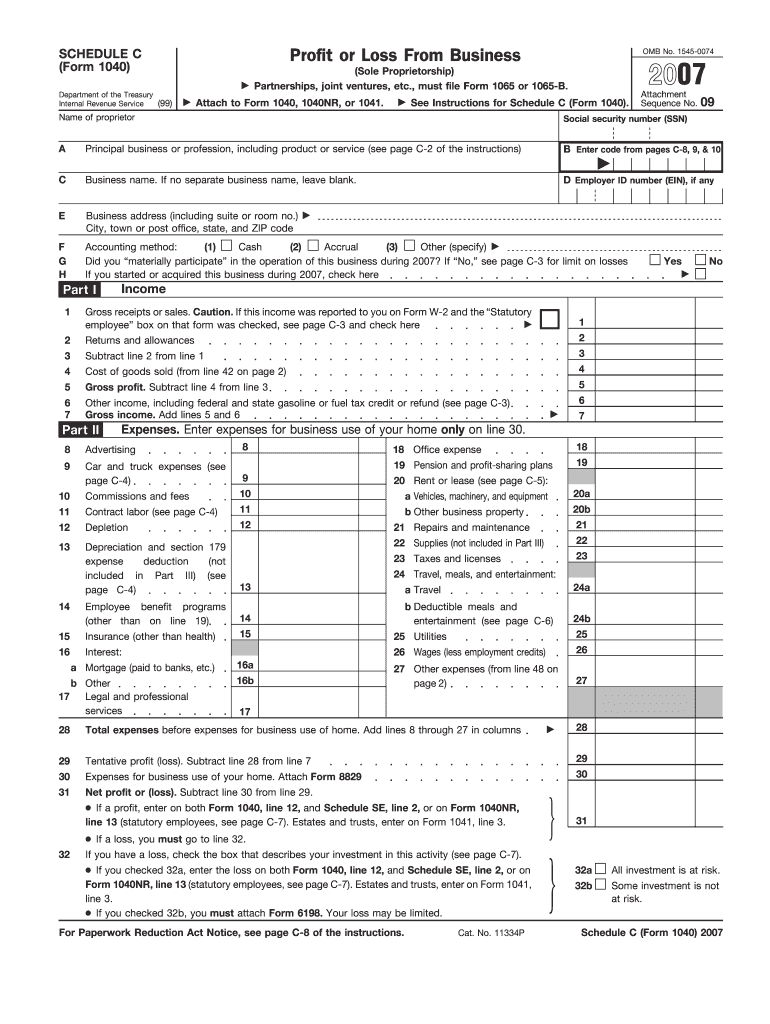

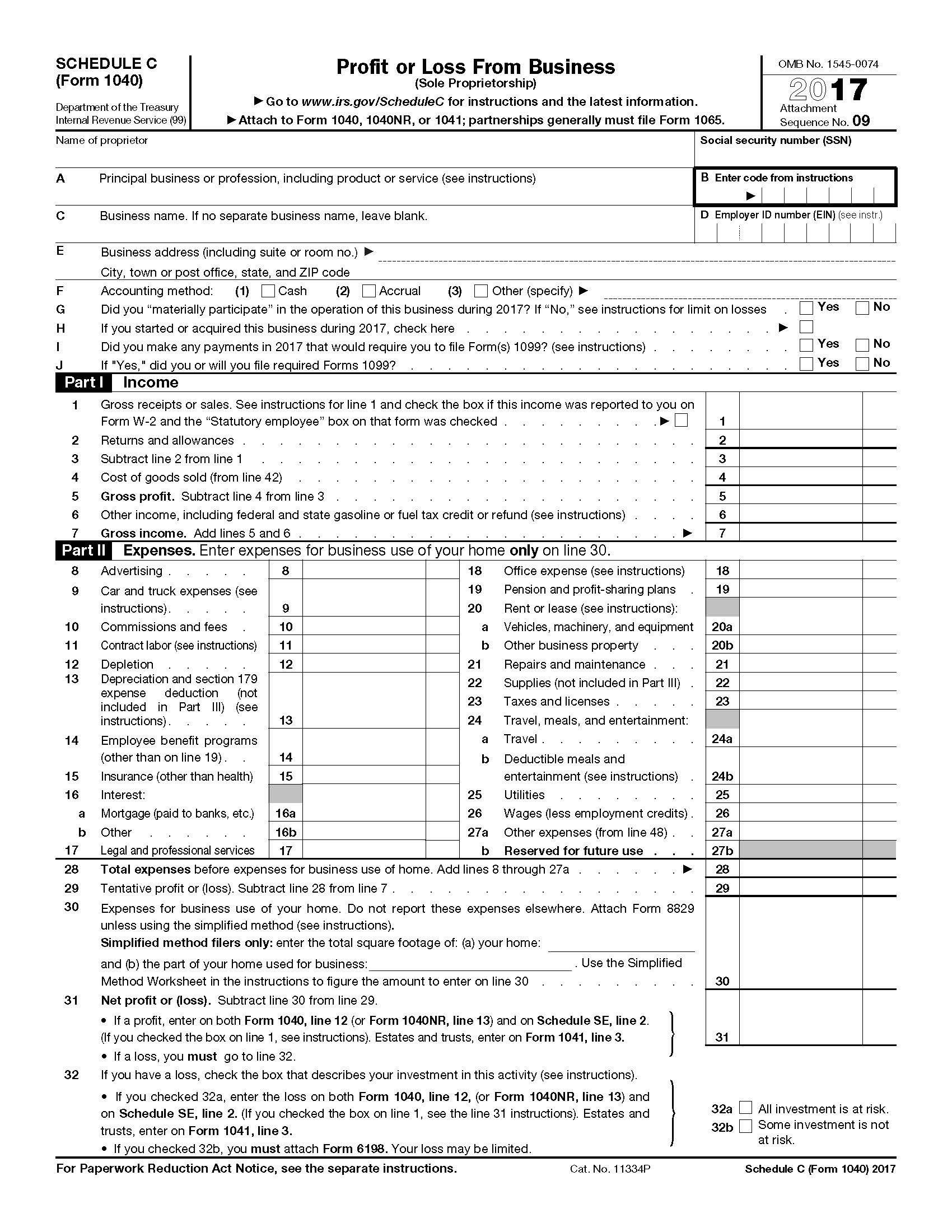

Schedule C 1040 2107 Printable Form Go to www irs gov ScheduleC for instructions and the latest information Sequence No Attach to Form 1040 1040NR or 1041 partnerships generally must file Form 1065 OMB No 1545 0074 2017 Attachment 09 Name of proprietor Social security number SSN A

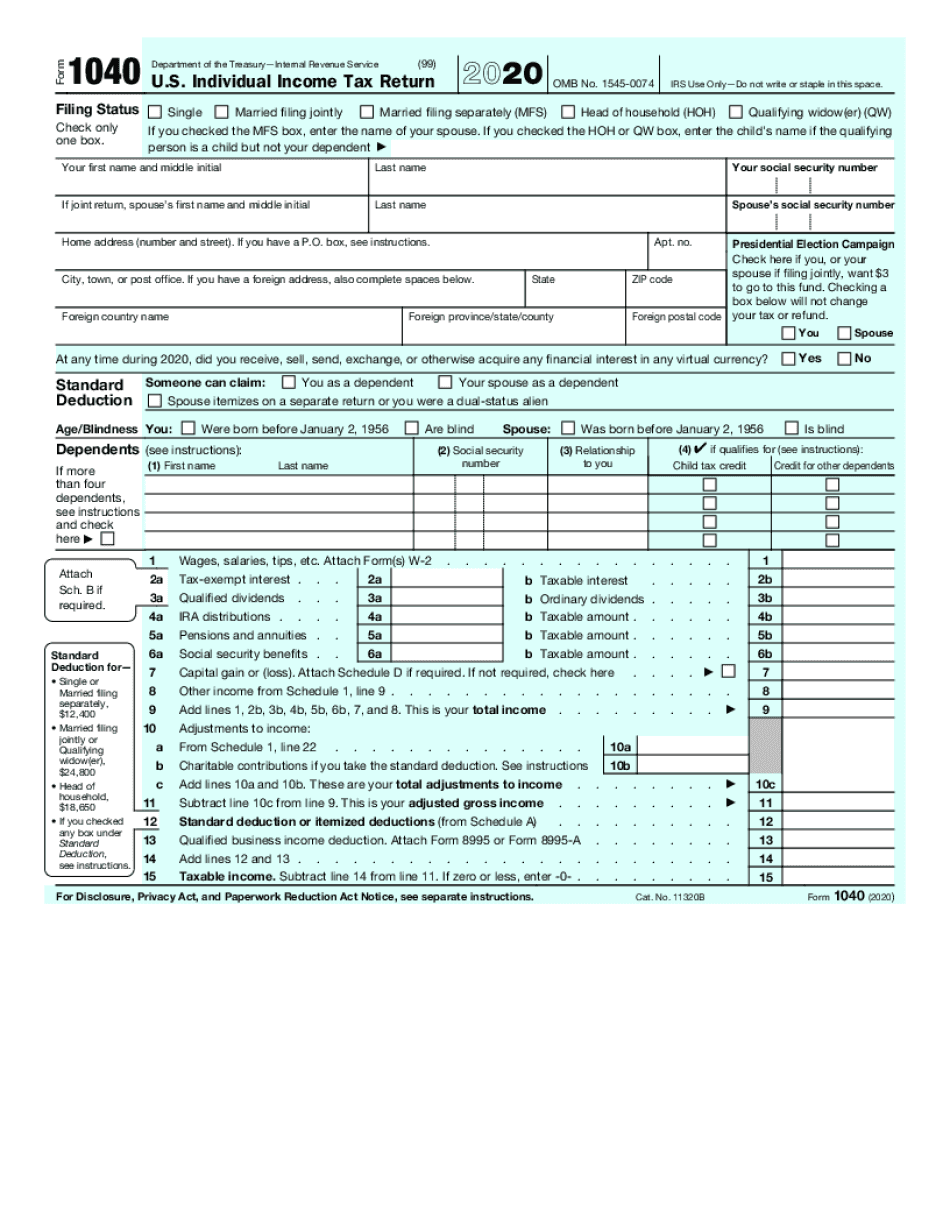

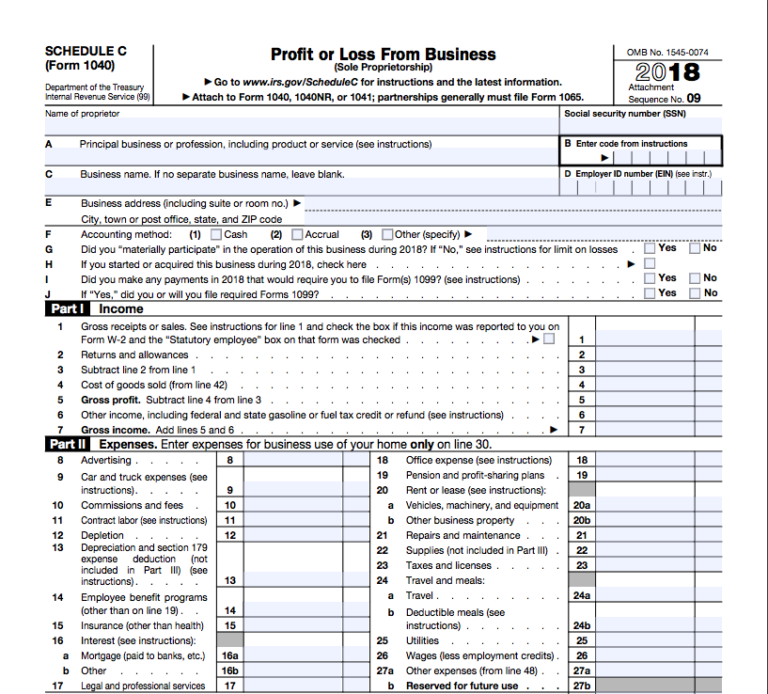

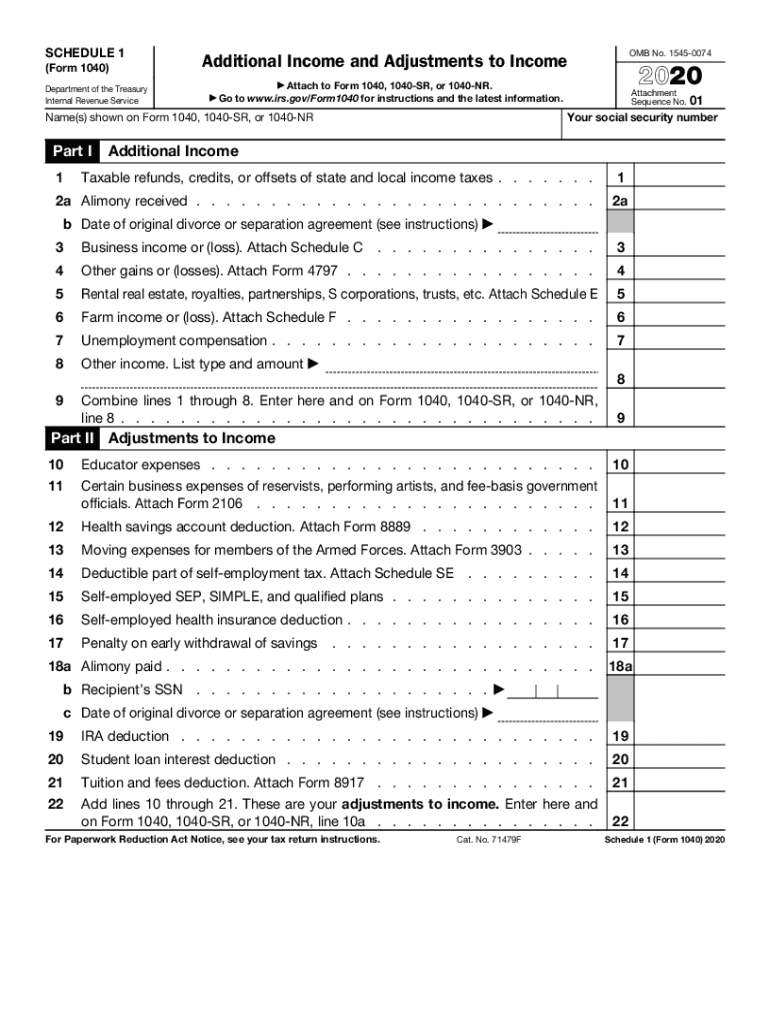

SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2023 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065 What Is Form 1040 Schedule C Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule C or Schedule C EZ to report a business income or loss You can not file Schedule C with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule C is the long version of the simplified easy Schedule C EZ form

Schedule C 1040 2107 Printable Form

Schedule C 1040 2107 Printable Form

https://www.pdffiller.com/preview/100/639/100639784/large.png

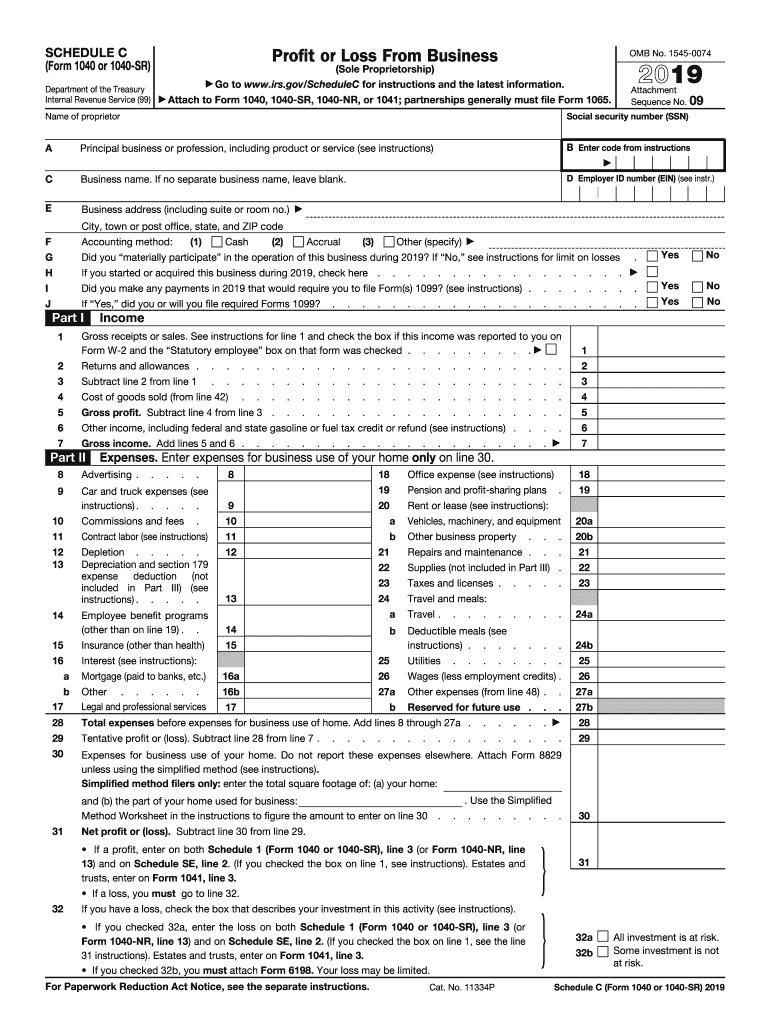

2019 Form 1040 Schedule C Download Dsadetroit

https://www.pdffiller.com/preview/535/781/535781055/big.png

Schedule C Form 1040 Expense Cost Of Goods Sold

https://imgv2-2-f.scribdassets.com/img/document/21529586/original/30d5dde74c/1624602768?v=1

2 File Forms 1099 for all contractors The first section on Schedule C asks whether you made any payments subject to filing a Form 1099 You must file a 1099 form for every contract employee to Option A involves completing Form 8829 by calculating the total area of your home and getting a percentage for your home business Include the total allowable expenses resulting from those calculations on Line 30 of Schedule C Option B is a simplified calculation 5 per square foot of home business space up to 300 square feet for a maximum 1 500 deduction

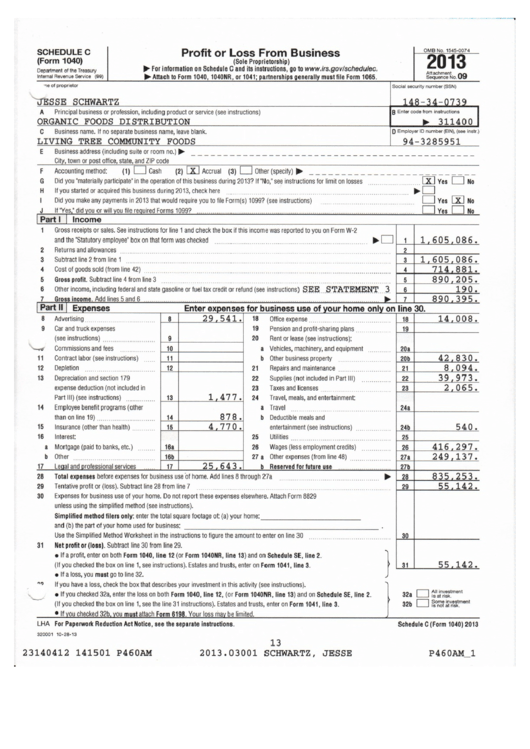

IRS Form 1040 Schedule C Profit or Loss From Business Reporting form sequence number 09 for attachment to IRS Form 1040 Profit or Loss from a Sole Proprietorship business OMB 1545 0074 OMB report IRS OMB 1545 0074 2020 Form 1040 Schedule C Document pdf Download PDF pdf Line 1 The form says Gross receipts or sales See instructions for Line 1 and check the box if this income was reported to you on Form W 2 and the statutory employee box on that form was checked Translation Total income not including sales tax goes here

More picture related to Schedule C 1040 2107 Printable Form

Fillable Schedule C Irs Form 1040 Printable Pdf Download

https://i0.wp.com/individuals.healthreformquotes.com/wp-content/uploads/sites/3/2021/04/schedule-c-1.jpg

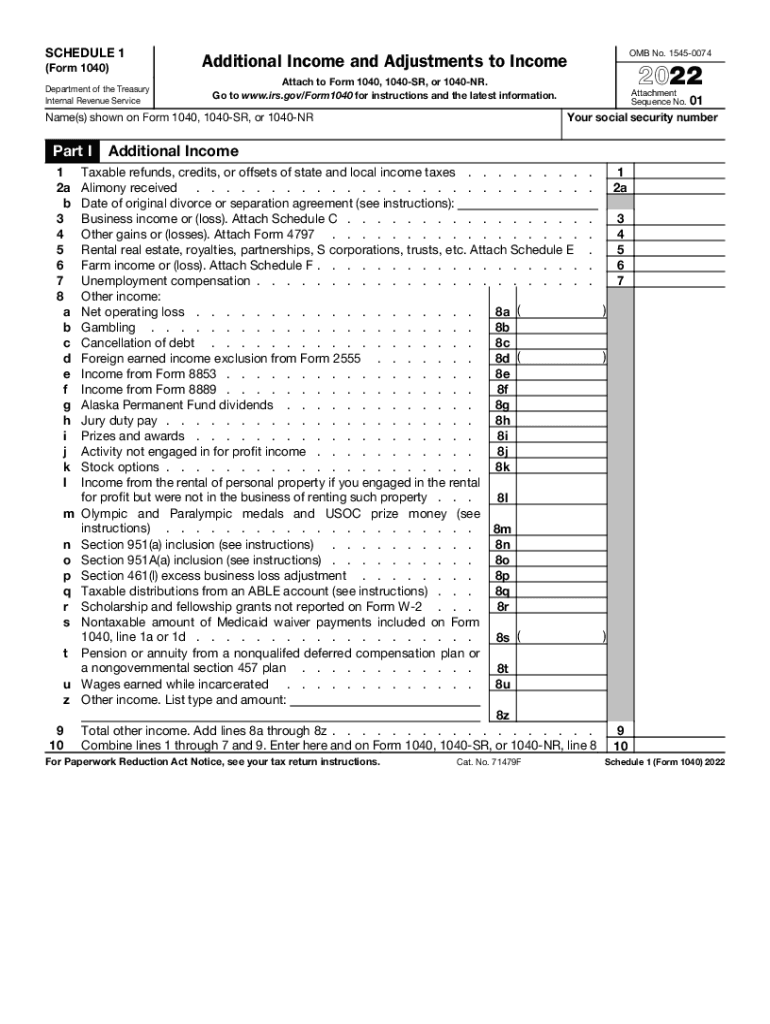

Schedule 1 2022 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/624/654/624654308/large.png

2019 Form IRS 1040 Schedule C Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/484/966/484966746/large.png

Schedule 1 Form 1040 line 3 and on Schedule SE line 2 If you checked the box on line 1 see instructions Estates and trusts enter on Form 1041 line 3 If a loss you must go to line 32 31 32 If you have a loss check the box that describes your investment in this activity See instructions If you checked 32a Use Schedule C to report income or loss from a business or profession in which you were the sole proprietor Small businesses and statutory employees with business expenses of 5 000 or less may be able to file Schedule C EZ instead of Schedule C For more information about the Federal Income Tax see the Federal Income Tax page

You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule C is typically for people who operate sole proprietorships or single member LLCs A Schedule Rent mortgage etc you will fill out Form 8829 Line 31 You will subtract your total expenses to calculate your business net profit or loss This amount will travel over to your personal 1040 to be lumped in with you and or your spouse s regular job income and everything else That lump sum will be multiplied by your

FREE 8 Sample Schedule C Forms PDF 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/free-8-sample-schedule-c-forms-pdf-9.jpg

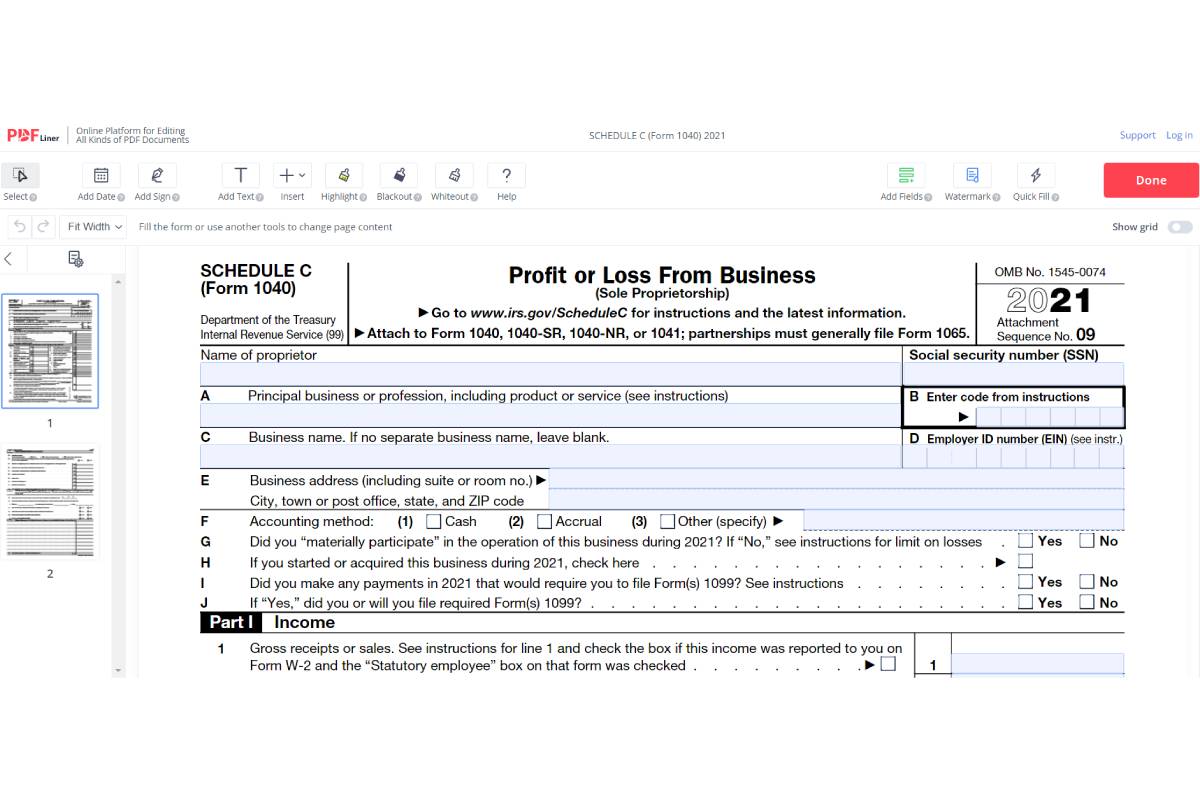

Schedule C Instructions For Self Employed To File Form 1040

https://www.computertechreviews.com/wp-content/uploads/2022/03/Schedule-C-1040-on-PDFLiner.jpg

https://www.irs.gov/pub/irs-prior/f1040sc--2017.pdf

Go to www irs gov ScheduleC for instructions and the latest information Sequence No Attach to Form 1040 1040NR or 1041 partnerships generally must file Form 1065 OMB No 1545 0074 2017 Attachment 09 Name of proprietor Social security number SSN A

https://www.taxformfinder.org/federal/1040-schedule-c

SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2023 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065

USA 1040 Schedule C Form Template ALL PSD TEMPLATES Getting Things Done Templates Schedule

FREE 8 Sample Schedule C Forms PDF 2021 Tax Forms 1040 Printable

2018 Schedule C Fill Out Sign Online DocHub

Federal Naics Code Form 1040 Schedule C 1040 Form Printable

1040 Form Instructions 2022 1040 form instructions

Schedule C Form 1040 How To Complete It The Usual Stuff

Schedule C Form 1040 How To Complete It The Usual Stuff

Form 1040 Schedule C Sample Profit Or Loss From Business Printable Pdf Download

How To File Schedule C Form 1040 Bench Accounting 2021 Tax Forms 1040 Printable

Fillable Schedule C Irs Form 1040 Printable Pdf Download Gambaran

Schedule C 1040 2107 Printable Form - IRS Form 1040 Schedule C Profit or Loss From Business Reporting form sequence number 09 for attachment to IRS Form 1040 Profit or Loss from a Sole Proprietorship business OMB 1545 0074 OMB report IRS OMB 1545 0074 2020 Form 1040 Schedule C Document pdf Download PDF pdf