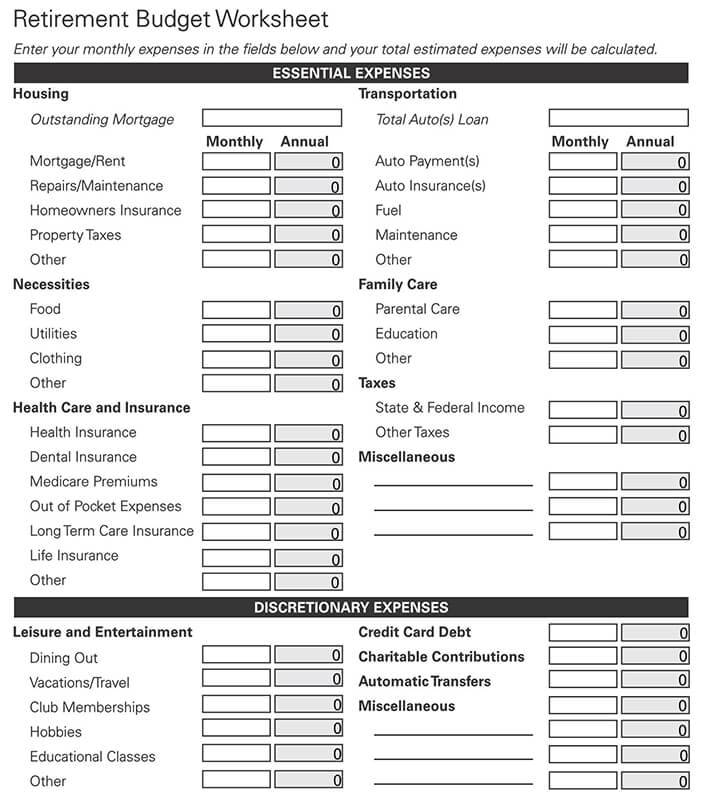

How To Plan A Retirement Budget Free Worksheets Excel PDF

Free Printable Retirement Certificate Template Classic Style In 2021 Retirement Certificate

Retirement Checklist Bethany Holt

Record Keeping Forms To Printable For Retirement - Federal Record Retention Requirements The following chart includes federal requirements for record keeping and retention of employee files and other employment related records Individual states also have requirements not addressed here therefore employers should review state employment laws for additional record keeping and retention