W 1099 Misc Form Printable Beginning with Tax Year 2020 you must use Form 1099 NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099 MISC The separate instructions for filers issuers for Form 1099 NEC are available in the Instructions for Forms 1099 MISC and 1099 NEC PDF

Updated March 29 2023 Reviewed by Isaiah McCoy CPA If you hired a contractor or freelancer and paid them more than 600 in a year directly you have to send them a 1099 NEC Filing W 2 and 1099 Forms Online You can file W 2 forms online directly with the Social Security Administration through their Business Services Online portal You can file 1099 forms and other 1099 forms online with the IRS through the Filing Information Returns Electronically FIRE system online To use this system you must be able to

W 1099 Misc Form Printable

W 1099 Misc Form Printable

https://legaltemplates.net/wp-content/uploads/Form-1099-screenshot.png

Printable 1099 Misc Tax Form Template Printable Templates

https://www.pdffiller.com/preview/421/116/421116584/big.png

Free Printable 1099 Misc Forms Free Printable

https://4freeprintable.com/wp-content/uploads/2019/06/irs-form-1099-reporting-for-small-business-owners-free-printable-1099-misc-forms.png

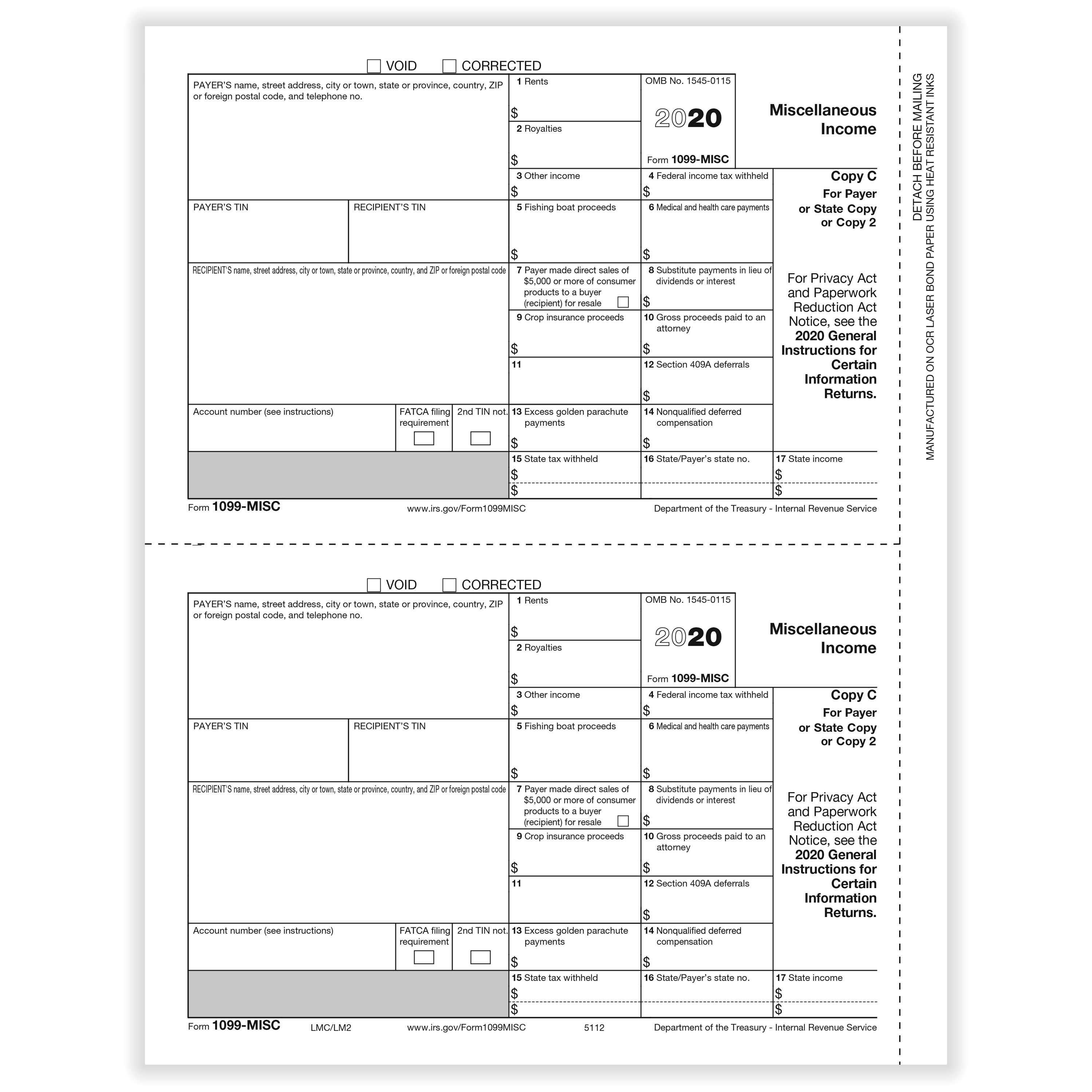

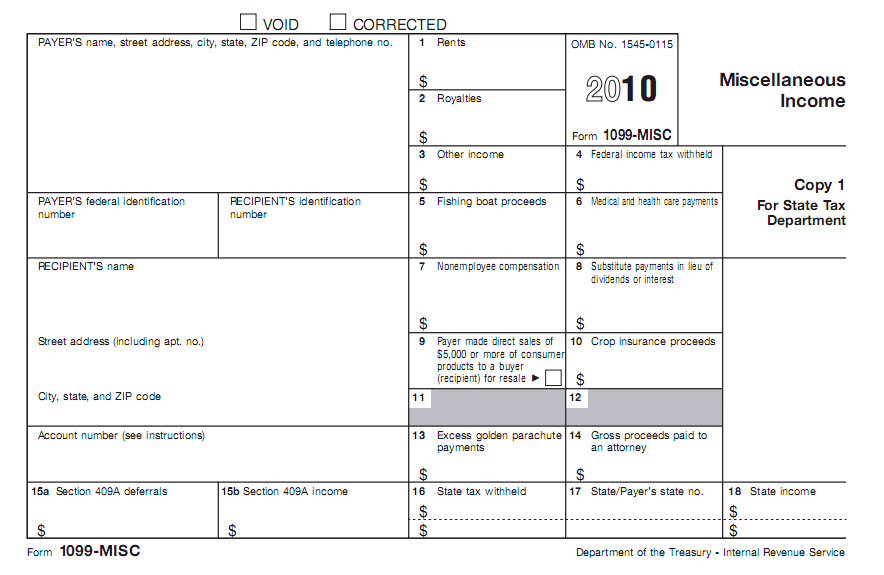

A 1099 MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest 1 Landlords are typically required to file 1099 MISC forms for payments made to property managers contractors attorneys repair professionals and anyone else who performs services for your property and does not qualify as your employee You report instances where these payments equal 600 or more during the year

Form 1099 Misc is a tax form that reports the year end summary of all non employee compensation The 1099 Misc form covers rent royalties self employment and independent contractor income crop A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

More picture related to W 1099 Misc Form Printable

What Is Form 1099 MISC When Do I Need To File A 1099 MISC Gusto

https://gusto.com/wp-content/uploads/2020/12/1099-MISC-1024x663.png

Printable 1099 Misc Tax Form Template Printable Templates

https://www.pandadoc.com/app/uploads/form-1099-misc.png

How To Fill Out And Print 1099 MISC Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

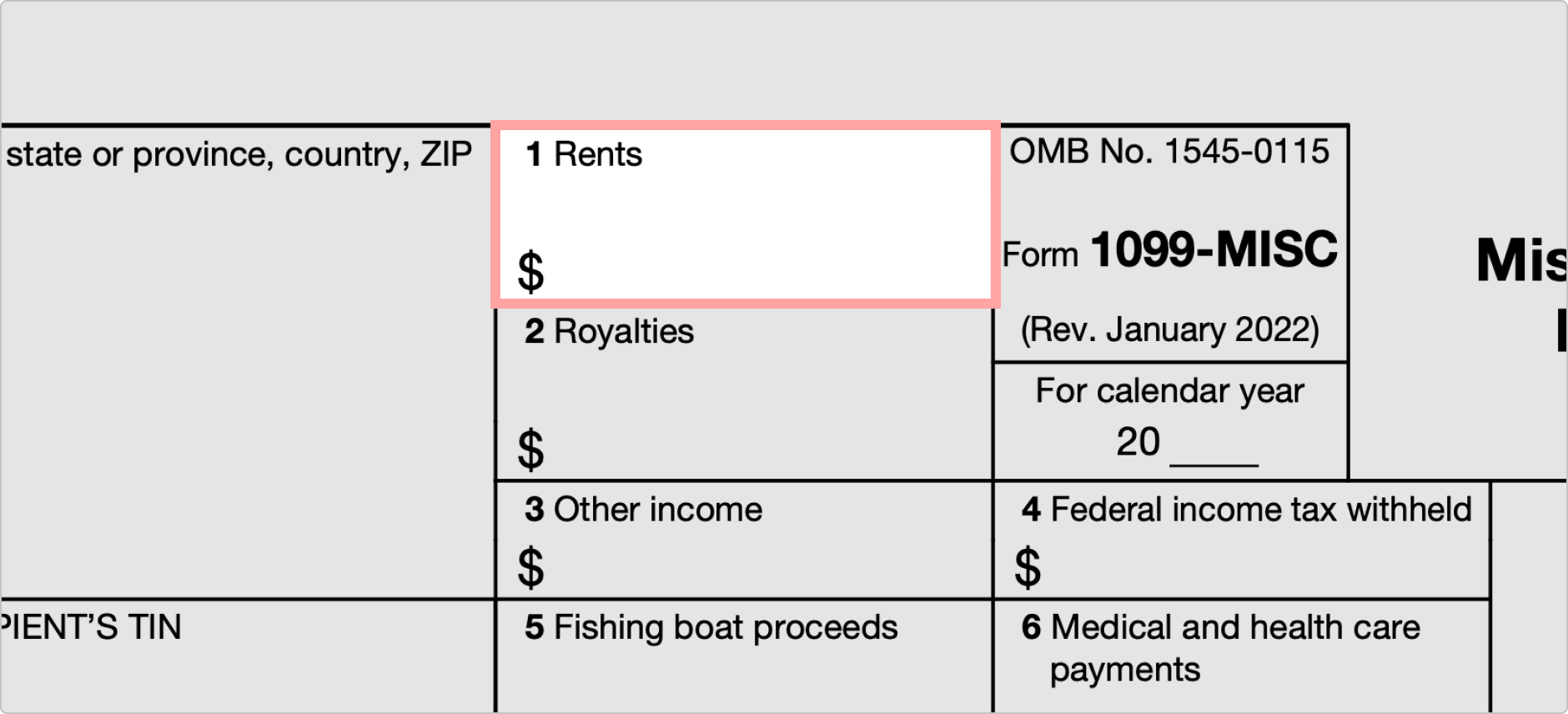

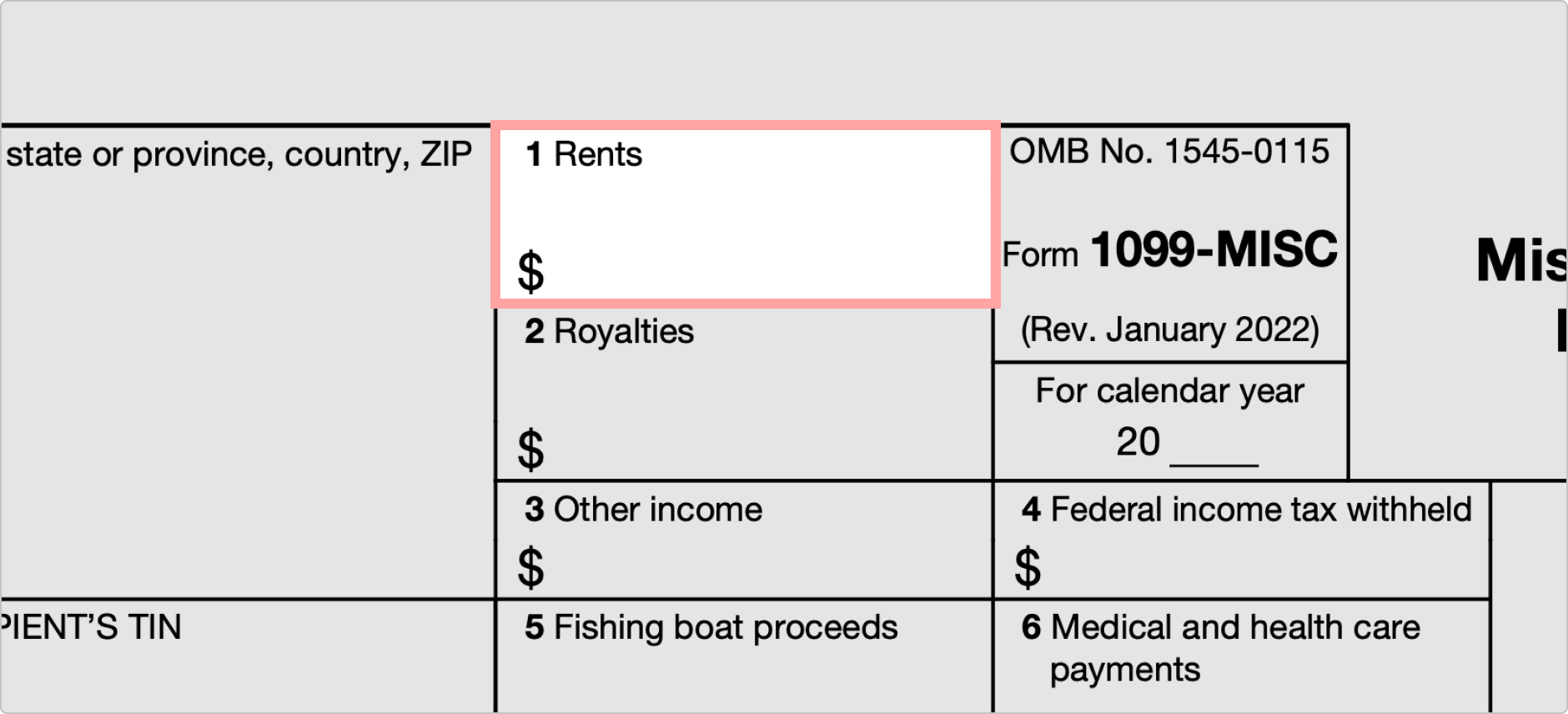

In tax year 2020 the IRS reintroduced Form 1099 NEC for reporting independent contractor income otherwise known as nonemployee compensation If you re self employed income you receive during the year might be reported on the 1099 NEC but Form 1099 MISC is still used to report certain payments of 600 or more you made to other businesses and people This article covers the 1099 MISC Form 1099 MISC Miscellaneous Information is an information return businesses use to report payments and miscellaneous payments File Form 1099 MISC for each person you have given the following types of payments in the course of your business during the tax year

2023 Pre Printed 1099 MISC Kits Starting at 58 99 Use federal 1099 MISC tax forms to report payments of 600 or more for rents royalties medical and health care payments and gross proceeds paid to attorneys These continuous use forms no longer include the tax year QuickBooks will print the year on the forms for you Instructions for Forms 1099 MISC and 1099 NEC Introductory Material Future Developments For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s New E filing returns

1099 MISC Form Fillable Printable Download 2023 Instructions

https://formswift.com/seo-pages-assets/uploads/1099-misc-2022-assets/box-1-2x.png

1099 MISC Income Form 1099 Form Copy C 1099 Form Formstax

https://cdn.formstax.com/Images/Products/L0759-5112-2020-1099MISC-Laser-Copy-C_xl.jpg

https://www.irs.gov/businesses/small-businesses-self-employed/forms-and-associated-taxes-for-independent-contractors

Beginning with Tax Year 2020 you must use Form 1099 NEC Nonemployee Compensation to report payments of nonemployee compensation NEC previously reported in box 7 on Form 1099 MISC The separate instructions for filers issuers for Form 1099 NEC are available in the Instructions for Forms 1099 MISC and 1099 NEC PDF

https://www.keepertax.com/posts/how-do-i-print-a-1099

Updated March 29 2023 Reviewed by Isaiah McCoy CPA If you hired a contractor or freelancer and paid them more than 600 in a year directly you have to send them a 1099 NEC

How To Fill Out And Print 1099 MISC Forms

1099 MISC Form Fillable Printable Download 2023 Instructions

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Fillable 1099 Misc Fill Out Sign Online DocHub

Everything You Need To Know About 1099 Misc Forms 1099 Mom

1099 MISC Form Fillable Printable Download Free 2021 Instructions

1099 MISC Form Fillable Printable Download Free 2021 Instructions

1099 MISC 3 Part Continuous 1 Wide Formstax

Irs Printable 1099 Form Printable Form 2023

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Print Blank 1099 Form Printable Form Templates And Letter

W 1099 Misc Form Printable - If you re a business owner you may need to create W 2 and 1099 forms including 1099 NEC and 1099 MISC for your employees or contractors Select your product and follow the instructions to create W 2s and 1099s using Quick Employer Forms