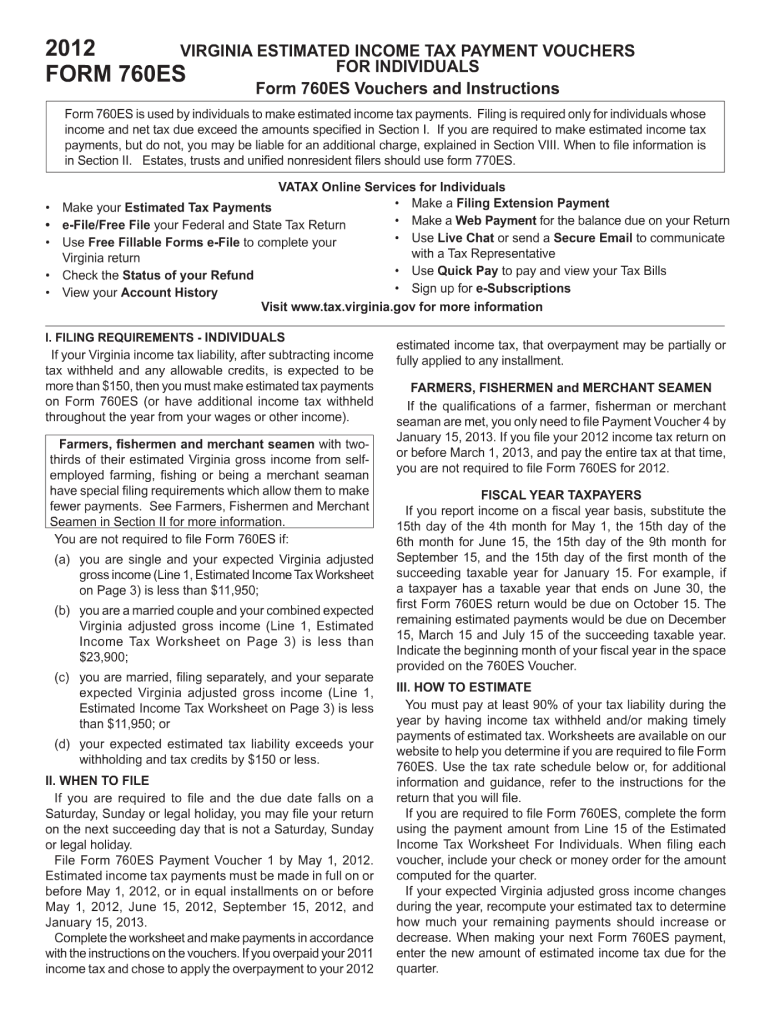

Virginia Vehicle Personal Property Tax Form Printable Find Forms Instructions by Category Individual Income Tax Corporation and Pass Through Entity Tax Credits Subtractions and Deductions Insurance Premiums License Tax Sales Use Tax Withholding Miscellaneous Business Registration Cigarette Tobacco Products Commodity Excise Taxes Communications Taxes Ordering Forms

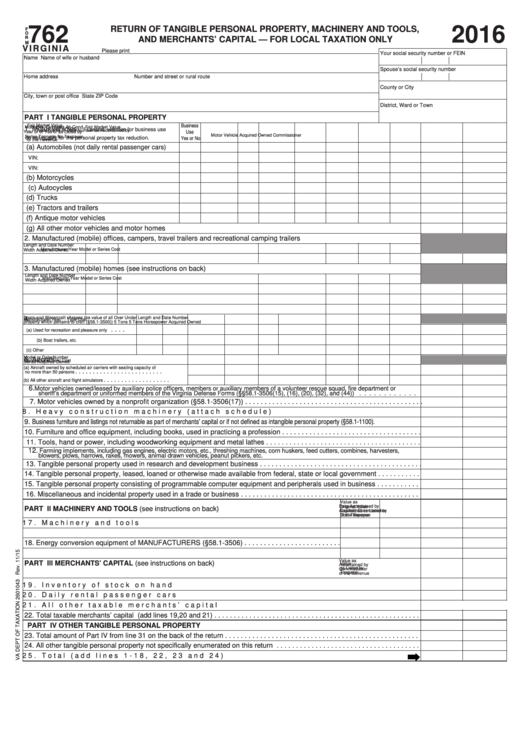

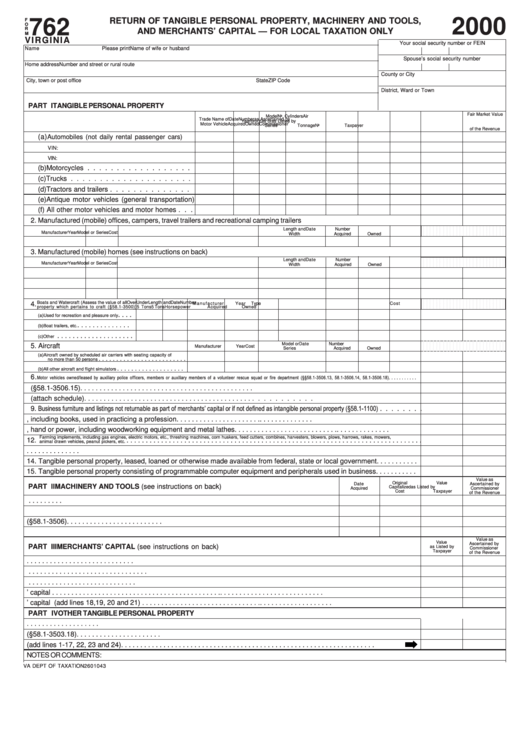

Return of Tangible Personal Property Machinery and Tools and Merchant s Capital for local taxation only 500ES and Instructions 2024 Forms and Instructions for Declaration of Estimated Income Tax File Online 800ES and Instructions 2024 Insurance Premiums License Tax Estimated Payment Vouchers File Online As a result of new Virginia legislation enacted on July 1 2022 which amends Virginia Code Section 58 1 3503 B localities in which a Commissioner adjusts the valuation of specific property to account for the amount of mileage on such vehicles must also make the same adjustments for MOTORCYCLES

Virginia Vehicle Personal Property Tax Form Printable

Virginia Vehicle Personal Property Tax Form Printable

https://www.signnow.com/preview/100/6/100006516/large.png

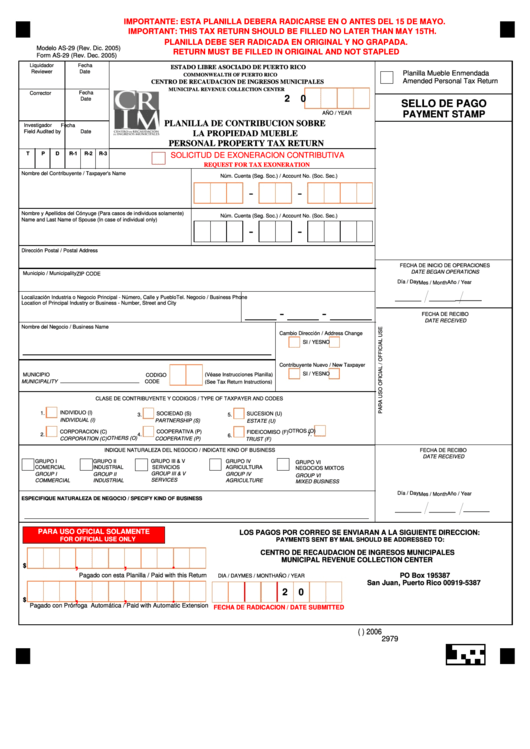

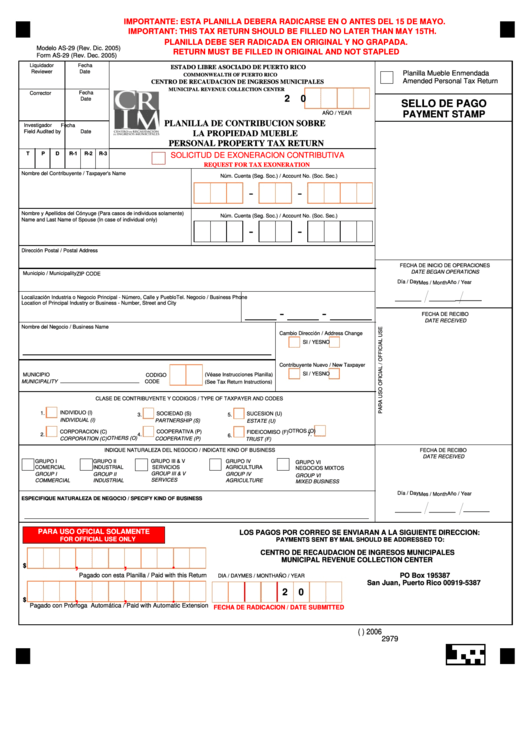

Form As 29 Personal Property Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/245/2452/245296/page_1_thumb_big.png

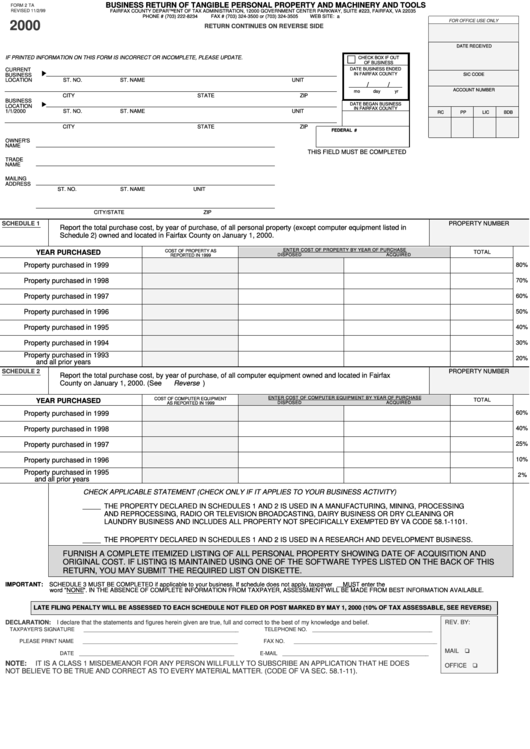

Form 2 Ta Business Return Of Tangible Personal Property And Machinery And Tools State Of

https://data.formsbank.com/pdf_docs_html/266/2666/266641/page_1_thumb_big.png

Effective January 1 2023 Fairfax County will automatically file personal property tax returns for motor vehicles trailers and semi trailers on behalf of Fairfax County residents that have registered with the Department of Motor Vehicles DMV within 30 days as required by Virginia Code 46 2 600 and 622 City of Alexandria Virginia 2022 Personal Property Tax Bill Due October 5 2022 I also found this associated with Loudoun County Virginia Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1

Form 762 Return of Tangible Personal Property Heavy Weight Vehicles and Trailers Printable Form 762A Return of Tangible Personal Property Airplanes ONLY Printable Form 762B Return of Tangible Personal Property Business Equipment Online Printable Form 762H Return of Tangible Personal Property Mobile Homes ONLY Contact Us Martinsville Municipal Building 55 W Church Street Room 101 Martinsville VA 24112 Phone 276 403 5131 Fax 276 403 5337 Forms can also be dropped in the City Treasurer s overnight lock box located beside the drive thru at Martinsville Municipal Building

More picture related to Virginia Vehicle Personal Property Tax Form Printable

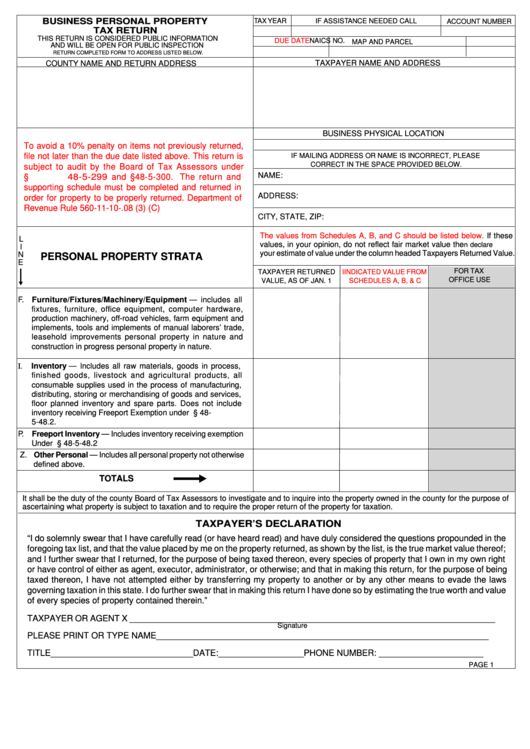

Fillable Business Personal Property Tax Return Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/178/1781/178104/page_1_thumb_big.png

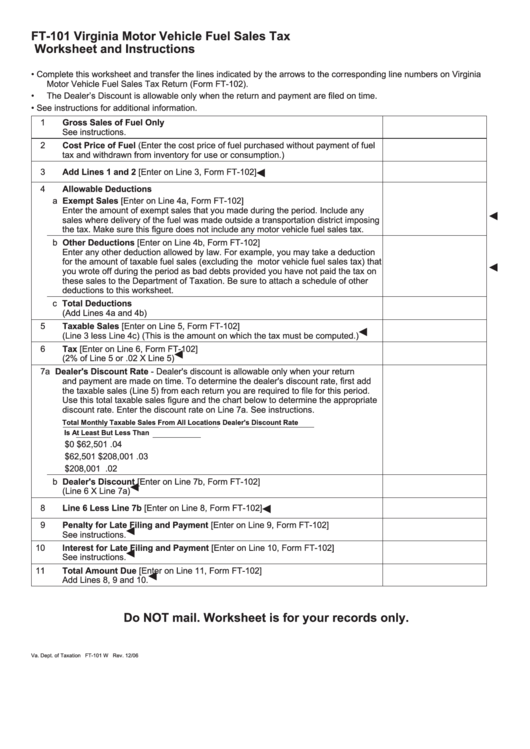

Form Ft 101 Virginia Motor Vehicle Fuel Sales Tax Worksheet Virginia Department Of Taxation

https://data.formsbank.com/pdf_docs_html/250/2503/250352/page_1_thumb_big.png

Amelia County Personal Property Tax PROPERTY HJE

https://i2.wp.com/data.formsbank.com/pdf_docs_html/315/3154/315457/page_1_thumb_big.png

Quick Links 757 385 4251 Businesses Income Tax Assistance Vehicles Tax Relief A collection of important documents and forms The files below are in pdf unless otherwise indicated Quick Links 757 385 4251 Businesses Income Tax Assistance Vehicles Tax Relief The Commissioner of the Revenue is responsible for the assessment of all personal property with taxable status in Virginia Beach

How to Get a Benefit Summary from the VA Request a letter through eBenefit Call the VA at 1 800 827 1000 or Request assistance from Virginia Department of Veterans Services Certain disabled veterans may be eligible for a Sales and Use Tax SUT exemption on purchased vehicles Veterans of the United States Armed Forces or the Virginia The Commissioner of Revenue COR is charged with providing what are fair market values on vehicle personal property by using values found in recognized vehicle pricing guides The COR cannot take any other action under the law in determining vehicle values The Arlington County Board establishes the personal property tax rate on motor vehicles trailers semitrailers and boats

Free Virginia Personal Property Bill Of Sale Form PDF Word doc

http://billofsale.net/wp-content/uploads/virginia-personal-property-bill-of-sale.jpg

Fillable Form 762 Virginia Return Of Tangible Personal Property Machinery And Tools 762 And

https://data.formsbank.com/pdf_docs_html/333/3336/333626/page_1_thumb_big.png

https://www.tax.virginia.gov/forms

Find Forms Instructions by Category Individual Income Tax Corporation and Pass Through Entity Tax Credits Subtractions and Deductions Insurance Premiums License Tax Sales Use Tax Withholding Miscellaneous Business Registration Cigarette Tobacco Products Commodity Excise Taxes Communications Taxes Ordering Forms

https://www.tax.virginia.gov/forms/search

Return of Tangible Personal Property Machinery and Tools and Merchant s Capital for local taxation only 500ES and Instructions 2024 Forms and Instructions for Declaration of Estimated Income Tax File Online 800ES and Instructions 2024 Insurance Premiums License Tax Estimated Payment Vouchers File Online

Virginia Form 762 Return Of Tangible Personal Property Machinery And Tools And Merchants

Free Virginia Personal Property Bill Of Sale Form PDF Word doc

Free Virginia Bill Of Sale Forms PDF Word

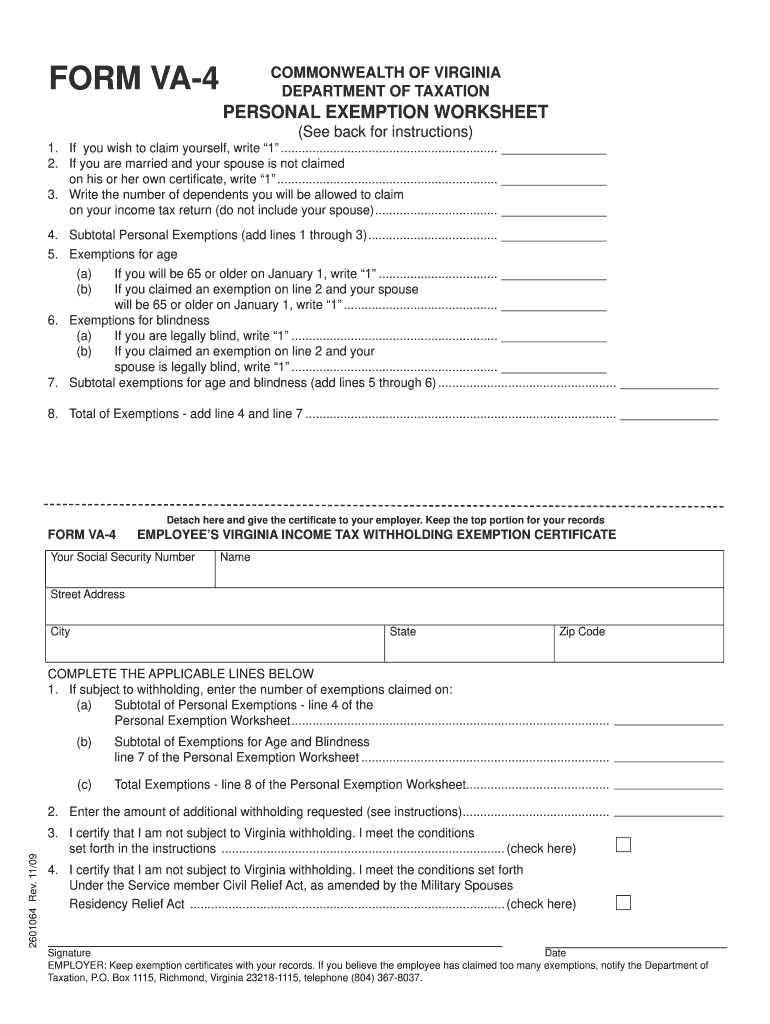

Va 4 State Tax Form Fillable Fill Out And Sign Printable PDF Template SignNow

Free Printable State Tax Forms Printable Templates

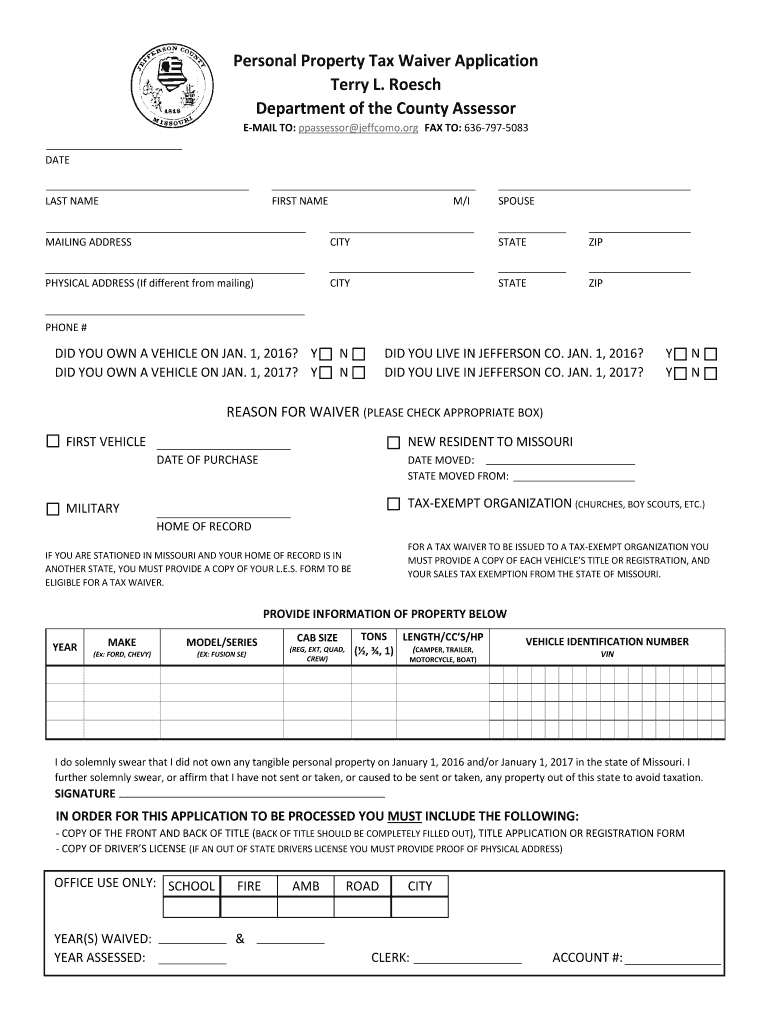

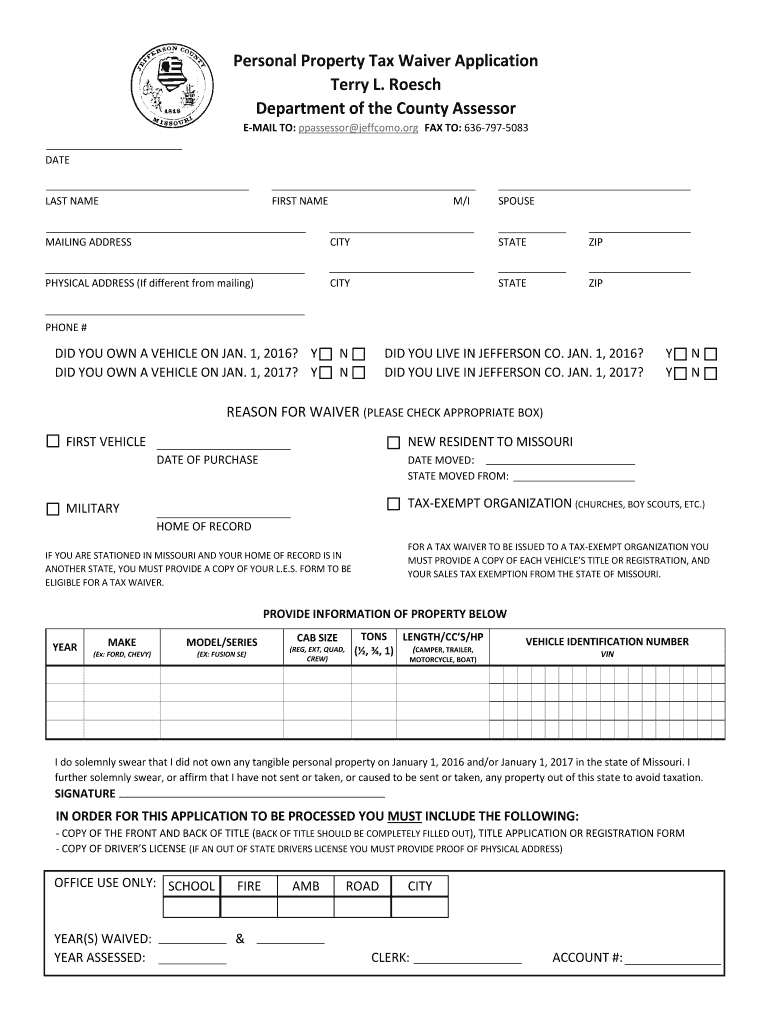

Personal Property Tax Waiver Jefferson County Mo Fill Out Sign Online DocHub

Personal Property Tax Waiver Jefferson County Mo Fill Out Sign Online DocHub

Va Dmv Form Vsa 24 Fill Out Sign Online DocHub

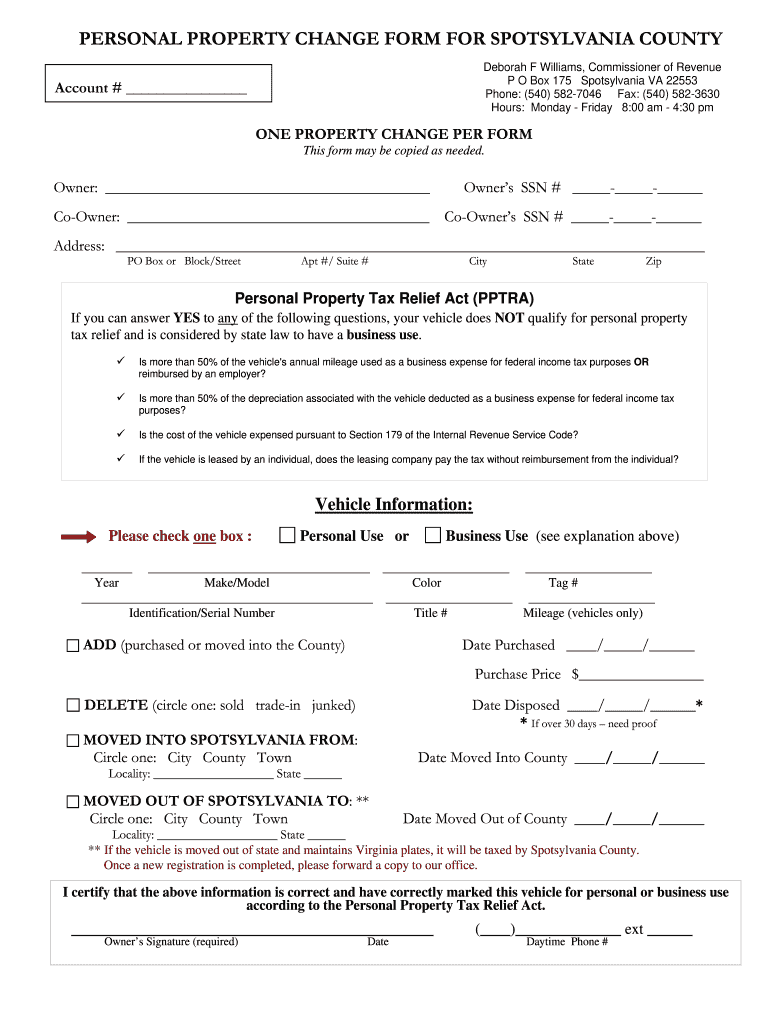

Spotsylvania Personal Property Tax Form Fill Out And Sign Printable PDF Template SignNow

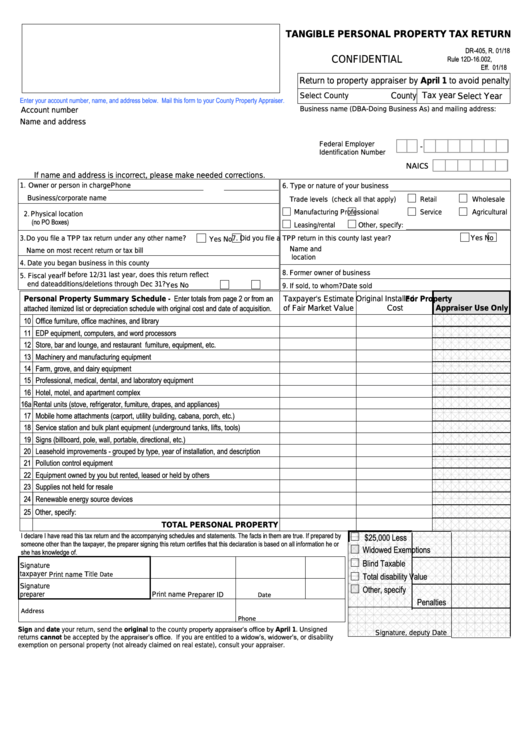

Fillable Form Dr 405 Tangible Personal Property Tax Return Printable Pdf Download

Virginia Vehicle Personal Property Tax Form Printable - Vehicle Personal Property Tax Due January 3 2024 Prince William County Personal Property taxes for 2023 are due on January 3 2024 If you have not received a tax bill for your vehicles and believe you should have contact the Taxpayer Services Office at 703 792 6710 or by email at email protected The Taxpayer Services office hours are Monday through Friday from 8 00 A M to 5 00 P M