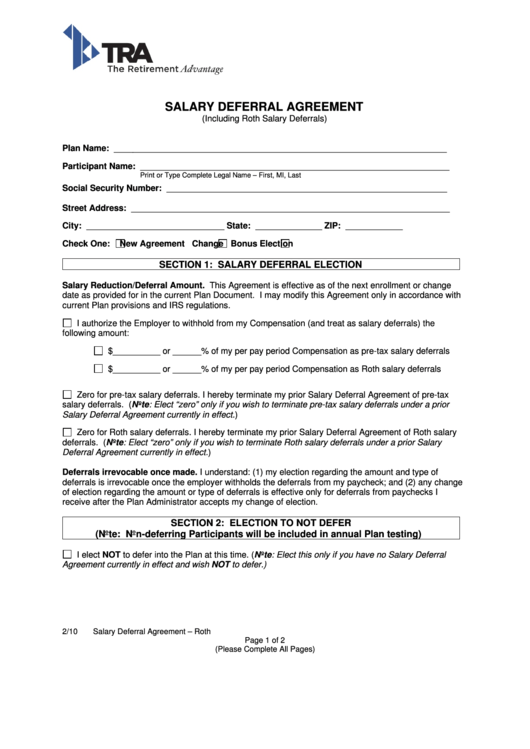

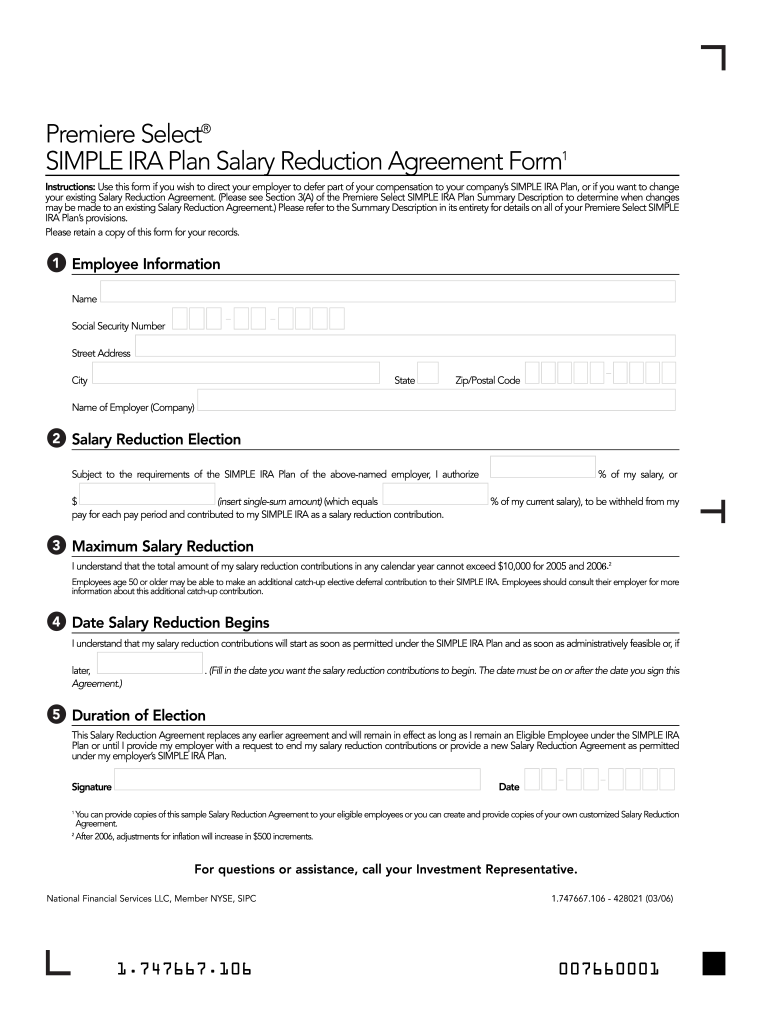

Simple Ira Salary Deferral Election Printable Blank Form Employees who defer salary into other employer retirement plans such as 401 k or 403 b during the same calendar year are subject to a maximum deferral limit of If the employee chooses to defer salary the employee must provide the salary deferral elections to the employer

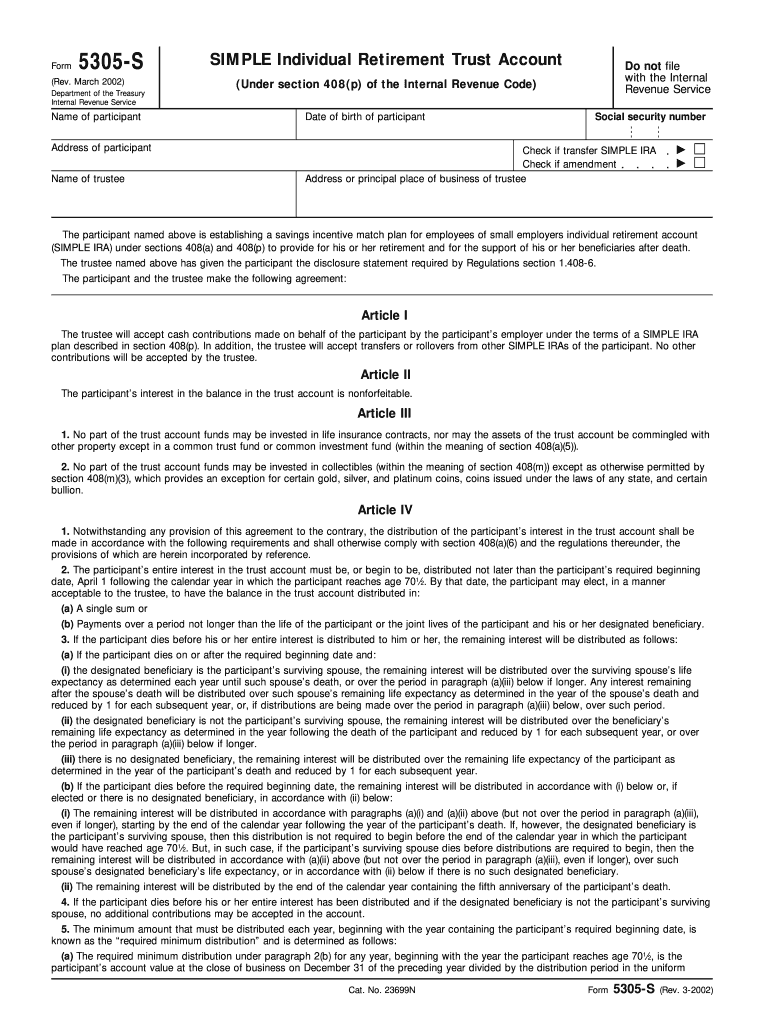

The Rockland matching contribution is 1 500 3 of 50 000 Therefore the total contribution to Elizabeth s SIMPLE IRA that year is 4 000 her 2 500 contribution plus Rockland s 1 500 contribution The financial institution holding Elizabeth s SIMPLE IRA has several investment choices and she is free to choose which ones suit her best Form that allows employees to set up salary deferrals for their SIMPLE IRAs This form is for employer and employee use only It should not be sent back to American Funds Service Company or Capital Bank and Trust Company For the hard copy version see the SIMPLE IRA Salary Deferral Election Hard Copy Fill in Print Not available to order

Simple Ira Salary Deferral Election Printable Blank Form

Simple Ira Salary Deferral Election Printable Blank Form

https://soulcompas.com/wp-content/uploads/2019/12/salary-reduction-agreement-form-simple-ira.jpg

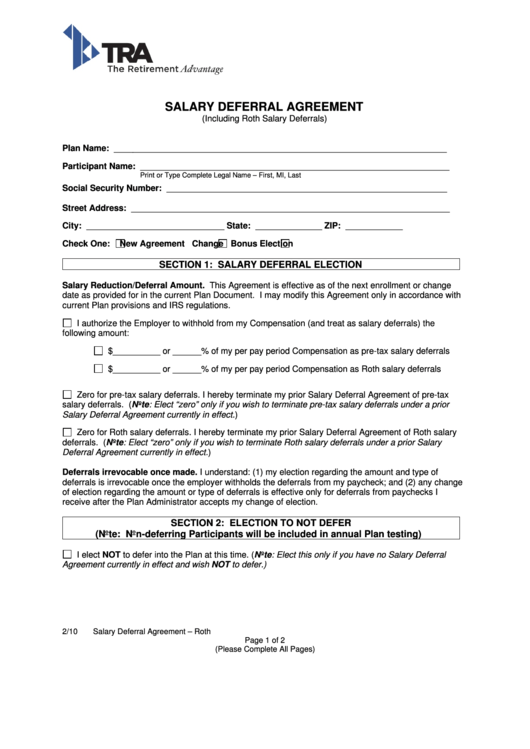

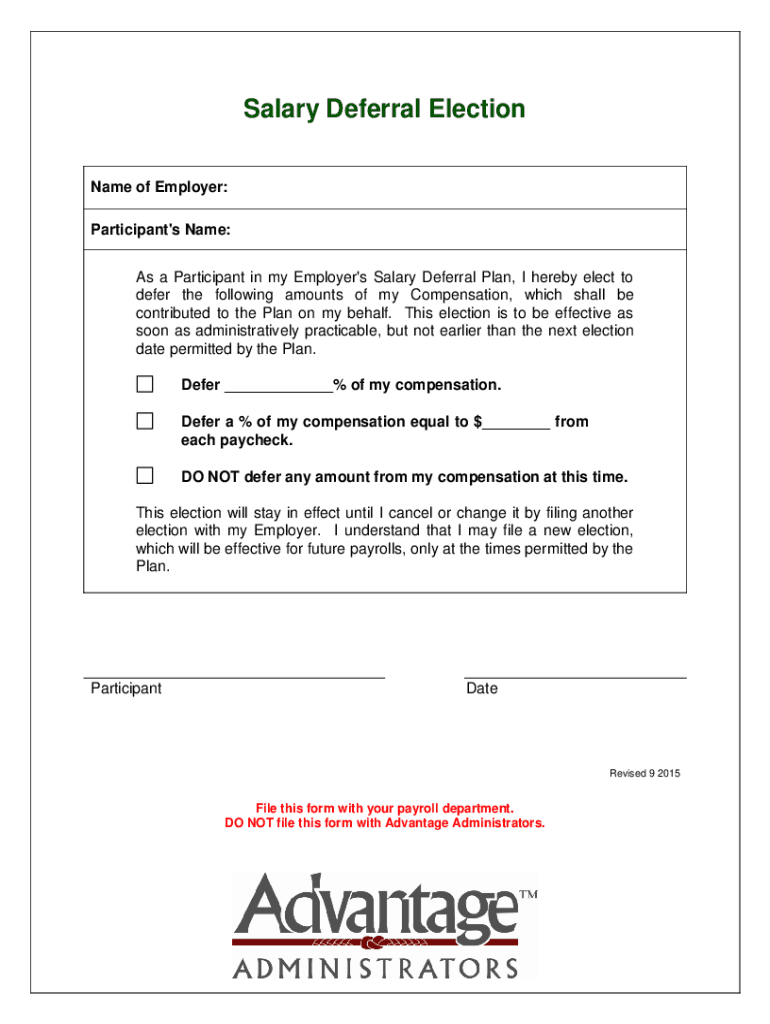

Fillable Salary Deferral Agreement Roth The Retirement Advantage Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/310/3101/310117/page_1_thumb_big.png

Form Simple Ira Contribution Fill Out And Sign Printable Pdf Template 5F4

https://www.signnow.com/preview/6/961/6961737/large.png

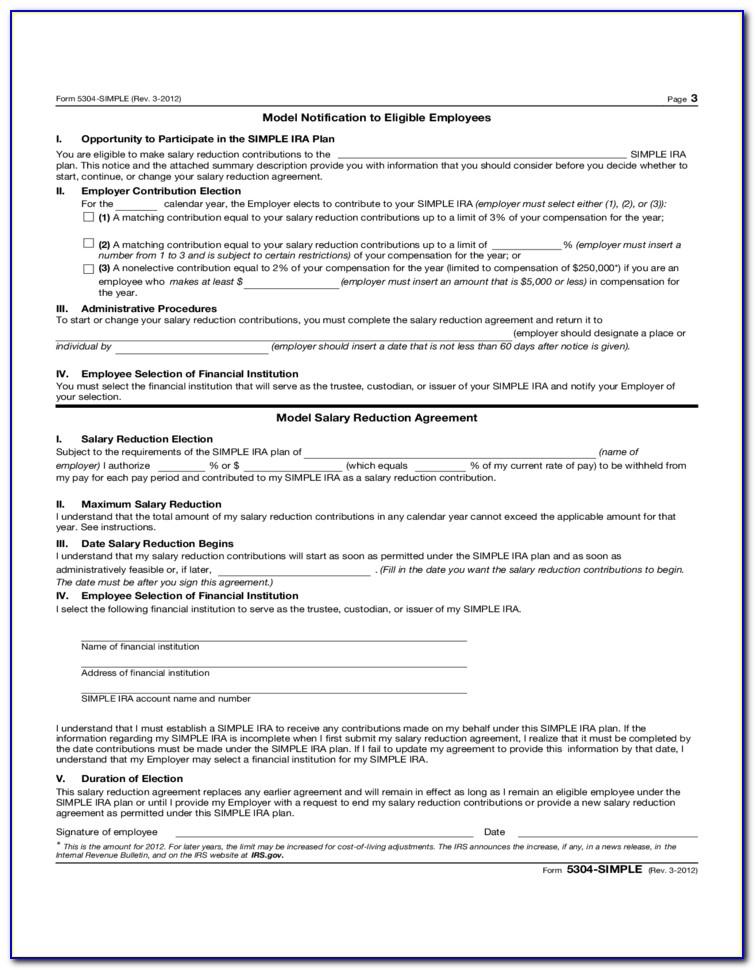

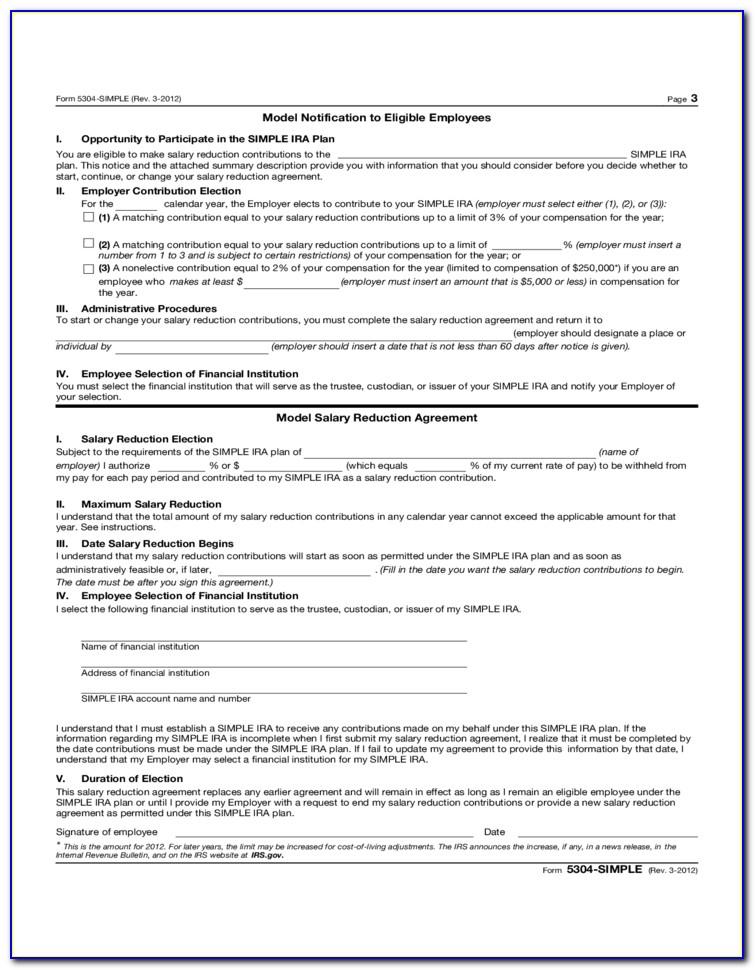

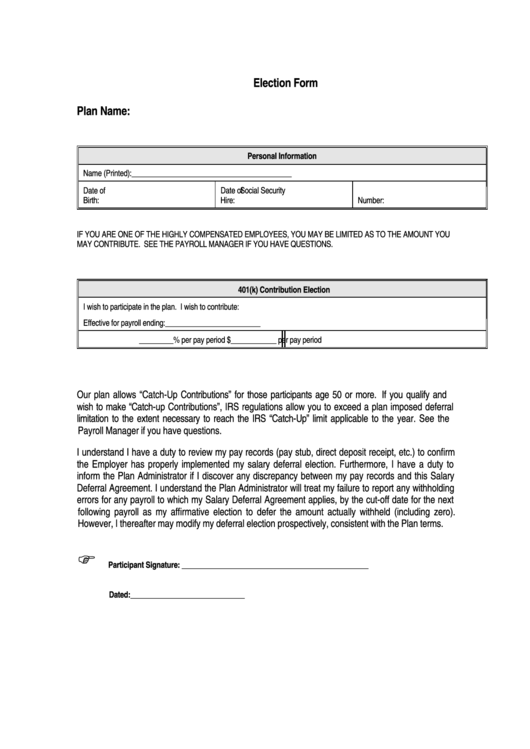

The Employer agrees to permit salary reduction contributions to be made in each calendar year to the SIMPLE IRA established by each employee who meets the following requirements select either 1a or 1b Full Eligibility All employees are eligible Limited Eligibility The salary reduction contributions under a SIMPLE IRA plan are elective deferrals that count toward the overall annual limit on elective deferrals an employee may make to this and other plans permitting elective deferrals employee contributions to a SIMPLE IRA plan are not deductible by participants from their income on their Form 1040

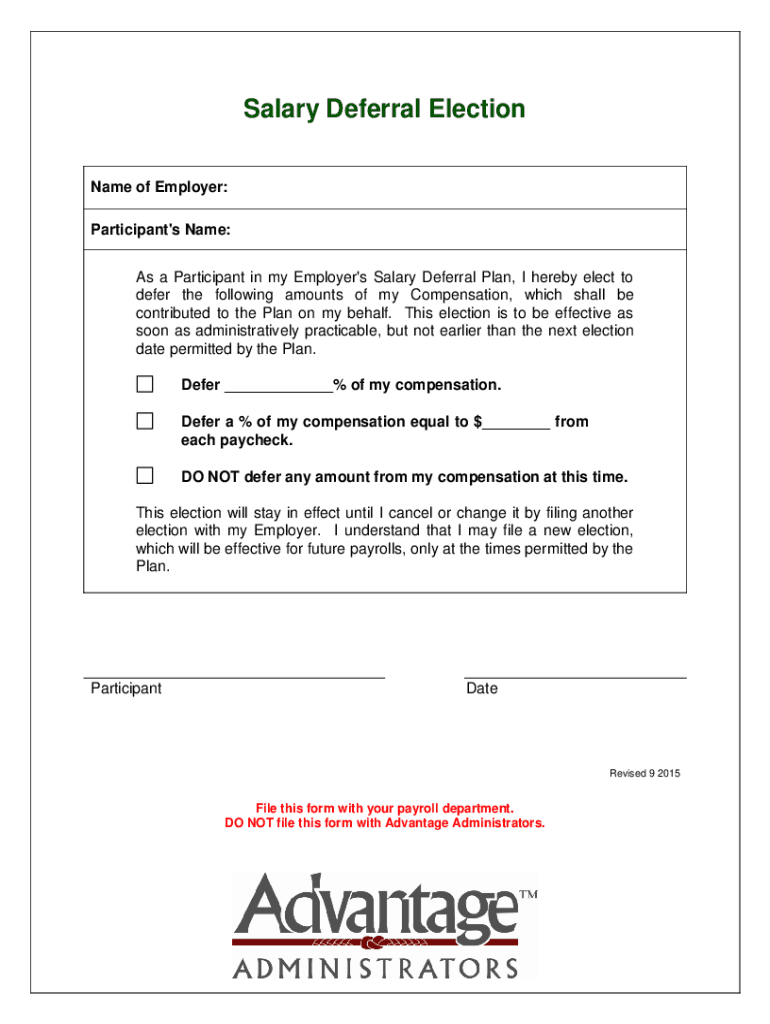

SIMPLE IRA Salary Deferral Election Do not send this form to American Funds Service Company or Capital Bank and Trust Company SM General information Please type or print clearly Name of employee Name of company Payroll election See the table at the bottom of this page for deferral and catch up limits Select one of the following five options SIMPLE IRA plan This form also can be used to or salary SIMPLE IRA deferral 3 match Total contribution Owner 80 000 14 000 2 165 16 165 Employee No 1 30 000 2 000 900 2 900 within a reasonable time before the 60 day election period ending on Dec 31 Please note that you

More picture related to Simple Ira Salary Deferral Election Printable Blank Form

Simple Ira Salary Deferral Election Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/240/850/240850536/large.png

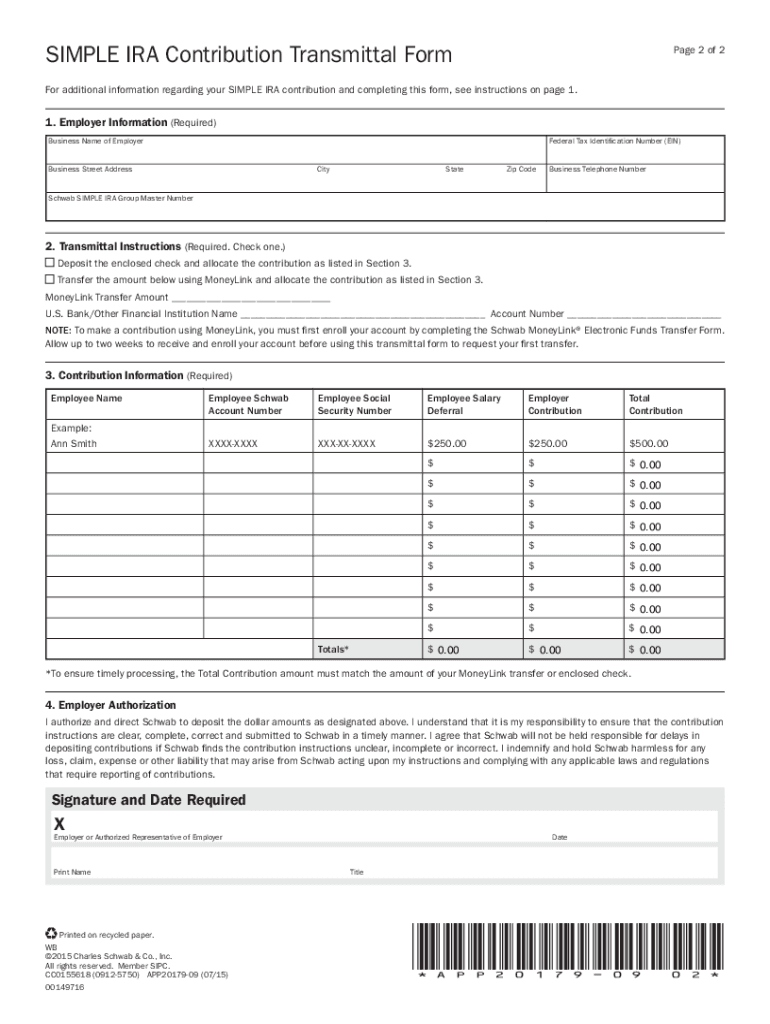

Simple IRA Contribution Transmittal Form 2015 2022 Fill And Sign Printable Template Online

https://www.pdffiller.com/preview/6/963/6963591/large.png

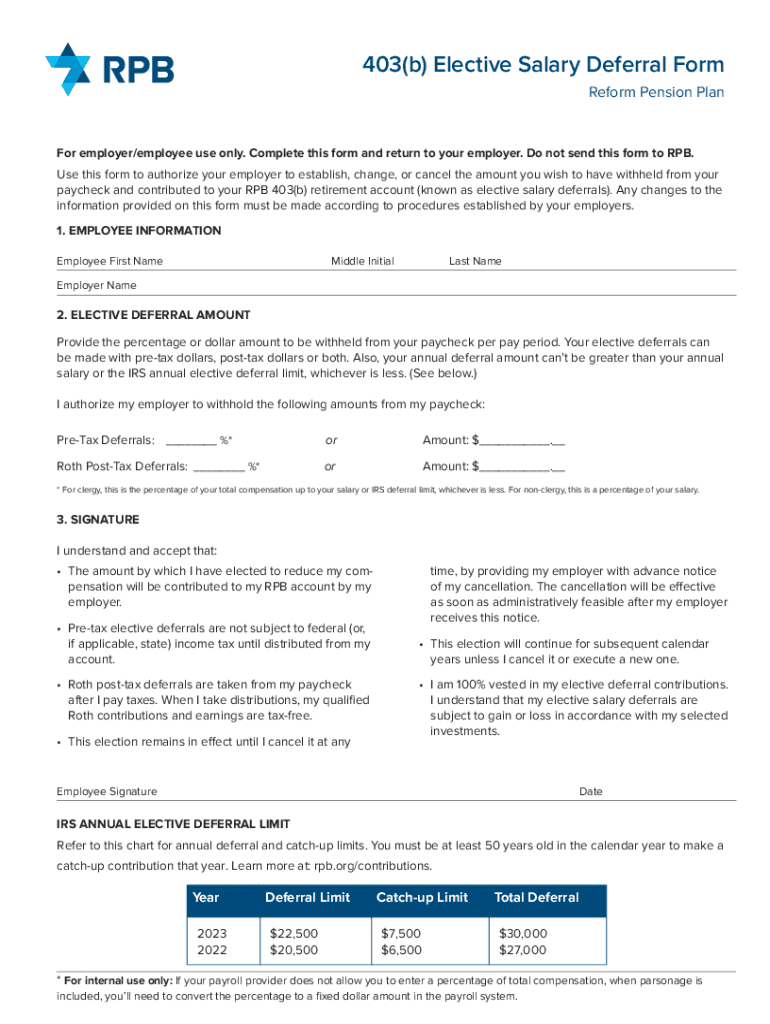

Fillable Online 403 b Elective Salary Deferral Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/671/453/671453986/large.png

Fill in print and save an online form IRA Withholding Election Form PDF Initiate a transfer or exchange from a 403 b salary deferral only Plan to a 403 b plan at another financial institution 403 b Transfer Out Form Employer Sponsored Plans Only PDF Employer of your selection Please use the Salary Deferral form provided by your Employer or Plan You must establish a SIMPLE IRA to receive any contributions made on your behalf under this SIMPLE IRA Plan If the information regarding your SIMPLE IRA is incomplete when you first submit your salary reduction agreement it must be completed by the

Download a blank fillable Simple Ira Salary Deferral Election in PDF format just by clicking the DOWNLOAD PDF button Open the file in any PDF viewing software Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content A Salary Reduction Agreement is an arrangement between your business and your employees Your employees can elect to withhold and deposit a portion of their paychecks into your business s SIMPLE IRA plan This form also can be used to have employees elect not to defer in to the plan The amount contributed under the arrangement is called an

Ira Single Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/385/100385165/large.png

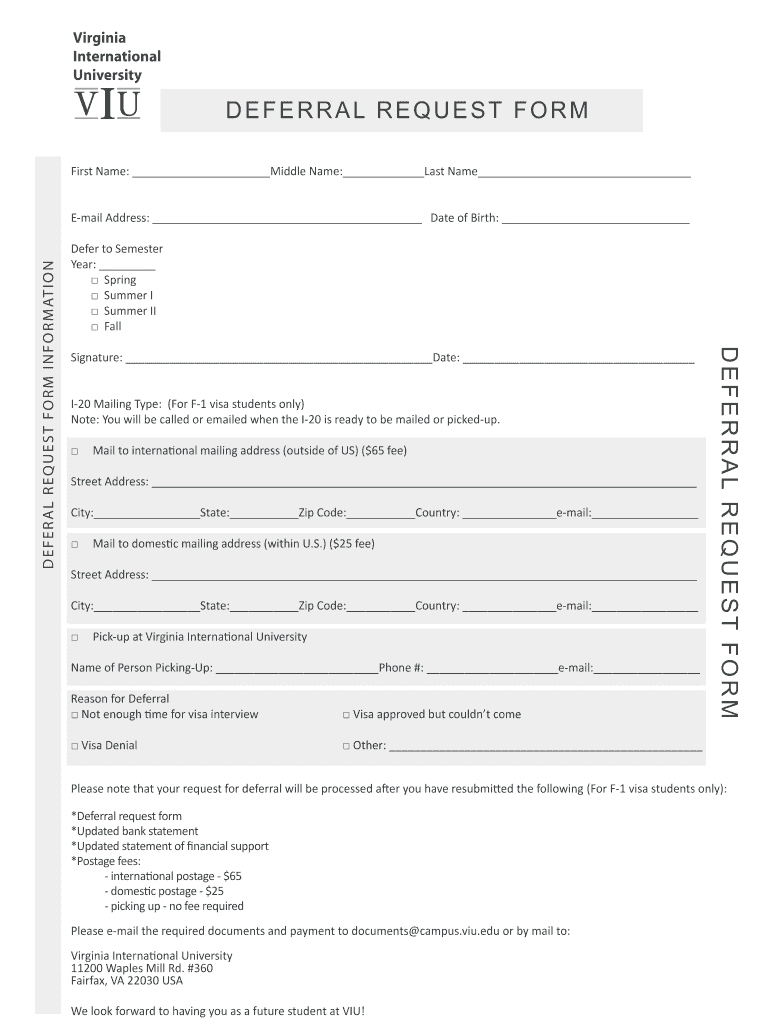

Deferral Request Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/1/28/1028659/large.png

https://www.edwardjones.com/sites/default/files/acquiadam/2022-12/LGL-11459C-A-Final.pdf

Employees who defer salary into other employer retirement plans such as 401 k or 403 b during the same calendar year are subject to a maximum deferral limit of If the employee chooses to defer salary the employee must provide the salary deferral elections to the employer

https://www.irs.gov/retirement-plans/plan-sponsor/simple-ira-plan

The Rockland matching contribution is 1 500 3 of 50 000 Therefore the total contribution to Elizabeth s SIMPLE IRA that year is 4 000 her 2 500 contribution plus Rockland s 1 500 contribution The financial institution holding Elizabeth s SIMPLE IRA has several investment choices and she is free to choose which ones suit her best

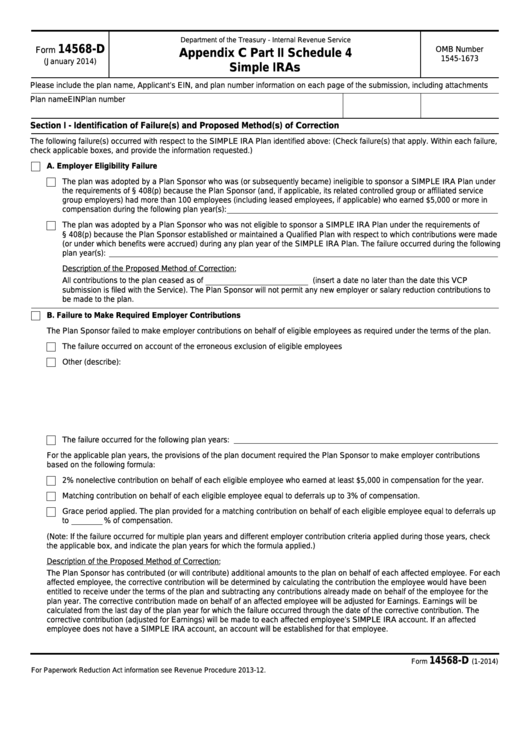

Fillable Form 14568 D Appendix C Part Ii Schedule 4 Simple Iras Printable Pdf Download

Ira Single Form Fill Out Sign Online DocHub

2019 Form Invesco IRA FRM 11 Fill Online Printable Fillable Blank PdfFiller

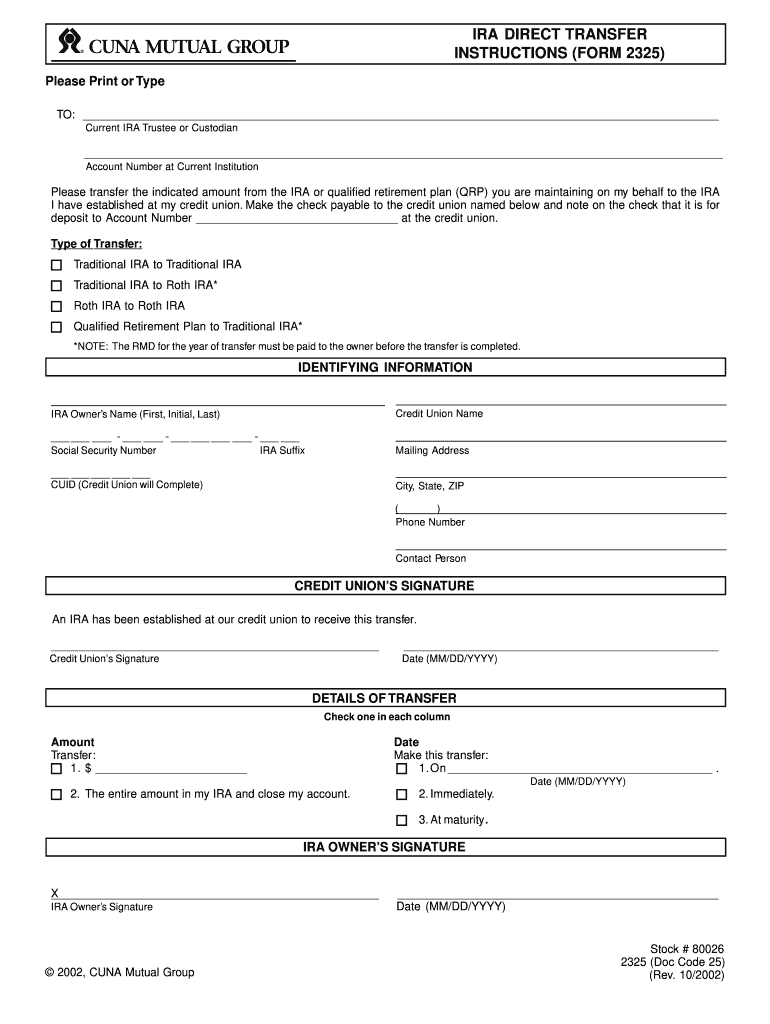

IRA Form 2325 2002 Fill And Sign Printable Template Online US Legal Forms

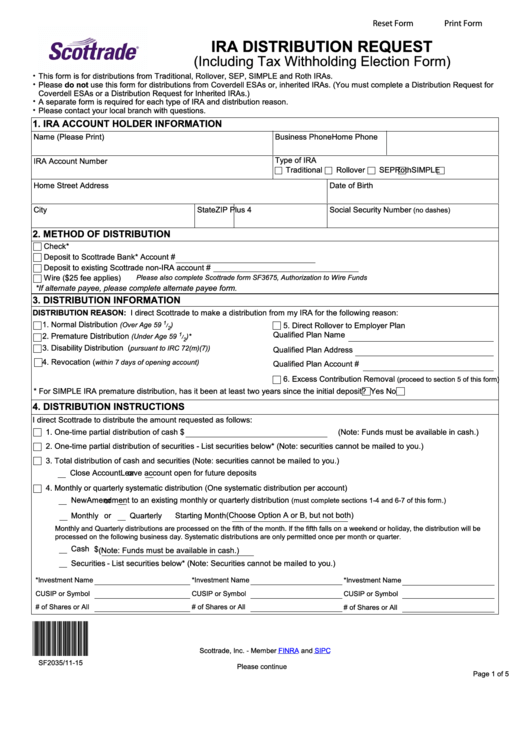

Fillable Ira Distribution Request Form Printable Pdf Download

Fillable Online Salary Deferral Election Sample Clauses Law Insider Fax Email Print PdfFiller

Fillable Online Salary Deferral Election Sample Clauses Law Insider Fax Email Print PdfFiller

401 K Deferral Election Form Printable Pdf Download

Salary Deferral Change Form Instructions

Ira Application Form Fill Online Printable Fillable Blank PdfFiller

Simple Ira Salary Deferral Election Printable Blank Form - SIMPLE IRA plan This form also can be used to or salary SIMPLE IRA deferral 3 match Total contribution Owner 80 000 14 000 2 165 16 165 Employee No 1 30 000 2 000 900 2 900 within a reasonable time before the 60 day election period ending on Dec 31 Please note that you