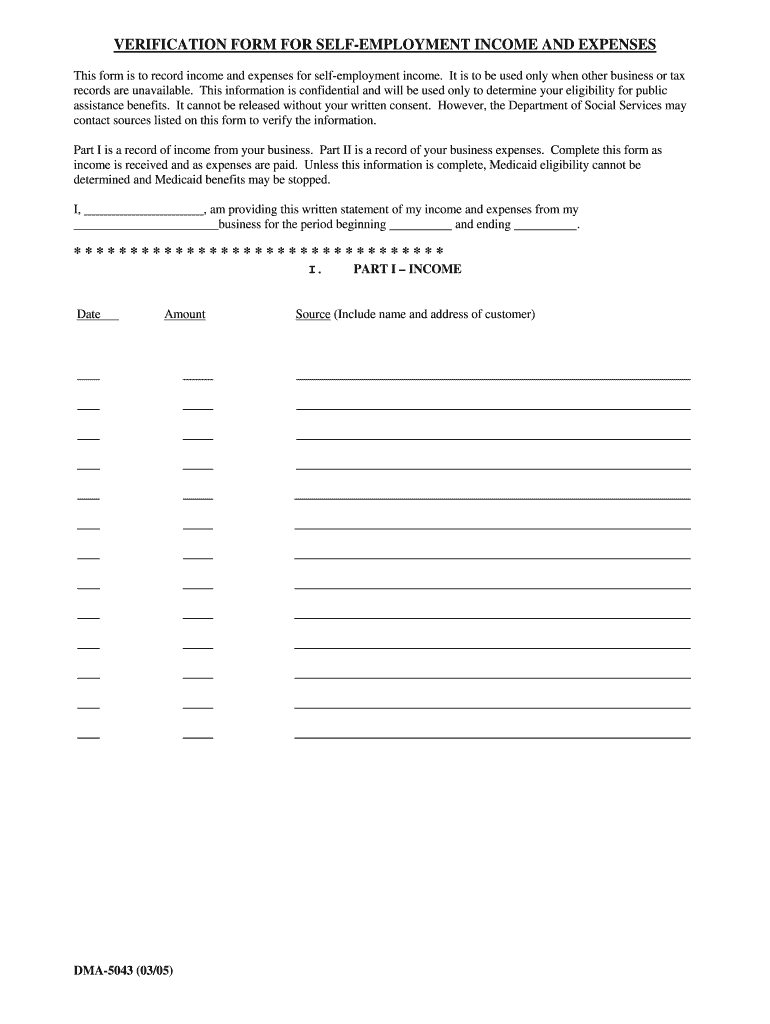

Self Income Printable Form Report Self employment forms Register if you re self employed or a sole trader Guide Self Assessment claim to reduce payments on account SA303 30 November 2015 Form Keeping records for your

English Cymraeg Use supplementary pages SA103S to record self employment income on your SA100 tax return if your annual business turnover was below the VAT threshold for the tax year From HM You should fill in the Self employment full pages if either your turnover including any taxable coronavirus support payments was 85 000 or more or would have been if you d traded for a

Self Income Printable Form Report

Self Income Printable Form Report

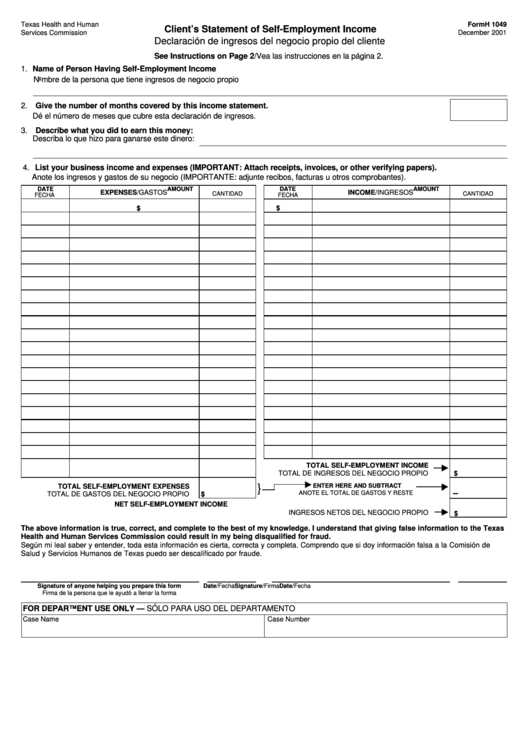

https://data.formsbank.com/pdf_docs_html/310/3100/310039/page_1_thumb_big.png

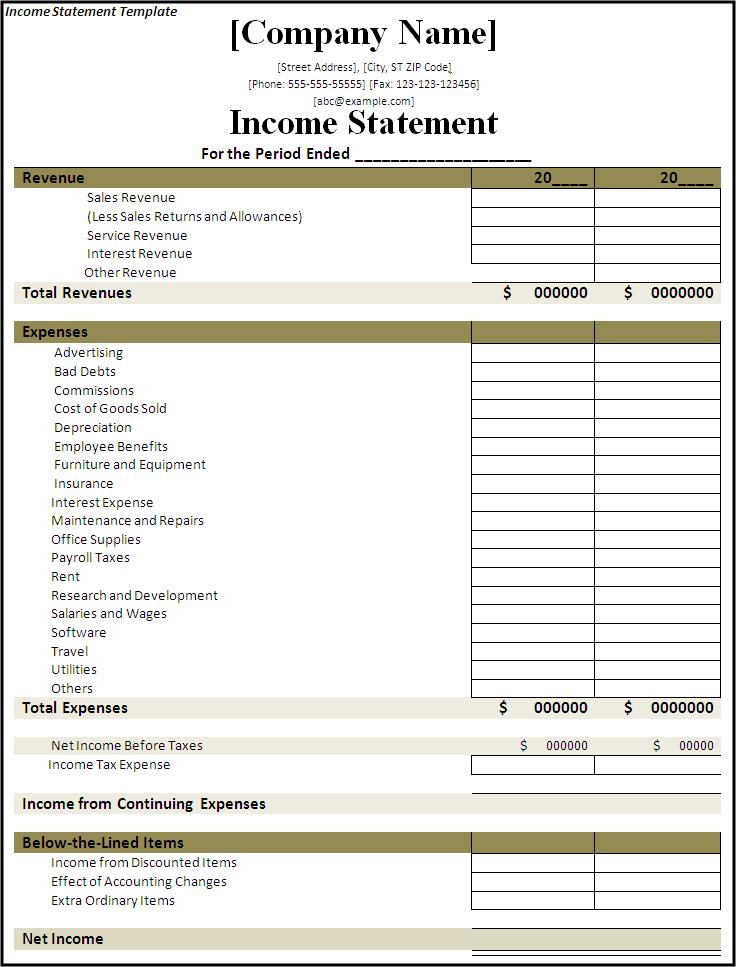

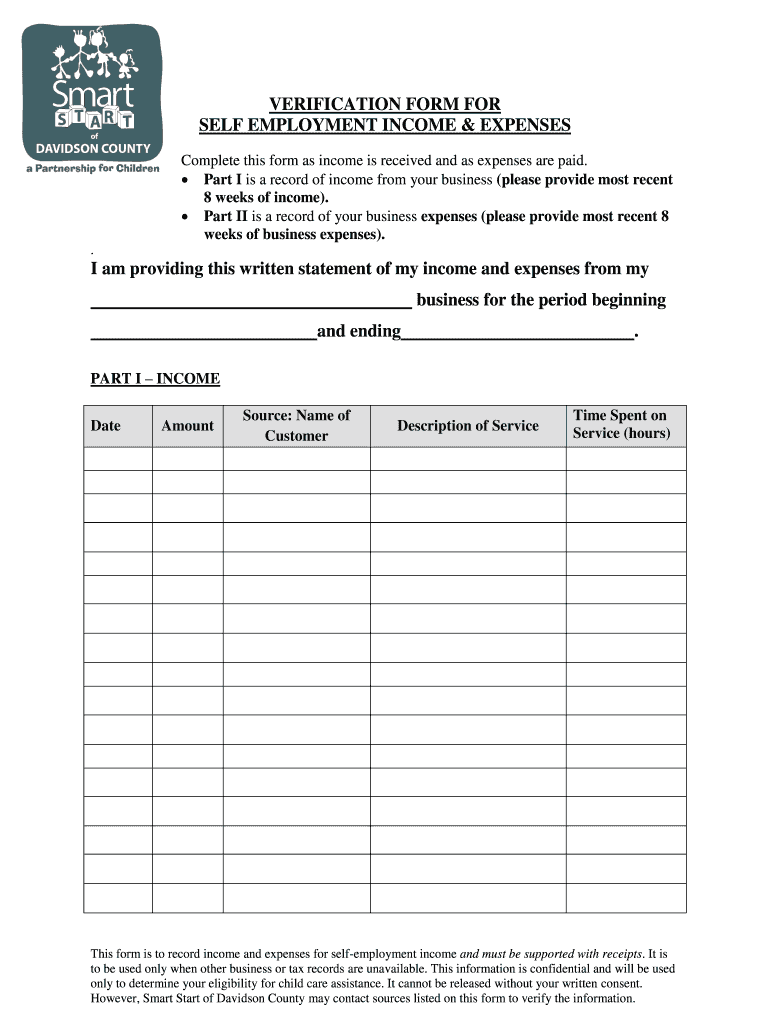

Printable Income Statement Free Word Templates

https://www.wordstemplates.org/wp-content/uploads/2012/09/Income-Statement-Template.jpg

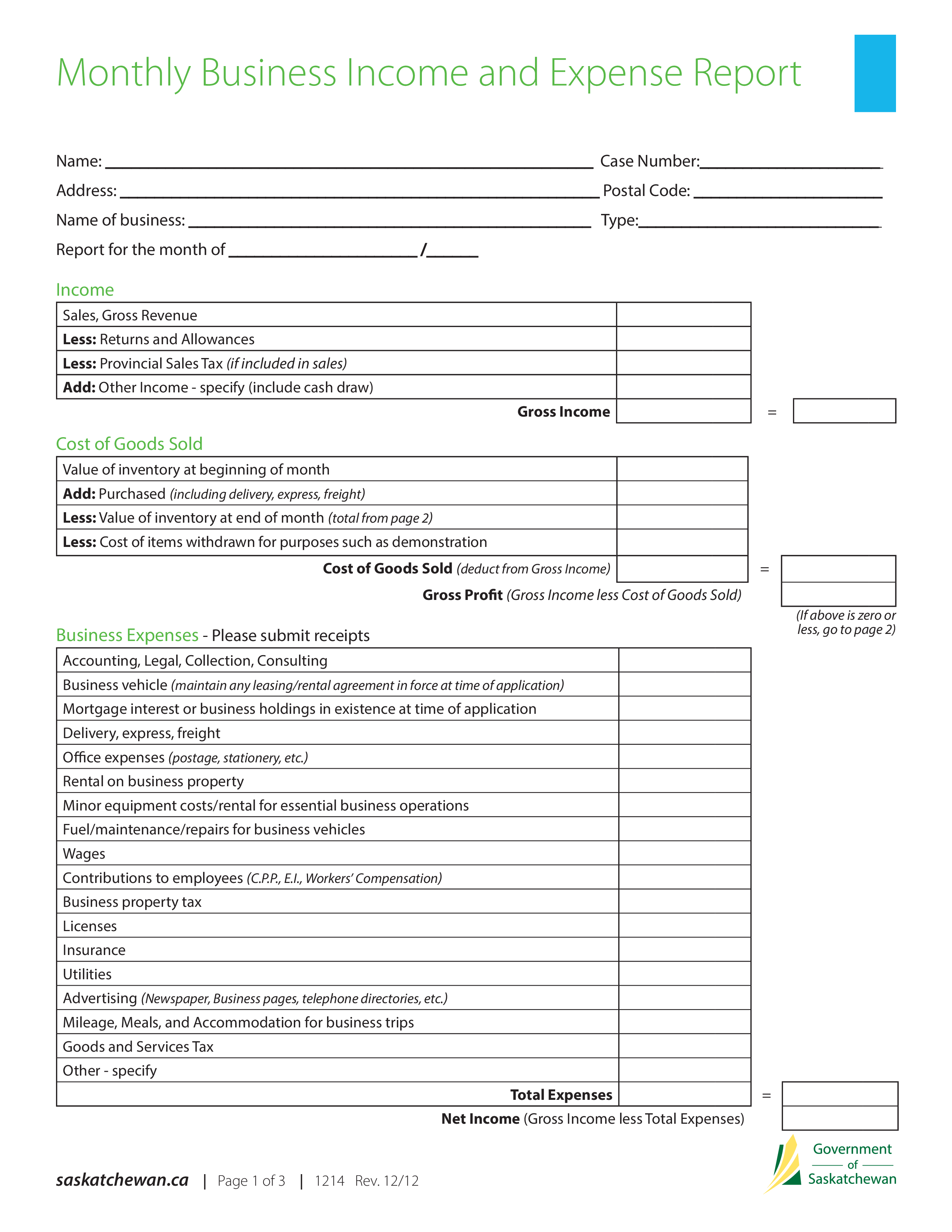

Monthly Income And Expense Report Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/2e32c9e6-10e9-4f4f-9467-c8d8d5eb0e0a_1.png

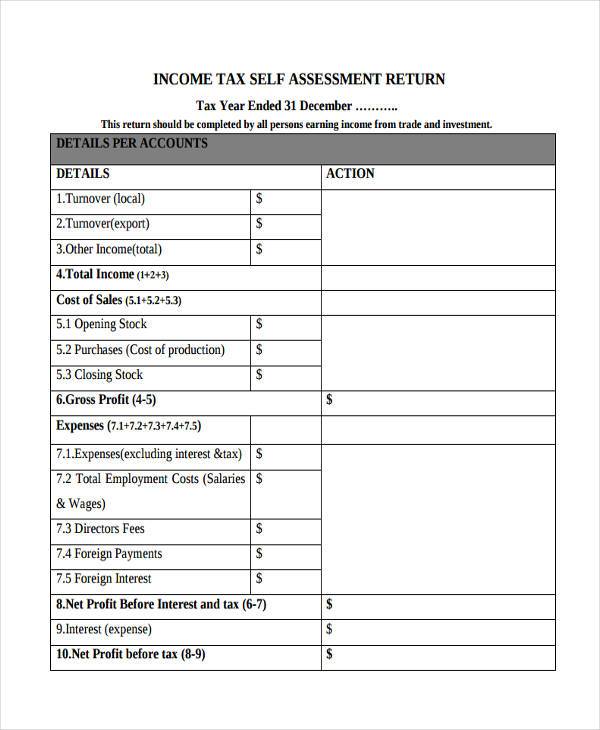

Please read the Self employment full notes and use the examples to work out your capital allowances Net profit or loss 47 Net profit if your business income is more than your expenses if box 15 box 16 minus box 31 is positive 0 0 48 Or net loss if your expenses are more than your business income if box 31 minus Use these notes to help you fill in the Self employment short pages of your tax return Fill in the Self employment short pages if your turnover including any taxable coronavirus support scheme payments was less than 85 000 or would have been if you had traded for a full year If it was 1 000 or less read Trading income

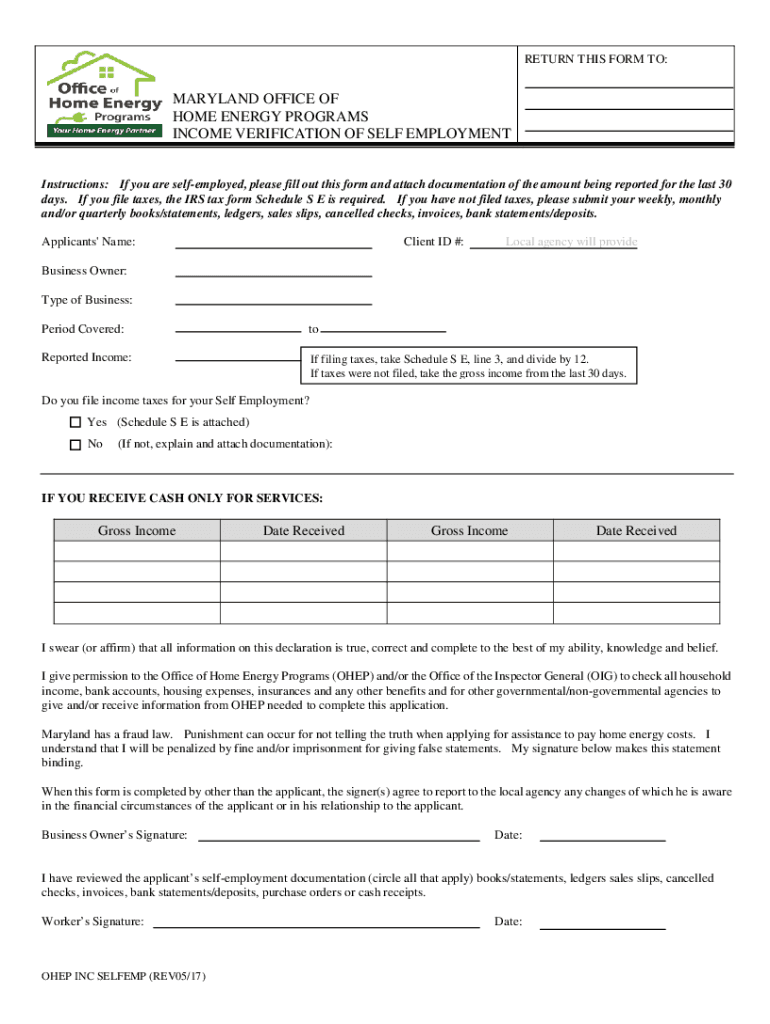

The SA302 form is a vital document for self employed individuals serving as a key indicator of financial health for mortgage and business loan applications While it offers a comprehensive overview of one s income and tax details alternatives exist for those who might not have this form Understanding both the SA302 and Tax Year Overview as Unfortunately you can t opt to fill in this shorter form HMRC will decide and send it out to you Details you may need to include on your tax return include Income all taxed and un taxed income from self employment taxable interest from savings dividends from shares or capital gains from selling assets

More picture related to Self Income Printable Form Report

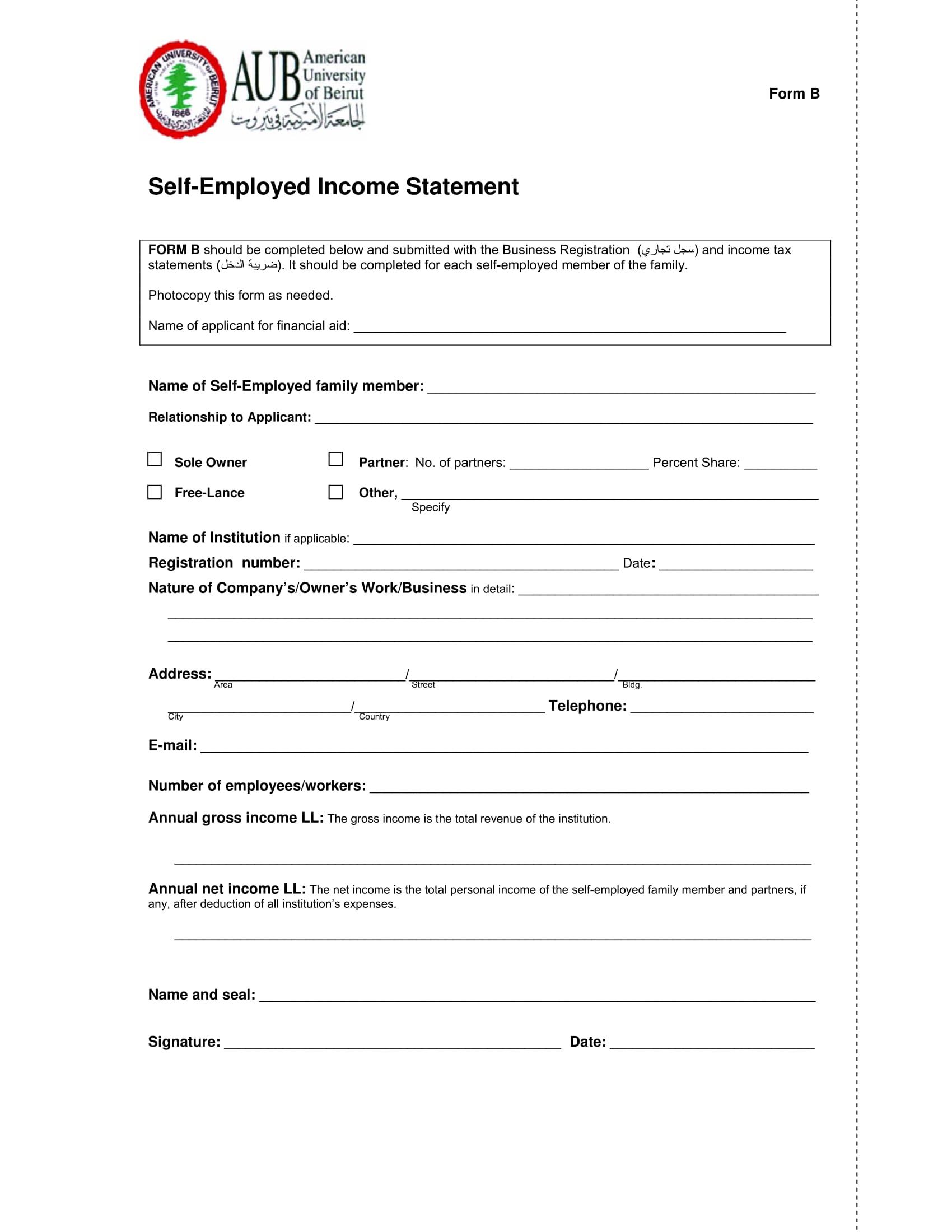

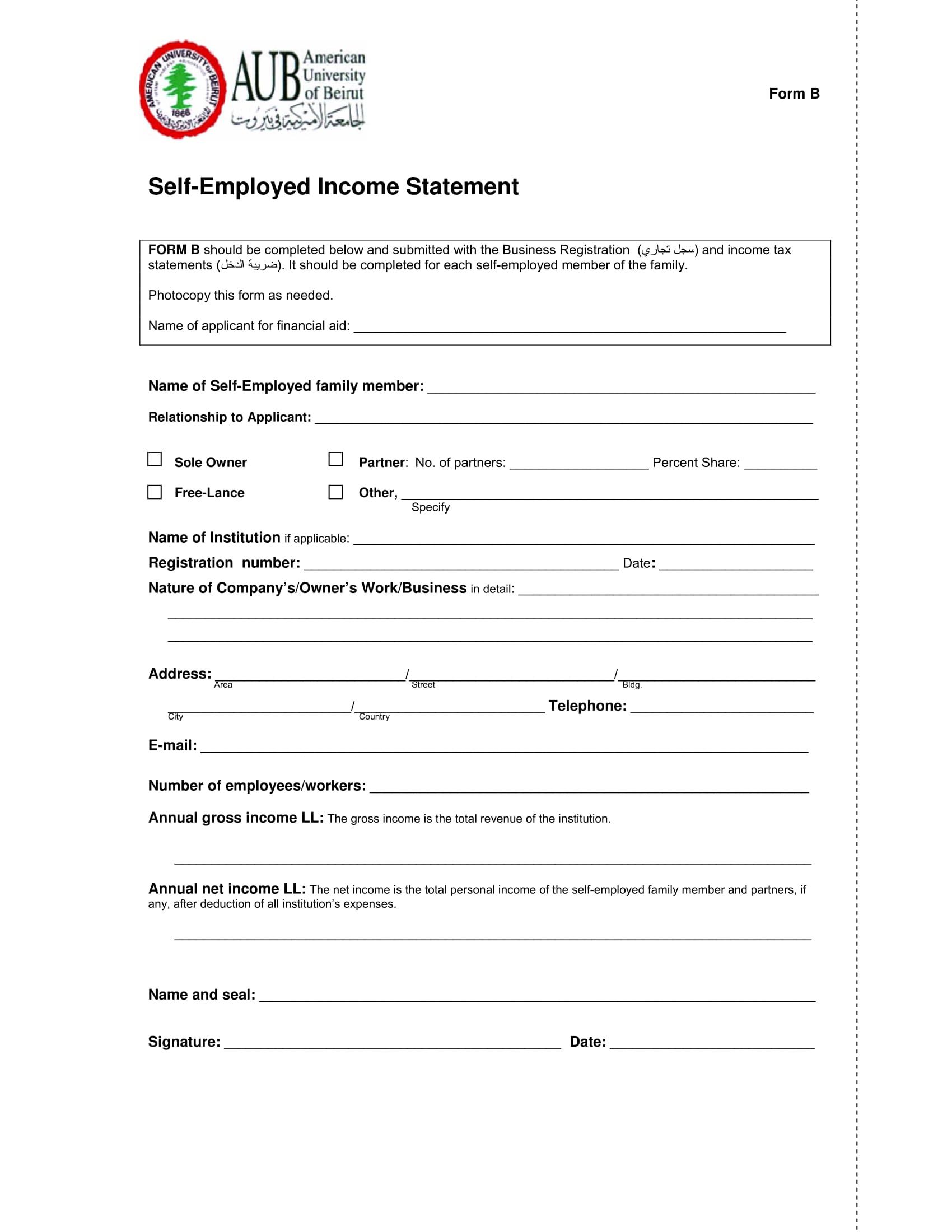

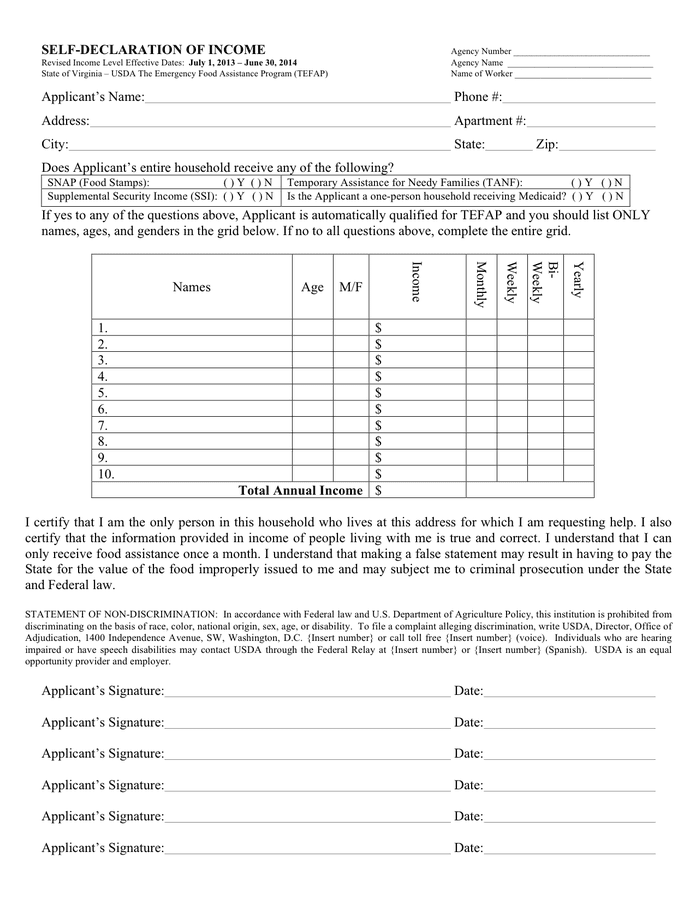

Self Employment Income Statement Template Fresh Profit And Loss Statement For Self Employed

https://i.pinimg.com/originals/68/f0/76/68f076a60cc17705d33f2c3789dd1352.jpg

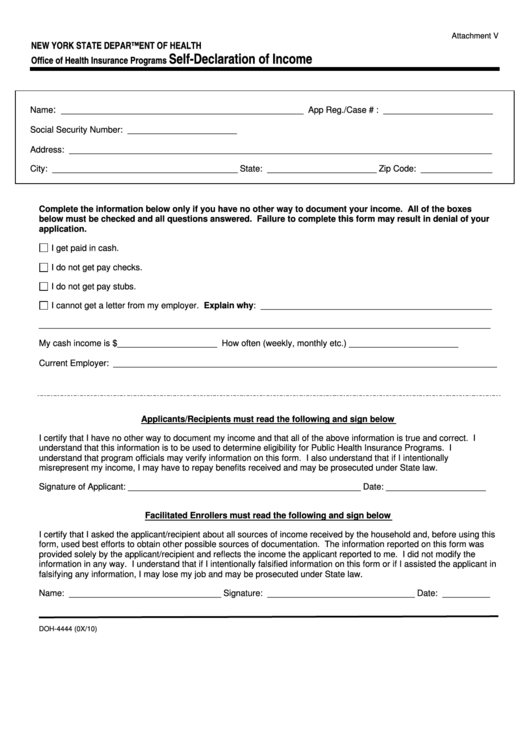

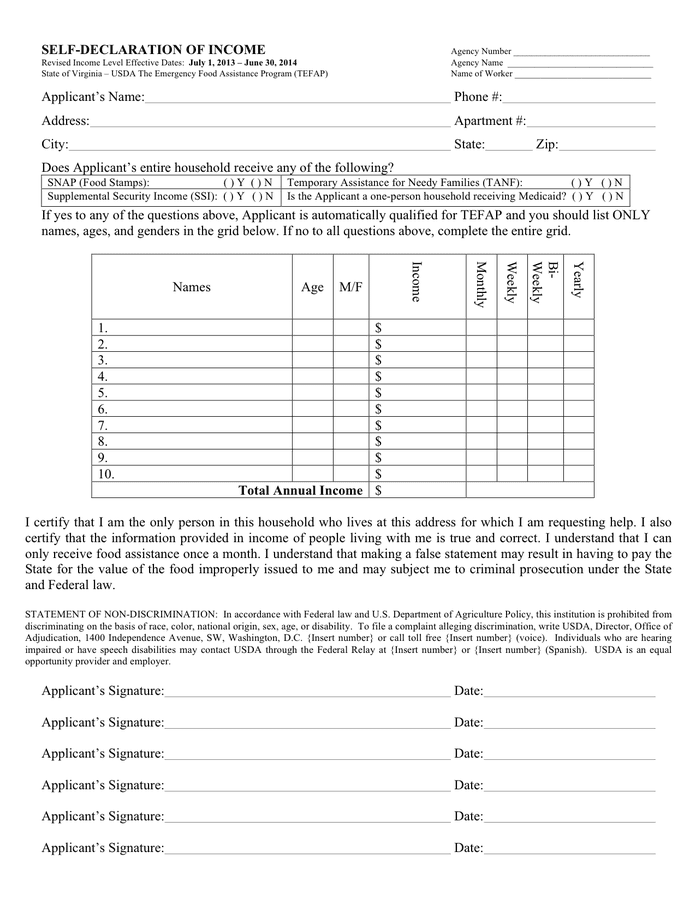

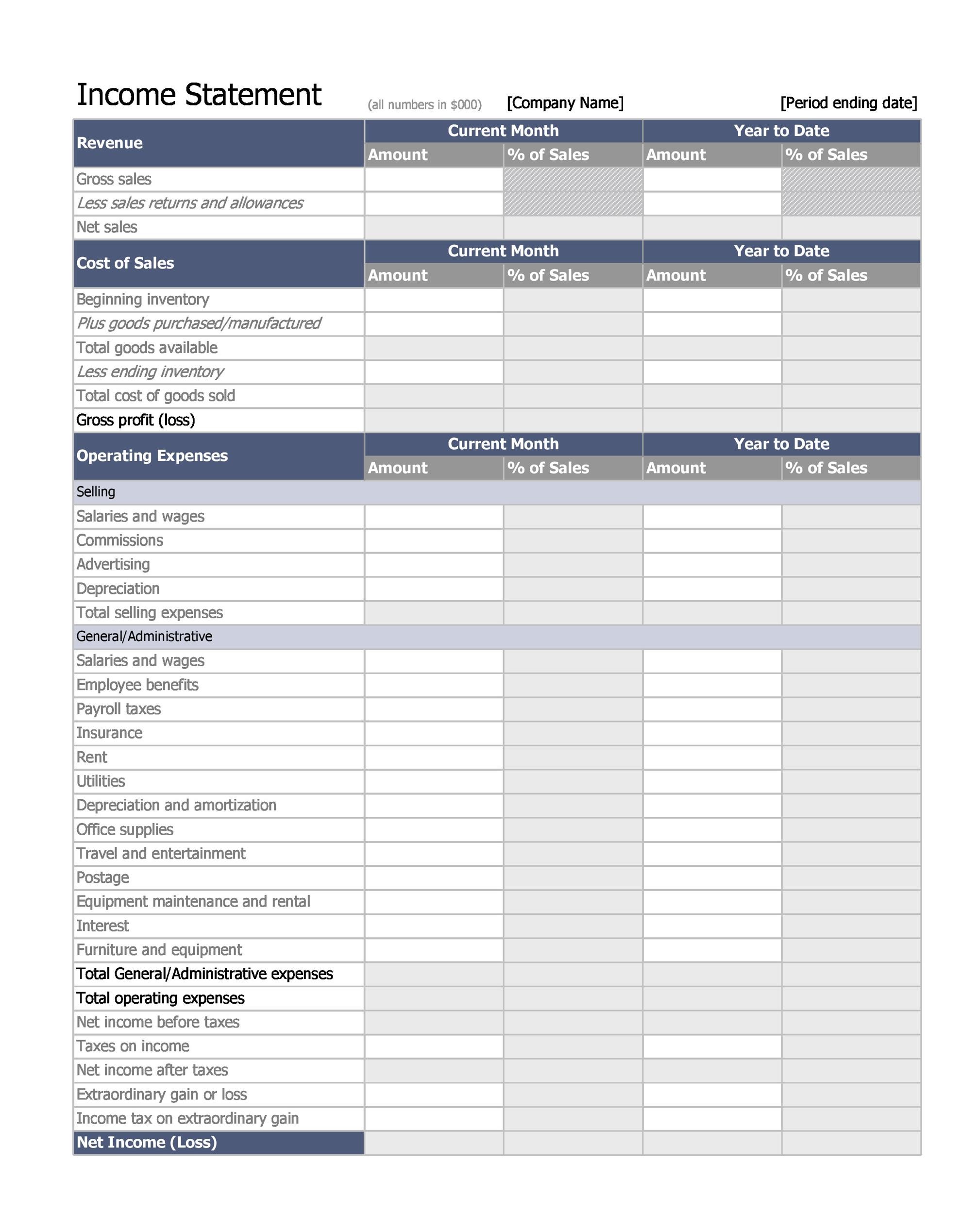

Form Doh 4444 Self Declaration Of Income Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/200/2001/200141/page_1_thumb_big.png

Self Employment Proof Of Income Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/42/697/42697560/large.png

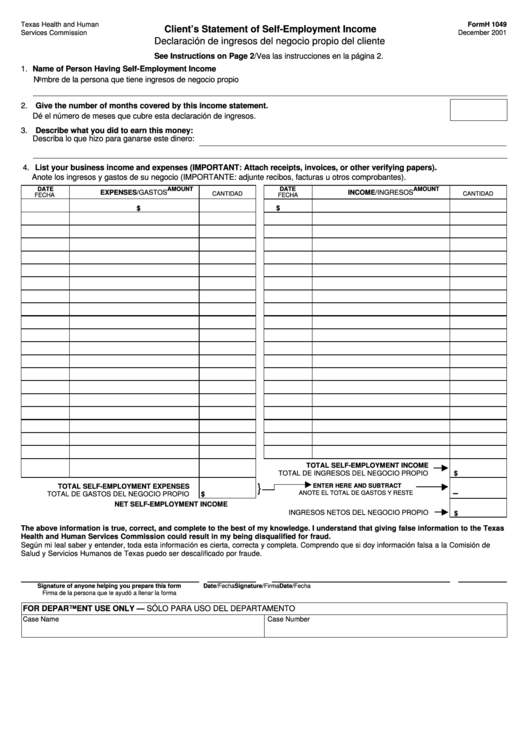

Self Assessment tax return forms Download or request forms to help you send your tax return either online or by post You must send your tax return by the deadline or you ll get a penalty A self employed person gets his or her income by conducting profitable actions either from trade or business that he or she operates Examples of self employed individuals are self sufficient contractors sole proprietors of businesses and those with partnerships in businesses Contents hide

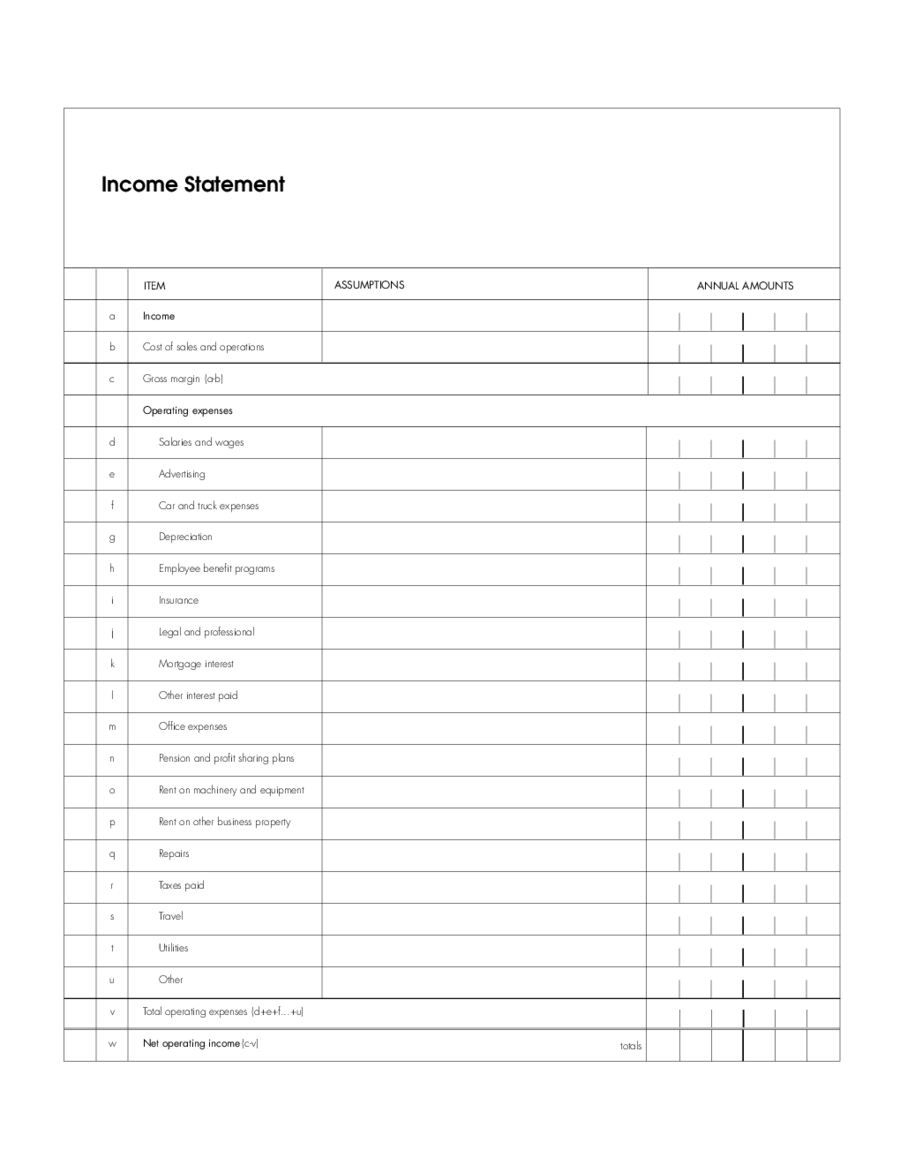

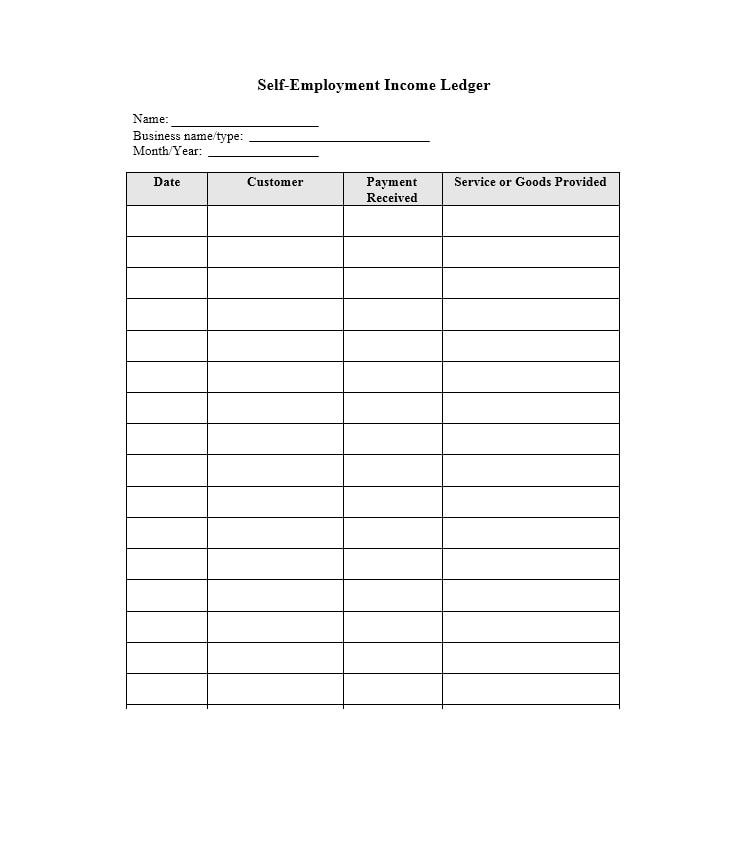

If you re self employed you ll need to complete SA103 If you re reporting property income then fill in SA105 If you re declaring capital gains complete SA108 You ll also be able to declare any allowable expenses in these sections which will then be deducted from your tax bill by HMRC By Andy Marker April 6 2022 We ve compiled a collection of the most helpful small business income statements worksheets and templates for small business owners and other stakeholders free to download

FREE 30 Income Statement Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/10/Self-Employed-Income-Statement-Form-2.jpg

MI Self Employment Income And Expense Statement Fill And Sign Printable Template Online US

https://www.pdffiller.com/preview/41/404/41404890/large.png

https://www.gov.uk/government/collections/self-employment-forms-and-helpsheets

Self employment forms Register if you re self employed or a sole trader Guide Self Assessment claim to reduce payments on account SA303 30 November 2015 Form Keeping records for your

https://www.gov.uk/government/publications/self-assessment-self-employment-short-sa103s

English Cymraeg Use supplementary pages SA103S to record self employment income on your SA100 tax return if your annual business turnover was below the VAT threshold for the tax year From HM

2023 Income Statement Form Fillable Printable PDF Forms Handypdf

FREE 30 Income Statement Forms In PDF MS Word

FREE 22 Sample Self Assessment Forms In PDF MS Word Excel

Printable Self Employment Ledger Template Templates Printable Download

Income Verification Of Self Employment Form Fill Out And Sign Printable PDF Template SignNow

Self Declaration Of Income Form In Word And Pdf Formats

Self Declaration Of Income Form In Word And Pdf Formats

41 FREE Income Statement Templates Examples TemplateLab

Verification Self Employment Income Form Fill Out And Sign Printable PDF Template SignNow

Free Printable Income Statement Template Printable Templates

Self Income Printable Form Report - Select the year that you need the form for Download and print it Fill it in Send it to HMRC alongside your main SA100 tax return form In any case make sure you first download and read the Foreign notes pdf for that tax year it s on the same HMRC page It will explain what each item from the SA106 form means