State Income Tax Arkansas Forms Printable Arkansas has a state income tax that ranges between 2 and 4 9 which is administered by the Arkansas Department of Revenue TaxFormFinder provides printable PDF copies of 40 current Arkansas income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 31

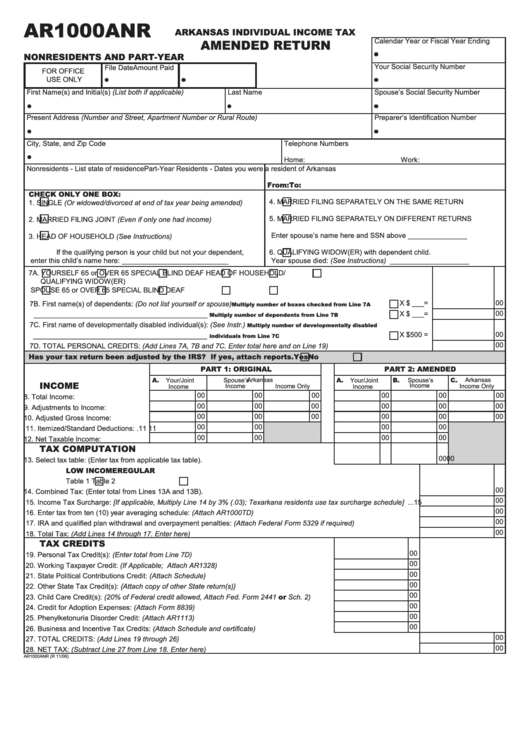

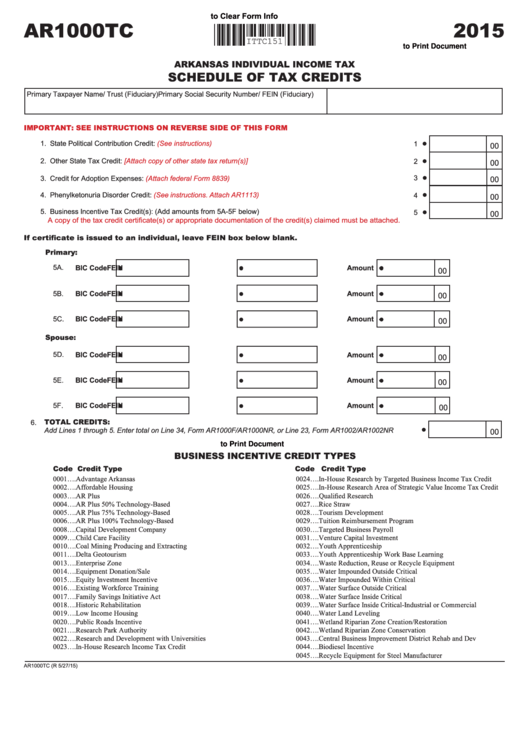

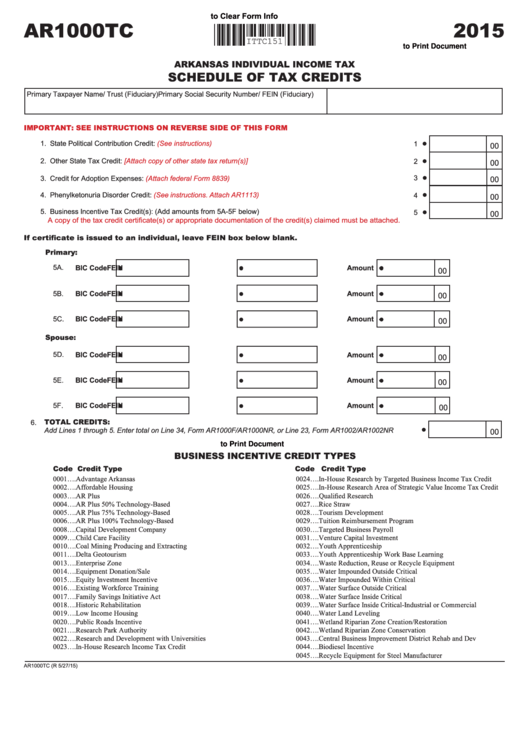

AR1000NR Part Year or Non Resident Individual Income Tax Return 01 04 2022 AR1000 OD Organ Donor Donation 01 04 2022 AR1000RC5 Individuals With Developmental Disabilites Certificate 01 04 2022 AR1000TC Schedule of Tax Credits and Business Incentive Credits 11 18 2022 AR1000TC Schedule of Tax Credits and Business Incentive Credits TAX HELP AND FORMS Internet You can access the Department of Finance and Administration s website atwww dfa arkansas gov Check the status of your refund Get current and prior year forms and instructions Access latest income tax info and archived news Get e file information You can e mail questions to individual income dfa arkansas gov

State Income Tax Arkansas Forms Printable

State Income Tax Arkansas Forms Printable

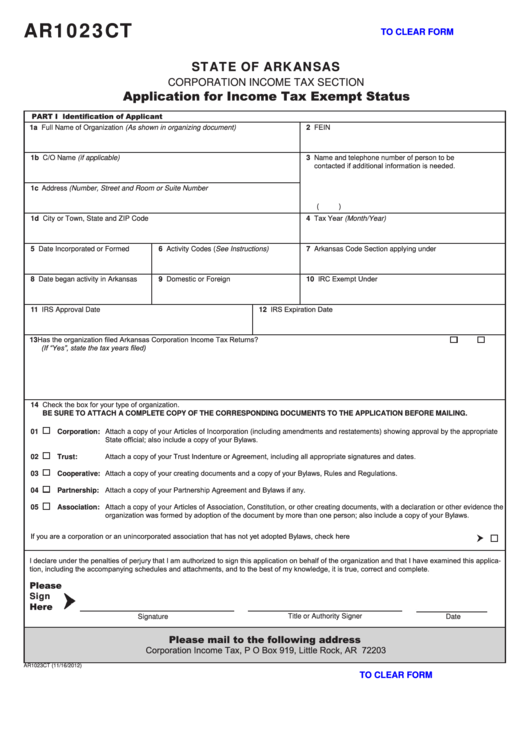

https://data.formsbank.com/pdf_docs_html/334/3341/334100/page_1_thumb_big.png

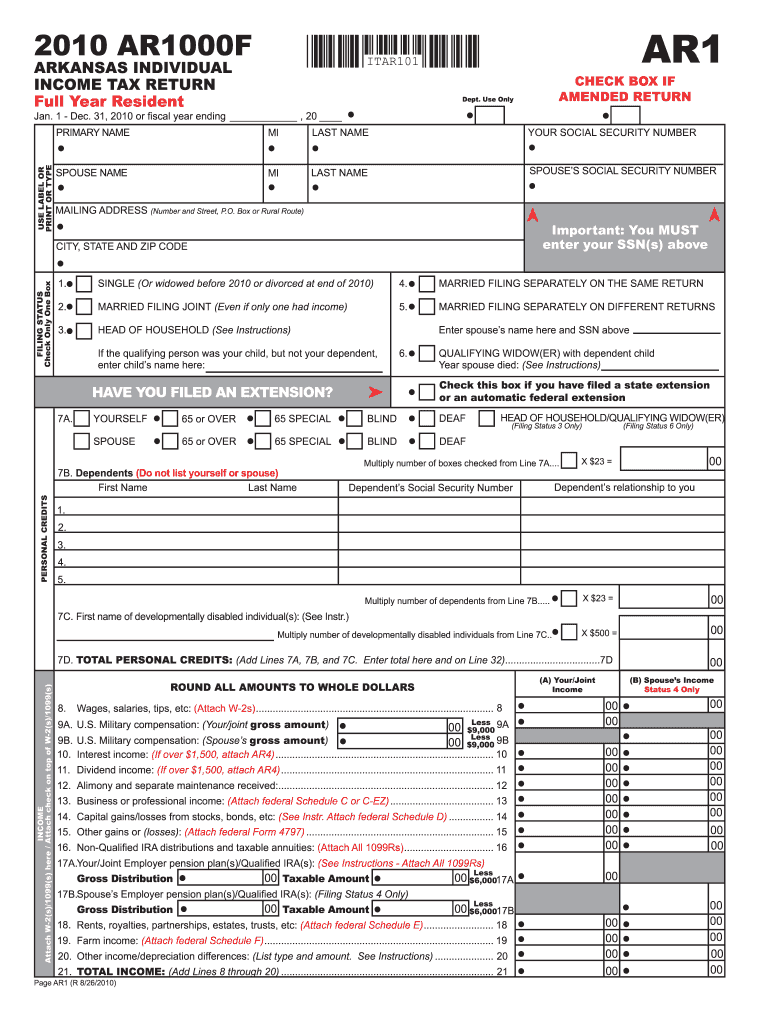

Individual Income Tax Return Arkansas Free Download

http://www.formsbirds.com/formimg/individual-income-tax/4003/individual-income-tax-return-arkansas-l2.png

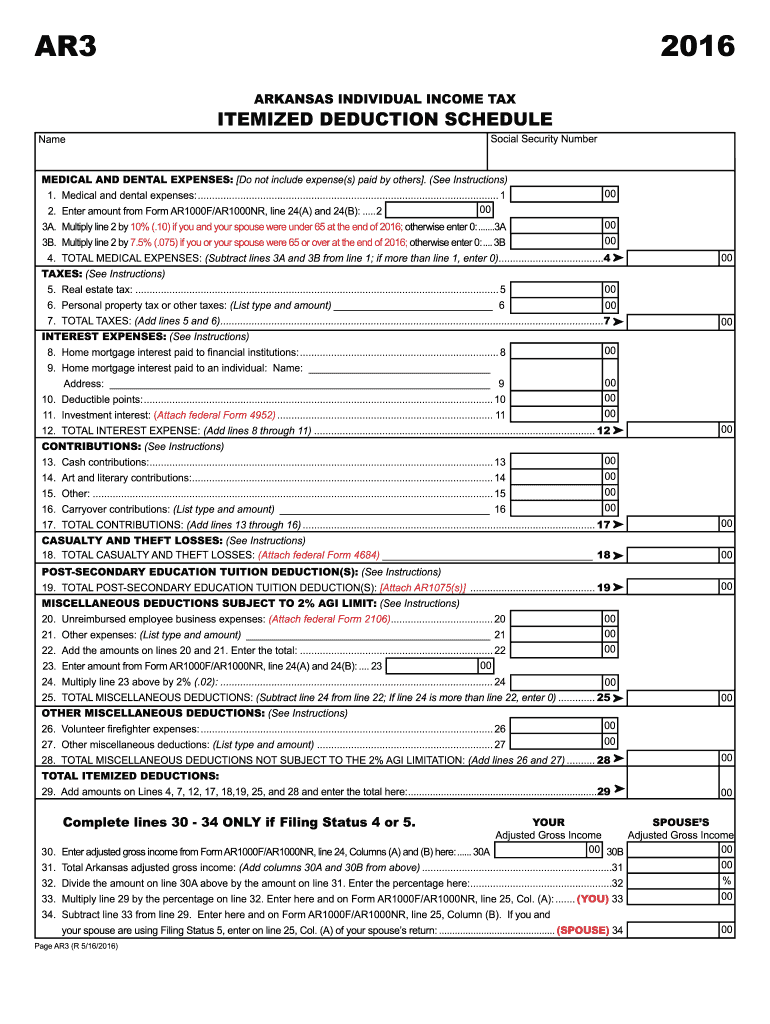

Tax Ar3 2016 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/101/156/101156688/large.png

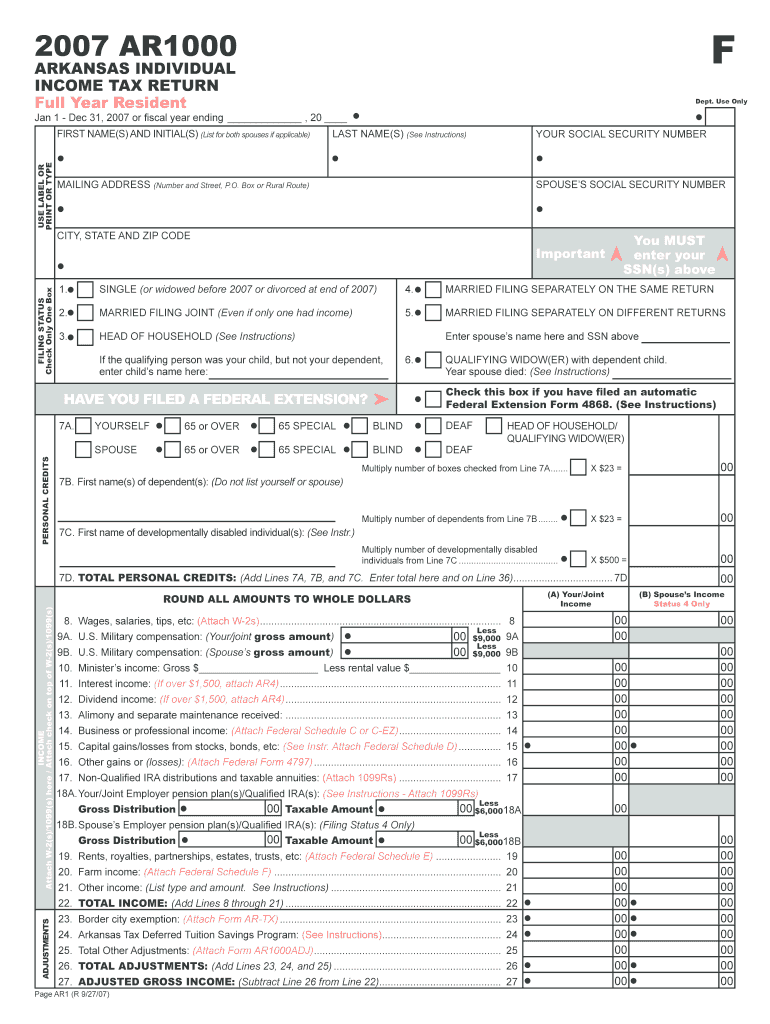

Access latest income tax info and archived news Get e file information You can e mail questions to individual income dfa arkansas gov Mail Choose the appropriate address below to mail your return TAX DUE RETURN Arkansas State Income Tax P O Box 2144 Little Rock AR 72203 2144 REFUND RETURN Arkansas State Income Tax P O Box 1000 Download and fill out the 2022 AR1000F form to file your income tax return as a full year resident of Arkansas Learn about the tax credits deductions and exemptions that may apply to you You can also find the instructions and other related forms on the Department of Finance and Administration website

ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident We will no longer automatically mail 1099 G forms Instead we ask that you get this information from our website ZLWKKHOG Attach state copies of W 2 and or 1099R W2 G 39 40 VWLPDWHG WD SDLG RU FUHGLW EURXJKW IRUZDUG IURP 40 Arkansas has a state income tax that ranges between 2 and 4 9 For your convenience Tax Brackets provides printable copies of 40 current personal income tax forms from the Arkansas Department of Revenue The current tax year is 2023 with tax returns due in April 2024 Most states will release updated tax forms between January and April

More picture related to State Income Tax Arkansas Forms Printable

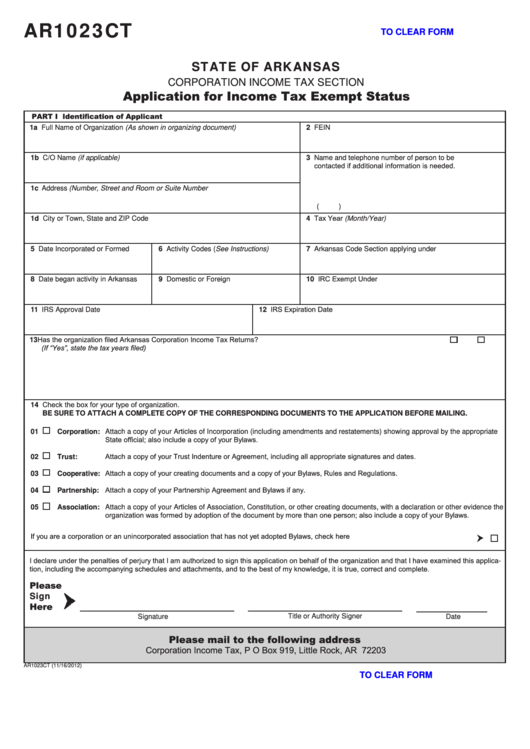

Arkansas Et 1 Form Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/100/63/100063475/large.png

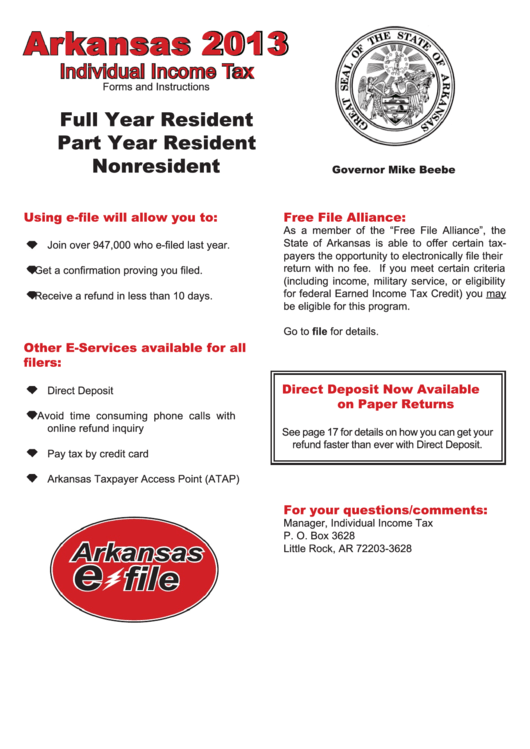

Arkansas Individual Income Tax Forms And Instructions 2013 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/361/3619/361985/page_1_thumb_big.png

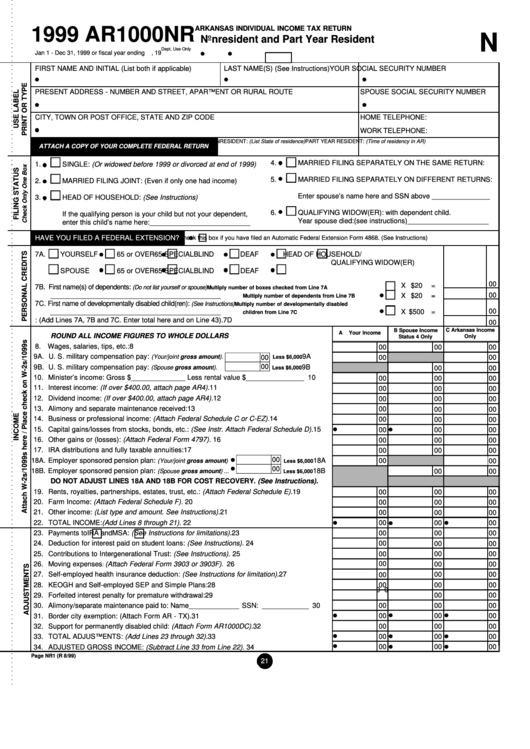

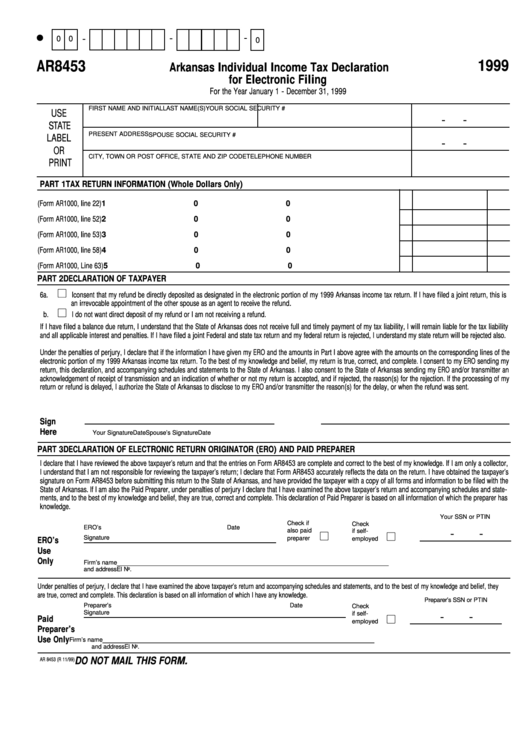

Form Ar1000nr Arkansas Individual Income Tax Return Nonresident And Part Year Resident 1999

https://data.formsbank.com/pdf_docs_html/271/2714/271481/page_1_thumb_big.png

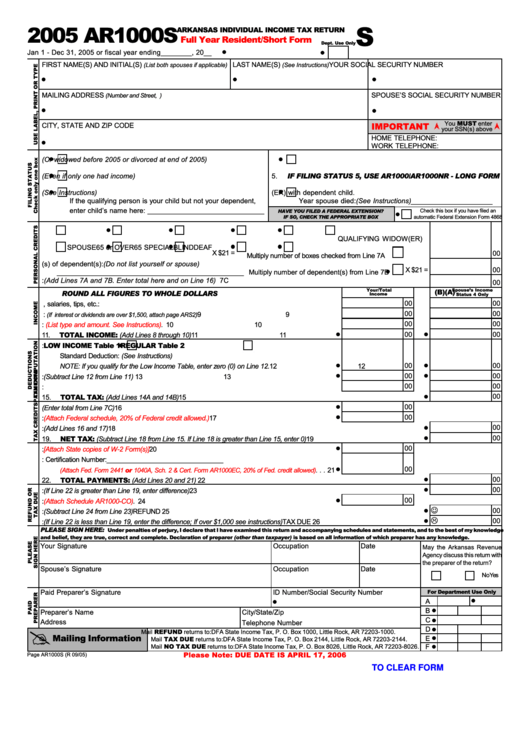

A HDHP will have the following deductions and limitations 1 for self only coverage the minimum deductible is 1 100 and the maximum out of pocket expense is 5 500 and 2 for family coverage the minimum deductible is 2 200 and the maximum out of pocket expense is 11 000 City State Zip Telephone Number Mail REFUND returns to DFA State Income Tax P O Box 1000 Little Rock AR 72203 1000 Mail TAX DUE returns to DFA State Income Tax P O Box 2144 Little Rock AR 72203 2144 Mail NO TAX DUE returns to DFA State Income Tax P O Box 8026 Little Rock AR 72203 8026 A May the Arkansas Revenue

Mail REFUND returns to DFA State Income Tax P O Box 1000 Little Rock AR 72203 1000 Mail TAX DUE returns to DFA State Income Tax P O Box 2144 Little Rock AR 72203 2144 Mail NO TAX DUE returns to DFA State Income Tax P O Box 8026 Little Rock AR 72203 8026 For Department Use Only A May the Arkansas Revenue Agency discuss Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state s revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer s entire liability

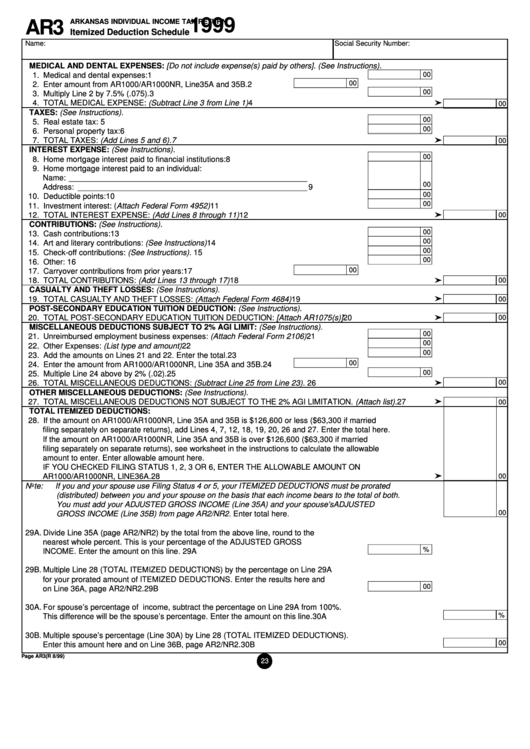

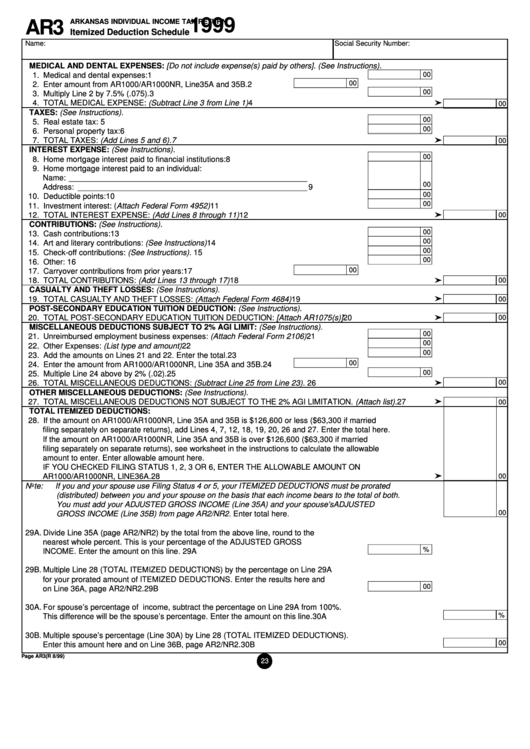

Form Ar3 Arkansas Individual Income Tax Return Itemized Deduction Schedule 1999 Printable

https://data.formsbank.com/pdf_docs_html/280/2809/280947/page_1_thumb_big.png

Arkansas State Income Tax Forms Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/0/100/100374/large.png

https://www.taxformfinder.org/arkansas

Arkansas has a state income tax that ranges between 2 and 4 9 which is administered by the Arkansas Department of Revenue TaxFormFinder provides printable PDF copies of 40 current Arkansas income tax forms The current tax year is 2023 and most states will release updated tax forms between January and April of 2024 Individual Income Tax 31

https://www.dfa.arkansas.gov/income-tax/individual-income-tax/forms/2021-tax-year-forms

AR1000NR Part Year or Non Resident Individual Income Tax Return 01 04 2022 AR1000 OD Organ Donor Donation 01 04 2022 AR1000RC5 Individuals With Developmental Disabilites Certificate 01 04 2022 AR1000TC Schedule of Tax Credits and Business Incentive Credits 11 18 2022 AR1000TC Schedule of Tax Credits and Business Incentive Credits

Form Ar1000anr Arkansas Individual Income Tax Amended Return Printable Pdf Download

Form Ar3 Arkansas Individual Income Tax Return Itemized Deduction Schedule 1999 Printable

Printable Arkansas State Income Tax Forms Printable Forms Free Online

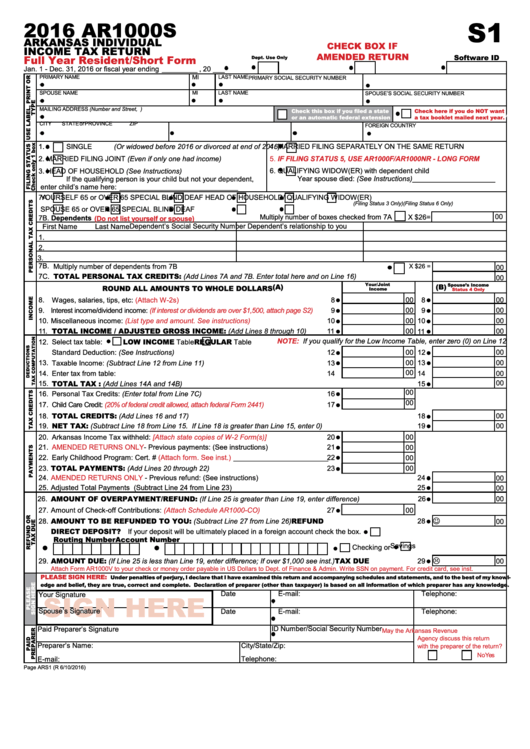

Form Ar1000s Arkansas Individual Income Tax Return 2016 Printable Pdf Download

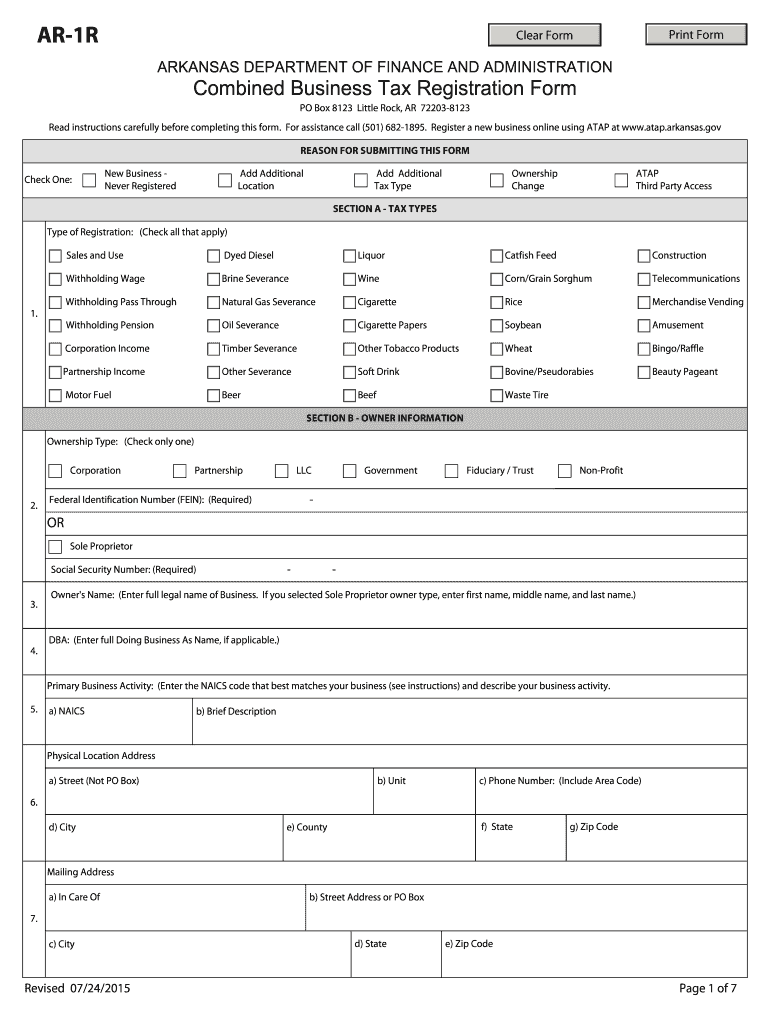

2015 2023 Form AR DFA AR 1R Fill Online Printable Fillable Blank PdfFiller

Fillable Form Ar1000tc Schedule Of Tax Credits Arkansas Individual Income Tax 2015

Fillable Form Ar1000tc Schedule Of Tax Credits Arkansas Individual Income Tax 2015

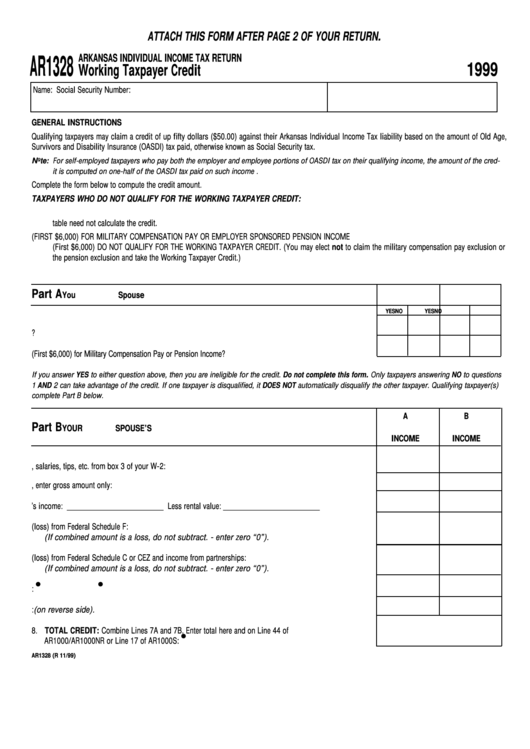

Form Ar1328 Arkansas Individual Income Tax Return Printable Pdf Download

F AR1000 ARKANSAS INDIVIDUAL INCOME TAX RETURN Full Year Resident Dept Arkansas Fill Out And

Arkansas State Tax Forms Printable Printable Forms Free Online

State Income Tax Arkansas Forms Printable - Employee File this form with your employer Otherwise your employer must withhold state income tax from your wages without exemptions or dependents Employer Keep this certificate with your records How to Claim Your Withholding Number of Exemptions See instructions below Claimed