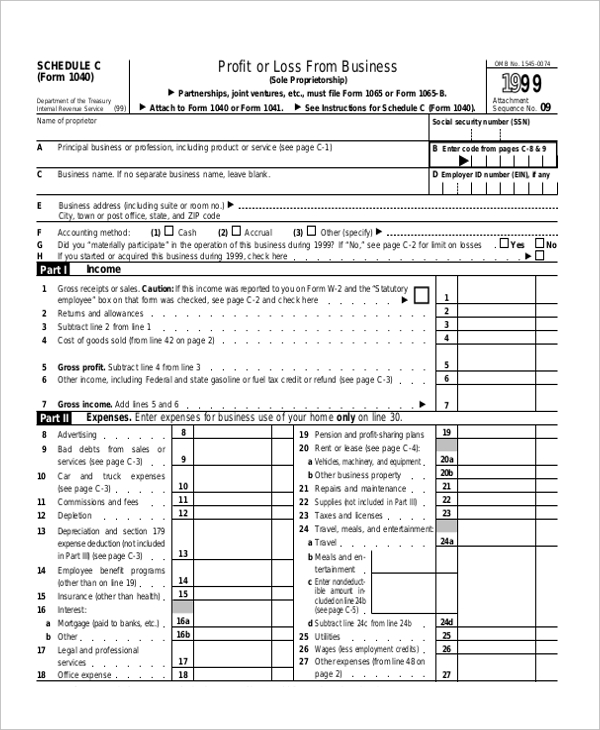

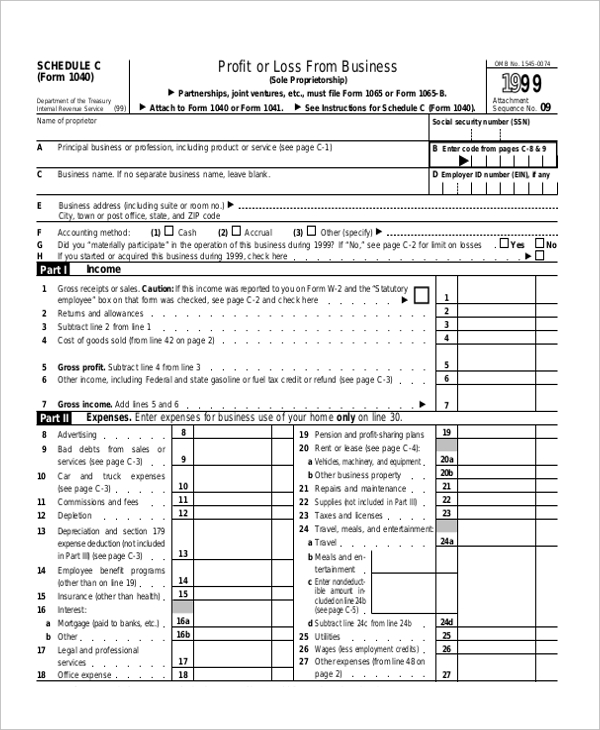

Schedule C Form 1040 Printable Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

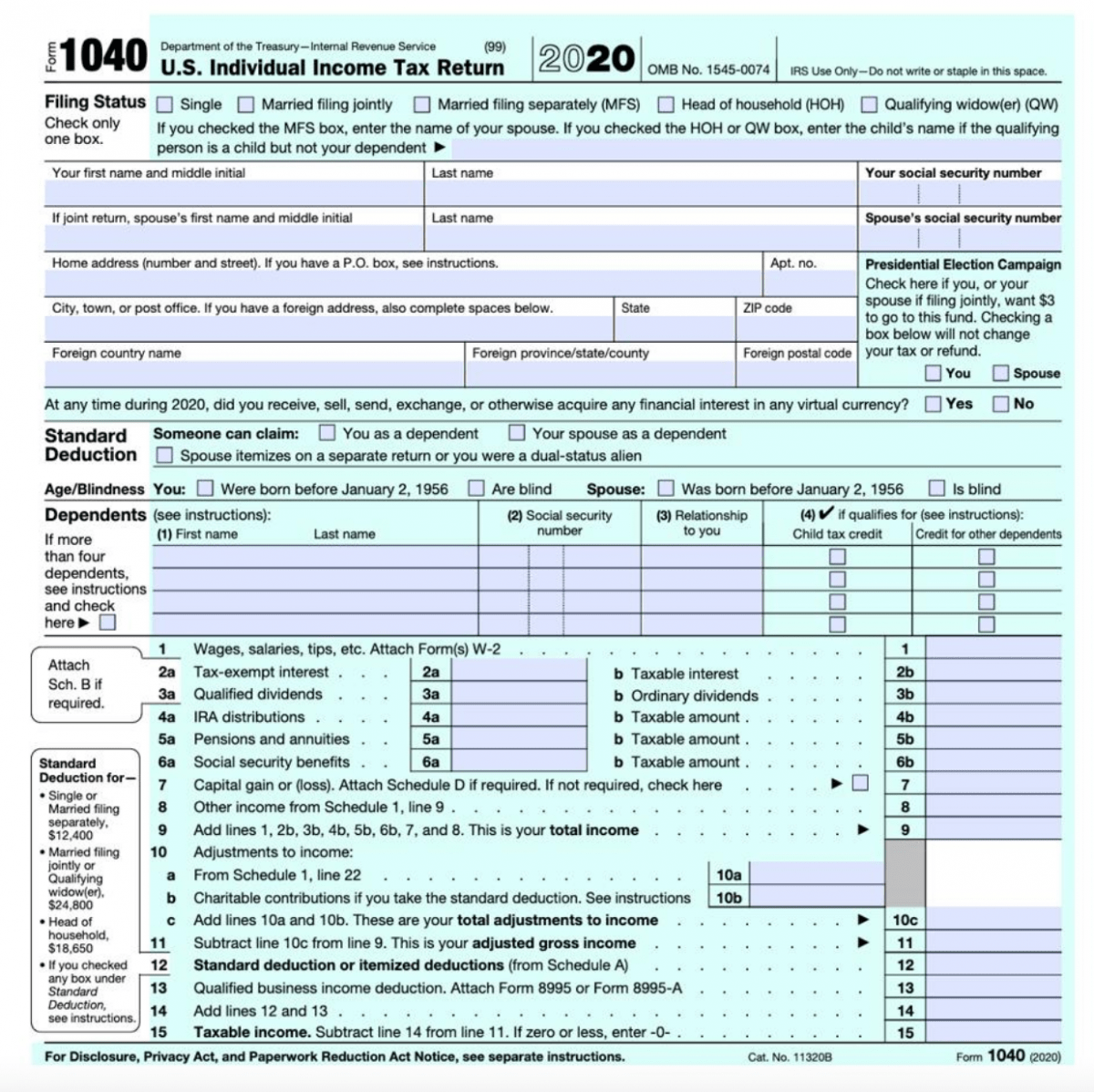

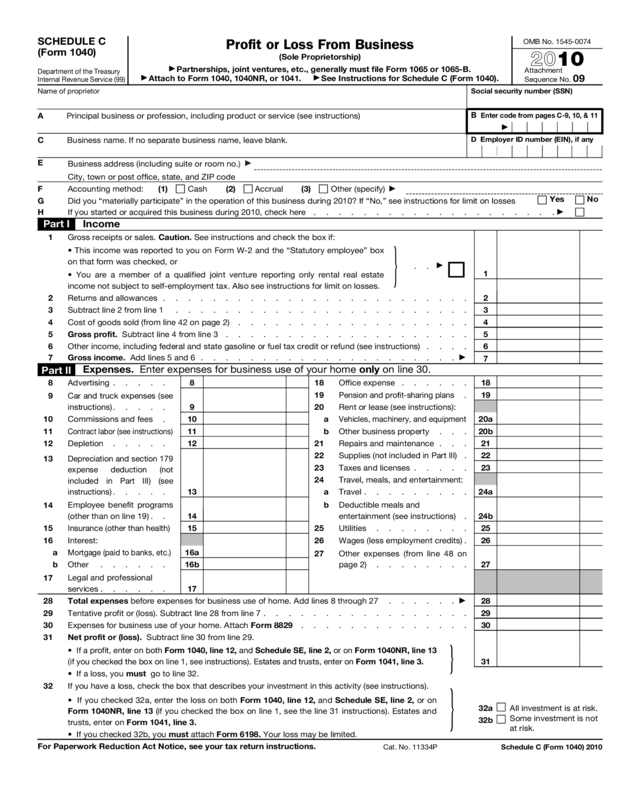

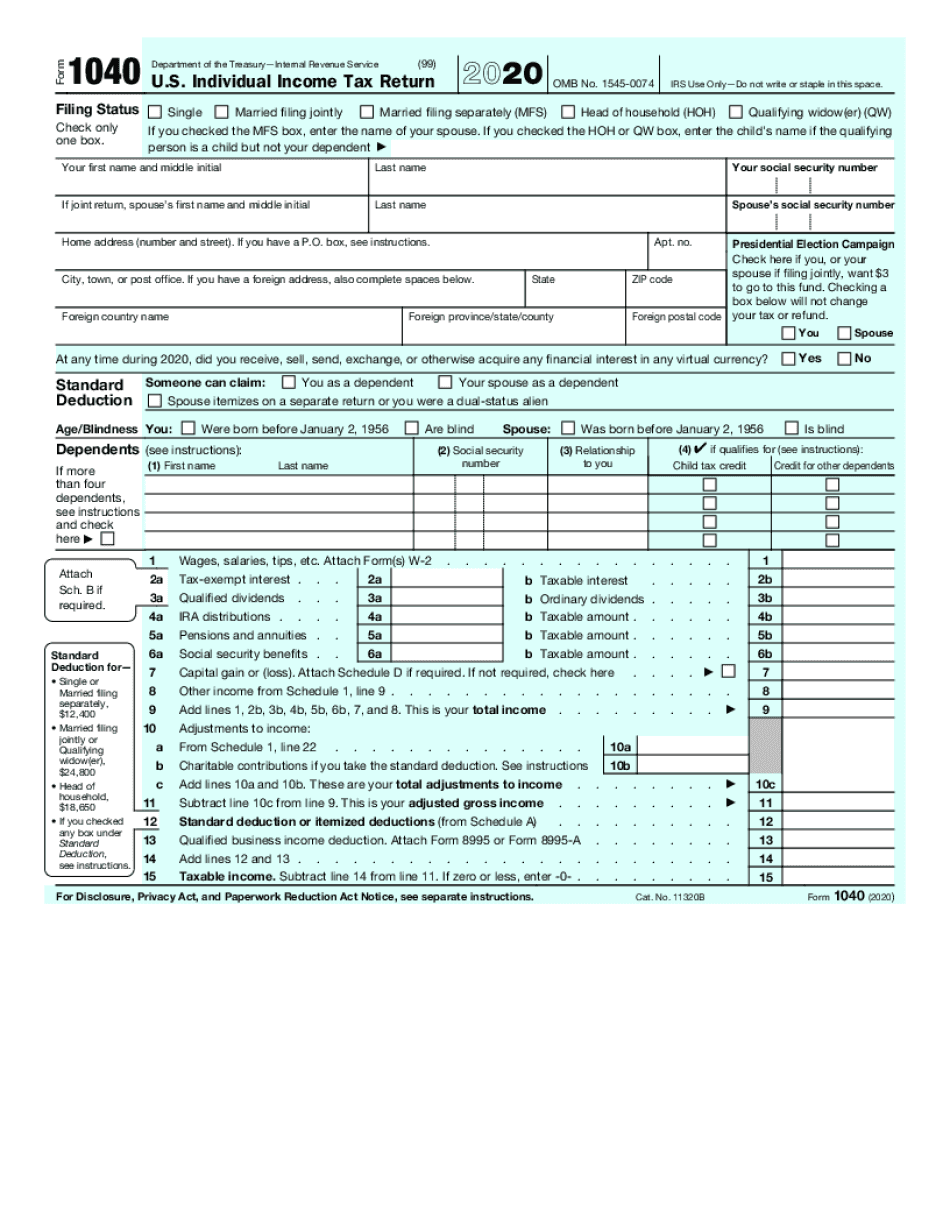

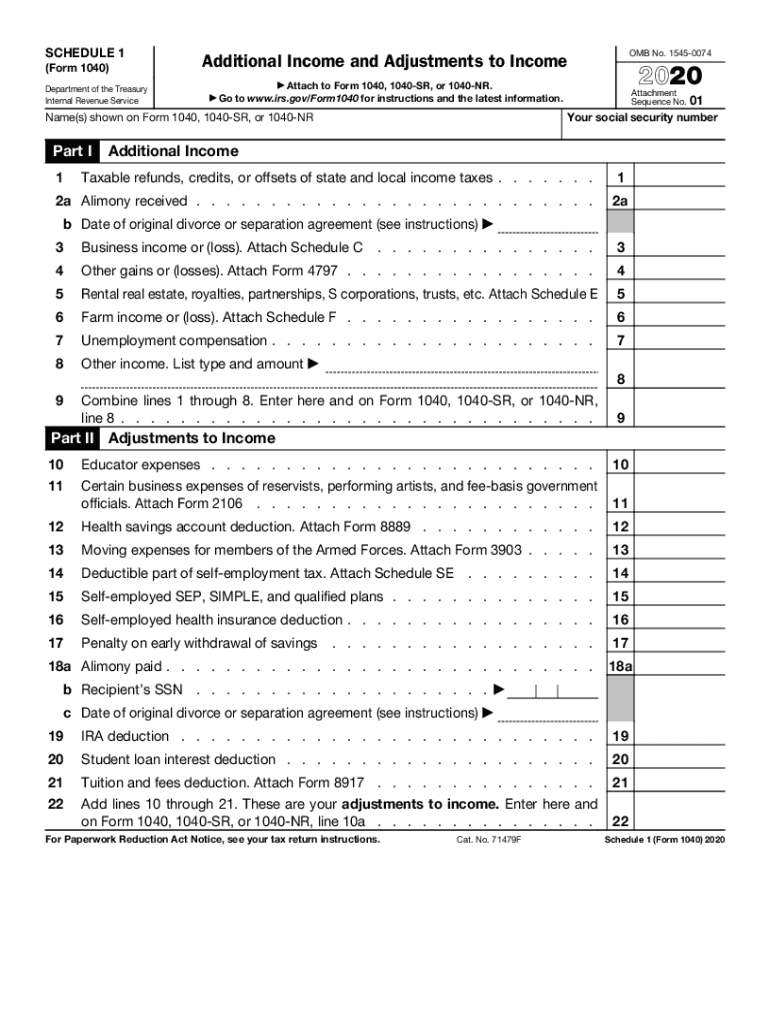

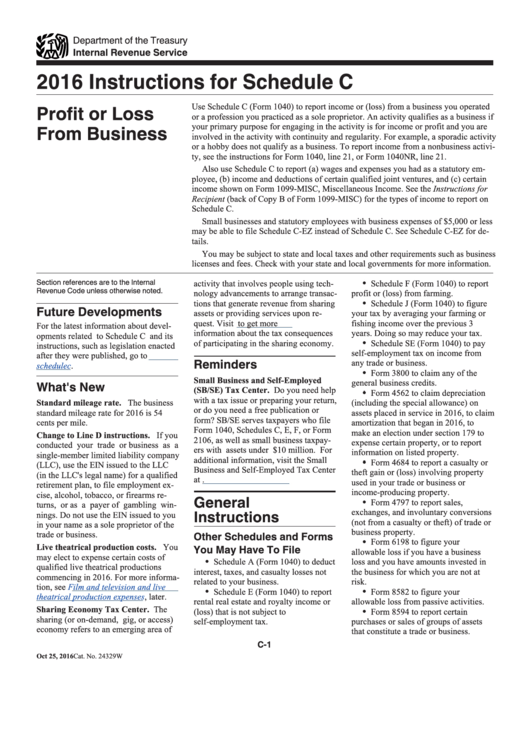

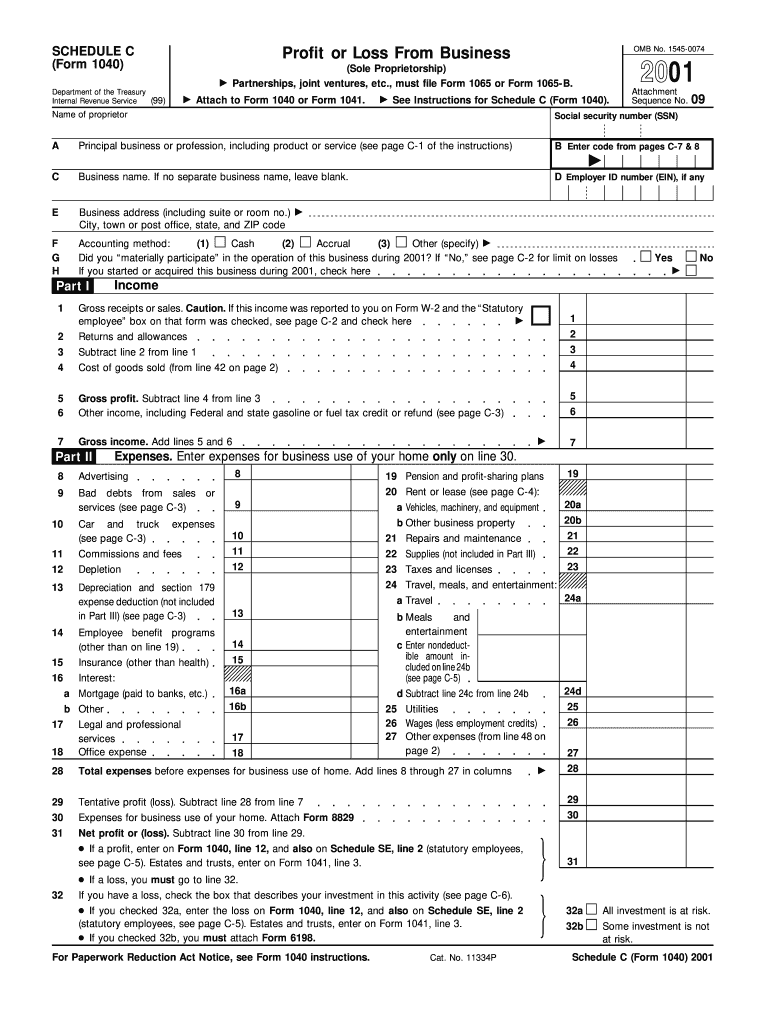

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity SCHEDULE C Form 1040 Profit or Loss From Business Go OMB No 1545 0074 2020 Sole Proprietorship to www irs gov ScheduleC for instructions and the latest information Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040 SR 1040 NR or 1041 partnerships generally must file Form 1065

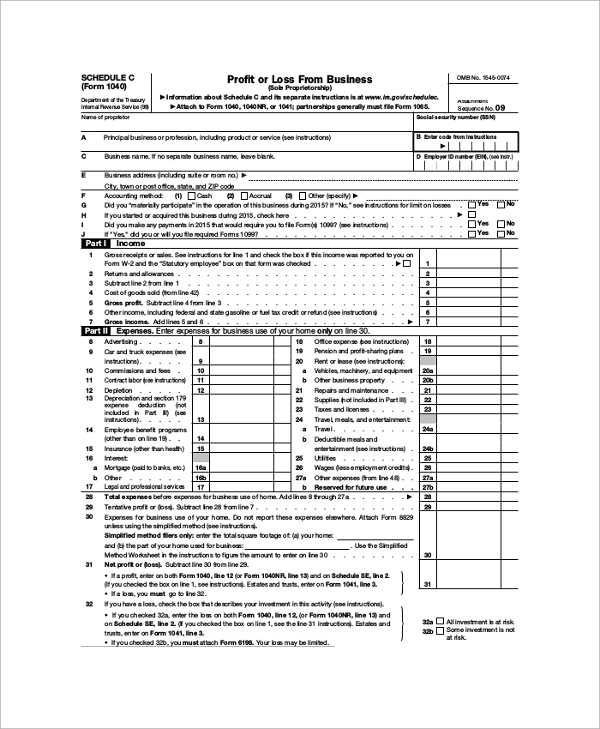

Schedule C Form 1040 Printable

Schedule C Form 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/sample-schedule-c-form-examples-in-pdf-word.jpg

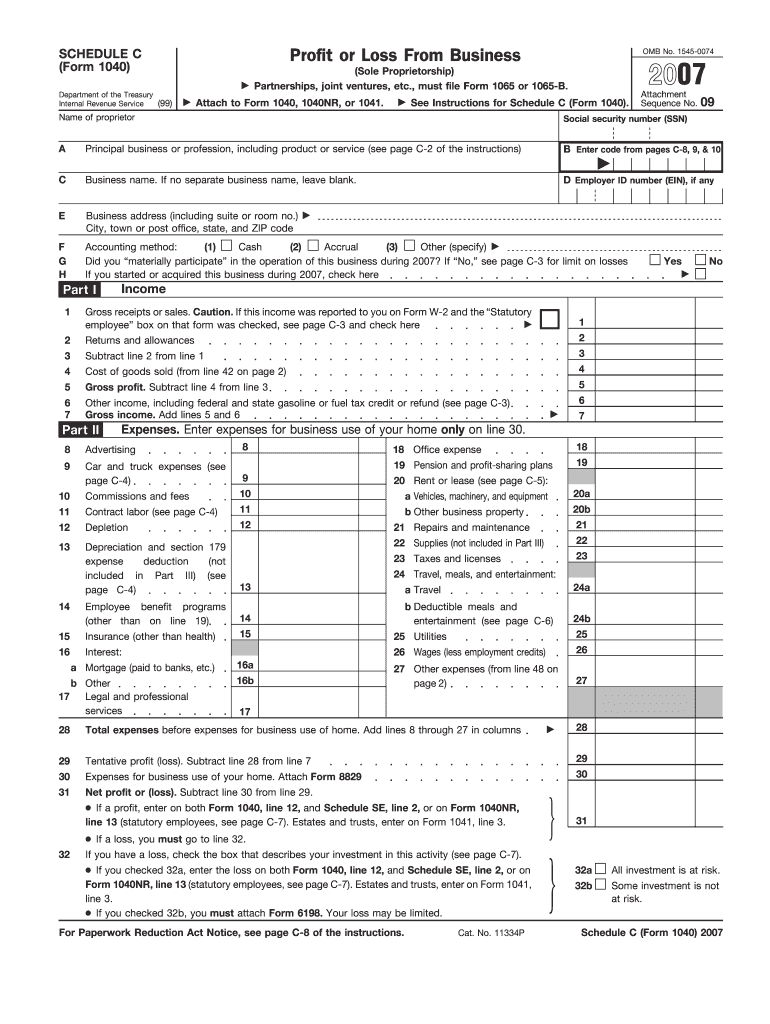

IRS 1040 Schedule C 2007 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/100/639/100639784/large.png

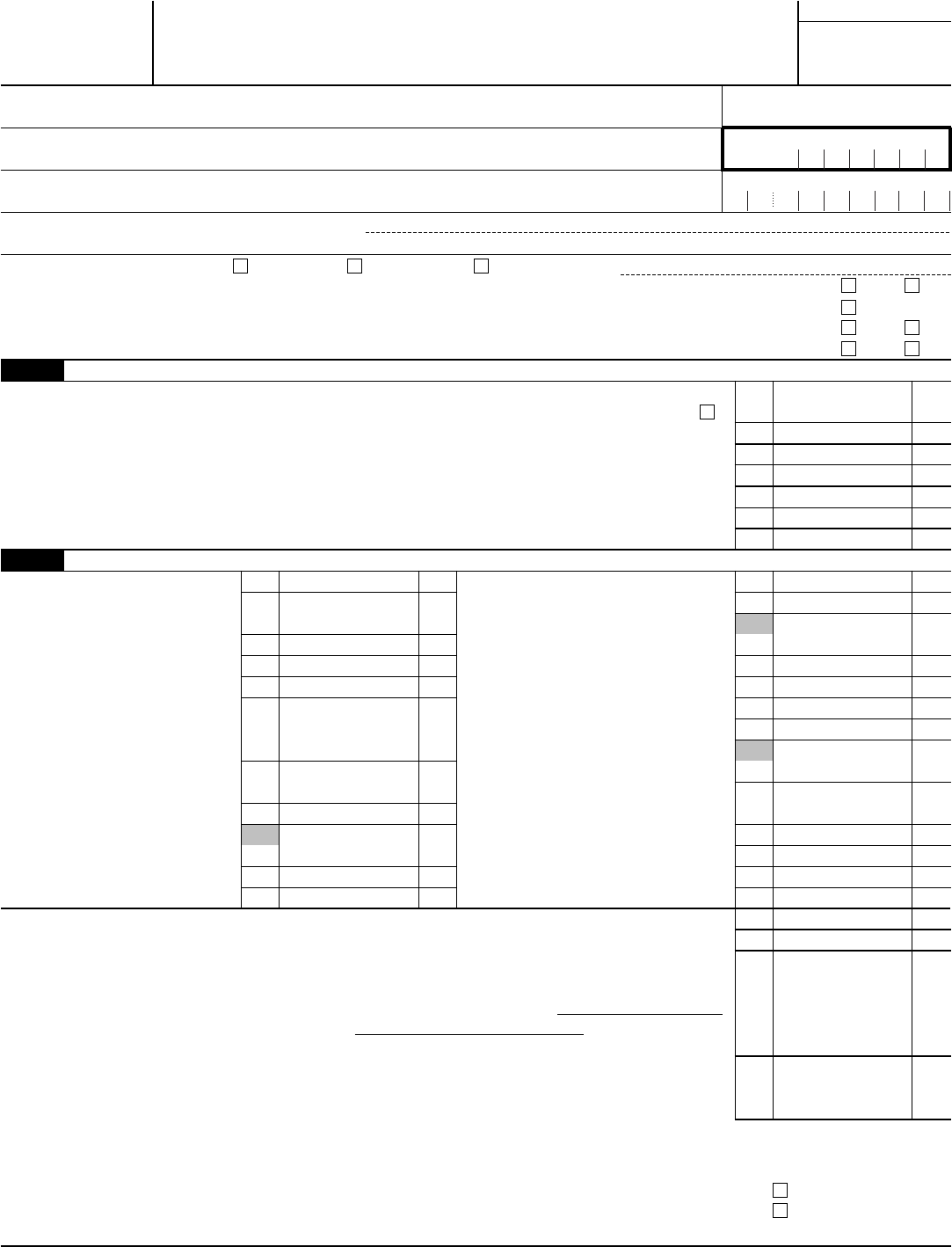

Form 1040 Schedule C Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/htmls/10002/form-1040-schedule-c/bg1.png

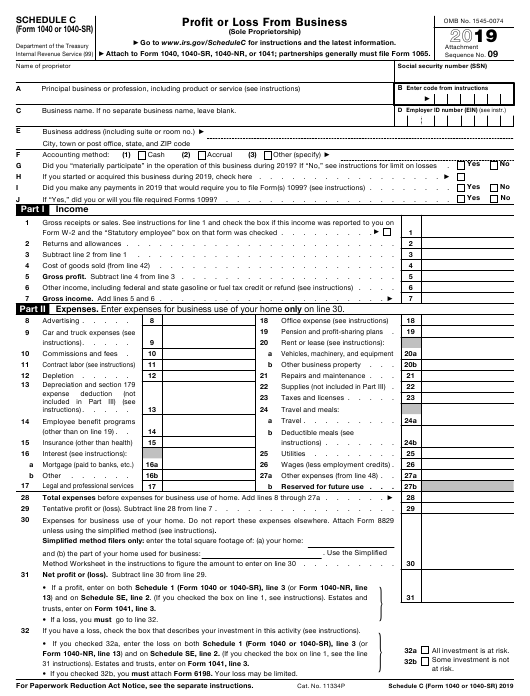

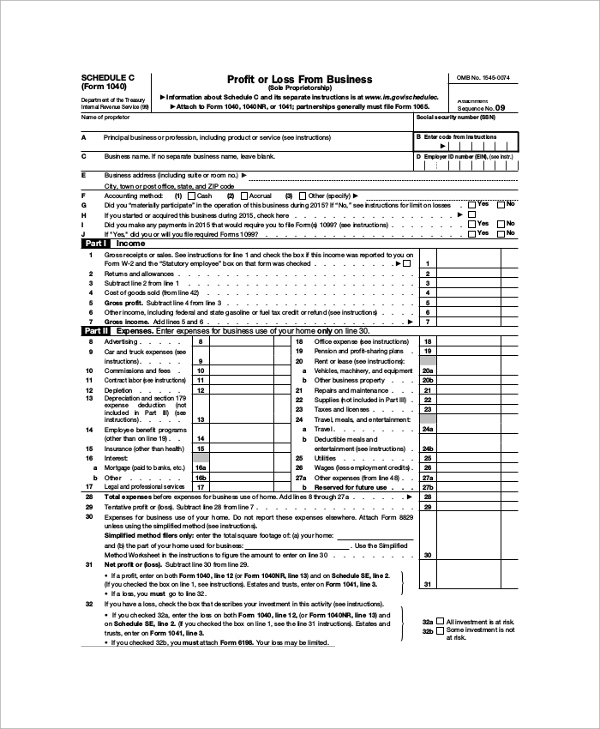

SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2023 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065 What Is Form 1040 Schedule C Page one of IRS Form 1040 and Form 1040NR requests that you attach Schedule C or Schedule C EZ to report a business income or loss You can not file Schedule C with one of the shorter IRS forms such as Form 1040A or Form 1040EZ Schedule C is the long version of the simplified easy Schedule C EZ form

2 File Forms 1099 for all contractors The first section on Schedule C asks whether you made any payments subject to filing a Form 1099 You must file a 1099 form for every contract employee to You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule C is typically for people who operate sole proprietorships or single member LLCs

More picture related to Schedule C Form 1040 Printable

IRS Form 1040 1040 SR Schedule C Download Fillable PDF 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/irs-form-1040-1040-sr-schedule-c-download-fillable-pdf.png

1040 Form 2022 Schedule C Season Schedule 2022

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.08.56-PM-1200x1198.png

How To Fill Out Your 2021 Schedule C With Example

https://fitsmallbusiness.com/wp-content/uploads/2021/12/Screenshot_of_Schedule_C_Form_1040_Part_II.jpg

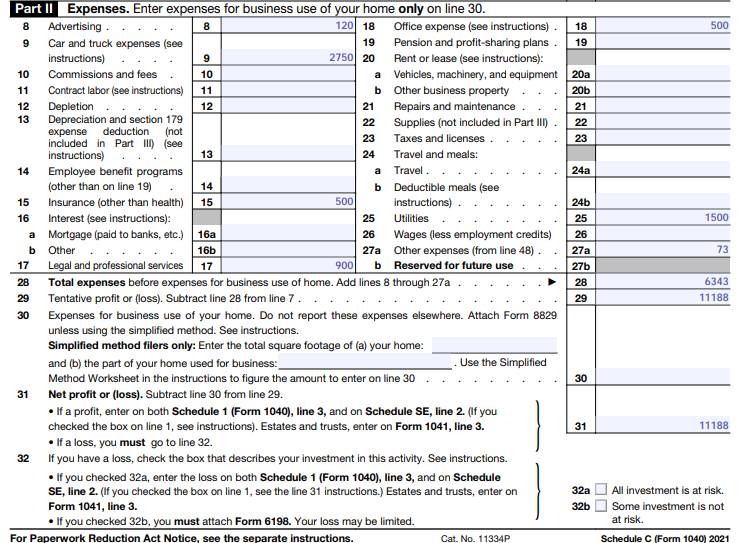

Option A involves completing Form 8829 by calculating the total area of your home and getting a percentage for your home business Include the total allowable expenses resulting from those calculations on Line 30 of Schedule C Option B is a simplified calculation 5 per square foot of home business space up to 300 square feet for a maximum 1 500 deduction 1040 Schedule C Federal Profit or Loss from Business Sole Proprietorship Download This Form Print This Form It appears you don t have a PDF plugin for this browser Please use the link below to download 2023 federal 1040 schedule c pdf and you can print it directly from your computer More about the Federal 1040 Schedule C

If you received any 1099 NEC 1099 MISC or 1099 K tax forms reporting money you earned working as a contractor or selling stuff you ll have to report that as income on Line 1 of Schedule C You ll also need to add any other money you earned while being self employed Unfortunately you have to pay taxes on it all A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form it is used to provide information about both the profit and the loss sustained in business by the sole proprietor This form includes information about income for the business and its various expenses

FREE 9 Sample Schedule C Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2016/11/SCHEDULE-C-1040-Form.jpg

2018 2023 Form IRS 1040 Schedule C EZ Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/454/878/454878824/large.png

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if Your primary purpose for engaging in the activity is for income or profit You are involved in the activity with continuity and regularity Current Revision

https://www.irs.gov/instructions/i1040sc

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)

What Is Schedule C Of Form 1040

FREE 9 Sample Schedule C Forms In PDF MS Word

2010 Form 1040 Schedule C Edit Fill Sign Online Handypdf

2019 Form 1040 Schedule C Download Dsadetroit

Fillable Schedule C Irs Form 1040 Printable Pdf Download Gambaran

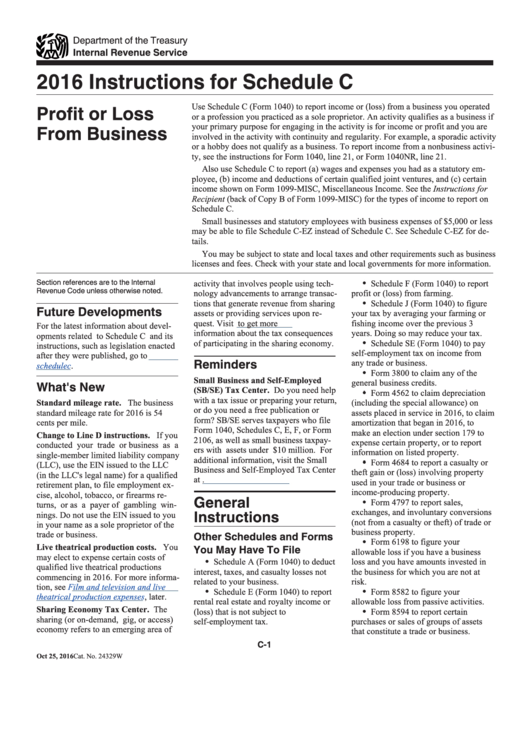

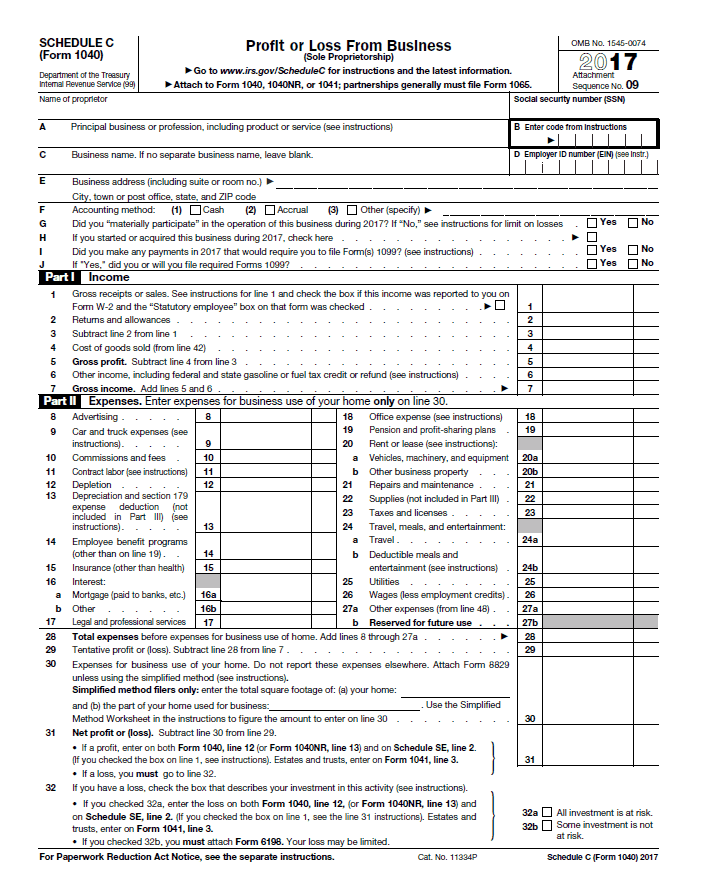

Instructions For Schedule C 1040 2016 Printable Pdf Download

Instructions For Schedule C 1040 2016 Printable Pdf Download

Schedule C Fill Online Printable Fillable Blank 2021 Tax Forms 1040 Printable

Schedule C Form 1040 How To Complete It The Usual Stuff

Schedule C Form 1040 Expense Cost Of Goods Sold

Schedule C Form 1040 Printable - You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule C is typically for people who operate sole proprietorships or single member LLCs