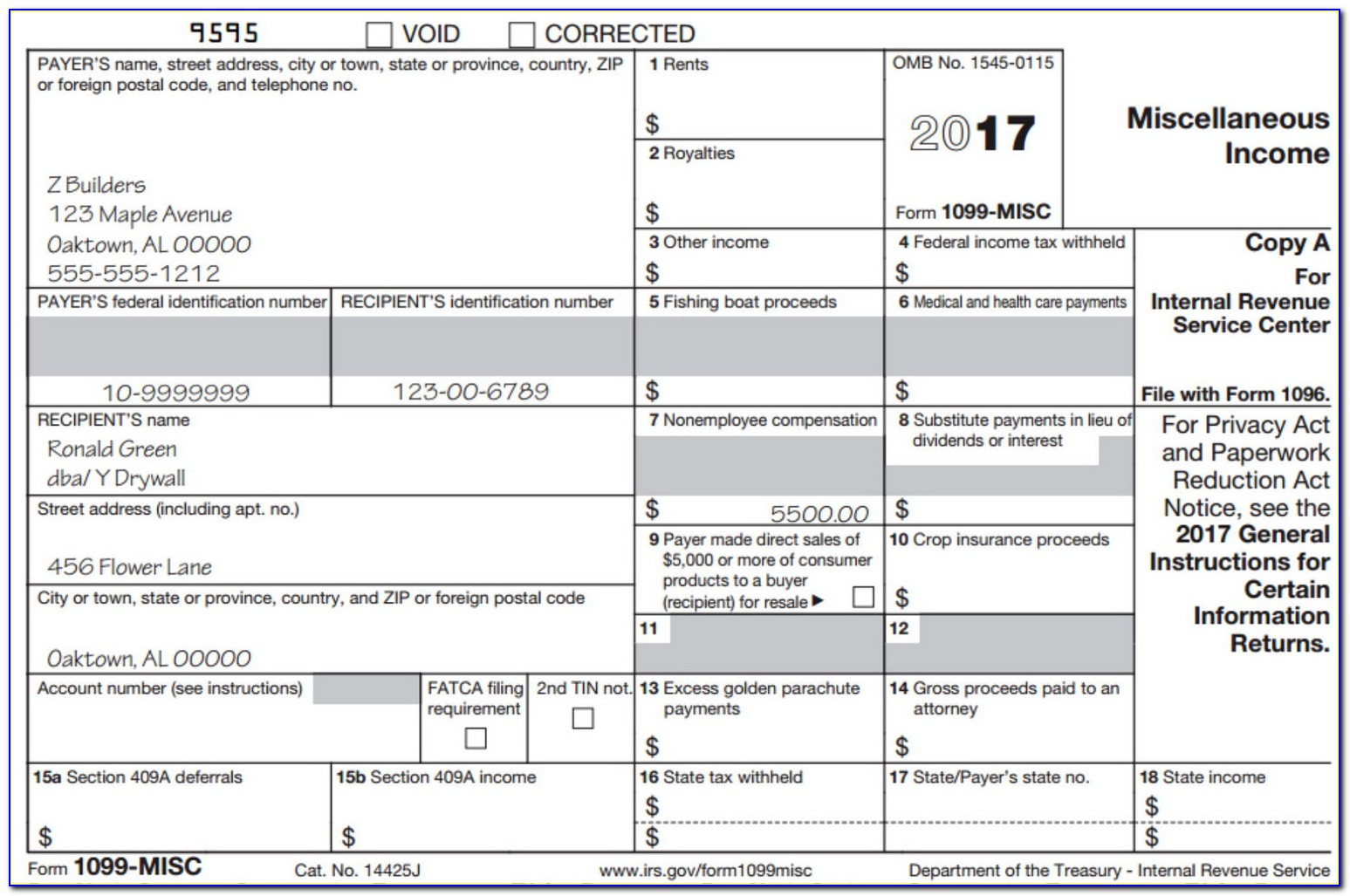

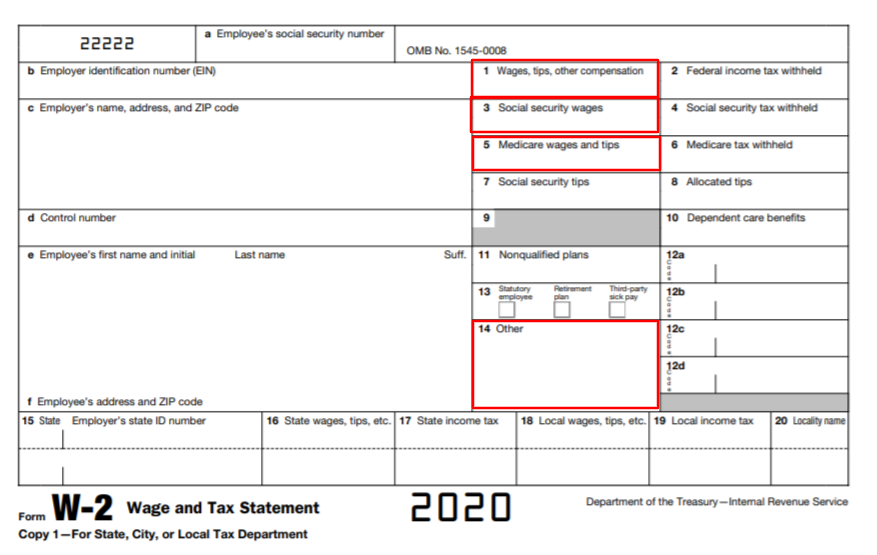

W 2 A Form Printable Enter this amount on the wages line of your tax return Box 2 Enter this amount on the federal income tax withheld line of your tax return Box 5 You may be required to report this amount on Form 8959 Additional Medicare Tax See the Form 1040 instructions to determine if you are required to complete Form 8959

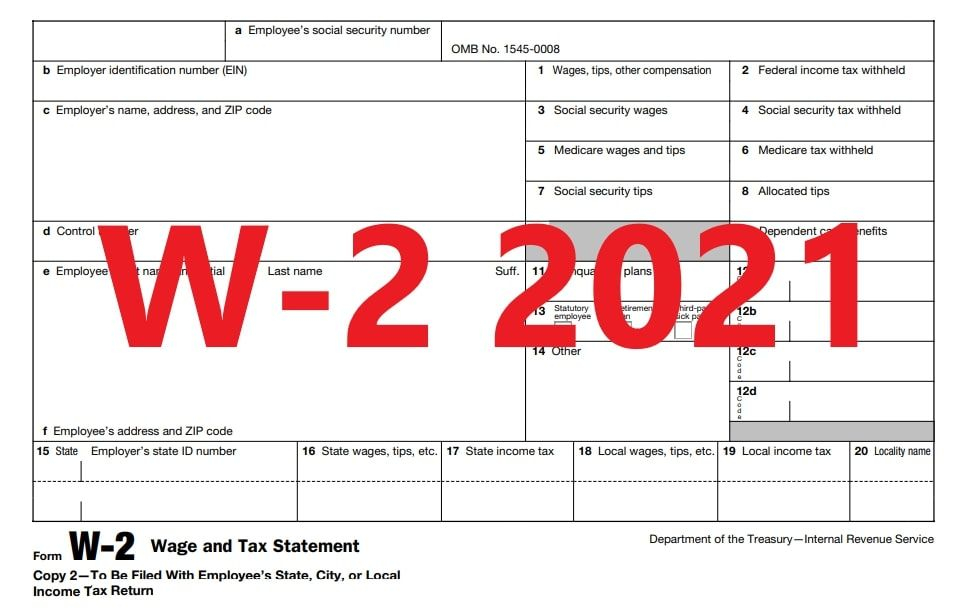

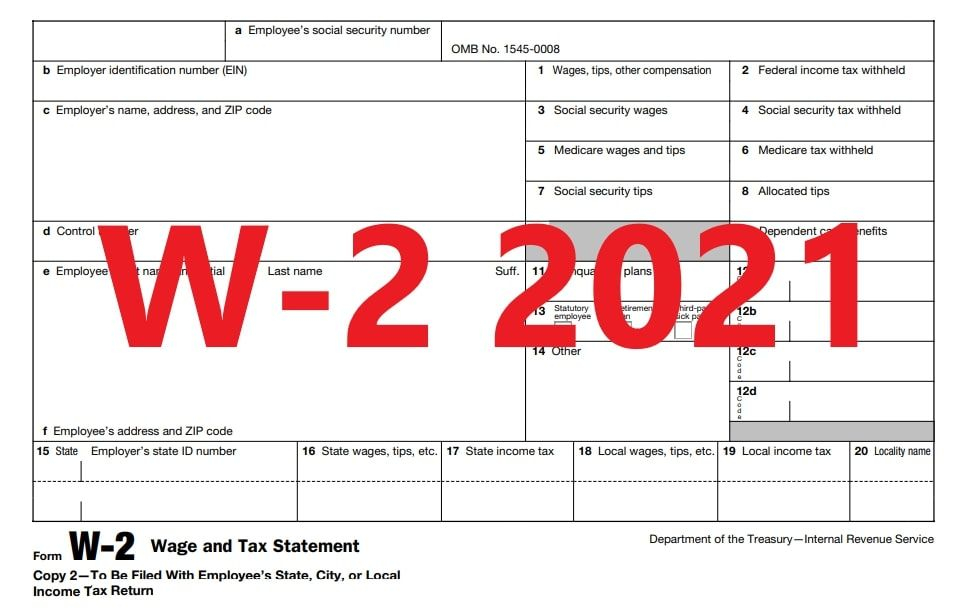

A W 2 form also known as a Wage and Tax Statement is an IRS document used by an employer to report an employee s annual wages in a calendar year and the amount of taxes withheld from their paycheck Forms are submitted to the SSA Social Security Administration and the information is shared with the IRS A W 2 Form also known as a Wage and Tax Statement is a form that an employer completes and provides to the employee to complete their tax return Form W 2 must contain certain information including wages earned and state federal and other taxes withheld from an employee s earnings The Form W 2 must be provided to employees by January 31

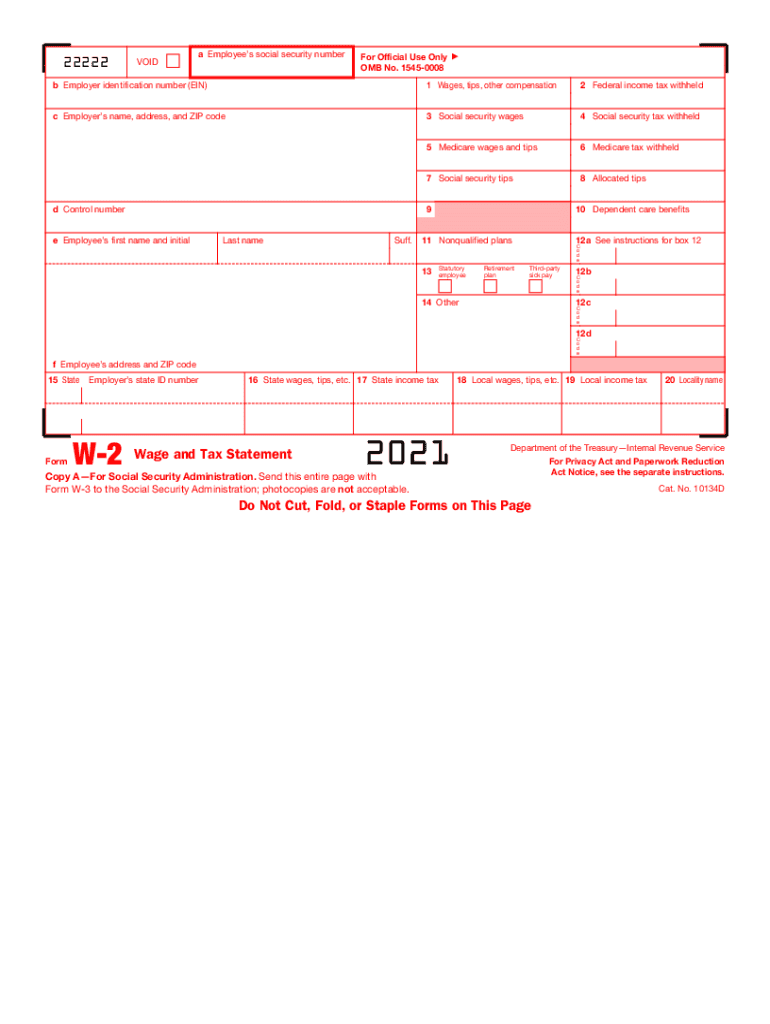

W 2 A Form Printable

W 2 A Form Printable

https://gusto.com/wp-content/uploads/2019/12/Form-W-2-Box-14.jpg

Free Printable W2 Form 2021 Printable Form Templates And Letter

https://www.pdffiller.com/preview/539/448/539448884/large.png

What Is A W 2 Form TurboTax Tax Tips Videos

https://digitalasset.intuit.com/IMAGE/A809v9tTY/2017-W-2-Form.png

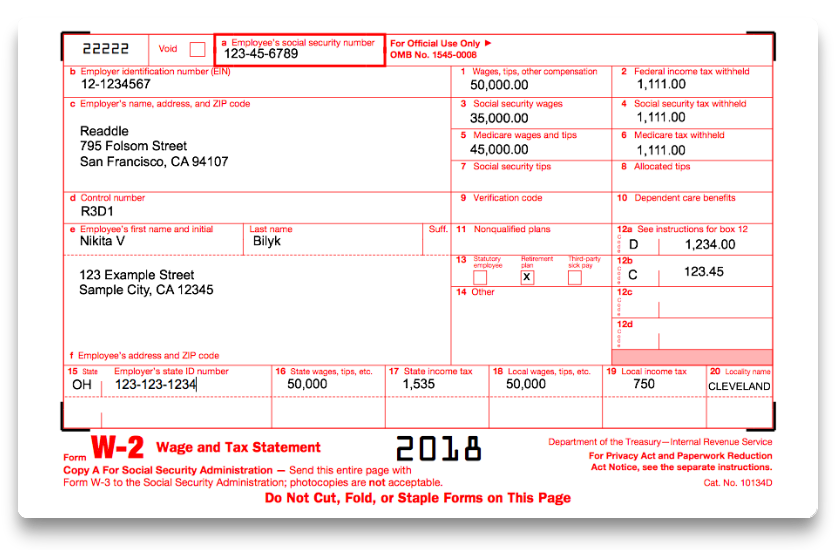

Above is a fillable Form W 2 that you can print or download If you need a W 2 form from the previous year it is available to download below Download the 2022 version of Form W 2 Get paper copies of federal and state tax forms their instructions and the address for mailing them Find easier to read tax forms for seniors and people with different needs What to do if your W 2 form is incorrect stolen or you never received it W 2 forms show the income you earned the previous year and what taxes were withheld

IRS Form W 2 also known as a Wage and Tax Statement reports an employee s income from the prior year and how much tax the employer withheld Employers send out W 2s to employees in Review your paper Forms W 2 especially Copy A to ensure that they print accurately prior to mailing them to Social Security s Wilkes Barre Direct Operations Center Form W 2 W 3 Instructions Form W 2c W 3c Instructions Social Security accepts laser printed Forms W 2 W 3 as well as the standard red drop out ink forms

More picture related to W 2 A Form Printable

How To Fill Out And Print W2 Forms

https://www.halfpricesoft.com/w2-software/images/w2_form_ssa_substitute_m.jpg

How To Fill Out Form W 2 Detailed Guide For Employers 2023

https://www.patriotsoftware.com/wp-content/uploads/2022/12/image.png

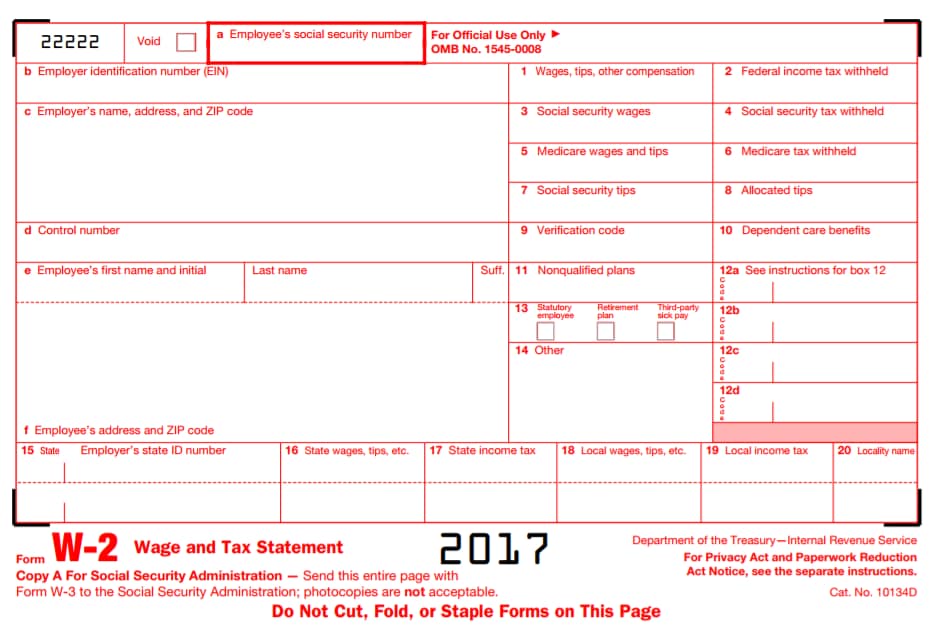

How To Fill Out IRS Form W 2 2017 2018 PDF Expert

https://pdfexpert.com/img/howto/fill-w2-form/how-to-fill-w2-filledform.png

A W 2 Form known officially as a Wage and Tax Statement is an important tax document providing valuable information for employees and the Internal Revenue Service IRS This document shows the total earnings of an employee for the year as well as the amount of taxes withheld from their paychecks It also includes other deductions such as contributions to retirement plans health 2023 Pre Printed W 2 Kits Starting at 57 99 Use for reporting employee wages and salaries to federal state and local agencies each kit includes a copy for your employee Easily print W 2 information directly from QuickBooks Desktop onto the correct blank section of each tax form Specifically designed for small businesses available in

Check out the image below and our notes to see how to read key parts of a W 2 Form Copies You may notice that there are several copies of your W 2 These show the intended use of the copy either the Federal return state return or your personal copy Names numbers and address This includes your employer s name and address plus Step 1 Buy W 2 paper if applicable If your employee lost or didn t get their original W 2 or you need a copy for your records you can use plain paper Go to Step 2 Print your W 2s and W 3 Buy W 2 paper if you re printing from QuickBooks and mailing official copies to your employees We recommend ordering W 2 kits W 2s and envelopes

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

https://giftcpas.com/wp-content/uploads/2017/12/2017_Form_W-2.png

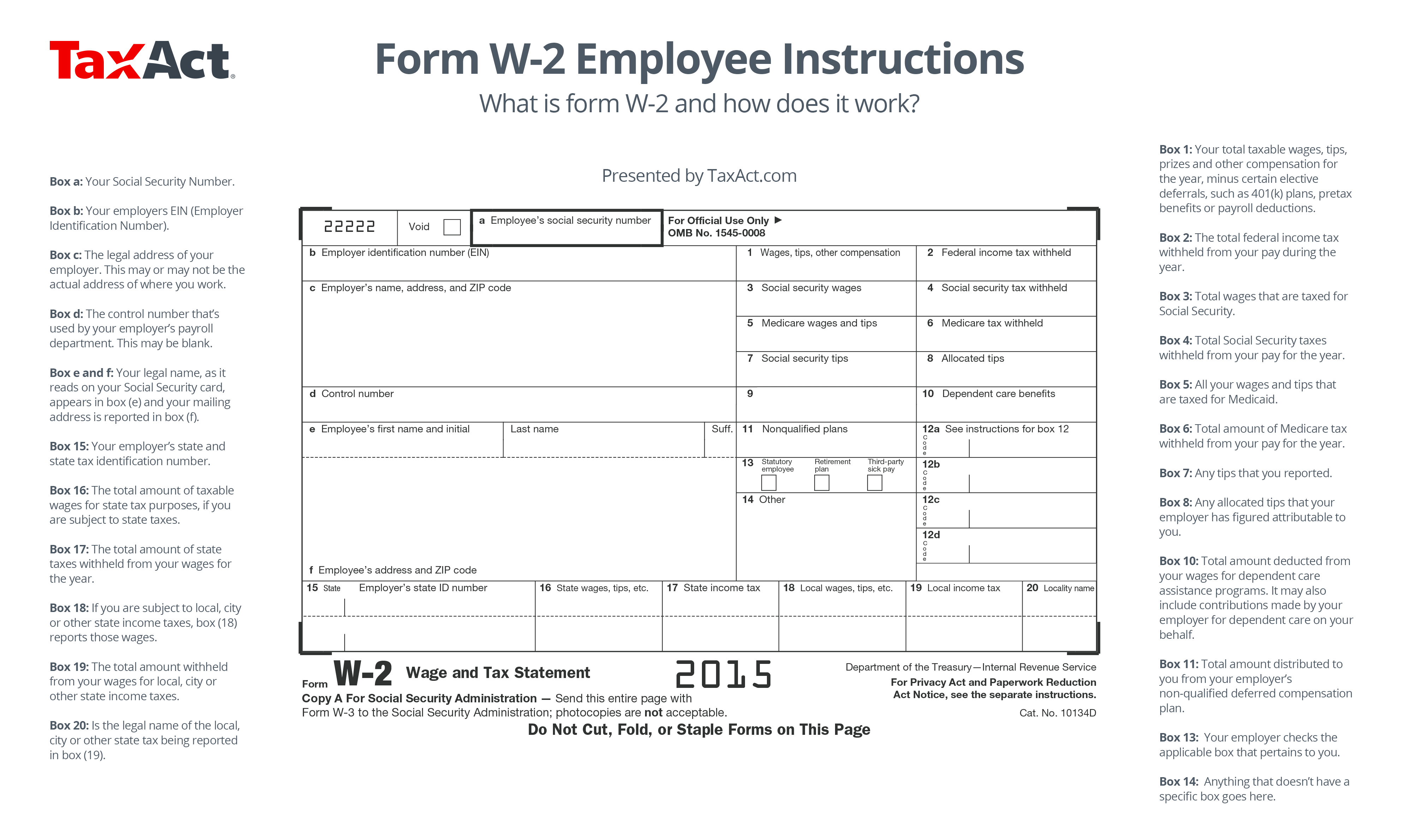

What Is W 2 Form And How Does It Work TaxAct Blog

https://blog.taxact.com/wp-content/uploads/Form-W-2-Employee-Instructions-1.png

https://www.irs.gov/pub/irs-prior/fw2--2022.pdf

Enter this amount on the wages line of your tax return Box 2 Enter this amount on the federal income tax withheld line of your tax return Box 5 You may be required to report this amount on Form 8959 Additional Medicare Tax See the Form 1040 instructions to determine if you are required to complete Form 8959

https://eforms.com/irs/w2/

A W 2 form also known as a Wage and Tax Statement is an IRS document used by an employer to report an employee s annual wages in a calendar year and the amount of taxes withheld from their paycheck Forms are submitted to the SSA Social Security Administration and the information is shared with the IRS

W 2 Form Legal Templates

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs Expert Small Business Advisors

Understanding 2015 W 2 Forms

W 2 Form Fillable Printable Downloadable 2023 Instructions FormSwift

Understanding 2017 W 2 Forms

W 2 Form 2021 Printable Form 2021

W 2 Form 2021 Printable Form 2021

Printable W2 Forms

Printable W2 Form For New Employee Printable Form 2023

W 2 Reporting Requirements W 2 Changes For 2020 Forms

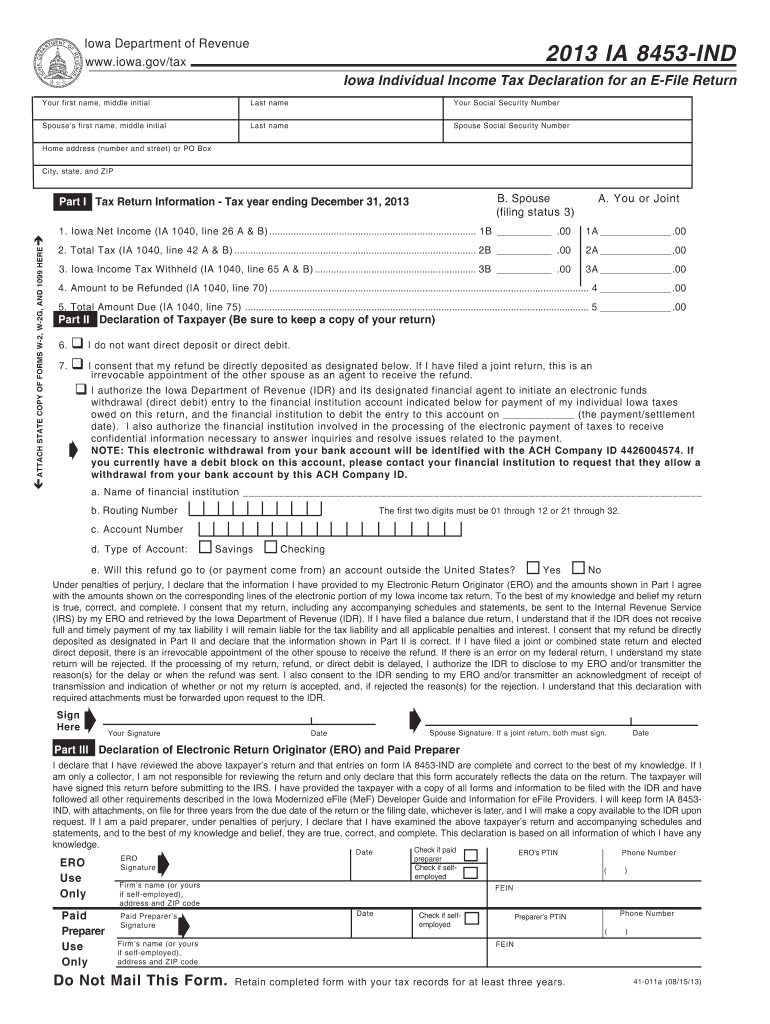

W 2 A Form Printable - This service offers fast free and secure online W 2 filing options to CPAs accountants enrolled agents and individuals who process W 2s the Wage and Tax Statement and W 2Cs Statement of Corrected Income and Tax Amounts Verify Employees Social Security Numbers