Sales And Use Tax Form Certificates For All States Printables A sales tax exemption certificate is a document that allows a business organization or individual to purchase normally taxable goods or services tax free Purchasers apply for exemption certificates and provide them to sellers at checkout

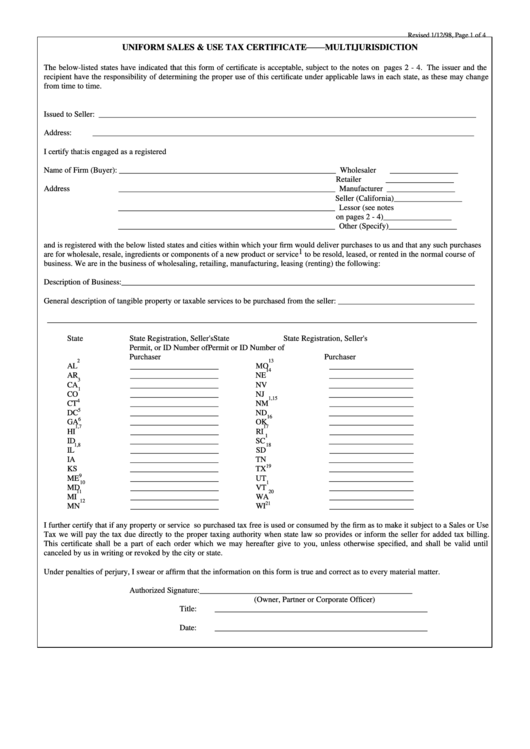

Notes 1 Alaska Remote Sellers Sales Tax Commission ARSSTC This certificate is valid as a resale certificate only if it contains the purchaser s name address signature and either the purchaser s ARSSTC Remote Reseller Certificate of Exemption number or the purchaser s resale certificate number issued by the local taxing jurisdiction Uniform Sales Use Tax Resale Certificate Multijurisdiction This multijurisdiction form has been updated as of October 14 2022 The Commission has developed a Uniform Sales Use Tax Resale Certificate that 36 States have indicated can be used as a resale certificate

Sales And Use Tax Form Certificates For All States Printables

Sales And Use Tax Form Certificates For All States Printables

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-st-127-nys-and-local-sales-and-use-tax-exemption-certificate-4.png

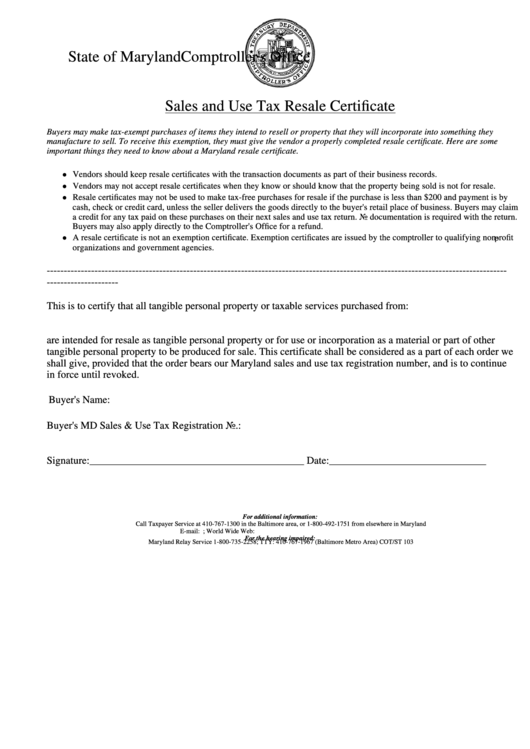

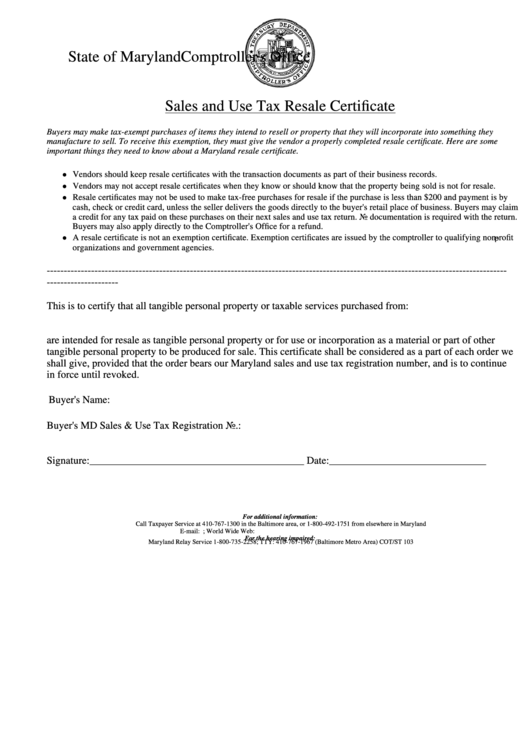

Sales And Use Tax Resale Certificate Template State Of Maryland Comptroller S Office Printable

https://data.formsbank.com/pdf_docs_html/177/1775/177537/page_1_thumb_big.png

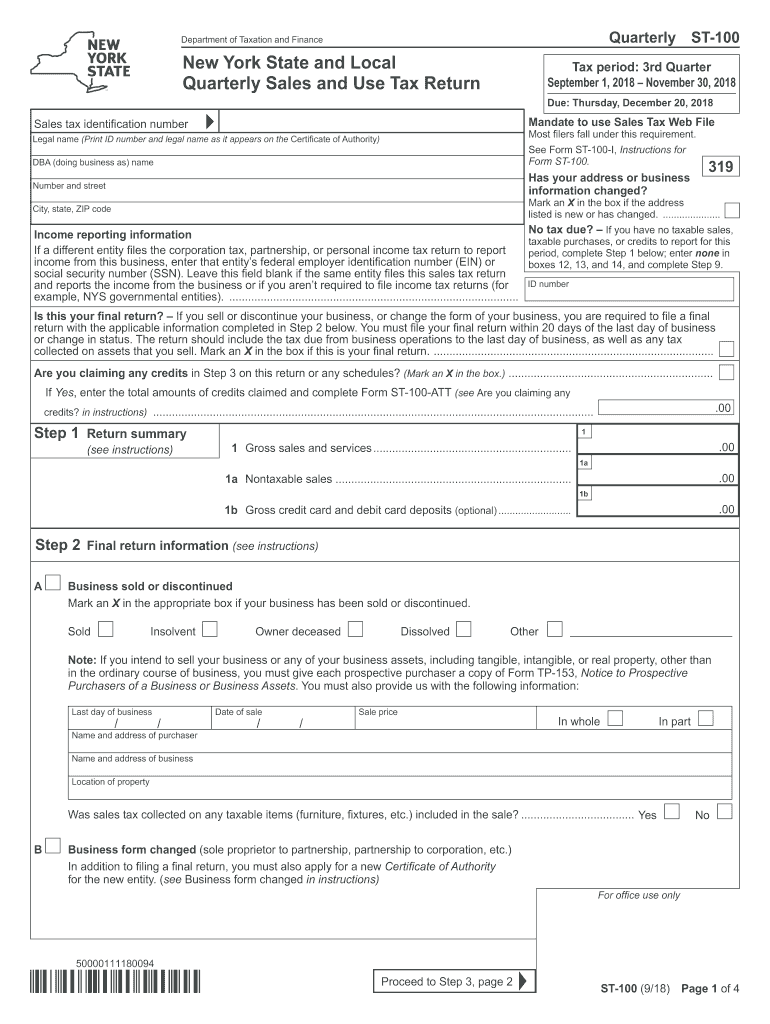

St 100 2018 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/464/533/464533320/large.png

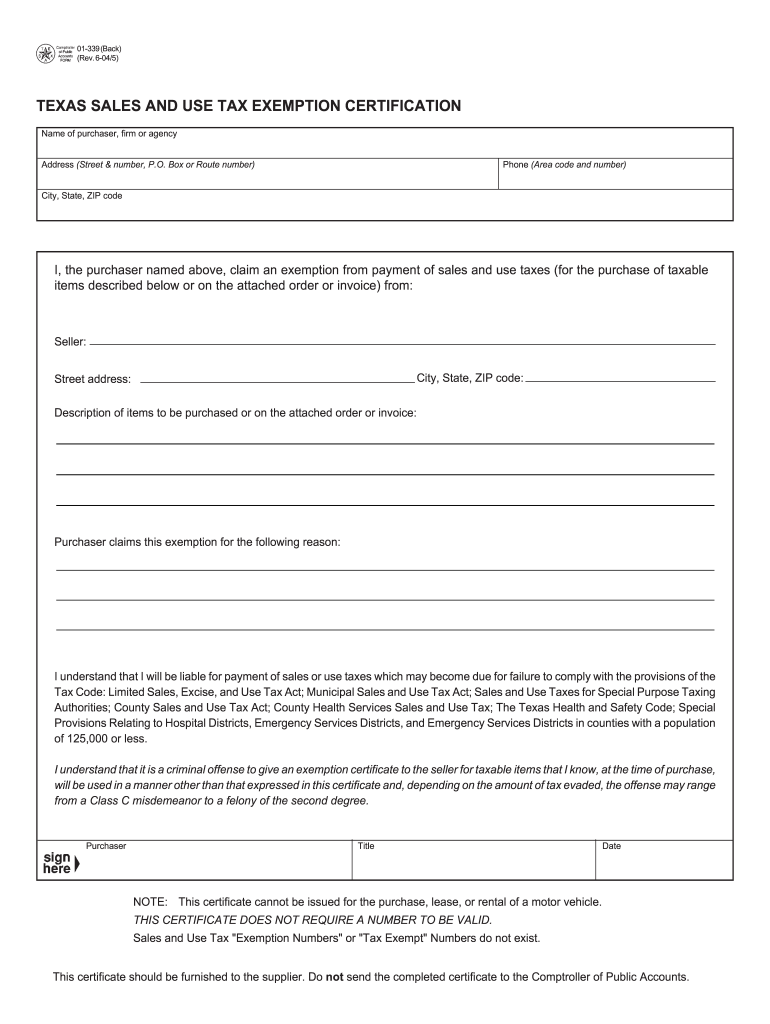

I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice from Seller Street address City State ZIP code Description of items to be purchased or on the attached order or invoice A resale certificate is a document that allows retailers to purchase goods for resale without having to pay local sales tax for those items With a resale certificate also called a tax

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale Florida s general state sales tax rate is 6 with the following exceptions Retail sales of new mobile homes 3 Amusement machine receipts 4 Rental lease or license of commercial real property 4 5 Florida Department of Revenue The Florida Department of Revenue has three primary lines of business 1 Administer tax law for 36 taxes and fees processing nearly 37 5 billion and more than 10 million tax filings annually 2 Enforce child support law on behalf of about 1 025 000 children with 1 26 billion collected in FY 06 07 3 Oversee property tax administration involving 10 9

More picture related to Sales And Use Tax Form Certificates For All States Printables

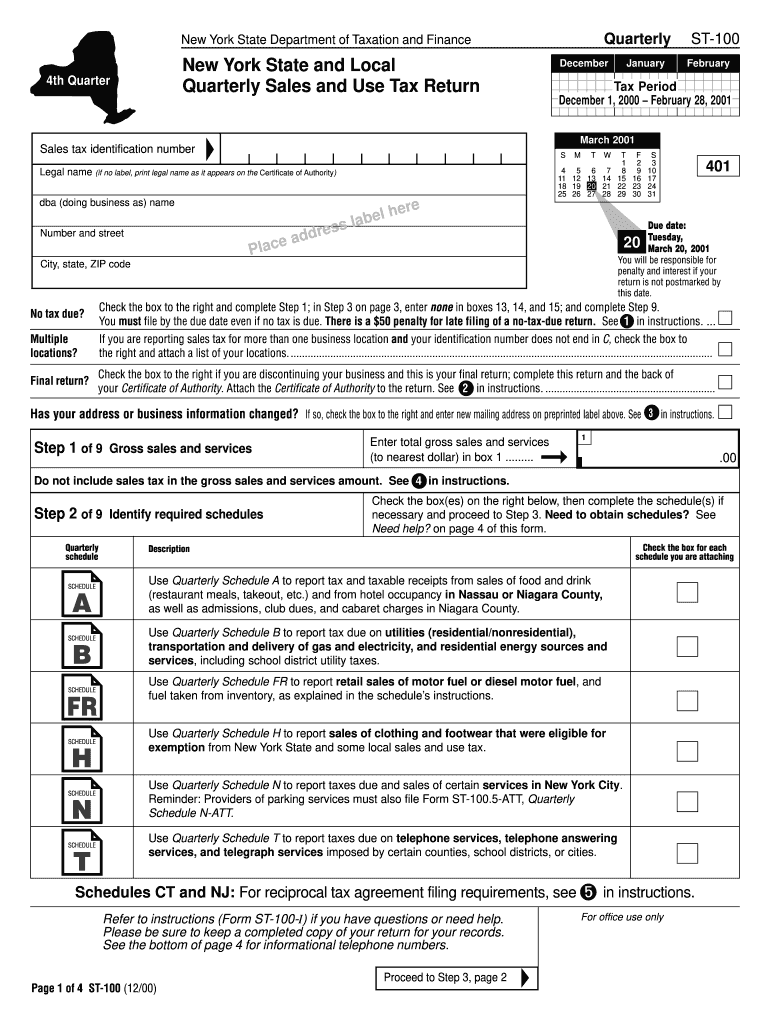

New York State Sales Tax Form St 100 Dec 12 Feb 13 Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/49/100049568/large.png

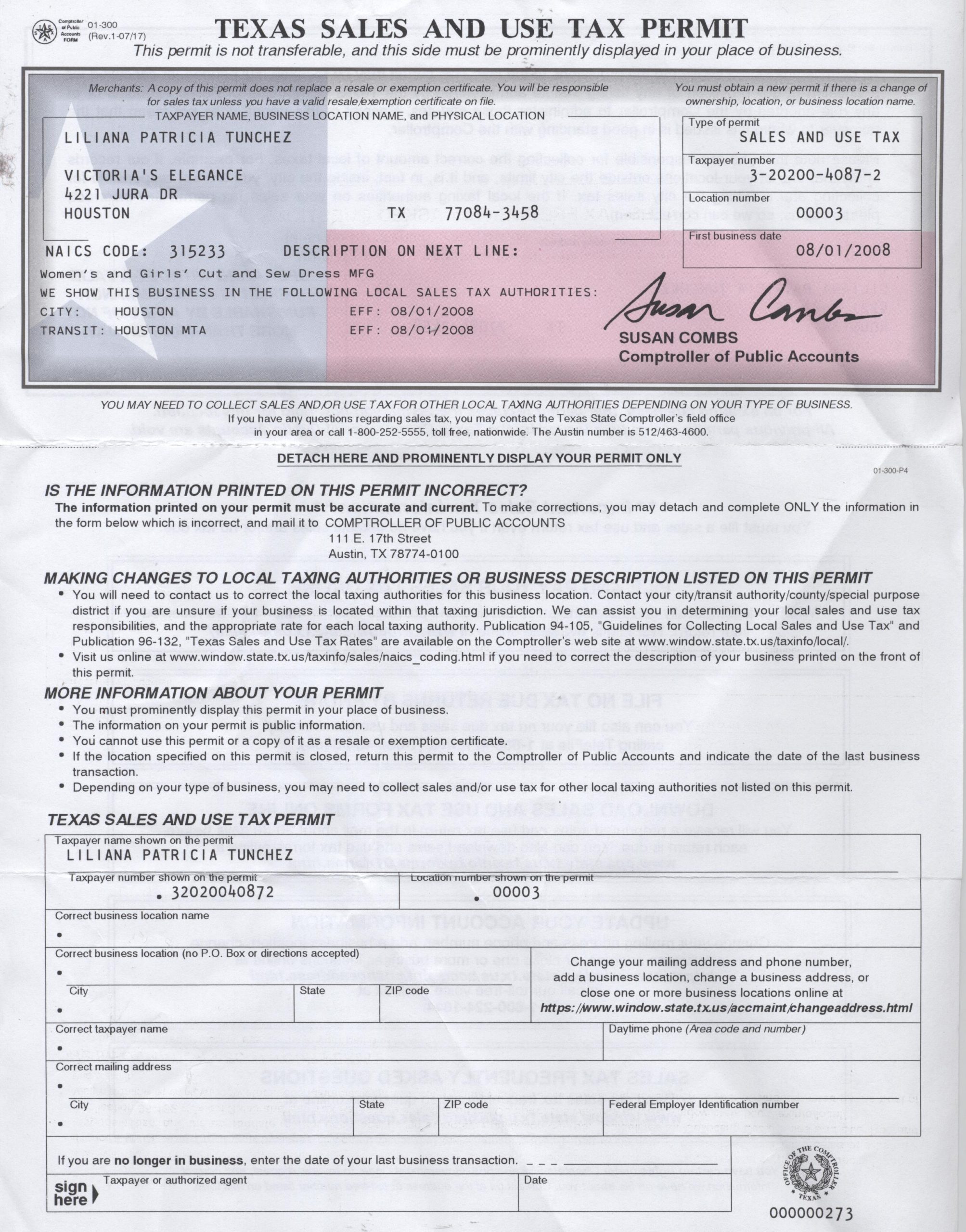

Texas Sales Tax Certificate jpg Eva USA

https://evausacollection.com/wp-content/uploads/2020/03/Texas-Sales-Tax-Certificate-scaled.jpg

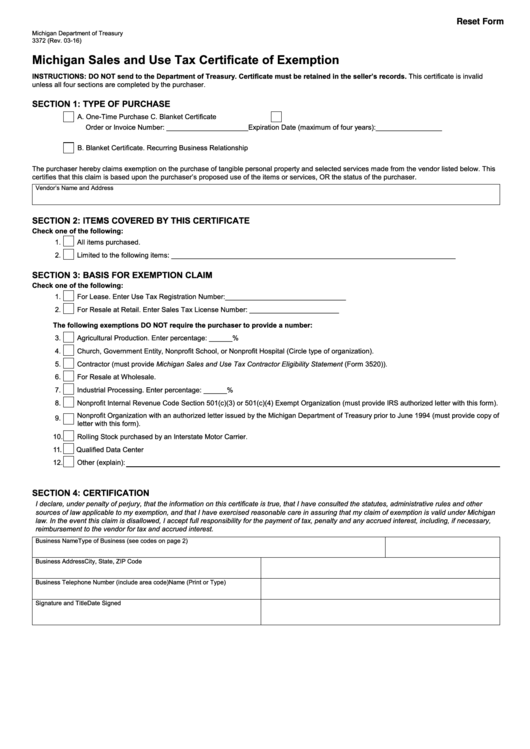

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of Exemption Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/132/1323/132389/page_1_thumb_big.png

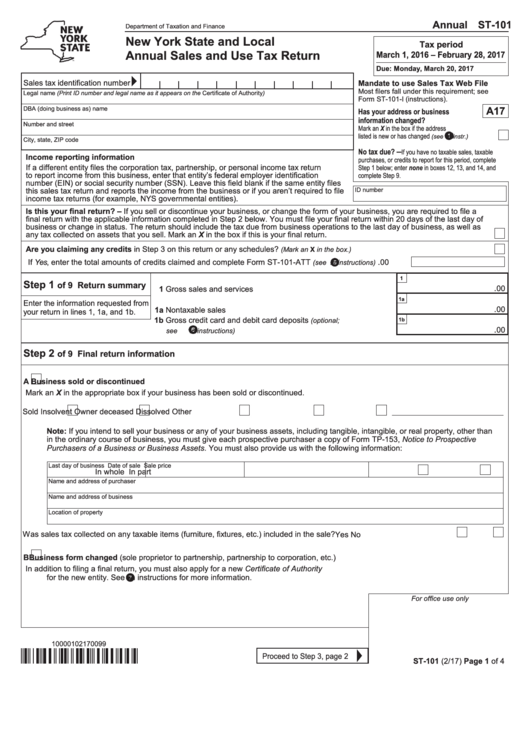

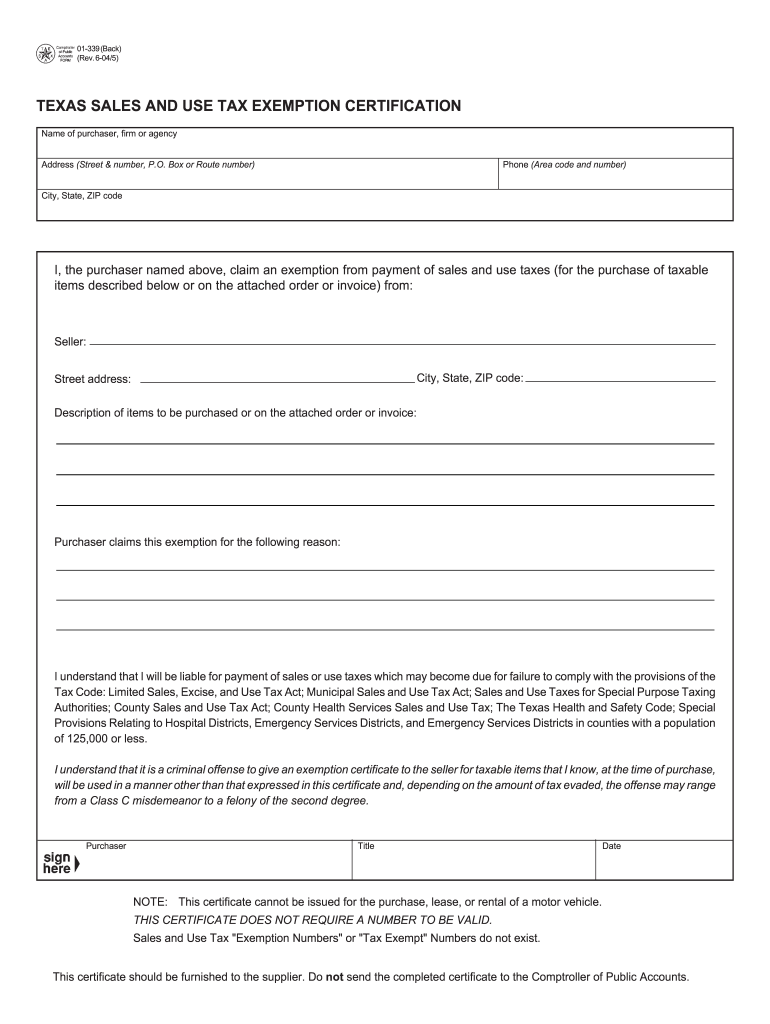

01 339 Rev 6 04 5 TEXAS SALES AND USE TAX RESALE CERTIFICATE Name of purchaser firm or agency Phone Area code and number Address Street number P O Box or Route number City State ZIP code Texas Sales or Use Tax Permit Number or out of state retailer s registration number or date applied for Texas Permit must contain 11 digits if from a Texas perm it Sales tax applies to retail sales of certain tangible personal property and services Use tax applies if you buy tangible personal property and services outside the state and use it within New York State For information on the Oneida Nation Settlement Agreement see Oneida Nation Settlement Agreement Sales tax rates and identifying the

An official website of the State of Georgia The gov means it s official Local state and federal government websites often end in gov State of Georgia government websites and email systems use georgia gov or ga gov at the end of the address Before sharing sensitive or personal information make sure you re on an official Nebraska Exemption Application for Sales and Use Tax 06 2020 4 Form Nebraska Exemption Application for Common or Contract Carrier s Sales and Use Tax Includes Schedule A 07 2018 5 Form Nebraska Sales Use Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales 07 2022 6

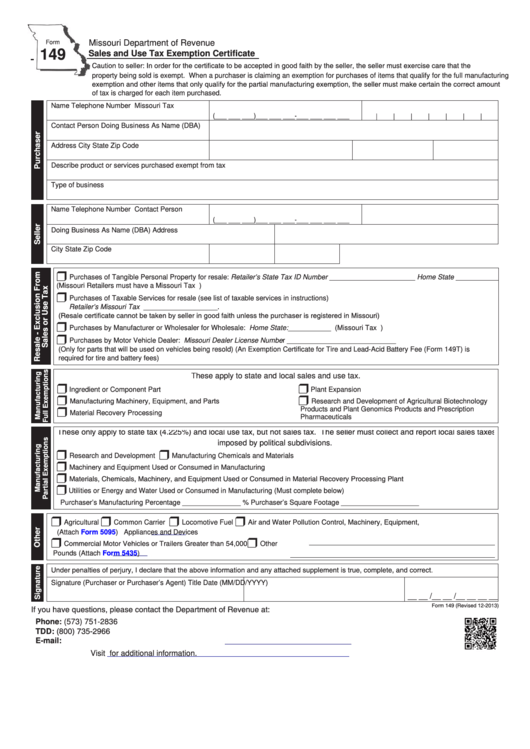

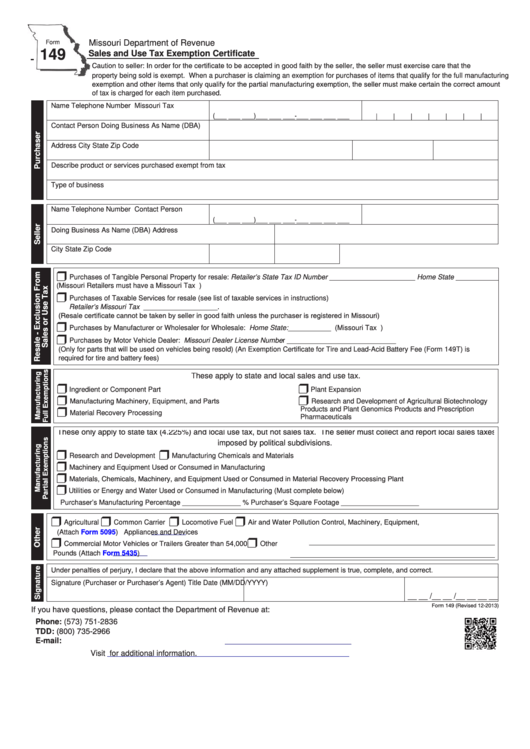

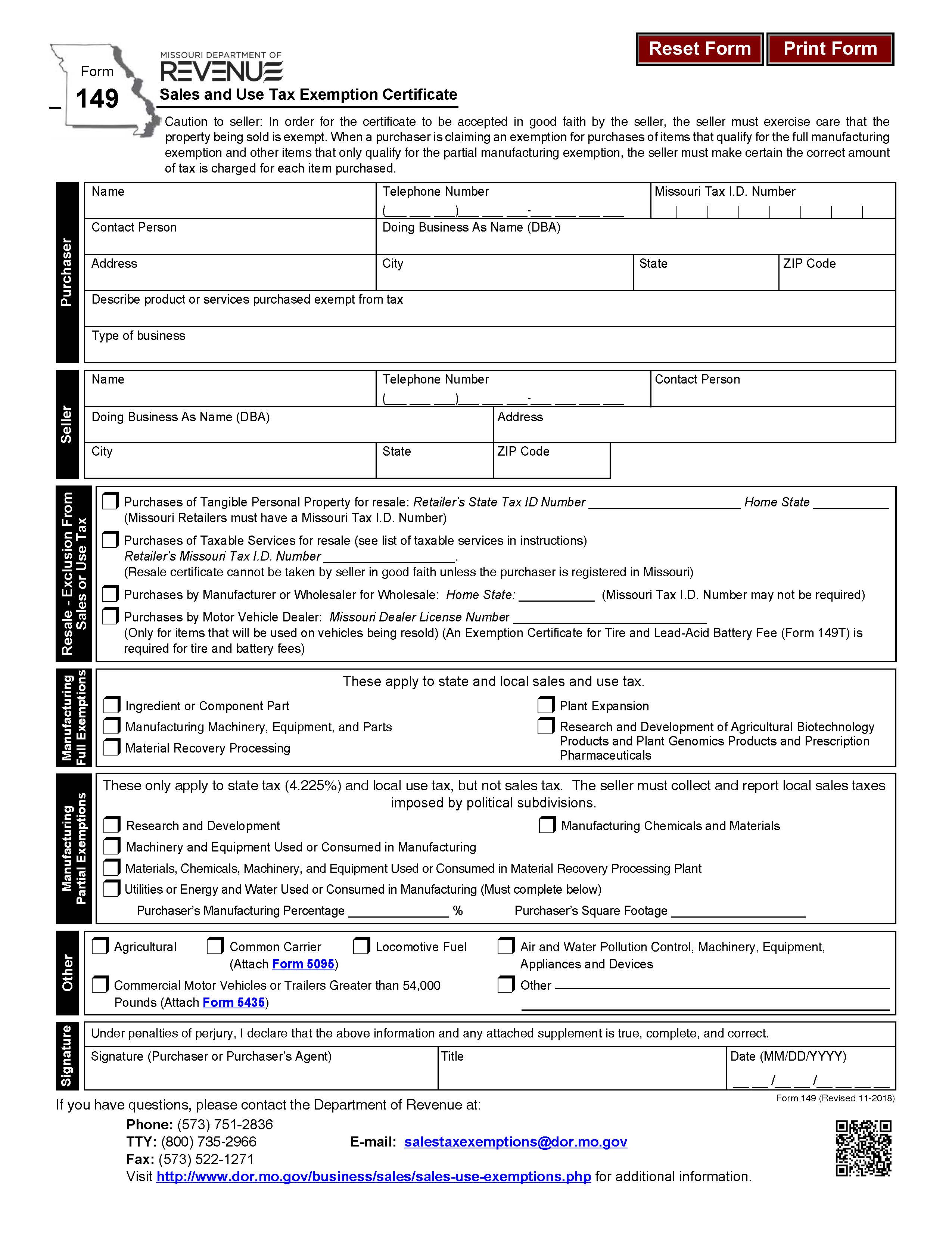

Fillable Form 149 Sales And Use Tax Exemption Certificate Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/281/2816/281665/page_1_thumb_big.png

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

https://blanker.org/files/images/01-339b.png

https://www.avalara.com/blog/en/north-america/2023/02/a-state-by-state-guide-to-exemption-certificates.html

A sales tax exemption certificate is a document that allows a business organization or individual to purchase normally taxable goods or services tax free Purchasers apply for exemption certificates and provide them to sellers at checkout

https://www.mtc.gov/wp-content/uploads/2023/01/Unif-Resale-Cert-revised-10-14-22.pdf

Notes 1 Alaska Remote Sellers Sales Tax Commission ARSSTC This certificate is valid as a resale certificate only if it contains the purchaser s name address signature and either the purchaser s ARSSTC Remote Reseller Certificate of Exemption number or the purchaser s resale certificate number issued by the local taxing jurisdiction

Fillable Uniform Sales Use Tax Certificate 3 4 Multijurisdiction Printable Pdf Download

Fillable Form 149 Sales And Use Tax Exemption Certificate Printable Pdf Download

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank PdfFiller

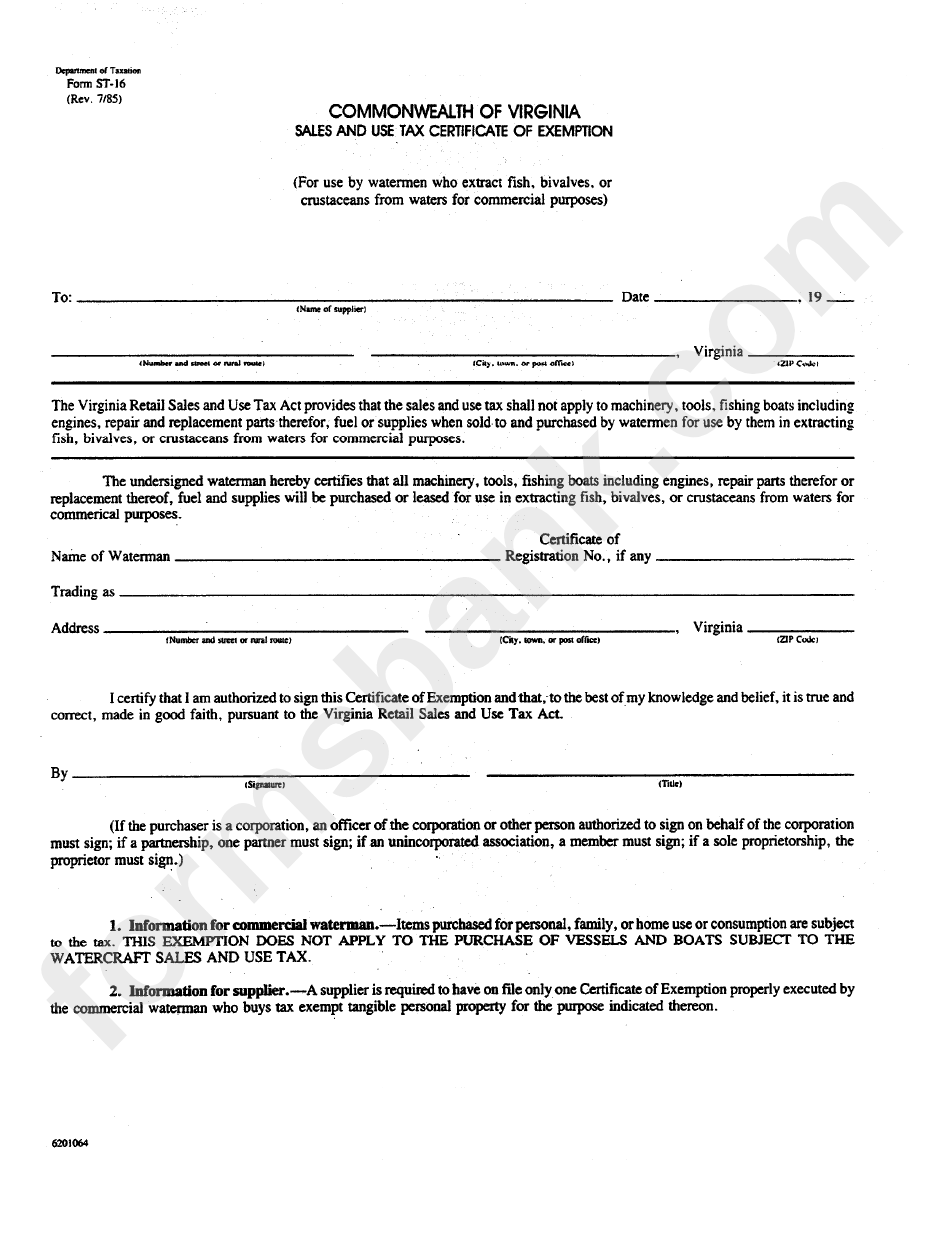

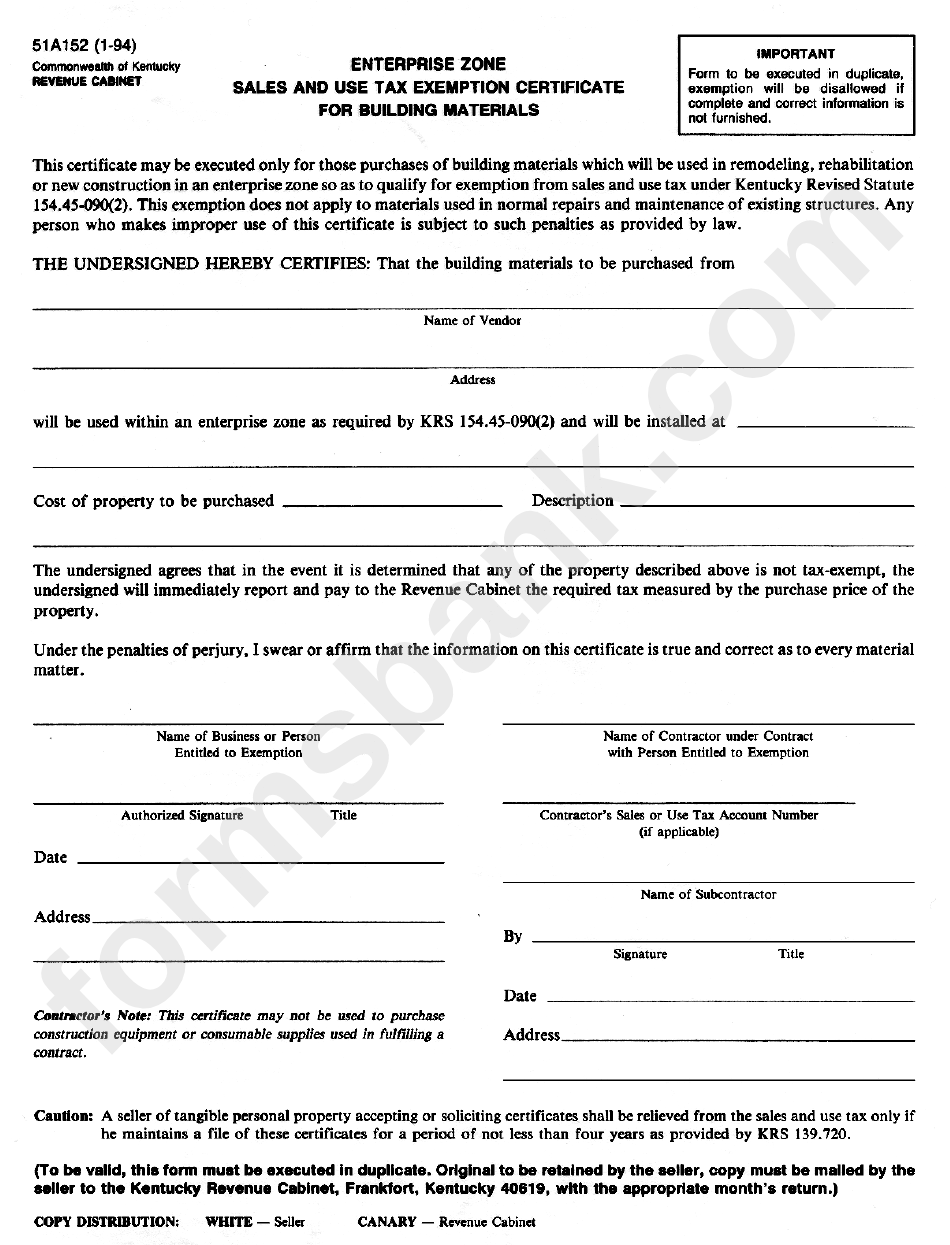

Form St 16 Sales And Use Tax Certificate Of Exemption Commonwealth Of Virginia Printable Pdf

Fillable Form St 101 New York State And Local Annual Sales And Use Tax Return Printable Pdf

Blank Nv Sales And Use Tax Form Blank Nv Sales And Use Tax Form Https Tax Nv Gov

Blank Nv Sales And Use Tax Form Blank Nv Sales And Use Tax Form Https Tax Nv Gov

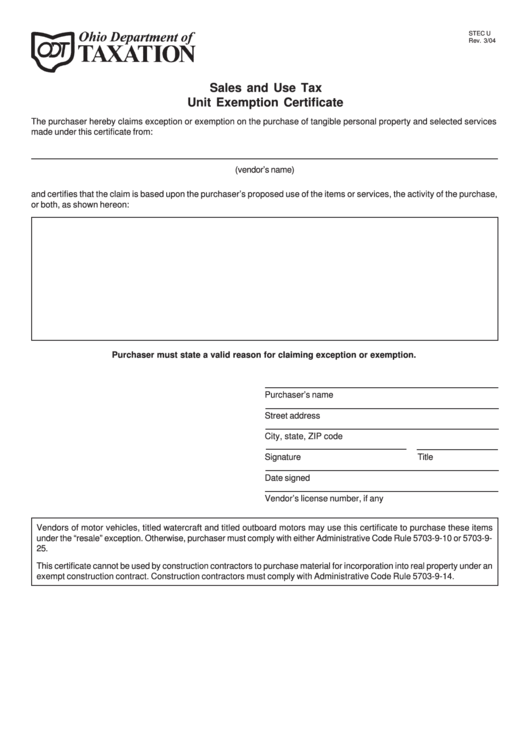

Fillable Sales And Use Tax Unit Exemption Certificate Printable Pdf Download

Missouri 149 Sales And Use Tax Exemption Certificate

Form 51a152 Sales And Use Tax Exemption Certificate 1994 Printable Pdf Download

Sales And Use Tax Form Certificates For All States Printables - I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached order or invoice from Seller Street address City State ZIP code Description of items to be purchased or on the attached order or invoice