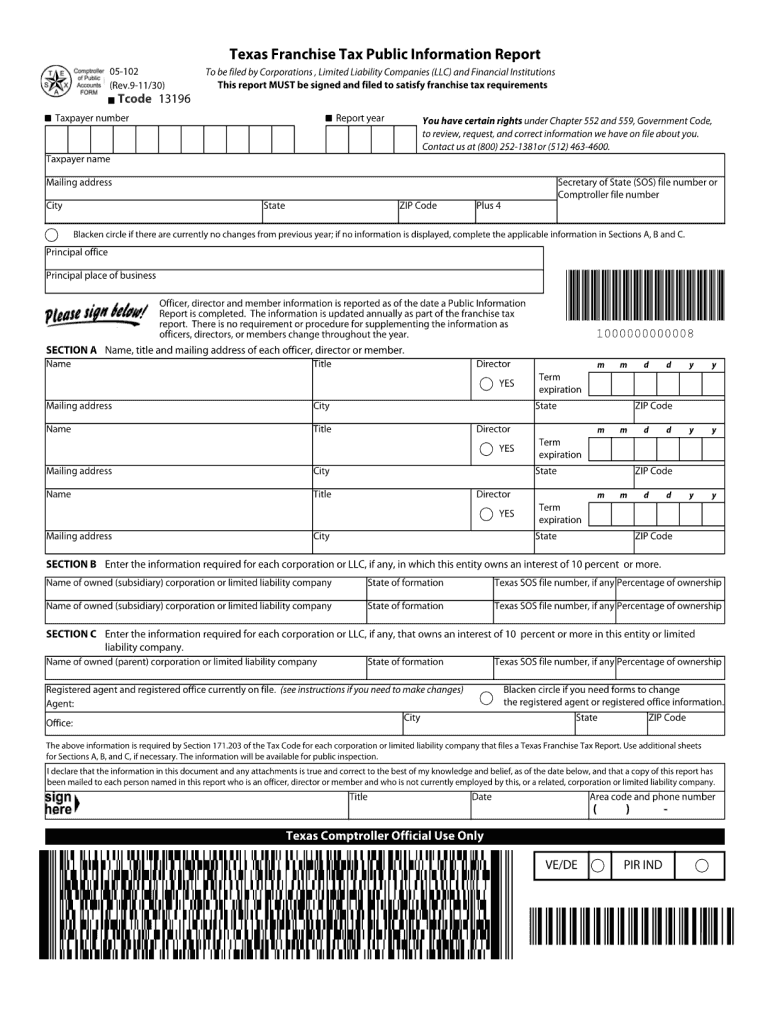

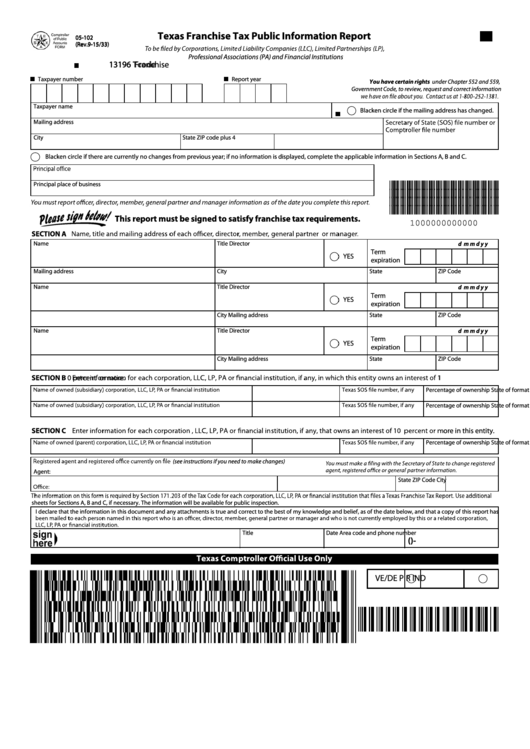

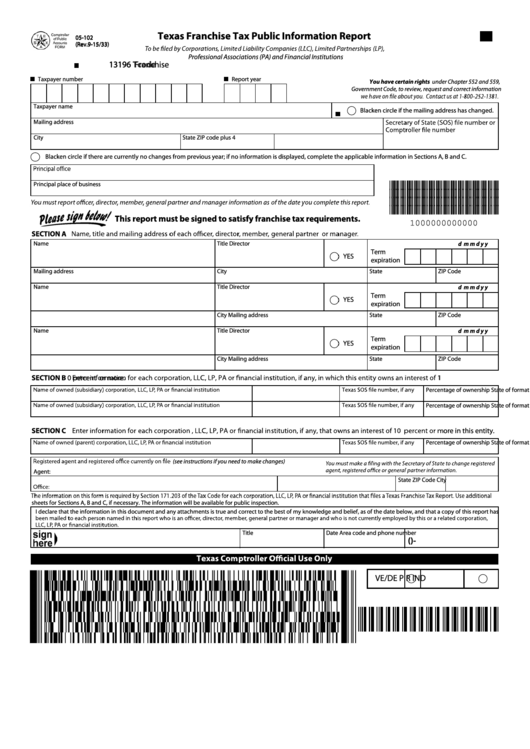

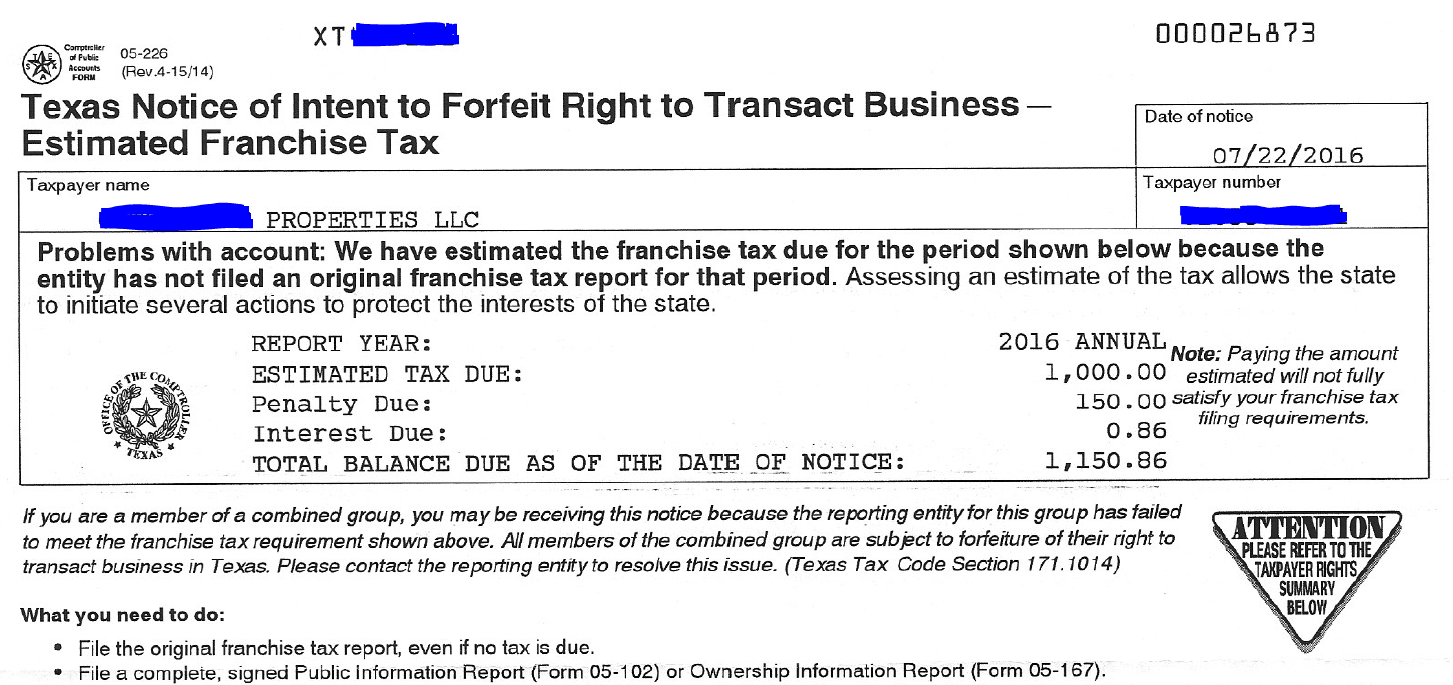

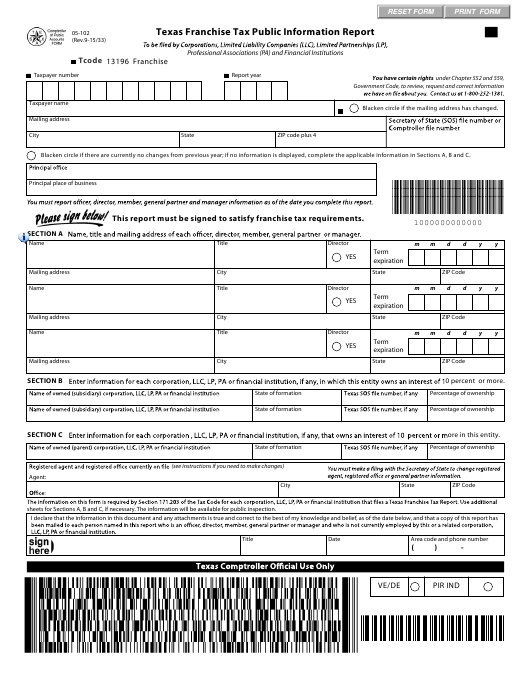

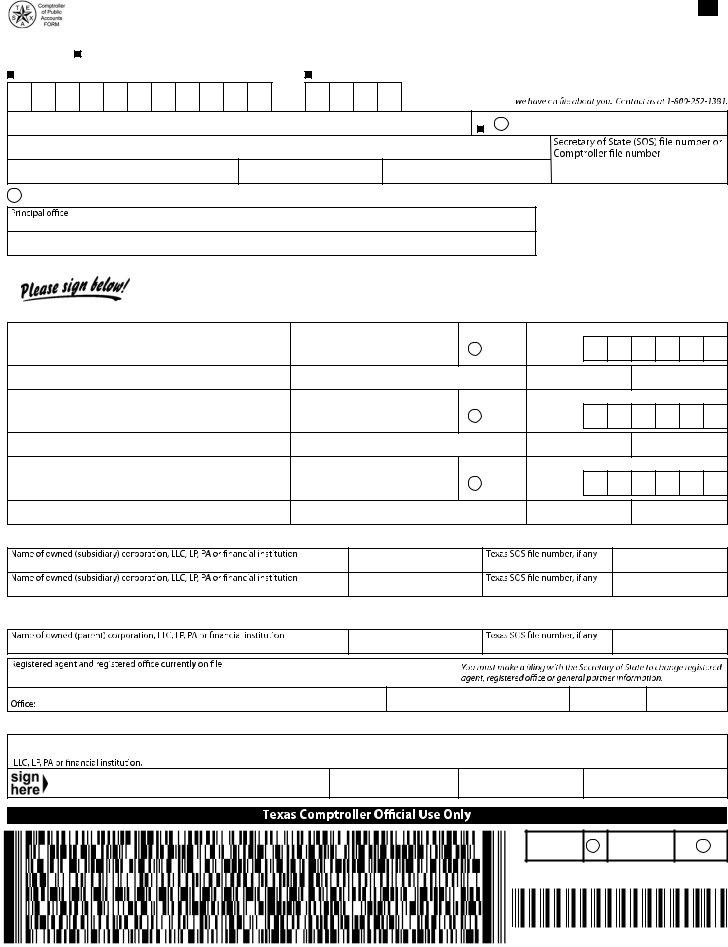

Texas Franchise Tax Form 05 102 Printable 05 102 Rev 11 12 31 Tcode 13196 To be filed by Corporations Limited Liability Companies LLC and Financial Institutions This report MUST be signed and filed to satisfy franchise tax requirements Taxpayer number Report year

This report must be signed to satisfy franchise tax requirements SECTION A 1000000000000 sheets for Sections A B and C if necessary The information will be available for public inspection Form 05 102 Texas Franchise Tax Public Information Report is a tax form filed by corporations limited partnerships and different business entities that are registered in Texas Franchise tax is a tax that enterprises pay when they want to establish their business in certain states

Texas Franchise Tax Form 05 102 Printable

Texas Franchise Tax Form 05 102 Printable

https://www.pdffiller.com/preview/0/139/139559/large.png

Top 17 Texas Franchise Tax Forms And Templates Free To Download In PDF Format

https://data.formsbank.com/pdf_docs_html/114/1141/114129/page_1_thumb_big.png

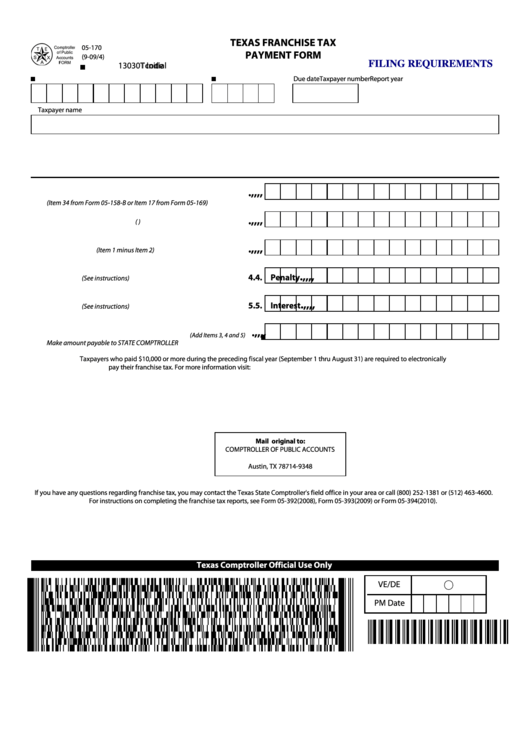

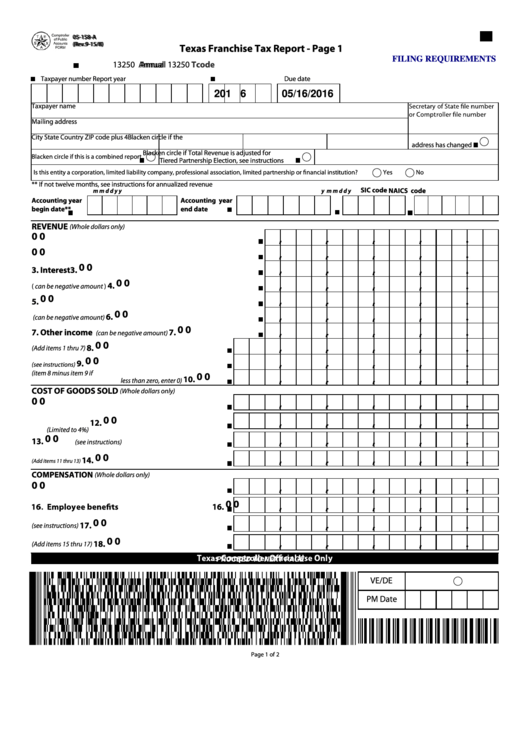

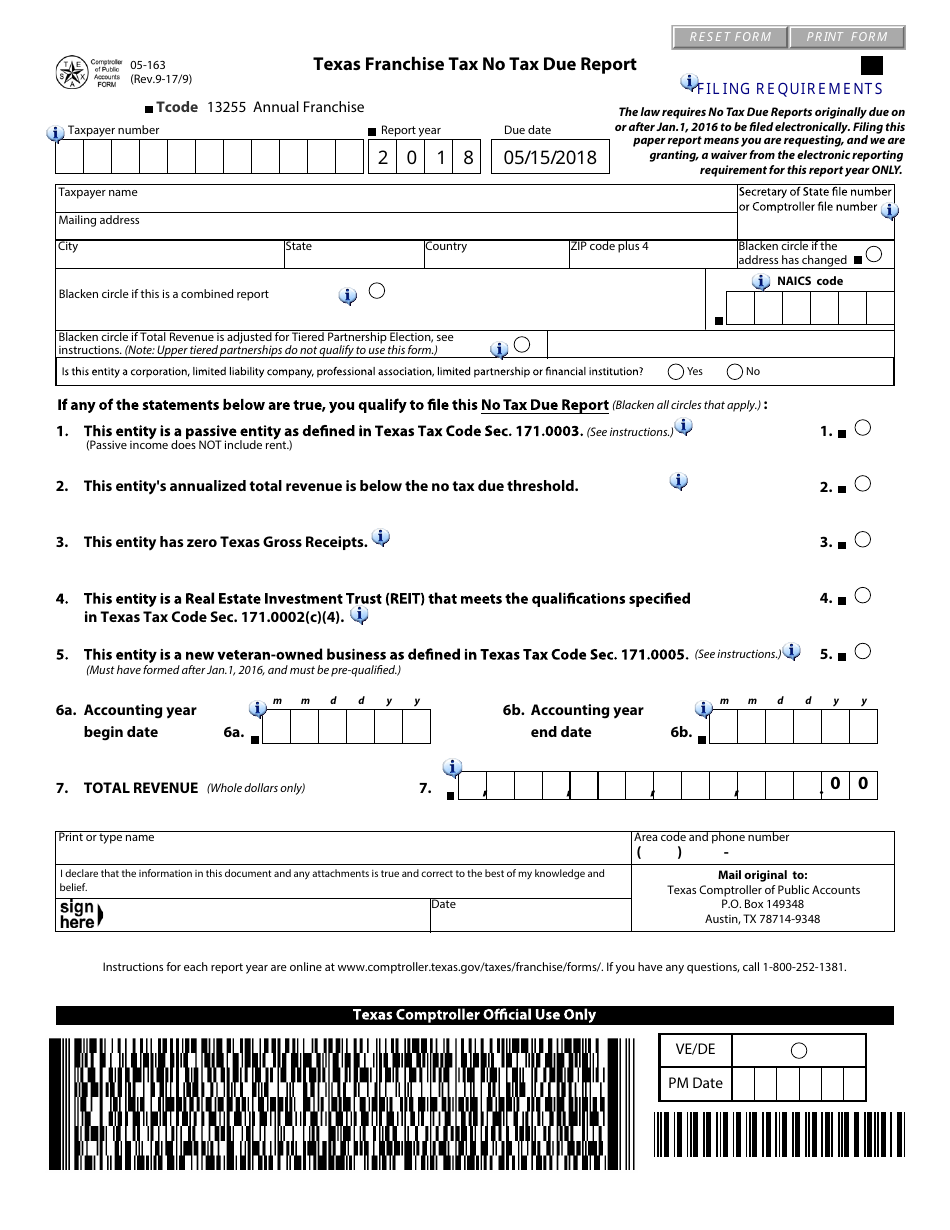

Fillable Annual Texas Franchise Tax Payment Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/114/1141/114131/page_1_thumb_big.png

Use the Print option from your browser s menu Texas Comptroller of Public Accounts STAR System 202312011L professional association and financial institution that is organized in Texas or has nexus in Texas must file Form 05 102 Texas Franchise Tax Public Information Report Minimum entries to produce TX 05 102 Franchise Tax Public Information Report Select Interview Form TX1 Texas Franchise Tax General Information In box 30 Type Franchise 1 Bank Franchise 2 MANDATORY input information as needed In box 31 Report type Annual default 1 Initial 2 Final 3 input 1 or 2

The Texas Franchise Tax is an annual business privilege tax processed by the Texas Comptroller of Public Accounts Essentially it s a tax levied on business owners in exchange for the opportunity to do business in Texas Here s what you should know about it How To Apply For an Extension About Our Texas Franchise Tax Report Service Can Form 05 102 Public Information Report be electronically filed separately for a Texas Franchise Tax return in CCH Axcess Tax or CCH ProSystem fx Tax If separate filing is desired the form must be paper filed with the taxing authority Solution Tools Email Print Attachments Solution Id 000204294 000075243 Direct Link

More picture related to Texas Franchise Tax Form 05 102 Printable

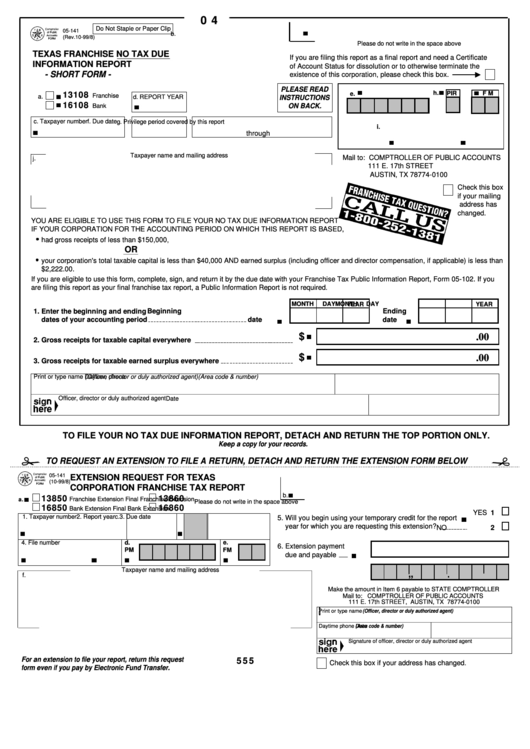

Fillable Form 05 141 Texas Franchise No Tax Due Information Report Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/329/3295/329570/page_1_thumb_big.png

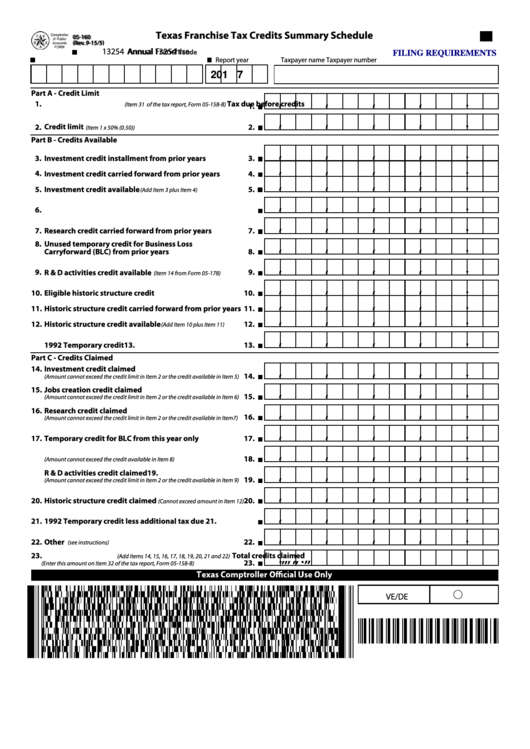

Fillable Form 05 160 2015 Texas Franchise Tax Credits Summary Schedule Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/151/1512/151214/page_1_thumb_big.png

LOGO

https://www.sec.gov/Archives/edgar/data/1089083/000119312513134588/g497607page_586.jpg

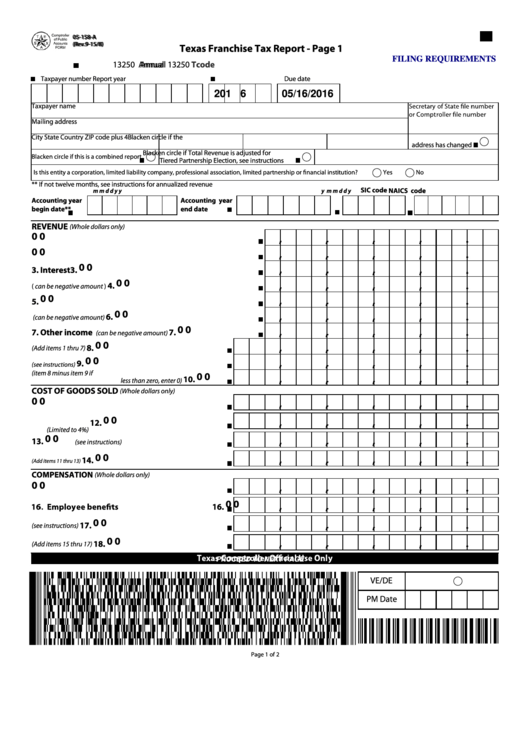

If any Officer Partner listed on Federal Partner Information is NOT to be included on Texas form 05 102 or 05 167 then check box on Texas Public or Ownership Reports Public Ownership Information Reports Officer Director Information Exclude Partner Shareholder If no Officer Partner number is used then the input on Texas Public Using entries from the federal return and Texas input the following forms are prepared for the Texas return Form TX 05 102 Texas Franchise Tax Public Information Report Click here to view how to generate Form TX 05 102 Form TX 05 158 A Franchise Tax Report Page 1 Form TX 05 158 A F Final Franchise Tax Report Page 1

The 05 102 Public Information Report must be filed with the Texas Report To complete this go to the 05 102 PIR tab on TX screen 1 If there are no changes to the directors or officers check the box at the top of the screen that says There are currently NO CHANGES to the officers or directors On Form 05 102 the names of officers are displayed twice How do I fix it Who must file the 05 102

Fillable 05 102 Texas Franchise Tax Public Information Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/114/1141/114128/page_1_thumb_big.png

How To Fill Out Texas Franchise Tax Report Ez Computation

https://www.pdffiller.com/preview/466/739/466739477/large.png

https://comptroller.texas.gov/forms/05-102-a-12.pdf

05 102 Rev 11 12 31 Tcode 13196 To be filed by Corporations Limited Liability Companies LLC and Financial Institutions This report MUST be signed and filed to satisfy franchise tax requirements Taxpayer number Report year

https://comptroller.texas.gov/forms/05-102-a-21.pdf

This report must be signed to satisfy franchise tax requirements SECTION A 1000000000000 sheets for Sections A B and C if necessary The information will be available for public inspection

FORM 05 102 PDF

Fillable 05 102 Texas Franchise Tax Public Information Printable Pdf Download

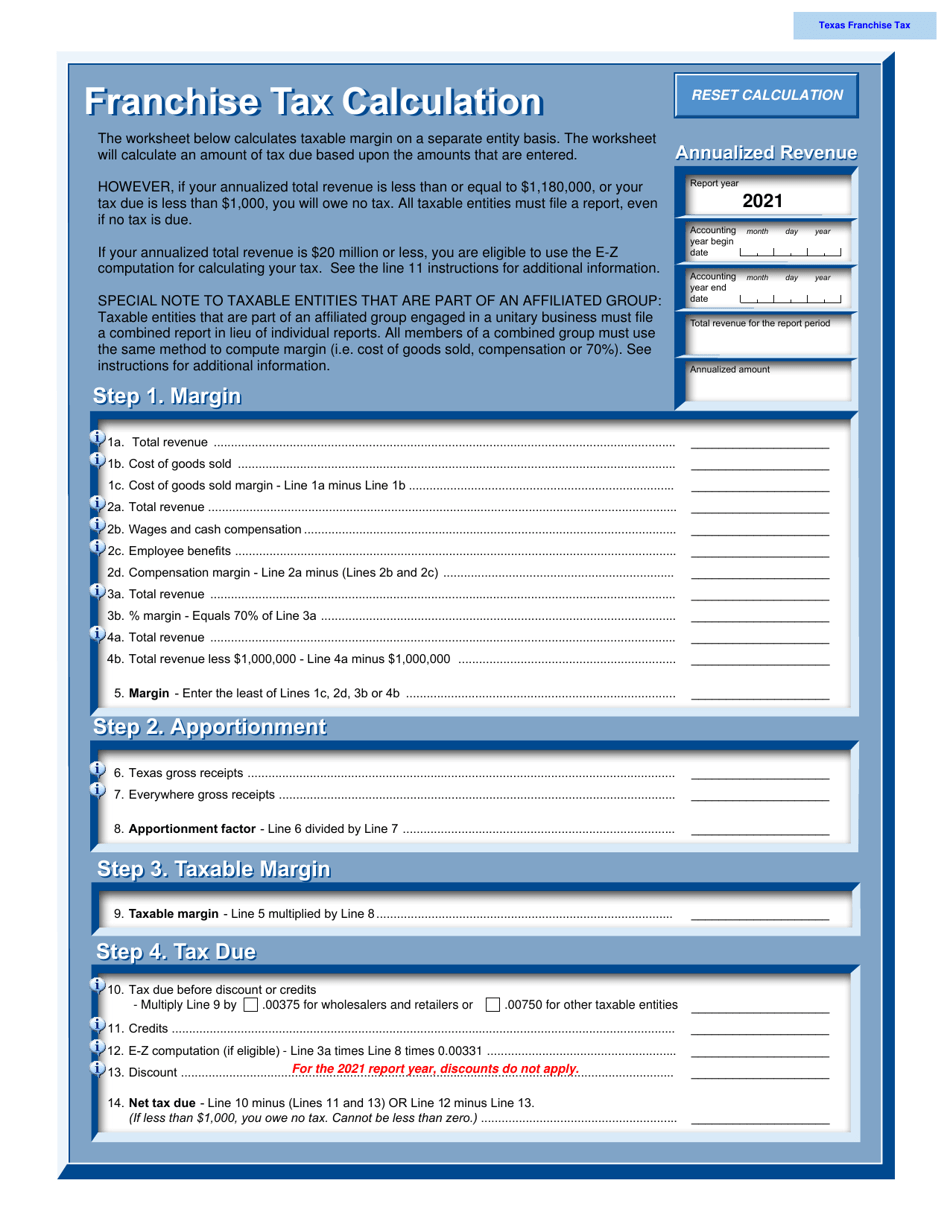

2021 Texas Franchise Tax Calculation Fill Out Sign Online And Download PDF Templateroller

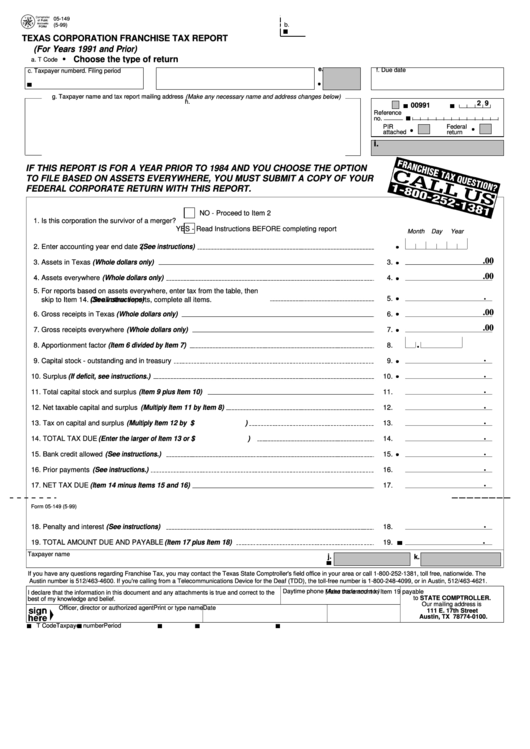

Fillable Form 05 364 Texas Corporation Franchise Tax Report Printable Pdf Download

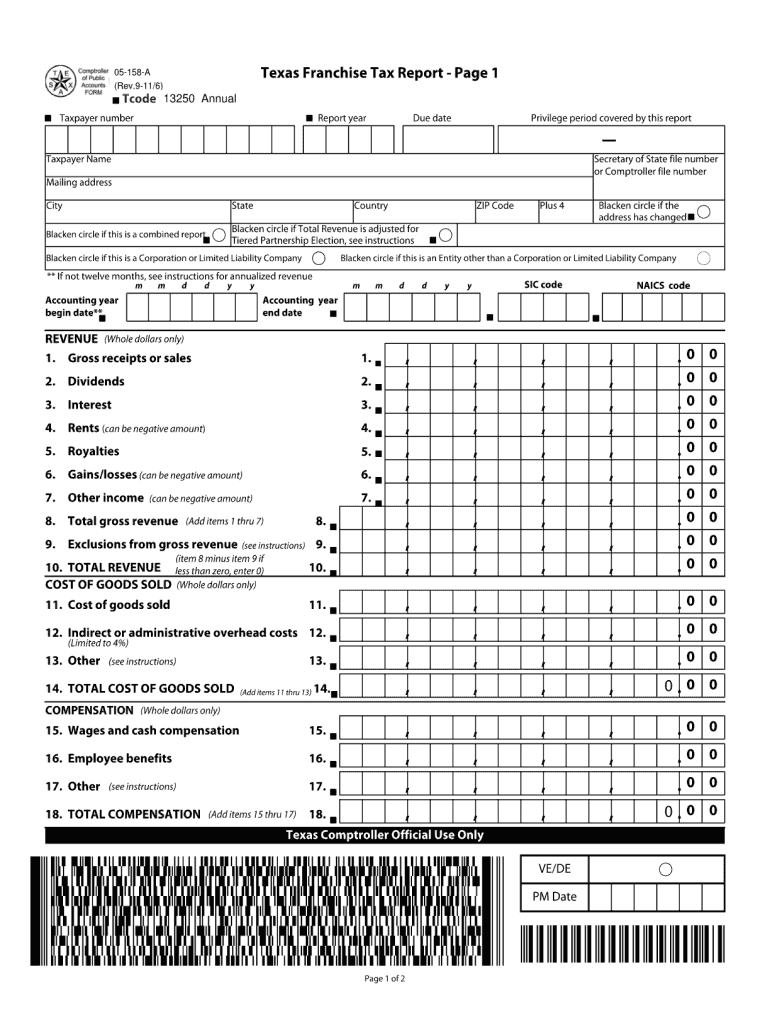

05 158 Texas Franchise Tax Annual Report Fill Out And Sign Printable PDF Template SignNow

Do It Yourself Tax Filing How To File Self Employment Taxes A Step By Step Guide

Do It Yourself Tax Filing How To File Self Employment Taxes A Step By Step Guide

Texas Franchise Tax Form 05 102 Printable Printable Forms Free Online

Texas Franchise Tax Report Forms For 2022 ReportForm

Tax Form 05 102 Fill Out Printable PDF Forms Online

Texas Franchise Tax Form 05 102 Printable - Minimum entries to produce TX 05 102 Franchise Tax Public Information Report Select Interview Form TX1 Texas Franchise Tax General Information In box 30 Type Franchise 1 Bank Franchise 2 MANDATORY input information as needed In box 31 Report type Annual default 1 Initial 2 Final 3 input 1 or 2