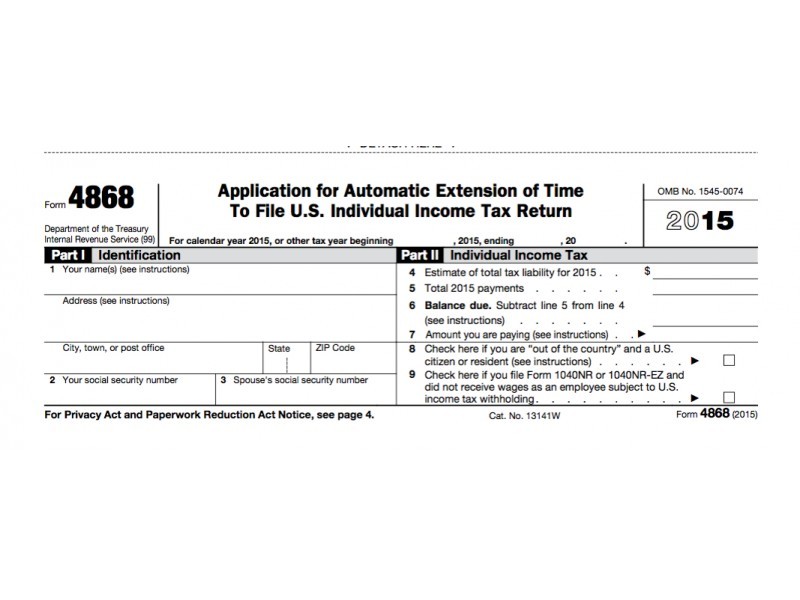

Tax Extension Form 4868 Printable Irs Gov The fastest and easiest way to get an extension is through IRS Free File on IRS gov Taxpayers can electronically request an extension on Form 4868 PDF Filing this form gives taxpayers until October 17 to file their tax return To get the extension taxpayers must estimate their tax liability on this form and should timely pay any amount due

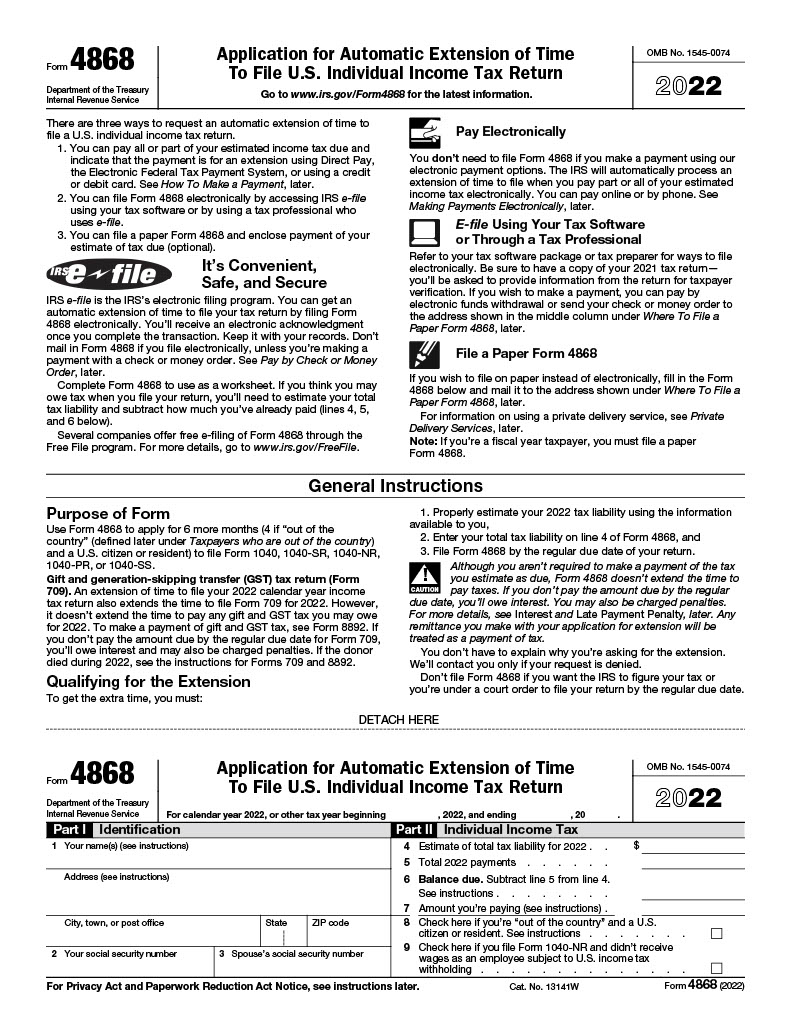

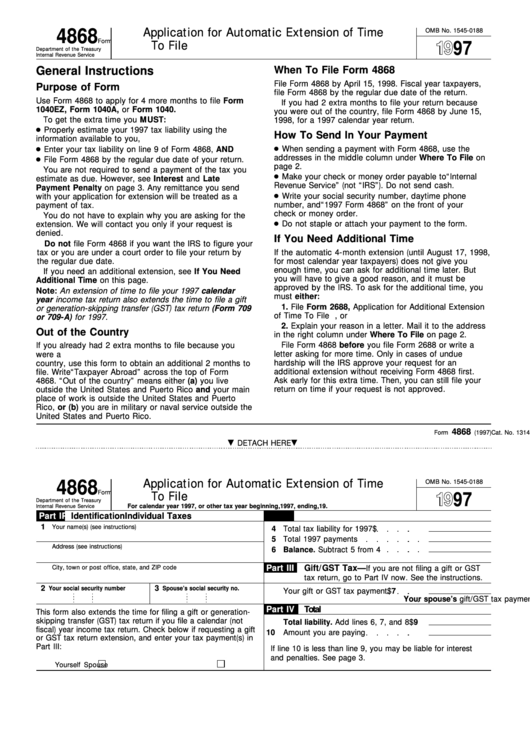

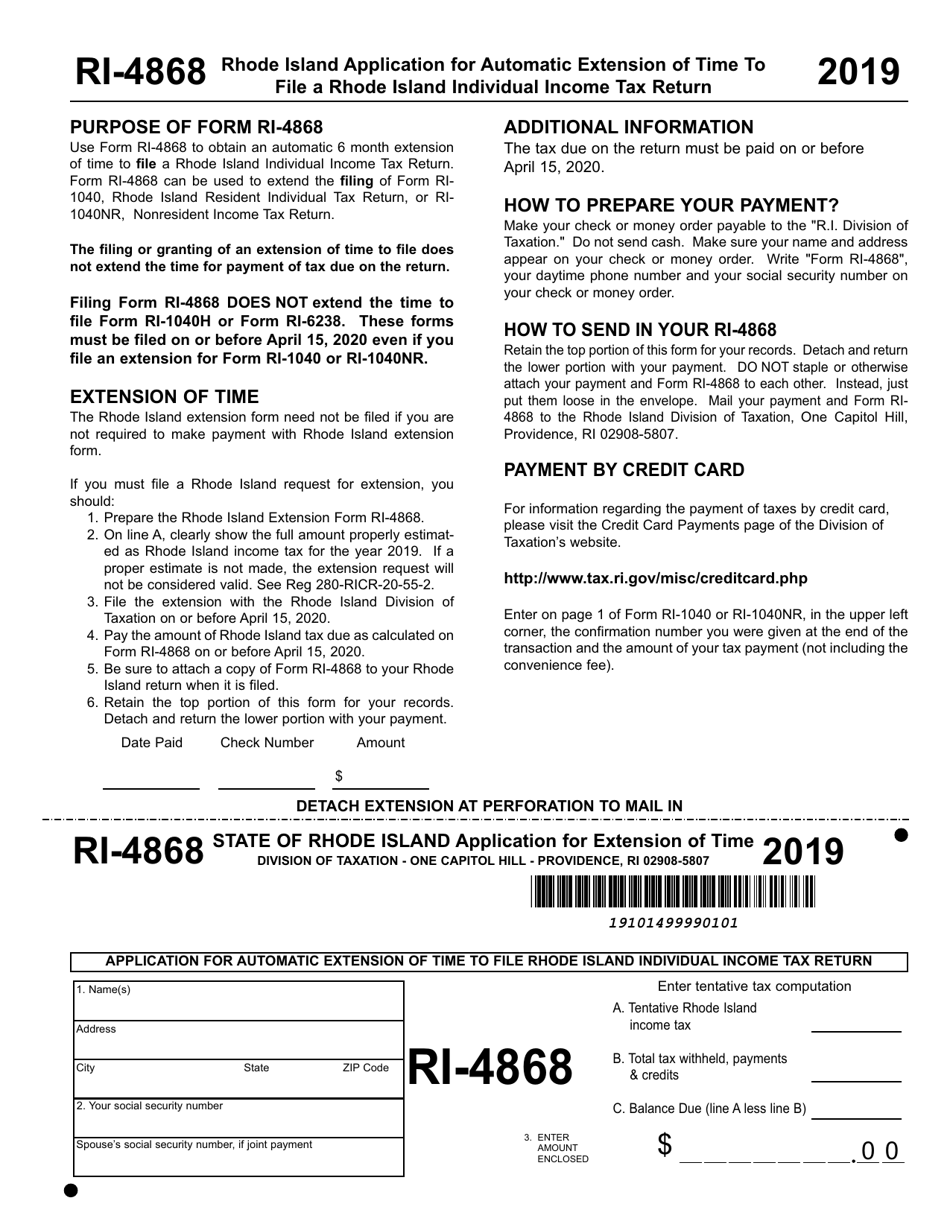

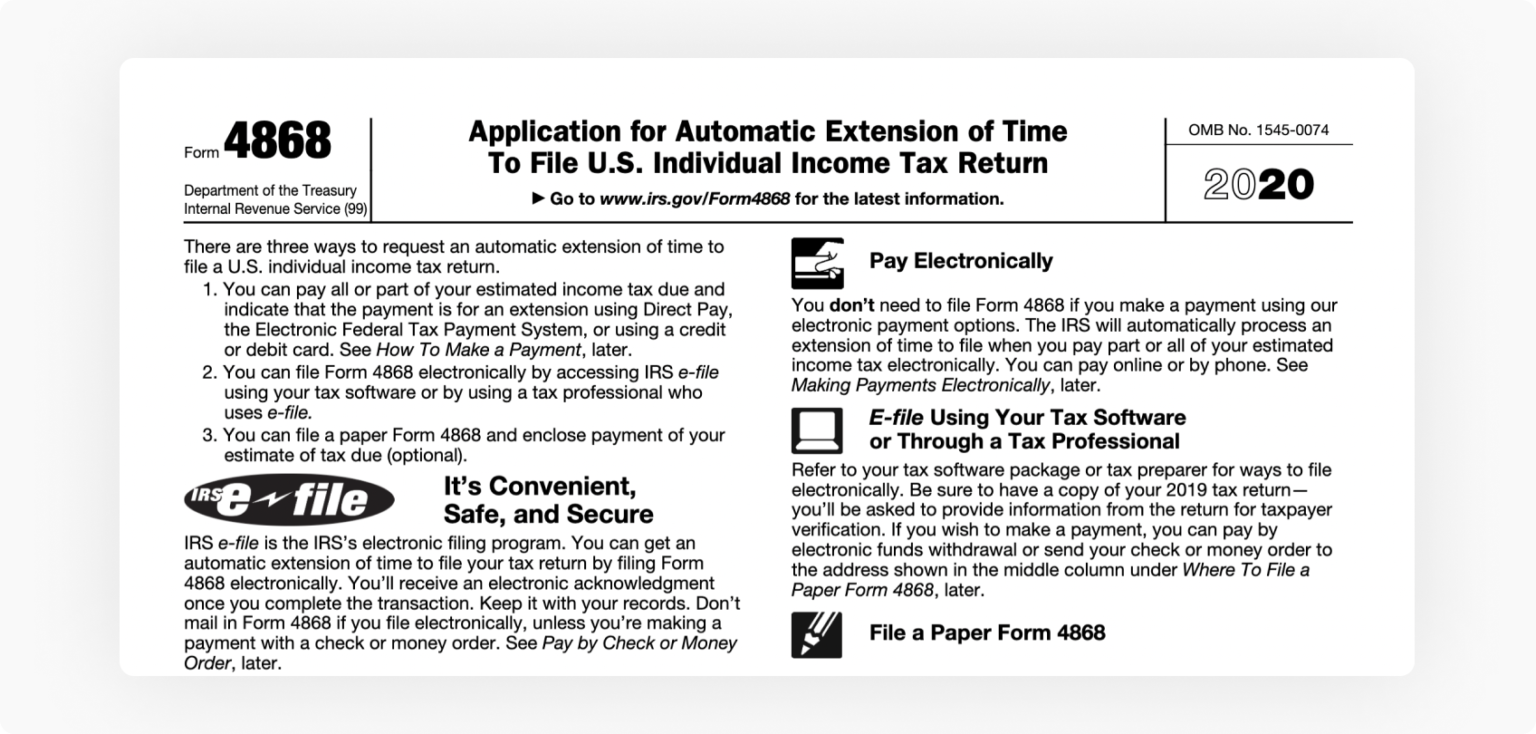

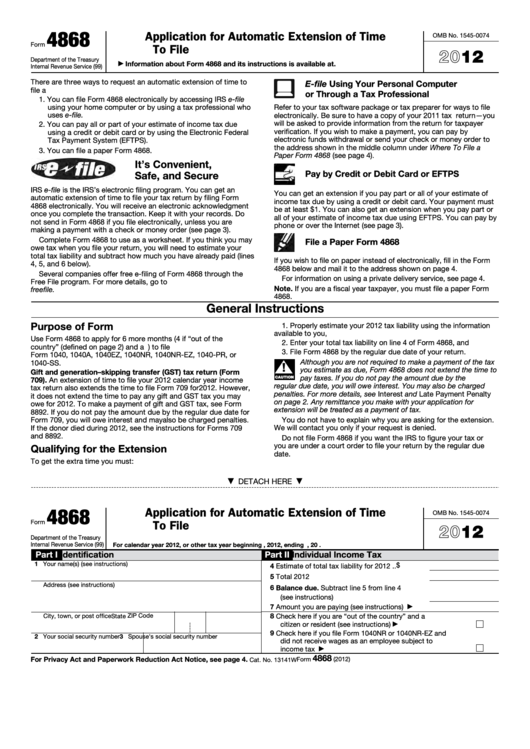

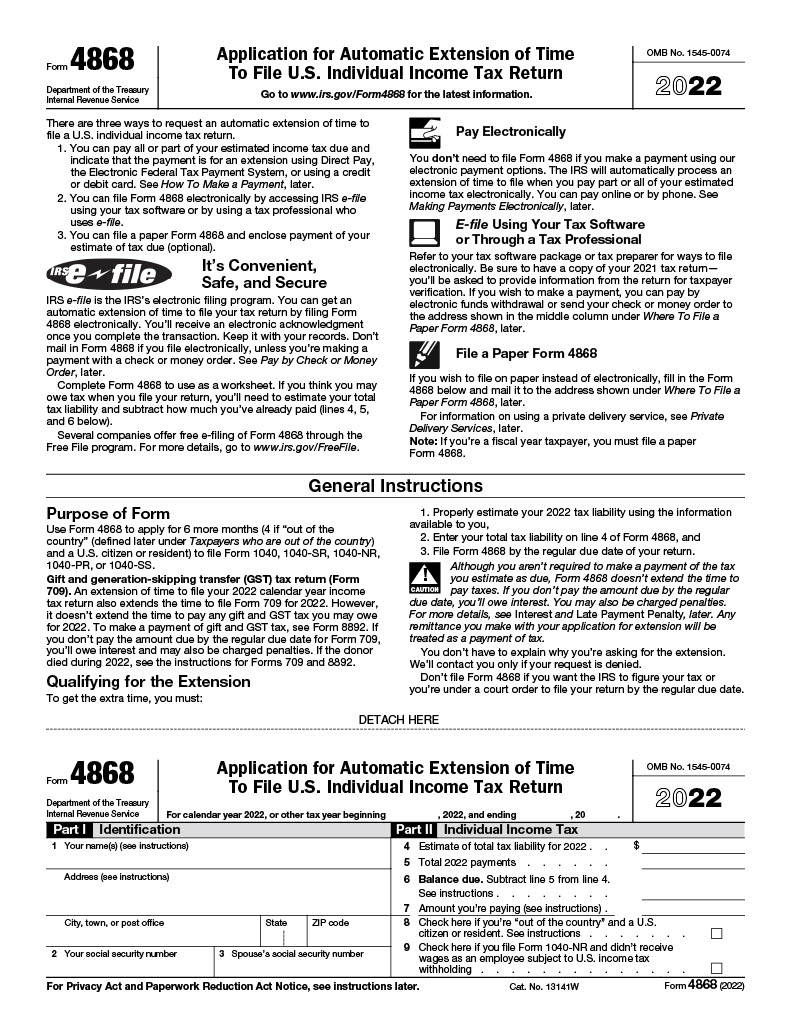

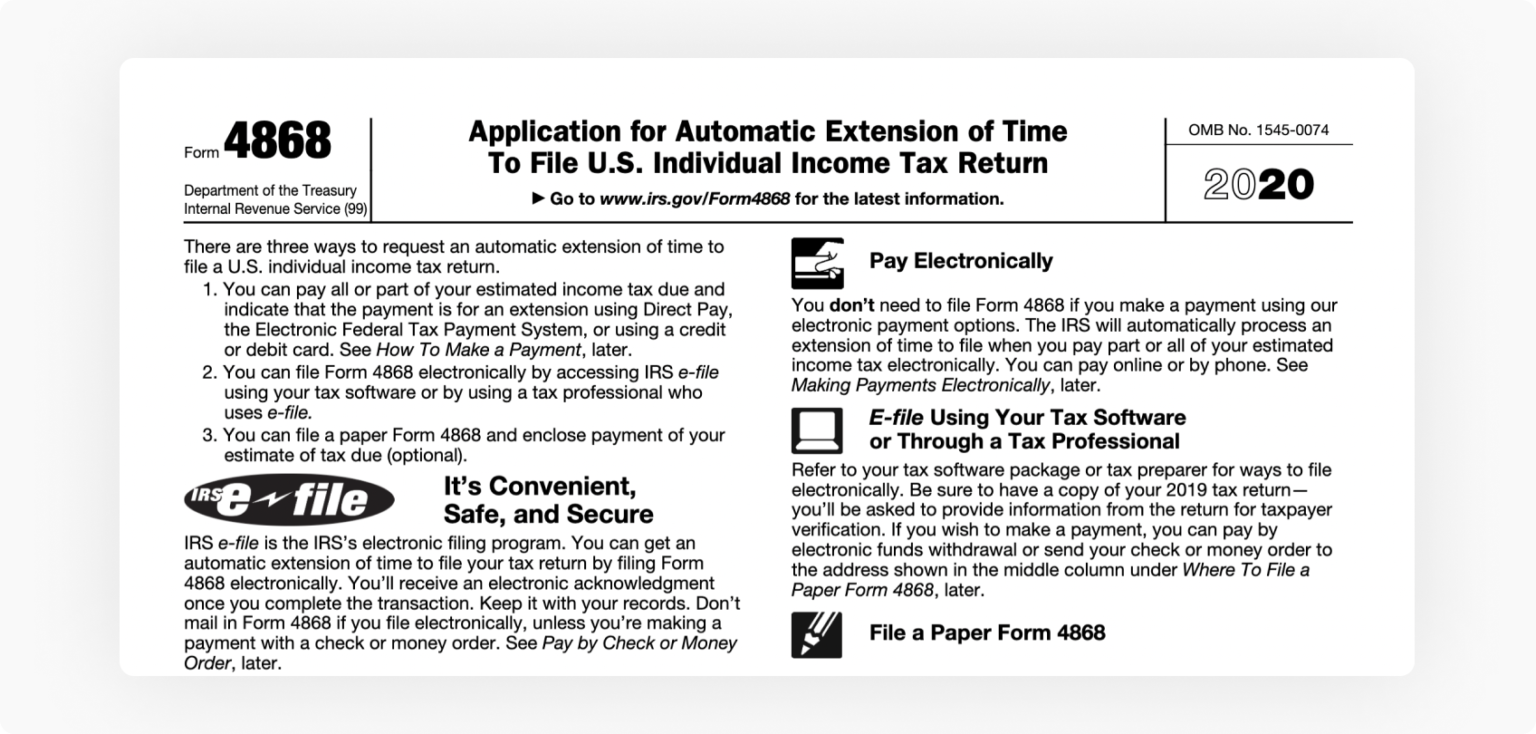

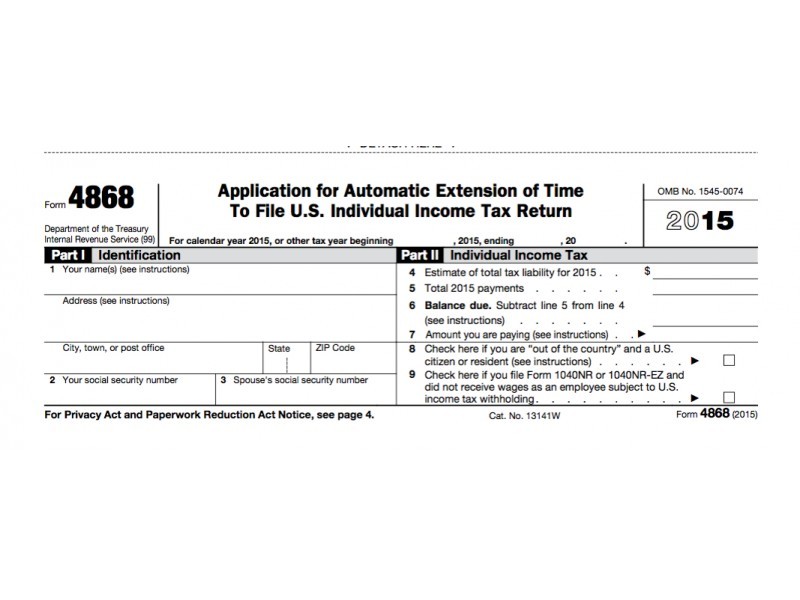

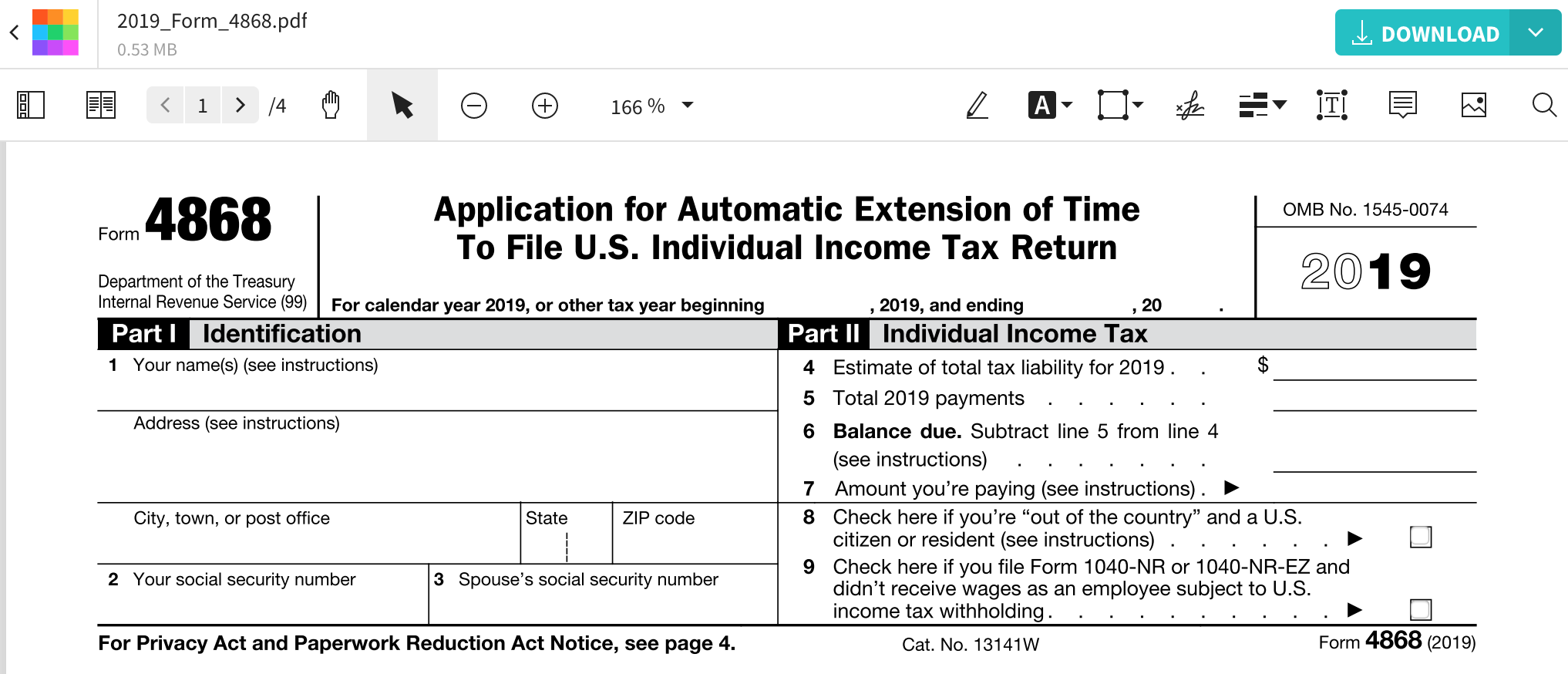

What is Form 4868 IRS Form 4868 also known as an Application for Automatic Extension of Time to File is a form that taxpayers can submit to the IRS if they need more time to Extensions for individual returns There are several ways to request an automatic extension of time to file your return Electronically file or mail an Form 4868 Application for Automatic Extension of Time to File U S Individual Income Tax Return You ll receive an acknowledgment or confirmation number for your records

Tax Extension Form 4868 Printable Irs Gov

Tax Extension Form 4868 Printable Irs Gov

https://www.irs.gov/pub/xml_bc/33751005.gif

IRS Form 4868 Extension Printable 4868 Form 2023

https://irstax-forms.com/wp-content/uploads/2023/04/IRS-Form-4868-Extension-Printable1024_1.jpg

Printable Form 4868

https://data.formsbank.com/pdf_docs_html/287/2871/287186/page_1_thumb_big.png

The Bottom Line Form 4868 is available to any U S taxpayer needing extra time to file their federal tax return By completing and sending it to the IRS they will receive a six month tax return Form 4868 is known as the Application for Automatic Extension of Time to File U S Individual Income Tax Return When you complete the form the IRS will automatically grant you a six month tax extension some businesses only get a five month extension Anyone can qualify for an automatic federal tax extension

The filing deadline for Form 4868 is April 15 2024 the date you would have filed your income tax return Where to file form 4868 You can file a paper Form 4868 along with an enclosed tax payment in the form of a check or money order to one of the following addresses provided by the IRS Which address you end up sending to will depend on Form 4868 is the IRS form you complete to receive an automatic extension to file your return You can file a tax extension online in one of several ways with H R Block While you won t be filling out the paper Form 4868 line by line your tax extension information will be sent online to the IRS

More picture related to Tax Extension Form 4868 Printable Irs Gov

Printable Form 4868

https://data.templateroller.com/pdf_docs_html/2060/20603/2060350/form-ri-4868-application-for-extension-of-time-rhode-island_print_big.png

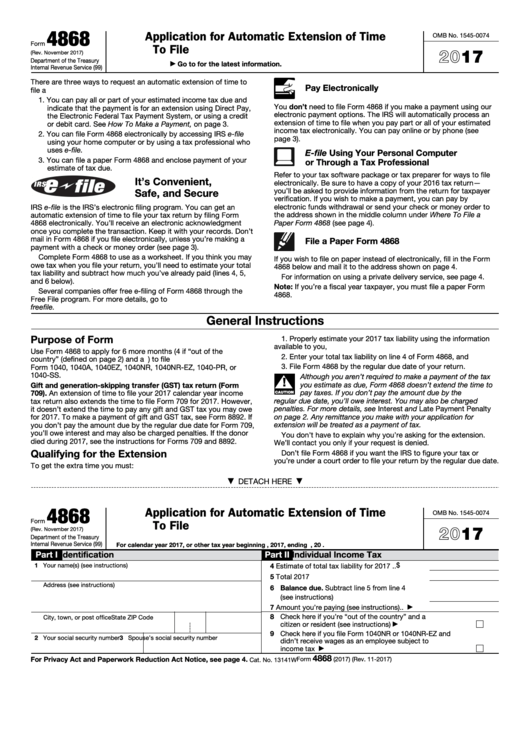

Fillable Online Printable IRS Form 4868 Income Tax Extension Tax Year 2017 Fax Email Print

https://www.pdffiller.com/preview/648/719/648719667/large.png

File Personal Tax Extension 2021 IRS Form 4868 Online

https://www.expressextension.com/Content/Images/newImages/personalTaxExtension.png

Obtain IRS Form 4868 You can get a copy of Form 4868 from the IRS website Fill out the form Provide your personal information estimated tax liability and any payments you ve A tax extension is a request for additional time to file your federal income tax return with the IRS Tax extensions can help you avoid incurring a late filing penalty You can submit Form 4868 to

Extension the withdrawal information will be sent b Pay by credit card You can use your credit card and pay by phone by contacting one of the IRS approved service providers c Mail in your payment with your Form 4868 The form will print with your draft tax return Mail the form with your payment by check or money order Filing Form 4868 for a federal tax filing extension allows all taxpayers to postpone filing their taxes until October 16th 2023 2 Even if you don t owe taxes you may still be required to file a tax return If you can t file your return by the deadline filing an extension can help you avoid failure to file penalties

Irs form 4868 application for automatic extension of time to file individual income tax return

https://blog.pdffiller.com/app/uploads/2021/12/irs-form-4868-application-for-automatic-extension-of-time-to-file-individual-income-tax-return-1536x734.png

Fillable Form 4868 Application For Automatic Extension Of Time To File U s Individual Income

https://data.formsbank.com/pdf_docs_html/337/3374/337472/page_1_thumb_big.png

https://www.irs.gov/newsroom/get-an-automatic-six-more-months-to-file-all-taxpayers-can-use-irs-free-file-to-request-an-extension

The fastest and easiest way to get an extension is through IRS Free File on IRS gov Taxpayers can electronically request an extension on Form 4868 PDF Filing this form gives taxpayers until October 17 to file their tax return To get the extension taxpayers must estimate their tax liability on this form and should timely pay any amount due

https://www.nerdwallet.com/article/taxes/form-4868-tax-extension-form

What is Form 4868 IRS Form 4868 also known as an Application for Automatic Extension of Time to File is a form that taxpayers can submit to the IRS if they need more time to

IRS File For Tax Extension How To Apply And Where To Apply To IRS Form 4868 AS USA

Irs form 4868 application for automatic extension of time to file individual income tax return

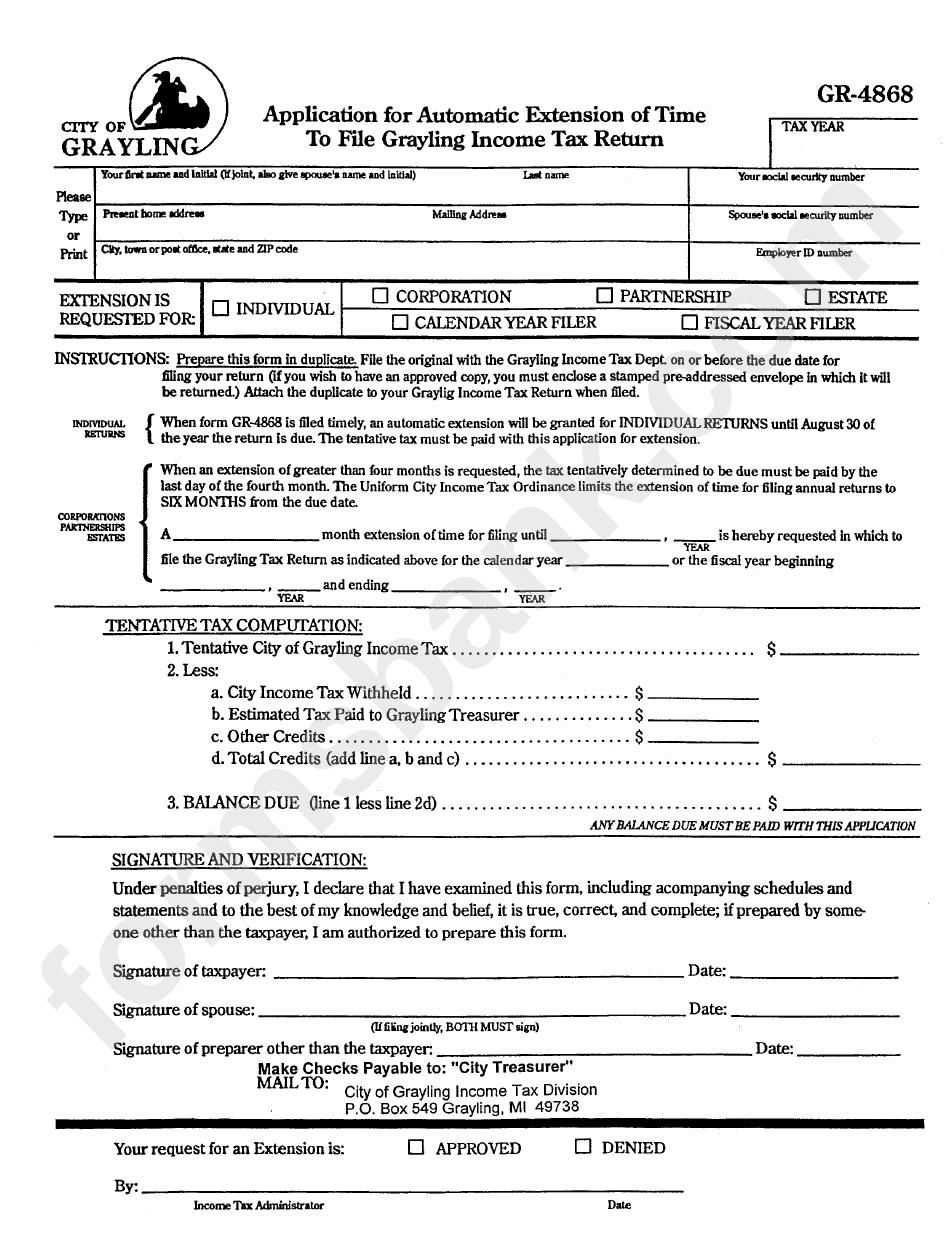

Form Gr 4868 Application For Automatic Extension Of Time To File Grayling Income Tax Return

Form 4868 Printable

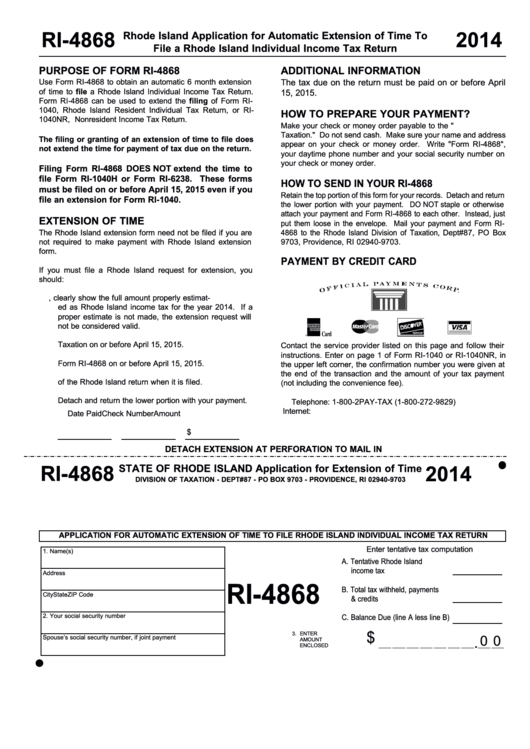

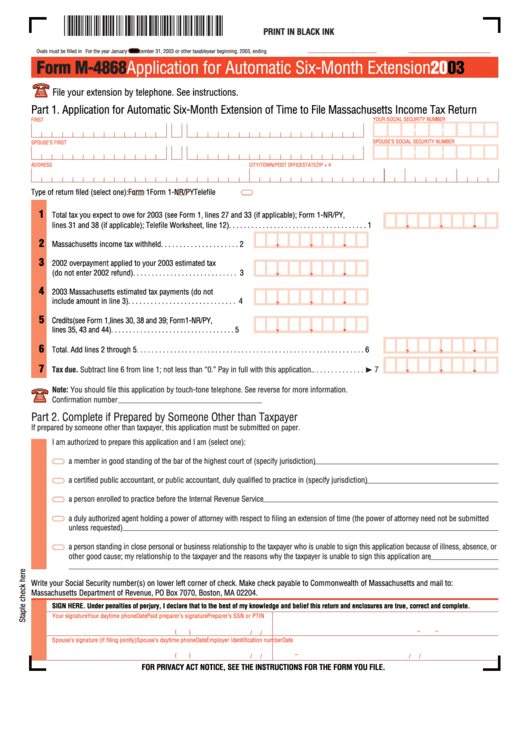

Form M 4868 Application For Automatic Six Month Extension 2003 Printable Pdf Download

IRS Form 4868 Extension For 2016 Tax Deadline In NJ Little Silver NJ Patch

IRS Form 4868 Extension For 2016 Tax Deadline In NJ Little Silver NJ Patch

Form 4868 Fill IRS Extension Form Online For Free Smallpdf

Fillable Form 4868 Application For Automatic Extension Of Time To File U s Individual Income

Form 4868 IRS Tax Extension Fill Out Online PDF FormSwift

Tax Extension Form 4868 Printable Irs Gov - Form 4868 is the IRS form you complete to receive an automatic extension to file your return You can file a tax extension online in one of several ways with H R Block While you won t be filling out the paper Form 4868 line by line your tax extension information will be sent online to the IRS